UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

| WISDOMTREE, INC. |

(Name of Registrant as Specified In Its Charter)

|

| |

ETFS CAPITAL

LIMITED

GRAHAM TUCKWELL

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

ETFS CAPITAL LIMITED

May 3, 2024

Dear Fellow WisdomTree Stockholders:

ETFS Capital Limited

and the other participant in this solicitation (collectively, “ETFS,” “we” or “our”) are the beneficial

owners of an aggregate of 15,250,000 shares of common stock, par value $0.01 per share (the “Common Stock”), of WisdomTree,

Inc., a Delaware corporation (“WisdomTree” or the “Company”), representing approximately 10.0% of the outstanding

shares of Common Stock. For the reasons set forth in the attached Proxy Statement, we believe that immediate action is required by the

Company to unlock significant value for all stockholders and stop any further value destruction.

We believe there is significant

value to be unlocked within the Company’s shares. As a long-term stockholder of the Company, with deep ETF industry and operating

expertise, we have attempted to constructively engage with the Company’s Board of Directors (the “Board”) both before

and after the Company’s 2023 Annual Meeting of Stockholders regarding the Company’s long-term destruction of stockholder value,

excessive cost-structure, negligent capital allocation, and the consistent inability to keep the best interest of stockholders in mind.

A prime example of

the Company’s shortcomings, as discussed in greater detail in the enclosed Proxy Statement, is the ill-advised strategy of trying

to transform the Company from an ETF business to a decentralized finance (“DeFi”) business over the past several years, which

we believe has resulted in the core ETF business being poorly managed. Moreover, all of the Company’s DeFi efforts continue to

flounder. Specifically, the Company’s flagship DeFi initiatives, namely WisdomTree Prime (“WT Prime”), which was launched

in July of 2023, and the Company’s Bitcoin ETF, which was launched in January of 2024, have been unsuccessful in generating any

meaningful market interest, and have diverted management’s attention from the Company’s principal ETF business, where we

believe the true value of WisdomTree lies. In our view, WT Prime is and always has been a complete folly, and in crypto ETFs, the Company

continues to rank towards the bottom relative to its peers as discussed in the enclosed Proxy Statement. The result of this misguided

‘transformation’ strategy is that, despite record assets under management, WisdomTree’s traditional ETF business continues

to suffer from poor profitability. Consequently, we believe WisdomTree trades at a significant discount to its intrinsic value if it

were a well-run pure-play ETF business.

In the hope of having

a collaborative and productive dialogue, we attempted to engage privately with the Board on the actions we believe are required to close

the value gap and enhance stockholder value. To that end, we met with members of the Board on February 13, 2024, and on February 20,

2024, we wrote a letter to the Board, in which we acknowledged that individual members of the Board and stockholders have divergent views

about the best way forward to unlock value at WisdomTree. We proposed that the Board consider forming a special committee of independent

directors with a mandate to consider strategic alternatives including, but not limited to, a sale of part or all of the business and

returning capital to stockholders, as well as a significant repositioning of the business, including replacing certain members of WisdomTree’s

senior leadership team. We further proposed that the special committee retain a recognized tier-one investment bank along with independent

counsel to assist with this review of strategic alternatives.

Unfortunately, rather than

genuinely engage with one of its largest stockholders, the Company decided to respond to our private proposal with a public and bafflingly

hostile response. However, this did not come as a surprise to us. Over the past several years, we have attempted to address operational

and governance shortcomings at the Company through a myriad of ways, including by writing public and private letters to the Board, discussing

our ideas with members of senior management and by running full proxy campaigns. Unfortunately, the resulting change to the Board has

been insufficient to overcome the pervasive influence that management and long-tenured directors exert in maintaining the status quo.

We believe that stockholders

must send a strong message to the Board that they do not approve of the Company’s current trajectory or the Board’s stewardship

and oversight of management and the Company, and that the Board must take the necessary steps for the Company’s stockholders to

realize the maximum value of their investments and hold management accountable. For the reasons set forth above and in the enclosed Proxy

Statement, we intend to vote AGAINST the re-election of Jonathan Steinberg, Win Neuger and Anthony Bossone at the Company’s

upcoming annual meeting of stockholders as a referendum on the Company’s ill-advised transformation strategy and its refusal to

unlock value through a strategic review process, and we urge other stockholders to do the same.

By voting AGAINST the re-election of Mr. Steinberg, as Chief Executive

Officer of the Company, Mr. Neuger, as Chairman of the Board, and Mr. Bossone, each of whom serve in significant leadership positions

at the Company and, as the longest-tenured directors, have supported management’s efforts to transform WisdomTree into a DeFi business

by investing in WisdomTree Prime, Bitcoin ETFs and other unrelated ventures, we believe stockholders will be sending a strong message

to the Board that they are dissatisfied with the status quo and that the Company should hire a reputable banker and evaluate all options

to unlock value as soon as possible. Accordingly, we are urging you to vote AGAINST the re-election of Messrs. Steinberg, Neuger

and Bossone as directors at the Company’s upcoming annual meeting of stockholders and we urge Board members to reconsider their

decision and act as independent fiduciaries for all stockholders – the true owners of WisdomTree.

We note that the election

of directors at WisdomTree requires the affirmative vote of a majority of the votes cast in uncontested elections. Importantly, the

Company has a director resignation policy in place for uncontested elections, whereby an incumbent

director who is not re-elected shall tender his or her resignation to the Board. The

Nominating and Governance Committee of the Board will make a recommendation to the Board on whether to accept or reject the resignation,

or whether other action should be taken. The Board will act on the recommendation of such committee and will publicly disclose its decision

within 90 days from the date of the certification of the election results. If our proxy solicitation results in any directors failing

to receive a majority of the votes cast for his or her election, then we believe it would clearly be inappropriate for any such director

to continue to serve on the Board. We believe the failure of the Board to accept any such tendered resignations that may result from the

Company’s upcoming annual meeting of stockholders would be an egregious violation of proper corporate governance, and in direct

opposition to a clear stockholder directive.

We urge you to carefully

consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed

GOLD proxy card today. The attached Proxy Statement and the enclosed GOLD proxy card are first being furnished to stockholders

on or about May 3, 2024.

If you have already

voted for the incumbent management slate, you have every right to change your vote by signing, dating and returning a later dated GOLD

proxy card or by voting in person at the upcoming annual meeting of stockholders.

If you have any questions

or require any assistance with your vote, please contact Saratoga Proxy Consulting LLC, which is assisting us, at its address and toll-free

numbers listed below.

Thank you for your support,

/s/ Graham Tuckwell

Graham Tuckwell

ETFS Capital Limited

|

If you have any questions, require assistance in

voting your GOLD proxy card,

or need additional copies of ETFS’ proxy materials,

please contact Saratoga at the phone numbers listed

below.

520 8th Avenue, 14th Floor

New York, NY 10018

(212) 257-1311

Stockholders call toll free at (888) 368-0379

Email: info@saratogaproxy.com |

2024 ANNUAL MEETING OF STOCKHOLDERS

OF

WISDOMTREE, INC.

_________________________

PROXY STATEMENT

OF

ETFS CAPITAL LIMITED

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED GOLD PROXY CARD TODAY

ETFS Capital Limited, a

Jersey company (“ETFS Capital”), and the other participant in this solicitation (collectively, “ETFS,” “we”

or “our”) are significant stockholders of WisdomTree, Inc., a Delaware corporation (“WisdomTree” or the “Company”),

who beneficially own an aggregate of 15,250,000 shares of common stock, par value $0.01 per share (the “Common Stock”), of

WisdomTree, representing approximately 10.0% of the outstanding shares of Common Stock. We believe that stockholders must send a strong

message to the Company’s Board of Directors (the “Board”) that they do not approve of the Company’s current trajectory

or the Board’s stewardship and oversight of the Company, and that the Board must take the necessary steps for the Company’s

stockholders to realize the maximum value of their investments and conduct a comprehensive strategic review process. To that end, we are

seeking your support at the Company’s 2024 annual meeting of stockholders scheduled to be held at Paul Hastings LLP, 200 Park Avenue,

26th Floor, New York, NY 10166 on June 12, 2024 at 10:00 a.m., Eastern Time (including any adjournments or postponements thereof and any

meeting which may be called in lieu thereof, the “2024 Annual Meeting”), to vote AGAINST the re-election of Jonathan

Steinberg, Chief Executive Officer of the Company, Win Neuger, Chairman of the Board, and Anthony Bossone. This Proxy Statement and the

enclosed GOLD proxy card are first being mailed to stockholders on or about May 3, 2024.

