UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 001-10932

WisdomTree Investments, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 13-3487784 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) | |

| 380 Madison Avenue, 21st Floor New York, New York |

10017 | |

| (Address of principal executive officers) | (Zip Code) | |

212-801-2080

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act’) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of May 11, 2012 there were 123,316,360 shares of the registrant’s Common Stock, $0.01 par value per share, outstanding (voting shares).

Form 10-Q

For the Quarterly Period Ended March 31, 2012

TABLE OF CONTENTS

| Page Number |

||||

| 4 | ||||

| 4 | ||||

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

15 | |||

| Item 3. Quantitative and Qualitative Disclosures about Market Risk |

25 | |||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds |

26 | |||

| 27 | ||||

| 27 | ||||

| Item 5. Other Information |

||||

| 28 | ||||

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q, or this Report, contains forward-looking statements that are based on our management’s belief and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed in the section entitled “Risk Factors” and elsewhere in this Report. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this Report and the documents that we reference in this Report and have filed with the Securities and Exchange Commission completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements.

In particular, forward-looking statements in this Report include statements about:

| • | anticipated trends, conditions and investor sentiment in the global markets; |

| • | anticipated levels of inflows into and outflows out of our exchange traded funds; |

| • | our ability to deliver favorable rates of return to investors; |

| • | our ability to develop new products and services; |

| • | our ability to maintain current vendors or find new vendors to provide services to us at favorable costs; |

| • | the outcome and impact of current and future litigation involving us; |

| • | competition in our business; and |

| • | the effect of laws and regulations that apply to our business. |

The forward-looking statements in this Report represent our views as of the date of this Report. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views as of any date other than the date of this Report.

3

| ITEM 1. | CONSOLIDATED FINANCIAL STATEMENTS |

WisdomTree Investments, Inc. and Subsidiaries

Consolidated Balance Sheets

(In Thousands, Except Per Share Amounts)

| March 31, 2012 |

December 31, 2011 |

|||||||

| (Unaudited) | ||||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 32,138 | $ | 25,630 | ||||

| Accounts receivable |

7,129 | 5,625 | ||||||

| Other current assets |

1,410 | 1,601 | ||||||

|

|

|

|

|

|||||

| Total current assets |

40,677 | 32,856 | ||||||

| Fixed assets, net |

582 | 597 | ||||||

| Investments |

10,086 | 9,056 | ||||||

| Other noncurrent assets |

63 | 58 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 51,408 | $ | 42,567 | ||||

|

|

|

|

|

|||||

| Liabilities and stockholders’ equity |

||||||||

| Liabilities: |

||||||||

| Current liabilities: |

||||||||

| Fund management and administration payable |

$ | 11,948 | $ | 10,035 | ||||

| Compensation and benefits payable |

1,237 | 4,168 | ||||||

| Accounts payable and other liabilities |

4,077 | 2,360 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

17,262 | 16,563 | ||||||

| Other noncurrent liabilities |

117 | 151 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

17,379 | 16,714 | ||||||

|

|

|

|

|

|||||

| Stockholders’ equity: |

||||||||

| Preferred stock, par value $0.01; 2,000 shares authorized: |

— | — | ||||||

| Common stock, par value $0.01; 250,000 shares authorized; issued: 123,235 and 116,703; outstanding: 121,463 and 115,392 |

1,232 | 1,167 | ||||||

| Additional paid-in capital |

170,743 | 163,747 | ||||||

| Accumulated deficit |

(137,946 | ) | (139,061 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

34,029 | 25,853 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 51,408 | $ | 42,567 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these consolidated financial statements

4

WisdomTree Investments, Inc. and Subsidiaries

Consolidated Statements of Operations

(In Thousands, Except Per Share Amounts)

(Unaudited)

| Three Months Ended | ||||||||

| March 31, | March 31, | |||||||

| 2012 | 2011 | |||||||

| Revenues: |

||||||||

| ETF advisory fees |

$ | 18,975 | $ | 14,273 | ||||

| Other income |

195 | 260 | ||||||

|

|

|

|

|

|||||

| Total revenues |

19,170 | 14,533 | ||||||

| Expenses: |

||||||||

| Compensation and benefits |

5,857 | 5,217 | ||||||

| Fund management and administration |

5,439 | 4,162 | ||||||

| Marketing and advertising |

1,326 | 972 | ||||||

| Sales and business development |

860 | 745 | ||||||

| Professional and consulting fees |

1,109 | 977 | ||||||

| Occupancy, communication, and equipment |

301 | 273 | ||||||

| Depreciation and amortization |

71 | 65 | ||||||

| Third party sharing arrangements |

1,745 | 1,128 | ||||||

| Other |

609 | 457 | ||||||

| Litigation and ETF shareholder proxy |

738 | — | ||||||

| Exchange listing |

— | 382 | ||||||

|

|

|

|

|

|||||

| Total expenses |

18,055 | 14,378 | ||||||

|

|

|

|

|

|||||

| Income before provision for income taxes |

1,115 | 155 | ||||||

| Provision for income taxes |

— | — | ||||||

|

|

|

|

|

|||||

| Net income |

$ | 1,115 | $ | 155 | ||||

|

|

|

|

|

|||||

| Net income per share—basic |

$ | 0.01 | $ | 0.00 | ||||

|

|

|

|

|

|||||

| Net income per share—diluted |

$ | 0.01 | $ | 0.00 | ||||

|

|

|

|

|

|||||

| Weighted-average common shares—basic |

119,182 | 113,463 | ||||||

|

|

|

|

|

|||||

| Weighted-average common shares—diluted |

137,400 | 134,470 | ||||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these consolidated financial statements

5

WisdomTree Investments, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In Thousands)

(Unaudited)

| Three Months Ended | ||||||||

| March 31, | March 31, | |||||||

| 2012 | 2011 | |||||||

| Cash flows from operating activities: |

||||||||

| Net income |

$ | 1,115 | $ | 155 | ||||

| Adjustments to reconcile net income to net cash provided by/(used in) operating activities: |

||||||||

| Depreciation and amortization |

71 | 65 | ||||||

| Stock-based compensation |

2,115 | 2,119 | ||||||

| Deferred rent |

(37 | ) | (38 | ) | ||||

| Accretion to interest income and other |

20 | 24 | ||||||

| Net change in operating assets and liabilities: |

||||||||

| Accounts receivable |

(1,504 | ) | (365 | ) | ||||

| Other assets |

198 | (170 | ) | |||||

| Fund management and administration payable |

1,913 | 722 | ||||||

| Compensation and benefits payable |

(2,931 | ) | (2,542 | ) | ||||

| Accounts payable and other liabilities |

1,720 | 553 | ||||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

2,680 | 523 | ||||||

| Cash flows from investing activities: |

||||||||

| Purchase of fixed assets |

(56 | ) | (6 | ) | ||||

| Purchase of investments |

(3,549 | ) | (2,494 | ) | ||||

| Proceeds from the redemption of investments |

2,486 | 2,147 | ||||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(1,119 | ) | (353 | ) | ||||

| Cash flows from financing activities: |

||||||||

| Net proceeds from sale of common stock |

4,329 | — | ||||||

| Shares repurchased |

(995 | ) | (1,599 | ) | ||||

| Proceeds from exercise of stock options |

1,613 | — | ||||||

|

|

|

|

|

|||||

| Net cash provided/(used in) by financing activities |

4,947 | (1,599 | ) | |||||

|

|

|

|

|

|||||

| Net increase/(decrease) in cash and cash equivalents |

6,508 | (1,429 | ) | |||||

| Cash and cash equivalents—beginning of year |

25,630 | 14,233 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents—end of year |

