A STRATEGIC PARTNERSHIP TO HELP ADVISORS DIGITIZE + DIFFERENTIATE Exhibit 99.2

Forward Looking Statements This presentation contains forward-looking statements that are based on our management’s belief and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, the risks described below. If one or more of these or other risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this presentation completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements. In particular, forward-looking statements in this presentation may include statements about: anticipated trends, conditions and investor sentiment in the global markets and exchange-traded products (“ETPs”); anticipated levels of inflows into and outflows out of our ETPs; our ability to deliver favorable rates of return to investors; our ability to develop new products and services; our ability to maintain current vendors or find new vendors to provide services to us at favorable costs; our ability to successfully expand our business into non-U.S. markets; timing of payment of our cash income taxes; competition in our business; and the effect of laws and regulations that apply to our business. Our business is subject to many risks and uncertainties, including without limitation: Financial growth in recent years may not provide an accurate representation of the financial growth we may experience in the future, which may make it difficult to evaluate our future prospects. Declining prices of securities can adversely affect our business by reducing the market value of the assets we manage or causing customers to sell their fund shares and trigger redemptions. Fluctuations in the amount and mix of our AUM may negatively impact revenues and operating margins. We derive a substantial portion of our revenues from two products – the WisdomTree Europe Hedged Equity Fund and the WisdomTree Japan Hedged Equity Fund – and, as a result, our operating results are particularly exposed to the performance of these funds and our ability to maintain the AUM of these funds, as well as investor sentiment toward investing in the funds’ strategies and market-specific and political and economic risk. Most of our AUM are held in our U.S. listed ETFs that invest in foreign securities and we therefore have substantial exposure to foreign market conditions and are subject to currency exchange rate risks. Many of our ETPs and ETFs have a limited track record, and poor investment performance could cause our revenues to decline. We depend on third parties to provide many critical services to operate our business and our ETPs and ETFs. The failure of key vendors to adequately provide such services could materially affect our operating business and harm our customers. Other factors, such as general economic conditions, including currency exchange rate fluctuations, also may have an effect on the results of our operations. For a more complete description of the risks noted above and other risks that could cause our actual results to differ from our current expectations, please see the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015. The forward-looking statements in this presentation represent our views as of the date of this presentation. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views as of any date other than the date of this presentation.

Deal Terms / Structure $20 million cash investment for 36% minority equity interest in AdvisorEngine (formerly Vanare) Entered into strategic agreement whereby WisdomTree’s asset allocation models will be made available as defaults on AdvisorEngine’s open architecture platform Balance sheet investment with no recognition of AdvisorEngine revenues or expenses Impact to WisdomTree’s income statement over time will be driven by advisory fees from WisdomTree ETFs on the platform and asset allocation fees A STRATEGIC PARTNERSHIP TO HELP ADVISORS DIGITIZE + DIFFERENTIATE

Deepens existing client relationships by providing solutions/tools to help advisors digitize and differentiate their businesses as well as offers opportunities to establish new relationships Makes WisdomTree’s asset allocation models actionable via a new distribution channel Helps drive diversified flows into WisdomTree ETFs and adds opportunity for asset allocation revenue Allows WisdomTree to stay top-of-mind with advisors and end-clients by delivering targeted relevant content and actionable product recommendations Strategic Rationale of Partnership

