Exhibit 99.1

|

Changes to Financial and

Operating Disclosure Post ETF

May 9, 2018

Securities Transaction

|

Forward Looking Statements

This presentation contains forward-looking statements that are based on our management’s belief and assumptions and on information currently available to our management.

Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other

factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking

statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current

expectations include, among other things, the risks described below. If one or more of these or other risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those

implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this presentation completely and with the understanding that our actual future results may be materially

different from any future results expressed or implied by these forward-looking statements.

In particular, forward-looking statements in this presentation may

include statements about: anticipated trends, conditions and investor sentiment in the global markets and exchange-traded products (“ETPs”); anticipated levels of inflows into and outflows out of our ETPs; our ability to deliver favorable

rates of return to investors; our ability to develop new products and services; our ability to maintain current vendors or find new vendors to provide services to us at favorable costs; our ability to successfully expand our business into non-U.S.

markets; competition in our business; and the effect of laws and regulations that apply to our business.

Our business is subject to many risks and uncertainties,

including without limitation:

Net outflows in our two largest ETFs – the WisdomTree Europe Hedged Equity Fund and the WisdomTree Japan Hedged Equity Fund

– have had, and in the future could continue to have, a negative impact on our revenues.

Over the last few years, we have expanded our business into Europe,

Japan and Canada. This expansion subjects us to increased operational, regulatory, financial and other risks.

The ETFS acquisition is significant in size relative

to our assets and operations and may result in significant changes in our business. Our failure to integrate and manage ETFS successfully could materially and adversely affect our business, results of operations and financial condition.

Declining prices of securities, precious metals and other commodities can adversely affect our business by reducing the market value of the assets we manage or causing customers to

sell their fund shares and trigger redemptions.

Fluctuations in the amount and mix of our AUM, whether caused by disruptions in the financial markets or otherwise,

may negatively impact revenues and operating margins, and may impede our ability to refinance our debt upon maturity, increase the cost of borrowing or result in our debt being called prior to maturity.

We derive a substantial portion of our revenues from a limited number of products, and as a result, our operating results are particularly exposed to the performance of these

products and our ability to maintain the AUM of these products, as well as investor sentiment toward investing in the products’ strategies and market-specific and political and economic risk.

Much of our AUM is held in our U.S. listed ETFs that invest in foreign securities and we therefore have substantial exposure to foreign market conditions and are subject to

currency exchange rate risks.

Many of our ETPs and ETFs have a limited track record, and poor investment performance could cause our revenues to decline.

We depend on third parties to provide many critical services to operate our business and our ETPs. The failure of key vendors to adequately provide such services

could materially affect our operating business and harm our customers.

Other factors, such as general economic conditions, including currency exchange rate

fluctuations, also may have an effect on the results of our operations. For a more complete description of the risks noted above and other risks that could cause our actual results to differ from our current expectations, please see the section

entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017.

The forward-looking statements

in this presentation represent our views as of the date of this presentation. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point

in the future, we have no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views as of any date other than the date of this presentation.

2

|

Overview

+ On April 11, 2018, we acquired the European exchange-traded commodity, currency and short-and-leveraged business (“ETFS”) from ETF Securities Limited (“ETF

Securities”), which includes $17.6 billion of assets under management (“AUM”) as of April 10, 2018.

+ The acquisition elevates us to the 9th

largest ETP sponsor globally and the largest global independent ETP provider based on AUM, with significant scale and presence in the U.S. and Europe, the two largest ETP markets.

+ The purchase price was $523 million consisting of $253 million of cash and 30 million shares of WisdomTree common stock, based on the market close on April 10, 2018.

The cash portion of the purchase price was funded with $53 million of balance sheet cash and $200 million from a newly raised term loan.

+ Given the size of the

transaction, we filed proforma financial statements reflecting what the combined financial statements of the company would look like had the acquisition occurred in 2017. This disclosure is required by the SEC.

