UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For fiscal year ended December 31, 2011

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 001-10932

WisdomTree Investments, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 13-3487784 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) | |

| 380 Madison Avenue, 21st Floor New York, New York |

10017 | |

| (Address of principal executive officers) | (Zip Code) |

212-801-2080

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

Name of each exchange on which registered: | |

| Common Stock, $0.01 par value | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in 12b-2 of the Exchange Act.

| ¨ Large accelerated filer | ¨ Accelerated filer | |||

| x Non-accelerated filer | (Do not check if a smaller reporting company) | ¨ Smaller reporting company | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

At June 30, 2011, the aggregate market value of the registrant’s Common Stock held by non-affiliates (computed by reference to the price at which the Common Stock was last sold on the NASDAQ Global Market on June 30, 2011) was $248,114,676.

At March 15, 2012, there were 123,128,388 shares of the registrant’s Common Stock outstanding (voting shares).

WISDOMTREE INVESTMENTS, INC.

Form 10-K

For the Fiscal Year Ended December 31, 2011

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that are based on our management’s belief and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed in the section entitled “Risk Factors” and elsewhere in this Report. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this Report and the documents that we reference in this Report and have filed with the Securities and Exchange Commission as exhibits to this Report, completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements.

In particular, forward-looking statements in this Report include statements about:

| • | anticipated trends, conditions and investor sentiment in the global markets; |

| • | anticipated levels of inflows into and outflows out of our exchange traded funds; |

| • | our ability to deliver favorable rates of return to investors; |

| • | our ability to develop new products and services; |

| • | our ability to maintain current vendors or find new vendors to provide services to us at favorable costs; |

| • | competition in our business; and |

| • | the effect of laws and regulations that apply to our business. |

The forward-looking statements in this Report represent our views as of the date of this Report. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views as of any date other than the date of this Report.

1

| ITEM 1. | BUSINESS |

Our Company

We are the only publicly-traded asset management company that focuses exclusively on ETFs. We are the seventh largest ETF sponsor in the United States with AUM of approximately $15.6 billion as of March 16, 2012. Our family of ETFs includes both fundamentally weighted funds that track our own indexes, and actively managed funds. We distribute our ETFs through all major channels within the asset management industry, including brokerage firms, registered investment advisors, institutional investors, private wealth managers and discount brokers.

We focus on creating innovative and thoughtful ETFs for investors. We believe that our differentiated approach, employing a distinctive index-based methodology, delivers better risk adjusted returns over the long term. Our index-based funds employ a fundamental weighted investment methodology, which weights securities on the basis of factors such as dividends or earnings, whereas most other ETF indexes use a capitalization weighted methodology. Using our approach, 85% of the $9.4 billion invested in our 34 equity ETFs were in funds that, since their respective inceptions through December 31, 2011, outperformed their market capitalization-weighted or competitive benchmarks. Similarly, 26 of our 34 equity ETFs have outperformed their market capitalization-weighted or competitive benchmarks over the same period. In addition, we are one of a small number of ETF sponsors that have received the necessary exemptive relief from the SEC to offer actively managed ETFs, which are ETFs that are not based on a particular index but rather are actively managed with complete transparency into the ETF’s portfolio on a daily basis. Our exemptive relief enables us to use our own indexes for certain of our ETFs, actively manage other ETFs and incorporate the use of derivatives in certain products, thereby allowing us to develop certain ETFs not yet offered by other sponsors. For example, we are the only ETF sponsor that has launched a managed futures strategy ETF.

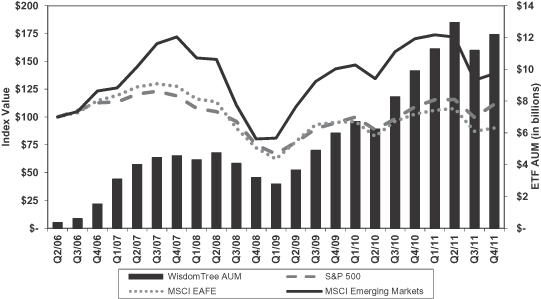

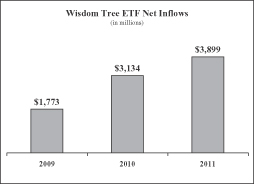

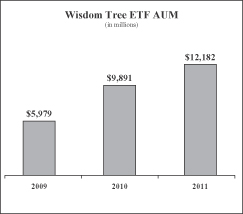

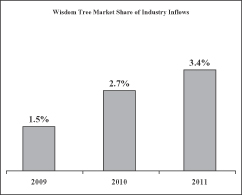

Despite a challenging economic environment, our AUM increased by $2.3 billion, or 23%, from the beginning of 2011 to $12.2 billion at December 31, 2011. Net inflows into our ETFs reached $3.9 billion in 2011, up 24% from 2010, and our market share of the ETF industry net inflows reached 3.4% compared to 2.7% in 2010. As a result of strong net inflows and growth in our AUM, our revenues increased 56.6% to $65.2 million in 2011, while our corresponding expenses increased 26.3% over the same period. We recorded net income of $3.1 million in 2011 compared to a net loss of $7.5 million in 2010.

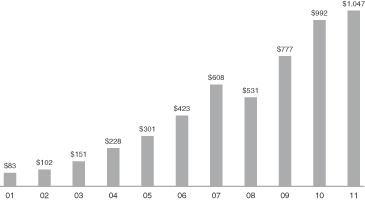

The following charts show our AUM as of the dates indicated and the net inflows of our ETFs for the periods indicated:

2

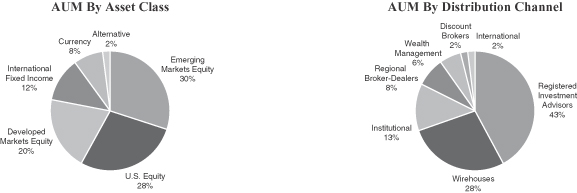

The following charts show the asset mix and distribution of our ETFs as of December 31, 2011:

Our Industry

An ETF is an investment fund that holds securities such as equities or bonds and generally trades at approximately the same price as the net asset value of its underlying components over the course of the trading day. ETFs offer exposure to a wide variety of asset classes and investment themes, including domestic, international and global equities, fixed income securities, as well as securities in specific industries and countries. There are also ETFs that track certain specific investments, such as commodities, real estate or currencies.

We believe ETFs have been one of the most innovative, revolutionary and disruptive investment products to emerge in the last two decades in the asset management industry. As of December 31, 2011, there were approximately 937 ETFs in the United States with aggregate AUM over $1 trillion. McKinsey & Company projects the global aggregate AUM of ETFs could grow by $1.5 trillion by 2015, and Strategic Insight predicts the U.S. ETF market will hit $2 trillion before the end of 2015. The chart below reflects the AUM of the ETF industry in the United States since 2001:

U.S. ETF Industry AUM

(in billions)

Source: Investment Company Institute, Bloomberg, WisdomTree.

