UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

WisdomTree Investments, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

WisdomTree Investments, Inc.

245 Park Avenue, 35th Floor

New York, New York 10167

April 30, 2015

Dear Stockholder:

We are pleased to invite you to the 2015 Annual Meeting of Stockholders to be held on June 24, 2015 at 11:00 a.m. Eastern Time. This year’s Annual Meeting will be a completely virtual meeting of stockholders held over the Internet. You will be able to attend the Annual Meeting, vote your shares electronically and submit your questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/wisdomtree15 and entering your 16-digit control number.

Similar to last year, most of our stockholders will not receive paper copies of our proxy materials and will instead receive a Notice of Internet Availability of Proxy Materials with instructions on how to access our proxy materials and how to vote online or by telephone. Such Notice will also provide information on how to obtain paper copies of our proxy materials if a stockholder so requests. This method expedites the receipt of your proxy materials, lowers the costs of our Annual Meeting and helps to conserve our natural resources.

Every stockholder’s vote is important, so whether or not you are planning to attend the meeting, we encourage you to vote your shares by voting (i) over the Internet or (ii) by telephone, or (iii) by requesting a paper copy of the proxy materials, including a proxy card, and returning an executed proxy card.

We hope that you will join us at the Annual Meeting live webcast on June 24, 2015. I thank you for your commitment to WisdomTree and urge you to vote your shares.

Sincerely,

Jonathan Steinberg

Chief Executive Officer

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS

Date: Wednesday, June 24, 2015

Time: 11:00 a.m., Eastern Time

Place: Live Webcast at www.virtualshareholdermeeting.com/wisdomtree15

At the meeting, stockholders will be asked to:

| 1. | elect three Class I members of the Board of Directors, to serve until the Company’s 2018 Annual Meeting of Stockholders; |

| 2. | ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015; |

| 3. | vote on an advisory resolution to approve the compensation of the Company’s named executive officers; and |

| 4. | transact any other business that may properly come before the meeting or any postponements or adjournments thereof. |

The close of business on April 27, 2015 is the record date for determining stockholders entitled to vote at the Annual Meeting. A list of these stockholders will be available at WisdomTree’s headquarters, 245 Park Avenue, 35th Floor, New York, New York, for at least 10 days before the Annual Meeting or any adjournment or postponement thereof.

In accordance with the rules of the Securities and Exchange Commission, we have also sent a Notice of Internet Availability of Proxy Materials and provided access to our proxy materials over the Internet, beginning on April 30, 2015, to the holders of record and beneficial owners of our capital stock as of the close of business on the record date.

Distribution to stockholders of this proxy statement and a proxy card is scheduled to begin on or about April 30, 2015.

By order of the Board of Directors,

Peter M. Ziemba, Secretary

New York, New York

April 30, 2015

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders

To Be Held on June 24, 2015.

The proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 are available at: http://ir.wisdomtree.com by following the link for “Financial Information.”

Proxy Statement

This proxy statement contains information about the 2015 Annual Meeting of Stockholders of WisdomTree Investments, Inc. Proxy materials or a Notice of Internet Availability of Proxy Materials will be first sent to stockholders on or about April 30, 2015.

| QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND PROXY MATERIALS |

1 | |||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| Board Leadership Structure and Board’s Role in Risk Oversight |

12 | |||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 30 | ||||

| 33 | ||||

| 33 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

34 | |||

| 34 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| Proposal 2 : Ratification of Appointment of Independent Registered Public Accounting Firm |

41 | |||

| 41 | ||||

| 41 | ||||

| 42 |

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND PROXY MATERIALS

Who is soliciting my vote?

The Board of Directors of WisdomTree Investments, Inc. (“WisdomTree” or the “Company”) is soliciting your vote for the 2015 Annual Meeting of Stockholders.

Who pays for the cost of soliciting proxies?

WisdomTree will pay the cost for the solicitation of proxies by the Board of Directors. Proxies may be solicited personally, by telephone, fax or e-mail by employees of WisdomTree without any remuneration to such individuals other than their regular compensation. WisdomTree also will reimburse brokers, banks, custodians, other nominees and fiduciaries for forwarding these materials to their principals to obtain the authorization for the execution of proxies.

Why did I receive a one-page notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission (“SEC”), the Company has elected to provide access to its proxy materials via the Internet. Accordingly, the Company is sending a Notice of Internet Availability of Proxy Materials (“Notice”) to the Company’s stockholders. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. The Company encourages stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of its annual meetings.

How can I get electronic access to the proxy materials?

The Notice will provide you with instructions regarding how to:

| • | View on the Internet the Company’s proxy materials for the Annual Meeting; and |

| • | Instruct the Company to send future proxy materials to you by email. |

The Company’s proxy materials also are available on the Company’s investor relations website at http://ir.wisdomtree.com by following the link for “Financial Information.”

Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to you and will reduce the impact of the Company’s annual meetings on the environment. If you choose to receive future proxy materials by email, you will receive an email message next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

How do I attend the Annual Meeting and may I ask questions?

This year’s Annual Meeting will be a completely virtual meeting of stockholders held over the Internet. Please go to www.virtualshareholdermeeting.com/wisdomtree15 for instructions on how to attend and participate in the Annual Meeting. Any stockholder may attend and listen live to the webcast of the Annual Meeting over the Internet at such site. Stockholders as of the record date of the Annual Meeting may submit questions while attending the Annual Meeting over the Internet by using the 16-digit control number included in the Notice, proxy card or the voting instructions that accompanied these proxy materials.

1

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Stockholder of record. If your shares are registered directly in your name with the Company’s transfer agent (Continental Stock Transfer & Trust Company), you are considered a stockholder of record (or record holder) with respect to those shares, and the Notice was sent directly to you by the Company.

Beneficial owner of shares held in street name. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the “beneficial owner” of shares held in “street name,” and a Notice was forwarded to you by that organization. As a beneficial owner, you have the right to instruct your broker, bank, trustee, or nominee how to vote your shares.

How do I vote my shares?

Whether you are a “stockholder of record” or hold your shares in “street name,” you may vote by proxy prior to the polls closing without participating in the online Annual Meeting. To vote by proxy, stockholders have a choice of voting over the Internet, by telephone or by using a traditional proxy card. Your shares will be voted in accordance with your instructions. If you plan to attend and participate in our online Annual Meeting, we still encourage you to vote prior to the Annual Meeting by telephone or Internet, or by returning a proxy card following your request of printed materials. This will ensure that your vote will be counted if you are unable to, or later decide not to, participate in the online Annual Meeting. You also may vote online at the Annual Meeting prior to the polls closing. You will need to enter your 16-digit control number (included in your Notice, your proxy card or the voting instructions that accompanied your proxy materials) to vote your shares at the Annual Meeting.

|

|

|

|

| ||||

| Vote by Internet Go to www.proxyvote.com. You will need your 16-digit control number included in your proxy card, voter instruction form or Notice. |

Vote by Mobile Phone If you have your proxy card, you can directly scan the QR code on the proxy card with your mobile phone or, if you have the 16-digit control number included in your proxy card, voter instruction form or Notice, you can scan the above QR code. |

Vote by Phone Call 1-800-690-6903 toll-free from the U.S., U.S. territories and Canada or the number on your voter instruction form. You will need the 16-digit control number included in your proxy card, voter instruction form or Notice. |

Vote by Mail Send the completed and signed proxy card or voter instruction form to the address on the proxy card or voter instruction form. |

Vote at the Meeting You can vote by attending the online Annual Meeting. You will need your 16-digit control number to vote electronically at the Annual Meeting. To attend, go to www.virtualshareholder meeting.com/wisdomtree15 |

2

What are the Board’s recommendations on how to vote my shares?

