UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Information Required in Proxy Statement

Schedule 14a Information

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

|

WISDOMTREE, INC. |

| (Name of Registrant as Specified in Its Charter) |

|

ETFS CAPITAL LIMITED GRAHAM TUCKWELL Bruce E. Aust tonia Pankopf |

| (Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

ETFS CAPITAL LIMITED

May 4, 2023

Dear Fellow WisdomTree Stockholders:

ETFS Capital Limited and the other participants in this solicitation (collectively, “ETFS,” “we” or “our”) are the beneficial owners of an aggregate of 15,250,000 shares of common stock, par value $0.01 per share (the “Common Stock”), of WisdomTree, Inc., a Delaware corporation (“WisdomTree” or the “Company”), representing approximately 10.2% of the outstanding shares of Common Stock. For the reasons set forth in the attached Proxy Statement, we believe meaningful changes to the composition of the Board of Directors of the Company (the “Board”) are necessary in order to ensure that the Company is being run in a manner consistent with your best interests.

We are seeking your support for the election of our three (3) nominees as directors at the 2023 annual meeting of stockholders (“Annual Meeting”) scheduled to be held on June 16, 2023 because we believe that the Board will benefit from the addition of directors who collectively possess the relevant ETF skill sets, a shared objective of enhancing value for the benefit of all WisdomTree stockholders and who will be able to hold management accountable. The individuals that we have nominated are highly qualified, capable and ready to serve the stockholders of WisdomTree.

Our extensive due diligence has led us to believe there is significant value to be realized at WisdomTree given the Company’s valuable assets, apparent governance and cultural issues and tremendous potential. However, we are concerned that the Board is not taking the appropriate actions to address the Company’s prolonged underperformance and actively oversee management. Given the Company’s consistent stock price underperformance and history of poor corporate governance practices, we strongly believe that the Board must be meaningfully refreshed to ensure that the interests of stockholders, the true owners of WisdomTree, are appropriately represented in the boardroom.

The Board is currently composed of nine (9) directors. At the Company’s 2022 annual meeting of stockholders (the “2022 Annual Meeting”), stockholders approved an amendment to the Company’s Amended and Restated Certificate of Incorporation to phase out the classification of the Board over a two-year period commencing at the 2022 Annual Meeting and concluding at the Company’s 2024 annual meeting of stockholders (the “2024 Annual Meeting”). According to the Company, the terms of three (3) Class II directors and three (3) Class III directors currently serving on the Board expire at the Annual Meeting. Beginning with the 2024 Annual Meeting, WisdomTree stockholders will be able to elect all members of the Board on an annual basis.

Through the attached Proxy Statement and enclosed GOLD universal proxy card, we are soliciting proxies to elect not only our three (3) nominees, but also three (3) of the Company’s nominees whose election we do not oppose. This gives stockholders who wish to vote for our nominees the ability to vote for a full slate of six (6) nominees in total. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other information concerning the Company’s nominees.

ETFS and WisdomTree will each be using a universal proxy card for voting on the election of directors at the Annual Meeting, which will include the names of all nominees for election to the Board. Stockholders will have the ability to vote for up to six (6) nominees on ETFS’ enclosed GOLD universal proxy card. Any stockholder who wishes to vote for any combination of our nominees and the Company nominees may do so on ETFS’ GOLD universal proxy card. There is no need to use the Company’s white proxy card or voting instruction form, regardless of how you wish to vote. We urge stockholders to use our GOLD universal proxy card to vote “FOR” our three (3) nominees and the three (3) Company nominees whose election we do not oppose.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed GOLD universal proxy card today. The attached Proxy Statement and the enclosed GOLD universal proxy card are first being furnished to stockholders on or about May 4, 2023.

If you have already voted for the incumbent management slate, you have every right to change your vote by signing, dating and returning a later dated GOLD universal proxy card or by voting in person at the Annual Meeting.

If you have any questions or require any assistance with your vote, please contact Okapi Partners LLC, which is assisting us, at its address and toll-free numbers listed below.

| Thank you for your support, | |

| Graham Tuckwell | |

| ETFS Capital Limited |

If you have any questions, require assistance in voting your GOLD universal proxy card, or need additional copies of ETFS’ proxy materials, please contact Okapi Partners at the phone numbers or email address listed below.

Okapi Partners LLC

1212 Avenue of the Americas, 17th Floor

New York, New York 10036

Stockholders may call toll-free: (877) 629-6356

Banks and brokers call: (212) 297-0720

E-mail: info@okapipartners.com

2023 ANNUAL MEETING OF STOCKHOLDERS

OF

WISDOMTREE, INC.

_________________________

PROXY STATEMENT

OF

ETFS CAPITAL LIMITED

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED GOLD UNIVERSAL PROXY CARD TODAY

ETFS Capital Limited, a Jersey company (“ETFS Capital”), and the other participants in this solicitation (collectively, “ETFS,” “we” or “our”) are significant stockholders of WisdomTree, Inc., a Delaware corporation (“WisdomTree” or the “Company”), who beneficially own an aggregate of 15,250,000 shares of common stock, par value $0.01 per share (the “Common Stock”), of WisdomTree, representing approximately 10.2% of the outstanding shares of Common Stock. We believe that the Board of Directors of the Company (the “Board”) must be meaningfully refreshed to ensure that the Board takes the necessary steps for the Company’s stockholders to realize the maximum value of their investments and hold management accountable. We have nominated directors who have strong, relevant backgrounds and who are committed to fully exploring all opportunities to unlock stockholder value. Accordingly, we are seeking your support at the annual meeting of stockholders scheduled to be held at 250 West 34th Street, 2nd Floor, New York, NY 10119 on June 16, 2023 at 10:00 a.m., Eastern Time (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following:

| 1. | To elect ETFS Capital’s three (3) director nominees, Bruce E. Aust, Tonia Pankopf and Graham Tuckwell (each an “ETFS Nominee” and collectively, the “ETFS Nominees”), as members of the Board, to serve until the 2024 annual meeting of stockholders (the “2024 Annual Meeting”); |

| 2. | To vote on the Company’s proposal to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023; |

| 3. | To vote on the Company’s advisory resolution to approve the compensation of the Company’s named executive officers; and |

| 4. | To vote on the Company’s proposal to ratify the adoption by the Board of the Stockholder Rights Agreement, dated March 17, 2023 (the “Poison Pill”), by and between the Company and Continental Stock Transfer & Trust Company. |

In addition, stockholders are asked to transact such other business that may properly come before the Annual Meeting or any postponements or adjournments thereof.

This Proxy Statement and the enclosed GOLD universal proxy card are first being mailed to stockholders on or about May 4, 2023.

The Board is currently composed of nine (9) directors. At the Company’s 2022 annual meeting of stockholders (the “2022 Annual Meeting”), the Company’s stockholders approved an amendment to the Company’s Amended and Restated Certificate of Incorporation to phase out the classification of the Board over a two-year period commencing at the 2022 Annual Meeting and concluding at the 2024 Annual Meeting. According to the Company, the terms of three (3) Class II directors and three (3) Class III directors currently serving on the Board expire at the Annual Meeting. Beginning with the 2024 Annual Meeting, WisdomTree stockholders will be electing all members of the Board on an annual basis.

Through the attached Proxy Statement and enclosed GOLD universal proxy card, we are soliciting proxies to elect not only our three (3) ETFS Nominees, but also three (3) of the Company’s nominees whose election we do not oppose, Lynn S. Blake, Daniela Mielke and Jonathan Steinberg (collectively, the “Unopposed Company Nominees”). ETFS and WisdomTree will each be using a universal proxy card for voting on the election of directors at the Annual Meeting, which will include the names of all nominees for election to the Board. Stockholders will have the ability vote for up to six (6) nominees on ETFS’ enclosed GOLD universal proxy card. Any stockholder who wishes to vote for any combination of the ETFS Nominees and the Company’s nominees may do so on ETFS’ enclosed GOLD universal proxy card. There is no need to use the Company’s white proxy card or voting instruction form, regardless of how you wish to vote.