3

As of December 31, 2011, we were the seventh largest ETF sponsor in the United States by AUM and had the highest percentage growth rate in AUM of the top ten ETF sponsors in 2011:

| AUM as

of December 31, 2011 |

2011 % Growth in AUM |

|||||||

| (in billions) | ||||||||

| 1 iShares |

$ | 448 | 0.3 | % | ||||

| 2 StateStreet |

267 | 7.6 | % | |||||

| 3 Vanguard |

170 | 14.7 | % | |||||

| 4 PowerShares |

45 | 7.7 | % | |||||

| 5 Van Eck |

23 | 17.7 | % | |||||

| 6 ProShares |

23 | 1.4 | % | |||||

|

7 WisdomTree |

12 | 23.2 | % | |||||

| 8 Deutsche Bank |

12 | 3.7 | % | |||||

| 9 Rydex |

8 | 3.4 | % | |||||

| 10 Direxion |

7 | 1.8 | % | |||||

|

|

|

|||||||

| Top Ten Total |

1,015 | |||||||

|

|

|

|||||||

| Other ETF Sponsors |

32 | |||||||

|

|

|

|||||||

| Total U.S. ETF Industry AUM |

$ | 1,047 | ||||||

|

|

|

|||||||

Source: Bloomberg, WisdomTree

According to Morningstar, Inc., ETFs were initially marketed mostly to institutional investors, but today, institutional investors account for only about half of the assets held in ETFs. ETFs have become more popular among a broad range of investors as they have come to realize their benefits and use them for a variety of purposes and strategies, including low cost index investing and asset allocation, access to specific asset classes, protective hedging, income generation, exploitation of arbitrage opportunities, and diversification strategies.

While ETFs are similar to mutual funds in many respects, they have some important differences as well:

| • | Transparency. ETFs disclose the composition of their underlying portfolios on a daily basis, unlike mutual funds which typically disclose their holdings only every 90 days. |

| • | Intraday trading, hedging strategies and complex orders. Like stocks, ETFs can be bought and sold on exchanges throughout the trading day at market prices. ETFs update the indicative values of their underlying portfolios every 15 seconds. As publicly-traded securities, ETF shares can be purchased on margin and sold short, enabling the use of hedging strategies, and traded using stop orders and limit orders, which allow investors to specify the price points at which they are willing to trade. |

| • | Tax efficiency. In the United States, whenever a mutual fund or ETF realizes a capital gain that is not balanced by a realized loss, it must distribute the capital gain to its shareholders. These gains are taxable to all shareholders, even those who reinvest the gain distributions in additional shares of the fund. However, most ETFs typically redeem their shares through “in-kind” redemptions in which low-cost securities are transferred out of the ETF in exchange for fund shares in a non-taxable transaction. As a practical matter, mutual funds cannot use this process. By using this process, ETFs avoid the transaction fees and tax impact incurred by mutual funds that sell securities to generate cash to pay out redemptions. |

| • | Uniform pricing. From a cost perspective, ETFs are one of the most equitable investment products on the market. Investors, regardless of their size, structure or sophistication, pay identical advisory fees. Unlike mutual funds, there are not different share classes or different expense structures for retail and institutional clients and ETFs are not sold with sales loads or 12b-1 fees. In many cases, ETFs offer lower expense ratios than comparable mutual funds. |

4

ETFs are used in various ways by a range of investors, from conservative to speculative uses including:

| • | Low cost index investing. Because of their low cost, ETFs are used by investors seeking to track a variety of indexes encompassing equities, commodities or fixed income over the short and long term. |

| • | Improved access to specific asset classes. Investors often use ETFs to gain access to specific market sectors or regions around the world by using an ETF that holds a portfolio of securities in that region or segment rather than buying individual securities. |

| • | Protective hedging. Investors seeking to protect their portfolios may use ETFs as a hedge against unexpected declines in prices. |

| • | Income generation. Investors seeking to obtain income from their portfolios may buy dividend-paying ETFs, which encompass a basket of dividend-paying stocks rather than buying individual stocks or a fixed income ETF that typically distributes monthly income. |

| • | Speculative investing. Investors with a specific directional opinion about a market sector may choose to buy or sell (long or short) an ETF covering or leveraging that market sector. |

| • | Arbitrage. Sophisticated investors may use ETFs in order to exploit perceived value differences between the ETF and the value of the ETF’s underlying portfolio of securities. |

| • | Asset allocation. Investors seeking to invest in various asset classes to develop an asset allocation model in a cost-effective manner can do so easily with ETFs, which offer broad exposure to various asset classes in a single security. |

| • | Diversification. By definition, ETFs represent a basket of securities and each fund may contain hundreds or even thousands of different individual securities. The “instant diversification” of ETFs provides investors with broad exposure to an asset class, market sector or geography. |

ETFs are one of the fastest growing sectors of the asset management industry, having expanded at a compound annual growth rate of 29% from $66 billion in AUM in 2000 to over $1 trillion in AUM at the end of 2011. According to the Investment Company Institute, ETF AUM increased from 4.2% of total ETF and long-term mutual fund AUM in 2005 to nearly 11% in 2011, while ETF inflows have increased from 23% of total ETF and long-term mutual fund inflows in 2005 to 34% in 2010. We expect this trend to continue. For example, during the recent market downturn in 2008, while traditional long-term mutual funds experienced outflows of $225 billion, ETFs experienced inflows of $177 billion. More recently, in 2011, ETFs experienced nearly four times the inflows of mutual funds.

We believe our growth, and the growth of the ETF industry in general, will continue to be driven by the following factors:

| • | Education and greater investor awareness. Over the last several years, ETFs have been taking a greater share of inflows and AUM from mutual funds. We believe as a result of the recent market downturns, investors have become more aware of some of the deficiencies of their mutual fund and other financial products. In particular, we believe investors are beginning to focus on important characteristics of their traditional investments—namely transparency, tradability, liquidity, tax efficiency and fees. Their attention and education focused on these important investment characteristics may be one of the drivers of the shift in inflows from traditional mutual funds to ETFs. We believe as investors become more aware and educated about ETFs and their benefits, ETFs will continue to take market share from traditional mutual funds and other financial products or structures such as hedge funds, separate accounts and single stocks. |

| • | Move to fee-based models. Over the last several years, many financial advisors have changed the revenue model that they charge clients from one that is “transaction-based,” that is, based on commissions for trades or receiving sales loads, to a “fee-based” approach, where an overall fee is charged based on the value of AUM. This fee-based approach lends itself to the advisor selecting |