The Board of Directors recommends a vote:

| Proposal 1: | FOR the election of the three Class I directors set forth in the Proxy Statement (page 40) | |

| Proposal 2 | FOR the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015 (page 41) | |

| Proposal 3: | FOR the approval of the advisory resolution on the compensation of the Company’s named executive officers (page 42) | |

Can I change my vote?

You may revoke your proxy at any time before it is voted by notifying the Secretary of WisdomTree in writing, by returning a signed proxy with a later date, by transmitting a subsequent vote over the Internet or by telephone prior to the close of the Internet voting facility or the telephone voting facility, or by attending the online meeting, entering your 16-digit control number and voting again electronically at the Annual Meeting.

How many votes can be cast by all stockholders?

137,033,096 shares of the Company’s common stock were outstanding on April 27, 2015 (record date for determining stockholders eligible to vote) and entitled to be voted at the meeting. Each share of common stock is entitled to one vote on each matter.

What percentage of the vote is required for a proposal to be approved?

The three nominees for election as Class I directors who receive a plurality of the votes cast for election of directors shall be elected directors (Proposal 1). A majority of votes cast is necessary for ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015 (Proposal 2). A majority of votes cast is necessary for the approval of the advisory resolution on the compensation of the Company’s named executive officers (Proposal 3). If there are insufficient votes to approve Proposal 2, your proxy may be voted by the persons named in the proxy to adjourn the Annual Meeting in order to solicit additional proxies in favor of the approval of such proposal. If the Annual Meeting is adjourned or postponed for any purpose, at any subsequent reconvening of the meeting, your proxy will be voted in the same manner as it would have been voted at the original convening of the Annual Meeting unless you withdraw or revoke your proxy. Your proxy may be voted in this manner even though it may have been voted on the same or any other matter at a previous session of the Annual Meeting.

How is a quorum reached?

The presence, in person or by proxy, of holders of at least a majority of the total number of outstanding shares entitled to vote is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Shares held of record by stockholders or brokers, bankers or other nominees who do not return a signed and dated proxy or attend the online Annual Meeting in person will not be considered present or represented at the Annual Meeting and will not be counted in determining the presence of a quorum. Abstentions and “broker non-votes” (i.e., shares represented at the meeting held by brokers, bankers or other nominees as to which instructions have not been received from the beneficial owners or persons entitled to vote such shares and, with respect to one or more but not all issues, such brokers or nominees do not have discretionary voting power to vote such shares), if any, will be counted for purposes of determining whether a quorum is present for the transaction of business at the meeting.

3

How is the vote counted?

Votes cast by proxy or in person at the Annual Meeting will be counted by the person(s) appointed by WisdomTree to act as inspector(s) of election for the meeting. The inspector(s) of election will count all votes “for,” “against,” “withhold,” and abstentions and broker non-votes, as applicable, for each matter to be voted on at the Annual Meeting. Shares represented by proxies that withhold authority to vote for a nominee for election as a director will not be counted as votes “for” a director. Shares properly voted to “abstain” on a particular matter and broker non-votes are treated as having not voted on the particular matter and will therefore not affect the outcome of Proposals 1, 2 and 3.

What does it mean if I receive more than one proxy card or voting instruction form?

It means that you have multiple accounts at the transfer agent or with brokers. Please complete and return all proxy cards or voting instruction forms to ensure that all of your shares are voted.

Could other matters be decided at the Annual Meeting?

WisdomTree does not know of any other matters that may be presented for action at the Annual Meeting. Should any other business come before the meeting, the persons named on the enclosed proxy will have discretionary authority to vote the shares represented by such proxies in accordance with their best judgment. If you hold shares through a broker, bank or other nominee as described above, they will not be able to vote your shares on any other business that comes before the Annual Meeting unless they receive instructions from you with respect to such matters.

What happens if the Annual Meeting is postponed?

Your proxy may be voted at the postponed or adjourned meeting. You will be able to change your proxy until it is voted.

Will the Annual Meeting be webcast?

Yes. This year’s Annual Meeting will be a completely virtual meeting and will be webcast live at www.virtualshareholdermeeting.com/wisdomtree15.

What is the deadline to propose actions for consideration or to nominate individuals to serve as directors at the 2016 Annual Meeting?

Stockholders who wish to present proposals for inclusion in our proxy materials for our 2016 Annual Meeting of Stockholders may do so by following the procedures prescribed in Rule 14a-8 under the Securities Exchange Act of 1934 (“Exchange Act”) and in our by-laws. Our Secretary must receive stockholder proposals intended to be included in our proxy statement and form of proxy relating to our 2016 Annual Meeting of Stockholders made under Rule 14a-8 by December 31, 2015. It is the policy of our Nominating Committee to consider nominations for candidates to our Board of Directors that are properly submitted by our stockholders in accordance with our by-laws. Under our current by-laws, proposals of business and nominations for directors other than those to be included in our proxy materials following the procedures described in Rule 14a-8 may be made by any stockholder who was a stockholder of record at the time of the giving of notice provided for in our by-laws, who is entitled to vote at the meeting, who is present (in person or by proxy) at the meeting and who complies with the notice procedures set forth in our by-laws (i.e., notice must be timely given and contain the information required by the by-laws). To be timely, a notice with respect to the 2016 Annual Meeting of Stockholders must be delivered to our Secretary no earlier than Tuesday, February 24, 2016 and no later than Thursday, March 26, 2016, unless the date of the 2016 Annual Meeting is advanced by more than thirty (30) days or delayed by more than sixty (60) days from the anniversary date of the 2015 Annual Meeting, in which event the by-laws provide

4

different notice requirements. Any proposal of business or nomination should be mailed to: Peter M. Ziemba, Secretary, WisdomTree Investments, Inc., 245 Park Avenue, 35th Floor, New York, New York 10167. The Nominating Committee will evaluate candidates for the position of director recommended by stockholders in the same manner as candidates from other sources and will determine whether to interview any candidates or seek any additional information.

Who should I call if I have any additional questions?

If you hold your shares directly, please call Peter M. Ziemba at (212) 801-2080. If your shares are held in street name, please call the telephone number provided on your voting instruction form or contact your broker or nominee holder directly.

Policies on Reporting of Concerns Regarding Accounting and Other Matters and on Communicating With Non-Management Directors

The Board of Directors and the Audit Committee have adopted policies on reporting concerns regarding accounting and other matters and on communicating with the non-management directors. Any person, whether or not an employee, who has a concern about the conduct of WisdomTree, or any of its people, including with respect to accounting, internal accounting controls or auditing matters, may, in a confidential or anonymous manner, communicate that concern to Mr. Frank Salerno, the chairperson of the Audit Committee, who is the designated contact for these purposes. Contact may be made by writing to him care of the Audit Committee at the Company’s offices at 245 Park Avenue, 35th Floor, New York, New York 10167, by email at auditcommittee@wisdomtree.com. Any interested party, whether or not an employee, who wishes to communicate directly with the presiding director of the executive sessions of our non-management directors, or with our non-management directors as a group, also may contact Mr. Salerno using one of the above methods.