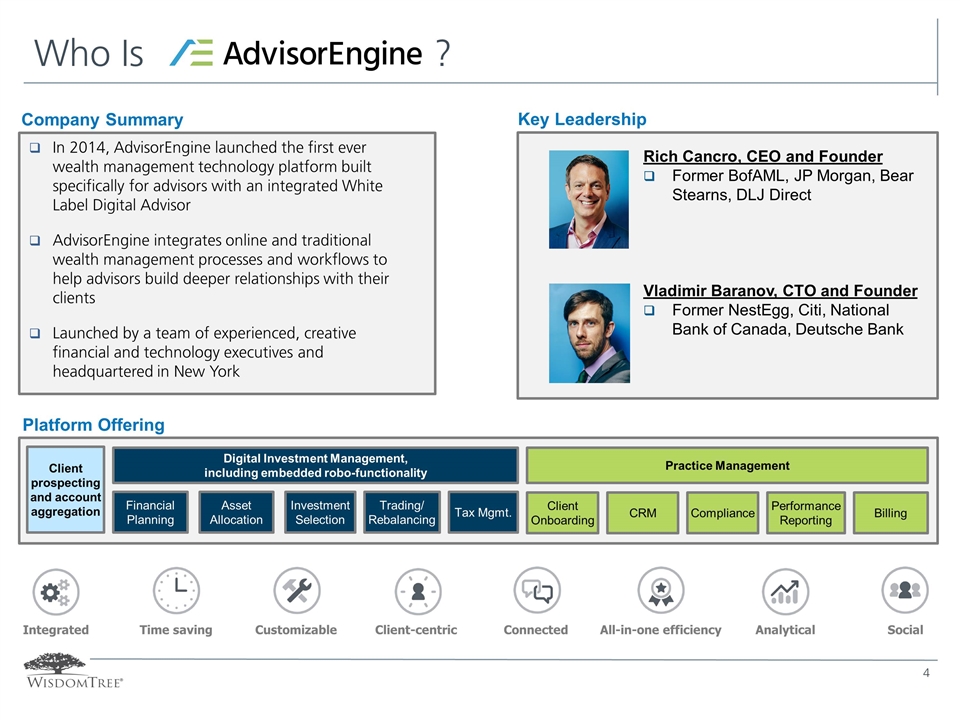

Who Is ? Digital Investment Management, including embedded robo-functionality Client prospecting and account aggregation Financial Planning Asset Allocation Investment Selection Trading/ Rebalancing Tax Mgmt. Practice Management Compliance Performance Reporting Billing CRM Client Onboarding Platform Offering Rich Cancro, CEO and Founder Former BofAML, JP Morgan, Bear Stearns, DLJ Direct Vladimir Baranov, CTO and Founder Former NestEgg, Citi, National Bank of Canada, Deutsche Bank Key Leadership Integrated Time saving Customizable Client-centric Connected All-in-one efficiency Analytical Social Company Summary In 2014, AdvisorEngine launched the first ever wealth management technology platform built specifically for advisors with an integrated White Label Digital Advisor AdvisorEngine integrates online and traditional wealth management processes and workflows to help advisors build deeper relationships with their clients Launched by a team of experienced, creative financial and technology executives and headquartered in New York