5

| no-load, lower-fee financial products, and in our opinion, better aligns advisors with the interests of their clients. Since ETFs generally charge lower fees than mutual funds, we believe this model shift will benefit the ETF industry. As major brokerage firms and asset managers encourage their advisors to move towards fee-based models, we believe overall usage of ETFs will likely increase. |

| • | Innovative product offerings. Historically, ETFs tracked traditional equity indexes, but the volume of ETF growth has led to significant innovation and product development. As demand increased, the number of ETFs has also increased and today, ETFs are available for virtually every asset class including commodities, fixed income, alternative strategies, leveraged/inverse, real estate and currencies. We believe, though, that there remain substantial areas for ETF sponsors to continue to innovate, including alternative-based strategies, hard and soft commodities, and actively-managed strategies. We believe the further expansion of ETFs will fuel further growth and investments from investors who typically access these products through hedge funds, separate accounts, stock investments or the futures and commodity markets. |

| • | New distribution channels. Discount brokers, including E*Trade, TD Ameritrade, Schwab and Fidelity, now offer free trading and promotion of select ETFs. We believe the promotion of ETF trading by discount brokers and their marketing of ETFs to a wider retail channel will contribute to the future growth of ETFs. |

| • | Changing demographics. As the “baby boomer” generation continues to mature and retire, we expect that there will be a greater demand for a broad range of investment solutions, with a particular emphasis on income generation and principal protection, and that more of these investors will seek advice from professional financial advisors. We believe these financial advisors will migrate more of their clients’ portfolios to ETFs due to their lower fees, better fit within fee-based models, and their ability to (i) provide access to more diverse market sectors, (ii) improve multi-asset class allocation, and (iii) be used for different investment strategies, including income generation. Overall, we believe ETFs are well-suited to meet the needs of this large and important group of investors. |

| • | Expansion into 401(k) retirement plans. Historically, 401(k) plans were almost exclusively comprised of mutual funds. However, we believe ETFs are particularly well-suited to 401(k) retirement plans and that these plans present a large and growing opportunity for our industry. ETFs are easy-to-implement, fully transparent investment vehicles covering the full range of asset allocation categories, and are available at significantly lower costs than most traditional mutual funds. In addition, regulatory reform laws are anticipated to go into effect in the future that will require 401(k) retirement plan sponsors to disclose all fees associated with their plans. We believe that as investors become aware of fees associated with using mutual funds in traditional 401(k) retirement plans, they will replace their mutual funds with ETFs because of their lower fees. |

Our Competitive Strengths

| • | Well-positioned in large and growing markets. We believe that ETFs are well-positioned to grow significantly faster than the asset management industry as a whole, making our concentration in ETFs a significant advantage versus other traditional asset management firms. In 2011, our AUM grew at a faster rate than any of the other top 10 ETF sponsors. We have markedly increased our share of ETF industry net flows from 0.5% in 2008 to 3.4% in 2011. Within the ETF industry, being a first mover, or one of the first providers of ETFs in a particular asset class, can be a significant advantage. We believe that our early leadership in a number of asset classes, including small cap emerging markets equities, international local currency denominated fixed income, and managed futures positions us well to maintain a leadership position. |

| • | Strong performance through a differentiated approach. We create our own indexes, rebalanced annually, that weight companies in our equity ETFs by a measure of fundamental value. In contrast, traditional indexes are market capitalization weighted and tend to track the momentum of the market. Using our approach, 85% of the $9.4 billion invested in our 34 equity ETFs were in funds that, since |

6

| their respective inceptions through December 31, 2011, outperformed their market capitalization-weighted or competitive benchmarks. Similarly, 26 of our 34 equity ETFs have outperformed their market capitalization-weighted or competitive benchmarks over the same period. We believe our approach differentiates us from our competitors and will allow us to take a greater share of the expected growth in the ETF market. |

| • | Diversified product set, powered by innovation. We have a broad and diverse product set. Our products span a variety of traditional and high growth asset classes, including emerging markets, international and U.S. equities, currencies, international fixed income, and alternatives, and include both passive and actively managed funds. Our product development and research teams work closely to identify potential new ETFs for the marketplace. Because we have the regulatory exemptive relief that enables us to use our own indexes in our ETFs, we have the ability to create certain indexes and related ETFs more rapidly than our competitors who must license indexes from third party index providers. Our exemptive relief also enables us to offer actively managed funds and incorporate the use of derivatives. Our innovations include launching the industry’s first emerging markets small cap equity ETF, the first actively managed currency ETFs, one of the first international local currency denominated fixed income ETFs and the first managed futures ETF. We believe that our expertise in product development combined with our regulatory exemptive relief provides a strategic advantage, enabling us to launch innovative ETFs that others may not be able to launch as quickly. For example, the top 10 ETF sponsors launched approximately 95 ETFs in 2011 of which we launched 3. We ranked third in terms of inflows into new ETFs gathering approximately 10% or $723 million of net inflows. |

| • | Extensive marketing, research and sales efforts. Since 2006, we have invested significant resources to establish the WisdomTree brand through targeted television, print and online advertising, as well as public relations efforts. The majority of our employees are dedicated to marketing, research and sales. Our sales professionals are the primary points of contact for financial advisors who use our ETFs. Their efforts are enhanced through value-added services provided by our research and marketing efforts. We have strong relationships with financial advisors at leading national brokerage firms, registered investment advisors and high net worth advisors. We believe the recent growth we have experienced by strategically aligning these advisor relationships and marketing campaigns with targeted research and sales initiatives differentiates us from our competitors and contributes to our strong inflows. |

| • | Efficient business model with lower risk profile. We have invested heavily in the internal development of our core competencies with respect to product development, marketing, research and sales of ETFs. We outsource to third parties those services that are not our core competencies or may be resource or risk intensive, such as the portfolio management responsibilities and fund accounting operations of our ETFs. In addition, since we create our own indexes, we do not incur licensing costs and can therefore be more competitive in terms of the fees we charge for our index-based ETFs. We have already made substantial investments in our core competencies, and we expect to be able to leverage these existing capabilities across our business, positioning us to maintain both growth and profitability. |

| • | Strong, seasoned and creative management team. We have built a strong and dedicated senior leadership team. Most of our leadership team has significant ETF or financial services industry experience in fund operations, regulatory and compliance oversight, product development and management or marketing and communications. We believe our team, by developing an ETF sponsor from the ground up despite significant competitive, regulatory and operational barriers, has demonstrated an ability to innovate as well as recognize and respond to market opportunities and effectively execute our strategy. |

Our Growth Strategies

Our goal is to be among the top five U.S. sponsors in the ETF industry, where scale is a competitive advantage. In 2009, we were the eleventh largest ETF sponsor. We increased our AUM to become the eighth largest ETF sponsor in 2010 and today we are the seventh largest. We believe our continued execution will

7

enable us to increase trading volumes and build longer performance track records, which should allow us to attract additional investors and, in turn, further grow our AUM. We will seek to increase our market share and build additional scale by continuing to implement the following growth strategies:

| • | Increase penetration within existing distribution channels. We believe there is an opportunity to increase our market share by further penetrating existing distribution channels and by cross-selling additional WisdomTree ETFs. In order to achieve these objectives, we intend to continue our strategy of targeted advertising and direct marketing, coupled with our research-focused sales support initiatives, to enhance product awareness and increase our market share of ETF net inflows. We have increased our share of ETF industry net inflows from 0.5% in 2008 to 3.4% in 2011, and we are focused on continuing this trend. |

| • | Launch innovative new products that diversify our product offerings and revenues. We believe our track record has shown that we can create and sell innovative ETFs that meet market demand. We believe that continued launches of new products will strengthen our business by allowing us to realize additional inflows, maintain and grow our AUM and generate revenues across different market cycles as particular investment strategies move in and out of favor. |

| • | Expand internationally. To date, our sales and marketing has been principally focused on the domestic U.S. market. However, since April 2010, 11 of our ETFs have been cross-listed in the special international section on the Mexican stock exchange, Bolsa Mexicana De Valores, where certain institutional investors trade foreign securities in Mexico. As ETFs are increasingly traded globally we believe that international expansion of our marketing, communication and sales strategies will provide significant new growth avenues. We are currently developing a plan for further international expansion, and have established an international fund company to capitalize on growth opportunities outside of the United States. |

| • | Selectively pursue acquisitions or partnerships. We may pursue acquisitions or enter into partnerships or other commercial arrangements that will enable us to strengthen our current business, expand and diversify our product offering, increase our AUM or enter into new markets. We believe entering into partnerships or pursuing acquisitions is a cost-effective means of growing our business and AUM. For example, in 2007, we purchased certain assets and intellectual property from Treasury Equity, LLC which formed the basis for our currency ETFs. In addition, in 2008, we entered into a joint venture with Mellon Capital Management Corporation and The Dreyfus Corporation with respect to our currency and fixed income ETFs, which enabled us to bring these ETFs to market faster than would otherwise have been possible. |