Your vote to elect the ETFS Nominees will have the legal effect of replacing three (3) incumbent directors with the ETFS Nominees. There is no assurance that any of the Company’s nominees will serve as directors if all or some of the ETFS Nominees are elected. If elected, the ETFS Nominees, subject to their fiduciary duties as directors, will seek to work with the other members of the Board to position the Company to maximize stockholder value. However, the ETFS Nominees will constitute a minority on the Board and there can be no guarantee that they will be able to implement the actions that they believe are necessary, but we believe the election of our ETFS Nominees is an important step in the right direction for enhancing long-term value at the Company. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement.

Stockholders are permitted to vote for less than six (6) nominees or for any combination (up to six (6) total) of the ETFS Nominees and the Company’s nominees on the GOLD universal proxy card. However, if stockholders choose to vote for any of the Company’s nominees, we recommend that stockholders vote in favor of only the Company’s nominees who we believe are most qualified to serve as directors – the Unopposed Company Nominees – to help achieve a Board composition that we believe is in the best interest of all stockholders. We recommend that stockholders do not vote for any of the Company’s nominees other than the Unopposed Company Nominees. Among other potential consequences, voting for Company nominees other than the Unopposed Company Nominees may result in the failure of one or all of the ETFS Nominees to be elected to the Board. ETFS urges stockholders to use our GOLD universal proxy card to vote “FOR” all of the ETFS Nominees and “FOR” the Unopposed Company Nominees.

IF YOU MARK FEWER THAN SIX (6) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, OUR GOLD UNIVERSAL PROXY CARD, WHEN DULY EXECUTED, WILL BE VOTED ONLY AS DIRECTED. IF NO DIRECTION IS INDICATED WITH RESPECT TO HOW YOU WISH TO VOTE YOUR SHARES, THE PROXIES NAMED THEREIN WILL VOTE SUCH SHARES “FOR” THE THREE (3) ETFS NOMINEES AND THE THREE (3) UNOPPOSED COMPANY NOMINEES. IMPORTANTLY, IF YOU MARK MORE THAN SIX (6) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, ALL OF YOUR VOTES FOR THE ELECTION OF DIRECTORS WILL BE DEEMED INVALID.

2

As of the date hereof, ETFS Capital and each of the ETFS Nominees (each a “Participant” and collectively, the “Participants”), collectively own 15,250,000 shares of Common Stock (the “ETFS Shares”), as well as 14,750 shares of Series A Non-Voting Convertible Preferred Stock (the “Series A Preferred Stock”), which are convertible into 14,750,000 shares of Common Stock, subject to certain limitations. We intend to vote the ETFS Shares FOR the election of the ETFS Nominees and the Unopposed Company Nominees, FOR the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023, AGAINST approval of the advisory vote on the compensation of the Company’s named executive officers and AGAINST the ratification of the Poison Pill, as described herein.

The Company has set the close of business on April 27, 2023 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is 250 West 34th Street, 3rd Floor, New York, NY 10119. Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were 149,263,168 shares of Common Stock outstanding and entitled to vote at the Annual Meeting.

We urge you to carefully consider the information contained in this Proxy Statement and then support our efforts by signing, dating and returning the enclosed GOLD universal proxy card today.

THIS SOLICITATION IS BEING MADE BY ETFS AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH ETFS IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED GOLD UNIVERSAL PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

ETFS URGES YOU TO SIGN, DATE AND RETURN THE GOLD UNIVERSAL PROXY CARD VOTING “FOR” THE ELECTION OF THE ETFS NOMINEES AND THE UNOPPOSED COMPANY NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED GOLD UNIVERSAL PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting—This Proxy Statement and our GOLD universal proxy card are available at:

www.WiseUpWT.com

3

IMPORTANT

Your vote is important, no matter how few shares of Common Stock you own. ETFS urges you to sign, date and return the enclosed GOLD universal proxy card today to vote FOR the election of the ETFS Nominees.

| · | If your shares of Common Stock are registered in your own name, please sign and date the enclosed GOLD universal proxy card and return it to ETFS, c/o Okapi Partners LLC (“Okapi”), in the enclosed postage-paid envelope today. Stockholders also have the following two options for authorizing a proxy to vote shares registered in their name: |

| o | Via the Internet at www.okapivote.com/WT at any time prior to 11:59 p.m. (Eastern Time) on the day before the Annual Meeting, and follow the instructions provided on the GOLD universal proxy card; or |

| o | By telephone, by calling (877) 219-9623 at any time prior to 11:59 p.m. (Eastern Time) on the day before the Annual Meeting, and follow the instructions provided on the GOLD universal proxy card. |

| · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy materials, together with a GOLD voting instruction form, are being forwarded to you by your broker or bank. As a beneficial owner, if you wish to vote, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions. |

| · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting instruction form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting instruction form. |

| · | You may vote your shares in person at the Annual Meeting. Even if you plan to attend the Annual Meeting in person, we recommend that you submit your GOLD proxy card by mail, internet or telephone by the applicable deadline so that your vote will be counted if you later decide not to attend the Annual Meeting. |

As ETFS is using a “universal” proxy card, which includes our ETFS Nominees as well as the Company’s nominees, there is no need to use any other proxy card regardless of how you intend to vote. ETFS strongly urges you NOT to sign or return any white proxy cards or voting instruction forms that you may receive from the Company. Even if you return the Company’s white proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us.

4

If you have any questions, require assistance in voting your GOLD universal proxy card, or need additional copies of ETFS’ proxy materials, please contact Okapi Partners at the phone numbers or email address listed below.

Okapi Partners LLC

1212 Avenue of the Americas, 17th Floor

New York, New York 10036

Stockholders may call toll-free: (877) 629-6356

Banks and brokers call: (212) 297-0720

E-mail: info@okapipartners.com

5

BACKGROUND TO THE SOLICITATION

The following is a chronology of material events leading up to this proxy solicitation:

| · | On November 13, 2017, the Company announced it had entered into a definitive agreement to acquire our European exchange-traded commodity (“ETC”) currency and short-and-leveraged business. |

| · | On April 11, 2018, the Company completed the acquisition of our European ETC, currency and short-and-leveraged business. In connection with the completion of the acquisition, ETFS Capital and Mr. Tuckwell entered into an Investor Rights Agreement with the Company and certain other parties thereto, which included, among other things, customary standstill provisions that lasted for three years. |

| · | Also on April 11, 2018, the Company and ETFS Capital entered into the Gold Royalty Agreement, which provided for the Contractual Gold Payments (as defined below). |

| · | On April 11, 2021, the standstill provisions under the Investor Rights Agreement expired. |

| · | On January 18, 2022, Mr. Tuckwell spoke with Frank Salerno and Win Neuger to discuss potential Board and management changes in light of the Company’s underperformance. During this conversation, Mr. Tuckwell expressed his belief that Mr. Steinberg should be replaced as the Chief Executive Officer of the Company and indicated that he was willing to take necessary action on behalf of the Company’s stockholders if the Board failed to address the serious concerns of the stockholders. |

| · | On January 24, 2022, ETFS Capital and Mr. Tuckwell, who had previously filed a Schedule 13G with respect to the Company, filed a Schedule 13D (the “ETFS 13D”) with the Securities and Exchange Commission (the “SEC”) disclosing their continued holding of 30,000,000 shares, comprised of 15,250,000 shares of Common Stock, representing 10.5% of the outstanding Common Stock, and shares of Series A Preferred Stock economically equivalent to 14,750,000 million shares of Common Stock. The ETFS 13D stated, among other things, that since the Company’s acquisition of the European ETC, currency and short-and-leveraged business, Mr. Tuckwell had grown increasingly concerned by the prolonged underperformance of the Company, and that ETFS Capital and Mr. Tuckwell had engaged in discussions with the Company in furtherance of seeking changes to the composition of the Board and management of the Company, including the appointment of Mr. Tuckwell to the Board. In addition, the ETFS 13D stated that ETFS Capital and Mr. Tuckwell were concerned that the staggered structure of the Board, together with the long tenure of certain directors, had resulted in a boardroom that lacks accountability and appropriate oversight of management, but were disappointed that the Company had been unwilling to date to work constructively with ETFS Capital and Mr. Tuckwell in furtherance of the appointment of Mr. Tuckwell to the Board. |

| · | Also on January 24, 2022, the Company issued a press release in response to the ETFS 13D. |

| · | On January 28, 2022, the Company announced its new direct-to-consumer product “WisdomTree Prime” (“WT Prime”) on its 2021 Q4 Earnings Call. |