Where You Can Find More Information

WisdomTree files annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any reports, statements, or other information that WisdomTree files at the SEC’s public reference room at the following location: 100 F Street, N.E., Washington, D.C. 20549.

Please call the SEC at 1-800-732-0330 for further information regarding the operation of the public reference room. The Company’s SEC filings are also available to the public from commercial document retrieval services and at the website maintained by the SEC at http://www.sec.gov. You may also read and copy any document WisdomTree files with the SEC on our investor relations website at http://ir.wisdomtree.com by following the link for “Financial Information.”

You should rely on the information contained in this document to vote your shares at the Annual Meeting. WisdomTree has not authorized anyone to provide you with information that is different from what is contained in this document. This document is dated April 30, 2015. You should not assume that the information contained in this document is accurate as of any date other than that date, and the mailing of this document to stockholders at any time after that date does not create an implication to the contrary. This Proxy Statement does not constitute a solicitation of a proxy in any jurisdiction where, or to or from any person to whom, it is unlawful to make such proxy solicitations in such jurisdiction.

Incorporation by Reference

To the extent that this Proxy Statement has been or will be specifically incorporated by reference into any other filing of WisdomTree under the Securities Act of 1933 (“Securities Act”) or the Exchange Act, the sections of this proxy statement entitled “Audit Committee Report” (to the extent permitted by the rules of the SEC) and “Compensation Committee Report” shall not be deemed to be so incorporated, unless specifically provided otherwise in such filing.

5

Important Notice Regarding Delivery of Stockholder Documents

In accordance with a notice sent to certain stockholders of WisdomTree common stock who share a single address, only one copy of this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 is being sent to that address unless WisdomTree has received contrary instructions from any stockholder at that address. This practice, known as “householding,” is designed to reduce the Company’s printing and postage costs. However, if any stockholder residing at such an address wishes to receive a separate copy of this Proxy Statement or our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, he or she may contact WisdomTree Investments, Inc., 245 Park Avenue, 35th Floor, New York, New York 10167, Attention: Investor Relations, Tel: (212) 801-2080, and WisdomTree will deliver those documents to such stockholder promptly upon receiving the request. Any such stockholder may also contact Investor Relations using the above contact information if he or she would like to receive separate proxy statements, annual reports or Notices of Internet Availability of Proxy Materials, as applicable, in the future. If you are receiving multiple copies of our annual reports and proxy statements, you may request householding in the future by contacting Investor Relations.

6

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Our Board of Directors currently consists of eight members. Our certificate of incorporation and by-laws provide that the number of our directors shall be fixed from time to time by a resolution of the majority of our Board of Directors. Pursuant to our by-laws, the Board of Directors has fixed the number of directors at eight as of the date of this year’s Annual Meeting of Stockholders. In accordance with Delaware law and the Company’s certificate of incorporation and by-laws, the Board of Directors is divided into three staggered classes of directors of the same or nearly the same number. At each annual meeting of the stockholders, a class of directors will be elected for a three year term to succeed the directors of the same class whose terms are then expiring. The terms of the directors will expire upon the election and qualification of successor directors at the annual meeting of stockholders to be held in 2015 for Class I directors, 2016 for Class II directors and 2017 for Class III directors. The following directors serve in Class I, II and III:

| • | Class I: Anthony Bossone, Bruce Lavine and Michael Steinhardt |

| • | Class II: Steven L. Begleiter and Win Neuger |

| • | Class III: Frank Salerno, R. Jarrett Lilien and Jonathan Steinberg |

Any directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class shall consist of one third of the Board of Directors. The division of our Board of Directors into three classes with staggered three-year terms may delay or prevent stockholder efforts to effect a change of our management or a change in control.

Our Nominating Committee and Board of Directors consider a broad range of factors relating to the qualifications and background of nominees. We have no formal policy regarding board diversity. Our Nominating Committee’s and Board of Directors’ priority in selecting board members is identification of persons who will further the interests of our stockholders through his or her established record of professional accomplishment, the ability to contribute positively to the collaborative culture among board members, and professional and personal experiences and expertise relevant to our growth strategy.

Our Board of Directors is divided into three staggered classes of directors of the same or nearly the same number. At the Annual Meeting, three individuals will be elected to serve as Class I Directors until their term expires in 2018, and until their successors are elected and qualified. During 2014, each of the nominees to the Board served as a Director.

7

Class I Director Nominees whose terms, if elected, will expire in 2018:

|

Anthony Bossone Age: 44 Director Since: 2009 Independent Committees: Audit |

Mr. Bossone has been the Chief Financial Officer of Atlantic-Pacific Capital, Inc., a broker-dealer and global placement agent dedicated to raising capital for alternative investment funds, since 2003. From 2001 to 2003, Mr. Bossone was the Assistant Controller at SAC Capital Advisors, LLC, a hedge fund advisory firm, and from 1999 until 2001, Mr. Bossone served as an equity trader at Schonfeld Securities, LLC, a securities trading firm. Mr. Bossone began his career at PricewaterhouseCoopers LLP in 1993 where he was an audit manager until 1999. Mr. Bossone received his B.S. in Business and Economics with highest honors from Lehigh University and is a Certified Public Accountant. We believe Mr. Bossone’s qualifications to serve on the Board of Directors include his financial and accounting expertise. The Board also benefits from his experience as an equity trader. | |

|

Bruce Lavine Age: 47 Director Since: 2009 |

Mr. Lavine has served as our Vice Chairman (non-executive) since August 2012, and previously served as our President and Chief Operating Officer from May 2006 until August 2012. Mr. Lavine has been a member of our Board of Directors since January 2007. From 1998 to 2006, he was employed by Barclays Global Investors, an asset management firm, in the following positions: from 1998 to 1999, he served as Director, Financial Planning, Global Finance; from 1999 to 2003, he served as Chief Financial Officer, Director of New Product Development, U.S. iShares and Individual Investor Business; and from 2003 to May 2006 he served as Head of iShares Exchange Traded Funds, Europe. From 1995 to 1998, Mr. Lavine served as the Manager of Business Planning at Sequel, Inc., a computer hardware services company. From 1991 to 1994, Mr. Lavine was employed by Bristol-Myers Squibb Company, a pharmaceutical company, first as a financial associate and then as a senior treasury analyst. Mr. Lavine received a B.S. with distinction in Commerce and an M.B.A. in Finance from the University of Virginia. Mr. Lavine is a Chartered Financial Analyst. We believe Mr. Lavine’s qualifications to serve on the Board of Directors include his many years of experience in senior management positions in the ETF industry and extensive knowledge of our business. | |

|

Michael Steinhardt Age: 74 Director Since: 2004 Independent Committees: Nominating |