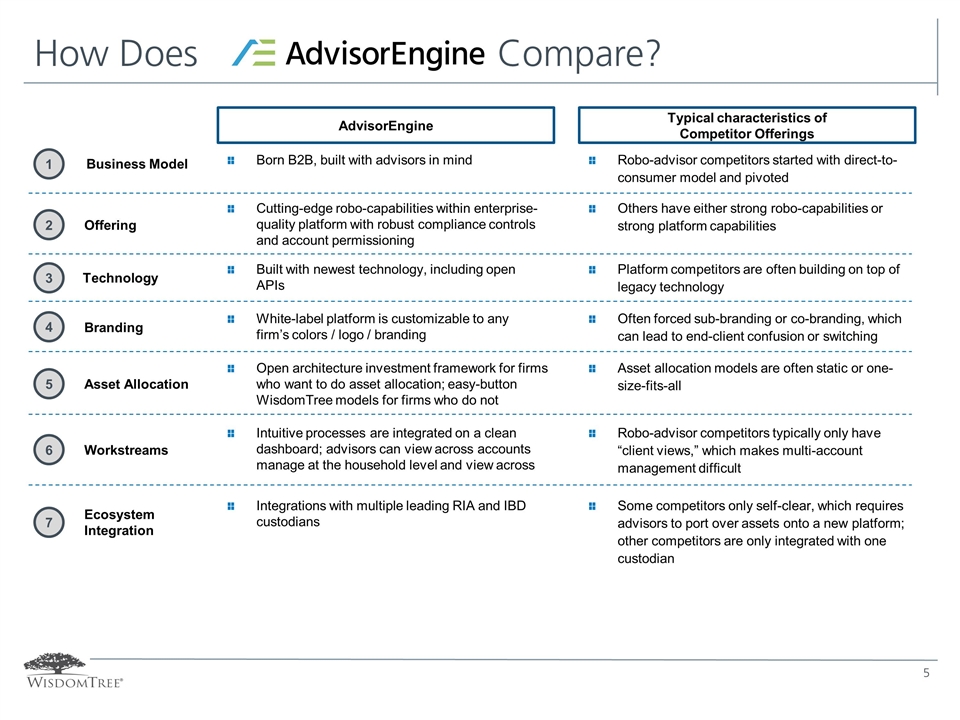

How Does Compare? AdvisorEngine Typical characteristics of Competitor Offerings 1 2 3 4 7 5 6 Born B2B, built with advisors in mind Robo-advisor competitors started with direct-to-consumer model and pivoted Cutting-edge robo-capabilities within enterprise-quality platform with robust compliance controls and account permissioning Others have either strong robo-capabilities or strong platform capabilities Built with newest technology, including open APIs Platform competitors are often building on top of legacy technology White-label platform is customizable to any firm’s colors / logo / branding Often forced sub-branding or co-branding, which can lead to end-client confusion or switching Open architecture investment framework for firms who want to do asset allocation; easy-button WisdomTree models for firms who do not Asset allocation models are often static or one-size-fits-all Intuitive processes are integrated on a clean dashboard; advisors can view across accounts manage at the household level and view across Robo-advisor competitors typically only have “client views,” which makes multi-account management difficult Integrations with multiple leading RIA and IBD custodians Some competitors only self-clear, which requires advisors to port over assets onto a new platform; other competitors are only integrated with one custodian Business Model Offering Technology Branding Asset Allocation Workstreams Ecosystem Integration

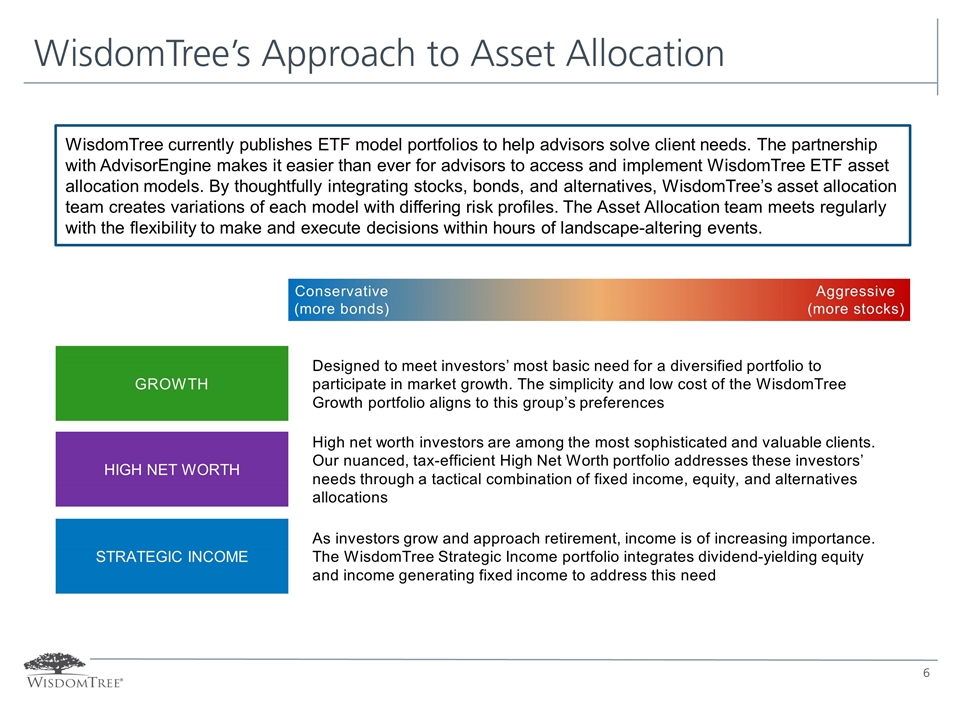

WisdomTree’s Approach to Asset Allocation WisdomTree currently publishes ETF model portfolios to help advisors solve client needs. The partnership with AdvisorEngine makes it easier than ever for advisors to access and implement WisdomTree ETF asset allocation models. By thoughtfully integrating stocks, bonds, and alternatives, WisdomTree’s asset allocation team creates variations of each model with differing risk profiles. The Asset Allocation team meets regularly with the flexibility to make and execute decisions within hours of landscape-altering events. Designed to meet investors’ most basic need for a diversified portfolio to participate in market growth. The simplicity and low cost of the WisdomTree Growth portfolio aligns to this group’s preferences GROWTH As investors grow and approach retirement, income is of increasing importance. The WisdomTree Strategic Income portfolio integrates dividend-yielding equity and income generating fixed income to address this need STRATEGIC INCOME High net worth investors are among the most sophisticated and valuable clients. Our nuanced, tax-efficient High Net Worth portfolio addresses these investors’ needs through a tactical combination of fixed income, equity, and alternatives allocations HIGH NET WORTH Conservative (more bonds) Aggressive (more stocks)