ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read together with our consolidated financial statements and the related notes and the other financial information included elsewhere in this Report. In addition to historical consolidated financial information, the following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include those discussed below. For a more complete description of the risks noted above and other risks that could cause our actual results to materially differ from our current expectations, please see Item 1A “Risk Factors” in our Annual Report on Form

10-K

for the fiscal year ended December 31, 2020 and our Quarterly Report on Form 10-Q

for the quarter ended June 30, 2021. We assume no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by law. Executive Summary

Introduction

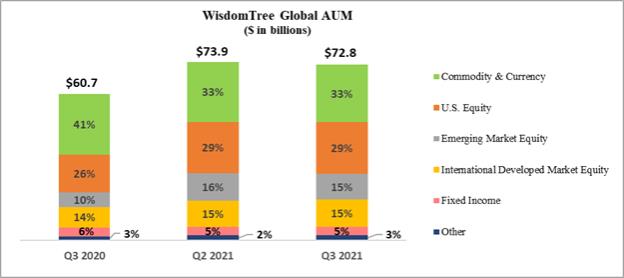

We are the only publicly-traded asset management company that focuses exclusively on exchange-traded products, or ETPs, and are a leading global ETP sponsor based on assets under management, or AUM, with AUM of $72.8 billion globally as of September 30, 2021. An ETP is a pooled investment vehicle that holds a basket of securities, financial instruments or other assets and generally seeks to track (index-based) or outperform (actively managed) the performance of a broad or specific equity, fixed income or alternatives market segment, commodity or currency (or an inverse or multiple thereof). ETPs are listed on an exchange with their shares traded in the secondary market at market prices, generally at approximately the same price as the net asset value of their underlying components. ETP is an umbrella term that includes exchange-traded funds, or ETFs, exchange-traded notes and exchange-traded commodities.

Our family of ETPs includes products that track our own indexes, third-party indexes and market prices of commodities. We also offer actively managed products. Most of our equity-based funds employ a fundamentally weighted investment methodology, which weights securities based on factors such as dividends, earnings or investment factors, whereas most other industry indexes use a capitalization weighted methodology. We distribute our products through all major channels in the asset management industry, including banks, brokerage firms, registered investment advisers, institutional investors, private wealth managers and online brokers primarily through our sales force. Our sales efforts are not primarily directed towards the retail segment but rather are directed towards financial advisers that act as intermediaries between the

end-client

and us or institutional investors. We focus on creating products for investors that offer thoughtful innovation, smart engineering and redefined investing. We have launched many products and pioneered alternative weighting we call “Modern Alpha,” which combines the outperformance potential of active management with the benefits of passive management to offer investors cost-effective funds that are built to perform.

first-to-market

Through our operating subsidiaries, we provide investment advisory and other management services to our ETPs collectively offering products covering equity, commodity, fixed income, leveraged and inverse, currency, cryptocurrency and alternative strategies. In exchange for providing these services, we receive advisory fee revenues based on a percentage of the ETPs’ average daily AUM. Our expenses are predominantly related to selling, operating and marketing our products. We have contracted with third parties to provide certain operational services for the ETPs.

We strive to deliver a better investing experience through innovative solutions. Continued investments in technology-enabled and research-driven solutions and our Advisor Solutions program, which includes portfolio construction, asset allocation, practice management services and digital tools for financial advisors, are meant to differentiate us in the market, expand our distribution and further enhance our relationships with financial advisors.

We were incorporated under the laws of the state of Delaware on September 19, 1985 as Financial Data Systems, Inc. and ultimately renamed WisdomTree Investments, Inc. on September 6, 2005.

Digital Assets – Developments

We are executing on our digital assets initiative and have made meaningful advancements. We filed registration statements for the WisdomTree Bitcoin Trust, the WisdomTree Ethereum Trust and the WisdomTree Digital Short-Term Treasury Fund with the SEC, among other regulatory and product related digital asset advancements which we expect to communicate in the future. The WisdomTree Enhanced Commodity Strategy Fund (GCC) became the first ETF to add bitcoin futures exposure. We cross-listed our European-domiciled WisdomTree Bitcoin ETP, or BTCW, in Germany, appointed Coinbase Custody as a custodian and received approval to passport BTCW in the European Union, or EU, allowing for a wider audience to access and invest in the product. We launched a physically backed Ethereum ETP in Europe, which is also passported across the EU. We also invested in Securrency, Inc.’s Series B funding round, as we believe their team is uniquely suited to lead in blockchain-based financial and regulatory technology going forward. We also recently invested in Onramp Invest, a technology firm that provides access to digital assets for registered investment advisers. Collaborations with Onramp Invest and Federal Life Insurance Company were also announced with respect to making available WisdomTree model portfolios that include digital assets in different channels. These initiatives were undertaken in our pursuit to establish ourselves as a leader in this space.