Mr. Steinhardt has served as our non-executive Chairman of the Board since November 2004. From 1967 through 1995, Mr. Steinhardt served as Senior Managing Partner of Steinhardt Partners, L.P., a private investment company, and related investment entities. In 1995, Mr. Steinhardt closed Steinhardt Partners and eliminated his involvement in managing client assets. He founded and now serves as President of Steinhardt Management Co., Inc., which currently manages his family office. Mr. Steinhardt currently devotes most of his time and financial resources to Jewish philanthropic causes, directed through The Steinhardt Foundation for Jewish Life for which he serves as Chairman. Mr. Steinhardt is the co-founder of Birthright Israel and is a major supporter. He also serves as Co-Chair of the Areivim Philanthropic Group. He also serves on the Board of Trustees of New York University and the Steinhardt Foundation and on the Board of Directors of the Taub Center for Social Policy Studies in Israel. Mr. Steinhardt received his B.S. in Economics from The Wharton School of Business of the University of Pennsylvania. We believe Mr. Steinhardt’s qualifications to serve on the Board of Directors include his extensive years of experience as a founder of a private investment management company. The Board also benefits from his perspective and knowledge of financial markets as well as his strategic vision. | |

8

Class II Directors whose terms expire in 2016:

|

Steven L. Begleiter Age: 53 Director Since: 2011 Independent Committees: Nominating |

Mr. Begleiter has served as Senior Principal at Flexpoint Ford, LLC, a private equity group focused on investments in financial services and healthcare, since October 2008. Prior to joining Flexpoint Ford, Mr. Begleiter spent 24 years at Bear, Stearns & Co. Inc., serving first as an investment banker in the Financial Institutions Group and then as Senior Managing Director and member of its Management and Compensation Committee from 2002 to September 2008. Mr. Begleiter also served as head of Bear, Stearns’ Corporate Strategy Group. Mr. Begleiter has been a director of Great Ajax Corp. (NYSE: AJX), a mortgage REIT, since June 2014, and a director of MarketAxess Holdings Inc. (Nasdaq: MKTX), the operator of a leading electronic trading platform for fixed-income securities, and the provider of market data and post-trade services for the global fixed-income markets, since April 2012. Mr. Begleiter received his B.A. in Economics with honors from Haverford College. We believe Mr. Begleiter’s qualifications to serve on the Board of Directors include his many years of experience in leadership positions in the financial services industry as well as his private equity experience. The Board also benefits from his extensive industry knowledge and perspectives on capital formation. | |

|

Win Neuger Age: 65 Director Since: 2013 Independent Committees: Compensation, Nominating |

Mr. Neuger is an independent investor and consultant. Since July 2014, he has served as Chairman of EcoAlpha Asset Management LLC, a private investment management company focused on investing in companies providing solutions to the global problems of burdened resources. From March 2012 until January 2013, Mr. Neuger served as Vice-Chairman of the Board of Directors of PineBridge Investments, an independent asset manager offering investment opportunities in emerging and developed markets, and from March 2010 to March 2012, he served as its Chief Executive Officer and Chair of the Executive Committee. From December 2008 to March 2010, Mr. Neuger served as Executive Vice-President of the American International Group (“AIG”), an international insurance organization serving commercial, institutional, and individual customers, as well as Chairman and Chief Executive Officer of AIG Investments, AIG’s asset management company. Prior to January 2009, Mr. Neuger served as Executive Vice-President and Chief Investment Officer of AIG as well as Chairman and Chief Executive Officer of AIG Investments. Prior to AIG, Mr. Neuger served as both Managing Director, Fixed Income and, subsequently, as Managing Director, Global Equities at Bankers Trust Company. Before Bankers Trust Mr. Neuger was Chief Investment Officer at Western Asset Management. Mr. Neuger also served as Head of Fixed Income at Northwestern National Bank. Mr. Neuger has previously served on our Board of Directors from January 2007 to December 2009. He currently serves as Chairman of the Board of Directors of Neuger Communications Group, a private strategic marketing communications and public relations firm. Mr. Neuger received his A.B. from Dartmouth College and an M.B.A. from the Amos Tuck Graduate School of Business. We believe that Mr. Neuger’s qualifications to serve on the Board of Directors include his prior service on our Board of Directors and familiarity with our business model and his years of experience in management positions in the asset management industry. | |

9

Class III Directors whose terms expire in 2017:

|

R. Jarrett Lilien Age: 53 Director Since: 2008 Independent Committees: Audit, Compensation, Nominating |

Mr. Lilien is the Managing Partner of Bendigo Partners, which he founded in 2008. Bendigo Partners engages in venture capital investing and advisory services within the financial services industry. Bendigo’s investment model is for one or more of its partners to be employed within its investments. From 2003 to 2008, Mr. Lilien served as President and Chief Operating Officer of E*TRADE Financial Corporation. In this role, he was responsible for the tactical execution of all of E*TRADE’s global business strategies. Previously, he served as the President and Chief Brokerage Officer at E*TRADE Securities. In this capacity, Mr. Lilien reorganized the business, adding new product lines and providing innovative brokerage capabilities to its retail, institutional, and corporate clients around the world. With experience in more than 40 global markets, he was instrumental in developing a flexible infrastructure for E*TRADE’s brokerage units designed to provide retail and institutional clients with seamless execution, clearing, and settlement. Prior to joining E*TRADE, Mr. Lilien spent 10 years as Chief Executive Officer at TIR (Holdings) Limited, a global institutional broker, which E*TRADE acquired in 1999. Mr. Lilien currently serves as President of the Jazz Foundation of America, is on the Board of Directors of Barton Mines Corporation, the Baryshnikov Arts Center and Tradier, Inc., and is on the Advisory Board of WFUV FM Radio. In April 2015, he joined the Board of Directors of ITG (NYSE: ITG), an independent execution broker and research provider. Mr. Lilien received his B.A. in Economics from the University of Vermont. We believe Mr. Lilien’s qualifications to serve on the Board of Directors include his experience in founding and building financial services companies. The Board also benefits from his extensive leadership experience and his ability to provide strategic guidance. | |

|

Frank Salerno Age: 55 Director Since: 2005 Lead Independent Director Committees: Audit, Compensation |

Mr. Salerno was Managing Director and Chief Operating Officer of Merrill Lynch Investment Advisors—Americas Institutional Division, an investment advisory company, from July 1999 until his retirement in February 2004. Before joining Merrill Lynch, Mr. Salerno spent 18 years with Bankers Trust Company in various positions. In 1990, he assumed responsibility for Bankers Trust’s domestic index management business and in 1995 he became Chief Investment Officer for its Structured Investment Management Group. Mr. Salerno received a B.S. in Economics from Syracuse University and an M.B.A. in Finance from New York University. Mr. Salerno served as a director and member of the audit committee and conflicts committee of K-Sea Transportation Partners, L.P., formerly a NYSE-listed company, from 2004 until its acquisition in 2011. We believe Mr. Salerno’s qualifications to serve on the Board of Directors include his extensive years in senior management positions at large asset management firms as well as his service on the board of directors of another public company. The Board also benefits from his strategic insights on the asset management industry. | |

10

|

Jonathan L. Steinberg Age: 50 Director Since: 2008 |

Mr. Steinberg founded our Company and has served as our Chief Executive Officer since October 1988 and since August 2012, he has also served as our President. He has been a member of our Board of Directors since October 1988, serving as Chairman of the Board of Directors from October 1988 to November 2004. He also served as Editor-in-Chief of Individual Investor and Ticker, two magazines formerly published by our Company. Mr. Steinberg, together with Mr. Siracusano, was responsible for the creation and development of our proprietary index methodology. Prior to founding WisdomTree, Mr. Steinberg was employed as an analyst in the Mergers and Acquisitions Department of Bear, Stearns & Co. Inc., an investment banking firm, from 1986 to 1988. Mr. Steinberg is the author of Midas Investing, published by Times Books, a division of Random House, Inc. He attended The Wharton School of Business at the University of Pennsylvania. We believe Mr. Steinberg’s qualifications to serve on the Board of Directors include his extensive knowledge of our business, his experience in founding and developing our fundamentally weighted index methodology, as well as his corporate and strategic vision, which provide strategic guidance to the Board. As our Chief Executive Officer and President, Mr. Steinberg provides essential insight and guidance to the Board from a management perspective. |