$ | 32,138 | $ | 12,804 | ||||

|

|

|

|

|

|||||

| Supplemental disclosure of cash flow information: |

||||||||

| Cash paid for income taxes |

$ | 3 | $ | 7 | ||||

|

|

|

|

|

|||||

| Noncash investing and financing activities: |

||||||||

| Cash less exercise of stock options |

$ | — | $ | 84 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these consolidated financial statements

6

WisdomTree Investments, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

(In Thousands, Except Share and Per Share Amounts)

1. Organization and Description of Business

WisdomTree Investments, Inc. (“WisdomTree” or the “Company”) is a New York-based exchange-traded fund (“ETF”) sponsor and asset manager. Through its operating subsidiary, the Company provides investment advisory and other management services to the WisdomTree Trust (“WTT”) and WisdomTree ETFs. The Company also licenses its indexes to third parties and promotes the use of WisdomTree ETFs in 401(k) plans. The Company has the following subsidiaries:

| • | WisdomTree Asset Management, Inc. (“WTAM”)—a wholly owned subsidiary formed in February 2005, is an investment advisor registered with the Securities and Exchange Commission (“SEC”). WTAM provides investment advisory and other management services to WTT and the WisdomTree ETFs. In exchange for providing these services, the Company receives advisory fee revenues based on a percentage of the ETFs average daily net assets under management. |

| • | WisdomTree Retirement Services, Inc. (“WTRS”)—a wholly owned subsidiary formed in August 2007, markets with selected third parties the use of WisdomTree ETFs in 401(k) plans. |

The WisdomTree ETFs are issued by WTT. WTT, a non-consolidated third-party, is a Delaware statutory trust registered with the SEC as an open-end management investment company. WTT offers ETFs across international and domestic equities, currency, fixed income and alternatives asset classes. The Company has licensed the use of its own fundamentally-weighted indexes on an exclusive basis to WTT for the WisdomTree ETFs. The Board of WTT, or the Trustees, is separate from the Board of the Company. The Trustees are primarily responsible for overseeing the management and affairs of the WisdomTree ETFs and the Trust for the benefit of the WisdomTree ETF shareholders and has contracted with the Company to provide for general management and administration services of WTT and the WisdomTree ETFs. The Company, in turn, has contracted with third parties to provide the majority of these administration services. In addition, certain officers of the Company provide general management services for WTT.

2. Significant Accounting Policies

Basis of Presentation

These consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“GAAP”) and in the opinion of management reflect all adjustments, consisting of only normal recurring adjustments, necessary for a fair statement of financial condition, results of operations, and cash flows for the periods presented. The consolidated financial statements include the accounts of the Company’s wholly owned subsidiaries WTAM and WTRS. All intercompany accounts and transactions have been eliminated in consolidation. Certain accounts in the prior years’ consolidated financial statements have been reclassified to conform to the current year’s consolidated financial statements presentation. These reclassifications had no effect on the previously reported net income.

Use of Estimates

The preparation of the Company’s consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the balance sheet dates and the reported amounts of revenues and expenses for the periods presented. Actual results could differ materially from those estimates.

7

Revenue Recognition

The Company earns investment advisory fees for ETFs and separately managed accounts as well as licensing fees from third parties. ETF advisory fees are based on a percentage of the ETFs average daily net assets and recognized over the period the related service is provided. Fees for separately managed accounts and licensing are based on a percentage of the average monthly net assets and recognized over the period the related service is provided.

Depreciation and Amortization

Depreciation is provided for using the straight-line method over the estimated useful lives of the related assets as follows:

| Equipment |

3 years | |||

| Furniture and fixtures |

7 years |

Leasehold improvements are amortized over the term of their respective leases or service lives of the improvements, whichever is shorter. Fixed assets are stated at cost less accumulated depreciation and amortization.

Marketing and Advertising

Advertising costs, including media advertising and production costs, are expensed when incurred.

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of 90 days or less at the time of purchase to be classified as cash equivalents. Cash and cash equivalents are held with one large financial institution.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are customers’ obligations due under normal trade terms. An allowance for doubtful accounts is not provided since, in the opinion of management, all accounts receivable recorded are deemed collectible.

Impairment of Long-Lived Assets

On a periodic basis, the Company performs a review for the impairment of long-lived assets when events or changes in circumstances indicate that the estimated undiscounted future cash flows expected to be generated by the assets are less than their carrying amounts or when other events occur which may indicate that the carrying amount of an asset may not be recoverable.

Earnings per Share

Basic earnings per share is computed by dividing net income available to common stockholders by the weighted-average number of common shares outstanding for the period. Diluted earnings per share reflects the potential reduction in earnings per share that could occur if options or other contracts to issue common stock were exercised or converted into common stock. Options and restricted shares to purchase shares of common stock were included in the calculation of diluted earnings per share in the three months ended March 31, 2012 and 2011, respectively.

8

Investments

The Company accounts for all of its investments as held-to-maturity, which are recorded at amortized cost, which approximates fair value. For held-to-maturity investments, the Company has the intent and ability to hold investments to maturity and it is not more likely than not that the Company will be required to sell the investments before recovery of their amortized cost bases, which may be maturity.

On a periodic basis, the Company reviews its portfolio of investments for impairment. If a decline in fair value is deemed to be other-than-temporary, the security is written down to its fair value through earnings.

Subsequent Events

The Company has evaluated subsequent events after the date of the consolidated financial statements to consider whether or not the impact of such events needed to be reflected or disclosed in the consolidated financial statements. Such evaluation was performed through the issuance date of the consolidated financial statements.

Stock-Based Awards

Accounting for share-based compensation requires the measurement and recognition of compensation expense for all equity awards based on estimated fair values. The Company accounts for stock-based compensation for its employees based on the cost of employee services received in exchange for a stock-based award. Stock-based compensation is measured based on the grant-date fair value of the award and are amortized over the relevant service period.

Stock-based awards granted to non-employees for goods or services are valued at the fair value of the equity instruments issued or the fair value of consideration received, whichever is a more reliable measure of the fair value of the transaction, and recognized when performance obligations are complete.

Income Taxes

The Company accounts for income taxes using the liability method, which requires the determination of deferred tax assets and liabilities based on the differences between the financial and tax basis of assets and liabilities using the enacted tax rates in effect for the year in which differences are expected to reverse. Deferred tax assets are adjusted by a valuation allowance if, based on the weight of available evidence, it is more-likely-than-not that some portion or all of the deferred tax assets will not be realized.

In order to recognize and measure any unrecognized tax benefits, management evaluates and determines whether any of its tax positions are more-likely-than-not to be sustained upon examination, including resolution of any related appeals or litigation processes, based on the technical merits of the position. Once it is determined that a position meets this recognition threshold, the position is measured to determine the amount of benefit to be recognized in the consolidated financial statements.

Related-Party Transactions

The Company’s revenues are derived primarily from investment advisory agreements with WTT and WisdomTree ETFs. Under these agreements, the Company has granted WTT an exclusive license to its own indexes for operation of the WisdomTree ETFs. The Trustees are primarily responsible for overseeing the management and affairs of the WisdomTree ETFs and the Trust for the benefit of the WisdomTree ETF shareholders and has contracted with the Company to provide for general management and administration of WTT and the WisdomTree ETFs. The Company is also responsible for expenses of WTT, including the cost of transfer agency, custody, fund administration and accounting, legal, audit, and other non-distribution services. In exchange, the Company receives fees based on a percentage of the ETF average daily net assets. The advisory agreements may be terminated by WTT upon notice. Certain officers of the Company also provide general management oversight of WTT; however, these officers have no material decision making responsibilities and primarily implement the decisions of the Trustees. At March 31, 2012 and December 31, 2011, the balance of accounts receivable from WTT was approximately $7,007 and $5,457, respectively. Revenue from advisory services provided to WTT for the three months years ended March 31, 2012 and 2011was approximately $18,975, and $14,273, respectively.

