As filed with the Securities and Exchange Commission on June 28, 2011

File No. 001-10932

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Amendment No. 2

to

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF

THE SECURITIES EXCHANGE ACT OF 1934

WisdomTree Investments, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 13-3487784 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 380 Madison Avenue, 21st Floor New York, New York |

10017 | |

| (Address of Principal Executive Office) | (Zip Code) | |

Registrant’s telephone number, including area code:

(212) 801-2080

Securities to be registered pursuant to Section 12(b) of the Act:

| Title of each class to be registered |

Name of each exchange on which each class is to be registered | |

| Common Stock, $0.01 par value per share | The Nasdaq Stock Market, LLC |

Securities to be registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

| ITEM 1. |

1 | |||||

| ITEM 1A. |

18 | |||||

| ITEM 2. |

28 | |||||

| ITEM 3. |

49 | |||||

| ITEM 4. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

50 | ||||

| ITEM 5. |

52 | |||||

| ITEM 6. |

55 | |||||

| ITEM 7. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

72 | ||||

| ITEM 8. |

74 | |||||

| ITEM 9. |

MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS |

74 | ||||

| ITEM 10. |

75 | |||||

| ITEM 11. |

77 | |||||

| ITEM 12. |

77 | |||||

| ITEM 13. |

79 | |||||

| ITEM 14. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

79 | ||||

| ITEM 15. |

80 |

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this registration statement, including documents incorporated by reference herein, constitute “forward-looking statements.” Forward-looking statements generally can be identified by the use of forward- looking terminology such as “outlook,” “objective,” “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “plans,” or “continue,” or similar expressions suggesting future outcomes or events. Such forward-looking statements reflect our current expectations regarding future events and operating performance and speak only as of the date of this registration statement. Such forward-looking statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to the assumption that the projects will operate and perform in accordance with our expectations. Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether or not or the times at or by which such performance or results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including, but not limited to, the factors discussed under “Risk Factors.” Our business is both competitive and subject to various risks.

These risks include, without limitation:

| • | We have only a limited operating history and, as a result, recent historical growth may not provide an accurate representation of the growth we may experience in the future, which will make it difficult to evaluate our future prospects. |

| • | Difficult market conditions and declining prices of securities can adversely affect our business by reducing the market value of the assets we manage or causing customers to sell their fund shares and triggering redemptions. |

| • | Volatility and disruption of the capital and credit markets, and adverse changes in the global economy, may significantly affect our results of operations and may put pressure on our financial results. |

| • | The amount and mix of our assets under management, which impact revenue, are subject to significant fluctuations. |

| • | Most of our assets under management are held in ETFs that invest in foreign securities and we have substantial exposure to foreign market conditions and we are subject to currency exchange rate risks. |

| • | We derive a substantial portion of our revenue from products invested in emerging markets and are exposed to the market-specific political and economic risks as well as general investor sentiment regarding future growth of those markets. |

| • | We derive a substantial portion of our revenue from a limited number of products and, as a result, our operating results are particularly exposed to the performance of those funds, investor sentiment toward investing in the strategies pursued by those funds and our ability to maintain the assets under management of those funds. |

Other factors, such as general economic conditions, including currency exchange rate fluctuations, also may have an effect on the results of our operations. Many of these risks and uncertainties can affect our actual results and could cause our actual results to differ materially from those expressed or implied in any forward-looking statement made by us or on our behalf. For a description of risks that could cause our actual results to materially differ from our current expectations, please see Item 1A. “Risk Factors” in this registration statement.

These forward-looking statements are made as of the date of this registration statement and, except as expressly required by applicable law, we assume no obligation to update or revise them to reflect new events or circumstances.

ii

Unless otherwise stated, or the context otherwise requires, references in this registration statement to “we,” “us,” “our” and “WisdomTree” refer to WisdomTree Investments, Inc. and those entities owned or controlled by WisdomTree Investments, Inc. “WisdomTree ETFs” refer to the exchange traded funds issued by the WisdomTree Trust for which we serve as investment advisor. WisdomTree® is our U.S. registered service mark. Diversified Trends Indicator™ and DTI® are trademarks of Alpha Financial Technologies, LLC.

Summary

We are the eighth largest sponsor of exchange traded funds, or ETFs, in the United States based on assets under management, or AUM, as of April 29, 2011, with an AUM of more than $12 billion. An ETF is an investment fund that holds assets such as equities, bonds, currencies or commodities and trades at approximately the same price as the net asset value of its underlying assets. ETFs offer exposure to a wide variety of investment themes, including the broad U.S. and global markets, as well as specific sectors, regions, countries and asset classes, such as commodities, real estate or currencies. We currently offer a comprehensive family of 46 ETFs, which includes 34 international and domestic equity ETFs, 9 currency ETFs, two recently launched international fixed income ETFs and one recently launched managed futures strategy ETF.

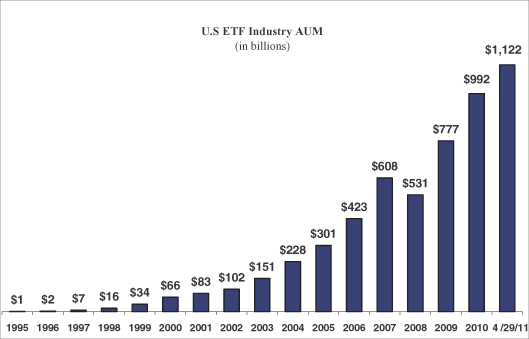

We believe ETFs have been one of the most innovative, revolutionary and disruptive technologies to emerge in the last two decades in the asset management industry. The ETF industry is among the fastest growing sectors of the broader asset management industry, experiencing a compound annual growth rate of 31.2% over the past ten years, from $66 billion in AUM in 2000 to nearly $1 trillion in AUM at the end of 2010. Despite this rapid growth, we believe there is considerable potential for further growth in the ETF industry as investors become more familiar with the benefits of ETFs compared to mutual funds and other investment products. Over the last several years, as a percent of total ETF and long-term mutual fund inflows and AUM, ETFs’ share has been growing. In fact, in 2008, the mutual fund industry experienced net outflows while the ETF industry experienced net inflows. We believe the trend towards ETFs will continue and accelerate as the ETF industry benefits from investor education initiatives, the shift by financial advisors to fee-based models, the launch of innovative new products, the introduction of new distribution channels and changing investor demographics.

We are not a traditional asset manager. We are an ETF sponsor focused on creating the most innovative and thoughtful ETFs for the marketplace. We believe there is a considerable growth opportunity for ETFs and are positioning WisdomTree to capitalize on this growth. Our goal is to become one of the top five ETF sponsors in the United States by focusing on our core competitive strengths:

| • | the strong performance of our ETFs; |

| • | a track record of innovative product development; |

| • | our strong, seasoned and innovative management team; |

| • | our marketing, research and sales expertise; |

| • | strong brand recognition; |

| • | our ability to develop our own proprietary indexes; and |

| • | our highly scalable business model. |

We intend to use these core competitive strengths to:

| • | leverage our asset levels, trading volumes and performance track record; |

| • | continue to launch innovative new products that diversify our product offerings and revenue stream; and |

| • | selectively pursuing acquisitions and partnerships. |

We provide investment advisory and other management services to the WisdomTree Trust and WisdomTree ETFs. In exchange for providing these services, we receive advisory fee revenues based on a percentage of the ETFs average daily net assets. Our expenses are predominantly related to selling, operating and marketing our ETFs. Our revenues have

- 1 -

increased substantially since we launched in June 2006. Our revenues increased to $41.6 million in 2010 compared to $22.1 million in 2009 and $23.6 million in 2008. For the first quarter of 2011, our revenues were $14.5 million, compared to $8.7 million in the first quarter of 2010. We have improved our net loss to $7.5 million in 2010, from a loss of $21.2 million in 2009 and a loss of $27.0 million in 2008. We recorded our first net income of approximately $0.2 million during the first quarter of 2011, compared to a net loss of $3.6 million in the first quarter of 2010.

Our principal executive office is located at 380 Madison Avenue, 21st Floor, New York, New York, 10017, and our telephone number is (212) 801-2080. Our website is www.WisdomTree.com. Information contained on, or that can be accessed through, our website is not part of this registration statement.

We have applied to have our common stock listed on The NASDAQ Global Market under the symbol “WETF.”