In addition, our GOLD proxy

card will also allow stockholders to vote on the following proposals that are being presented by the Company for stockholder consideration

at the 2024 Annual Meeting:

| · | The

ratification of the appointment of Ernst & Young LLP as the Company’s independent

registered public accounting firm for the fiscal year ending December 31, 2024; |

| · | An

advisory resolution to approve the compensation of the Company’s named executive officers; |

| · | A

non-binding, advisory vote on the frequency of future advisory votes to approve the compensation

of the Company’s named executive officers; and |

| · | The

ratification of the approval by the Board of the extension of the Stockholder Rights Agreement,

dated March 17, 2023, as amended (the “Poison Pill”), by and between the Company

and Continental Stock Transfer & Trust Company. |

Stockholders may also transact

such other business as may properly come before the 2024 Annual Meeting.

As of the date hereof,

ETFS Capital and Graham Tuckwell (each a “Participant”), own 15,250,000 shares of Common Stock (the “ETFS Shares”),

as well as 14,750 shares of Series A Non-Voting Convertible Preferred Stock (the “Series A Preferred Stock”), which are convertible

into 14,750,000 shares of Common Stock, subject to certain limitations. We intend to vote the ETFS Shares AGAINST the re-election

of Messrs. Steinberg, Neuger and Bossone and FOR the election of the remaining Company

director nominees up for election at the 2024 Annual Meeting (collectively, the “Company Nominees”), FOR the ratification

of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year

ending December 31, 2024, AGAINST approval of the advisory vote on the compensation of the Company’s named executive officers,

ONE YEAR on the vote on the frequency of future advisory votes to approve the compensation of the Company’s named executive

officers, and AGAINST the ratification of the Board’s approval of the extension of the Poison Pill.

By voting AGAINST the re-election of Mr. Steinberg, as Chief Executive

Officer of the Company, Mr. Neuger, as Chairman of the Board, and Mr. Bossone, each of whom serve in significant leadership positions

at the Company and, as the longest-tenured directors, have supported management’s efforts to transform WisdomTree into a DeFi business

by investing in WisdomTree Prime, Bitcoin ETFs and other unrelated ventures, we believe stockholders will be sending a strong message

to the Board that they are dissatisfied with the status quo and that the Company should hire a reputable banker and evaluate all options

to unlock value as soon as possible. Accordingly, we are urging you to vote AGAINST the re-election of Messrs. Steinberg, Neuger

and Bossone as directors at the 2024 Annual Meeting.

The enclosed Proxy

Statement and GOLD proxy card includes the ability to vote for all Company Nominees, including Lynn S. Blake, Anthony Bossone,

Smita Conjeevaram, Rilla Delorier, Daniela Mielke, Shamla Naidoo, Tonia Pankopf, Win Neuger and Jonathan Steinberg. Please note, however,

that the Company Nominees are not the nominees of ETFS, and, accordingly, they are not participants in this solicitation. We can provide

no assurance that any of the Company Nominees will serve as directors if elected.

The Company has set

the close of business on April 19, 2024 as the record date for determining stockholders entitled to notice of and to vote at the 2024

Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is 250 West 34th

Street, 3rd Floor, New York, NY 10119. Stockholders of record at the close of business on the Record Date will be entitled

to vote at the 2024 Annual Meeting. According to the Company, as of the Record Date, there were 151,818,674 shares of Common Stock outstanding

and entitled to vote at the 2024 Annual Meeting.

We urge you to carefully

consider the information contained in this Proxy Statement and then support our efforts by signing, dating and returning the enclosed

GOLD proxy card today.

IF YOU MARK FEWER THAN

A TOTAL OF NINE (9) “FOR”, “AGAINST” OR “ABSTAIN” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS,

OUR GOLD PROXY CARD, WHEN DULY EXECUTED, WILL BE VOTED ONLY AS DIRECTED.

THIS SOLICITATION IS BEING

MADE BY ETFS AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE

2024 ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH ETFS IS NOT AWARE OF A REASONABLE TIME

BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE 2024 ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED GOLD PROXY CARD

WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

ETFS URGES YOU TO SIGN,

DATE AND RETURN THE GOLD PROXY CARD TO VOTE AGAINST THE ELECTION OF MESSRS. STEINBERG, NEUGER AND BOSSONE TO THE BOARD

AT THE 2024 ANNUAL MEETING.

IF YOU HAVE ALREADY

SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED

IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED GOLD PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE

THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE 2024 ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A

LATER DATED PROXY FOR THE 2024 ANNUAL MEETING OR BY VOTING IN PERSON AT THE 2024 ANNUAL MEETING.

Important Notice Regarding the Availability

of Proxy Materials for the 2024 Annual Meeting—This Proxy Statement and our GOLD proxy card are available at

www.unlockwt.com

IMPORTANT

Your vote is important,

no matter how few shares of Common Stock you own. ETFS urges you to sign, date, and return the enclosed GOLD proxy card today

to vote “AGAINST” the election of Jonathan Steinberg, Win Neuger and Anthony Bossone to the Board. ETFS makes no recommendations

with respect to the other proposals on the agenda for the 2024 Annual Meeting.

| · | If

your shares of Common Stock are registered in your own name, please sign and date the enclosed

GOLD proxy card and return it to ETFS, c/o Saratoga Proxy Consulting LLC (“Saratoga”),

in the enclosed postage-paid envelope today. |

| · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial

owner of the shares of Common Stock, and these proxy materials, together with a GOLD voting instruction form, are being forwarded

to you by your broker or bank. As a beneficial owner, if you wish to vote, you must instruct your broker, trustee or other representative

how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions. |

| · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the

Internet. Please refer to the enclosed voting instruction form for instructions on how to vote electronically. You may also vote by signing,

dating and returning the enclosed voting instruction form. |

| · | You

may vote your shares in person at the 2024 Annual Meeting. Even if you plan to attend the

2024 Annual Meeting in person, we recommend that you submit your GOLD proxy card by

mail prior to the 2024 Annual Meeting so that your vote will be counted if you later decide

not to attend the 2024 Annual Meeting. |

Since only your latest

dated proxy card will count, we urge you not to return any proxy card you receive from the Company, as it will revoke any proxy card you

may have previously sent to us. So please make sure that the latest dated proxy card you return is the GOLD proxy card.

|

If you have any questions, require assistance in

voting your GOLD proxy card,

or need additional copies of ETFS’ proxy materials,

please contact Saratoga at the phone numbers listed

below.

520 8th Avenue, 14th Floor

New York, NY 10018

(212) 257-1311

Stockholders call toll free at (888) 368-0379

Email: info@saratogaproxy.com |

BACKGROUND TO THE SOLICITATION

The following is a chronology of material events

leading up to this proxy solicitation:

| · | On June 16, 2023, the Company held its 2023 annual meeting of stockholders (the “2023 Annual Meeting”). |

| · | On

October 12, 2023, Mr. Tuckwell emailed the Chairman of the Board, Win Neuger, requesting

a meeting with the Board in person in New York the following month. Mr. Neuger responded

to Mr. Tuckwell and offered a video meeting with the Board. |

| · | On November 14, 2023, Mr. Tuckwell and other representatives from ETFS

met with various members of the Board and management in a video call. On the video call, Mr. Tuckwell expressed his concern that the Company

does not appear to be interested in having a two-way dialogue with ETFS. Mr. Tuckwell stated that ETFS had given the Board quite a lot

of detailed information and suggestions regarding the Company and how to improve the Company in two presentations last year but had received

no feedback to date. Mr. Tuckwell expressed his view that ETFS was politely listened to but completely ignored by the Board. Although

some two-way discussion did follow regarding some aspects of the Company’s business and strategy, the Company did not commit to

taking any steps to effect any of the changes suggested by ETFS nor was there any written follow-up by the Company regarding the matters

discussed. |

| · | On February 13, 2024, Mr. Tuckwell met with certain members of the Board, Win Neuger and Tonia Pankopf.