Gregory Barton has served as our Executive Vice President—Operations and Chief Operating Officer since October 2012. Before joining our Company, Mr. Barton served as Executive Vice President Business and Legal Affairs, General Counsel and Secretary of TheStreet, Inc., a financial media company, from June 2009 to July 2012, following his service as General Counsel and Secretary of Martha Stewart Living Omnimedia, Inc., a media and merchandising company, from October 2007 to August 2008. From October 2004 to October 2007, Mr. Barton served as Executive Vice President, Licensing and Legal Affairs, General Counsel and Secretary, and from November 2002 to October 2004, as Executive Vice President, General Counsel and Secretary, of Ziff Davis Media Inc., a technology media company. Preceding Ziff Davis, Mr. Barton served in a variety of positions at WisdomTree (then known as Individual Investor Group, Inc.) from August 1998 to November 2002, including President, Chief Financial Officer and General Counsel; and prior to that served from September 1996 to August 1998 as Vice President, Corporate and Legal Affairs, and General Counsel, and from May 1995 to September 1996 as General Counsel, of Alliance Semiconductor Corporation, an integrated circuit company. Mr. Barton was previously an attorney at the law firm of Gibson, Dunn & Crutcher LLP. From June 2006 through October 2012, Mr. Barton served as an Independent Trustee and Chairman of the Audit Committee for the WisdomTree Trust. Mr. Barton received a B.A. degree, summa cum laude, from Claremont McKenna College and a J.D. degree, magna cum laude, from Harvard Law School. Mr. Barton is 53 years old.

Amit Muni has served as our Executive Vice President—Finance and Chief Financial Officer since March 2008. Prior to joining our Company, Mr. Muni served as Controller and Chief Accounting Officer of International Securities Exchange Holdings, Inc., an electronic options exchange, from 2003 until March 2008. Mr. Muni was Vice President, Finance, of Instinet Group Incorporated, an electronic agency broker-dealer, from 2000 to 2003. From 1996 until 2000, Mr. Muni was employed as a Manager of the Financial Services Industry Practice of PricewaterhouseCoopers LLP, an accounting firm. From 1991 until 1996, Mr. Muni was an accountant and a senior auditor for National Securities Clearing Corporation, a firm that provides centralized clearing, information and settlement services to the financial industry. Mr. Muni received a B.B.A. in Accounting from Pace University and is a Certified Public Accountant. Mr. Muni is 46 years old.

Luciano Siracusano, III has served as our Executive Vice President—Head of Sales and Chief Investment Strategist since March 2011. From October 2008 to March 2011, Mr. Siracusano served as our Director of Sales and Chief Investment Strategist. Prior to serving in those positions, Mr. Siracusano served as our Director of

11

Research from 2001 until October 2008, and as a research analyst and editor of our various media publications from 1999 until 2001. Mr. Siracusano, together with Mr. Steinberg, was responsible for the creation and development of our fundamentally weighted index methodology. Prior to joining our Company in 1999, Mr. Siracusano was an Equity Analyst at Value Line, Inc., an investment research firm, from 1998 to 1999. Preceding his career in finance, Mr. Siracusano served as Special Assistant to HUD Secretary Henry Cisneros and as a Special Assistant to New York Governor Mario Cuomo. Mr. Siracusano received his B.A. in Political Science from Columbia University. Mr. Siracusano is 49 years old.

Peter M. Ziemba has served as our Executive Vice President—Business and Legal Affairs since January 2008 and Chief Legal Officer since March 2011. From April 2007 to March 2011, Mr. Ziemba served as our General Counsel. Prior to joining our Company, Mr. Ziemba was a partner in the Corporate and Securities department of Graubard Miller, which served as our primary corporate counsel, from 1991 to 2007, and was employed at that firm beginning in 1982. Mr. Ziemba received his B.A. in History with university honors from Binghamton University and his J.D., cum laude, from Benjamin N. Cardozo School of Law. Mr. Ziemba served as a director of our Company from 1996 to 2003. Mr. Ziemba is 57 years old.

Jonathan Steinberg, our President and Chief Executive Officer, and Bruce Lavine, our Non-Executive Vice Chairman, are also executive officers of the Company, and their biographical information is set forth above in the descriptions of our Directors.

NASDAQ rules require listed companies to have a board of directors with at least a majority of independent directors. Our Board of Directors has determined that six of our eight directors are independent under the listing standards of the NASDAQ Stock Market. The members determined to be independent are Messrs. Begleiter, Bossone, Lilien, Neuger, Salerno and Steinhardt.

In 2008, our Board of Directors determined that it would be good corporate practice to designate one of our independent directors as Lead Independent Director. Mr. Salerno has held this designation since the position was established. The duties of our Lead Independent Director are as follows:

| • | serve as the intra-meeting liaison between our Board of Directors and management, and among the independent directors; |

| • | serve as an ex-officio, non-voting member of each standing committee (of which he is not a member) of our Board of Directors; |

| • | ensure that appropriate reports and information are circulated to the independent directors on a timely basis by management and others; |

| • | lead our Board of Directors in the process of periodic reviews of the performance of the Chief Executive Officer, as well as in discussions regarding the Chief Executive Officer’s reports on senior management performance and management succession issues and plans; |

| • | chair meetings of the independent directors if the chairman is not present; and |

| • | perform such other appropriate duties as the independent directors shall assign to him from time to time. |

Board Leadership Structure and Board’s Role in Risk Oversight

At present, the Board of Directors has chosen to separate the roles of chairman of the Board of Directors and chief executive officer. Jonathan L. Steinberg is our President and Chief Executive Officer and Michael

12

Steinhardt is our non-executive Chairman of the Board of Directors. We believe that separating these positions is optimal for WisdomTree at this time because it allows our Mr. Steinberg to focus on our day-to-day business, while allowing Mr. Steinhardt to focus on leadership of the Board of Directors in its fundamental role of providing advice to and independent oversight of management. Our Board of Directors recognizes the time, effort and energy that the chief executive officer is required to devote to his position in the current business environment, as well as the commitment required to serve as our chairman, particularly as the Board of Directors’ oversight responsibilities continue to grow. While our by-laws and corporate governance guidelines do not require that our chairman and chief executive officer positions be separate, our Board of Directors believes that having separate positions is the appropriate leadership structure for us at this time and demonstrates our commitment to good corporate governance.

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks; including risks relating to our operations, strategic direction and intellectual property as more fully discussed under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as updated from time to time. Management is responsible for the day-to-day management of the risks we face, while our Board of Directors, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, our Board of Directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

The Board of Directors’ role in overseeing the management of our risks is conducted primarily through committees of the Board of Directors, as disclosed in the descriptions of each of the committees below and in the charters of each of the committees. The full Board of Directors (or the appropriate board committee in the case of risks that are under the purview of a particular committee) discusses with management our major risk exposures, their potential impact on our Company and the steps we take to manage them. When a board committee is responsible for evaluating and overseeing the management of a particular risk or risks, the chairman of the relevant committee reports on the discussion to the full Board of Directors during the committee reports portion of the next board meeting. This enables our Board of Directors and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships.