Our Industry

ETFs have been in existence for nearly two decades. The first ETF, the Standard & Poor’s Depositary Receipts commonly known as the SPDR, or the “Spider,” was launched in the United States in 1993 and tracked the Standard & Poor’s 500 index. The success of this first ETF led to the creation of additional ETFs. In 1996, Barclays Global Investors launched “iShares” ETFs (then known as World Equity Benchmark Shares, or WEBS) based on MSCI country indexes. The “Diamond” ETF, which is based on the Dow Jones Industrial Average Index, was introduced in 1998 and the “QQQ”, which tracks the Nasdaq 100 index, was launched in 1999. Due to the success of these and other early ETFs, the scale and scope of ETFs has grown rapidly. As of April 29, 2011, there were approximately 1,200 ETFs in the United States with an aggregate AUM reaching over $1 trillion.

ETFs were initially marketed mostly to institutional investors for use primarily in sophisticated trading strategies like hedging, but today, industry experts believe that institutional investors account for only about half of the assets held in ETFs. ETFs have gained in popularity among a broad range of investors and have impacted the way they invest and where they invest. ETFs have provided investors with access to various investment themes and asset classes such as international and emerging market equities, commodities, real estate, currencies and sophisticated trading strategies, which were once reserved for the exclusive use of hedge funds and other institutional investors, and all at significantly lower fees.

Exchange Traded Funds

An ETF is an investment fund that holds assets such as equities, bonds, currencies or commodities and trades at approximately the same price as the net asset value of its underlying assets over the course of the trading day. ETFs offer exposure to a wide variety of asset classes and investment themes, including the broad U.S. and global markets and specific sectors, regions and countries, as well as the standard asset classes and investment styles. There are also ETFs that track certain specific investments, such as commodities, real estate or currencies. Like mutual funds, equity ETFs are baskets of investments that represent a diversified group of companies. However, ETFs have the following characteristics that distinguish them from mutual funds:

| • | Transparency. ETFs disclose the composition of their underlying portfolios on a daily basis, unlike mutual funds which typically disclose their holdings every 90 days. As a result, investors “know what they own” and can make more informed investment decisions and respond to market activity. |

| • | Intraday Trading. Like stocks, ETFs can be bought and sold on exchanges throughout the trading day at market prices. ETFs update the indicative values of their underlying portfolios every 15 seconds. In contrast, mutual funds cannot be bought or sold using intraday prices but rather are bought or sold using end-of-day net asset values. As publicly-traded securities, ETF shares can be purchased on margin and sold short, enabling the use of hedging strategies, and traded using stop orders and limit orders, which allow investors to specify the price points at which they are willing to trade. |

| • | Tax Efficiency. In the United States, whenever a mutual fund or ETF realizes a capital gain that is not balanced by a realized loss, it must distribute the capital gain to its shareholders. These gains are taxable to all shareholders, even those who reinvest the gain distributions in additional shares of the fund. However, most ETFs have an additional mechanism not utilized by mutual funds that helps them reduce or eliminate taxable gains. ETFs typically redeem their shares through “in-kind” redemptions in which low-cost securities are transferred out of the ETF in exchange for fund shares. As a practical matter, mutual funds can not use this process. These in-kind redemption transactions are not taxable events for the ETF. By using this process, ETFs avoid the transaction fees and tax impact incurred by mutual funds that sell securities to generate cash to pay out redemptions. It is not uncommon for equity ETFs to distribute no capital gains to shareholders at the end of the year. In fact, all of our 34 WisdomTree equity ETFs had zero capital gain |

- 2 -

| distributions in 2010. Tax-efficiency is also improved by the relatively low turnover in the indexes the ETFs are designed to track, which contrasts with active mutual fund managers who typically trade their holdings much more frequently. |

| • | Lower Fees. ETFs typically offer lower expense ratios because the vast majority of ETFs are not actively managed. While there are typically brokerage commissions charged for the purchase and sale of an ETF similar to what you would pay when you purchase or sell individual securities, the administrative fees that ETFs charge tend to be significantly lower as compared to their mutual fund counterparts. Also, ETFs are generally shielded from the costs associated with buying and selling shares to accommodate purchases and redemptions. On average, the fee for U.S. equity funds charged by ETFs is 0.53% while mutual funds are 1.42%. |

Since ETFs trade like an equity security, they also offer significant accessibility and flexibility for investors. ETFs do not carry a minimum holding period or trade size. They can be easily accessed through online brokers or through a financial advisor. No paperwork is required between the fund sponsor and the end customer. Although investors typically pay brokerage commissions to buy or sell an ETF, ETFs do not carry “sales loads” or pay trailer fees to brokers like mutual funds. We believe these features make ETFs an attractive alternative to mutual funds or high-fee financial products or structures such as hedge funds.

Reasons for Using ETFs

ETFs are used in various ways by a range of investors, from conservative to speculative. ETF strategies include:

| • | Low Cost Index Investing. Because of their low cost, ETFs are used by investors seeking to track a variety of indexes encompassing equities, commodities or fixed income over the short and long term. |

| • | Improved Access to Specific Asset Classes. Investors often use ETFs to gain access to specific market sectors or regions around the world using an ETF that holds a portfolio of securities in that region or segment instead of buying individual securities. |

| • | Protective Hedging. Investors seeking to protect their portfolios may use ETFs as a hedge against unexpected declines in prices. |

| • | Income Generation. Investors seeking to obtain income from their portfolios may buy dividend-paying ETFs, which encompass a basket of dividend-paying stocks rather than buying individual stocks or a fixed income ETF that typically distributes monthly income. |

| • | Speculative Investing. Investors with a specific directional opinion about a market sector may choose to buy or sell (long or short) an ETF covering or leveraging that market sector. |

| • | Arbitrage. Sophisticated investors may use ETFs in order to exploit perceived value differences between the ETF and the value of the ETF’s underlying portfolio of securities. |

| • | Asset Allocation. Investors seeking to invest in various asset classes to develop an asset allocation model in a cost-effective manner can do so easily with ETFs, which offer broad exposure to various asset classes in a single security. |

| • | Diversification. By definition, ETFs represent a basket of securities and each fund may contain hundreds or even thousands of different individual securities. The “instant diversification” of ETFs provides investors with broad exposure to an asset class, market sector or geography. |

| • | Unconflicted Advice. Currently, ETFs are not sold with a sales loads or 12b-1 fees, which are fees paid for marketing and selling mutual fund shares, such as compensating brokers and others who sell fund shares. Therefore, we believe a financial advisor recommending an ETF for their client is generally giving objective advice when recommending an ETF over a mutual fund. We do not pay commissions nor do we offer 12b-1 fees to financial advisors to use or recommend our ETFs. |

- 3 -

The ETF Industry

Over the last decade, ETFs have experienced a compound annual growth rate of 31.2% from $66 billion in AUM in 2000 to nearly $1 trillion in AUM at the end of 2010, yet, at the end of 2010, there were approximately 900 ETFs compared to more than 8,000 mutual funds. The chart below reflects the AUM of the ETF industry in the United States since 1995:

Source: Investment Company Institute, Bloomberg, WisdomTree

- 4 -

As of April 29, 2011, we were the eighth largest ETF sponsor in the United States by AUM:

| Total | ||||||||

| (in millions) | ||||||||

| 1 |

iShares | $ | 498,075 | |||||

| 2 |

StateStreet | $ | 269,478 | |||||

| 3 |

Vanguard | $ | 172,880 | |||||

| 4 |

PowerShares | $ | 49,182 | |||||

| 5 |

ProShares | $ | 26,731 | |||||

| 6 |

Van Eck | $ | 23,217 | |||||

| 7 |

Deutsche Bank | $ | 14,972 | |||||

| 8 |

WisdomTree | $ | 12,151 | |||||

| 9 |

Rydex | $ | 8,790 | |||||

| 10 |

First Trust | $ | 8,005 | |||||

| 11 |

Direxion | $ | 6,501 | |||||

| 12 |

Merrill (HOLDRs) | $ | 5,428 | |||||

| 13 |

U.S. Commodity Funds | $ | 4,884 | |||||

| 14 |

ETF Securities | $ | 4,530 | |||||

| 15 |

Schwab | $ | 4,249 | |||||

| 16 |

Claymore | $ | 4,015 | |||||

| 17 |

PIMCO | $ | 2,704 | |||||

| 18 |

GlobalX | $ | 1,795 | |||||

| 19 |

ALPS | $ | 1,403 | |||||

| 20 |

GreenHaven | $ | 868 | |||||

| 21 |

RevenueShares | $ | 635 | |||||

| 22 |

Emerging Global Shares | $ | 557 | |||||

| 23 |

IndexIQ | $ | 515 | |||||

| 24 |

AdvisorShares | $ | 287 | |||||

| 25 |

Fidelity | $ | 192 | |||||

| 26 |

X-Shares | $ | 138 | |||||

| 27 |

Teucrium | $ | 113 | |||||

| 28 |

Focus Shares | $ | 79 | |||||

| 29 |

Grail | $ | 30 | |||||

| 30 |

FactorShares | $ | 24 | |||||

| 31 |

Javelin | $ | 15 | |||||

| 32 |

OneFund | $ | 14 | |||||

| 33 |

FaithShares | $ | 11 | |||||

| 34 |

ESG Shares | $ | 3 | |||||

| Total | $ | 1,122,471 | ||||||

Source: Bloomberg, WisdomTree

- 5 -

ETF Industry Growth Opportunity

We believe there is considerable growth potential in the ETF industry and that we are well-positioned to capitalize on this growth. We believe our growth, and the growth of the ETF industry in general, will be accelerated by the following factors:

| • | Education and Greater Investor Awareness. Over the last several years, ETFs have been taking a greater share of inflows and AUM from mutual funds. For example: |

| • | As a percent of total ETF and long-term mutual fund inflows, ETF inflows have increased from 23% in 2005 to 34% in 2010, according to the Investment Company Institute, and we expect this trend to continue or accelerate. |

| • | The same data reflects that during the recent market downturn in 2008, while traditional long-term mutual funds were experiencing outflows of $225 billion, ETFs were experiencing inflows of $177 billion. |

| • | As a percent of total ETF and long-term mutual fund AUM, ETF AUM has increased from 4.2 % in 2005 to 10% in 2010. |

We believe as a result of the recent market downturn, investors have become more aware of some of the deficiencies of their mutual fund and other financial products. In particular, we believe investors are beginning to focus on important characteristics of their traditional investments – namely transparency, liquidity and fees. Their attention and education focused on these important investment characteristics may be one of the drivers of the shift in inflows from traditional mutual funds to ETFs. We believe as investors become more aware and educated about ETFs and their benefits, ETFs will continue to take market share from traditional mutual funds and other financial products or structures such as hedge funds, separate accounts and single stocks.

| • | Move to Fee-Based Models. Over the last several years, many financial advisors have changed the fees they charge clients from one that is “transaction-based”, that is based on commission for trades or receiving sales loads, to a “fee-based” approach, where an overall fee is charged based on the value of AUM. This fee-based approach lends itself to the advisor selecting no-load, lower-fee financial products, and in our opinion, better aligns the advisor with the interests of their client. Since ETFs generally charge lower fees than mutual funds, we believe this model shift will benefit the ETF industry. As major brokerage firms and asset managers encourage their advisors to move towards fee-based models, we believe overall usage of ETFs will likely increase. |

- 6 -

| • | Innovative Product Offerings. Historically, ETFs tracked traditional equity indexes, but the volume of ETF growth has lead to significant innovation and product development. As demand increased, ETF sponsors continued to innovate and today, ETFs are in virtually every asset class including commodities, fixed income, alternative strategies, leveraged/inverse, real estate and currencies. We believe there are substantial areas for ETFs to continue to innovate, including alternative-based strategies, hard and soft commodities, and actively-managed strategies. We believe the expansion of ETFs into these new asset classes will fuel further growth and investments from investors who typically access these products through hedge funds, separate accounts, stock investments or the futures and commodity markets. |

| • | New Distribution Channels. Discount brokers, including TD Ameritrade, E*Trade and Fidelity, now offer free trading and promotion of select ETFs. We believe the promotion of ETF trading by discount brokers and their marketing of ETFs to a wider retail channel will contribute to the future growth of ETFs. |

| • | Changing Demographics. As the “baby boomer” generation continues to mature and begins to retire, we expect that there will be a greater demand for a broad range of investment solutions, with a particular emphasis on income generation and principal protection, and that more of these retiring investors will seek advice from professional financial advisors. We believe these financial advisors will migrate more of their clients’ portfolios to ETFs due to their lower fees, better fit within fee-based models, and their ability to (i) provide access to more diverse market sectors, (ii) improve multi-asset class allocation and (iii) be used for different investment strategies, including income generation. Overall, we believe ETFs are well-suited to meet the needs of this large and important group of investors. |

| • | Expansion Into 401(k) Retirement Plans. Historically, 401(k) plans were almost exclusively comprised of mutual funds. However, we believe ETFs are particularly well-suited to 401(k) retirement plans and that these plans present a large and growing opportunity for our industry. ETFs are easy-to-implement, fully transparent investment vehicles covering the full range of asset allocation categories, and are available at significantly lower costs than most traditional mutual funds. In addition, regulatory reform laws are anticipated to go into effect in the second half of 2011 that will require 401(k) retirement plan sponsors to disclose all fees associated with their plans. We believe that as investors become aware of fees associated with using mutual funds in traditional 401(k) retirement plans, they will replace their mutual funds with ETFs because of their lower fees. |

Regulatory Framework of the ETF Industry

Not all exchange traded products, or ETPs, are ETFs. ETFs are a distinct type of security that have benefits very different than other ETPs. ETFs are open-end investment companies or unit investment trusts regulated by the Investment Company Act of 1940, as amended. This regulatory structure provides for the highest level of investor protection within a pooled investment product. For example, the Investment Company Act of 1940 requires that at least 40% of the Trustees for each ETF may not be affiliated with the fund’s investment manager (“Independent Trustees”). If the ETF seeks to rely on certain rules under the Investment Company Act of 1940, a majority of the Trustees for that ETF must be Independent Trustees. In addition, as discussed below, ETF’s have received orders from the staff of the SEC which exempt them from certain provisions of the Investment Company Act of 1940; however, ETFs generally operate under regulations that prohibit affiliated transactions, have standard pricing and valuation rules and mandated compliance programs. ETPs that are not ETFs are not registered under the Investment Company Act and are not required to operate under these higher standards. ETPs can take a number of forms, including exchange traded notes, grantor trusts or limited partnerships. A key differentiating factor between exchange traded funds, grantor trust and limited partnerships from exchange traded notes is that the former holds assets underlying the ETP. Exchange traded notes on the other hand are backed by debt instruments issued by the exchange traded note sponsor. Because of this differentiation, exchange traded funds, grantor trust and limited partnerships are generally referred together as exchange traded funds even though there are technical differences. Also, each of these structures has implications for taxes, liquidity, tracking error and credit risk. Though creating an ETF may require additional regulatory and operational hurdles, we believe that ETFs are the best investment structure for investors and we expect to continue creating products using the ETF structure.

Because ETFs do not fit into the regulatory provisions governing mutual funds, ETF sponsors need to apply to the Securities and Exchange Commission, or SEC, for “exemptive relief” from certain provisions of the Investment Company Act in order to operate ETFs. This exemptive relief allows the ETF sponsor to bring products to market for the specific products or structures they have applied for. Applying for exemptive relief can be costly and take several months to several years depending on the type of exemptive relief sought.

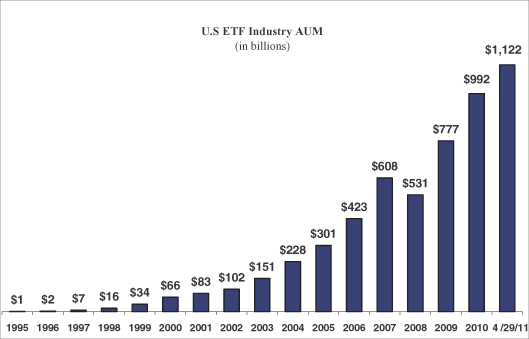

Corporate Structure

The WisdomTree ETFs are issued by the WisdomTree Trust. The WisdomTree Trust is a Delaware statutory trust registered with the SEC as an open-end management investment company. The Board of the WisdomTree Trust, or the Trustees, is separate from the Board of Directors of our company, WisdomTree Investments, Inc. The Trustees are primarily responsible for overseeing the management and affairs of the WisdomTree ETFs and the Trust for the benefit of the WisdomTree ETF stockholders. We have licensed the use of our own fundamentally-weighted indexes for ETFs on an exclusive basis to the WisdomTree Trust for the WisdomTree ETFs.

