| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

WISDOMTREE, INC.

Notice of 2023 Annual Meeting of Stockholders

We cordially invite you to attend the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of WisdomTree, Inc. (“WisdomTree”, the “Company”, “we” or “our”). Stockholders as of the record date for the Annual Meeting are entitled to vote on the items set forth below. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on.

See the “General Information for Stockholders About the Annual Meeting” section of the proxy statement on page 10 for information about voting and attending the Annual Meeting.

|

DATE AND TIME:

June 16, 2023 at 10:00 a.m., Eastern Time |

MEETING ADDRESS:

250 West 34th Street, 2nd Floor New York, NY 10119 |

RECORD DATE:

April 27, 2023 |

MAILING DATE:

On or about May 1, 2023 |

VOTING MATTERS AND BOARD RECOMMENDATIONS

At or before the Annual Meeting, we ask that you vote on the following items:

| Proposal |

Board Recommendation |

Page Reference | ||||

| 1 |

Elect three Class II and three Class III members of our Board of Directors |

FOR | 24 | |||

|

2 |

Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 |

FOR

|

39

| |||

|

3 |

Vote on an advisory resolution to approve the compensation of our named executive officers |

FOR

|

42

| |||

| 4 |

Ratify the adoption by our Board of Directors of the Stockholder Rights Agreement, dated March 17, 2023, by and between the Company and Continental Stock Transfer & Trust Company |

FOR | 43 | |||

In addition, stockholders are asked to transact any other business that may properly come before the meeting or any postponements or adjournments thereof.

WISDOMTREE, INC. | 2023 PROXY STATEMENT

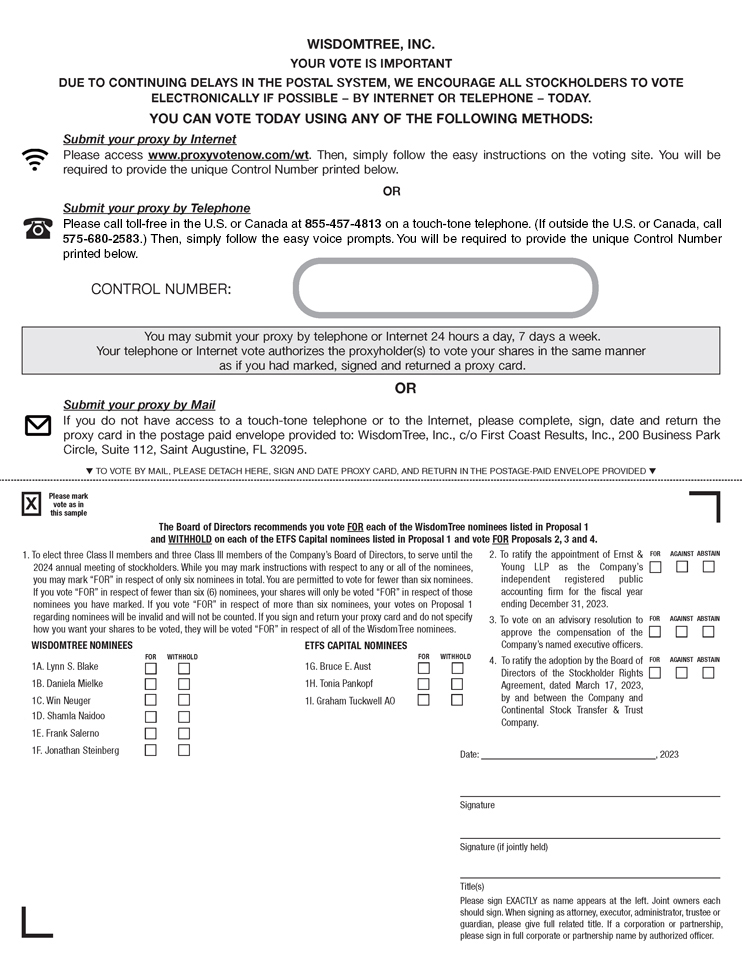

HOW TO VOTE

Please follow the easy instructions on your proxy card or voting instruction form to vote in any of the following ways:

|

|

|

VOTE BY INTERNET You may vote electronically by locating the control number on your WHITE proxy card or voting instruction form and accessing the website indicated therein. | ||

|

|

VOTE BY MAIL If you received printed proxy materials, you may submit your vote by completing, signing, and dating each proxy card or voting instruction form received and returning it in the prepaid envelope. | |||

|

|

VOTE AT THE MEETING Stockholders of record, or beneficial owners with a legal proxy from their bank, broker or other nominee, can also vote at the Annual Meeting. Please find instructions below regarding attendance. | |||