6

| · | On March 10, 2022, ETFS Capital filed an amendment to the ETFS 13D disclosing that it had formed a group with Lion Point Capital, LP, and certain of its affiliates (together, “Lion Point,” and, collectively with ETFS Capital, the “2022 Group”), in connection with their collective efforts to seek changes to the composition of the Board and management of the Company. The 2022 Group disclosed that they intended to attempt to work constructively with the Company to arrive at a solution that puts the Company in the best position to unlock value for the benefit of all stockholders and expect to have a dialogue with members of the Board to this end. The 2022 Group disclosed that Lion Point held approximately 4,500,000 shares of Common Stock, giving an aggregate voting position of 13.6%. |

| · | On March 13, 2022, the Board adopted a limited duration stockholder rights plan in an apparent attempt to prevent the members of the 2022 Group from increasing their ownership in Company. |

| · | On March 18, 2022, the 2022 Group delivered a notice of nomination (the “2022 Nomination Notice”) to the Company nominating Lynn Blake, Deborah Fuhr and Mr. Tuckwell (the “2022 Nominees”) as candidates for election to the Board at the 2022 Annual Meeting. The 2022 Group also issued a press release announcing that it delivered the Nomination Notice and an open letter to the Board highlighting the 2022 Group’s concerns with the Company and the need for change. |

| · | Also on March 18, 2022, the Company issued a press release in response to ETFS Capital’s nominations. |

| · | On March 22, 2022, ETFS Capital filed an amendment to the ETFS 13D disclosing the delivery of the 2022 Nomination Notice. |

| · | Between March 29, 2022 and May 4, 2022, the 2022 Group had numerous meetings with Mr. Salerno and Smita Conjeevaram regarding a potential settlement, to avoid the distraction and cost of a 2022 proxy contest. |

| · | On May 4, 2022, ETFS Capital, after providing a courtesy notice via email to Mr. Salerno and Ms. Conjeevaram, issued a press release and open letter to the Board announcing and detailing the breakdown of settlement discussions. |

| · | On May 5, 2022, the Company issued a press release in response to ETFS Capital’s press release and open letter. |

| · | On May 25, 2022, the 2022 Group and the Company entered into a Cooperation Agreement (the “Cooperation Agreement”) pursuant to which, among other things, Ms. Blake and Ms. Fuhr were appointed to the Board, the Company agreed to form an Operations and Strategy Committee, the Company agreed to include a proposal to gradually declassify the Board on the agenda for the 2022 Annual Meeting, and the Company agreed to terminate the stockholder rights plan. |

| · | On August 16, 2022, representatives from ETFS Capital made a presentation to the Board, without the CEO being included, regarding aspects of the Company’s business and the extremely poor long-term performance of the Company. |

| · | On September 21, 2022, the Company appointed Daniela Mielke to the Board to fill the vacancy resulting from the resignation of Susan Cosgrove as a director on September 15, 2022. |

| · | On November 1, 2022, representatives from ETFS Capital, including Mr. Tuckwell, presented to the Board, without the CEO being included, and the wider executive team of the Company involved in the digital initiatives, on the reasons that ETFS Capital does not believe in WT Prime and the other digital initiatives being pursued by the Company. |

7

| · | On December 16, 2022, ETFS Capital filed an amendment to the ETFS 13D disclosing that Lion Point were no longer members of a group with ETFS Capital and Mr. Tuckwell. |

| · | On December 21, 2022, the Company issued a letter to stockholders of the Company which, among other things, included an announcement that the Company would dissolve the Operations and Strategy Committee by December 31, 2022. |

| · | On February 3, 2023, the Company announced it was in negotiations with the World Gold Council (the “WGC”) to settle the Company’s obligation to pay the portion of the Contractual Gold Payments that is ultimately received by the WGC, despite that fact that any and all obligations of the Company pursuant to the Contractual Gold Payments are owed to ETFS Capital, and the Company did not involve or include ETFS Capital in such negotiations. |

| · | On March 9, 2023, Martyn James, a Managing Director of ETFS Capital, contacted a director of the Company, Harold Singleton III, to request a conversation with Mr. Singleton. |

| · | On March 10, 2023, Messrs. James and Singleton had a discussion whereby Mr. James informed Mr. Singleton that ETFS Capital intended to nominate director candidates for election at the Annual Meeting in order to preserve its rights as a stockholder, but that ETFS Capital was interested in reaching a settlement that would benefit all stockholders in order to avoid a potentially costly proxy contest. Mr. Singleton simply replied that he would inform the Board of their conversation. |

| · | On March 13, 2023, Mr. Singleton informed Mr. James that he had updated the Board about their discussion but provided no substantive updates on a potential settlement. |

| · | On March 17, 2023, the standstill provisions under the Cooperation Agreement expired. |

| · | Also on March 17, 2023, the Company announced that it had adopted another limited duration stockholder rights plan, the Poison Pill, seemingly in response to the expiration of the standstill provisions under the Cooperation Agreement. |

| · | Also on March 17, 2023, and despite taking what ETFS Capital viewed as recent stockholder-unfriendly actions, including the adoption of a second Poison Pill, Mr. Singleton contacted Mr. James to inform him that he, Mr. Salerno and Ms. Conjeevaram would be open to meeting with ETFS Capital and that the Board was willing to discuss a potential settlement with ETFS Capital. |

| · | On March 24, 2023, Ms. Conjeevaram and Messrs. Salerno and Singleton had a conversation with Messrs. Tuckwell and James to discuss terms for a potential settlement. |

| · | On March 31, 2023, Messrs. James and Tuckwell had a discussion with Ms. Conjeevaram and Messrs. Salerno and Singleton regarding, among other matters, a potential settlement. |

8

| · | On April 4, 2023, Mr. Tuckwell and James Hyett, ETFS Capital’s Chief Financial Officer, had a video meeting with Bryan Edmiston, the Company’s Chief Financial Officer, and R. Jarrett Lilien, the Company’s President and Chief Operating Officer, to discuss the Contractual Gold Payments. |

| · | On April 5, 2023, Mr. James contacted Mr. Singleton to inquire about the Board’s response to ETFS Capital’s proposed settlement framework and requested confirmation on whether the Company would extend its advance notice deadline for the nomination of directors under the the Company’s Fourth Amended and Restated By-laws (the “Bylaws”) so that the parties could continue settlement talks without ETFS Capital relinquishing its right to nominate director candidates for election at the Annual Meeting if no settlement was reached. |

| · | On April 6, 2023, Mr. Singleton responded to Mr. James and informed him that the Board rejected ETFS Capital’s proposed framework for a settlement and that it refused to extend the advance notice deadline for nominating directors. |

| · | On April 7, 2023, Mr. James contacted Mr. Singleton to further discuss a potential settlement and asked specifically about how many of the incumbent directors the Company was willing to have stand down and who they might be. |

| · | Also on April 7, 2023, Mr. Singleton responded to Mr. James without answering the questions asked in Mr. James’ email. |