At the meeting, Mr. Tuckwell explained his concerns that since mid-2018 the Company’s assets under management (“AUM”)

had almost doubled but the share price had remained stagnant because of poor management. To restore value to stockholders, Mr. Tuckwell

discussed a number of proposals which he requested the Board consider, as discussed in the bullet below. |

| · | On February 20, 2024, ETFS sent a private letter to Mr. Neuger and Ms. Pankopf following up on their February

13, 2024 meeting. In the letter, ETFS expressed their disappointment with the Company’s execution of its strategy and performance

and highlighted the Company’s underperformance as compared to relevant peers and indices over the last 5-year and 10-year periods,

and since the Company’s acquisition of ETFS’ successful ETC business in 2018. ETFS requested that the Board consider three

proposals: (i) replacing the Company’s CEO with someone who can add and not destroy value; (ii) raising outside money for WisdomTree

Prime (“WT Prime”) rather than wasting stockholder money on it; and (iii) appointing a reputable investment bank to review

strategic alternatives for the Company. In the letter, ETFS also proposed that, at a minimum, (a) a special committee of the Board consisting

of independent directors should be formed and the Company should publicly announce that it will run a strategic review process of the

entire business, (b) the special committee should retain an independent financial advisor from a recognized tier-one investment bank and

retain independent counsel, and (c) the special committee should be given a mandate to consider various strategic alternatives for WisdomTree,

including, but not limited to, a sale of part or all of the business, returning capital to stockholders, and a significant repositioning

of the business, including the replacement of members of the Company’s senior leadership team. |

| · | On February 27, 2024, the Company issued a public letter to ETFS in response to ETFS’ private letter

to the Board. In this letter, the Board stated that, after reviewing ETFS’ proposals, it concluded not to implement any of them

because the Board believed taking any of these actions would undermine the Company’s long-term growth strategy and value-creation

initiatives for the reasons set forth therein. The letter, among other things, also highlighted the Company’s engagement with ETFS

over the prior two years, discussed the Company’s corporate governance practices, and claimed that the Company has a track record

of delivering value to stockholders and that it has a clear and compelling strategy for the future. |

| · | On March 18, 2024, the Company announced it was extending the expiration

of its Poison Pill to March 17, 2025, provided that if stockholders did not ratify the Board’s approval of the extension of the

Poison Pill at the 2024 Annual Meeting, then the Poison Pill would expire by the close of business on the first day after the 2024 Annual

Meeting. |

| · | On March 21, 2024, ETFS issued a public letter to stockholders in response to the Company’s unconventional

public response to Mr. Tuckwell’s private communications to the Board. In this letter, ETFS discussed its attempts to constructively

engage with the Company both recently and over the prior three years, its concerns with the Company’s ill-advised strategy of trying

to transform the Company from an ETF business to a DeFi business, and its belief that further change to the Board is required to break

the status quo. |

| · | On

April 12, 2024, the Company filed a preliminary proxy statement with the SEC in connection

with the 2024 Annual Meeting. |

| · | On April 17, 2024, ETFS filed its preliminary proxy statement with the SEC in connection with the 2024

Annual Meeting. |

| · | On

April 19, 2024, the Company filed a new preliminary proxy statement with the SEC in connection

with the 2024 Annual Meeting. |

| · | On

April 26, 2024, the Company filed a revised preliminary proxy statement with the SEC in connection

with the 2024 Annual Meeting. |

| · | On

April 29, 2024, the Company filed its definitive proxy statement with the SEC in connection

with the 2024 Annual Meeting. |

| · | On

April 30, 2024, ETFS filed a revised preliminary proxy statement with the SEC in connection

with the 2024 Annual Meeting. |

| · | On May 3, 2024, ETFS filed this definitive proxy statement with the SEC in connection with the 2024 Annual

Meeting. |

REASONS FOR THE SOLICITATION

WE BELIEVE THAT IMMEDIATE ACTION IS REQUIRED

BY THE BOARD TO UNLOCK SIGNIFICANT VALUE FOR ALL STOCKHOLDERS BY INITIATING A STRATEGIC REVIEW OF WISDOMTREE’S CORE ETF BUSINESS

AND ITS DEFI BUSINESSES

For

many years now WisdomTree has embarked on what we believe is an ill-advised strategy of trying to transform the Company from an ETF business

to a DeFi business, which has, in our view, resulted in the core ETF business being poorly managed whilst the Company’s DeFi efforts

have floundered. Specifically, as discussed below, WT Prime and the Company’s Bitcoin ETF have been unsuccessful in generating

any meaningful market interest and appear to have diverted management’s attention from the Company’s principal ETF business,

where we believe the true value of WisdomTree lies. After years of attempting to constructively engage with the Company, it is clear

to us that the Board is incapable of acknowledging the value destruction caused by this ill-advised strategy and of accepting that a

change of strategy is urgently needed to restore and unlock the true value of the Company.

We strongly

believe change is needed and we ask that you vote with us to precipitate that change. We are voting to tell the Board they must appoint

an independent financial advisor to examine strategic alternatives, including casting a critical eye over the Company’s existing

strategy. We believe any qualified and independent financial advisor will conclude that there is substantial value to be unlocked, as

detailed below.

The way to vote for this change is to follow ETFS’ voting recommendation

and to vote AGAINST the re-election of the following director nominees, Messrs. Steinberg, Neuger and Bossone. We believe a stockholder

majority vote against the re-election of Mr. Steinberg, as Chief Executive Officer of the Company, Mr. Neuger, as Chairman of the Board,

and Mr. Bossone, as a member of the Compensation Committee of the Board, each of whom serve in significant leadership positions at the

Company and, as the longest-tenured directors, have supported management’s efforts to transform WisdomTree into a DeFi business

by investing in WisdomTree Prime, Bitcoin ETFs and other unrelated ventures, will send a clear and unequivocal message to the Board that

they are dissatisfied with the status quo and that the Board must appoint an independent financial advisor to examine strategic alternatives

to restore value for all stockholders.

To be

clear, we are not seeking to take over the Company or nominate individuals for election to the Board, and we also have no desire to significantly

destabilize the Company by potentially having all members of the Board fail to receive the requisite number of votes for their re-election.

Rather, we are seeking to compel the Board to restore value for all stockholders.

No Amount of Bluster by the

Company can Paper Over the Following Compelling Conclusions which the Board Refuses to Acknowledge

| 1) | Based on our substantial ETF industry expertise,

we believe WisdomTree trades at a significant discount to its intrinsic value if it were

a well-run pure-play ETF business. We also believe that WisdomTree’s current

valuation represents a significant discount to what its ETF business could be worth to a

strategic investor. |

| 2) | We believe the core ETF business

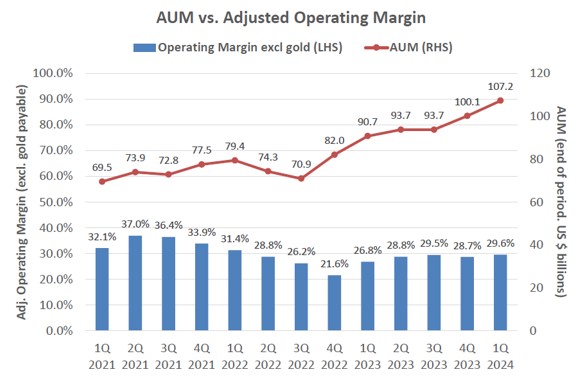

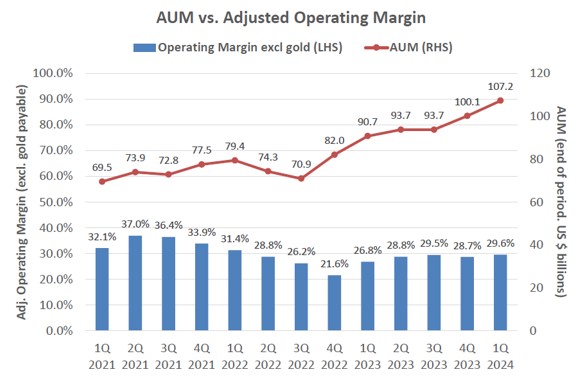

has been poorly managed, as measured by the following ETF industry metrics: |

| Ø |

Based on our substantial ETF industry experience and expertise, the

operating margin for a well-run ETF business should be around 40% to 45%1 rather than the approximately 28.5% for the Company