9

Third Party Sharing Arrangements

Included in third party sharing arrangements expense are payments (reimbursements) from/(to) the Company with respect to (i) a collaborative arrangement and (ii) marketing agreements with third parties:

Collaborative Arrangement—In 2008, the Company entered into a mutual participation agreement with Mellon Capital Management Corporation (“Mellon Capital”) and The Dreyfus Corporation (“Dreyfus”) in which the parties agreed to collaborate in developing currency and fixed income ETFs under WTT. Under the agreement, the Company is responsible for operating the ETFs and providing sales, marketing and research support at its own cost. Mellon Capital and Dreyfus are responsible for providing sub-advisory, fund administration and accounting services for these collaborative ETFs at its own cost. Any revenues less third party costs, such as marketing, legal, accounting or fund management, related to these collaborative products are shared equally, including any losses (“net profit/(loss)”). The Company is responsible for arranging any third party costs related to this collaborative arrangement. This agreement expires in March 2013. The Company has determined it is the principal participant for transactions under this collaborative arrangement and as such, records these transactions on a gross basis reflecting all of the revenues and third party expenses on its consolidated financial statements in accordance with the nature of the revenue or expense. Any net profit/(loss) payments are reflected in Third Party Sharing Arrangements expense on the consolidated financial statements.

Revenues and expenses under this collaborative arrangement included in the Company’s consolidated financial statements are as follows:

| Three Month Ended March 31, |

||||||||

| 2012 | 2011 | |||||||

| ETF advisory fee revenue |

$ | 2,790 | $ | 2,467 | ||||

| Expenses: |

||||||||

| Fund management and administration |

341 | 327 | ||||||

| Marketing and advertising |

10 | 181 | ||||||

| Sales and business development |

4 | 19 | ||||||

|

|

|

|

|

|||||

| Third party expenses |

355 | 527 | ||||||

| Net profit |

2,435 | 1,940 | ||||||

| Sharing |

$ | 1,195 | $ | 970 | ||||

Marketing agreements—In 2010, the Company entered into agreements with two external distribution firms to serve as the external marketing agents for the WisdomTree ETFs in the U.S. independent broker-dealer channel and in Latin America. Under these agreements, the Company will pay a percentage of their advisory fee revenue, subject to caps, to the marketing agents based on incremental growth in assets under management in the respective sales channel. The Company incurred marketing fees of $550 and $158 for the three months ended March 31, 2012 and 2011, respectively. In addition, during the three months ended March 31, 2012, the Company terminated the marketing agreement with the firm covering the U.S. Independent broker and incurred a cancellation fee of $385 which is included in the amount described above.

Segment, Geographic and Customer Information

The Company operates as one business segment, as an ETF sponsor and asset manager providing investment advisory services. Revenues are derived in the U.S. and all of the Company’s assets are located in the U.S.

10

Recently Issued Accounting Pronouncements

In May 2011, FASB issued ASU No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial Reporting Standards (“IFRS”).” ASU No. 2011-04 includes common requirements for measurement of and disclosure about fair value between U.S. GAAP and IFRS. ASU No. 2011-04 requires reporting entities to disclose the following information for fair value measurements categorized within Level 3 of the fair value hierarchy: quantitative information about the unobservable inputs used in the fair value measurement, the valuation processes used by the reporting entity and a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs and the interrelationships between those unobservable inputs. In addition, ASU No. 2011-04 requires reporting entities to make disclosures about amounts and reasons for all transfers in and out of Level 1 and Level 2 fair value measurements, which is effective for fiscal years beginning after December 15, 2011. This standard did not have a material impact on our consolidated financial statements.

3. Investments and Fair Value Measurements

The following table is a summary of the Company’s investments:

| March 31, 2012 |

December 31, 2011 |

|||||||

| Held-to- Maturity |

Held-to- Maturity |

|||||||

| Federal agency debt instruments |

$ | 10,086 | $ | 9,056 | ||||

|

|

|

|

|

|||||

The following table summarizes unrealized gains, losses, and fair value of investments:

| March 31, | December 31, | |||||||

| 2012 | 2011 | |||||||

| Held-to- Maturity |

Held-to- Maturity |

|||||||

| Cost/amortized cost |

$ | 10,086 | $ | 9,056 | ||||

| Gross unrealized gains |

48 | 53 | ||||||

| Gross unrealized losses |

(204 | ) | (112 | ) | ||||

|

|

|

|

|

|||||

| Fair value |

$ | 9,930 | $ | 8,997 | ||||

|

|

|

|

|

|||||

The following table sets forth the maturity profile of investments:

| March 31, | December 31, | |||||||

| 2012 | 2011 | |||||||

| Held-to- Maturity |

Held-to- Maturity |

|||||||

| Due within one year |

$ | — | $ | — | ||||

| Due one year through five years |

250 | 250 | ||||||

| Due five years through ten years |

1,070 | 1,134 | ||||||

| Due over ten years |

8,766 | 7,672 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 10,086 | $ | 9,056 | ||||

|

|

|

|

|

|||||

Fair Value Measurement

Under the accounting for fair value measurements and disclosures, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability, or the exit price, in an orderly transaction between market participants at the measurement date. The accounting guidance establishes a hierarchy of valuation techniques based on whether the inputs to those valuation techniques are observable or unobservable. Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect the Company’s market assumptions.

11

These three types of inputs create the following fair value hierarchy:

Level 1—Quoted prices for identical instruments in active markets.

Level 2—Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3—Instruments whose significant value drivers are unobservable.

This hierarchy requires the use of observable market data when available. The Company’s held-to-maturity securities and money market investments included in cash equivalents are categorized as Level 1. The Company does not intend to sell its investments held-to maturity before the recovery of their amortized cost bases which may be at maturity.

Some of our financial instruments are not measured at fair value on a recurring basis but are recorded at amounts that approximate fair value due to their liquid or short-term nature. Such financial assets and financial liabilities include: accounts receivable, certain other current assets, accounts payable and other liabilities, fund management and administration payable, and compensation and benefits payable.

4. Fixed Assets

The following table summarized fixed assets:

| March 31, 2012 |

December 31, 2011 |

|||||||

| Equipment |

$ | 693 | $ | 669 | ||||

| Furniture and fixtures |

276 | 244 | ||||||

| Leasehold improvements |

1,053 | 1,053 | ||||||

| Less accumulated depreciation and amortization |

(1,440 | ) | (1,369 | ) | ||||

|

|

|

|

|

|||||

| Total |

$ | 582 | $ | 597 | ||||

|

|

|

|

|

|||||

5. Commitments and Contingencies

Contractual Obligations

The Company has entered into obligations under operating leases with initial non-cancelable terms in excess of one year for office space, telephone, and data services. Expenses recorded under these agreements for the months ended March 31, 2012 and 2011 were approximately $288 and $255, respectively.