34

Industry Developments

In September 2021, Senator Ron Wyden, Senate Finance Committee Chair, released draft tax legislation that would directly impact the tax treatment of ETFs. The proposed legislation would eliminate ETFs’ chief tax advantage by repealing Section 852(b)(6) of the Internal Revenue Code, which allows ETFs to redeem shares

in-kind

without exposing long-term investors to capital gains on any individual security in the underlying ETF structure. We believe that ETFs are an important tool used by retail investors striving to build financial security, as well as younger investors who are participating in the financial markets for the first time. The ETF creation and redemption process ensures accurate index tracking for the benefit of all shareholders and it is the most cost-effective and tax-efficient

way to achieve this, directly benefiting the end investor. We believe that ETFs have proven to be a successful investment structure that should be protected. If eliminated, ETFs would lose a valuable benefit associated with the structure; however, overall industry growth should not be materially affected due to the other inherent benefits of ETFs – transparency and liquidity. Termination of New York Office Lease

On September 9, 2021, we entered into a Surrender Agreement to terminate the lease for our principal executive office at 245 Park Avenue, New York, effective immediately. In consideration for the landlord’s agreement to enter into the Surrender Agreement and accelerate the expiration date of the term of the lease from August 31, 2029, we paid a termination fee of $12.7 million. As a result, we recognized a loss on the termination of a lease of $15.9 million during the three months ended September 30, 2021 which is included in impairments and was inclusive of the asset, leasehold improvements and fixed assets broker fees and a reduction in operating lease liabilities.

right-of-use

Cost savings were $0.2 million during the third quarter of 2021 and are estimated to be approximately $0.6 million during the fourth quarter of 2021 when compared to actual occupancy and depreciation expense recognized during the second quarter of 2021. Cost savings for the year ending December 31, 2022 resulting from the reduction in the New York and London office footprints are estimated to be approximately $3.5 million when compared to actual occupancy and depreciation expense recognized during the year ended December 31, 2020. Anticipated rent for new office space in New York and London with a smaller footprint is included in these estimates.

Assets Under Management

WisdomTree ETPs

We offer ETPs covering equity, commodity, fixed income, leveraged and inverse, currency, cryptocurrency and alternative strategies. The chart below sets forth the asset mix of our ETPs at September 30, 2020, June 30, 2021 and September 30, 2021:

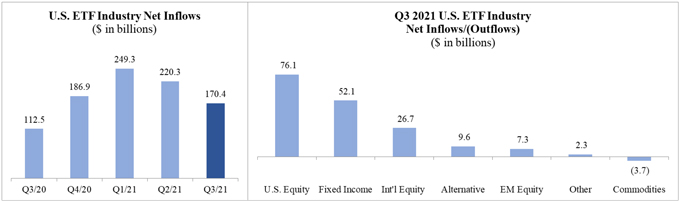

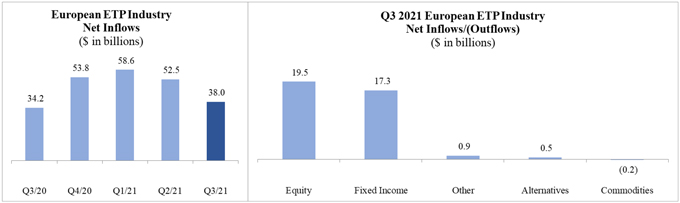

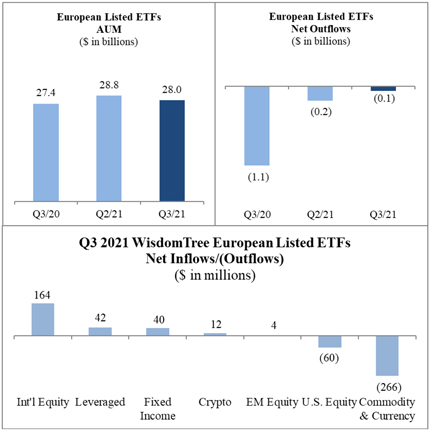

Market Environment

During the third quarter of 2021, the U.S and Eurozone markets were flat as growth and inflation concerns arising in September erased prior gains. Emerging markets underperformed amid a

sell-off

in China and concerns over continued supply chain disruptions. Gold prices also decreased modestly during the quarter. 35