(based on 2023 annual figures removing contractual Gold payments and activist campaign related costs).2 So it appears to us

that the Company is wasting around 11.5% to 16.5% of its revenues on unnecessary expenses. With the Company’s global ETF revenues

running at $389 million per annum,3 that means WisdomTree could reduce its expenses by $58 million per annum which, at a tax

rate of 25% and a PE multiple of 14x, would translate into an additional $613 million of stockholder value.4

|

1

Our assertion that WisdomTree’s operating margin should be in the

range of 40% to 45% is based on the operating margin for Blackrock, Inc.’s ETF business, which is 45% according to ETFS’ calculations

(https://ir.blackrock.com/financials/quarterly-results/default.aspx), as well as ETFS’ extensive experience in investing and managing

ETF businesses. Specifically, ETFS Capital managed a successful ETF business which it sold to WisdomTree in 2018. Since then, ETFS Capital

has invested in leading ETF companies such as 21 Shares – a company that offers the largest suite of crypto-currency ETFS in the

world. Furthermore, WisdomTree itself has discussed achieving incremental margins greater than 50% in its quarterly earnings presentations

since 2022 (https://ir.wisdomtree.com/news-events/presentations), which provides further credence to

ETFS’ assertion that the Company’s core ETF business should achieve operating margin of 40-45%.

2

Company 2023 Annual Report on Form 10-K.

3

Run rate revenues as of March 31, 2024, calculated using WisdomTree data on the Company’s website.

4

Assumed global tax rate of 25% as disclosed in the Company’s 2023 Annual Report on Form 10-K. PE multiple based on

LTM earnings as of April 16, 2024. FactSet.

| Ø | WisdomTree

has lost significant ETF market share in the US compared to its main competitors (being ProShares,

Van Eck and Global X). When WisdomTree was still focused on its core ETF business (six years

ago), it had approximately 37% of the market share amongst those four, but that has now declined

to approximately 28%.5

Had WisdomTree maintained its market share, it would have an extra $23 billion of AUM6

and an extra $412 million of stockholder value.7 |

| Ø | The

combined loss in value from the above two items is $1,025 million, which, in our view, has

all been caused by poor management of the core ETF business. |

| 3) | The DeFi initiatives

have been a massive distraction and utterly unsuccessful in our view, as evidenced by: |

| Ø | A

huge event in crypto ETFs occurred in January 2024 when the SEC finally approved the launch

of physical Bitcoin ETFs. Despite the hype from WisdomTree about it being a significant player

in crypto ETFs, it has managed to garner only 0.2% in market share measured in AUM and is

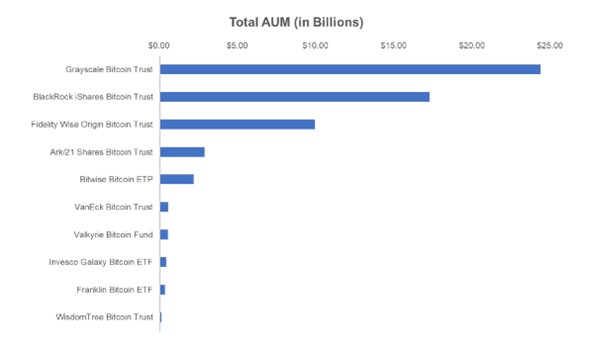

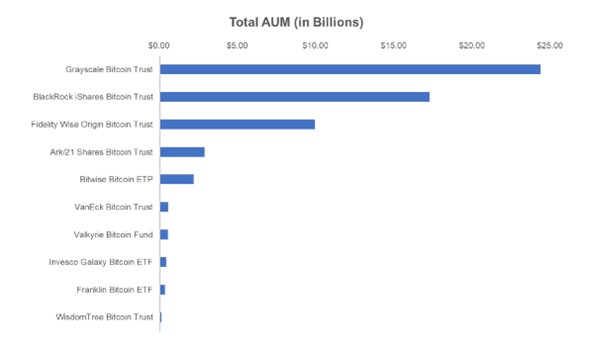

floundering in 8th place in issuer rankings as shown in the chart below;8 |

Source: https://blockworks.co/bitcoin-etf

| Ø | In

Europe, where crypto ETFs have been listed for a number of years and WisdomTree was an early

entrant, the Company is struggling in 4th place in issuer rankings.9 It has only

garnered 6% in market share measured in AUM, but even worse, it only has 1% in market share

of run-rate revenues;10

and |

| Ø | WT

Prime has not been able to gain any traction, with run-rate revenues a mere $0.03 million

per annum.11 The

app is a poor offering compared to what firms such as Schwab offer in our view and there

is no logical reason for investors to sign up to it other than for those curious to see how

bad it is. Given the amount of time and money the Company has spent and wasted on this, we

believe the Board should expect it to be earning millions in revenue by now – it is

not. The Company has refused to provide information on WT Prime related revenue or KPIs that

would allow stockholders to properly evaluate its performance and hold the Board accountable. |

We believe

that, as a result of its misguided ‘transformation’ strategy, WisdomTree has lost focus on the core ETF business, which despite

record AUM, suffers from poor profitability, as demonstrated below.12

Even though the ETF business model is highly scalable, management has yet to achieve the requisite operating leverage that translates

record growth in AUM and net inflows into comparable gains in earnings growth and profitability.

5

As of end-March 2018 WisdomTree’s AUM was $43 billion and the combined AUM of all four companies was $116 billion

for the US businesses, giving WisdomTree a market share of 37%. As of end-March 2024 WisdomTree’s AUM was $78 billion and the combined

AUM of all four companies was $274 billion for the US businesses, giving WisdomTree a market share of 28%. Based on AUM data calculated

and provided by Bloomberg using a Bloomberg Terminal.

6

Assuming 37% market share of combined AUM of $274 billion per note 5 above.

7

Applying WisdomTree’s current blended average fee rate of 36 bps pa to incremental AUM of $23 billion gives $83 million

of additional revenue. Assuming an incremental operating margin of 45% and a US tax rate of 21% gives $29 million of post-tax earnings,

which at a PE of 14x gives $412 million of value. Fee rate of 36 bps pa taken from WisdomTree Report of Monthly Metrics for March 2024.

WisdomTree Q4 2023 Earnings Presentation states an incremental operating margin of over 50% but ETFS assumes only 45%. PE of 14x per

note 3 above.

8

These results are far worse if the legacy crypto ETF products of Grayscale and ProShares are included. Based on data calculated

and provided by Bloomberg using a Bloomberg Terminal.

9

Based on AUM data calculated and provided by Bloomberg using a Bloomberg Terminal.

10

Based on AUM data calculated and provided by Bloomberg using a Bloomberg Terminal.

11 Run

rate revenues as of April 16, 2024 calculated using WisdomTree Digital Fund data found at

https://www.wisdomtree.com/investments/digital-funds.

12

Company SEC filings.

Source: Company SEC filings

The Board and Management

Appear Unwilling to Make Necessary Changes Unless Pushed by Stockholders. We Believe this “VOTE AGAINST” Campaign is the

Only Way of Getting the Board to Conduct an Independent Strategic Review to Unlock Value for all Stockholders, Particularly Given the

Significant Leadership Positions That Messrs. Steinberg, Neuger and Bossone Occupy at the Company.