Committees of Our Board of Directors

Our Board of Directors has established an Audit Committee, a Compensation Committee and a Nominating Committee, each of which operates pursuant to a charter adopted by our Board of Directors. Membership on each committee is limited to independent directors as defined under the listing standards of the NASDAQ Stock Market. In addition, members of the Audit Committee must also meet the independence standards for Audit Committee members adopted by the SEC. Our Board of Directors may from time to time establish other committees. Charters for each of the Audit Committee, Compensation Committee and Nominating Committee are available on our website at http://ir.wisdomtree.com by following the link for “Corporate Governance,” under the heading “Committee Charters.”

Audit Committee

Messrs. Bossone, Lilien and Salerno currently serve on the Audit Committee, which is chaired by Mr. Salerno. Our Board of Directors has determined that each member is an “audit committee financial expert,” as defined under the applicable rules of the SEC. The Audit Committee’s responsibilities include:

| • | overseeing the accounting and financial reporting processes of the Company and the audits of the Company’s financial statements; |

| • | approving auditing and permissible non-audit services, and the terms of such services, to be provided by our independent registered public accounting firm; |

13

| • | establishing policies and procedures for the receipt and retention of accounting-related complaints and concerns; |

| • | monitoring, reporting to and reviewing with the Board of Directors regarding the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to our financial statements and accounting matters; |

| • | reviewing all related person transactions for potential conflict of interest situations and approving all such transactions; and |

| • | taking, or recommending that the Board of Directors take, appropriate action to oversee the qualifications, independence and performance of the Company’s independent auditor. |

Compensation Committee

Messrs. Lilien, Neuger and Salerno currently serve on the Compensation Committee, which is chaired by Mr. Salerno. The Compensation Committee’s responsibilities include:

| • | overseeing the administration of the Company’s compensation programs; |

| • | reviewing and discussing with the Board corporate succession plans for the CEO and other key officers of the Company; |

| • | determining and approving the compensation of the Company’s CEO; |

| • | approving the compensation of the non-CEO executive officers and certain other senior employees; and |

| • | approving all discretionary bonuses for the Company’s employees, advisers and consultants. |

Nominating Committee

Messrs. Begleiter, Lilien, Neuger and Steinhardt currently serve on the Nominating Committee, which is chaired by Mr. Steinhardt. The Nominating Committee’s responsibilities include:

| • | recommending criteria and qualifications for board membership; |

| • | identifying and evaluating candidates for nomination for election to the Board of Directors or to fill vacancies on the Board of Directors; |

| • | recommending that the Board of Directors select the director nominees for election at each annual meeting of stockholders; |

| • | establishing a policy with regard to the consideration of director candidates recommended by stockholders; and |

| • | reviewing all stockholder nominations submitted to the Company. |

Compensation Committee Interlocks and Insider Participation

Messrs. Lilien, Neuger, Salerno and Steinhardt served as members of the Compensation Committee during 2014, with Mr. Neuger replacing Mr. Steinhardt as a member of the Compensation Committee following the 2014 Annual Meeting. None of the members of the Compensation Committee has been an officer of the Company and none were employees of the Company during 2014 and, other than Mr. Steinhardt, none had any relationship with the Company or any of its subsidiaries during 2014 that would be required to be disclosed as a transaction with a related person.

None of the executive officers of the Company has served on the board of directors or compensation committee of another company (or other board committee performing equivalent functions) at any time during which an executive officer of such other company served on the Company’s Board of Directors or the Compensation Committee.

14

We have adopted a code of conduct that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. Our code of conduct is available on our investor relations website at http://ir.wisdomtree.com. We intend to disclose any amendments to this code, or any waivers of its requirements, on our website.

During 2014, the Board of Directors held six meetings. Each director attended at least 75% of all board of directors and applicable committee meetings. Our policy is for all of our directors to attend our annual meeting of stockholders. All eight of our directors attended our 2014 Annual Meeting of Stockholders.

15

EXECUTIVE OFFICER AND DIRECTOR COMPENSATION

The following report of the Compensation Committee shall not be deemed to be “soliciting material” or to otherwise be considered “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act or the Exchange Act except to the extent that the Company specifically incorporates it by reference into such filing.

The Compensation Committee of the Board of Directors of WisdomTree has reviewed and discussed with management the information contained in the Compensation Discussion and Analysis section of this proxy statement for the fiscal year ended December 31, 2014. Based upon that review and discussion, the Compensation Committee has recommended to the Board of Directors that the information set forth below under the heading “Compensation Discussion and Analysis” be included in this proxy statement.

Compensation Committee

| Frank Salerno (Chairperson) |

R. Jarrett Lilien | Win Neuger |

Compensation Discussion and Analysis

Overview

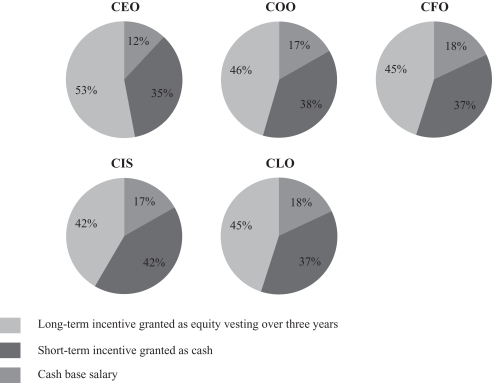

This Compensation Discussion and Analysis provides comprehensive information regarding our compensation programs and policies for our following named executive officers:

| • | Jonathan Steinberg, our President and Chief Executive Officer (“CEO”); |

| • | Gregory Barton, our Chief Operating Officer (“COO”); |

| • | Amit Muni, our Chief Financial Officer (“CFO”); |

| • | Luciano Siracusano, our Chief Investment Strategist and Head of Sales (“CIS”); and |

| • | Peter M. Ziemba, our Chief Legal Officer (“CLO”). |

We believe we provide a competitive total compensation opportunity for our executive management team through a combination of base salary, cash incentive bonuses, equity compensation and broad-based benefits programs. This Compensation Discussion and Analysis explains the following:

| • | our compensation philosophy and objectives; |

| • | our compensation process, including the roles our Compensation Committee, management and compensation consultant serve in the process; |

| • | our policies and practices with respect to each compensation element; and |

| • | 2014 compensation results. |

Executive Summary

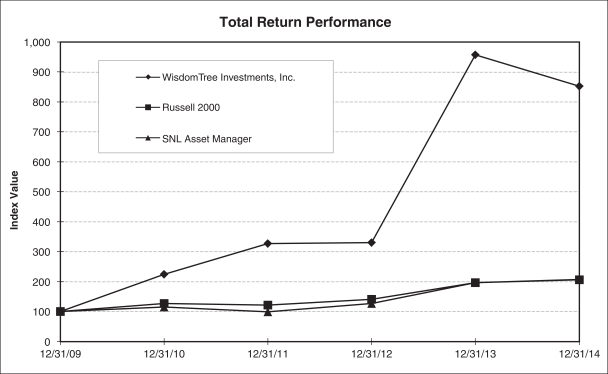

2014 was a year of challenges and successes relevant to the key business metrics used to measure compensation of our named executive officers. Despite negative investor sentiment towards emerging markets, we generated $5.1 billion of net inflows into our U.S. listed ETFs, our U.S. listed AUM increased 12.6% to a record $39.3 billion, and our U.S. market share of industry inflows was 2.1%. These operating results translated into record financial results with total revenues increasing 22.9% to $183.8 million in 2014 and pretax income increasing 42.7% to $73.5 million. Our pretax margin increased from 34.5% to 40.0%. Our AUM concentration

16

in Japan and emerging markets contributed to our stock price decline of 12% in 2014 and we ranked 14th of the 19 publicly traded asset managers in the U.S.; yet we continued to have the fastest organic growth rate of this peer group.