Regulatory Framework of the ETF Industry

Not all exchange traded products, or ETPs, are ETFs. ETFs are a distinct type of security with features that are different than other ETPs. ETFs are open-end investment companies or unit investment trusts regulated by the Investment Company Act. This regulatory structure is designed to provide investor protection within a pooled investment product. For example, the Investment Company Act requires that at least 40% of the Trustees for each ETF must not be affiliated persons of the fund’s investment manager (“Independent Trustees”). If the ETF seeks to rely on certain rules under the Investment Company Act, a majority of the Trustees for that ETF must be Independent Trustees. In addition, as discussed below, ETFs have received orders from the staff of the SEC which exempt them from certain provisions of the Investment Company Act; however, ETFs generally operate under regulations that prohibit affiliated transactions, are subject to standard pricing and valuation rules and have mandated compliance programs. ETPs can take a number of forms other than ETFs, including exchange traded notes, grantor trusts or limited partnerships. A key factor differentiating ETFs, grantor trusts and limited partnerships from exchange traded notes is that the former hold assets underlying the ETP. Exchange traded notes on the other hand are debt instruments issued by the exchange traded note sponsor. Also, each of these structures has implications for taxes, liquidity, tracking error and credit risk.

8

Because ETFs do not fit into the regulatory provisions governing mutual funds, ETF sponsors need to obtain from the SEC “exemptive relief” from certain provisions of the Investment Company Act in order to operate ETFs. This exemptive relief allows the ETF sponsor to bring products to market for the specific products or structures they have applied for. Applying for exemptive relief can be costly and take several months to several years depending on the type of exemptive relief sought.

Our Products

Today, we offer a comprehensive family of 48 ETFs, which includes 34 international and domestic equity ETFs, seven currency ETFs, five international fixed income ETFs and two alternative strategy ETFs. Currently, 46 of our ETFs are listed on NYSE Arca, a listing venue of NYSE Euronext, and two of our ETFs are listed on the NASDAQ Stock Market. Since April 2010, 11 of our ETFs have also been cross-listed in the special international section on the Mexican stock exchange, Bolsa Mexicana De Valores, where certain institutional investors trade foreign securities in Mexico.

The type and AUM for each of our ETFs are listed below as of March 16, 2012:

| Number of Funds |

Type | AUM | ||||||||

| (in millions) | ||||||||||

| Equity ETFs: |

||||||||||

| U.S. Equity ETFs |

12 | Index based | $ | 4,337 | ||||||

| Emerging Markets Equity ETFs |

4 | Index based | 5,496 | |||||||

| International Developed Equity ETFs |

18 | Index based | 2,901 | |||||||

| Currency ETFs |

7 | Actively Managed | 899 | |||||||

| International Fixed Income ETFs |

5 | Actively Managed | 1,731 | |||||||

| Alternative Strategy ETFs |

2 | Actively Managed | 253 | |||||||

|

|

|

|

|

|||||||

| Total |

48 | $ | 15,617 | |||||||

|

|

|

|

|

|||||||

Equity ETFs

We offer equity ETFs covering the U.S., international developed and emerging markets. These ETFs offer access to the securities of large, mid and small-cap companies, companies located in the United States, developed markets and emerging markets, as well as companies in particular market sectors, including basic materials, energy, utilities and real estate. Our equity ETFs track our own fundamentally weighted indexes, as opposed to market capitalization weighted indexes, which assign more weight to stocks with the highest market capitalizations. These fundamentally weighted indexes focus on securities of companies that pay regular cash dividends or on securities of companies that have generated positive cumulative earnings over a certain period. We believe these factors, rather than market capitalization alone, can provide investors with better risk-adjusted returns over the long term.

Currency ETFs

We launched the industry’s first currency ETFs in May 2008 using an actively managed strategy. We offer currency ETFs that provide investors with exposure to developed and emerging market currencies, including the Chinese Yuan, the Brazilian Real and the Japanese Yen. Currency ETFs invest in U.S. money market securities, forward currency contracts and swaps and seek to achieve the total returns reflective of both money market rates in selected countries available to foreign investors and changes to the value of these currencies relative to the U.S. dollar.

International Fixed Income ETFs

In August 2010, we launched an ETF that invests predominantly in a broad range of local debt denominated in the currencies of emerging market countries and in March 2011, we launched an ETF that invests in local debt

9

denominated in the currencies of Asia Pacific ex-Japan countries. In October 2011, we changed the investment objective of two currency ETFs, which further expanded our international fixed income product line and in March 2012, we launched an emerging markets corporate bond ETF. We intend to launch additional fixed income bond funds and broaden our product offerings in this category.

Alternative Strategy ETFs

In January 2011, we launched the industry’s first managed futures strategy ETF. This fund seeks to achieve positive returns in rising or falling markets that are not directly correlated to broad market equity or fixed income returns. In July 2011, we launched a global real return ETF. This fund seeks total returns (capital appreciation plus income) that exceed the rate of inflation over long-term investment horizons. This fund combines domestic and global inflation-linked bonds with disciplined commodity strategies and gold exposure. We also intend to explore additional alternative strategy products in the future.

Index Based ETFs

Our equity ETFs seek to track our own fundamentally weighted indexes. Most of today’s ETFs track market capitalization weighted indexes and most of these indexes are licensed from third parties by ETF sponsors. Market capitalization weighted ETFs assign more weight to stocks with the highest market capitalizations, which is a function of stock price. We believe this means that if a stock is overvalued, market capitalization weighted funds will give the overvalued stock greater weight as its price and market capitalization increase. The opposite is true if a stock is undervalued, as market capitalization weighted funds will give it less weight. Without a way to rebalance away from these stocks, we believe market capitalization weighted funds essentially hold more of a company’s stock as its price is going up and less as the price of the company’s stock is going down. In other words, we believe these funds buy high and sell low. Market history includes many points in time when stocks were overvalued, for example, the technology and dot-com bubble of the late 1990s. We believe this structural flaw can expose investors to potentially higher risks and lower returns.