Over

the past three years, we have attempted to address operational and governance failures at the Company through patient and direct engagement

with the Board and management of WisdomTree and by nominating individuals for election to the Board. Following our multi-year engagement

with the Company, we believe that the Board will not be truly open to ending the status quo and examining strategic alternatives without

being pushed by stockholders, particularly while these long tenured directors continue to serve on the Board and in leadership positions

at the Company.

We

believe our prior proxy campaign and public engagement with the Company has highlighted important issues for stockholders including:13,

14

| · | The value destruction suffered by stockholders, including ETFS, since we sold our market leading European

ETC business to WisdomTree in 2018. |

| · | ETFS’ belief that the Board and management have been unable to articulate a credible strategy for

stockholder value creation – a situation that we believe persists today. |

| · | Our

concerns about the Company’s WT Prime effort to diversify into DeFi as set forth above. |

| · | Poor corporate governance and flawed refreshment of the Board, including long-tenured directors and committee

chairs, a pay-for-performance disconnect, and the expansion of golden parachute change in control provisions that were triggered by a

loss of majority Board control by incumbents. |

| · | An urgent need for an infusion of skills, experience, expertise and fresh stockholder-focused perspective

on the Board. |

Unfortunately,

the resulting change to WisdomTree’s Board, as a result of our engagement and the incremental Board change we were able to bring

about, appears to have been insufficient to compel the Board to take the actions that we believe are necessary to unlock value.

We believe

the Company’s significant undervaluation could be addressed by WisdomTree undertaking a strategic review to unlock the value of

its core ETF business. However, the Board’s continued rejection of our good faith engagement on this issue led us to conclude that

the Board needed to hear from a plurality of the Company’s stockholders before they will take action.

As a

referendum on the Company’s failed diversification strategy and the Board’s refusal to unlock value through a strategic review

process, we believe voting AGAINST the re-election of Messrs. Steinberg, Neuger and Bossone would send a strong message to the

Board to undertake the much-needed strategic review process to unlock the value inherent in WisdomTree’s core ETF business.

For

the avoidance of doubt, even if Messrs. Steinberg, Neuger and Bossone are not re-elected to the Board at the 2024 Annual Meeting, if

the remaining Company Nominees are re-elected at the 2024 Annual Meeting, they will constitute a majority of the Board. In addition,

even if Messrs. Steinberg, Neuger and Bossone are not re-elected to the Board at the 2024 Annual Meeting and tender their respective

resignations in accordance with the Company’s Fourth Amended and Restated Bylaws (the “Bylaws”), and the Board determines

to accept such resignations, the Board may nonetheless re-appoint any of Messrs. Steinberg, Neuger and Bossone to the Board after the

2024 Annual Meeting under the Company’s Amended and Restated Certificate of Incorporation, as amended (the “Certificate of

Incorporation”), and the Bylaws. Notwithstanding the foregoing, for the reasons set forth above, we urge stockholders to join us

in voting AGAINST the re-election of Messrs. Steinberg, Neuger and Bossone.

13

ETFS 2023 definitive proxy statement: https://www.sec.gov/Archives/edgar/data/880631/000092189523001037/defc14a13246002_05042023.htm.

14

ETFS letter to stockholders, dated May 4, 2023: https://www.sec.gov/Archives/edgar/data/880631/000092189523001042/ex1todfan14a13246002_050423.pdf.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

As of the 2024 Annual

Meeting, the Company will have an annually elected Board composed of nine (9) directors. We believe that the terms of all nine (9) directors

currently serving on the Board expire at the 2024 Annual Meeting. For the reasons stated above, we are seeking your support at the 2024

Annual Meeting to vote AGAINST the election of Messrs. Steinberg, Neuger and Bossone.

The Company has adopted

a majority vote standard for uncontested elections. Since we are not proposing an alternate slate of directors, the election is considered

to be uncontested despite our opposition to the election of certain of the Company Nominees. According to the Bylaws, a nominee for director

shall be elected to the Board if the number of votes cast “for” such nominee’s election exceeds the number of votes

cast “against” such nominee’s election. The Bylaws also set forth a resignation policy for uncontested elections, which

provides that if an incumbent director is not re-elected, the director shall tender his or her resignation to the Board. The Nominating

and Governance Committee of the Board will make a recommendation to the Board on whether to accept or reject the resignation, or whether

other action should be taken. The Board will act on the recommendation of such committee and will publicly disclose its decision within

90 days from the date of the certification of the election results.

Accordingly, if we

are successful in soliciting your support to vote AGAINST the election of each of Messrs. Steinberg, Neuger and Bossone such that

they receive more votes “against” their election than votes “for” their election at the 2024 Annual Meeting,

each of Messrs. Steinberg, Neuger and Bossone must tender his resignation, effective immediately upon the failure to receive the required

vote, and the Board, upon the Nominating and Governance Committee’s recommendation, must determine whether to accept the resignations

tendered by each of Messrs. Steinberg, Neuger and Bossone.

For the avoidance of

doubt, even if Messrs. Steinberg, Neuger and Bossone are not re-elected to the Board at the 2024 Annual Meeting, if the remaining Company

Nominees are re-elected at the 2024 Annual Meeting, they will constitute a majority of the Board. In addition, even if Messrs. Steinberg,

Neuger and Bossone are not re-elected to the Board at the 2024 Annual Meeting and tender their respective resignations in accordance

with the Bylaws, and the Board determines to accept such resignations, the Board may nonetheless reappoint Messrs. Steinberg, Neuger

and Bossone to the Board after the 2024 Annual Meeting under the Certificate of Incorporation and the Bylaws. Notwithstanding the foregoing,

for the reasons set forth above, we urge stockholders to join us in voting AGAINST the re-election of Messrs. Steinberg, Neuger

and Bossone.

This Proxy Statement

and the enclosed GOLD proxy card includes the ability to vote for all Company Nominees, including Lynn S. Blake, Anthony Bossone,

Smita Conjeevaram, Rilla Delorier, Daniela Mielke, Shamla Naidoo, Tonia Pankopf, Win Neuger and Jonathan Steinberg. Please note, however,

that the Company Nominees are not the nominees of ETFS and are the nominees of the Company. Because the Company Nominees are not ETFS’

nominees, they are not participants in this solicitation. We can provide no assurance that any of the Company Nominees will serve as

directors if elected. The names, backgrounds and qualifications of the Company Nominees, and other information about them, can be found

in the Company’s proxy statement.

IF YOU MARK FEWER

THAN A TOTAL OF NINE (9) “FOR”, “AGAINST” OR “ABSTAIN” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS,

OUR GOLD PROXY CARD, WHEN DULY EXECUTED, WILL BE VOTED ONLY AS DIRECTED.

WE STRONGLY URGE YOU TO VOTE “AGAINST”

THE ELECTION OF MESSRS. STEINBERG, NEUGER AND BOSSONE ON THE ENCLOSED GOLD PROXY CARD

WE MAKE NO RECOMMENDATION

WITH RESPECT TO THE ELECTION OF THE OTHER COMPANY NOMINEES

PROPOSAL NO. 2

RATIFICATION OF THE APPOINTMENT OF ERNST

& YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further

detail in the Company’s proxy statement, the Audit Committee of the Board has appointed Ernst & Young LLP as the Company’s

independent registered public accounting firm for the fiscal year ending December 31, 2024.

As disclosed in the Company’s

proxy statement, the Company’s organizational documents do not require that the stockholders ratify the selection of Ernst &

Young LLP as the Company’s independent registered public accounting firm, but the Company is submitting the selection of Ernst &

Young LLP for ratification by stockholders at the 2024 Annual Meeting. The Company has disclosed that if stockholders do not ratify the

selection, the Audit Committee will reconsider whether to retain Ernst & Young LLP, but still may retain them. The Company has further

disclosed that, even if the selection is ratified, the Audit Committee, in its discretion, may change the appointment at any time during

the year if it determines that such a change would be in the best interests of the Company and its stockholders.

According to the Company’s

proxy statement, the affirmative vote of a majority of votes cast is necessary for the ratification of the appointment of Ernst &

Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024.