A list of the stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose germane to the Annual Meeting on a reasonably accessible electronic network for a period of ten (10) days prior to the Annual Meeting date. Please email Marci Frankenthaler, Secretary, at mfrankenthaler@wisdomtree.com if you wish to examine the stockholder list prior to the Annual Meeting.

As you may be aware, we have received notice from ETFS Capital Limited, a Jersey company (“ETFS Capital”), which owns approximately 10.2% of our common stock, expressing the intention of ETFS Capital to nominate three director candidates for election to our Board of Directors at the Annual Meeting at which three Class II and three Class III directors are to be elected (the “ETFS Capital Nominees”). We do not endorse the election of any of the ETFS Capital Nominees as directors. You may receive proxy solicitation materials from ETFS Capital or other persons or entities affiliated with ETFS Capital, including an opposition proxy statement and proxy card. Please be advised that we are not responsible for the accuracy of any information provided by or relating to ETFS Capital contained in any proxy solicitation materials filed or disseminated by ETFS Capital or any other statements that they may otherwise make.

Our Board of Directors does not endorse any of the ETFS Capital Nominees and unanimously recommends that you vote “FOR” the six WisdomTree nominees proposed by our Board of Directors using the WHITE proxy card and vote “WITHHOLD” on the ETFS Capital Nominees.

Our Board of Directors strongly urges you NOT to sign or return any proxy card or voting instruction form that ETFS Capital may send to you. If you do sign a proxy card or voting instruction form sent to you by ETFS Capital, however, you have the right to change your vote by using the enclosed WHITE proxy card or voting instruction form. Only the latest dated, signed proxy card or voting instruction form you vote will be counted.

PLEASE NOTE THAT THIS YEAR, YOUR PROXY CARD LOOKS DIFFERENT. IT HAS MORE NAMES ON IT THAN THERE ARE SEATS UP FOR ELECTION, UNDER NEW REQUIREMENTS CALLED A “UNIVERSAL PROXY CARD.” THIS MEANS THE COMPANY’S PROXY CARD IS REQUIRED TO LIST THE ETFS CAPITAL NOMINEES IN ADDITION TO YOUR BOARD’S NOMINEES. WE RECOMMEND THAT YOU MARK YOUR CARD CAREFULLY AND ONLY VOTE “FOR” THE WISDOMTREE NOMINEES AND PROPOSALS RECOMMENDED BY YOUR BOARD AND “WITHHOLD” ON THE ETFS CAPITAL NOMINEES.

Your vote is extremely important no matter how many shares you own. Whether or not you expect to attend the Annual Meeting, please vote and submit your proxy card or voting instruction form over the Internet or by mail.

By order of the Board of Directors,

Marci Frankenthaler, Secretary

WISDOMTREE, INC. | 2023 PROXY STATEMENT

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders To Be Held on June 16, 2023.

We have elected to utilize the “full set delivery” option and are delivering paper copies to all stockholders entitled thereto of all proxy materials, as well as providing access to those proxy materials on a publicly accessible website. The proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2022 are available on our investor relations website at: https://ir.wisdomtree.com/company-information/annual-reports-proxy.

This proxy statement contains information about the 2023 annual meeting of stockholders of WisdomTree, Inc. Proxy materials will be first sent to stockholders on or about May 1, 2023. |

IMPORTANT

Your vote at this year’s Annual Meeting is especially important, no matter how many or how few shares you own. Please sign and date the enclosed WHITE proxy card and return it in the enclosed postage-paid envelope promptly, or follow the instructions set forth on the enclosed WHITE proxy card to vote over the Internet.