Future minimum lease payments with respect to non-cancelable operating leases at March 31, 2012 are approximately as follows:

| Remainder of 2012 |

$ | 1,061 | ||

| 2013 |

1,343 | |||

| 2014 |

80 | |||

| 2015 and thereafter |

— | |||

|

|

|

|||

| Total |

$ | 2,484 | ||

|

|

|

Letter of Credit

The Company collateralizes its office lease space through a standby letter credit in the amount of $700 held as an investment in debt securities, which is included in investments on the consolidated balance sheets at March 31, 2012 and December 31, 2011.

12

Contingencies

The Company is subject to various routine regulatory reviews and inspections by the SEC as well as legal proceedings arising in the ordinary course of business.

On December 1, 2011, Research Affiliates, LLC filed suit against the Company in the United States District Court for the Central District of California, alleging that the fundamentally weighted investment methodology the Company employs infringes three of plaintiff’s patents, and seeking both unspecified monetary damages and an injunction to prevent further infringement. The Company filed an answer to the complaint on January 17, 2012 and believes it has strong defenses to this lawsuit. While at this early stage of the proceedings, management has determined it is not possible to determine the probability of any outcome or probability or amount of any loss and therefore has not recorded any reserves related to this lawsuit.

6. Stock-Based Awards

The Company grants equity awards to employees, directors and special advisors for services:

| • | Options are issued generally for terms of ten years and vest between two to four years. Options are issued with an exercise price equal to the fair value of the Company on the date of grant. The Company estimated the fair value for options using the Black-Scholes Option Pricing Model. |

| • | All restricted stock awards require future service as a condition of delivery of the underlying shares of common stock along with certain other requirements outlined in the award agreements. Restricted stock awards generally vest over one to four years. |

| • | Stock awards granted to advisors vest over the contractual period of the consulting arrangement. The fair value of these awards is measured at the grant dated fair value and re-measured at each reporting period. Fair value is determined as the closing price of the Company’s common stock on the date of grant. |

A summary of options and restricted stock activity is as follows:

| Options | Weighted Average Exercise Price of Options |

Restricted Stock Awards |

||||||||||

| Balance at January 1, 2012 |

20,852,614 | $ | 0.79 | 1,311,371 | ||||||||

| Granted |

— | $ | — | 946,996 | ||||||||

| Exercised/vested |

(4,677,351 | ) | $ | 0.26 | (484,979 | ) | ||||||

| Forfeitures |

(73,750 | ) | $ | 2.02 | (2,157 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Balance at March 31, 2012 |

16,101,513 | $ | 0.94 | 1,771,231 | ||||||||

|

|

|

|

|

|

|

|||||||

A summary of stock-based compensation expense is as follows:

| Three Months Ended March 31, |

||||||||

| 2012 | 2011 | |||||||

| Employees and directors |

$ | 1,424 | $ | 1,525 | ||||

| Non-employees |

691 | 594 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 2,115 | $ | 2,119 | ||||

|

|

|

|

|

|||||

13

7. Earnings and Dividend Per Share

The following is a reconciliation of the basic and diluted earnings per share computation:

| Three Months Ended March 31, |

||||||||

| 2012 | 2011 | |||||||

| (shares in thousands) | ||||||||

| Net income |

$ | 1,115 | $ | 155 | ||||

|

|

|

|

|

|||||

| Shares of common stock and common stock equivalents: |

||||||||

| Weighted averages shares used in basic computation |

119,182 | 113,463 | ||||||

| Dilutive effect of stock options and unvested restricted stock |

18,218 | 21,007 | ||||||

|

|

|

|

|

|||||

| Weighted averages shares used in dilutive computation |

137,400 | 134,470 | ||||||

|

|

|

|

|

|||||

| Basic earnings per share |

$ | 0.01 | $ | 0.00 | ||||

| Dilutive earnings per share |

$ | 0.01 | $ | 0.00 | ||||

Diluted earnings per share reflects the potential reduction in earnings per share that could occur if options or other contracts to issue common stock were exercised or converted into common stock. Options and restricted shares to purchase shares of common stock were included in the three months ending March 31, 2012 and 2011.

8. Shares Repurchased

During the three months ended March 31, 2012 and 2011, the Company repurchased 157,080 and 309,502 shares of its Company stock for an aggregate price of $995 and $1,599, respectively. The shares repurchased related to the vesting of restricted stock granted to employees.

9. Financing

On February 2, 2012, the Company completed a secondary offering of its common stock at $5.61 per share. The Company sold 1,000,000 shares and certain selling stockholders of the Company sold 15,516,587. Proceeds to Company, less commissions and other direct selling expenses, were approximately $4,329. The proceeds from the offering will be used for working capital and other general corporate purposes.

14

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis of our financial condition and results of operations should be read together with our consolidated financial statements and the related notes and the other financial information included elsewhere in this Report. In addition to historical consolidated financial information, the following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include those discussed below. For a more complete description of the risks noted above and other risks that could cause our actual results to materially differ from our current expectations, please see the Item 1A. “Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2011. We assume no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by law.

Our Business

We are the seventh largest sponsor of ETFs in the United States based on AUM, with AUM of approximately $15.7 billion as of March 31, 2012. An ETF is an investment fund that holds securities such as stocks or bonds and trades at approximately the same price as the net asset value of its underlying assets. ETFs offer exposure to a wide variety of investment themes, including domestic, international and emerging market equities, fixed income securities, currencies or commodities, as well as securities in specific industries and countries. We currently offer a comprehensive family of 48 ETFs, which includes 34 international and domestic equity ETFs, seven currency ETFs, five international fixed income ETFs and two alternative strategy ETFs.

Through our operating subsidiary, we provide investment advisory and other management services to the WisdomTree ETFs. In exchange for providing these services, we receive advisory fee revenues based on a percentage of the ETFs average daily net assets under management.

Our expenses are predominantly related to selling, operating and marketing our ETFs and we have contracted with third parties to provide certain operational services for the ETFs including sub-advisory, portfolio management services, fund administration, custody, accounting and other related services for the WisdomTree ETFs.

We distribute our ETFs through all major channels within the asset management industry, including brokerage firms, registered investment advisors, institutional investors, private wealth managers and discount brokers. We do not target our ETFs for sale directly to the retail segment but rather to the financial advisor who acts as the intermediary between the end-client and us.

Our revenues are highly correlated to the level and relative mix of our AUM, as well as the fee rate associated with our ETFs. While our AUM has increased on an annual basis, we have experienced fluctuations on a quarterly basis due to changes in net inflows and, most significantly, market movement. A significant portion of our AUM is invested in securities issued outside of the United States, in particular emerging market countries. Therefore, our AUM and our revenues are affected by movements in global capital market levels, investor sentiment towards emerging markets and the strengthening or weakening of the U.S. dollar against other currencies. It is our belief that our ability to gather inflows into our ETFs, coupled with general stock market trends, will have the greatest impact on our business.