We continued to make investments to focus on growth and our long term success. We expanded our product offering with the launch of nine new U.S. listed ETFs in 2014. We successfully transitioned our fund accounting, administrative and custody services to State Street Bank and Trust Company yielding enhanced capabilities and improvements to our gross margin. We closed our acquisition of Boost ETP, or Boost, and launched six WisdomTree branded UCITS ETFs in Europe within six months of closing. Through state tax planning, we lowered our U.S. tax rate to approximately 38% from 45%. To prepare for expansion to help support our growth, we moved into new office space without experiencing any disruptions to our operations. Lastly, we strengthened our team with the net addition of 14 employees in the U.S. across all business functions.

Overall, the performance of the executive team and employees of WisdomTree met the Compensation Committee’s expectations. Based on these overall results, the Compensation Committee approved a total incentive compensation pool that was approximately 88% of the targeted amount in accordance with our performance based incentive plan which is discussed further below.

Our Compensation Philosophy and Objectives

Our compensation philosophy and objectives are primarily shaped by strategies targeted to achieve our long-term goals within the business environment in which we operate. We operate in an intensively competitive and challenging business environment and we expect competition to continue and intensify. We directly compete with numerous other ETF sponsors and indirectly compete with other larger and multi-national traditional asset management companies. We compete on a number of factors including the breadth and depth of our product offering as well as the investment performance and fees of our ETFs. We believe our long-term success depends on our ability to continue to:

| • | innovate and introduce new ETFs to the marketplace to diversify and expand our product offerings; |

| • | grow our market share of industry inflows to remain one of the top five ETF sponsors in the United States and continue on our path to achieve $100 billion in AUM; |

| • | leverage our existing product offering; |

| • | generate improved financial results; and |

| • | employ the industry’s most talented, professional and dedicated people at all levels within the Company. |

The primary objectives of our compensation program are as follows:

| • | attract, retain, and motivate our professional, dedicated, and expert employees in the highly competitive asset management industry; |

| • | reward and retain employees whose knowledge, skills and performance are critical to our continued success; |

| • | align the interest of all our employees with those of our stockholders by motivating them to increase stockholder value; and |

| • | motivate our executives to manage our business to meet short-term and long-term objectives and reward them appropriately for meeting or exceeding them. |

The following principles guide our compensation programs:

| • | Pay-for-performance. Our compensation programs are designed to reward our employees for their individual performance as well as our Company’s performance. If our employee is a top-tier performer, |

17

| he or she should receive higher rewards. Likewise, where individual performance falls short of expectations and/or our Company’s financial performance declines, the programs should deliver lower levels of compensation. In addition, the objectives of pay-for-performance and retention must be balanced. Even in periods of temporary downturns in our Company’s performance, our programs should continue to ensure that our successful, high-achieving employees will remain motivated and committed to us. |

| • | Every employee should be a stake-holder aligned with our stockholders. We believe a key factor in our success has been and continues to be fostering an entrepreneurial culture where our employees act and think like our owners. As such, our compensation programs encourage stock ownership throughout our organization to align our employees’ interests with our stockholders. Our stock awards, accordingly, are long-term in nature. |

| • | Higher levels of responsibility are reflected in compensation. Compensation is based on each employee’s level of job responsibility. As employees progress to higher levels in our organization, an increasing proportion of their pay is tied to our Company’s long-term performance because they are more able to affect our results. |

| • | Competitive compensation levels. Our compensation programs reflect the value of the position in the marketplace. To attract and retain a highly skilled work force, we must remain competitive with the pay of other premier employers who compete with us for talent. |

| • | Team approach. We believe our success has been based on the coordinated efforts of all our employees working towards our common goals, not on the efforts of any one individual. As such, our compensation programs should be applied across the organization, taking into account differences in job responsibilities and marketplace considerations. Perquisites are rare and limited to those that are important to our employees’ ability to safely and effectively carry out their responsibilities. |

| • | Align with long-term success. We believe our compensation programs closely link incentive rewards to our long-term strategic priorities and successes and not to short-term excessive risk taking. |

We believe we have designed our competitive compensation packages to incorporate the above principles and ensure that our executive compensation is aligned with corporate strategies and business objectives.

Components of Compensation

We have established the following components of compensation to satisfy our compensation objectives:

| • | base salary; |

| • | annual incentive compensation; |

| • | long-term equity compensation; |

| • | benefit programs; |

| • | severance benefits; and |

| • | change in control benefits. |

We believe these components provide competitive compensation packages recognizing and rewarding individual contributions; ensure that executive compensation is aligned with corporate strategies and business objectives; and promote the achievement of key strategic and operating performance measures.

Base Salary – We use base salary as a means of providing steady pay or a fixed source of compensation for our executive officers allowing them a degree of certainty in order to attract and retain them. Our Compensation Committee believes the majority of our executives’ compensation should be earned through incentive compensation and therefore, keeps base salary at a fixed level year over year, similar to other companies in the financial services industry.

18

Annual Incentive Compensation – Incentive compensation is awarded in cash and is used to motivate and reward our employees for achieving certain short-term operating, financial and other business goals.

Long-Term Equity Compensation – Because short-term performance does not by itself accurately reflect our overall performance nor the return realized by our stockholders, we offer our employees equity awards as a long-term incentive. We believe that providing equity ownership:

| • | serves to align the interests of our employees with our stockholders by creating an ownership culture and a direct link between compensation and stockholder return; |

| • | creates a significant, long-term interest for our employees to contribute to our success; |

| • | aids in the retention of employees in a highly competitive market for talent; and |

| • | allows the executives to participate in our longer-term success through potential stock price appreciation. |

In determining the appropriate mix of short-term and long-term incentive compensation to our executives, and all our employees, our Compensation Committee and management believe that employees with higher authority, responsibility and ability to significantly influence our growth and profitability, should receive their incentive compensation more weighted towards long term equity to align their interest with our long term success. As a result, our CEO’s incentive compensation is more heavily weighted to long term equity incentives, followed by our other executive officers.

Benefits and Perquisites – As stated in our compensation philosophy, our executive officers and Compensation Committee agree that perquisites should be rare and limited to those that are important to our employees’ ability to safely and effectively carry out their responsibilities. Our executive officers are entitled to participate in directors’ and officers’ liability insurance, as well as the various benefits made available to our other employees, such as our group health plans, paid vacation and sick leave, basic life insurance, short and long-term disability benefits and 401(k) plan with contribution matching up to 50%.