All stockholders are invited to attend the Annual Meeting. Whether or not you expect to attend the Annual Meeting, we respectfully urge you to vote over the Internet or sign, date and return the enclosed WHITE proxy card as promptly as possible. Stockholders who execute a proxy card may nevertheless attend the Annual Meeting, revoke their proxy and vote their shares during the Annual Meeting. “Street name” stockholders who wish to vote their shares during the Annual Meeting will need to obtain a legal proxy from the bank, broker or other nominee in whose name their shares are registered. The instructions for voting over the Internet are provided on your proxy card.

ETFS Capital has nominated three individuals for election as directors at the Annual Meeting in opposition to the nominees recommended by our Board of Directors. THE BOARD OF DIRECTORS STRONGLY URGES YOU NOT TO SIGN OR RETURN ANY PROXY CARD OR VOTING INSTRUCTION FORM THAT YOU MAY RECEIVE FROM ETFS CAPITAL OR ANY PERSON OTHER THAN THE COMPANY EVEN AS A PROTEST VOTE AGAINST ETFS CAPITAL OR ANY OF ETFS CAPITAL’S NOMINEES. IF YOU HAVE PREVIOUSLY SIGNED A PROXY CARD SENT TO YOU BY ETFS CAPITAL, YOU MAY REVOKE IT AND VOTE FOR YOUR BOARD OF DIRECTORS’ NOMINEES AND IN ACCORDANCE WITH THE BOARD OF DIRECTORS’ RECOMMENDATIONS ON THE OTHER MATTERS TO BE VOTED ON AT THE ANNUAL MEETING BY SUBMITTING A LATER-DATED PROXY ELECTRONICALLY BY FOLLOWING THE INSTRUCTIONS ON THE ENCLOSED WHITE PROXY CARD, OR BY SIGNING, MARKING, DATING AND MAILING THE ENCLOSED WHITE PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED. Any proxy card you sign and return from ETFS Capital for any reason could invalidate previous WHITE proxy cards sent by you to support our Board of Directors.

Only your latest dated, signed proxy card or voting instruction form will be counted. Any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in this proxy statement.

| IMPORTANT! PLEASE VOTE THE WHITE PROXY CARD TODAY “FOR” THE WISDOMTREE NOMINEES AND “WITHHOLD” ON THE ETFS CAPITAL NOMINEES!

WE URGE YOU NOT TO SIGN ANY PROXY CARD OR VOTING INSTRUCTION FORM SENT TO YOU BY ETFS CAPITAL.

Remember, you can vote your shares over the Internet.

Please follow the easy instructions on the enclosed WHITE proxy card.

If you have any questions or need assistance in voting your shares, please contact our proxy solicitor:

Innisfree M&A Incorporated 501 Madison Avenue, 20th Floor New York, NY 10022 Stockholders and All Others Call Toll Free: (877) 750-5836 Banks and Brokers Call: (212) 750-5833 |

WISDOMTREE, INC. | 2023 PROXY STATEMENT

Table of Contents

WISDOMTREE, INC. | 2023 PROXY STATEMENT

Table of Contents

Unless otherwise indicated, references to “the Company,” “we,” “us,” “our” and “WisdomTree” mean WisdomTree, Inc. and its subsidiaries.

WISDOMTREE, INC. | 2023 PROXY STATEMENT

WISDOMTREE, INC. | 250 WEST 34th STREET, 3rd FLOOR | NEW YORK, NY 10119

Proxy Statement for the 2023 Annual Meeting of Stockholders

TO BE HELD ON JUNE 16, 2023

Proxy Summary

This summary does not contain all the information that you should consider before voting. Please read this entire proxy statement carefully. For more information about our 2022 performance, please review our Annual Report on Form 10-K for the year ended December 31, 2022, a copy of which is available on our investor relations website at https://ir.wisdomtree.com/sec-filings/annual-reports.

This proxy statement and our annual report is first being mailed on or about May 1, 2023 to stockholders entitled to vote at the Annual Meeting.

ABOUT OUR COMPANY

WisdomTree, Inc. is a global financial innovator, offering a well-diversified suite of exchange-traded products (“ETPs”), models and solutions. We empower investors to shape their future and support financial professionals to better serve their clients and grow their businesses. We leverage the latest financial infrastructure to create products that provide access, transparency and an enhanced user experience. Building on our heritage of innovation, we are also developing next-generation digital products and structures, including digital or blockchain-enabled mutual funds and tokenized assets, as well as our blockchain-native digital wallet, WisdomTree Prime™.