To address the structural flaw of market capitalization-weighting, we developed fundamentally weighted indexes that weight companies by a measure of fundamental value instead of market capitalization using a rules-based methodology. After researching fundamental indicators of value, we believe the most effective metrics are cash dividends or earnings. Our research indicated that weighting by cash dividends or earnings provided investors with better risk adjusted returns than market capitalization weighted indexes. The rules-based methodology that we created weights companies in our index based on either dividends or earnings in order to magnify the effect that dividends or earnings play on the total return of the index. For example, in our typical U.S. based indexes under our rules-based methodology, we weight each company based on their projected cash dividends to be paid over the coming year over the sum of the projected cash dividends to be paid by all companies or we weight each company based on their previous annual earnings over the sum of the earnings by all companies in the index. Our funds are rebalanced annually and designed to reset back to an indicator of fundamental value—either cash dividends paid or earnings generated. All of our index based equity ETFs are based on this approach. We believe this fundamentally weighted approach offers better returns than comparable ETFs or mutual funds tracking market capitalization weighted indexes over the long-term.

We benchmark our fundamentally weighted indexes against traditional market capitalization-weighted indexes designed to track similar companies, sectors, regions or exposure. Using this approach, 85% of the $9.4 billion invested in our 34 equity ETFs on December 31, 2011 were in funds that, since their respective inceptions, outperformed their market capitalization-weighted or competitive benchmarks through that date. Similarly, 26 of our 34 equity ETFs outperformed their market capitalization-weighted or competitive benchmarks over the same period. We believe this outperformance has been achieved primarily due to the weighting and selection of companies in our fundamentally weighted indexes using our rules-based methodology, rather than market capitalization-weighted indexes.

10

Actively Managed ETFs

In 2008, we obtained regulatory approval to launch actively managed ETFs, which are ETFs that are not based on an index but rather are actively managed with complete transparency of the ETF’s portfolio on a daily basis. Currently, we are one of several ETF sponsors that have already received the necessary exemptive relief from the SEC to launch actively managed ETFs. This has enabled us to develop products not yet offered by other ETF sponsors. Our actively managed ETFs includes our currency, international fixed income and alternative strategy ETFs.

The securities purchased and sold by our ETFs include U.S. and foreign equities, forward currency contracts and U.S. and foreign debt instruments. In addition, we enter into derivative transactions, in particular U.S. listed futures contracts, non-deliverable currency forward contracts, and total return swap agreements in order to gain exposure to commodities, foreign currencies, and interest rates. The exchanges these securities trade on include all the major exchanges worldwide.

Sales, Marketing and Research

We distribute our ETFs through all major channels within the asset management industry, including brokerage firms, registered investment advisors, institutional investors, private wealth managers and discount brokers. We do not target our ETFs for sale directly to the retail segment but rather to the financial advisor who acts as the intermediary between the end-client and us. We do not pay commissions nor do we offer 12b-1 fees to financial advisors to use or recommend the use of our ETFs.

We have developed an extensive network and relationships with financial advisors and we believe our ETFs and related research are well structured to meet their needs and those of their clients. Our sales professionals act in a consultative role to provide the financial advisor with value-added services. We seek to consistently grow our network of financial advisors and we opportunistically seek to introduce new products that best deliver our investment strategies to investors through these distribution channels. We have our own team of 32 sales professionals located in the United States as of December 31, 2011.

In 2010, we entered into agreements with Advisors Asset Management, Inc. and Compass Group Holdings S.A. to serve as the external marketing agents for the WisdomTree ETFs in the U.S. independent broker-dealer channel and in Latin America, respectively. These arrangements expand our distribution capabilities to channels that we believe would otherwise be difficult to access in a cost-effective manner. Under these agreements, we pay these marketing agents a percentage of our advisory fee revenue based on incremental growth in assets under management in the respective sales channel. Since inception, we have incurred in total approximately $0.6 million in expenses as of December 31, 2011 related to these marketing arrangements and we may enter into additional marketing agreements in the future. We do not expect this expense to be material in any fiscal period. We have ended our relationship with Advisors Asset Management and will handle that function with our own sales force.

Our marketing effort is focused on three objectives: (1) generating new clients and inflows to our ETFs; (2) retaining existing clients, with a focus on cross-selling additional WisdomTree ETFs; and (3) building brand awareness. We pursue these objectives through a multi-faceted marketing strategy targeted at financial advisors within the asset management industry. We utilize the following strategies:

| • | Targeted advertising. We create highly targeted multi-media advertising campaigns limited to established core financial media. For example, our television advertising runs exclusively on the cable networks CNBC and Bloomberg Television; online advertising runs on ETF-specific web sites, such as www.seekingalpha.com and www.etfdatabase.com; and print advertising runs in core financial publications, including Barron’s and Institutional Investor. |

11

| • | Media relations. We have a full time public relations director who has established relationships with the major financial media outlets including: the Wall Street Journal, Barron’s, the Financial Times, Bloomberg, Reuters and USA Today. We utilize these relationships to help create awareness of the WisdomTree ETFs and the ETF industry in general. Key members of management, including our CEO, Jonathan Steinberg, our Chief Investment Strategist, Luciano Siracusano, our President and Chief Operating Officer, Bruce Lavine, and our Director of Research, Jeremy Schwartz, are frequent market commentators and conference panelists. |

| • | Direct marketing. We have a database of financial advisors to which we regularly market through targeted and segmented communications, such as on-demand research presentations, ETF-specific or educational events and presentations, quarterly newsletters and market commentary from our senior investment strategy advisor, Professor Jeremy Siegel. |

| • | Sales support. We create comprehensive marketing materials to support our sales process including whitepapers, research reports, investment ideas and performance data for all WisdomTree ETFs. |

We will continue to evolve our marketing and communication efforts in response to changes in the ETF industry, market conditions and marketing trends.

Our research team has three core functions: index development and oversight, investment research and sales support. In its index development role, the research group is responsible for creating the investment methodologies and overseeing the maintenance of our indexes that WisdomTree’s equity ETFs are designed to track. The team also provides a variety of investment research around these indexes and market segments. Our research is typically academic-type research to support our products, including white papers on the strategies underlying our indexes and ETFs, investment insight on current market trends, and types of investment strategies that drive long-term performance. We distribute our research through our sales professionals, online through our website, targeted emails to financial advisors, or through financial media outlets, including interviews on CNBC. On some occasions our research has been included in “op-ed” letters appearing in the Wall Street Journal. Finally, the research team supports our sales professionals in meetings as market experts and through custom reports. In addition, we consult with our senior investment strategy advisor, Professor Jeremy Siegel, on product development ideas.

Competition

The asset management industry is highly competitive and we face substantial competition in virtually all aspects of our business. Factors affecting our business include fees for our products, investment performance, brand recognition, business reputation, quality of service and the continuity of our financial advisor relationships. We compete directly with other ETF sponsors and mutual fund companies and indirectly against other investment management firms, insurance companies, banks, brokerage firms and other financial institutions that offer products that have similar features and investment objectives to those offered by us. The vast majority of the firms we compete with are subsidiaries of large diversified financial companies and many others are much larger in terms of AUM, years in operations and revenues and, accordingly, have much larger sales organizations and budgets. In addition, these larger competitors may attract business through means that are not available to us, including retail bank offices, investment banking, insurance agencies and broker-dealers.