Severance – Pursuant to employment agreements that we have entered into with our CFO and CLO, each of them is entitled to specified benefits in the event of termination of his employment under certain conditions, including partial acceleration of unvested restricted stock and guaranteed minimum severance payments and benefits. Our COO also was entitled to such benefits pursuant to his employment agreement prior to December 31, 2014. We anticipate entering into new employment agreements with all of our executive officers prior to the Annual Meeting which will entitle each of them to specified benefits in the event of the involuntary termination of his employment without cause or the voluntary termination of his employment for good reason. These benefits are described under “2015 Fiscal Year Employment Agreements.”

Change-in-Control Benefits – Upon a change in control that occurs during the employment of our executive officers or, in certain circumstances, within 12 months following the executive’s involuntary termination without cause or voluntary termination for good reason, certain of the equity awards that have been granted to our named executive officers will accelerate (stock options will become fully or partially vested and the conditions and restrictions on any restricted stock awards will be removed). We have provided more detailed information about these benefits, along with estimates of value under various circumstances, in the table below under “Potential Payments Upon Termination or Change of Control.” The new employment agreements which we anticipate will be executed prior to the Annual Meeting with our named executive officers will provide for specified benefits in the event of a change in control, which are described under “2015 Fiscal Year Employment Agreements.”

Our goal in providing severance and change in control benefits is to offer sufficient certainty in compensation such that our executive officers will focus their full time and attention on the requirements of the business rather than the potential implications for their respective positions. We believe these benefits assist in maintaining a competitive position in terms of attracting and retaining key executives which is in the best interests of our stockholders.

19

Role of the Compensation Committee, Performance Evaluations and Management

The Compensation Committee, which is comprised entirely of independent directors, is responsible for the general oversight of our compensation policies and practices. The Compensation Committee also reviews the overall compensation structure and evaluates the overall performance of our executive officers in order to determine that compensation is fair, reasonable, competitive and consistent with our compensation philosophies and objectives based on their collective experiences and business judgment. The Compensation Committee engages an independent compensation consultant with respect to executive compensation.

The Compensation Committee specifically evaluates the performance of our CEO and, with input from our CEO, the overall performance of our other executive officers. The Compensation Committee also discusses the overall performance and compensation of our executives with members of our Board of Directors and presents them with information regarding compensation matters throughout the year as needed.

The Compensation Committee oversees the development, implementation and administration of our compensation programs, including all compensation plans adopted by the Board under which equity grants are made, determines and approves performance measures and goals and objectives relevant to the compensation program, evaluates the performance of the CEO in light of those goals and objectives, and determines and approves the CEO’s compensation based on this evaluation, reviews and approves the compensation of the non-CEO executive officers, reviews and approves all discretionary bonuses to our employees, and reviews and approves employment, severance, and change in control agreements as well as any other supplemental benefits provided to our executive officers and other senior employees under the Committee’s purview. The Compensation Committee also reviews and makes recommendations to our Board of Directors with respect to directors’ compensation. The Compensation Committee also works with our CLO to annually review and reassess the adequacy of its charter, proposing changes as necessary to our Board of Directors for approval.

Our management and executive officers play a critical and important role in setting or recommending compensation levels throughout our organization. Our CEO makes incentive compensation recommendations to the Compensation Committee for the executive officers other than the CEO. In considering the CEO’s recommendations, the Compensation Committee evaluates results measured by the performance measures, goals and objectives of our compensation programs as well as qualitative factors to ensure that compensation is fair, reasonable, competitive and consistent with our compensation philosophies and objectives.

Management works with the Compensation Committee to design and develop compensation programs applicable to all our employees, including recommending changes to existing compensation programs and operational performance targets, preparing analyses of Company financial, operational data or other Compensation Committee briefing materials, analyzing industry data, and, ultimately, implementing the decisions of the Compensation Committee.

Use of Compensation Consultant

The Compensation Committee has retained Frederic W. Cook & Co., a compensation consultant, to provide objective advice on the pay practices, compensation plan design and the competitive landscape for compensation. WisdomTree pays the cost for Frederic W. Cook’s services. However, the Compensation Committee retains the sole authority to direct, terminate or continue Frederic W. Cook & Co.’s services. The compensation consultant also reviews and makes recommendations for the selection process and pay information used for market compensation benchmarking discussed below. The Compensation Committee has confirmed the independence of Frederic W. Cook & Co. in accordance with SEC and NASDAQ rules.

20

Market Compensation Benchmarking

The Compensation Committee monitors relevant market and industry statistics on executive compensation as one of several factors it considers in determining compensation to our executive officers. In making compensation decisions, the Compensation Committee reviews:

Industry surveys – McLagan Partners, Inc., a compensation consulting firm for the financial services industry, prepares annual comprehensive compensation surveys for the asset management industry. These surveys consist of consolidated average compensation information of publicly traded and private asset management firms.

Industry peers – Publicly disclosed pay information for certain publicly traded asset management firms that are generally similar in size, market capitalization, product offering or financial metrics as WisdomTree.

The Compensation Committee uses this information for compensation decisions to understand evolving pay trends at asset managers; however, the Compensation Committee recognizes that there are inherent limitations on the comparability and usefulness of the market data, including time lags, differences in scope of responsibilities, geographic differences and other factors. While the Compensation Committee believes such comparative information is useful, such data is intended solely to serve as a reference point to assist the Compensation Committee in its discussions and deliberations.

The Compensation Committee, working with its compensation consultant, reviews the appropriateness of the companies included in the industry peer group twice a year – first, at the beginning of the year, when determining the target pool, and second, at the end of the year, when determining year end compensation. The Committee will adjust the peer group based on relevant metric changes. The 2014 peer group and changes from the 2013 peer group are noted below. Peer group changes were primarily due to better aligning peer companies with our relevant business metrics, including size of AUM:

| Beginning of Year | End of Year | |

| • Artisan Partners • Calamos Asset Management • CIFC Corp. • Cohen & Steers • Diamond Hill Investment • Financial Engines • GAMCO Investors • Manning & Napier • Pzena Investment Management • Virtus Investment Partners • Westwood Holding Group |

• Artisan Partners • Calamos Asset Management • CIFC Corp. • Cohen & Steers • Diamond Hill Investment • Financial Engines • GAMCO Investors • Virtus Investment Partners • Westwood Holding Group • Waddell & Reed – added

• Manning & Napier – removed • Pzena Investment Management – removed |

Consideration of Results of Say-on-Pay Vote

Beginning with our 2012 Annual Meeting of stockholders, and once every three years thereafter, we provide our stockholders with the opportunity to cast an advisory vote on compensation paid to our named executive officers, or say-on-pay. At the 2012 Annual Meeting of stockholders, 78% of our stockholders voting on say-on-pay cast a vote in favor of the proposal. The Compensation Committee reviews the outcome of our stockholders’ advisory say-on-pay proposal in its evaluation and determination of executive compensation. The Compensation Committee considered the results of the stockholders’ advisory vote at our 2012 Annual Meeting, and did not make any changes to our executive compensation policies and decisions as a result of such vote. At this Annual Meeting, we are providing our stockholders with the opportunity to cast an advisory vote on our fiscal year 2014 compensation paid to our named executive officers. The Compensation Committee intends to review the outcome of this say-on-pay proposal in its evaluation and determination of executive compensation for fiscal year 2015.

21

2014 Incentive Compensation Program