- 7 -

Like most ETFs, the day-to-day business of the Trust is generally performed by third-party service providers, such as the adviser, sub-adviser, distributor and administrator, although the Trustees are responsible for overseeing the Trust’s service providers. The Trustees have approved us to serve as the investment adviser to the WisdomTree Trust as well as provide general management and administration of WisdomTree Trust and each of its ETFs. In turn, we have contracted with other third party service providers for some of these services. In addition, Jonathan Steinberg, our Chief Executive Officer, serves as a Trustee and President of the WisdomTree Trust and Amit Muni, our Chief Financial Officer, serves as Treasurer of the Trust.

Our investment management agreement with the WisdomTree Trust and WisdomTree ETFs must be renewed and specifically approved at least annually by a vote of the Independent Trustees. The advisory agreements are subject to initial review and approval. After the initial two-year term of the agreement for each ETF, the continuation of such agreement must be reviewed and approved by a majority of the independent trustees at least annually. In determining whether to approve the agreements, the independent trustees consider factors such as (i) the nature and quality of the services provided by us, (ii) the fees charged by us and the costs and profits realized by us in connection with such services, as well as any ancillary or “fallout” benefits from such services, (iii) the extent to which economies of scale are shared with the WisdomTree ETFs, and (iv) the level of fees paid by other similar funds.

The following diagram depicts the corporate structure:

- 8 -

Corporate History

WisdomTree Investments, Inc. was incorporated by our Chief Executive Officer and founder, Jonathan Steinberg, in Delaware as Financial Data Systems, Inc., on September 19, 1985, but was inactive until October 1988 when it acquired the assets relating to what would become Individual Investor magazine, a monthly personal finance magazine. In December 1991, it completed an initial public offering and commenced trading on the Nasdaq Stock Market. In 1993, the company’s name was changed to Individual Investor Group, Inc. and throughout the 1990’s it was a financial media company that published several magazines, including Individual Investor and Ticker, newsletters, as well as maintained several online financial related websites. In addition, the company also began developing stock indexes. Due to the economic downturn in the financial media industry in 2000 and 2001, the company sold its media properties in order to preserve its capital while it pursued a new business plan focusing on developing and licensing its stock indexes. The company’s common stock was de-listed from Nasdaq and began quotation on the over-the-counter market known as the Pink Sheets. In 2002, the company’s name was changed to Index Development Partners, Inc., and Jonathan Steinberg, along with Luciano Siracusano, our Chief Investment Strategist, continued development of the concepts for our fundamentally weighted index methodology. While this concept was being developed, the company sought to obtain financing to recapitalize and become an ETF sponsor. Between 2004 and 2005, the company obtained financing from a core group of investors including former hedge fund manager Michael Steinhardt, Professor Jeremy Siegel of The Wharton School of the University of Pennsylvania and the venture capital firm of RRE Ventures, LLC. Michael Steinhardt became our Chairman and Professor Jeremy Siegel became the senior investment strategy advisor for our company and Board. James Robinson, IV of RRE Ventures also joined our Board. In 2005, the company’s name was changed to WisdomTree Investments, Inc. WisdomTree Investments, Inc. launched its first 20 ETFs in June 2006. Our common stock continues to be quoted on the Pink Sheets, now known as OTC Markets, and we intend to seek listing of our common stock on in connection with the filing of this Form 10 with the U.S. Securities and Exchange Commission.

Our Business

Overview

We are the eighth largest sponsor of ETFs in the United States based on AUM. In June 2006, we launched 20 ETFs and, as of April 29, 2011, we had 46 ETFs with AUM of approximately $12.2 billion.

Through our operating subsidiary, we provide investment advisory and other management services to the WisdomTree Trust and WisdomTree ETFs. In exchange for providing these services, we receive advisory fee revenues based on a percentage of the ETFs average daily net assets. Our expenses are predominantly related to selling, operating and marketing our ETFs.

We have contracted with third parties to provide some of the investment advisory and other management services to the WisdomTree ETFs. We have contracted with Mellon Capital Management Corporation to act as sub-advisor and provide portfolio management services for the WisdomTree ETFs. We have also contracted with Bank of New York to provide fund administration, custody, accounting and other related services for the WisdomTree ETFs. Both of these parties are part of The Bank of New York Mellon Corporation, collectively BNY Mellon.

Our primary business is an ETF sponsor. However, in conjunction with the development of our indexes for our ETFs, we also license our indexes to third parties for use in financial products or for separate accounts. This is not currently a material part of our business and we do not believe this will become a material part of our business in the future.

We also have a small team dedicated to promoting the use of WisdomTree ETFs in 401(k) retirement plans through our wholly-owned subsidiary, WisdomTree Retirement Services, Inc. We believe the benefits of ETFs, along with pending regulatory disclosure of fees paid by 401(k) plan participants and sponsors, will foster more use of low cost ETFs in 401(k) plans. This initiative is still in its early stages and is expected to be a long-term investment.

Our revenues have increased substantially since we launched in June 2006. Our revenues increased to $41.6 million in 2010 compared to $22.1 million in 2009 and $23.6 million in 2008. For the first quarter of 2011, our revenues were $14.5 million, compared to $8.7 million in the first quarter of 2010. With only approximately five years of operations, we have improved our net loss to $7.5 million in 2010, from a loss of $21.2 million in 2009 and a loss of $27.0 million in 2008. We recorded our first net income of approximately $0.2 million during the first quarter of 2011, compared to a net loss of $3.6 million in the first quarter of 2010.

Our Products

Today, we offer a comprehensive family of 46 ETFs, which includes 34 international and domestic equity ETFs, 9 currency income ETFs, two recently launched international fixed income ETFs and one recently launched managed futures strategy ETF. 45 of our ETFs are listed on NYSE Arca, a listing venue of NYSE Euronext, and one of our ETFs is listed on the Nasdaq Stock Market. In April 2010, ten of our ETFs also were cross-listed in the special international section on the Mexican stock exchange, Bolsa Mexicana De Valores, where certain institutional investors trade foreign securities in Mexico.

- 9 -

Equity ETFs

We offer equity ETFs covering the U.S. and international developed and emerging markets. These ETFs offer access to the securities of large, mid and small-cap companies, companies located in the United States, developed markets and emerging markets, as well as companies in particular market sectors, including basic materials, energy, utilities and real estate. As described in more detail below, our equity ETFs track our proprietary fundamentally weighted indexes, as opposed to market capitalization weighted indexes, which assign more weight to stocks with the highest market capitalizations. These fundamentally weighted indexes focus on securities of companies that pay regular cash dividends or on securities of companies that have generated positive cumulative earnings over a certain period. We believe these factors, rather than market capitalization alone, provide investors with better risk adjusted returns.

Currency ETFs

We offer currency ETFs that provide investors with exposure to developed and emerging market currencies, including the Chinese Yuan, the Brazilian Real, the Euro and the Japanese Yen. Currency ETFs invest in U.S. money market securities, forward currency contracts and swaps and seek to achieve the total returns reflective of both money market rates in selected countries available to foreign investors and changes to the value of these currencies relative to the U.S. dollar. We launched the industry’s first currency ETFs in May 2008 using an actively managed strategy.

International Fixed Income ETF

In August 2010, we launched an ETF that predominantly invests in a broad range of local debt denominated in the currencies of emerging market countries and on March 17, 2011, we launched an ETF that invests in local debt denominated in the currencies of Asia Pacific ex-Japan countries. We intend to launch additional fixed income bond funds and broaden our product offerings in this category.

Alternative Strategy ETF

In January 2011, we launched the industry’s first managed futures strategy ETF. This fund seeks to achieve positive returns in rising or falling markets that are not directly correlated to broad market equity or fixed income returns. This fund is managed using a quantitative, rules-based strategy designed to provide returns that correspond to the Diversified Trends Indicator™, or DTI®. The DTI is a long/short rules-based managed futures indicator developed by Victor Sperandeo of Alpha Financial Technologies, LLC and is a widely used indicator designed to capture the economic benefit derived from rising or declining price trends in the markets for commodity, currency and U.S. Treasury futures. We have an exclusive license to manage an ETF against this indicator. We also intend to explore additional alternative strategy products in the future.