15

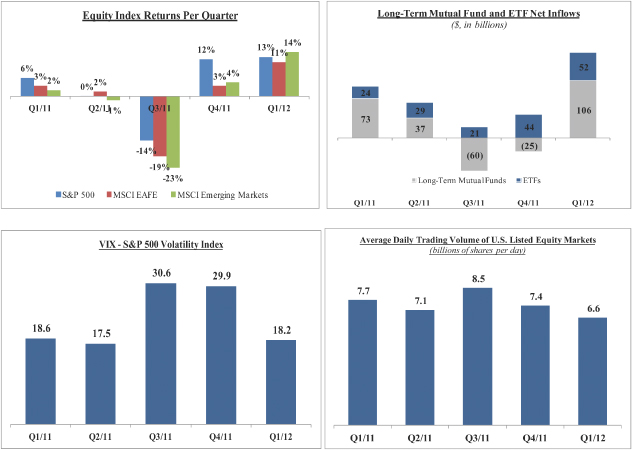

Market Environment

We have been and continue to operate in a challenging economic environment. Equity markets worldwide experienced positive results for the first three months of 2012. For example, the S&P 500, MSCI EAFE and MSCI Emerging Market indexes increased 13%, 11% and 14%, respectively, in the first quarter of 2012. These positive returns helped increase investors’ net inflows into long-term mutual funds (predominantly in fixed income mutual funds) and ETFs, which increased from approximately $19 billion in the fourth quarter of 2011 to $158 billion in the first quarter of 2012. Volatility also subsided as the average value of the S&P 500 volatility index, commonly referred to as the VIX, decreased from 29.9 in the fourth quarter of 2011 to 18.2 in the first quarter of 2012. However, despite this positive momentum, investors continue to remain cautious given the concerns over European sovereign debt and the pace of economic recovery in the U.S. For example, equity trading volumes remain weak. The average daily trading volume of the U.S. listed equity markets decreased to 6.6 billion shares a day in the first quarter of 2012 as compared to 7.4 billion shares in the fourth quarter of 2011 and 7.7 billion in the first quarter of 2011.

16

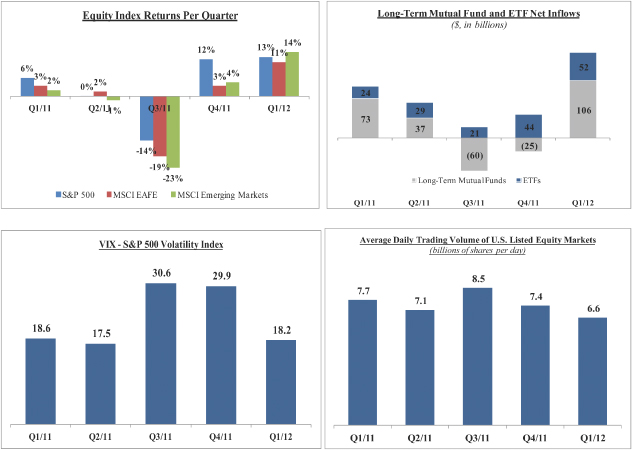

Our Results

Despite these challenges, we have experienced record operating results in the first three months of 2012. Our AUM increased 28.8% from $12.2 billion at December 31, 2011 to $15.7 billion at March 31, 2012. Our net inflows during the first quarter of 2012 reached a record $2.3 billion. The majority of the net inflows into our ETFs were in our emerging market equity and U.S. dividend based ETFs. In the continuing low interest rate environment, we believe there is increased demand for financial products with higher yields. In particular, dividend-paying companies have been in focus for investors due to their dividend yield, and our dividend weighted ETFs have benefited from this investor sentiment. Our market share of industry net inflows was 4.4% in the first quarter of 2012 as compared to 5.4% in the comparable period in the first quarter of 2011. Our strong operating results have generated record revenues for us. Our revenues increased to a record $19.2 million and our net income was $1.1 million in the first quarter of 2012 as compared to revenues of $14.5 million and net income of $0.2 million in the first quarter of 2011.

Other Highlights

New ETF Launch

In January 2012, we announced a new sub-advisory relationship with Western Asset Management Company. In March 2012, we launched an actively managed international fixed income ETF with Western Asset Management Company as the sub-advisor. With this new ETF, we now offer a suite of five international fixed income ETFs.

Secondary Offering

On February 2, 2012, we completed a public offering of our common stock at $5.61 per share. We sold 1 million shares and certain of our stockholders sold 15.5 million shares. Proceeds to us, less commissions and other direct selling expenses, were approximately $4.3 million and will be used for working capital and other general corporate purposes. We did not receive any proceeds from the sale of shares of our common stock by the selling stockholders.

17

Other Matters

Litigation

On December 1, 2011, Research Affiliates, LLC filed suit against us in the United States District Court for the Central District of California, alleging that the fundamentally weighted investment methodology we employ infringes three of plaintiff’s patents, and seeking both unspecified monetary damages in an amount to be determined and an injunction to prevent further infringement. We believe that (i) we do not practice the indexing methods as claimed in the asserted patents and (ii) the patents should be declared invalid because, among other reasons, there is ample evidence that the concept of fundamentals based indexing was widely known and in commercial use by asset managers and index providers well before the patent applications at issue were filed by plaintiff. We filed our answer to the complaint on January 17, 2012 and believe we have strong defenses to this lawsuit and therefore intend to vigorously defend against plaintiff’s claims.

During the first quarter of 2012, we incurred approximately $0.7 million in legal expenses related to this litigation. We estimate our legal costs could potentially be between $4.0 to $7.5 million through the first half of 2013. While at this early stage of this litigation, it is not possible to determine the probability of any outcome or probability or amount of any loss, we are confident in the merits of our position.

ETF shareholder proxy solicitation

We intend to mail later this month a proxy statement to obtain approval from the shareholders of the WisdomTree ETFs for us to continue as investment advisor for the WisdomTree ETFs if our largest stockholder, Michael Steinhardt, who beneficially owns 25.5% of our common stock, were to sell or otherwise transfer shares of common stock in the future such that his beneficial ownership would fall below 25%. The Investment Company Act presumes a change in control of our Company if Mr. Steinhardt’s ownership falls below the 25% threshold. A change in control of our Company would trigger an automatic termination of our investment advisory agreements with the WisdomTree Trust. We also intend to seek approval from the WisdomTree ETF shareholders to give us the option to change sub-advisors in the future from BNY-Mellon. In the first three months of 2012, we incurred approximately $0.1 million in expenses and we expect to incur approximately $2.5 million to $3.5 million in costs in 2012.

Regulatory Reform

On February 9, 2012, the Commodity Futures Trading Commission (CFTC) adopted regulations that would impose upon us additional registration and licensing requirements for a select number of our ETFs and subject us to an additional and extensive regulatory structure. These new regulations will highly likely cause us to incur additional costs to achieve and maintain compliance. On April 17, 2012, the Investment Company Institute and the Chamber of Commerce filed a lawsuit against the CFTC claiming that this new rule was unlawfully adopted. The complaint argues that the CFTC did not conduct the cost-benefit analysis required by the Administrative Procedures Act. While we are currently evaluating implementation of the new rule with our regulatory advisors, we do not know what effect, if any, this lawsuit will have on the new rule.