+ The proforma financials do not completely reflect what we believe will be the operating results of ETFS as it does not account for synergies we believe we can achieve through the

acquisition and due to GAAP requirements, reflected higher expenses of the legacy ETF Securities business which we did not acquire.

+ Therefore, the purpose of

this presentation is to provide:

? additional information on key transactions related to our acquisition of ETFS

a description of changes we are making to our financial reporting and operating data disclosures to better reflect the global scale of our business guidance for our international

business segment, which will now include ETFS

Additional information on taxes

3

|

|

Key Items Post Transaction

Below are key items associated with our acquisition of ETFS that we believe investors should understand to better analyze our business going forward:

+ Contractual gold payments

+ Term loan and revolving credit facility

+ Issuance of preferred stock

+ Preliminary purchase price allocation

+ Taxes

4

|

|

Contractual Gold Payments—Deferred

Consideration

+ In 2008, ETF Securities acquired Gold Bullion Securities (“GBS”) a gold-backed ETC owned by Gold Bullion

Holdings (“GBH”), a company owned two-thirds by the World Gold Council and one-third by Graham Tuckwell.

+ The acquisition did not involve any up-front payment. Instead, ETF Securities agreed to pay GBH’s shareholders

9,500 ounces of gold per year until March 2058, which is then reduced to 6,333 ounces into perpetuity.

+ Our acquisition of ETFS did not terminate this contractual gold payment obligation. Instead, we assumed this obligation and entered into a new agreement with ETF Securities which

provides for the same contractual gold payment in order for ETF Securities to satisfy its obligation to GBH. We refer to this payment to ETF Securities as

“contractual gold payments” on our income statement.

+ The

contractual gold payment is paid from the advisory fee income we earn for managing the gold-backed ETCs. The payment can be reduced if our advisory fee income from the gold ETCs is not enough to cover this obligation. However, any unpaid amounts

accrue and are payable when the advisory fee income is enough to satisfy the obligation. There is no recourse back to WisdomTree for any unpaid amounts.

+ 9,500

ounces of gold is currently worth $12.5 million based on the price of gold as of May 9, 2018. This amount will be recorded as an operating expense titled “contractual gold payments” on our revised income statement

(see page 9).

+ We also recorded the fair value of this obligation on our balance sheet as

“deferred consideration” since it arises from ETF Securities’ acquisition of GBS. We determined the present value of this obligation as $172.7 million based on the future price of gold. Every quarter, we will re-measure the fair value

of this liability. The change to the fair value, which will be predominantly driven by the price of gold, will flow through our income statement as a non-operating item titled “revaluation of deferred consideration.”

5

|

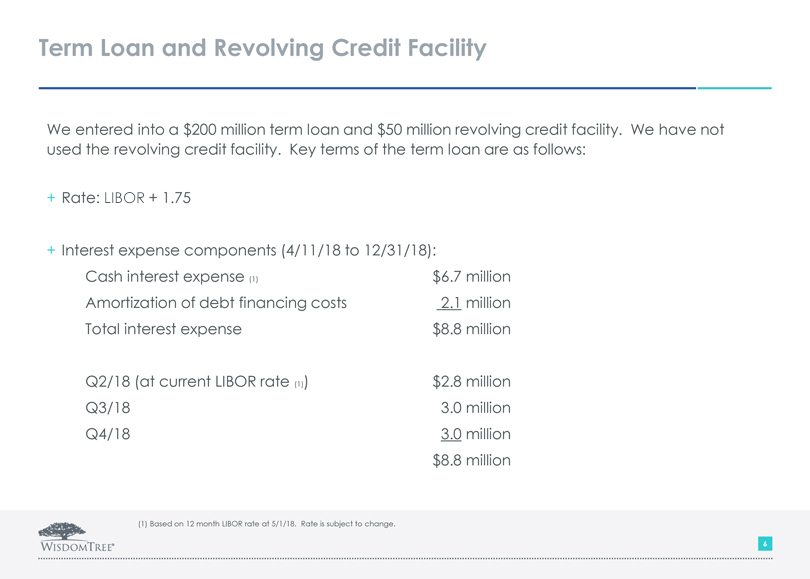

Term Loan and Revolving Credit Facility

We entered into a $200 million term loan and $50 million revolving credit facility. We have not used the revolving credit facility. Key terms of the term loan are

as follows:

+ Rate: LIBOr + 1.75

+

Interest expense components (4/11/18 to 12/31/18):

Cash interest expense (1)

$6.7

million

Amortization of debt financing costs

2.1

million

Total interest expense

Q2/18 (at current LIBOR rate (1))

$2.8

million

Q3/18

3.0

million

Q4/18

3.0

million

$8.8

million

(1) Based on 12 month LIBOR rate at 5/1/18. Rate is subject to change.

6

|

Preferred Stock

WisdomTree issued common and preferred stock as part of the ETFS acquisition. Key terms for the stock portion of the transaction consideration are as follows:

+ 15.25 million shares of common stock

+ 14,750 non-voting preferred shares convertible

into 14.75 million shares of common stock

+ The preferred shares have the same priority for dividends, distributions and payments as WisdomTree’s common

stock; however, the preferred shares have no voting rights and are not transferable.

+ ETF Securities has a maximum 9.99% voting interest

+ There are lockups and standstill agreements in place. The lockups are as follows:

~ 3 months

post closing until July 11, 2018 – 10 million shares

~9 months post closing until January 7, 2019 – 10 million shares

~ 15 months post closing until July 6, 2019 – 10 million shares

+ A portion of

the preferred shares are treated as mezzanine equity on the balance sheet between Liabilities and Equity as they may redeemed by ETF Securities under certain circumstances.

7

|

|

Preliminary Purchase Price Allocation

+ WisdomTree engaged a valuation consultant to allocate the purchase price across the assets acquired from ETF Securities. Preliminary allocation of the purchase

price using the proforma financial statements as of December 31, 2017 is as follows:

($ millions)

Cash

$253.0

Shares (30m x $9.00)

270.0

Purchase price

523.0

Contractual gold payments/Deferred consideration

172.7

Total to allocate

$695.7

Net assets acquired

$8.4

Identifiable intangible assets

602.4

Goodwill

84.9

Total

$695.7

+ The intangible assets will have an indefinite useful life (non-amortizing) and are not tax deductible

+ Goodwill is not tax deductible as it was structured as a UK stock acquisition

| 8 |

|

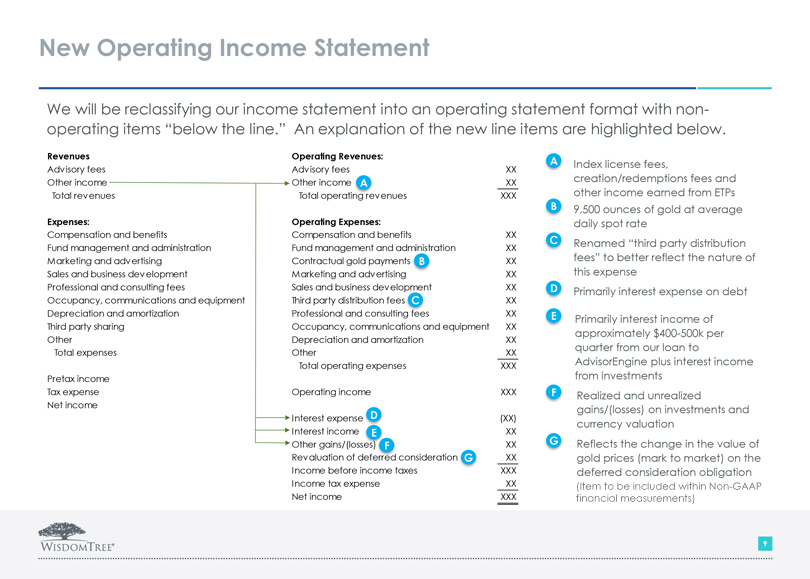

New Operating Income Statement

We will be reclassifying our income statement into an operating statement format with non-operating items “below the line.” An explanation of the new line items are

highlighted below.