Recently, our competitors, Vanguard, Charles Schwab, iShares and FocusShares (through Scottrade Inc.), became engaged in significant price competition by lowering fees charged for ETFs offering similar investment strategies and waiving trading commissions. These ETFs typically track broad based market capitalization-weighted equity indexes or, with respect to iShares, are related to gold. We do compete against these firms for similar related equity strategies; however, as described above, our indexes are fundamentally weighted, not market capitalization-weighted. An index developer has created a series of fundamentally weighted indexes similar to ours which may be licensed by a competitor of ours. Some of our competitors have launched or will be launching fundamentally weighted ETFs of their own. Both the index developer and our competitors are using

12

indexes with different fundamental weighting than our approach. If price competition intensifies or we begin to compete with other ETF sponsors using a fundamentally weighted approach that is similar to ours at a lower price than ours, we may be required to reduce the advisory fees we charge in order to compete.

In 2008, the SEC announced a proposal to allow ETFs to form and operate without the need to obtain exemptive relief. This proposed rule has not yet been adopted and we do not know if or when it may be adopted. In addition, in March 2010, the SEC announced it would defer approval of applications for exemptive relief for ETFs that make significant use of derivatives pending a review by the SEC of the use of derivatives by mutual funds, ETFs and other investment companies. This moratorium may serve to prevent potential competitors from directly competing with certain of our products until this moratorium is lifted. Removing the time barrier and expense needed to obtain exemptive relief may bring additional competitors into the marketplace.

We believe our ability to successfully compete will depend largely on our competitive fee structure and our ability to achieve consistently strong investment performance, develop distribution relationships, create new investment products, offer a diverse platform of investment choices and attract and retain talented sales professionals and other employees.

Business Transactions

Joint Venture with Mellon Capital Management Corporation and The Dreyfus Corporation

In 2008, we entered into a mutual participation agreement with Mellon Capital Management Corporation and The Dreyfus Corporation in which we agreed to collaborate in developing currency and fixed income ETFs under the WisdomTree Trust. Under the agreement, we contribute our expertise in operating the ETFs, sales, marketing and research, and Mellon Capital and Dreyfus contributed sub-advisory, fund administration and accounting services for these collaborated ETFs. All third-party costs and profits and losses are shared equally. This agreement expires in March 2013. As of December 31, 2011, approximately $2.1 billion of our AUM is related to this agreement. If this agreement were to expire, we would be required to contract separately with Mellon Capital and Dreyfus, or pay another third party to provide for these services. Although we would then have to pay for these services, we would not have to share any profits or losses related to these ETFs. At this time, we have no information whether this agreement will expire or be renewed.

Treasury Equity, LLC

In 2007, we acquired the rights to an application pending with the SEC for exemptive relief to operate currency funds from Treasury Equity, LLC, a private company. Following this purchase we continued to pursue the application for the exemptive relief and ultimately it formed the basis for our regulatory ability to operate currency ETFs. In exchange, we issued approximately 1.2 million shares of common stock valued at approximately $2.3 million during 2008 and 2009. In addition, until March 2017, we will pay Treasury Equity, LLC a quarterly fee which is calculated as the lesser of 0.03% of the average daily assets under management for our currency ETFs or 10% of revenues we earn from our currency ETFs. We have paid in total $0.2 million in trailer fees as of December 31, 2011.

Regulation

The investment management industry is subject to extensive regulation and virtually all aspects of our business are subject to various federal and state laws and regulations. These laws and regulations are primarily intended to protect investment advisory clients and shareholders of registered investment companies. These laws generally grant supervisory agencies broad administrative powers, including the power to limit or restrict the conduct of our business and to impose sanctions for failure to comply with these laws and regulations. Further, such laws and regulations may provide the basis for litigation that may also result in significant costs to us.

13

We are currently subject to the following laws and regulations, among others. The costs of complying with such laws and regulations have increased and will continue to contribute to the costs of doing business:

| • | The Investment Advisers Act of 1940—The SEC is the federal agency generally responsible for administering the U.S. federal securities laws. Our subsidiary, WTAM, is registered as an investment adviser under the Investment Advisers Act and, as such, is regulated by the SEC. The Investment Advisers Act requires registered investment advisers to comply with numerous and broad obligations, including, among others, recordkeeping requirements, operational procedures, registration and reporting and disclosure obligations. |

| • | The Investment Company Act of 1940—The WisdomTree ETFs are registered with the SEC pursuant to the Investment Company Act. The WisdomTree ETFs must comply with the requirements of the Investment Company Act and related regulations, as well as conditions imposed in the exemptive orders received by the ETFs, including, among others, requirements relating to operations, fees charged, sales, accounting, recordkeeping, disclosure and governance. |

| • | Broker-Dealer Regulations—Although we are not registered with the SEC as a broker-dealer under the Securities Exchange Act of 1934, as amended, nor are we a member firm of the Financial Industry Regulatory Authority (FINRA), many of our employees, including all of our salespersons, are licensed with FINRA and are registered as associated persons of the distributor of the WisdomTree ETFs and, as such, are subject to the regulations of FINRA that relate to licensing, continuing education requirements and sales practices. FINRA also regulates the content of our marketing and sales material. |

| • | Internal Revenue Code—WisdomTree Trust generally has obligations with respect to the qualification of the registered investment company for pass-through tax treatment under the Internal Revenue Code. |

| • | U.S. Commodity Futures Trading Commission (CFTC)—On February 8, 2012, the CFTC adopted regulations that will likely require us to register as a commodity pool operator and may require us to register as a commodity trading adviser, which will impose upon us additional registration and licensing requirements for a select number of our ETFs that use commodities or derivatives and subject us to an additional and extensive regulatory structure. |

Because ETFs do not fit into the regulatory provisions governing mutual funds, ETF sponsors need to obtain from the SEC “exemptive relief” from certain provisions of the Investment Company Act in order to operate ETFs. This exemptive relief allows the ETF sponsor to bring products to market for the specific products or structures they have applied for. Applying for exemptive relief can be costly and take several months to several years depending on the type of exemptive relief sought.

In August 2011, the SEC published a concept release and request for comments on a wide range of issues relating to the use of derivatives by investment companies regulated under the Investment Company Act, including ETFs. The purpose of the release is to assist in the SEC’s evaluation of whether the current regulatory framework, as it applies to a fund’s use of derivatives, continues to further the policies underlying the Investment Company Act and is consistent with investor protection. While we cannot predict what new or modified regulations may be adopted as a result of the SEC’s review, it is possible that new or modified regulations could adversely affect our ability to use derivatives for certain of our products.

FINRA rules and guidance may affect how WisdomTree ETFs are sold by member firms. Although WisdomTree does not offer so-called leveraged ETFs, which may include within their holdings derivative instruments such as options futures or swaps, recent FINRA guidance on margin requirements and suitability determinations with respect to customers trading in leveraged ETFs may influence how member firms effect sales of certain WisdomTree ETFs, such as currency ETFs, which also use some forms of derivatives, including forward currency contracts and swaps.

Finally, our common stock is traded on the NASDAQ Global Market and we are therefore also subject to their rules including corporate governance listing standards. In addition, the WisdomTree ETFs are listed on NYSE Arca or the NASDAQ Market, and accordingly are subject to the listing requirements of those exchanges.