CORPORATE PERFORMANCE HIGHLIGHTS

Strong Performance

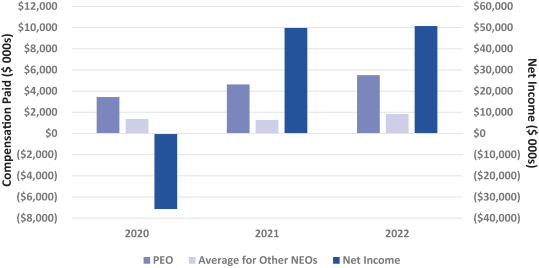

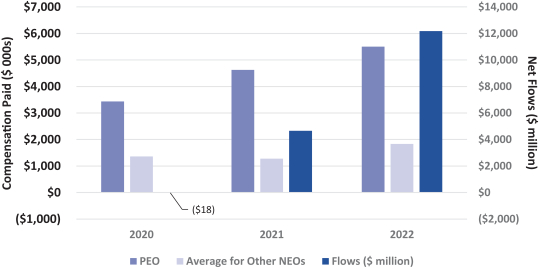

| • | 2022 was marked by many achievements in advancing our long-term strategic objectives, including successfully broadening our ETP business and advancing our early mover strategic expansion into digital assets and blockchain-enabled finance. The year was also one of heightened volatility, with major market indices operating near bear market territory, resulting in negative market movement, reducing our assets under management (“AUM”) by almost $8 billion and our revenues by approximately $20 million. However, we overcame this challenging market backdrop, having generated over $12 billion of net inflows in 2022 and achieving a 16% annualized pace of organic flow growth – the best of all publicly traded U.S. asset managers and our strongest flowing year since 2015. This performance largely offset the impact of negative market movement on our revenues, which were essentially unchanged as compared to the prior year. |

| • | Our AUM as of December 31, 2022 was $82.0 billion, an all-time high. The last quarter of 2022 marked the ninth consecutive quarter of organic growth. |

| • | Our models strategy is succeeding as we continue to expand both the number of model partners and the number of models on their platforms. Continued success in winning advisor mindshare should lead to model flows that are recurring in nature and stackable on top of our current inflow profile. |

| • | We have advanced our strategic expansion into digital assets and blockchain-enabled finance. In 2022, we tokenized real-world assets like physical gold (i.e., gold tokens) and U.S. dollars. We also achieved key milestones with the Securities and Exchange Commission (the “SEC”) declaring effective the registration of 10 blockchain-enabled funds, allowing us to lay claim to the deepest exposures in the digital wrapper. WisdomTree Prime™, our blockchain-native wallet developed for saving, spending and investing in both native crypto assets and tokenized versions of mainstream financial assets, is on track for a nationwide rollout targeted in 2023. The Financial Industry Regulatory Authority approved our limited purpose broker-dealer, WisdomTree Securities, Inc., to operate as a mutual fund retailer, which |

WISDOMTREE, INC. | 2023 PROXY STATEMENT 1

Proxy Summary

| will allow it to facilitate transactions in digital or blockchain-enabled mutual funds offered in the WisdomTree Prime mobile application. As an early mover in digital assets and blockchain-enabled financial services, we are ahead of the curve and establishing ourselves as a leader in this space. |

