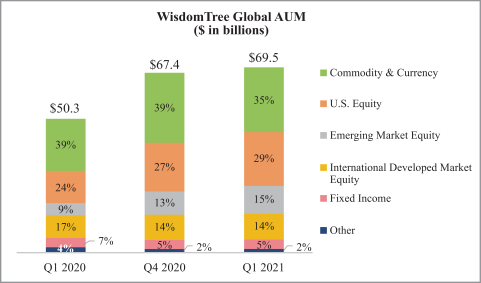

Assets Under Management

WisdomTree ETPs

We offer ETPs covering equity, commodity, fixed income, currency, cryptocurrency and alternative strategies. The chart below sets forth the asset mix of our ETPs at March 31, 2020, December 31, 2020 and March 31, 2021:

leveraged-and-inverse,

Market Environment

During the first quarter of 2021, global equity markets performed favorably upon the rollout of

COVID-19

vaccines and further economic stimulus. These developments contributed to a sharp rise in government bond yields and a decline in gold prices during the quarter. The S&P 500 rose 6.2%, MSCI EAFE (local currency) rose 7.7%, MSCI Emerging Markets Index (U.S. dollar) rose 2.3%, while gold prices declined 10.6% during the first quarter of 2021. In addition, the European and Japanese equities markets both appreciated with the MSCI EMU Index and MSCI Japan Index increasing 9.1% and 8.9%, respectively, in local currency terms for the quarter. Also, the U.S. dollar strengthened 7.3% and 1.3% versus the Japanese yen and British pound, while weakening 4.4% versus the euro during the quarter.

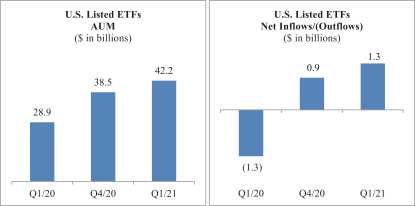

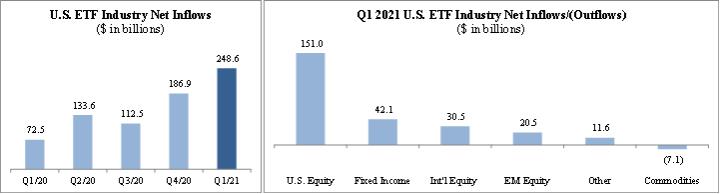

U.S. Listed ETF Industry Flows

U.S. listed ETF net flows for the three months ended March 31, 2021 were $248.6 billion. U.S. equity gathered the majority of those flows.

Source: Morningstar

31