WISDOMTREE INVESTMENTS, INC.

Form

10-K

For the Fiscal Year Ended December 31, 2019

TABLE OF CONTENTS

| Page |

||||

| 3 |

||||

| 3 |

||||

| 27 |

||||

| 41 |

||||

| 41 |

||||

| 41 |

||||

| 42 |

||||

| 43 |

||||

| 43 |

||||

| 44 |

||||

| 46 |

||||

| 81 |

||||

| 82 |

||||

| 82 |

||||

| 82 |

||||

| 83 |

||||

| 83 |

||||

| 83 |

||||

| 83 |

||||

| 83 |

||||

| 84 |

||||

| 84 |

||||

| 84 |

||||

| 84 |

||||

| 84 |

||||

Unless otherwise indicated, references to “the Company,” “we,” “us,” “our” and “WisdomTree” mean WisdomTree Investments, Inc. and its subsidiaries.

WisdomTree

®

and Modern Alpha®

are registered trademarks of WisdomTree Investments, Inc. in the United States and in other countries. All other trademarks are the property of their respective owners. i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form

10-K,

or Report, contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect our results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed in the section entitled “Risk Factors” and elsewhere in this Report. If one or more of these or other risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this Report and the documents that we reference in this Report and have filed with the Securities and Exchange Commission, or the SEC, as exhibits to this Report, completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements.

In particular, forward-looking statements in this Report may include statements about:

| • | anticipated trends, conditions and investor sentiment in the global markets and exchange traded products, or ETPs; |

| • | anticipated levels of inflows into and outflows out of our ETPs; |

| • | our ability to deliver favorable rates of return to investors; |

| • | competition in our business; |

| • | our ability to develop new products and services; |

| • | our ability to maintain current vendors or find new vendors to provide services to us at favorable costs; |

| • | our ability to successfully operate and expand our business in non-U.S. markets; and |

| • | the effect of laws and regulations that apply to our business. |

The forward-looking statements in this Report represent our views as of the date of this Report. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views as of any date other than the date of this Report.

2

PART I

ITEM 1. |

BUSINESS |

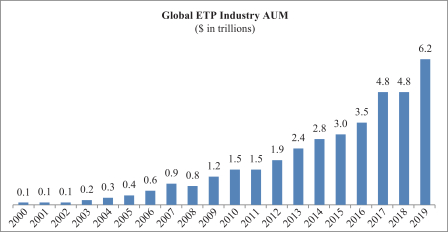

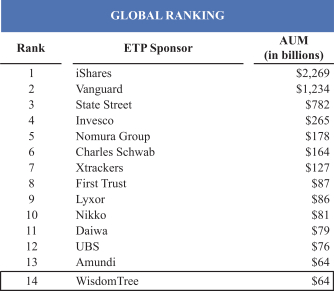

Our Company

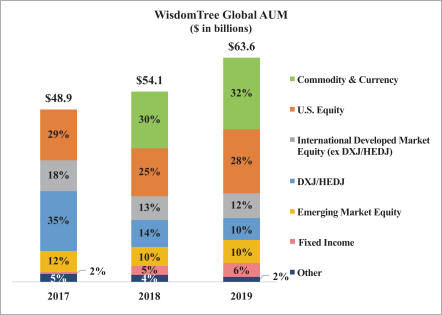

We are the only publicly-traded asset management company that focuses exclusively on exchange-traded products, or ETPs, and are a leading global ETP sponsor based on assets under management, or AUM, with AUM of $63.6 billion globally as of December 31, 2019. An ETP is a pooled investment vehicle that holds a basket of securities, financial instruments or other assets and generally seeks to track (index-based) or outperform (actively managed) the performance of a broad or specific equity, fixed income or alternatives market segment, commodity or currency (or an inverse or multiple thereof). ETPs are listed on an exchange with their shares traded in the secondary market at market prices, generally at approximately the same price as the net asset value of their underlying components. ETP is an umbrella term that includes exchange-traded funds, or ETFs, exchange-traded notes and exchange-traded commodities.

Our family of ETFs includes funds that track our own indexes, funds that track third-party indexes and actively managed funds. Most of our equity-based funds employ a fundamentally weighted investment methodology, which weights securities based on factors such as dividends, earnings or investment factors, whereas most other ETF industry indexes use a capitalization weighted methodology. We distribute our ETFs through all major channels within the asset management industry, including brokerage firms, registered investment advisers, institutional investors, private wealth managers and discount brokers primarily through our sales force. Our sales efforts are not directed towards the retail segment but rather are directed towards financial or investment advisers that act as intermediaries between the

end-client

and us.We focus on creating ETFs for investors that offer thoughtful innovation, smart engineering and redefined investing. We have launched many

first-to-market

ETFs and pioneered alternative weighting and performance methods commonly referred to as “smart beta.” However, our U.S. listed ETFs are not beta, but rather an investment approach we call “Modern Alpha,” which combines the outperformance potential of active management with the benefits of passive management to offer investors cost-effective ETFs that are built to perform.We strive to deliver a better investing experience through innovative solutions. Continued investments in technology-enabled services and our Advisor Solutions program, which includes portfolio construction, asset allocation, practice management services and digital tools for financial advisors, are meant to differentiate us in the market, expand our distribution and further enhance our relationships with financial advisors.

