Industry Developments

On June 5, 2019, the SEC adopted Regulation Best Interest, which requires broker-dealers to act in the best interest of their retail customers when making a recommendation. The SEC also adopted the Form CRS relationship summary, which requires registered investment advisers and broker-dealers to deliver to retail investors a succinct, plain English summary about the relationship and services provided by the firm and the required standard of conduct associated with the relationship and services. Regulation Best Interest, Form CRS and the related rule will become effective 60 days after their publication in the Federal Register. The compliance date for both rules is June 30, 2020. Congress and individual state legislatures have continued to debate, and in some instances taken further action, in seeking to ensure heightened standards. We believe that the increased focus on fiduciary and best interest standards will continue to raise investor awareness of the benefits that ETFs provide – transparency, tax efficiency and liquidity – which we believe will expand ETFs’ competitiveness generally.

Assets Under Management

WisdomTree ETPs

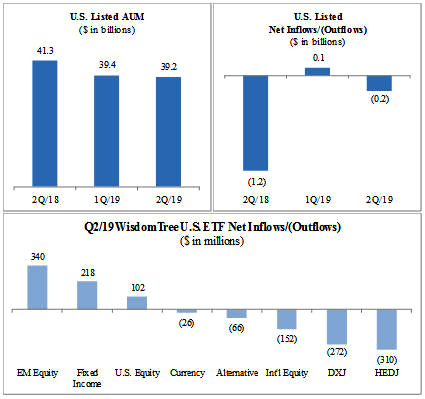

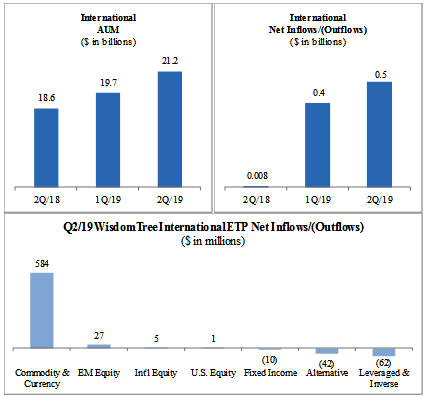

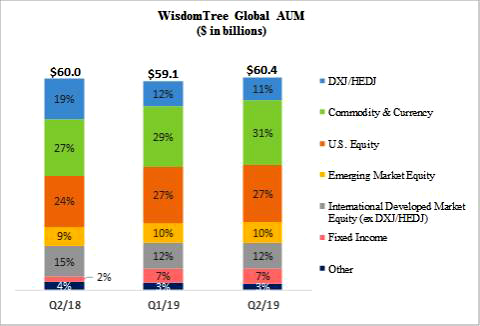

The chart below sets forth the asset mix of our ETPs at June 30, 2018, March 31, 2019 and June 30, 2019:

Over the last few years, concentrations in HEDJ, our European equity ETF which hedges exposure to the euro, and DXJ, our Japanese equity ETF which hedges exposure to the yen, have declined dramatically as negative investor sentiment toward these products has led to considerable net outflows. Recently, these outflows have largely been offset by strong inflows into our fixed income, U.S. equity and emerging markets products. In addition, the ETFS Acquisition has further diversified our investment theme concentrations by adding commodity exposures, predominantly gold.

Market Environment

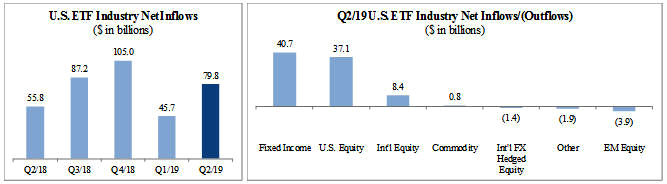

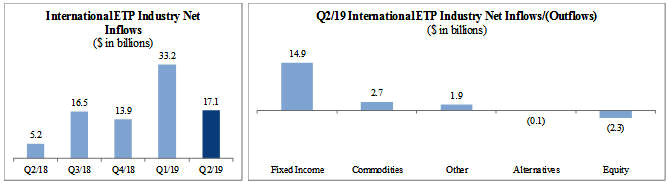

During the second quarter of 2019, U.S. and European markets experienced bouts of volatility and ultimately performed favorably as a result of accommodative monetary policies and continued progress in the U.S. and China trade dispute. Emerging markets were largely unchanged as a result of global trade uncertainties, while the Japanese markets suffered as the yen strengthened during the quarter. In addition, gold advanced as a result of geopolitical issues, a weakening U.S. dollar and a declining interest rate environment during the quarter.

The S&P 500 rose 4.3%, MSCI EAFE (local currency) rose 3.1%, MSCI Emerging Markets Index (U.S. dollar) rose 0.8% and gold prices rose 8.8% during the second quarter of 2019. In addition, the European equity market appreciated with the MSCI EMU Index rising 4.9%, while the Japanese equity market depreciated with the MSCI Japan Index declining 1.6%, both in local currency terms for the quarter. Also, the U.S. dollar weakened 2.7% versus the yen and 1.4% versus the euro during the quarter.

37