| · | On April 12, 2023, ETFS Capital delivered a notice of nomination (the “2023 Nomination Notice”) to the Company nominating Mr. Aust, Ms. Pankopf and Mr. Tuckwell as candidates for election to the Board at the Annual Meeting. ETFS Capital also issued a press release announcing that it delivered the Nomination Notice and an open letter to the Board highlighting ETFS Capital’s continued concerns with the Company and the need for further change. |

| · | Also on April 12, 2023, the Company issued a press release in response to ETFS Capital’s nominations. |

| · | On April 14, 2023, ETFS Capital delivered a letter to the Company requesting the inspection of certain stockholder list materials and related information pursuant to Section 220 of the Delaware General Corporation Law (the “220 Demand”). |

| · | Also on April 14, 2023, ETFS Capital filed an amendment to the ETFS 13D disclosing the nomination of the ETFS Nominees. |

| · | Also on April 14, 2023, Messrs. Tuckwell and Hyett had a second video meeting with Messrs. Edmiston and Lilien to further progress discussions regarding the Contractual Gold Payments. A third meeting was held on April 16, 2023 amongst the same group set out above. |

| · | On April 17, 2023, Mr. Tuckwell emailed Messrs. Edmiston and Lilien and the WGC with materials to progress discussions regarding the Contractual Gold Payments. |

| · | On April 19, 2023, the Company filed its preliminary proxy statement with the SEC in connection with the Annual Meeting. In its preliminary proxy statement, the Company disclosed that the Board had determined that Ms. Fuhr not be included in the Board’s slate of nominees at the Annual Meeting. |

| · | On April 20, 2023, Mr. James and Steph Poulier, Senior Legal Counsel for ETFS Capital, met with Mr. Lilien and Bryan Governey, together with the WGC, to further progress discussions regarding the Contractual Gold Payments. |

| · | On April 21, 2023, counsel to the Company responded to the 220 Demand regarding certain alleged deficiencies in the 220 Demand. |

| · | On April 24, 2023, ETFS Capital filed its preliminary proxy statement with the SEC in connection with the Annual Meeting. |

| · | On April 26, 2023, counsel to ETFS Capital responded to counsel to the Company to address the alleged deficiencies in the 220 Demand. |

| · | On April 28, 2023 and April 29, 2023, counsel to ETFS Capital and counsel to the Company discussed the 220 Demand via email. |

| · | On May 1, 2023, the Company filed its definitive proxy statement with the SEC in connection with the Annual Meeting. |

| · | On May 4, 2023, ETFS Capital filed this definitive proxy statement with the SEC in connection with the Annual Meeting. |

9

REASONS FOR THE SOLICITATION

WE BELIEVE THAT CHANGE TO THE WISDOMTREE BOARD IS NEEDED NOW

We believe that WisdomTree has failed to create stockholder value and has lost credibility with investors because it is unwilling to hold its current management to account. In our opinion, WisdomTree neither has a credible plan nor the capital allocation discipline required to turn its underperformance around and unlock stockholder value, as indicated by the Company’s long history of total shareholder return (“TSR”) underperformance relative to benchmark indices. Additionally, it has failed to create any operating leverage and achieve the desired profitability. Moreover, we believe that the Company’s focus and emphasis on digital initiatives (WisdomTree Prime (“WT Prime”)) is completely misplaced, considering, in our view, the Company neither has the resources nor the expertise to effectively compete with established participants in the decentralized finance (“DeFi”) space.

We believe that urgent change is needed on the Board to solidify the Company’s long-term strategy, enhance the Company’s operational performance, add rigor and discipline to capital allocation, and ensure better accountability at both the Board and management levels.

As the Company’s largest stockholder (holding approximately 18.3% ownership on an as-converted basis) and as a stockholder with extensive ETF industry experience and knowledge, we have worked diligently to provide much needed guidance to the Board and management. Specifically, we delivered two detailed presentations to WisdomTree management and the Board on August 16, 2022 and November 1, 2022. On both occasions we highlighted key areas of focus that we believe are likely to create stockholder value and our concerns with WisdomTree’s misguided reliance on WT Prime.

We reiterate that WisdomTree is at a critical crossroads and in order to ensure that the Company finds the right path forward and that the will of stockholders will no longer be ignored, further change is needed from the boardroom. Over the past year, we have attempted in good faith to resolve our concerns privately with management and the Board in order to prevent the distraction and cost associated with a public contest. However, we have been met with delay tactics, misrepresentations, and a consistent lack of transparency. Given the Board’s seeming disregard for the concerns of its stockholders, its unwillingness to hold the Company’s management accountable for consistently poor performance and failed strategies, and the Board’s overall lack of industry-specific expertise and independence, we felt obligated to nominate our three highly qualified ETFS Nominees for election at the Annual Meeting.

We believe the ETFS Nominees would add fresh and independent perspectives, relevant and significant expertise, and an enduring commitment to the long-term success of the Company on behalf of all stockholders. We also believe that certain of the incumbent members of the Board, notably the ones that pre-dated our engagement with the Board in connection with the 2022 Annual Meeting (the “Incumbent Directors”)1 must be replaced and that the ETFS Nominees give stockholders the best hope of bringing about the change and insight necessary to unlock maximum value for all stockholders.

1 For the avoidance of doubt, these “Incumbent Directors” include Messrs. Win Neuger, Frank Salerno, Jonathan Steinberg, Anthony Bosson and Harold Singleton III and Ms. Smita Conjeevarm and exclude Mss. Lynn S. Blake, Daniela Mielke, and Shamla Naidoo.

10

WISDOMTREE’S LONG-TENURED DIRECTORS AND MANAGEMENT ARE RESPONSIBLE FOR PERSISTENT UNDERPERFORMANCE AND LOST CREDIBILITY

RECENT SHARE PRICE IMPROVEMENT IS LARGELY DUE TO STOCKHOLDER PRESSURE AND EXPECTATION OF MUCH NEEDED ADDITIONAL BOARD CHANGE

| 1. | WisdomTree’s Total Shareholder Return (TSR) had Consistently Underperformed its Peers and Relevant Indices over Short- and Long-term Periods Until Stockholder Pressure in 2022 |

Last year, when ETFS Capital filed the ETFS 13D in January 2022, WisdomTree had significantly underperformed its peers (as defined by the Company in its proxy statement as its “Traditional Asset Management Peer Group” or “Compensation Peer Group”) and relevant indices over both short and long-term periods.

Total Shareholder Return

| 1-year | 3-year | 5-year | 10-year | ||||||

| Actual TSR Performance | |||||||||

| WisdomTree | 7.7% | -5.2% | -39.0% | 10.4% | |||||

| S&P 1500 Asset Management & Custody Banks | 19.5% | 66.8% | 76.2% | 241.6% | |||||

| Russell 2000 | -5.3% | 44.1% | 58.1% | 194.6% | |||||

| Proxy Peers (Median) | 19.4% | 78.5% | 64.5% | 302.2% | |||||

| Traditional Asset Manager Peers (Median) | 13.3% | 91.5% | 98.8% | 229.0% | |||||

| WisdomTree’s Relative TSR Performance | |||||||||

| Proxy Peers (Median)* | -12% | -84% | -104% | -292% | |||||

| Traditional Asset Manager Peers (Median)** | -6% | -97% | -138% | -219% | |||||

| S&P 1500 Asset Management & Custody Banks | -12% | -72% | -115% | -231% | |||||

| Russell 2000 | 13% | -49% | -97% | -184% | |||||

Source: Bloomberg. Data as of January 24, 2022.