Revenues

Advisory fees Other income Total revenues

Expenses:

Compensation and benefits

Fund management and administration Marketing and advertising Sales and business development Professional and consulting fees

Occupancy, communications and equipment Depreciation and amortization Third party sharing Other Total expenses

Pretax income Tax expense Net income

Operating Revenues:

Advisory fees

XX

Other income A

XX

Total operating revenues

XXX

Operating Expenses:

Compensation and benefits

XX

Fund management and administration

XX

Contractual gold payments B

XX

Marketing and advertising

XX

Sales and business development

XX

Third party distribution fees C

XX

Professional and consulting fees

XX

Occupancy, communications and equipment

XX

Depreciation and amortization

XX

Other

XX

Total operating expenses

XXX

Operating income

XXX

Interest expense D

(XX)

Interest income E

XX

Other gains/(losses)

F

XX

Revaluation of deferred

consideration G

XX

Income before income taxes

XXX

Income tax expense

XX

Net income

XXX

A

Index license fees,

creation/redemptions fees and

other income earned from ETPs

B

9,500 ounces of gold at average

daily spot rate

C

Renamed “third party distribution

fees” to better reflect the nature of

this expense

D

Primarily interest expense on debt

E

Primarily interest income of

approximately $400-500k per

quarter from our loan to

AdvisorEngine plus interest income

from investments

F

Realized and unrealized

gains/(losses) on investments and

currency valuation

G

Reflects the change in the value of

gold prices (mark to market) on the

deferred consideration obligation (Item to be included

within Non-GAAP financial measurements)

9

|

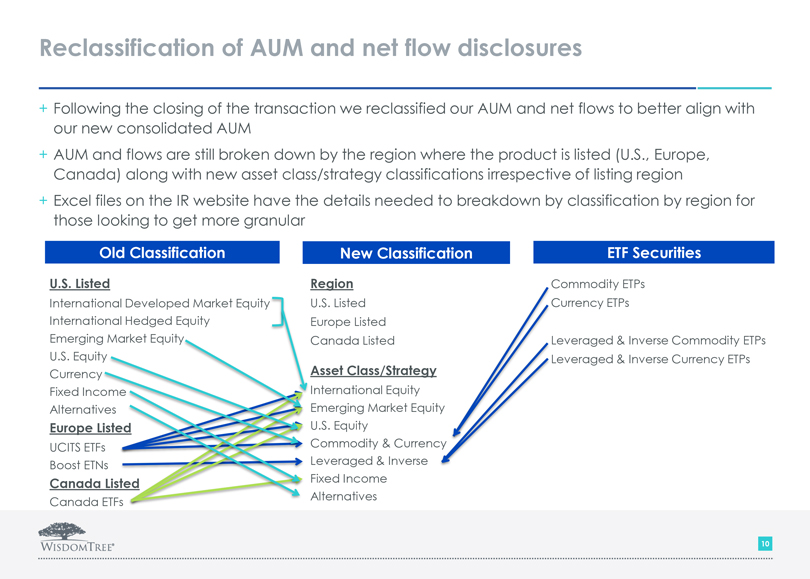

Reclassification of AUM and net flow disclosures

+ Following the closing of the transaction we reclassified our AUM and net flows to better align with our new consolidated AUM

+ AUM and flows are still broken down by the region where the product is listed (U.S., Europe, Canada) along with new asset class/strategy classifications irrespective of listing

region

+ Excel files on the IR website have the details needed to breakdown by classification by region for those looking to get more granular