14

Property

Our principal executive office is located at 380 Madison Ave, New York, New York 10017. We occupy approximately 20,000 square feet of office space under a lease that expires in January 2014. We believe that the space we lease is sufficient to meet our current and near term needs.

Intellectual Property

We regard our name, WisdomTree, as material to our business and have registered WisdomTree® as a service mark with the U.S. Patent and Trademark Office and in various foreign jurisdictions.

Our index-based equity ETFs are based on our own indexes and we do not license them from, nor do we pay licensing fees to, third parties for these indexes.

On March 6, 2012, the U.S. Patent and Trademark Office issued to us our patent on Financial Instrument Selection and Weighting System and Method, which is embodied in our dividend weighted equity indexes. We also have two patent applications pending with the U.S. Patent and Trademark office that relate to the operation of our ETFs and our index methodology. There is no assurance that patents will be issued from these applications and we currently do not rely upon our recently issued or future patents for a competitive advantage.

Employees

As of December 31, 2011, we had 65 full-time employees. Of these employees, 32 are engaged in our sales function with the remainder providing managerial, finance, marketing, legal, regulatory compliance, operations and research functions. None of our employees are covered by a collective bargaining agreement and we consider our relations with employees to be good.

Segment and Geographic Areas

We operate as one business segment, as an ETF sponsor and asset manager providing investment advisory services. Revenues are derived in the U.S. and all of our assets are located in the U.S.

Available Information

Company Website and Public Filings

Our website is located at www.wisdomtree.com, and our investor relations website is located at www.wisdomtree.com/investor-relations. We make available, free of charge through our investor relations website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to those reports, filed or furnished pursuant to Sections 13(a) or Section 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after they have been electronically filed with, or furnished to, the SEC. The public may read and copy any materials filed by us with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C., 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding the Company at www.sec.gov.

We webcast our earnings calls and certain events we participate in or host with members of the investment community on our investor relations website. Additionally, we provide notifications of news or announcements regarding our financial performance, including SEC filings, investor events, press and earnings releases as part of our investor relations website. Further corporate governance information, including board committee charters and code of conduct, is also available on our investor relations website under the heading “Corporate Governance.” The contents of our websites are not incorporated by reference into this Annual Report on Form 10-K or in any other report or document we file with the SEC, and any references to our websites are intended to be inactive textual references only.

15

| ITEM 1A. | RISK FACTORS |

Any investment in our common stock involves a high degree of risk. You should consider carefully the specific risk factors described below in addition to the other information contained in this Report before making a decision to invest in our common stock. If any of these risks actually occur, our business, operating results, financial condition and prospects could be harmed. This could cause the trading price of our common stock to decline and a loss of all or part of your investment. Certain statements below are forward-looking statements. See the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to Our Business and Our Industry

We have only a limited operating history and, as a result, recent historical growth may not provide an accurate representation of the growth we may experience in the future, which may make it difficult to evaluate our future prospects.

We launched our first 20 ETFs in June 2006 and have only a limited operating history in the asset management business upon which an evaluation of our performance can be made. We have incurred significant losses since we launched our first ETFs. We first reported net income in the first quarter of 2011 and we only began to generate positive cash flow on a full quarterly basis in the second fiscal quarter of the year ended December 31, 2010 and, as a result, recent historical growth may not provide an accurate representation of the growth we may experience in the future, which may make it difficult to evaluate our future prospects. We have a history of net losses and have not achieved sustained profitability, and we may not be able to maintain or increase our level of profitability. Prior to generating net income for 2011, we incurred net losses of $27.0 million, $21.2 million and $7.5 million in 2008, 2009 and 2010, respectively. Even though we have achieved profitability, because of the various risks outlined in this Report, we cannot assure you that we will continue to be profitable.

Challenging global market conditions associated with declining prices of securities can adversely affect our business by reducing the market value of the assets we manage or causing WisdomTree ETF shareholders to sell their fund shares and trigger redemptions.

We are subject to risks arising from adverse changes in global market conditions and the declining prices of securities, which may result in a decrease in demand for investment products, a higher redemption rate and/or a decline in AUM. The securities markets are highly volatile and securities prices may increase or decrease for many reasons, including general economic conditions, political events, acts of terrorism and other matters beyond our control. Substantially all of our revenue is determined by the amount of our AUM and a substantial part of our AUM is represented by equity securities, in both the international and U.S. markets. As a result, our business can be expected to generate lower revenue in declining equity market environments or general economic downturns, such as after the recent U.S. government debt rating downgrade and in response to concern over potential sovereign debt defaults by other countries. A decline in the prices of securities held by the WisdomTree ETFs may cause our revenue to decline by either causing the value of our AUM to decrease, which would result in lower advisory fees, or causing investors in the WisdomTree ETFs to sell their shares in favor of investments they perceive to offer greater opportunity or lower risk, thus triggering redemptions that would also result in decreased AUM and lower fees.

Fluctuations in the amount and mix of our AUM may negatively impact revenue and operating margin.

The level of our revenue depends on the level and mix of our AUM. Our revenue is derived primarily from advisory fees based on a percentage of the value of our AUM and varies with the nature of the ETFs, which have different fee levels. Fluctuations in the amount and mix of our AUM may be attributable in part to market conditions outside of our control that have had, and in the future could have, a negative impact on our revenue and operating margin.

We are subject to an increased risk of asset volatility from changes in the foreign markets as discussed below. Individual markets may be adversely affected by economic, political, financial, or other instabilities that

16

are particular to the country or regions in which a market is located, including without limitation local acts of terrorism, economic crises or other business, social or political crises. Declines in these markets and currency fluctuations have caused in the past, and may cause in the future, a decline in our revenue. Changing market conditions and currency fluctuations may cause a shift in our asset mix between foreign and U.S. assets, potentially resulting in a decline in our revenue since we generally derive higher fee revenue from our ETFs investing in foreign markets, particularly in emerging markets.

We have had in the past, and in the future may have, investors who maintain significant positions in one or more of our ETFs. If such an investor were to broadly change or withdraw its investments in our ETFs because of a change to its investment strategy, market conditions or any other reason, it may significantly change the level and mix of our AUM, which may negatively affect our revenue and operating margin.

Most of our assets under management are held in ETFs that invest in foreign securities and we therefore have substantial exposure to foreign market conditions and are subject to currency exchange rate risks.

Many of our ETFs invest in securities of companies, governments and other organizations located outside the United States and at December 31, 2011, approximately 62% of our AUM was held by these ETFs. Therefore, the success of our business is closely tied to market conditions in foreign markets. Investments in non-U.S. issuers are affected by political, social and economic uncertainty effecting a country or region in which we are invested. In addition, fluctuations in foreign currency exchange rates could reduce the revenue we earn from these foreign invested ETFs. This occurs because an increase in the value of the U.S. dollar relative to non-U.S. currencies may result in a decrease in the dollar value of the AUM in these ETFs, which, in turn, would result in lower revenue. Furthermore, investors are likely to believe these ETFs, as well as our suite of currency and fixed income ETFs, are a less attractive investment opportunity when the value of the U.S. dollar rises relative to non-U.S. currencies, which could have the effect of reducing investments in these ETFs, thus reducing revenue.