*Proxy Peers refers to the Compensation Peer Group as defined in WisdomTree’s 2023 Preliminary Proxy Statement

** Traditional Asset Manager Peer Group as defined in WisdomTree’s 2023 Preliminary Proxy Statement

| 2. | Since 2018, WisdomTree has Failed to Capitalize on the Acquisition of the Successful ETC Business for $611 million |

WisdomTree’s underperformance is more troubling when evaluated in the context of its acquisition of ETFS Capital’s European ETC business in 2018 for $611 million. WisdomTree recognized the value of the ETC acquisition, as highlighted in the following statements by its CEO2:

“The acquisition will immediately add scale, diversification and profitability to our business in Europe, the second largest ETF market in the world and a growing and strategically important region for us and the entire industry. The addition of this complementary and competitively positioned commodity business is an important development in WisdomTree’s strategy to establish itself as a differentiated and diversified ETP provider that can thrive globally and generate long-term stockholder value.” (emphasis added)

2 WisdomTree Press Release November 13, 2017, available at https://www.wisdomtree.eu/en-gb/press-room/tabs/latest-news/wisdomtree-to-acquire-etf-securities.

11

However, WisdomTree completely failed to realize any of those benefits that were conveyed to stockholders as indicated by its massive TSR underperformance, which continued until our ETFS 13D was filed in January 2022.

Total Shareholder Return

(Acquisition of ETC business in April 2018 to ETFS 13D filing in January 2022)

Source: Bloomberg. TSR data from April 12, 2018 to January 24, 2022.

| 3. | Stockholder Pressure in Early 2022 was Largely Responsible for TSR Improvement During that Period |

Against this backdrop, we believe that stockholder pressure was largely responsible for WisdomTree’s improved performance in early 2022. We believe that this improvement will continue only if certain of the Incumbent Directors are replaced and if the Board is refreshed. Without such change, we fear such improvement will be reversed.

12

Total Shareholder Return

(ETFS 13D filing in January 2022 to Settlement in May 2022)

Source: Bloomberg. TSR data from January 24, 2022 to May 25, 2022.

| 4. | Anticipated Further Stockholder Pressure in 2023 Largely Responsible for Recent TSR Improvement |

More recently, the run-up in WisdomTree’s share price in response to its adoption of the Poison Pill in March 2023 (an action taken by the Company in anticipation of further pressure from ETFS Capital) suggests to us that investors agree additional Board change is needed. As mentioned in its preliminary proxy statement, WisdomTree adopted the Poison Pill in anticipation of a proxy contest with ETFS Capital.

Total Shareholder Return

(Adoption of Poison Pill in March 2023 to Present)

Source: Bloomberg. TSR data from March 17, 2023 to April 18, 2023.

13

| 5. | WisdomTree has Failed to Take Advantage of the Rapid Growth of ETFs Despite Being the Only Pure-Play Publicly Listed ETF Company Globally |

The shift from mutual funds to ETFs and from active managers to passive managers has been a substantial tailwind to ETFs and likewise should have served as a substantial tailwind to WisdomTree’s core business. Yet despite double-digit market growth since 2018, WisdomTree has failed to achieve any meaningful organic growth across its ETF portfolio.

Source: ETFGI, WisdomTree IR Dropout

Importantly, the recent growth in WisdomTree’s assets under management (“AUM”) is mostly concentrated in a single product, the WisdomTree Floating Rate Treasury Fund (“USFR”), which accounts for 17% of the Company’s total AUM (as of April 21, 2023) and 93% of its total net flows in 2022. As USFR has benefited from a fast-raising interest rate environment, such over-reliance on a single product highlights the risk WisdomTree faces when rates revert to a more normalized level.

| 6. | WisdomTree has Failed to Achieve Proportionate Revenue Growth or Improve its Operating Margin Despite Record AUM |

WisdomTree has failed to capitalize on what should be a scalable business model. ETF issuance is largely a scalable business and as AUM rises, so should revenue and associated operating income margin. However, WisdomTree has failed to capitalize on the scalable nature of this business model due to an out-of-control and ever-increasing cost base.

Over the last five years, despite a 50% jump in the Company’s AUM, revenue increased by only 10% and operating margin contracted by 11.2% (240bps):

| 2018 | 2022 | % change | |

| AUM ($ billions) | 54.1 | 82.0 | +51.6% |

| Revenue ($ millions) | 274.1 | 301.3 | +9.9% |

| Operating Margin | 22.4% | 19.9% | -11.2% |

Source: WisdomTree website, WisdomTree Form 10-K filings

14

Source: WisdomTree website, WisdomTree Form 10-K filings

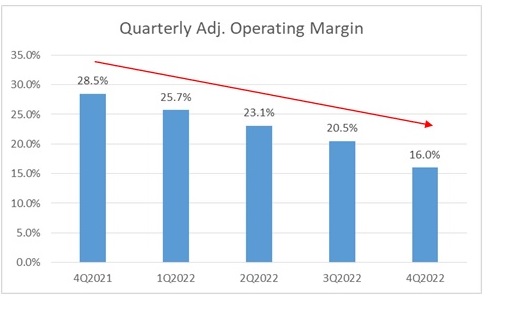

WisdomTree’s failure to translate AUM into profitability margin is also evident in rapid deterioration in operating margins despite record AUM.

Source: WisdomTree website, WisdomTree SEC filings

15

| 7. | WisdomTree has a Dismal Track Record of Capital Allocation Resulting in Write-Offs |

Since 2016, none of the investments made by the Company has created stockholder value. During that time, WisdomTree has written off $63 million of the $72 million it has spent on small to medium investments in its core business. Management’s desire to transform the Company from an ETF issuer to a consumer focussed DeFi business through WT Prime, is a wildly ambitious quest, in our opinion, for a management team with a track record of failure.

Source: WisdomTree Form 10-K filings

| 8. | Lack of Confidence in WisdomTree’s Management’s is Evidenced by Disappointing Analyst Ratings |

Of the seven Wall Street analysts who follow WisdomTree, five have a “Hold” or “Sell” recommendation. The analysts’ mean target price is $6.7 per share, suggesting minimal upside potential from current levels. It is clear to us that analysts do not expect the much-hyped WT Prime to be a key driver of growth in the near-term.

We believe WisdomTree lacks the expertise, capability and necessary financial resources to achieve meaningful results from WT Prime.

THE INCUMBENT DIRECTORS HAVE ADMINISTERED INEFFECTIVE OVERSIGHT AND RESISTED CHANGE

Despite our and other stockholders’ best efforts to hold the Board and management accountable, the Incumbent Directors have resisted change and maintained the status quo by retaining leadership of key committees. We believe that the Board, as currently constructed, suffers from several deficiencies that have hampered its ability to effectively govern the Company. Notably, a majority of the members of the Board lack relevant experience in WisdomTree’s core business and therefore, we believe, are not in a strong position to challenge management and its strategies. The Board has historically resisted change to the leadership structure by recycling over-tenured directors (i.e. the Incumbent Directors). Failures in leadership at the Board-level have had far-reaching consequences. Take the Company’s egregious executive compensation policies, for example - despite approximately $921 million of total stockholder value being destroyed over the last 5 years, the CEO’s pay has increased by approximately 20% over the same period3,4. It should also concern stockholders that the CEO and Chairman are net sellers of the Company’s shares.

| 1. | Reluctant Oversight and Disingenuous Governance |

In our opinion, the Board has long been comprised of directors that lack the skill and expertise to hold the Company’s management accountable for its poor performance. The absence of real oversight has allowed the business to suffer as a result of poor decision-making of a founder and CEO left unchecked. Additionally, the Incumbent Directors and the committees they control undermined any real progress demanded by stockholders. Board refreshment efforts have been mitigated by the failure to support new diverse members as two female directors have left after serving minimal terms. The most recent director to leave was appointed as part of a Cooperation Agreement we reached with the Company in 2022, and her forced departure reflects an unwillingness to work constructively with stockholders toward long-term solutions for the enterprise.

16

| 2. | While Stockholders Suffer Through Value Destruction, Management has Prospered |

Over the past five years, CEO Steinberg has failed to create value for stockholders; in fact he has overseen the destruction of approximately $921 million in the Company’s market value.3 Despite such value destruction, the Board has awarded the CEO over $20 million in aggregate reported pay for the period4. In fact, total annual reported CEO compensation grew during the period from $2.0 million in 2018 to $5.4 million in 2022, representing growth of approximately 177.7%. In light of these facts, it should come as no surprise that leading proxy advisory firm, Institutional Shareholder Services (“ISS”), had noted concerns about the Company’s compensation and related disclosure regarding the absence of performance criteria, resulting in consecutive AGAINST recommendations for Say on Pay in 2021 and 2022.