18

Key Operating Statistics

The following table presents key operating statistics that serve as indicators for the performance of our business:

| Three Months Ended | ||||||||||||

| March 31, | December 31, | March 31, | ||||||||||

| 2012 | 2011 | 2011 | ||||||||||

| Total ETFs (in millions) |

||||||||||||

| Beginning of period assets |

$ | 12,182 | $ | 11,184 | $ | 9,891 | ||||||

| Inflows/(outflows) |

2,299 | 756 | 1,264 | |||||||||

| Market appreciation/(depreciation) |

1,210 | 242 | 129 | |||||||||

|

|

|

|

|

|

|

|||||||

| End of period assets |

$ | 15,691 | $ | 12,182 | $ | 11,284 | ||||||

|

|

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 14,265 | $ | 11,836 | $ | 10,294 | ||||||

| ETF Industry and Market Share (in billions) |

||||||||||||

| ETF industry net inflows |

$ | 52 | $ | 44 | $ | 24 | ||||||

| WisdomTree market share of industry inflows |

4.4 | % | 1.7 | % | 5.4 | % | ||||||

| International Developed Equity ETFs (in millions) |

||||||||||||

| Beginning of period assets |

$ | 2,407 | $ | 2,501 | $ | 2,311 | ||||||

| Inflows/(outflows) |

302 | (94 | ) | 475 | ||||||||

| Market appreciation/(depreciation) |

255 | — | 79 | |||||||||

|

|

|

|

|

|

|

|||||||

| End of period assets |

$ | 2,964 | $ | 2,407 | $ | 2,865 | ||||||

|

|

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 2,680 | $ | 2,496 | $ | 2,463 | ||||||

| Emerging Markets Equity ETFs (in millions) |

||||||||||||

| Beginning of period assets |

$ | 3,613 | $ | 3,230 | $ | 3,780 | ||||||

| Inflows/(outflows) |

1,398 | 418 | 59 | |||||||||

| Market appreciation/(depreciation) |

583 | (35 | ) | (80 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| End of period assets |

$ | 5,594 | $ | 3,613 | $ | 3,759 | ||||||

|

|

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 4,780 | $ | 3,456 | $ | 3,618 | ||||||

| US Equity ETFs (in millions) |

||||||||||||

| Beginning of period assets |

$ | 3,429 | $ | 2,523 | $ | 2,057 | ||||||

| Inflows/(outflows) |

565 | 586 | 53 | |||||||||

| Market appreciation/(depreciation) |

281 | 320 | 108 | |||||||||

|

|

|

|

|

|

|

|||||||

| End of period assets |

$ | 4,275 | $ | 3,429 | $ | 2,218 | ||||||

|

|

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 3,990 | $ | 2,973 | $ | 2,164 | ||||||

| Currency ETFs (in millions) |

||||||||||||

| Beginning of period assets |

$ | 950 | $ | 1,194 | $ | 1,179 | ||||||

| Inflows/(outflows) |

(104 | ) | (157 | ) | 271 | |||||||

| Market appreciation/(depreciation) |

35 | (56 | ) | 17 | ||||||||

| Reclass to Int’l Fixed Income |

— | (31 | ) | — | ||||||||

|

|

|

|

|

|

|

|||||||

| End of period assets |

$ | 881 | $ | 950 | $ | 1,467 | ||||||

|

|

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 935 | $ | 1,120 | $ | 1,335 | ||||||

19

| International Fixed Income ETFs (in millions) |

||||||||||||

| Beginning of period assets |

$ | 1,506 | $ | 1,493 | $ | 564 | ||||||

| Inflows/(outflows) |

161 | (34 | ) | 335 | ||||||||

| Market appreciation/(depreciation) |

68 | 16 | 3 | |||||||||

| Reclass from Currency |

— | 31 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| End of period assets |

$ | 1,735 | $ | 1,506 | $ | 902 | ||||||

|

|

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 1,627 | $ | 1,536 | $ | 679 | ||||||

| Alternative Strategy ETFs (in millions) |

||||||||||||

| Beginning of period assets |

$ | 277 | $ | 243 | $ | — | ||||||

| Inflows/(outflows) |

(23 | ) | 37 | 71 | ||||||||

| Market appreciation/(depreciation) |

(12 | ) | (3 | ) | 2 | |||||||

|

|

|

|

|

|

|

|||||||

| End of period assets |

$ | 242 | $ | 277 | $ | 73 | ||||||

|

|

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 253 | $ | 255 | $ | 35 | ||||||

| Average ETF assets during the period |

||||||||||||

| Emerging markets equity ETFs |

33 | % | 29 | % | 35 | % | ||||||

| US equity ETFs |

28 | % | 25 | % | 21 | % | ||||||

| International developed equity ETFs |

19 | % | 21 | % | 24 | % | ||||||

| International fixed income ETFs |

12 | % | 13 | % | 7 | % | ||||||

| Currency ETFs |

7 | % | 10 | % | 13 | % | ||||||

| Alternative strategy ETFs |

1 | % | 2 | % | 0 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Total |

100 | % | 100 | % | 100 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Average ETF advisory fee during the period |

0.54 | % | 0.54 | % | 0.56 | % | ||||||

| Number of ETFs - end of the period |

||||||||||||

| International developed equity ETFs |

18 | 18 | 18 | |||||||||

| US equity ETFs |

12 | 12 | 12 | |||||||||

| Currency ETFs |

7 | 7 | 9 | |||||||||

| International fixed income ETFs |

5 | 4 | 2 | |||||||||

| Emerging markets equity ETFs |

4 | 4 | 4 | |||||||||

| Alternative strategy ETFs |

2 | 2 | 1 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

48 | 47 | 46 | |||||||||

|

|

|

|

|

|

|

|||||||

| Headcount |

64 | 65 | 61 | |||||||||

Note: Previously issued statistics may be restated due to trade adjustments

Source: Investment Company Institute, Bloomberg, WisdomTree

20

Three Months Ended March 31, 2012 Compared to March 31, 2011

Revenues

| Three Months Ended March 31, |

Change | Percent Change |

||||||||||||||

| 2012 | 2011 | |||||||||||||||

| Average assets under management (in millions) |

$ | 14,265 | $ | 10,294 | $ | 3,971 | 38.6 | % | ||||||||

| Average ETF advisory fee |

0.54 | % | 0.56 | % | (.02 | ) | ||||||||||

| ETF advisory fees (in thousands) |

$ | 18,975 | $ | 14,273 | $ | 4,702 | 32.9 | % | ||||||||

| Other income (in thousands) |

195 | 260 | (65 | ) | (25.0 | %) | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total revenues (in thousands) |

$ | 19,170 | $ | 14,533 | $ | 4,637 | 31.9 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

ETF advisory fees

ETF advisory fees revenue increased 32.9% from $14.3 million in the first three months of 2011 to $19.0 million in the comparable period in 2012. This increase was primarily due to higher average asset under management balances due to strong net inflows primarily into our emerging market and U.S. dividend based equity ETFs. The average fee earned decreased from 0.56% in the first three months of 2011 to 0.54% in the comparable period in 2012 primarily due to a change in mix of our assets under management, in particular from our emerging market equity and U.S. ETFs.

Other income

Other income decreased 25.0% from $0.3 million in the first three months of 2011 to $0.2 million in the comparable period in 2012. This decline was primarily due to lower separate account revenues. Following the first quarter of 2011, we no longer managed separate accounts.

Expenses

| (in thousands) |

Three Months Ended March 31, |

Change | Percent Change |

|||||||||||||

| 2012 | 2011 | |||||||||||||||

| Compensation and benefits |

$ | 5,857 | $ | 5,217 | $ | 640 | 12.3 | % | ||||||||

| Fund management and administration |

5,439 | 4,162 | 1,277 | 30.7 | % | |||||||||||

| Marketing and advertising |

1,326 | 972 | 354 | 36.4 | % | |||||||||||

| Sales and business development |

860 | 745 | 115 | 15.4 | % | |||||||||||

| Professional and consulting fees |

1,109 | 977 | 132 | 13.5 | % | |||||||||||

| Occupancy, communication and equipment |

301 | 273 | 28 | 10.3 | % | |||||||||||

| Depreciation and amortization |

71 | 65 | 6 | 9.2 | % | |||||||||||

| Third-party sharing arrangements |

1,745 | 1,128 | 617 | 54.7 | % | |||||||||||

| Other |

609 | 457 | 152 | 33.3 | % | |||||||||||

| Litigation and ETF shareholder proxy |

738 | — | 738 | na | ||||||||||||

| Exchange listing |

— | 382 | (382 | ) | na | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total expenses |