Old Classification

U.S. Listed

International Developed Market Equity International Hedged Equity

Emerging Market Equity

U.S. Equity

Currency

Fixed Income

Alternatives

Europe Listed

UCITS ETFs Boost ETNs

Canada Listed

Canada ETFs

New Classification

Region

U.S. Listed

Europe Listed

Canada Listed

Asset Class/Strategy International Equity

Emerging Market Equity

U.S. Equity

Commodity & Currency

Leveraged & Inverse

Fixed Income

Alternatives

ETF Securities

Commodity ETPs Currency ETPs

Leveraged & Inverse Commodity ETPs Leveraged & Inverse Currency ETPs

10

|

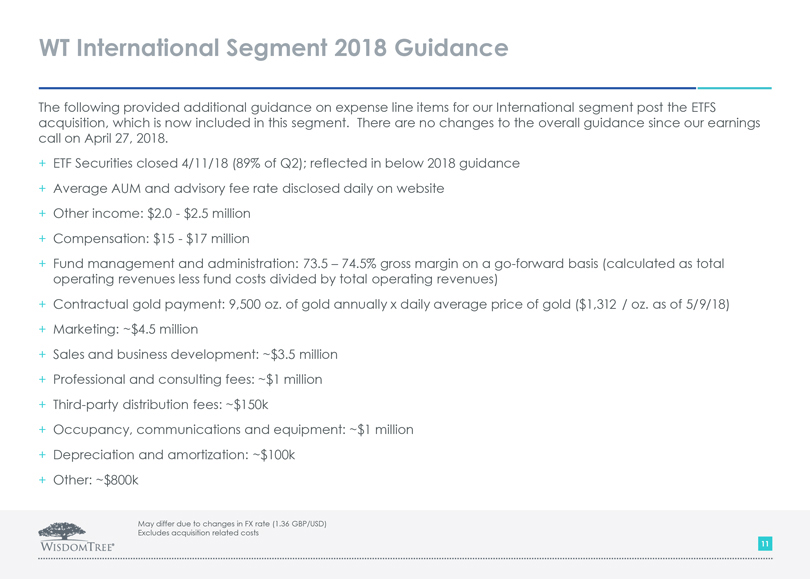

WT International Segment 2018 Guidance

The following provided additional guidance on expense line items for our International segment post the ETFS acquisition, which is now included in this segment.

There are no changes to the overall guidance since our earnings call on April 27, 2018.

+ ETF Securities closed 4/11/18 (89% of Q2); reflected in below 2018

guidance + Average AUM and advisory fee rate disclosed daily on website + Other income: $2.0—$2.5 million + Compensation: $15—$17 million

+ Fund

management and administration: 73.5 – 74.5% gross margin on a go-forward basis (calculated as total operating revenues less fund costs divided by total operating revenues)

+ Contractual gold payment: 9,500 oz. of gold annually x daily average price of gold ($1,312 / oz. as of 5/9/18)

+ Marketing: ~$4.5 million

+ Sales and business development: ~$3.5 million

+ Professional and consulting fees: ~$1 million

+ Third-party distribution fees: ~$150k

+ Occupancy, communications and equipment: ~$1 million

+ Depreciation and

amortization: ~$100k

+ Other: ~$800k

May differ due to changes in FX rate

(1.36 GBP/USD) Excludes acquisition related costs

11

|

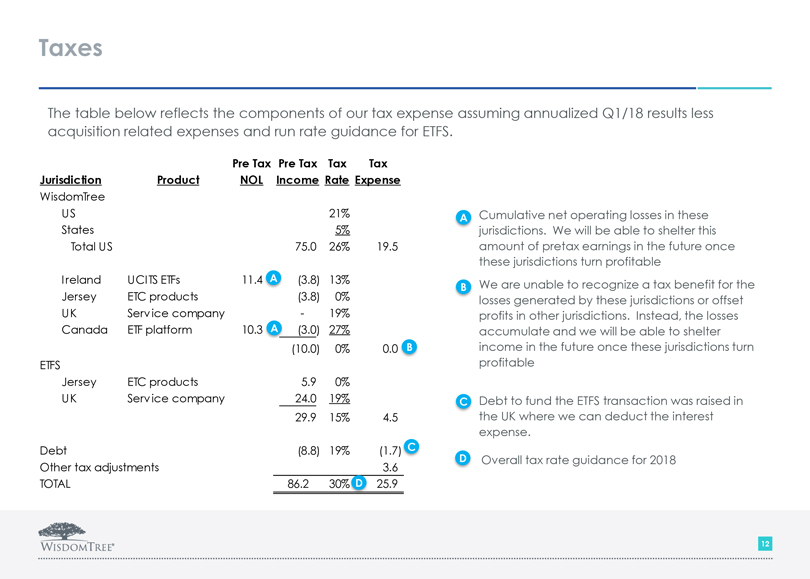

Taxes

The table below reflects the components of our tax expense assuming annualized Q1/18 results less acquisition related expenses and run rate guidance for ETFS. Pre Tax Pre Tax Tax