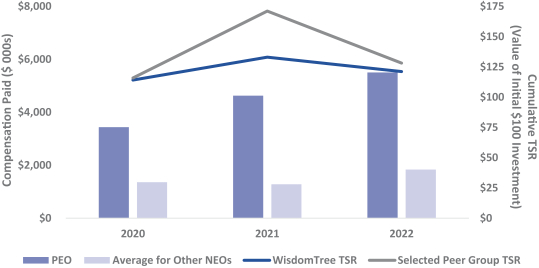

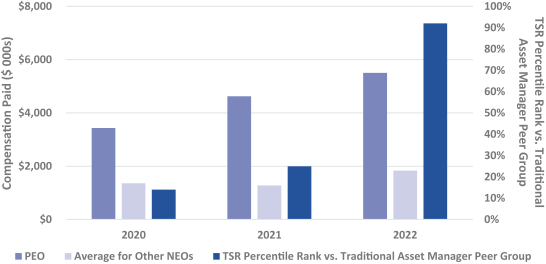

| • | Our recent achievements and our ability to overcome adverse market conditions was reflected in our stock price performance in relation to our peers. Our total shareholder return, or TSR (as described in the Compensation Discussion and Analysis section of this proxy statement in the subsection titled “2022 Incentive Compensation Program and Results”), ranking was 2nd among a peer group of 13 publicly traded asset managers. |

Balance Sheet Management

| • | Our balance sheet is strong, and we continue to return capital to our stockholders in the form of a quarterly cash dividend, which we have paid consecutively since 2014. Over the last three years, we also have repurchased 13.9 million shares of our common stock for an aggregate cost of $69.1 million. |

| • | In February 2023, we partially re-financed $175.0 million of our convertible notes maturing in June 2023 by issuing $130.0 million of convertible notes maturing in June 2028. The remaining outstanding notes will be settled no later than maturity. |

Environmental, Social and Governance (ESG) Leadership

| • | Environmental, social and governance (“ESG”) principles are a significant part of our global approach and tie in with existing and planned corporate initiatives. |

| • | In the U.S., we offer three core integrated ESG exchange traded funds (“ETFs”) in addition to ESG-screened funds and model portfolios as well as a suite of ex-state owned funds that screen out government-owned companies, which we believe can, at times, have poor corporate governance and environmental considerations. |

Disciplined Risk Management

| • | Our Board of Directors actively oversees the development of strategic objectives and receives updates on the implementation of strategic plans throughout the year at regularly scheduled Board meetings. The Board of Directors also reviews the risk assessment of the strategic plan. |

| • | In addition, we have established a Global Risk Committee, consisting of members of senior management, which oversees risks both inside and outside of the firm, including any heightened or changed risks as they relate to independent third-party service providers. The Global Risk Committee meets quarterly and reports to the Board of Directors at regularly scheduled Board meetings. |

MISSION, VISION, VALUES

We strive to differentiate ourselves in the asset management industry through our sense of community and purpose integrated into our culture, where every employee has a voice. Guided by our mission, vision and values and a defined framework for growth, we believe we are well positioned for success.

Our mission is to deliver a better investment and financial experience through the quality of our products, solutions and engagements.

Our vision is to be the leader in the best structures and executions in financial services, including ETPs and digital assets.

Our values are grounded in

| • | Excellence & Innovation – we relentlessly focus on improving our process, products and solutions to drive positive change in the business and continually advance our mission, and we “think big” and are not afraid to disrupt the status quo. |

| • | Transparency & Accountability – we learn from our mistakes and celebrate individual and group contributions to our achievements, and we always strive to do the right thing, without shortcuts or exceptions. |

| • | Fairness & Respect – we respect everyone’s personal sense of worth and value, and we strive to maintain a collaborative and empowering work environment. |

2 WISDOMTREE, INC. | 2023 PROXY STATEMENT

Proxy Summary

CORPORATE SOCIAL RESPONSIBILITY

Sustainability and responsibility are embedded throughout our business, which we believe benefits our investors, employees and stockholders. We have made a firm-wide commitment to incorporate social responsibility efforts through various initiatives, including becoming a signatory to the United Nations Principles for Responsible Investment and launching funds dedicated to ESG strategies. We are engaging in responsible investing, focused on diversity, equity and inclusion, working to enhance our employee experience through training and the provision of employee benefits, investing in our community through firmwide service projects, caring for our environment and continuously striving to improve corporate governance.