The type and AUM for each of our ETFs are listed below as of April 29, 2011:

| Number of Funds |

Type | AUM | ||||||||||

| (in millions) | ||||||||||||

| Equity ETFs: |

||||||||||||

| U.S. Equity ETFs |

12 | Index based | $ | 2,342 | ||||||||

| Emerging Markets Equity ETFs |

4 | Index based | $ | 3,914 | ||||||||

| International Developed Equity ETFs |

14 | Index based | $ | 2,737 | ||||||||

| International Sector Equity ETFs |

4 | Index based | $ | 273 | ||||||||

| Currency ETFs |

9 | Actively Managed | $ | 1,596 | ||||||||

| International Fixed Income ETFs |

2 | Actively Managed | $ | 1,193 | ||||||||

| Alternative Strategy ETF |

1 | Actively Managed | $ | 96 | ||||||||

| Total |

46 | $ | 12,151 | |||||||||

Index Based ETFs

Our equity ETFs seek to track our own fundamentally weighted indexes. Most of today’s ETFs track market capitalization weighted indexes. Market capitalization weighted ETFs assign more weight to stocks with the highest market capitalizations, which is a function of stock price. We believe this means that if a stock is overvalued, market capitalization weighted funds will give the overvalued stock greater weight as its price and market capitalization increases and the opposite is true if a stock is undervalued, where market capitalization weighted funds will give it less weight. Without a way to rebalance away from these stocks, we believe market capitalization weighted funds essentially hold more of a company’s stock as its price is going up and less

- 10 -

as the price of the company’s stock is going down. In other words, we believe these funds buy high and sell low. Market history contains many examples of overvalued stocks, for example, the technology and dot-com bubble of the late 1990s. We believe this structural flaw can expose investors to potentially higher risks and lower returns.

To address the structural flaw of market cap-weighting, we developed fundamentally weighted indexes that weight companies in our ETFs by a measure of fundamental value instead of market capitalization using a rules-based methodology. After researching fundamental indicators of value, we believe the most effective metrics are cash dividends or earnings. Our research indicated that weighting by cash dividends or earnings provided investors with better risk adjusted returns than market capitalization weighted indexes. The rules-based methodology that we created weights companies in our index based on either dividends or earnings in order to magnify the effect that dividends or earnings play on the total return of the index. Under our rules-based methodology, we weight each company based on their projected cash dividends to be paid over the coming year over the sum of the projected cash dividends to be paid by all companies or we weight each company based on their previous annual earnings over the sum of the earnings by all companies in the index. Our funds are rebalanced annually and designed to reset back to an indicator of fundamental value – either cash dividends paid or earnings generated. All of our index based equity ETFs are based on this approach. We believe this fundamentally weighted approach offers better returns than comparable ETFs or mutual funds tracking market capitalization weighted indexes over the long-term.

We benchmark each of our fundamentally weighted indexes against traditional market capitalization-weighted indexes designed to track similar companies, sectors, regions or exposure. As of April 29, 2011, approximately 80% of the approximately $9.3 billion invested in our 34 equity ETFs on April 29, 2011 were in funds that, since their respective inceptions, outperformed their competitive market capitalization-weighted benchmarks through that date. 21 of our 34 equity ETFs outperformed their competitive capitalization-weighted benchmarks since their respective inception through April 29, 2011. We believe this outperformance has been achieved primarily due to the weighting and selection of companies in our fundamentally weighted indexes using our rules-based methodology, rather than market capitalization-weighted indexes.

Actively Managed ETFs

In 2008, we obtained regulatory approval to launch actively managed ETFs, which are ETFs that are not based on an index but rather are actively managed with complete transparency of the ETF’s portfolio on a daily basis. Currently, we are one of several ETF sponsors that have already received the necessary exemptive relief from the SEC to launch actively managed ETFs. This has enabled us to develop products not yet offered by other ETF sponsors. Our actively managed ETFs include our currency ETFs, international fixed income ETFs and managed futures strategy ETF.

The securities purchased and sold by our ETFs include U.S. and foreign equities, forward currency contracts and U.S. and foreign debt instruments. In addition, we enter into derivative transactions, in particular U.S. listed futures contracts, non-deliverable currency forward contracts, and total return swap agreements in order to gain exposure to commodities, foreign currencies, and interest rates. The exchanges these securities trade on include all the major exchanges worldwide including:

| • Amman Stock Exchange |

• Johannesburg Stock Exchange | |

| • Athens Exchange |

• Korea Exchange | |

| • Australian Securities Exchange |

• London Stock Exchange | |

| • BM&FBOVESPA S.A. |

• NASDAQ OMX | |

| • BME Spanish Exchanges |

• National Stock Exchange of India Limited | |

| • Bolsa de Comercio de Santiago |

• NYSE Euronext | |

| • Bolsa Mexicana de Valores |

• Philippine Stock Exchange | |

| • Bombay Stock Exchange Ltd. |

• Singapore Exchange | |

| • Borsa Italiana SpA (London Stock Exchange Group) |

• SIX Swiss Exchange | |

| • Budapest Stock Exchange Ltd. (Wiener Börse AG) |

• Stock Exchange of Thailand | |

| • Bursa Malaysia |

• Taiwan Stock Exchange | |

| • Deutsche Börse AG |

• Tel-Aviv Stock Exchange | |

| • Hong Kong Exchanges and Clearing |

• The Egyptian Exchange | |

| • Indonesia Stock Exchange |

• Tokyo Stock Exchange Group, Inc. | |

| • Irish Stock Exchange |

• Warsaw Stock Exchange | |

| • Istanbul Stock Exchange |

||

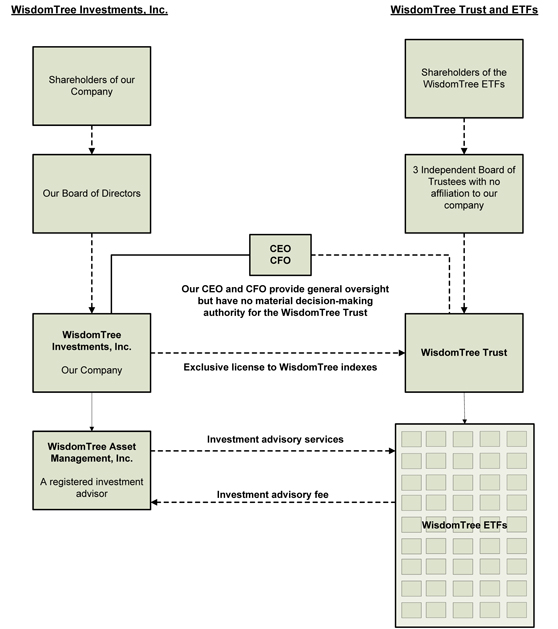

Historical Net ETF Inflows and AUM

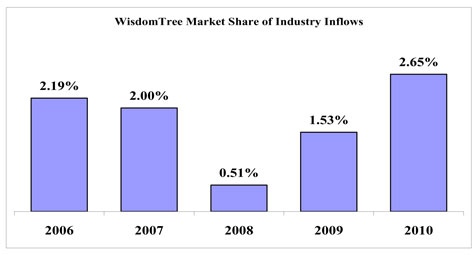

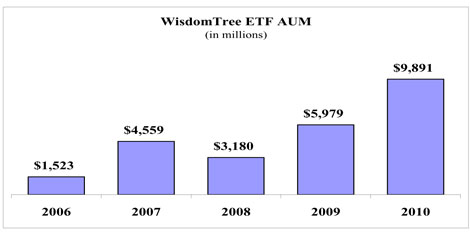

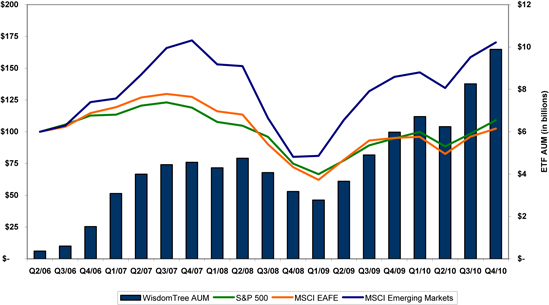

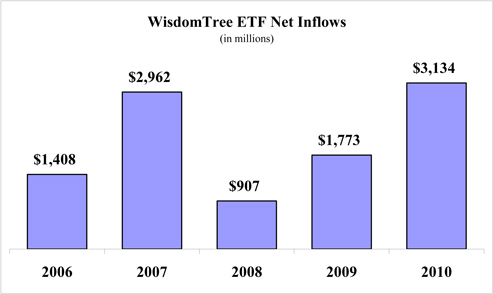

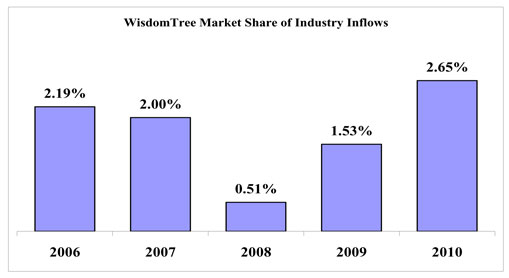

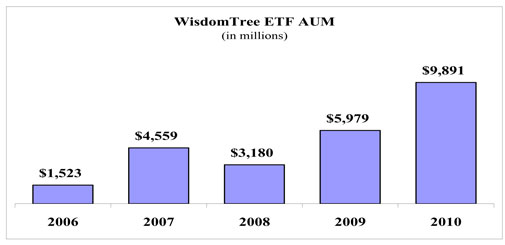

The following charts reflect our historical net ETF inflows, market share of industry inflows and ETF AUM since we launched our funds in June 2006:

- 11 -

We have experienced positive net inflows each year since we launched our first ETFs in June 2006. While we have experienced significant fluctuations in our net inflows quarter to quarter, we have only experienced one quarter of net outflows – approximately $15.5 million of net outflows in the third quarter of 2008 – when the overall market sentiment was extremely negative. Our ETF AUM declined from $4.6 billion in 2007 to $3.2 billion at the end of 2008 as a result of $2.3 billion decline in the market value of the securities our ETFs hold resulting from the global economic crisis despite $907 million of net inflows. Our market share also declined during that period as investors began to sell off equity investments and invest in government fixed income and commodity ETFs. At that time, we did not have fixed income or commodity presence. Part of our growth strategy is to diversify our product offering.

Over the last several quarters, our market share of net ETF inflows has also been increasing. We believe this trend is a result of our strong product offering in emerging market equities, new products we launched such as currency and international fixed income, as well as a longer track record for our equity funds launched in 2006 and 2007. Our growth strategy seeks to increase our market share of ETF industry inflows.

Distribution and Sales

We distribute our funds primarily through financial advisors in the major channels in the asset management industry using our own sales professionals. These channels include brokerage firms, registered investment advisors, institutional investors, private wealth managers and discount brokers. We typically do not target our ETFs directly to the retail segment but rather to financial advisors who act as the intermediary between the end client and us. We do not pay commissions nor do we offer 12b-1 fees to financial advisors to use or recommend the use of our ETFs.

We have developed an extensive network and relationships with financial advisors and we believe our ETFs and related research are structured to meet their needs and those of their clients. Our sales professionals act in a consultative role to provide the financial advisor with value-added services. We consistently grow our network of financial advisors and we opportunistically seek to introduce new products that best deliver our investment strategies to investors through these distribution channels. We have our own team of 25 sales professionals located in the United States as of April 29, 2011.

In 2010, we entered into agreements with Advisors Asset Management, Inc. and Compass Group Holdings S.A. to serve as the external marketing agents for the WisdomTree ETFs in the U.S. independent broker-dealer channel and in Latin America, respectively. These arrangements expand our distribution capabilities to channels that we believe we would have difficulty accessing in a cost-effective manner. Under these agreements, we pay these marketing agents a percentage of our advisory fee revenue based on incremental growth in assets under management in the respective sales channel. Since inception, we have incurred in total approximately $0.2 million in expenses as of March 31, 2011 related to these marketing arrangements. We do not expect this expense to be material in any fiscal period.

Marketing and Advertising

Our marketing effort is focused on three objectives: (1) generating new clients and inflows to our ETFs; (2) retaining existing clients, with a focus on cross-selling additional WisdomTree ETFs; and (3) building brand awareness. We pursue these objectives through a multi-faceted marketing strategy targeted at financial advisors within the asset management industry. We utilize the following strategies:

- 12 -

| • | Targeted Advertising. In an effort to maximize the goal of reaching financial advisors, we create highly targeted multi-media advertising campaigns limited to established core financial media. For example, our television advertising runs exclusively on the cable networks, CNBC, and Bloomberg Television; online advertising runs on ETF-specific web sites, such as www.seekingalpha.com and www.etfdatabase.com; and print advertising runs in core financial publications, including Barron’s and Institutional Investor. |

| • | Media Relations. We have a full time public relations manager who has established relationships with the major financial media outlets including: the Wall Street Journal, Barron’s, the Financial Times, Bloomberg, Reuters and USA Today. We utilize these relationships to help create awareness of the WisdomTree ETFs and the ETF industry in general. Key members of management including our Chief Investment Strategist, Luciano Siracusano, our President and Chief Operating Officer, Bruce Lavine, and our Director of Research, Jeremy Schwartz, are frequent market commentators and conference panelists regarding the ETF industry. |

| • | Direct Marketing. We have a database of approximately 100,000 financial advisors to which we regularly market through targeted and segmented communications such as on-demand research presentations, ETF-specific or educational events and presentations, quarterly newsletters and market commentary from our senior investment strategy advisor, Professor Jeremy Siegel. |

| • | Sales Support. We create comprehensive marketing materials to support our sales process including whitepapers, research reports, investment ideas and performance data for all WisdomTree ETFs. |

We will continue to evolve our marketing and communication efforts in response to changes in the ETF industry, market conditions and marketing trends.

Research

Our research team has three core functions: index development and oversight, investment research and sales support. In its index development role, the research group is responsible for creating the investment methodologies and overseeing the maintenance of our indexes that WisdomTree’s equity ETFs are designed to track. The team also provides a variety of investment research around these indexes and market segments. Our research is typically academic-type research to support our products, including white papers on the strategies underlying our indexes and ETFs, investment insight on current market trends, and types of investment strategies that drive long-term performance. We distribute our research through our sales professionals, online through our website, targeted emails to financial advisors, or through financial media outlets, including interviews on CNBC. On some occasions our research has been included in “op-ed” letters appearing in the Wall Street Journal. Finally, the research team supports our sales professionals in meetings as market experts and through custom reports. In addition, we often consult with our senior investment strategy advisor, Professor Jeremy Siegel, on product development ideas.

Business Transactions

Joint Venture with Mellon Capital Management Corporation and The Dreyfus Corporation

In 2008, we entered into a mutual participation agreement with Mellon Capital Management Corporation and The Dreyfus Corporation in which we agreed to collaborate in developing currency and fixed income ETFs under the WisdomTree Trust. Under the agreement, we contribute our expertise in operating the ETFs, sales, marketing and research, and Mellon Capital and Dreyfus contributed sub-advisory, fund administration and accounting services for these collaborated ETFs. All third-party costs and profits and losses are shared equally. This agreement expires in March 2013. As of February 28, 2011, approximately $2.0 billion of our AUM is related to this agreement. If this agreement were to expire, we would be required to contract separately with Mellon Capital and Dreyfus, or pay another third party to provide for these services. Although we would then have to pay for these services, we would not have to share any profits or losses related to these ETFs. At this time, we are not aware if this agreement will expire or be renewed.

Treasury Equity, LLC

In 2007, we acquired the rights to an application pending with the SEC for exemptive relief to operate currency funds from Treasury Equity, LLC, a private company. Following this purchase we continued to pursue the application for the exemptive relief and ultimately it formed the basis for our regulatory ability to operate currency ETFs. In exchange, we issued approximately 1.2 million shares of common stock valued at approximately $2.3 million during 2008 and 2009. In

- 13 -

addition, until March 2017, we will pay Treasury Equity, LLC a quarterly fee which is calculated as the lesser of 0.03% of the average daily assets under management for our currency ETFs or 10% of revenues we earn from our currency ETFs. We have paid in total $0.1 million in trailer fees as of March 31, 2011.