We were incorporated under the laws of the state of Delaware on September 19, 1985 as Financial Data Systems, Inc. and ultimately renamed WisdomTree Investments, Inc. on September 6, 2005.

3

Assets Under Management

WisdomTree ETPs

We offer ETPs covering equity, commodity, fixed income,

leveraged-and-inverse,

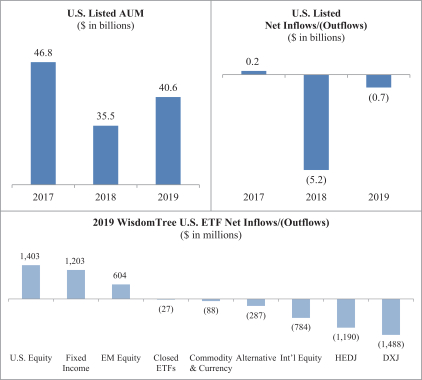

currency and alternative strategies. The chart below sets forth the asset mix of our ETPs for the last three years:

Our concentrations in the WisdomTree Europe Hedged Equity Fund, or HEDJ, our European equity ETF which hedges exposure to the euro, and the WisdomTree Japan Hedged Equity Fund, or DXJ, our Japanese equity ETF which hedges exposure to the yen, have declined dramatically over the last three years from 35% at December 31, 2017 to 10% at December 31, 2019, as negative investor sentiment toward these strategies led to net outflows of $13.0 billion during this timeframe. These outflows largely have been offset by strong inflows into our U.S. equity, fixed income, commodity and emerging markets products. During the years ended December 31, 2017, 2018 and 2019, net inflows were $3.7 billion, $3.2 billion and $3.3 billion, respectively, excluding outflows from HEDJ and DXJ.

Acquisition of ETFS

In April 2018, we acquired the European exchange-traded commodity, currency and

leveraged-and-inverse

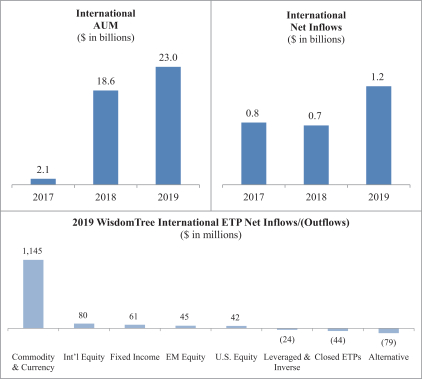

business of ETFS Capital Limited, or ETFS Capital. Throughout this Report, we refer to the acquired business as ETFS and the acquisition as the ETFS Acquisition. Following the ETFS Acquisition we became the largest global independent ETP provider based on AUM, with significant scale and presence in the U.S. and Europe, the two largest ETP markets. The ETFS Acquisition diversified our investment theme concentrations by adding European-listed gold and commodity products.Our Operating and Financial Results

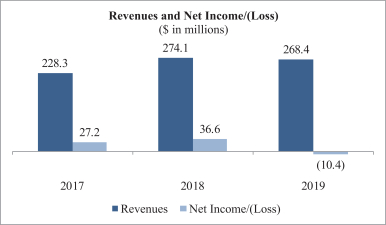

We operate as an ETP sponsor and asset manager providing investment advisory services globally. These activities are reported in our U.S. Business and International Business segments.

4

U.S. Business Segment

Our U.S. listed ETFs’ AUM increased from $35.5 billion at December 31, 2018 to $40.6 billion at December 31, 2019 due to market appreciation and net inflows into our U.S. equity, fixed income and emerging markets ETFs. These increases were partly offset by outflows from our international equity ETFs and HEDJ/DXJ.

Our U.S. Business segment included our Japan sales office, WTJ, which engaged in selling our U.S. listed ETFs to Japanese institutions. In July 2018, we determined to restructure our distribution strategy in Japan and expanded our existing relationship with Premia Partners Company Limited to manage distribution of our ETFs in Japan. As a result, WTJ has ceased operations and was liquidated during the year ended December 31, 2019.

WTJ reported operating losses during the years ended December 31, 2017, 2018 and 2019 of $4.6 million, $4.5 million and $0.6 million, respectively.

5