WE MAKE NO RECOMMENDATION WITH RESPECT TO

THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR

THE FISCAL YEAR ENDING DECEMBER 31, 2024 AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL

PROPOSAL NO. 3

VOTE ON AN ADVISORY RESOLUTION

TO APPROVE THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

As discussed in further

detail in the Company’s proxy statement, as required by Section 14A(a)(1) of the Securities Exchange Act of 1934 (the “Exchange

Act”), the Board is providing stockholders with an opportunity to vote on an advisory resolution to approve the compensation of

the Company’s named executive officers, which is discussed in further detail in the section titled “Executive Compensation

- Compensation Discussion and Analysis” in the Company’s proxy statement. Accordingly, the Board is asking stockholders to

approve the following resolution:

“RESOLVED, that the

Company’s stockholders hereby approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the

Company’s proxy statement for the 2024 annual meeting of stockholders pursuant to the compensation disclosure rules of the Securities

and Exchange Commission, including the Compensation Discussion and Analysis, the Summary Compensation Table and the other compensation

related tables and disclosure.”

As disclosed in the Company’s

proxy statement, as this vote is advisory, it will not be binding on the Board or the Compensation Committee of the Board and neither

the Board nor the Compensation Committee of the Board will be required to take any action as a result of the outcome of this vote. However,

the Board and the Compensation Committee of the Board will carefully consider the outcome of this vote when considering future executive

compensation policies.

According to the Company’s

proxy statement, the affirmative vote of a majority of votes cast is necessary for the approval of the advisory resolution to approve

the compensation of the Company’s named executive officers.

WE MAKE NO RECOMMENDATION WITH RESPECT TO

THE ADVISORY VOTE ON EXECUTIVE COMPENSATION AND INTEND TO VOTE OUR SHARES “AGAINST” THIS PROPOSAL

PROPOSAL NO. 4

NON-BINDING, ADVISORY VOTE ON THE FREQUENCY

OF FUTURE ADVISORY VOTES TO APPROVE THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

As discussed in further

detail in the Company’s proxy statement, as required by Section 14A(a)(2) of the Exchange Act, the Board is providing stockholders

with an opportunity to provide an advisory vote to recommend whether the vote on the advisory resolution on the compensation of the Company’s

named executive officers should occur every one, two or three years.

As disclosed in the Company’s

proxy statement, since this vote is advisory, the results will not be binding upon the Board and the Board may decide to hold an advisory

vote on executive compensation more or less frequently than the frequency receiving the most votes cast by stockholders. However, the

Board will carefully consider the outcome of this vote when considering the frequency of future advisory votes on executive compensation.

According to the Company’s

proxy statement, the non-binding, advisory vote on the frequency of future advisory votes to approve the compensation of the Company’s

named executive officers will be determined based on a plurality of the votes cast. This means that the option that receives the most

votes (every one year, every two years or every three years) will be approved on a non-binding, advisory basis.

WE MAKE NO RECOMMENDATION WITH RESPECT TO

THIS PROPOSAL AND INTEND TO VOTE OUR SHARES “ONE YEAR”

PROPOSAL NO. 5

RATIFICATION OF THE APPROVAL BY THE BOARD

OF THE EXTENSION OF THE

STOCKHOLDER RIGHTS AGREEMENT

As discussed in further

detail in the Company’s proxy statement, on March 17, 2023, the Board adopted the Poison Pill, which has subsequently been amended.

According to the Company’s

proxy statement, stockholders are being asked to ratify the Board’s approval of the extension of the Poison Pill to the close of

business on March 17, 2025. Stockholder ratification of the Board’s approval of the extension of the Poison Pill is not required

by applicable law, or by the Certificate of Incorporation, Bylaws or other governing documents. Nonetheless, according to the Company’s

proxy statement, the Board has determined to request stockholder ratification of the Board’s approval of the extension of the Poison

Pill to determine the viewpoint of stockholders as to the advisability of the Poison Pill. If stockholders do not ratify the Board’s

approval of the extension of the Poison Pill, it will expire automatically at the close of business on the day after the 2024 Annual

Meeting.

According to the Company’s

proxy statement, the affirmative vote of a majority of votes cast is necessary to ratify the Board’s approval of the extension of

the Poison Pill.

WE MAKE NO RECOMMENDATION WITH RESPECT TO

THE RATIFICATION OF THE BOARD’S APPROVAL OF THE EXTENSION OF THE POISON PILL AND INTEND TO VOTE OUR SHARES “AGAINST”

THIS PROPOSAL

VOTING AND PROXY PROCEDURES

Only stockholders of record

on the Record Date will be entitled to notice of and to vote at the 2024 Annual Meeting. Stockholders who sell their shares of Common

Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares. Stockholders of record

on the Record Date will retain their voting rights in connection with the 2024 Annual Meeting even if they sell such shares after the

Record Date. Based on publicly available information, ETFS believes that the only outstanding class of securities of the Company entitled

to vote at the 2024 Annual Meeting is the Common Stock.

Shares of Common Stock

represented by properly executed GOLD proxy cards will be voted at the 2024 Annual Meeting as marked and, in the absence of specific

instructions, will be voted “AGAINST” the election of each of Messrs. Steinberg, Neuger and Bossone and FOR the

election of the remaining Company Nominees, FOR the ratification of the appointment of Ernst & Young LLP as the Company’s

independent registered public accounting firm for the fiscal year ending December 31, 2024, AGAINST the advisory resolution to

approve the compensation of the Company’s named executive officers, ONE YEAR on the advisory vote on the frequency of future

advisory votes to approve the compensation of the Company’s named executive officers, AGAINST the ratification of the Board’s

approval of the extension of the Poison Pill and in the discretion of the persons named as proxies on all other matters as may properly

come before the 2024 Annual Meeting, as described herein.

This Proxy Statement

and the enclosed GOLD proxy card includes the ability to vote for all Company Nominees, including Lynn S. Blake, Anthony Bossone,

Smita Conjeevaram, Rilla Delorier, Daniela Mielke, Shamla Naidoo, Tonia Pankopf, Win Neuger and Jonathan Steinberg. Please note, however,

that the Company Nominees are not the nominees of ETFS and are the nominees of the Company. The names, backgrounds and qualifications

of the Company Nominees, and other information about them, can be found in the Company’s proxy statement. We can provide no assurance

that any of the Company Nominees will serve as directors if elected.

IF YOU MARK FEWER THAN

A TOTAL OF NINE (9) “FOR”, “AGAINST” OR “ABSTAIN” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS,

OUR GOLD PROXY CARD, WHEN DULY EXECUTED, WILL BE VOTED ONLY AS DIRECTED.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum

number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct

business at the meeting. According to the Company’ proxy statement, for the 2024 Annual Meeting, the presence, in person or by

proxy, of holders of at least a majority of the total number of outstanding shares entitled to vote at the 2024 Annual Meeting is necessary

to constitute a quorum for the transaction of business at the 2024 Annual Meeting. Shares held of record by stockholders or brokers,

bankers or other nominees who do not return a signed and dated proxy card or voting instruction form or attend the 2024 Annual Meeting

will not be considered present or represented at the 2024 Annual Meeting and will not be counted in determining the presence of a quorum.

Abstentions and broker non-votes, if any, will be counted for purposes of determining whether a quorum is present for the transaction

of business at the 2024 Annual Meeting.

If you are a stockholder

of record, you must deliver your vote by mail, attend the 2024 Annual Meeting in person and vote or vote by telephone in order to be

counted in the determination of a quorum.

If you are a beneficial

owner, your broker will vote your shares pursuant to your instructions, and those shares will count in the determination of a quorum.

A broker non-vote occurs when a broker holding shares for a beneficial owner has discretionary authority to vote on “routine”

matters brought before a stockholder meeting, but the beneficial owner of the shares fails to provide the broker with specific instructions

on how to vote on any “non-routine” matters brought to a vote at the stockholder meeting. Under the rules governing brokers’

discretionary authority, if a stockholder receives proxy materials from or on behalf of both ETFS and the Company, then brokers holding

shares in such stockholder’s account will not be permitted to exercise discretionary authority regarding any of the proposals to

be voted on at the Annual Meeting, whether “routine” or not. As a result, there would be no broker non-votes by such brokers.