Source: Company filings, FactSet

| 3. | Instead of Working Constructively with Stockholders Toward a Plan for Company Prosperity, Leadership Worked on a Windfall Payout in Case of Major Board Change |

The Board, no doubt, in our opinion, at the behest of CEO Steinberg and supported by the Incumbent Directors, took steps to ensure that if Mr. Steinberg’s position on the Board is challenged and lost, his windfall under the Company’s executive compensation policies would be guaranteed. Recently, according to the Company’s SEC filings, the Board expanded the change of control provisions in his employment agreement such that circumstances which trigger enhanced severance payments now include a loss of Board majority over a 24-month period. Instead of engaging with stockholders who sought necessary changes in strategy and Board refreshment, we believe that CEO Steinberg worked with his long-tenured Board Chairman and Chair of the Compensation Committee to ensure a profitable exit. We believe stockholders should hold the Incumbent Directors, including Messrs. Frank Salerno (Chairman of the Board and Chair of the Compensation Committee) and Win Neuger (Chair of the Nominating and Governance Committee) accountable for the egregious change in control provisions.

3 Estimated as the change in total Market Value of WisdomTree stock from the end of 2017 ($1.7 billion) to the end of 2022 ($798.5 million), FactSet

4 Total CEO reported pay for years 2018 – 2022, company filings

17

STOCKHOLDER PRESSURE HAS BEEN INSTRUMENTAL IN FORCING WISDOMTREE TO MAKE CORPORATE GOVERNANCE IMPROVEMENTS

The Board has undertaken certain corporate governance improvements such as enhancing diversity through Board refreshment and forming an Operations and Strategy Committee of the Board (a requirement under the Cooperation Agreement). The Committee was intended to evaluate additional changes proposed by us including a review of operations and corporate strategy, an expansion of reporting to include monthly metrics, termination of the limited duration stockholder rights plan, and consideration of a Board declassification proposal. While these actions can be viewed favorably as an initial step, we question if the Incumbent Directors would have ever taken these common-sense actions without our involvement or incessant stockholder pressure. Most importantly, however, we do not believe these steps have remedied the serious performance challenges faced by the Company and accordingly, further change is warranted.

WE BELIEVE THERE IS A BETTER PATH FORWARD FOR WISDOMTREE WITH THE ADDITION OF OUR HIGHLY QUALIFIED ETFS NOMINEES

WisdomTree is at an important juncture and faces critical decisions about its future direction. In contrast to some of WisdomTree’s current directors, we believe our ETFS Nominees possess the relevant expertise and the fortitude necessary to make real change. As evidenced by their brief biographies set out in this Proxy Statement, our three (3) highly qualified ETFS Nominees have deep operational, financial, and strategic experience within the industry, in addition to leadership, and public company governance.

We firmly believe that with the right Board in place, WisdomTree can be a best-in-class company in its industry and generate significant value for all stockholders.

18

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is currently composed of nine (9) directors and, according to the Company’s proxy statement, the terms of three (3) Class II directors and three (3) Class III directors currently serving on the Board expire at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our three (3) ETFS Nominees, Bruce E. Aust, Tonia Pankopf and Graham Tuckwell, for terms ending at the 2024 Annual Meeting. Your vote to elect the ETFS Nominees will have the legal effect of replacing three (3) directors of the Company with the ETFS Nominees. If elected, the ETFS Nominees will represent a minority of the members of the Board, and, therefore, it is not guaranteed that they will be able to implement any actions that they may believe are necessary to enhance stockholder value. However, we believe the election of the ETFS Nominees is an important step in the right direction for enhancing long-term value at the Company. There is no assurance that any of the Company’s nominees will serve as a director if our ETFS Nominees are elected to the Board. You should refer to the Company’s proxy statement for the names, background, qualifications and other information concerning the Company’s nominees

This Proxy Statement is soliciting proxies to elect not only the three (3) ETFS Nominees, but also the three (3) Unopposed Company Nominees. This proxy statement includes the notice information required to be provided to the Company pursuant to the Universal Proxy Rules, including Rule 14a-19(a)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This proxy statement includes the names of all nominees for whom we intend to solicit proxies. Further, we intend to solicit the holders of Common Stock representing at least 67% of the voting power of the Common Stock entitled to vote on the election of directors in support of director nominees other than the Company’s nominees.

THE NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five (5) years of each of the ETFS Nominees. The nominations were made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that led us to conclude that the ETFS Nominees should serve as directors of the Company are set forth above in the section entitled “Reasons for the Solicitation” and below. This information has been furnished to us by the ETFS Nominees. Mr. Aust and Ms. Pankopf are citizens of the United States of America. Mr. Tuckwell is a citizen of Australia.

Bruce E. Aust, ag 59, currently serves as a strategic advisor to the Anthemis Group, a venture capital firm, since February 2021, and a strategic advisor to 150Bond, an advisory firm to C-level executives, since March 2020. Previously, Mr. Aust served in various executive roles at Nasdaq, Inc. (NASDAQ: NDAQ), a global technology company serving the capital markets and other industries, including serving as Vice Chairman from 2015 to December 2019 and as Executive Vice President of Global Listings from 2003 to 2014. Earlier in his career, Mr. Aust served in several roles within the retail brokerage unit of Fidelity Investments, a multinational financial services corporation, including as Vice President. Mr. Aust currently serves as a member of the board of directors of Anthemis Digital Acquisitions I Corp. (NADAQ: ADALU), a publicly traded special purpose acquisition corporation, since January 2022, and as Chairman of the board of directors of AEGIS Swap Execution Facility, LLC, a marketplace for commodities brokers, financial counterparties and commercial end-users to negotiate and execute swaps, since September 2021. Mr. Aust also serves as a member of the Advisory Board of Ridgeway Partners, LLC, a global advisory firm specializing in executive search, board appointments and succession planning, since April 2021. He previously served as President of the Nasdaq Entrepreneurial Center, a non-profit organization designed to engage emerging entrepreneurs. Mr. Aust earned a B.S. in Business Administration from the University of Southern Mississippi.

19

We believe that Mr. Aust’s extensive history in the financial services industry at both a domestic and international level across a variety of markets, as well as his substantial capital markets and IPO experience, will make him a valuable addition to the Board.

Tonia Pankopf, age 55, currently serves as Managing Partner of Pareto Advisors, LLC, an investment, financial and strategic advisory firm, since 2005. Ms. Pankopf also currently serves on the board of directors as a member of the Valuation, Audit and Nominating and Corporate Governance Committees, of 180 Degree Capital Corp. (NASDAQ: TURN), a registered closed-end investment management company, since August 2020. Previously, Ms. Pankopf served on the board of directors, as well as serving as Audit Chair and as a member of the Nominating and Corporate Governance and CEO Search Committees, of Landec Corporation (formerly NASDAQ: LNDC) (n/k/a Lifecore Biomedical, Inc.), a fully integrated contract development and manufacturing organization in the pharmaceutical industry, from November 2012 to November 2022. From 2003 to 2017, Ms. Pankopf served on the board of directors of Oxford Square Capital Corporation (NASDAQ: OXSQ) (formerly TICC Capital Corporation), a registered closed-end investment management company. Earlier in her career, Ms. Pankopf held Vice President and Senior Equity Analyst positions at Goldman Sachs & Co. (NYSE: GS), a global investment bank, and Merrill Lynch & Co. (formerly NYSE: MER), a global investment bank. Ms. Pankopf’s experience also includes hedge fund portfolio management at P.A.W. Capital Partners, an investment advisory firm, and Palladio Capital Management, an investment advisory firm. Ms. Pankopf previously served on the Board of the University System of Maryland Foundation, from 2006 to 2012. Ms. Pankopf is a Governance Fellow and member of the National Association of Corporate Directors. She is also a qualified financial expert. Ms. Pankopf received a Bachelor of Arts summa cum laude from the University of Maryland and a Master of Science degree from the London School of Economics.

