Assets Under Management

WisdomTree ETPs

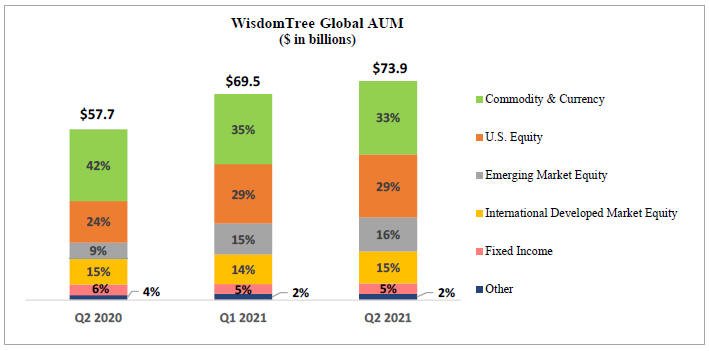

We offer ETPs covering equity, commodity, fixed income, leveraged and inverse, currency, cryptocurrency and alternative strategies. The chart below sets forth the asset mix of our ETPs at June 30, 2020, March 31, 2021 and June 30, 2021:

Market Environment

During the second quarter of 2021, global equity markets advanced upon the acceleration of the rollout of

COVID-19

vaccines. Rebounds in economic activity contributed to inflationary concerns and lower government bond yields. Gold prices also increased modestly during the quarter. The S&P 500 rose 8.6%, MSCI EAFE (local currency) rose 5.0%, MSCI Emerging Markets Index (U.S. dollar) rose 5.1%, and gold prices rose 4.3% during the second quarter of 2021. In addition, the European and Japanese equities markets both appreciated with the MSCI EMU Index and MSCI Japan Index increasing 6.2% and 0.2%, respectively, in local currency terms for the quarter. Also, the U.S. dollar weakened 1.4%, 0.7% and 0.2% versus the euro, British pound and Japanese yen, respectively, during the quarter.

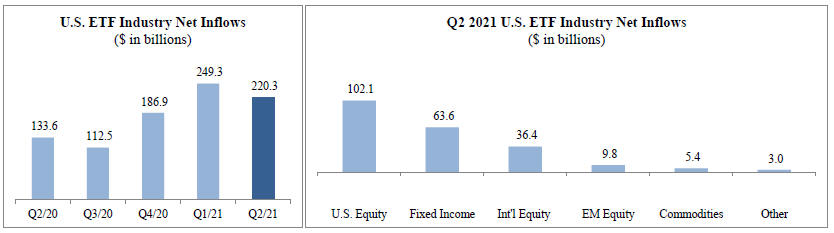

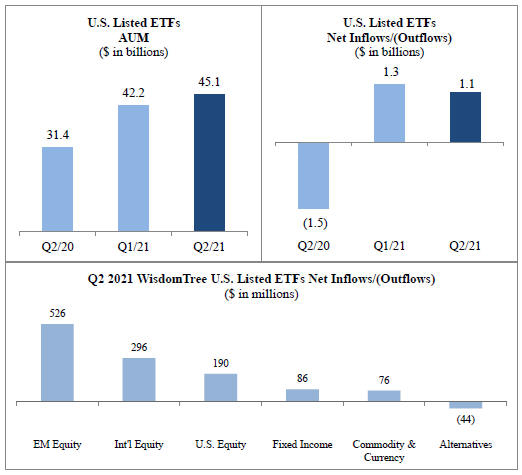

U.S. listed ETF Industry Flows

U.S. listed ETF industry net flows for the three months ended June 30, 2021 were $220.3 billion. U.S. equity and fixed income gathered the majority of those flows.

Source: Morningstar

33

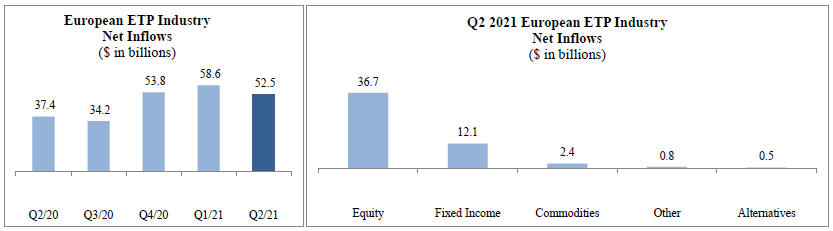

European ETP Industry Flows

European ETP industry net flows were $52.5 billion for the three months ended June 30, 2021. Equities and fixed income gathered the majority of those flows.

Source: Morningstar

Our Operating and Financial Results

We operate as an ETP sponsor and asset manager providing investment advisory services globally through our subsidiaries in the United States and Europe.

U.S. Listed ETFs

Our U.S. listed ETFs’ AUM increased from $42.2 billion at March 31, 2021 to $45.1 billion at June 30, 2021 due to market appreciation and net inflows.

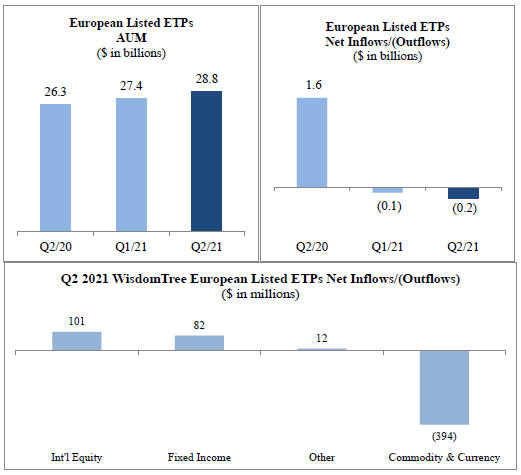

European Listed ETPs

Our European listed ETPs’ AUM increased from $27.4 billion at March 31, 2021 to $28.8 billion at June 30, 2021 due to market appreciation.

34