In such case, if you do not submit any voting instructions to your broker, then your shares will not be counted in determining the outcome

of any of the proposals at the 2024 Annual Meeting, nor will your shares be counted for purposes of determining whether a quorum exists.

However, if you receive proxy materials only from the Company, then brokers will be entitled to vote your shares on “routine”

matters without instructions from you. The only proposal that would be considered “routine” in such event is Proposal 2 (ratification

of the appointment of the Company’s independent registered public accounting firm). A broker will not be entitled to vote your

shares on any “non-routine” matters, absent instructions from you. We urge you to instruct your broker about how you wish

your shares to be voted.

VOTES REQUIRED FOR APPROVAL

Election of Directors

– The Company has adopted a majority vote standard for uncontested director elections. This means that each nominee who receives

a number of votes cast “for” his or her election that exceeds the number of votes cast “against” his or her election

will be elected to the Board. According to the Company’s proxy statement, abstentions and broker non-votes will have no effect on

the election of the directors. In a contested election, the required vote would be a plurality of votes cast.

The Bylaws set forth a

resignation policy for uncontested elections, pursuant to which any nominee who does not receive a majority of votes cast “for”

his or her election would be required to tender his or her resignation promptly following, and effective upon, the failure to receive

the required vote. The Nominating and Governance Committee of the Board will make a recommendation to the Board on whether to accept or

reject the resignation, or whether other action should be taken. The Board will act on the recommendation of such committee and will publicly

disclose its decision within 90 days from the date of the certification of the election results.

Ratification of the

Selection of Accounting Firm – According to the Company’s proxy statement, the affirmative vote of a majority of votes

cast is necessary for the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public

accounting firm for the fiscal year ending December 31, 2024. According to the Company’s proxy statement, abstentions and broker

non-votes, if any, will have no effect on the proposal.

Advisory Vote on Executive

Compensation – According to the Company’s proxy statement, the affirmative vote of a majority of votes cast is necessary

for the approval of the advisory resolution to approve the compensation of the Company’s named executive officers. According to

the Company’s proxy statement, abstentions and broker non-votes, if any, will have no effect on the proposal.

Advisory Vote on the

Frequency of Future Advisory Votes on Executive Compensation – According to the Company’s proxy statement, this proposal

will be determined based on a plurality of the votes cast. This means that the option that receives the most votes (every one year, every

two years or every three years) will be approved on a non-binding, advisory basis. According to the Company’s proxy statement, abstentions

and broker non-votes, if any, will have no effect on the proposal.

Ratification of the

Board’s Approval of the Extension of the Stockholder Rights Agreement – According to the Company’s proxy statement,

the affirmative vote of a majority of votes cast is necessary for the ratification of the Board’s approval of the extension of the

Poison Pill. According to the Company’s proxy statement, abstentions and broker non-votes, if any, will have no effect on the proposal.

Under applicable Delaware

law, none of the holders of Common Stock are entitled to appraisal rights in connection with any matter to be acted on at the 2024 Annual

Meeting.

If you sign and submit

your GOLD proxy card without specifying how you would like your shares voted, your shares will be voted AGAINST the election

of Messrs. Steinberg, Neuger and Bossone and FOR the election of the remaining Company Nominees up for election at the 2024 Annual

Meeting, FOR the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public

accounting firm for the fiscal year ending December 31, 2024, AGAINST approval of the advisory vote on the compensation of the

Company’s named executive officers, ONE YEAR on the vote on the frequency of future advisory votes to approve the compensation

of the Company’s named executive officers, AGAINST the ratification of the Board’s approval of the extension of the

Poison Pill and in accordance with the discretion of the persons named on the GOLD proxy card with respect to any other matters

that may be voted upon at the 2024 Annual Meeting.

REVOCATION OF PROXIES

Stockholders of the

Company may revoke their proxies at any time prior to exercise by attending the 2024 Annual Meeting and voting in person (although, attendance

at the 2024 Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation.

The delivery of a written revocation or a subsequently dated proxy which is properly completed will constitute a revocation of any earlier

proxy. The revocation may be delivered either to ETFS in care of Saratoga at the address set forth on the back cover of this Proxy Statement

or to the Secretary of the Company at the Company’s principal executive offices located at 250 West 24th Street, 3rd

Floor West, New York, NY 10119 or any other address provided by the Company. Although a revocation is effective if delivered to

the Company, we request that either the original or photostatic copies of all revocations be mailed to ETFS in care of Saratoga at the

address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine

if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding shares entitled

to be voted at the 2024 Annual Meeting. Additionally, Saratoga may use this information to contact stockholders who have revoked their

proxies in order to solicit later dated proxies to vote “AGAINST” the election of each of Messrs. Steinberg, Neuger

and Bossone.

IF YOU WISH TO VOTE "AGAINST”

THE RE-ELECTION OF MESSRS. STEINBERG, NEUGER AND BOSSONE TO THE BOARD, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED GOLD

PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION OF PROXIES

The solicitation of

proxies pursuant to this Proxy Statement is being made by ETFS. Proxies may be solicited by mail, facsimile, e-mail, in person and by

advertisements.

ETFS Capital has entered

into an agreement with Saratoga for solicitation and advisory services in connection with this solicitation, for which Saratoga will receive

a fee not to exceed $75,000, together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain

liabilities and expenses, including certain liabilities under the federal securities laws. Saratoga will solicit proxies from individuals,

brokers, banks, bank nominees and other institutional holders. We have requested banks, brokerage houses and other custodians, nominees

and fiduciaries to forward all solicitation materials to the beneficial owners of the shares of Common Stock they hold of record. ETFS

Capital will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. In addition, directors and officers

of ETFS Capital may solicit proxies in the normal course of their duties without any additional compensation. It is anticipated that Saratoga

will employ approximately 15 persons to solicit stockholders for the 2024 Annual Meeting.

The entire expense of soliciting

proxies is being borne by ETFS Capital. Costs of this solicitation of proxies are currently estimated to be approximately $525,000 (including,

but not limited to, fees for attorneys, solicitors and other advisors, and other costs incidental to the solicitation). ETFS Capital estimates

that through the date hereof its expenses in connection with this solicitation are approximately $255,000. To the extent legally permissible,

if ETFS Capital is successful in its proxy solicitation, ETFS Capital intends to seek reimbursement from the Company for the expenses

it incurs in connection with this solicitation. ETFS Capital does not intend to submit the question of such reimbursement to a vote of

security holders of the Company.

ADDITIONAL PARTICIPANT INFORMATION

The Participants in this

proxy solicitation are ETFS Capital and Graham Tuckwell. ETFS Capital is a private company incorporated in the Bailiwick of Jersey, Channel

Islands, and Graham Tuckwell is a citizen of Australia. The principal business of ETFS Capital is serving as an investment company. The

principal occupation of Mr. Tuckwell is serving as the Founder and Executive Chairman of ETFS Capital. The principal business address

of ETFS Capital is Ordnance House, 31 Pier Road, St. Helier, Jersey JE2 4XW. The principal business address of Mr. Tuckwell is 15 Rathbone

Place, London W1T 1HU, United Kingdom.

As of the date hereof,

ETFS Capital directly beneficially owns 15,250,000 shares of Common Stock as well as 14,750 shares of Series A Preferred Stock. Pursuant

to the Series A Certificate of Designation, no Holder shall have the right to convert any shares of Series A Preferred Stock into shares

of Common Stock if, after such conversion, such Holder and certain of its affiliates would be deemed to beneficially own, as determined

in accordance with Section 13(d) of the Exchange Act, more than 9.99% of the Company’s then outstanding shares of Common Stock (the

“Beneficial Ownership Limitation”). As of the date hereof, none of the 14,750 shares of Series A Preferred Stock is currently,

and is not expected within 60 days to be, convertible into any shares of Common Stock due to the Beneficial Ownership Limitation. Neither

ETFS Capital nor Mr. Tuckwell has entered into any transactions in the securities of the Company during the past two years. As the Executive

Chairman and controlling shareholder of ETFS Capital, Mr. Tuckwell may be deemed to be an indirect beneficial owner of the 15,250,000

shares of Common Stock directly owned by ETFS Capital and the 14,750 shares of Series A Preferred Stock directly owned by ETFS Capital.