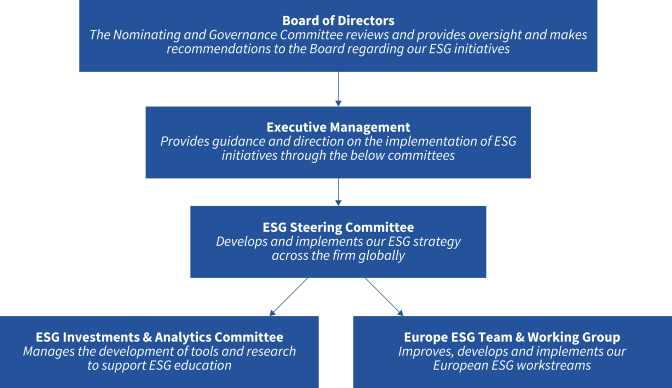

We have established a committee-based approach to driving ESG initiatives across our business with oversight from our Board of Directors, the Nominating and Governance Committee and our executive management team.

WISDOMTREE, INC. | 2023 PROXY STATEMENT 3

Proxy Summary

Included below are highlights of our ESG programs and practices. Our Corporate Social Responsibility Report, available on our investor relations website at https://resources.wisdomtree.com/corporate-social-responsibility/, provides additional details about these programs and policies and the ESG positioning of our firm as a whole.

| Responsible Investing |

• Our U.S. ESG offering includes our ex-state-owned methodology as well as three core equity strategies, offering exposure to U.S., international and emerging markets equities.

• In Europe, we offer a variety of products with ESG integration, including our Battery Solutions, European Union Bonds and EUR Aggregate Bond ESG Enhanced Yield UCITS products. We also apply ESG screens across all of our equity UCITS products.

• In 2021, we launched ESG model portfolios, our first models with explicit and specific ESG objectives, and in 2022, we integrated ESG metrics into our Fund Comparison online tool to help investors compare the ESG attributes of various WisdomTree and third-party funds.

• Since 2022, we have been offering a Climate Impact and Investing Program in collaboration with Columbia University, a training and certification program built to equip both advisors and our employees with the education and tools needed to make sound decisions around climate, environmental risks and investing.

• As of March 31, 2023, we offer in Europe 20 ETPs that are categorized as Article 8 products under the EU Sustainable Finance Disclosures Regulation (“SFDR”) and one ETP that is categorized as an Article 9 product under the SFDR. Article 8 products promote, among other characteristics, environmental or social characteristics or a combination of those characteristics, provided that the companies in which the investments are made follow good governance practices. Article 9 products have sustainable investment as their objective. | |

| Diversity, Equity and Inclusion |

• Our global DEI Council of senior leaders and employees represents our employee base and promotes a diverse and inclusive workplace culture.

• Our Women’s Initiative Network, or WIN, is an employee-led network designed to provide opportunities and support from all genders for women at WisdomTree, career development and professional training opportunities, and female empowerment and leadership within the organization. | |

| Enhancing Our Employee Experience |

• We offer our employees extensive health, wellness, career development and other benefits, including a monthly stipend to cover remote work-related business expenses, numerous wellness programs, an educational assistance program, and flexible paid time-off and sick leave policies.

• Our annual “Team Alpha” Awards recognize employees who led significant successes while exhibiting extraordinary teamwork and demonstrating strong character.

• In the U.S., we were named a 2022 Best Places to Work in Money Management by Pension & Investments for the third consecutive year and six years total, and were selected as the top firm within the category for managers with 100-499 employees. We were also named Best Workplace for medium-sized companies in the U.K. for a third consecutive year and a 2022 Best Workplace for Women for medium-sized companies by Great Place to Work. | |

| Investing in Our Community |

• We encourage employees to be active members of the community and to give back through a variety of programs, including paid time-off to volunteer at a charitable organization of their choice.

• We continue to support charitable causes through regular donations. In 2022, we contributed to the Equal Justice Initiative for Black History Month, Bigs & Littles NYC Mentoring for Women’s History Month, and the Trevor Project for Pride Month, among many others. Our U.S. WIN members also held an event in collaboration with Clean the World, an organization that collects and recycles discarded soap and plastic amenity bottles from participating hospitality partners, during which our employees packed 1,000 hygiene kits that were donated to Tillary Street Women’s Shelter.

• In our London office, we support a program that matches our employees with local charities and social enterprises to provide business guidance and support to become more efficient, effective and sustainable organizations. | |

| Caring for Our Environment |

• Our entire global workforce operates under our “Remote First” policy where employees can choose to work from home or from the office, based on their role. In keeping with “Remote First,” we maintain a smaller office footprint, which we believe has enhanced our efficiency and sustainability and will continue to do so over the long run.