We believe that Ms. Pankopf’s 28 years’ of investment experience with domestic and international public and private companies, coupled with her 20 years of public company board and corporate governance experience and significant capital market and corporate finance expertise, will make her a valuable addition to the Board.

Graham Tuckwell, AO, age 66, is the Founder and Executive Chairman of ETFS Capital Limited (f/k/a ETF Securities Limited), a strategic investment company focused on growth opportunities across the ETF ecosystem. Mr. Tuckwell founded ETF Securities Limited in 2004 and it became one of the leading issuers of Exchange Traded Products in Europe prior to the sale of its European ETC businesses to the Company in 2018. Mr. Tuckwell also serves as Founder and Co-Director of Rodber Investments Limited, his family office investment entity, since 2011. Prior to founding ETF Securities Limited, Mr. Tuckwell launched the world’s first gold ETF product on the Australian Stock Exchange. Earlier in his career, Mr. Tuckwell worked in corporate advisory and investment banking for 20 years in Australia and London and as an economist in the Department of Prime Minister and Cabinet in Canberra, Australia. Mr. Tuckwell was awarded an honorary Doctorate degree from Australia National University in 2015 and was appointed an Officer of the Order of Australia in the 2022 Australia Day Honours List. In 2013, Mr. Tuckwell founded the Tuckwell Scholarship Program, an undergraduate scholarship program which provides 25 scholarships every year to students attending the Australian National University, representing the largest ever donation to an Australian university. Mr. Tuckwell holds a Bachelor of Economics (Honours) degree and a Bachelor of Laws degree from the Australian National University.

20

We believe that Mr. Tuckwell’s extensive experience as a senior innovator and executive in the ETF industry, together with his investment and leadership expertise, and deep understanding of, and familiarity with, the Company’s business, would make him a valuable addition to the Board.

The principal business address of Mr. Aust is 1851 N Halsted Street, #3, Chicago, Illinois 60614. The principal business address of Ms. Pankopf is 7819 Hampden Lane, Bethesda, Maryland 20814. The principal business address of Mr. Tuckwell is 15 Rathbone Place, London W1T 1HU, United Kingdom.

As of the date hereof, neither of Mr. Aust or Ms. Pankopf own any securities of the Company and neither have entered into any transactions in the securities of the Company during the past two years.

As of the date hereof, Mr. Tuckwell does not directly own any securities of the Company and has not entered into any transactions in the securities of the Company during the past two years. Mr. Tuckwell, as the Executive Chairman and controlling shareholder of ETFS Capital, may be deemed to beneficially own the 15,250,000 shares of Common Stock beneficially owned directly by ETFS Capital, as well as the 14,750 shares of Series A Preferred Stock. Pursuant to the Certificate of Designations of the Series A Preferred Stock (the “Series A Certificate of Designation”), no Holder (as defined in the Series A Certificate of Designation) shall have the right to convert any shares of Series A Preferred Stock into shares of Common Stock if, after such conversion, such Holder and certain of its affiliates would be deemed to beneficially own, as determined in accordance with Section 13(d) of the Exchange Act, more than 9.99% of the Company’s then outstanding shares of Common Stock (the “Beneficial Ownership Limitation”). As of the date hereof, none of the 14,750 shares of Series A Preferred Stock is currently, and is not expected within 60 days to be, convertible into any shares of Common Stock due to the Beneficial Ownership Limitation. ETFS Capital has not entered into any transactions in the securities of the Company during the past two years.

Each of the ETFS Nominees may be deemed to be a member of a “group” with the other participants in this solicitation for the purposes of Section 13(d)(3) of the Exchange Act, and such group may be deemed to beneficially own the 15,250,000 shares of Common Stock owned in the aggregate by all of the Participants. Each Participant disclaims beneficial ownership of the shares of Common Stock that he, she or it does not directly own.

Except as set forth below with respect to Mr. Tuckwell, we believe that each ETFS Nominee, presently is, and if elected as a director of the Company, each of the ETFS Nominees would qualify as, an “independent director” within the meaning of (i) applicable New York Stock Exchange (“NYSE”) listing standards applicable to board composition and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. Notwithstanding the foregoing, we acknowledge that no director of an NYSE listed company qualifies as “independent” under the NYSE listing standards unless the board of directors affirmatively determines that such director is independent under such standards. Accordingly, we acknowledge that if any ETFS Nominee is elected, the determination of such ETFS Nominee’s independence under the NYSE listing standards ultimately rests with the judgment and discretion of the Board. No ETFS Nominee is a member of the Company’s compensation, nominating or audit committee that is not independent under any such committee’s applicable independence standards. As further described below, Mr. Tuckwell has an indirect interest in the Contractual Gold Payments and, as a result, may not be deemed to be an “independent director” within the meaning of the applicable NYSE listing standards.

Each of the ETFS Nominees has consented to being named as a nominee of ETFS Capital in any proxy statement relating to the Annual Meeting and to serving as a director of the Company if elected.

21

ETFS Capital has entered into letter agreements (the “Indemnification Agreements”) with each of the ETFS Nominees, other than Mr. Tuckwell, pursuant to which ETFS Capital has agreed to indemnify such ETFS Nominees against claims arising from the solicitation of proxies from the Company’s stockholders in connection with the Annual Meeting and any related transactions. For the avoidance of doubt, such indemnification does not apply to any claims made against such ETFS Nominee(s) in their capacity as a director of the Company, if so elected.

Each of the ETFS Nominees, other than Mr. Tuckwell, has granted Martyn James and Mr. Tuckwell a power of attorney to execute certain SEC filings in connection with the Solicitation (as defined below). Mr. Tuckwell has granted a power of attorney to Mr. James and Mark Weeks to execute certain SEC filings in connection with the Solicitation.

ETFS Capital has entered into compensation letter agreements with each of the ETFS Nominees, other than Mr. Tuckwell, (the “Compensation Agreements”) pursuant to which it has agreed to pay such ETFS Nominees: (i) $50,000 in cash upon the provision by such ETFS Nominee of executed nominee documents and other information requested by ETFS Capital or its representatives in connection with such ETFS Nominee’s nomination and (ii) $50,000 in cash upon the earlier to occur of (a) the filing of a definitive proxy statement by ETFS Capital with the SEC relating to a solicitation of proxies in favor of such ETFS Nominee’s election as a director of the Company at the Annual Meeting or (b) ETFS Capital and its affiliates entering into an agreement with the Company with respect to such ETFS Nominee’s election or appointment to the Board; provided, however, that, at ETFS Capital’s sole discretion, the payment provided for under clause (ii) above may be made at any time prior to the events in either (a) or (b) occurring. The Compensation Agreements terminate on the earliest to occur of (i) the Company’s appointment or nomination of such ETFS Nominee as a director of the Company, (ii) the date of any agreement with the Company (x) in furtherance of such ETFS Nominee’s nomination or appointment as a director of the Company or (y) with respect to the composition of the Board, (iii) ETFS Capital’s withdrawal of its nomination of such ETFS Nominee for election as a director of the Company, and (iv) the date of the Annual Meeting.