ETFS Capital and Mr.

Tuckwell may be deemed to be members of a “group” with each other for the purposes of Section 13(d)(3) of the Exchange Act,

and such group may be deemed to beneficially own the 15,250,000 shares of Common Stock owned in the aggregate by all of the Participants,

as well as the 14,750 shares of the Series A Preferred Stock. Each of the Participants disclaims beneficial ownership of the shares of

Common Stock that he or it does not directly own.

The shares of Common Stock

and Series A Preferred Stock beneficially owned by ETFS Capital and Mr. Tuckwell were acquired on April 11, 2018 pursuant to the Share

Sale Agreement, dated as of November 13, 2017 (the “Share Sale Agreement”), by and among the Company, WisdomTree International

Holdings Ltd, a wholly-owned subsidiary of the Company, and ETFS Capital. In connection with the Share Sale Agreement, in April 2018 the

Company assumed a deferred consideration obligation to ETFS Capital. The obligation consisted of fixed payments to ETFS Capital of physical

gold bullion equating to 9,500 ounces of gold per year through March 31, 2058 and thereafter 6,333 ounces of gold continuing into perpetuity

(“Contractual Gold Payments”). The Contractual Gold Payments were paid from management fee income generated by any of the

Company’s sponsored financial products backed by physical gold. Pursuant to internal arrangements with ETFS Capital, Mr. Tuckwell

had an indirect interest in the Contractual Gold Payments made by the Company to ETFS Capital. On May 10, 2023, the Company entered into

and closed on a Sale, Purchase and Assignment Deed (the “SPA Agreement”) relating to the Contractual Gold Payments with WisdomTree

International Holdings Ltd, Electra Target HoldCo Limited, ETFS Capital, the World Gold Council, Gold Bullion Holdings (Jersey) Limited

(“GBH”), a subsidiary of WGC, Mr. Tuckwell and Rodber Investments Limited (“RIL”), an entity controlled by Mr.

Tuckwell, to extinguish the Company’s obligations relating to the Contractual Gold Payments. Pursuant to the SPA Agreement, the

Company issued 13,087 shares of Series C Non-Voting Convertible Preferred Stock, $0.01 par value per share (the “Series C Preferred

Shares”), which were convertible into 13,087,000 Shares to GBH (but were subsequently repurchased by the Company) and paid an aggregate

of approximately $50 million. The consideration paid pursuant to the SPA Agreement resulted in GBH receiving approximately $4.4 million

in cash and the Series C Preferred Shares, and RIL receiving approximately $45.6 million in cash.

Except as set forth in

this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no Participant has been convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors); (ii) no Participant directly or indirectly beneficially owns any securities of

the Company; (iii) no Participant owns any securities of the Company which are owned of record but not beneficially; (iv) no Participant

has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the

securities of the Company owned by any Participant is represented by funds borrowed or otherwise obtained for the purpose of acquiring

or holding such securities; (vi) no Participant is, or within the past year was, a party to any contract, arrangements or understandings

with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements,

puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies;

(vii) no associate of any Participant owns beneficially, directly or indirectly, any securities of the Company; (viii) no Participant

owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no Participant or any of his

or its associates or immediate family members was a party to any transaction, or series of similar transactions, since the beginning of

the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which

the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no Participant or any

of his or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or

its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; (xi)

no Participant has a substantial interest, direct or indirect, by securities holdings or otherwise in any matter to be acted on at the

2024 Annual Meeting; (xii) no Participant holds any positions or offices with the Company; (xiii) no Participant has a family relationship

with any director, executive officer, or person nominated or chosen by the Company to become a director or executive officer and (xiv)

no companies or organizations, with which any of the Participants has been employed in the past five years, is a parent, subsidiary or

other affiliate of the Company.

There are no material proceedings

to which any Participant or any of his or its associates is a party adverse to the Company or any of its subsidiaries or has a material

interest adverse to the Company or any of its subsidiaries.

OTHER MATTERS AND ADDITIONAL INFORMATION

ETFS is unaware of any

other matters to be considered at the 2024 Annual Meeting. However, should other matters, which ETFS is not aware of at a reasonable time

before this solicitation, be brought before the 2024 Annual Meeting, the persons named as proxies on the enclosed GOLD proxy card

will vote on such matters in their discretion.

Some banks, brokers and

other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This

means that only one copy of this Proxy Statement may have been sent to multiple stockholders in your household. We will promptly deliver

a separate copy of the document to you if you write to our proxy solicitor, Saratoga, at the address set forth on the back cover of this

Proxy Statement, or call toll free at (888) 368-0379. If you want to receive separate copies of our proxy materials in the future, or

if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker

or other nominee record holder, or you may contact our proxy solicitor at the above address and phone number.

The information concerning

the Company and the proposals in the Company’s proxy statement contained in this Proxy Statement has been taken from, or is based

upon, publicly available documents on file with the SEC and other publicly available information. Although we have no knowledge that would

indicate that statements relating to the Company contained in this Proxy Statement, in reliance upon publicly available information, are

inaccurate or incomplete, to date we have not had access to the books and records of the Company, were not involved in the preparation

of such information and statements and are not in a position to verify such information and statements. All information relating to any

person other than the Participants is given only to our knowledge.

This Proxy Statement is

dated May 3, 2024. You should not assume that the information contained in this Proxy Statement is accurate as of any date other than

such date, and the mailing of this Proxy Statement to stockholders shall not create any implication to the contrary.

STOCKHOLDER PROPOSALS

According to the Company’s

proxy statement, stockholders who wish to present proposals for inclusion in the Company’s proxy materials for the 2025 Annual

Meeting of Stockholders (the “2025 Annual Meeting”) may do so by following the procedures prescribed in Rule 14a-8 under

the Exchange Act. The Company’s Secretary must receive stockholder proposals intended to be included in the Company’s proxy

statement and form of proxy relating to the 2025 Annual Meeting made under Rule 14a-8 by December 30, 2024. Any proposal of business

must be mailed to Marci Frankenthaler, Secretary, WisdomTree, Inc., 250 West 34th Street, 3rd Floor, New York,

NY 10119. The Company also encourages stockholders to submit any such proposals by email to mfrankenthaler@wisdomtree.com.

According to the Company’s

proxy statement, the Bylaws permit a stockholder or group of up to 20 stockholders, who meet the eligibility requirements of the Bylaws,

to utilize the “proxy access” Bylaw provision. “Proxy access” can be used to nominate up to the greater of two

nominees or 25% of the total number of directors who are members of the Board as of the date that the stockholder(s) notifies the Company

of the intent to utilize proxy access (the “proxy access notice”). Director nominations submitted under this Bylaw provision

must be delivered to the Company no earlier than December 30, 2024, and no later than January 29, 2025. The proxy access notice must

comply with the requirements in the Bylaws. To be eligible to utilize the proxy access Bylaw provision, the stockholder(s) must have

continuously owned at least 3% of the outstanding Common Stock for at least three years as of the date of the proxy access notice. Consistent

with standard market practice, proxy access is only available to eligible stockholders who acquired the Common Stock in the ordinary

course of business and not with the intent to change or influence control at the Company and who do not presently have such intent.

According to the Company’s

proxy statement, under the current Bylaws, proposals of business other than those to be included in the Company’s proxy materials

following the procedures described in Rule 14a-8 and nominations for directors may be made by any stockholder who was a stockholder of

record at the time of the giving of notice provided for in the Bylaws, who is entitled to vote at the meeting, who is present in person

or by proxy at the meeting and who complies with the notice procedures set forth in the Bylaws (i.e., notice must be timely given and

contain the information required by the Bylaws). To be timely, a notice with respect to the 2025 Annual Meeting must be delivered to