Our Competitive Strengths

Our business strategy is designed to support our efforts to be among the top 5 ETF sponsors in the United States. Key to executing this strategy is a focus on our core competitive strengths:

| • | Strong ETF Performance. We created indexes that weight companies in our equity ETFs by a measure of fundamental value instead of market capitalization. We believe this approach will yield better risk adjusted returns over the long-term than our competitors’ market capitalization weighted products. Approximately 80% of the approximately $9.3 billion invested in our 34 equity ETFs on April 29, 2011 were in funds that, since their respective inceptions, outperformed their competitive market capitalization-weighted benchmarks through that date. 21 of our 34 equity ETFs outperformed their competitive market capitalization-weighted benchmarks since their respective inception through April 29, 2011. Our strategy is to maintain our performance by consistently applying our investment philosophy and process. |

| • | Track Record of Innovative Product Development. We believe we have created a track record of innovation that places us at the forefront of ETF providers. This innovation began with our equity ETFs which follow our own fundamentally weighted methodology. Our recent innovations include: |

| • | We launched the industry’s first emerging markets small cap equity ETF. |

| • | We launched the industry’s first actively managed currency ETFs. |

| • | We launched the industry’s first equity ETF that invests in local shares in India using an innovative ETF structure that complies with regulations related to foreign ownership limits of Indian companies. |

| • | We launched the industry’s first ETF designed to offer investors broad exposure to the international developed equity markets while at the same time hedging the currency fluctuations between foreign currencies. |

| • | We launched the industry’s first managed futures strategy ETF. This ETF allows investors access to a sophisticated strategy at a much lower cost point than most competing products. We launched this fund under our actively managed ETF approval and used derivatives to maximize the ETFs performance in a cost-effective and risk-appropriate manner. |

We believe our expertise in using the breadth and depth of our regulatory exemptive relief, which allows us to launch index-based and actively managed ETFs, including ETFs that use alternative strategies and derivatives, creates a strategic advantage by enabling us to launch innovative ETFs that others may not be able to launch in the short-term.

| • | Strong, Seasoned and Innovative Management Team. We have built a strong and dedicated senior leadership team. Most of our leadership team have significant ETF or financial services industry experience in fund operations, regulatory and compliance oversight, product development and management or marketing and communications. We believe our team, by developing an ETF sponsor from the ground up despite significant competitive, regulatory and operational barriers, has demonstrated an ability to innovate as well as recognize and respond to market opportunities. |

| • | Marketing, Research and Sales Expertise. The majority of our personnel are professionals dedicated to marketing, research and sales. While our sales professionals are the primary point of contact with financial advisors who use our ETFs, their efforts are enhanced through value-added services provided by our research and marketing efforts. We believe the recent growth we have experienced by strategically aligning marketing campaigns with targeted research and sales initiatives differentiates us from our competitors. |

| • | Strong Brand Recognition. With our launch in 2006, we made a tactical decision to establish the WisdomTree brand through targeted television, print and online advertising, as well as public relations efforts using our investors, Michael Steinhardt and Professor Jeremy Siegel. We believe we have been successful in these efforts and WisdomTree has created a strong and recognized brand associated with product innovation, customer service and integrity. |

- 14 -

| • | Development of Indexes. Our equity ETFs use our own indexes, which we believe gives us several advantages. Most importantly, we are able to considerably increase our speed to market. Our product development and index teams work closely to identify potential new ETFs for the marketplace. Because we can create indexes ourselves, we have the ability to create innovative indexes and related ETFs much more rapidly than our competitors who have to work with third party index providers. Also, we are able to maintain a consistent investment philosophy for our products which creates a unified investing experience for investors. The second advantage of being able to create our own proprietary indexes is cost. Our competitors license indexes from third parties and in exchange, they pay licensing fees, which in some cases may be significant. Since we create our own indexes, we do not incur any of these licensing costs and can therefore be more competitive on the fees we charge for our ETFs. |

| • | Highly Scalable Business Model. We have built a lean and efficient organization focused on our core competencies of product development, marketing, research and sales of ETFs. We have chosen to outsource to third parties those services which do not fit our core competency or are either cost, risk or people intensive. For example, we have outsourced the portfolio management responsibilities and fund accounting operations of our ETFs to BNY Mellon; therefore, we do not bear the risks or costs associated with trading securities nor need to maintain complex fund accounting systems or staff required to perform those functions. We believe outsourcing these commoditized functions is more cost efficient than building these capabilities internally. In turn, we believe we have built a very highly scalable business model. |

Our Growth Strategy

Our goal is to be among the top five ETF sponsors in the United States. To achieve this goal, our strategy is to position us to capitalize on the growth of the ETF industry as well as increase our market share of industry inflows at a higher rate than we have historically experienced. Our average market share of industry inflows since inception was 1.8% as of March 31, 2011. Our market share in recent quarters has been increasing and is higher than our average since inception. We believe this is a result of a variety of factors including increased investor demand for equities; greater acceptance of WisdomTree ETFs, and in particular, our strong product offering in emerging market equities; introduction of new WisdomTree ETFs; and a longer track record for our existing ETFs. We will seek to increase our market share by continuing to implement the following growth strategies:

| • | Leverage our Asset Levels, Trading Volumes and Performance Track Record. We have built a professional sales force, established a strong brand, introduced innovative ETFs and established a performance track record. As we grow our assets under management, we believe several factors will continue to foster additional growth: |

| • | First, we believe higher asset levels in some of our ETFs make those ETFs more attractive to investors and financial advisors. For example, at December 31, 2009, our top 5 largest ETFs had assets under management of approximately $2.4 billion, yet one year later, they collectively had approximately $4.4 billion under management. |

| • | Second, higher trading volumes for ETFs make those ETFs more attractive for financial advisors and traders. As our assets under management have grown, so have our trading volumes. The average daily trading volume for our ETFs in 2009 was 1.8 million shares a day. In 2010, the average daily trading volume increased to approximately 3.6 million shares a day. |

| • | Third, a longer performance track record makes ETFs more attractive to all investors and in particular large institutional investors such as endowments or pension plans. Of particular significance are 3 year, 5 year and 10 year track records. At June 30, 2011, 31 of our ETFs will have at least 3 year track records, 19 of which will also have 5 year records. The existence of these track records now makes our ETFs eligible for evaluations by large investment research firms like Morningstar. |

| • | Continue to Launch Innovative New Products that Diversify our Product Offerings and Revenue Stream. Another key to increasing our AUM will be our ability to introduce new ETFs to the market place that meet investor needs. We believe our track record has shown we have the ability to create and sell innovative ETFs that meet market demand. It will also be important to diversify our product offering into different asset classes. As of April 29, 2011, 34 of our 46 ETFs are in equities. In 2008, we expanded into currency ETFs. In 2010, we launched our first international fixed income ETF and in early 2011, we launched our first alternative strategy ETF and another international fixed income ETF. Beginning in late 2008 and continuing into 2009 and early 2010, many investors sold their equity positions and invested in fixed income and |

- 15 -

| commodity ETFs. At that time, we did not have fixed income or commodity presence and, although we did not experience net outflows, our AUM and revenues declined as we experienced negative market movement. We believe continued diversification will strengthen our business by allowing us to obtain inflows, maintain AUM and generate revenues during different market cycles. |

| • | Selectively Pursue Acquisitions or Partnerships. We may pursue acquisitions or enter into partnership or other commercial arrangements that will enable us to strengthen our current business, expand and diversify our product offering, increase our assets under management or enter into new markets. We believe entering into partnerships or acquisitions is a cost-effective means of growing our business and AUM. In 2007, we purchased certain assets and intellectual property from Treasury Equity, LLC which formed the basis for our currency ETFs. In 2008, we entered into a joint venture with Mellon Capital Management Corporation and The Dreyfus Corporation with respect to our currency and fixed income ETFs. We believe our management team is well equipped to identify and execute strategic opportunities for us. |

Competition

The asset management industry is highly competitive and we face substantial competition in virtually all aspects of our business. Factors affecting our business include fees for our products, investment performance, brand recognition, business reputation, quality of service, and the continuity of our financial advisor relationships. We compete primarily with other ETF sponsors and mutual fund companies and secondarily against other investment management firms, insurance companies, banks, brokerage firms and other financial institutions that offer products that have similar features and investment objectives to those offered by us. The vast majority of the firms we compete with are subsidiaries of large diversified financial companies and many others are much larger in terms of AUM, years in operations, and revenues and, accordingly, have much larger sales organizations and budgets. In addition, these larger competitors may attract business through means that are not available to us, including retail bank offices, investment banking and underwriting contacts, insurance agencies and broker-dealers.