On April 12, 2023, ETFS Capital and each of the ETFS Nominees (collectively, the “Group”) entered into a Joint Filing and Solicitation Agreement in which, among other things, they agreed (a) to the joint filing on behalf of each of them of statements on Schedule 13D, and any amendments thereto, with respect to the securities of the Company, if applicable, (b) to form the Group to solicit proxies or written consents for the election of the ETFS Nominees, or any other person(s) nominated by the Group, to the Board at the Annual Meeting (the “Solicitation”) and take such other actions as the parties deem advisable, (c) to provide notice to the Group’s legal counsel no later than four (4) hours after each such transaction of (i) any of their purchases or sales of securities of the Company or (ii) any securities of the Company over which they acquire or dispose of beneficial ownership; provided, however, that each party agrees not to purchase or sell securities of the Company or otherwise increase or decrease its economic exposure to or beneficial ownership over the securities of the Company if it reasonably believes that, as a result of such action, the Group or any member thereof would be likely to be required to make any regulatory filing (including, but not limited to, a Schedule 13D amendment, Form 3 or Form 4) with the SEC without using its reasonable efforts to give the other members of the Group who will be a party to such filing at least twelve (12) hours prior written notice, (d) that each ETFS Nominee would provide ETFS Capital and Mr. Tuckwell with advance written notice prior to effecting any purchase, sale, acquisition or disposal of any securities of the Company which he has, or would have, direct or indirect beneficial ownership, so that ETFS Capital and Mr. Tuckwell has an opportunity to review the potential implications of any such transaction and such ETFS Nominees agreed that they shall not undertake or effect any purchase, sale, acquisition or disposal of any securities of the Company without the prior written consent of ETFS Capital and Mr. Tuckwell and (e) that ETFS Capital and Mr. Tuckwell agreed to bear all pre-approved expenses (including fees of outside legal counsel, but excluding obligations under the Indemnification Agreements, which are governed by the terms thereof) incurred in connection with the Group’s activities; provided, however, that any such reimbursement shall not exceed $7,500 in the aggregate for each ETFS Nominee (plus any applicable VAT/GST or sales tax).

22

Except as otherwise set forth in this Proxy Statement (including the Schedule hereto), (i) during the past 10 years, no ETFS Nominee has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no ETFS Nominee directly or indirectly beneficially owns any securities of the Company; (iii) no ETFS Nominee owns any securities of the Company which are owned of record but not beneficially; (iv) no ETFS Nominee has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any ETFS Nominee is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no ETFS Nominee is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any ETFS Nominee owns beneficially, directly or indirectly, any securities of the Company; (viii) no ETFS Nominee owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no ETFS Nominee or any of his or her associates or immediate family members was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no ETFS Nominee or any of his or her associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; (xi) no ETFS Nominee has a substantial interest, direct or indirect, by securities holdings or otherwise in any matter to be acted on at the Annual Meeting; (xii) no ETFS Nominee holds any positions or offices with the Company; (xiii) no ETFS Nominee has a family relationship with any director, executive officer, or person nominated or chosen by the Company to become a director or executive officer, (xiv) no companies or organizations, with which any of the ETFS Nominees has been employed in the past five years, is a parent, subsidiary or other affiliate of the Company and (xv) there are no material proceedings to which any ETFS Nominee or any of his associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. Except as disclosed herein, with respect to each of the ETFS Nominees, (a) none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act (“Regulation S-K”) occurred during the past 10 years, (b) there are no relationships involving any ETFS Nominee or any of such ETFS Nominee’s associates that would have required disclosure under Item 407(e)(4) of Regulation S-K had such ETFS Nominee been a director of the Company, and (c) none of the ETFS Nominees nor any of their associates has received any fees earned or paid in cash, stock awards, option awards, non-equity incentive plan compensation, changes in pension value or nonqualified deferred compensation earnings or any other compensation from the Company during the Company’s last completed fiscal year, or was subject to any other compensation arrangement described in Item 402 of Regulation S-K.

Other than as stated herein, there are no arrangements or understandings between ETFS Capital, the ETFS Nominees, or any other person or persons pursuant to which the nomination of the ETFS Nominees described herein is to be made. Other than as stated herein, none of the ETFS Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceeding.

23

We do not expect that any of the ETFS Nominees will be unable to stand for election, but, in the event any ETFS Nominee is unable to serve or for good cause will not serve, the shares of Common Stock represented by the enclosed GOLD universal proxy card will be voted for substitute nominee(s), to the extent this is not prohibited under the Bylaws and applicable law. In addition, we reserve the right to nominate substitute person(s) if the Company makes or announces any changes to the Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any ETFS Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, we would identify and properly nominate such substitute nominee(s) in accordance with the Bylaws and shares of Common Stock represented by the enclosed GOLD universal proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to any potential position of ETFS that any attempt to increase the size of the current Board or to reconstitute or reconfigure the classes on which the current directors serve, may constitute an unlawful manipulation of the Company’s corporate machinery.

Stockholders will have the ability to vote for up to six (6) nominees on ETFS’ enclosed GOLD universal proxy card. Any stockholder who wishes to vote for any combination of the ETFS Nominees and the Company’s nominees may do so on ETFS’ enclosed GOLD universal proxy card. There is no need to use the Company’s white proxy card or voting instruction form, regardless of how you wish to vote. ETFS urges stockholders to vote using our GOLD universal proxy card “FOR” the ETFS Nominees and the Unopposed Company Nominees.

Stockholders are permitted to vote for less than six (6) nominees or for any combination (up to six (6) total) of the ETFS Nominees and the Company’s nominees on the GOLD universal proxy card. However, if stockholders choose to vote for any of the Company’s nominees, we recommend that stockholders vote in favor of the Unopposed Company Nominees, who we believe are sufficiently qualified to serve as directors, to help achieve a Board composition that we believe is in the best interest of all stockholders. Certain information about the Unopposed Company Nominees is set forth in the Company’s proxy statement. ETFS is not responsible for the accuracy of any information provided by or relating to WisdomTree or its nominees contained in any proxy solicitation materials filed or disseminated by, or on behalf of, WisdomTree or any other statements that WisdomTree or its representatives have made or may otherwise make.

IMPORTANTLY, IF YOU MARK FEWER THAN SIX (6) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, OUR GOLD UNIVERSAL PROXY CARD, WHEN DULY EXECUTED, WILL BE VOTED ONLY AS DIRECTED. IF NO DIRECTION IS INDICATED WITH RESPECT TO HOW YOU WISH TO VOTE YOUR SHARES, THE PROXIES NAMED THEREIN WILL VOTE SUCH SHARES “FOR” THE THREE (3) ETFS NOMINEES AND THE THREE (3) UNOPPOSED COMPANY NOMINEES. IMPORTANTLY, IF YOU MARK MORE THAN SIX (6) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, ALL OF YOUR VOTES FOR THE ELECTION OF DIRECTORS WILL BE DEEMED INVALID.

WE STRONGLY URGE YOU TO VOTE “FOR” THE ELECTION OF THE ETFS NOMINEES ON THE ENCLOSED GOLD UNIVERSAL PROXY CARD.

24

PROPOSAL NO. 2

RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company’s proxy statement, the Audit Committee of the Board has appointed Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023.

As disclosed in the Company’s proxy statement, the Company’s organizational documents do not require that the stockholders ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm, but the Company is submitting the selection of Ernst & Young LLP for ratification by stockholders at the Annual Meeting. The Company has disclosed that if stockholders do not ratify the selection, the Audit Committee will reconsider whether to retain Ernst & Young LLP, but still may retain them. The Company has further disclosed that, even if the selection is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

According to the Company’s proxy statement, the affirmative vote of a majority of votes cast is necessary for the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2023 AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

25

PROPOSAL NO. 3

VOTE ON AN ADVISORY RESOLUTION TO APPROVE THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

As discussed in further detail in the Company’s proxy statement, as required by Section 14A(a)(1) of the Exchange Act, the Board is providing stockholders with an opportunity to vote on an advisory resolution to approve the compensation of the Company’s named executive officers, which is discussed in further detail in the section titled “Executive Compensation - Compensation Discussion and Analysis” in the Company’s proxy statement. Accordingly, the Board is asking stockholders to approve the following resolution:

“RESOLVED, that the Company’s stockholders hereby approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Company’s proxy statement for the 2023 annual meeting of stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the Summary Compensation Table and the other compensation related tables and disclosure.”