We derive a substantial portion of our revenue from products invested in emerging markets and are exposed to the market-specific political and economic risks as well as general investor sentiment regarding future growth of those markets.

At December 31, 2011, approximately 42% of our ETF AUM was concentrated in six of our WisdomTree ETFs that primarily invest in equity or fixed income securities issued by companies or governments in emerging markets. In 2011, approximately 51% of our revenue was derived from those six ETFs. As a result, our operating results are particularly exposed to the performance of those funds, economic and market conditions in those emerging markets, general investor sentiment regarding future growth in those emerging markets and our ability to maintain the assets under management of those funds. In addition, because these funds have a higher expense ratio than our other funds in general, they generate a disproportionate percentage of our total revenue. If the AUM in these funds were to decline, either because of declining market values or because of net outflows from these funds, our revenue would be adversely affected.

We derive a substantial portion of our revenue from a limited number of products and, as a result, our operating results are particularly exposed to the performance of those funds, investor sentiment toward the strategies pursued by those funds and our ability to maintain the assets under management of those funds.

At December 31, 2011, approximately 68% of our ETF AUM was concentrated in ten of our WisdomTree ETFs. As a result, our operating results are particularly exposed to the performance of those funds, investor sentiment toward investing in the strategies pursued by those funds and our ability to maintain the assets under management of those funds.

The WisdomTree ETFs have a limited track record and poor investment performance could cause our revenue to decline.

The WisdomTree ETFs have a limited track record upon which an evaluation of their investment performance can be made. At December 31, 2011, of our total 47 ETFs, only 22 ETFs had a five year track

17

record and 40 had a three year track record. Furthermore, as part of our strategy, we continuously evaluate our product offerings to ensure that all of our funds are useful, compelling and differentiated investment offerings, to more competitively align our overall product line in the current ETF landscape and to reallocate our attention and resources to areas of greater client interest. As a result, we may further adjust our product offering which may result in the closing of some of our ETFs, changing their investment objective or offering of new funds. The investment performance of our funds is important to our success. While strong investment performance could stimulate sales of our ETFs, poor investment performance, on an absolute basis or as compared to third-party benchmarks or competitive products, could lead to a decrease in sales or stimulate redemptions, thereby lowering the assets under management and reducing our revenue. Our fundamentally-weighted equity ETFs are designed to provide the potential for better risk-adjusted investment returns over full market cycles and are best suited for investors with a longer-term investment horizon. However, the investment approach of our equity ETFs may not perform well during certain shorter periods of time during different points in the economic cycle.

We currently depend on BNY Mellon to provide us with critical services to operate our business and the WisdomTree ETFs. The failure of BNY Mellon to adequately provide such services could materially affect our operating business and harm WisdomTree ETF shareholders.

We currently depend upon BNY Mellon to provide the WisdomTree Trust with portfolio management services for all of our ETFs except for one, which is managed by another subadvisor. BNY Mellon also provides us with custody services, fund accounting, administration, transfer agency and securities lending services. The failure of BNY Mellon to provide us and the WisdomTree ETFs with these services could result in financial loss to us and WisdomTree ETF shareholders. In addition, because BNY Mellon provides a multitude of important services to us, and portfolio management for the WisdomTree ETFs covers several different asset classes, changing this vendor relationship would be challenging. It might require us to devote a significant portion of management’s time to negotiate a similar relationship with a new vendor or have these services provided by multiple vendors, which would require us to coordinate the transfer of these functions to this new vendor or vendors.

We currently depend on BNY Mellon to provide us with portfolio management services to the WisdomTree ETFs and changing this vendor relationship is not completely within our control and effecting a change would be challenging to us.

BNY Mellon currently serves as our sub-advisor and provides the WisdomTree Trust with portfolio management services for all of our ETFs except for one, which is managed by another subadvisor. We cannot replace BNY Mellon as our sub-advisor without the approval of independent trustees of the WisdomTree Trust and the approval of the shareholders of the WisdomTree ETFs. Therefore our ability to replace BNY Mellon as sub-advisor is not completely within our control. In addition, because BNY Mellon provides portfolio management for several different asset classes, changing this vendor relationship would be challenging. It might require us to devote a significant portion of management’s time to negotiate a similar relationship with a new vendor or have these services provided by multiple vendors, which would require us to coordinate the transfer of this function to this new vendor or vendors.

We depend on other third parties to provide many critical services to operate our business and the WisdomTree ETFs. The failure of key vendors to adequately provide such services could materially affect our operating business and harm WisdomTree ETF shareholders.

In addition to BNY Mellon, we depend on other third-party vendors to provide us with many services that are critical to operating our business, including a third-party provider of index calculation services for our indexes, a distributor of the WisdomTree ETFs and a third-party provider of indicative values of the portfolios of the WisdomTree ETFs. The failure of these key vendors to provide us and the WisdomTree ETFs with these services could lead to operational issues and result in financial loss to us and WisdomTree ETF shareholders.

18

The asset management business is intensely competitive. Many of our competitors have greater market share, offer a broader range of products and have greater financial resources than we do. As a result, we may experience pressures on our pricing and market share.

Our business operates in intensely competitive industry segments. We compete directly with other ETF sponsors and mutual fund companies and indirectly against other investment management firms, insurance companies, banks, brokerage firms and other financial institutions that offer products that have similar features and investment objectives to those offered by us. We compete based on a number of factors, including name recognition, service, investment performance, product features and breadth of product choices, and fees. Many of our competitors have greater market share, offer a broader range of products and have greater financial resources than we do. Some financial institutions operate in a more favorable regulatory environment and/or have proprietary products and distribution channels which may provide certain competitive advantages to them and their investment products. Our competitors may also adopt products, services or strategies similar to ours, including the use of fundamentally-weighted indexes. In addition, over time certain sectors of the financial services industry have become considerably more concentrated, as financial institutions involved in a broad range of financial services have been acquired by or merged into other firms. This convergence could result in our competitors gaining greater resources and we may experience pressures on our pricing and market share as a result of these factors and as some of our competitors seek to increase market share by reducing prices. We believe that competition within the ETF industry will continue to increase as more traditional asset management companies become ETF sponsors.

Competitive fee pressures could reduce revenue and profit margins.

The investment management business is highly competitive and has relatively low barriers to entry. Although the ETF industry currently has a higher barrier to entry as a result of the need for ETF sponsors to obtain exemptive relief from the Securities and Exchange Commission, or SEC, in order to operate ETFs, we expect that additional companies, both new companies and traditional asset managers, many of whom are much larger than us, will enter the ETF space. In addition, in 2008, the SEC proposed a rule that, if adopted, would eliminate the need to obtain this exemptive relief. In March 2010, the SEC announced it would defer approval of applications for exemptive relief for ETFs that make significant use of derivatives pending a review by the SEC of the use of derivatives by mutual funds, ETFs and other investment companies. This moratorium may serve to prevent potential competitors from directly competing with certain of our products until this moratorium is lifted. To the extent that we are forced to compete increasingly on the basis of price, we may not be able to maintain our current fee structure. Fee reductions on existing or future new products could cause our revenue and profit margins to decline.

Our revenue could be adversely affected if the WisdomTree Trust determines that the advisory fees we receive from the WisdomTree ETFs should be reduced.