$ | 18,055 | $ | 14,378 | $ | 3,677 | 25.6 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| As a Percent of Revenues: |

Three Months Ended March 31, |

|||||||

| 2012 | 2011 | |||||||

| Compensation and benefits |

30.6 | % | 35.9 | % | ||||

| Fund management and administration |

28.4 | % | 28.6 | % | ||||

| Marketing and advertising |

6.9 | % | 6.7 | % | ||||

| Sales and business development |

4.5 | % | 5.1 | % | ||||

| Professional and consulting fees |

5.8 | % | 6.7 | % | ||||

| Occupancy, communication and equipment |

1.6 | % | 1.9 | % | ||||

| Depreciation and amortization |

0.4 | % | 0.4 | % | ||||

| Third-party sharing arrangements |

9.1 | % | 7.8 | % | ||||

| Other |

3.2 | % | 3.1 | % | ||||

21

| As a Percent of Revenues: |

Three Months Ended March 31, |

|||||||

| 2012 | 2011 | |||||||

| Litigation and ETF shareholder proxy |

3.8 | % | — | |||||

| Exchange listing |

— | 2.6 | % | |||||

|

|

|

|

|

|||||

| Total expenses |

94.2 | % | 98.9 | % | ||||

|

|

|

|

|

|||||

Compensation and benefits

Compensation and benefits expense increased 12.3% from $5.2 million in the first three months of 2011 to $5.9 million in the comparable period in 2012. This increase was primarily due to higher payroll tax expenses from employees exercising stock options in connection with our secondary offering and 2011 year-end bonus payments which were paid in February 2012. We incurred approximately $0.3 million in payroll taxes related to our secondary offering. Also increasing were higher headcount related costs and higher accrued incentive compensation as a result of our strong net inflows. Partly offsetting these increases was lower stock based compensation, which decreased to $1.4 million from $1.5 million as equity awards we granted in prior years with higher fair values became fully vested. Our headcount at March 31, 2012 was 64 compared to 61 at March 31, 2011.

Fund management and administration

Fund management and administration expenses increased 30.7% from $4.2 million in the first three months of 2011 to $5.4 million in the comparable period in 2012. This was primarily due to a $0.9 million increase in portfolio management, fund administration and accounting, index licensing and distribution fees due to higher average assets under management. In addition we incurred $0.2 million in higher auditing, legal and printing related expenses compared to the first three months of 2011 due to additional funds and an increase in the number of WisdomTree ETF shareholders. We had 48 ETFs at March 31, 2012 compared to 46 at March 31, 2011.

Marketing and advertising

Marketing and advertising expense increased 36.4% from $1.0 million in the first three months of 2011 to $1.3 million in the comparable period in 2012 primarily due to higher levels of advertising and television production related expenses to support our growth.

Sales and business development

Sales and business development expense increased 15.4% from $0.7 million in the first three months of 2011 to $0.9 million in the comparable period in 2012 primarily due to higher new product related spending and sales activities to support our growth.

Professional and consulting fees

Professional and consulting fees increased 13.5% from $1.0 million in the first three months of 2011 to $1.1 million in the comparable period in 2012. Variable stock based compensation for equity awards granted to strategic advisors increased $0.1 million from $0.6 million to $0.7 million due to an increase in our stock price. In addition, we incurred higher accounting related fees as a result of becoming a fully reporting exchange-listed company. Partly offsetting these increases was a decrease in corporate legal expenses.

Occupancy, communications and equipment

Occupancy, communications and equipment expense remained relatively unchanged at $0.3 million in the first three months of 2011 and 2012.

Depreciation and amortization

Depreciation and amortization expense remained relatively unchanged at $0.1 million in the first three months of 2011 and 2012.

Third-party sharing arrangements

Third-party sharing arrangements increased 54.7% from $1.1 million in the first three months of 2011 to $1.7 million in the comparable period in 2012. This increase was primarily due to a charge of $0.4 million due to terminating our agreement with Advisors Asset Management related to marketing our ETFs in the regional broker-dealer channel. As part of the termination, we are required to pay a fee based on asset levels raised by Advisors Asset Management at the time of the termination. This function will now be handled by our own sales force. In addition, we had lower expenses in our currency and international fixed income ETFs subject to the profit sharing arrangements with Bank of New York Mellon.

22

Other

Other expenses increased 33.3% from $0.5 million in the first three months of 2011 to $0.6 million in the comparable period in 2012 primarily due to higher expenses related to being an exchange-listed company as well as higher general and administrative expenses.

Liquidity and Capital Resources

The following table summarizes key data regarding our liquidity, capital resources and use of capital to fund our operations:

| March 31, 2012 |

December 31, 2011 |

|||||||

| Balance Sheet Data (in thousands): |

||||||||

| Cash and cash equivalents |

$ | 32,138 | $ | 25,630 | ||||

| Investments |

10,086 | 9,056 | ||||||

| Accounts receivable |

7,129 | 5,625 | ||||||

| Total liabilities |

(17,379 | ) | (16,714 | ) | ||||

|

|

|

|

|

|||||

| $ | 31,974 | $ | 23,597 | |||||

|

|

|

|

|

|||||

| Three Months Ended March 31, | ||||||||

| 2012 | 2011 | |||||||

| Cash Flow Data (in thousands): |

||||||||

| Operating cash flows |

$ | 2,680 | $ | 523 | ||||

| Investing cash flows |

(1,119 | ) | (353 | ) | ||||

| Financing cash flows |

4,947 | (1,599 | ) | |||||

|

|

|

|

|

|||||

| Increase/(decrease) in cash and cash equivalents |

$ | 6,508 | $ | (1,429 | ) | |||

|

|

|

|

|

|||||

Liquidity

We consider our available liquidity to be our liquid assets less our liabilities. Liquid assets consist of cash and cash equivalents, current receivables, and investments. The Company accounts for investments as held to maturity securities and has the intention and ability to hold to maturity. However, if needed such investments could be redeemed for liquidity. Cash and cash equivalents include cash on hand and non-interest-bearing and interest-bearing deposits with financial institutions. Accounts receivable primarily represents advisory fees we earn from the WisdomTree ETFs which is collected by the fifth business day of the month following the month earned. Investments represent debt instruments of U.S. government and agency securities. Our liabilities consist primarily of payments owed to vendors and third parties in the normal course of business as well as accrued year end incentive compensation for employees.

Cash and cash equivalents increased $6.5 million in the first three months of 2012 primarily due to $4.3 million we received in our secondary offering, $2.7 million of cash flows generated by our operating activities as a result of higher revenues from higher AUM and $1.6 million of cash proceeds from our employees exercising stock options. Partly offsetting these increases was $1.1 million of cash flows used for investing activities.

Cash and cash equivalents decreased $1.4 million in the first three months of 2011 primarily due to $1.6 million of cash flows used to repurchase our common stock.

Capital Resources

Currently, our principal source of financing is our operating cash flows, though historically, our principal source of financing was through the private placement of our common stock. We believe that current cash flows generated by our operating activities and the net proceeds raised through our offering in February 2012 should be sufficient for us to fund our operations for at least the next 12 months.

23

Use of Capital

Our business does not require us to maintain a significant cash position. We expect that our main uses of cash will be to fund the ongoing operations of our business, invest in strategic growth initiatives, re-acquire shares of our common stock issued to our employees as incentive compensation as discussed below or expand our business through strategic acquisitions.