Tax Jurisdiction Product NOL Income Rate Expense WisdomTree US 21% States 5% Total US 75.0 26% 19.5 Ireland UCITS ETFs 11. A (3.8) 13% Jersey ETC products (3.8) 0% UK Service company — 19% Canada ETF platform 10.3 A (3.0) 27% (10.0)

0% 0.0 B ETFS Jersey ETC products 5.9 0% UK Service company 24.0 19% 29.9 15% 4.5 Debt (8.8) 19% (1.7 C Other tax adjustments 3.6 TOTAL 86.2 30% D 25.9 A Cumulative net operating losses in these jurisdictions. We will be able to shelter this amount

of pretax earnings in the future once these jurisdictions turn profitable B We are unable to recognize a tax benefit for the losses generated by these jurisdictions or offset profits in other jurisdictions. Instead, the losses accumulate and we will

be able to shelter income in the future once these jurisdictions turn profitable C Debt to fund the ETFS transaction was raised in the UK where we can deduct the interest expense. D Overall tax rate guidance for 2018

12

|

Historical Financials

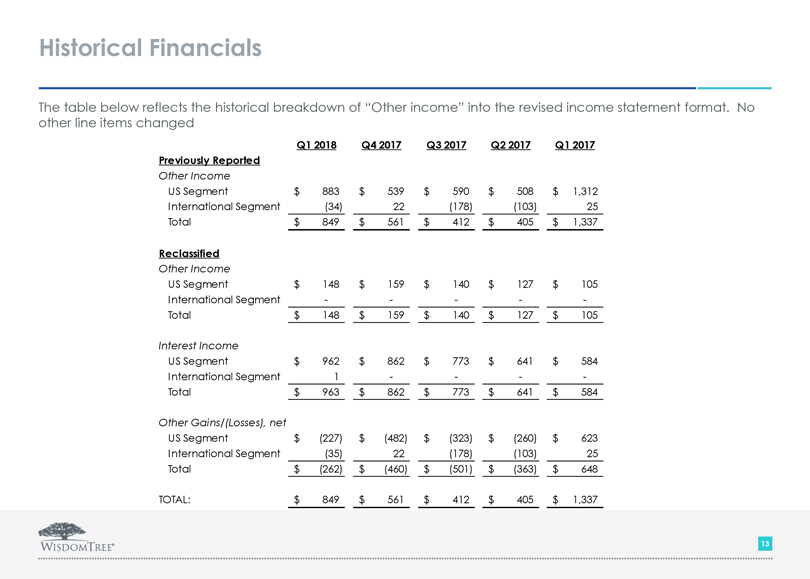

The table below reflects the historical breakdown of “Other income” into the revised income statement format. No other line items changed Q1 2018 Q4 2017 Q3 2017 Q2 2017

Q1 2017 Previously Reported Other Income US Segment $883 $539 $590 $508 $1,312 International Segment (34) 22 (178) (103) 25 Total $849 $561 $412 $405 $1,337 Reclassified Other Income US Segment $148 $159 $140 $127 $105 International Segment

— — — — — Total $148 $159 $140 $127 $105 Interest Income US Segment $962 $862 $773 $641 $584 International Segment 1 — —

— — Total $963 $862 $773 $641 $584 Other Gains/(Losses), net US Segment $(227) $(482) $(323) $(260) $623 International Segment (35) 22 (178) (103) 25 Total $(262) $(460) $(501) $(363) $648 TOTAL: $849 $561 $412 $405

$1,337

13

|