Recently, our competitors, Vanguard, Charles Schwab, iShares and FocusShares (through Scottrade Inc.), became engaged in significant price competition by lowering fees charged for ETFs offering similar investment strategies and waiving trading commission. These ETFs are broad based market capitalization weighted equity ETFs or with respect to iShares, related to gold. We do compete against these firms for similar related equity strategies; however, as described above, our indexes are fundamentally weighted, not market capitalization weighted. However, an index developer has created a series of fundamentally weighted indexes similar to ours which may be licensed by a competitor of ours. Some of our competitors have launched or will be launching fundamentally weighted ETFs of their own. Both the indexer and our competitors are using indexes with different fundamental weighting than our approach. If price competition intensifies or we begin to compete with other ETF sponsors using a fundamentally weighted approach at a lower price than ours, we may be required to reduce the advisory fees we charge in order to compete.

In 2008, the SEC announced a proposal to allow ETFs to form and operate without the need to obtain exemptive relief. This proposed rule has not yet been adopted and we do not know if or when it may be adopted. Removing the time barrier and expense needed to obtain exemptive relief may bring additional competitors into the marketplace.

We believe our ability to successfully compete will be based on our competitive fee structure and our ability to achieve consistently strong investment performance, develop distribution relationships, create new investment products, offer a diverse platform of investment choices and attract and retain talented sales professionals and other employees.

Regulation

The investment management industry is subject to extensive regulation and virtually all aspects of our business are subject to various federal and state laws and regulations. These laws and regulations are primarily intended to protect investment advisory clients and stockholders of registered investment companies. These laws and regulations generally grant supervisory agencies broad administrative powers, including the power to limit or restrict the conduct of our business and to impose sanctions for failure to comply with these laws and regulations. Further, such laws and regulations may provide the basis for litigation that may also result in significant costs to us. The costs of complying with such laws and regulations have increased and will continue to contribute to the costs of doing business:

| • | The Investment Advisers Act of 1940 – The SEC is the federal agency generally responsible for administering the U.S. federal securities laws. Our subsidiary, WisdomTree Asset Management, Inc., or WTAM, is registered as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Investment Advisers Act”) and, as such, is regulated by the SEC. The Investment Advisers Act requires |

- 16 -

| registered investment advisers to comply with numerous and pervasive obligations, including, among others, recordkeeping requirements, operational procedures, registration and reporting and disclosure obligations. |

| • | The Investment Company Act of 1940 – The WisdomTree ETFs are registered with the SEC pursuant to the Investment Company Act of 1940, as amended (the “1940 Act”). WTAM, as an adviser to a registered investment company, must ensure the ETFs comply with the requirements of the 1940 Act, conditions imposed in the exemptive orders received by the ETFs, and related regulations including, among others, requirements relating to operations, fees charged, sales, accounting, recordkeeping, disclosure and governance. In addition, the WisdomTree Trust generally has obligations with respect to the qualification of the registered investment company under the Internal Revenue Code. |

| • | Broker-Dealer Regulations – Although we are not registered with the SEC as a broker-dealer under the Securities Exchange Act of 1934, as amended, nor are we a member firm of the Financial Industry Regulatory Authority, or FINRA, many of our employees, including all of our salespersons, are licensed with FINRA and are registered as associated persons of the distributor of the WisdomTree ETFs and, as such, are subject to the regulations of FINRA that relate to licensing, continuing education requirements and sales practices. FINRA also regulates the content of our marketing and sales material. |

In addition, in connection with this Form 10 filing, we intend to list our common stock on The Nasdaq Global Market and will therefore be also subject to their rules including corporate governance listing standards.

Intellectual Property

We regard our name, WisdomTree, as material to our business and have registered WisdomTree® as a service mark with the U.S. Patent and Trademark Office and in various foreign jurisdictions.

Our index-based equity ETFs are based on our own indexes and we do not license them from, nor do we pay licensing fees to, third parties for these indexes.

We have three patent applications pending with the U.S. Patent and Trademark office that relate to the operation of our ETFs and our index methodology. There is no assurance that patents will be issued from these applications and we do not rely upon future patents for a competitive advantage.

Employees

As of April 29, 2011, we had 61 full-time employees. Of these employees, 25 are engaged in our sales function with the remainder in providing managerial, finance, marketing, legal, regulatory compliance, operations and research functions. None of our employees are covered by a collective bargaining agreement and we consider our relations with employees to be good.

- 17 -

Any investment in our common stock involves a high degree of risk. You should consider carefully the specific risk factors described below in addition to the other information contained in this prospectus before making a decision to invest in our common stock. If any of these risks actually occur, our business, operating results, financial condition and prospects could be harmed. This could cause the trading price of our common stock to decline and a loss of all or part of your investment.

Risks Relating to our Industry and Business

We have only a limited operating history and, as a result, recent historical growth may not provide an accurate representation of the growth we may experience in the future, which will make it difficult to evaluate our future prospects.

We launched our first 20 ETFs in June 2006 and have only a limited operating history in the asset management business upon which an evaluation of our performance can be made. Since we launched our first ETFs, we have incurred significant losses and we first reported net income in the first quarter of 2011. We only began to generate positive cash flow on a full quarterly basis in the second fiscal quarter of the year ended December 31, 2010 and, as a result, recent historical growth may not provide an accurate representation of the growth we may experience in the future, which will make it difficult to evaluate our future prospects. We have a history of net losses and have not achieved sustained profitability and we may not be able to maintain or increase our level of profitability. We incurred net losses of $27.0 million, $21.2 million and $7.5 million in the years ended December 31, 2008, 2009 and 2010, respectively. Even though we achieve profitability in one quarter, because of the various risks outlined in this registration statement, we cannot be assured that we will continue to be profitable. As a result, recent historical growth may not provide an accurate representation of the growth we may experience in the future, which will make it difficult to evaluate our future prospects.

Difficult market conditions and declining prices of securities can adversely affect our business by reducing the market value of the assets we manage or causing customers to sell their fund shares and triggering redemptions.

We are subject to risks arising from adverse changes in market conditions and the declining price of securities, which may result in a decrease in demand for investment products, a higher redemption rate or a decline in AUM. Our revenue is directly impacted by the value of the securities held by our funds. As a result, our business can be expected to generate lower revenue in declining markets or general economic downturns. Substantially all of our revenue is determined by the amount of our AUM and much our AUM is represented by equity securities. Under our advisory fee arrangements, the advisory fees we receive are based on the market value of our AUM. A decline in the prices of securities held by the WisdomTree ETFs may cause our revenue to decline by either causing the value of our AUM to decrease, which would result in lower advisory fees, or causing investors in the WisdomTree ETFs to sell their shares in favor of investments they perceive to offer greater opportunity or lower risk, thus triggering redemptions that would also result in decreased AUM and lower fees. The securities markets are highly volatile, and securities prices may increase or decrease for many reasons, including general economic conditions, political events, acts of terrorism and other matters beyond our control.

Volatility and disruption of the capital and credit markets, and adverse changes in the global economy, may significantly affect our results of operations and may put pressure on our financial results.

Since our family of ETFs invests in both U.S. and international markets, its investment performance is subject to changing conditions in the global financial markets, and may also be affected by political, social and economic conditions in general. Beginning in the second half of 2007, and particularly during the second half of 2008 through early 2009, the financial markets were characterized by unprecedented levels of volatility and limited liquidity. This materially and adversely affected the capital and credit markets and led to a widespread loss of investor confidence. Although we did not experience significant net outflows of AUM, the effects of the financial crisis on the economy caused a significant decline in the value of equity securities, the market value of our AUM declined substantially and we faced a severe reduction of revenue. A similar disruption in the future, even if of a lesser magnitude, could cause us to experience net outflows of AUM or a decline in the value of equity and debt securities, thus reducing our AUM and revenue.

Fluctuations in the amount and mix of our assets under management may negatively impact revenue and operating margin.