During the first three months of 2012, we repurchased 157,080 shares from our employees at then current market prices at a cost of $1.0 million in connection with tax withholding upon vesting of restricted stock. The amount repurchased represented the required amount of tax withholding. We expect to continue purchasing shares for similar reasons.

Contractual Obligations

The following table summarizes our future cash payments associated with contractual obligations as of March 31, 2012.

| Payments Due by Period | ||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Total | Less than 1 year |

1 to 3 years | 3 to 5 years | More than 5 years |

||||||||||||||||

| Operating leases |

$ | 2,484 | $ | 1,061 | $ | 1,423 | — | — | ||||||||||||

Off-Balance Sheet Arrangements

Other than operating leases, which are included in the table above, we do not have any off-balance sheet financing or other arrangements. We have neither created nor are party to any special-purpose or off-balance sheet entities for the purpose of raising capital, incurring debt or operating our business.

Critical Accounting Policies

Stock-Based Compensation

Stock-based compensation expense reflects the fair value of stock-based awards measured at grant date and is recognized over the relevant service period. The fair value of each option award is estimated on the date of grant using the Black-Scholes option valuation model. The Black-Scholes option valuation model we use includes the input of certain variables that are dependent on future expectations, including the expected lives of our options from grant date to exercise date, the volatility of our underlying common shares in the market over that time period, the rate of dividends that we may pay during that time and an appropriate risk-free interest rate. Many of these assumptions require management’s judgment. If actual experience differs significantly from these estimates, stock-based compensation expense and our results of operations could be materially affected.

Income and Deferred Taxes

We recognize an asset or liability for the deferred tax consequences of temporary differences between the tax basis of assets and liabilities and their reported amounts in the financial statements. These temporary differences will result in taxable or deductible amounts in future years when the reported amounts of assets are recovered or liabilities are settled. A valuation allowance is recorded to reduce the carrying values of deferred tax assets and liabilities to the amount that is more likely than not to be realized. As of March 31, 2012, we have net operating loss carry forwards and we have recognized a deferred tax asset for such carry forwards. Given the significant losses we have incurred since we began our operations, a valuation allowance has been recorded for the full amount of the deferred tax asset.

Recently Issued Accounting Pronouncements

In May 2011, FASB issued ASU No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial Reporting Standards (“IFRS”).” ASU No. 2011-04 includes common requirements for measurement of and disclosure about fair value between U.S. GAAP and IFRS. ASU No. 2011-04 requires reporting entities to disclose the following information for fair value measurements categorized within Level 3 of the fair value hierarchy: quantitative information about the unobservable inputs used in the fair value measurement, the valuation processes used by the reporting entity and a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs and the interrelationships between those unobservable inputs. In addition, ASU No. 2011-04 requires reporting entities to make disclosures about amounts and reasons for all transfers in and out of Level 1 and Level 2 fair value measurements, which is effective for fiscal years beginning after December 15, 2011. This standard did not have a material impact on our consolidated financial statements.

24

| ITEM 3: | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

In the normal course of business, our financial results are subject to market risk. Market risk to us generally represents the risk of changes in the value of financial instruments held in the portfolios of the WisdomTree ETFs that generally results from fluctuations in equity prices, foreign currency exchange rates against the U.S. dollar, and interest rates. Nearly all of our revenue is derived from advisory agreements for the WisdomTree ETFs. Under these agreements, the advisory fee we receive is based on the market value of the assets in the WisdomTree ETF portfolios we manage.

Fluctuations in the value of these securities are common and are generated by numerous factors such as market volatility, the overall economy, inflation, changes in investor strategies, availability of alternative investment vehicles, government regulations and others. Accordingly changes in any one or a combination of these factors may reduce the value of investment securities and, in turn, the underlying assets under management on which our revenues are earned. These declines may cause investors to withdraw funds from our ETFs in favor of investments that they perceive as offering greater opportunity or lower risk, thereby compounding the impact on our revenues. We believe challenging and volatile market conditions will continue to be present in the foreseeable future.

In order to maximize yields, we invest our corporate cash in short-term interest earning assets, primarily money market instruments at a commercial bank and U.S. government and agency debt instruments which totaled $42.2 million and $34.7 million as of March 31, 2012 and December 31, 2011, respectively. We do not anticipate that changes in interest rates will have a material impact on our financial condition, operating results or cash flows.

| ITEM 4. | CONTROLS AND PROCEDURES |

Evaluation of Disclosure Controls and Procedures

As of March 31, 2012, our management, with the participation of our Chief Executive Officer and our Executive Vice President—Finance and Chief Financial Officer, evaluated the effectiveness of our disclosure controls and procedures pursuant to Rule 13a-15(b) promulgated under the Securities Exchange Act of 1934, as amended, or the “Exchange Act”. Based upon that evaluation, our Chief Executive Officer and our Executive Vice President—Finance and Chief Financial Officer concluded that, as of March 31, 2012, our disclosure controls and procedures were effective at a reasonable assurance level in ensuring that material information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the rules, regulations and forms of the Securities and Exchange Commission, or the SEC, including ensuring that such material information is accumulated by and communicated to our management, including our Chief Executive Officer and our Executive Vice President—Finance and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

Changes in Internal Control Over Financial Reporting

During the quarter ended March 31, 2012, there were no changes in our internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

25

| ITEM 1. | LEGAL PROCEEDINGS |

As an investment advisor, we may be subject to routine reviews and inspections by the SEC, as well as legal proceedings arising in the ordinary course of business.

On December 1, 2011, Research Affiliates, LLC filed a complaint in the United States District Court for the Central District of California, (Research Affiliates, LLC v. WisdomTree Investments, Inc., et. al., Case No. SACV11-01846 DOC (ANx)), naming us and our subsidiaries, as well as WisdomTree Trust, Mellon Capital Management Corporation and ALPS Distributors, Inc., as defendants. In the complaint, plaintiff alleges that the fundamentally weighted investment methodology we employ for the exchange traded funds using our indexes infringes three of plaintiff’s patents and seeks both unspecified monetary damages to be determined and an injunction to prevent further infringement. We filed our answer to the complaint on January 17, 2012 and believe we have strong defenses to this lawsuit based on our belief that (i) we do not practice the indexing methods as claimed in the asserted patents because, for example, the factors we use to select assets included in the ETFs accused of infringement include market capitalization and the price of the assets, and thus fall outside the scope of the asserted patents, which generally provide that selection of the assets to be used for creation of the index must be based upon factors that are sufficiently independent of market capitalization; and (ii) the patents should be declared invalid because, among other reasons, there is ample evidence that the concept of fundamentals based indexing was widely known and in commercial use by asset managers and index providers well before the patent applications at issue were filed by plaintiff. For example, in support of our defenses that the asserted patents are invalid, we intend to present evidence that as far back as the early 1990s, Robert Jones at Goldman Sachs managed an earnings weighted index fund. As another example, we intend to present evidence that Dow Jones launched a dividend weighted stock index in 2003. These examples support our view that the asserted patents are invalid at least because earlier publications and activities of investment professionals anticipated or made obvious plaintiff’s alleged inventions. We therefore intend to vigorously defend against plaintiff’s claims.

In February 2012, defendants filed a motion to dismiss plaintiff’s claims on the basis that the claims asserted in plaintiff’s patents are unpatentable subject matter. On April 26, 2012, the court denied defendants’ motion to dismiss without prejudice to defendants’ right to reassert their claim of unpatentable subject matter at such time as the court will consider summary judgment motions regarding invalidity of the plaintiff’s patents. In denying the motion to dismiss the court did not address the merits of defendant’s claim.