• Through carbon-offsetting, our European operations have been certified carbon neutral since 2019. Partnering with Carbon Footprint, we successfully calculated and offset our carbon emissions in Europe. We are engaging with a third-party consultant to expand this initiative on a global level. | |

| Corporate Governance |

• As described under “Board Governance Overview” below, our Board of Directors is committed to strong and effective governance and oversight through a number of policies, practices and procedures. | |

4 WISDOMTREE, INC. | 2023 PROXY STATEMENT

Proxy Summary

BOARD OF DIRECTORS HIGHLIGHTS

| Name |

Age | Gender | Demographic Background |

Independent | Director Since |

Other Public Company Boards |

Board Committees | |||||||||||

| Audit | Compen- sation |

Nominating & Governance | ||||||||||||||||

| Class II Nominees |

|

|

|

|

|

|

| |||||||||||

| Lynn S. Blake |

58 | Female | White | ✓ | 2022 |

|

|

M |

| |||||||||

| Daniela Mielke |

57 | Female | White | ✓ | 2022 | Nuvei Corporation; The Bancorp, Inc.; FTAC Athena Acquisition Corp. |

|

|

| |||||||||

| Win Neuger |

73 | Male | White | ✓ | 2013 |

|

|

M | C | |||||||||

| Class III Nominees |

|

|

|

|

|

|

|

|

| |||||||||

| Shamla Naidoo |

58 | Female | Asian; Black or African American | ✓ | N/A | StoneBridge Acquisition Corporation |

|

|

| |||||||||

| Frank Salerno |

63 | Male | White | ✓ | 2005 |

|

|

C |

| |||||||||

| Jonathan Steinberg |

58 | Male | White |

|

1988 |

|

|

|

| |||||||||

| Continuing Directors |

|

|

|

|

|

|

|

|

| |||||||||

| Anthony Bossone |

52 | Male | White | ✓ | 2009 |

|

C* | M |

| |||||||||

| Smita Conjeevaram |

62 | Female | Asian | ✓ | 2021 | McGrath RentCorp; SkyWest, Inc.; SS&C Technologies Holdings, Inc. |

M* |

|

M | |||||||||

| Harold Singleton III |

61 | Male | Black | ✓ | 2022 |

|

M* |

|

| |||||||||

| * | Financial Expert M = Member C = Chair |

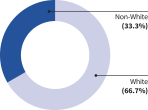

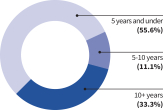

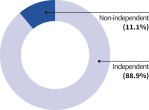

| Gender

|

Demographic Background

|

Tenure

|

Independence

| |||

|

|

|

|

WISDOMTREE, INC. | 2023 PROXY STATEMENT 5

Proxy Summary

The following Board Diversity Matrix presents self-disclosed diversity statistics of our director nominees and continuing directors.

BOARD DIVERSITY MATRIX (AS OF MAY 1, 2023)

| Total Number of Director Nominees and Continuing |

9 |

|

|

|

||||||||||||

| Part I: Gender Identity |

Female | Male | Non-Binary | Declined to Disclose | ||||||||||||

| Number of Director Nominees and Continuing Directors based on gender identity |

4 | 5 | — | — | ||||||||||||

| Part II: Demographic Background |

|

|

|

|

|

|

|

|

|

|

|

| ||||

| African American or Black |

— | 1 | — | — | ||||||||||||

| Alaskan Native or Native American |

— | — | — | — | ||||||||||||

| Asian |

1 | — | — | — | ||||||||||||

| Hispanic or Latinx |

— | — | — | — | ||||||||||||

| Native Hawaiian or Pacific Islander |

— | — | — | — | ||||||||||||

| White |

2 | 4 | — | — | ||||||||||||

| Two or More Races or Ethnicities |

1 | — | — | — | ||||||||||||

| LGBTQ+ |

— | — | — | — | ||||||||||||

| Did Not Disclose Demographic Background |

— | — | — | — | ||||||||||||

DIRECTOR QUALIFICATIONS AND EXPERIENCE

The following table provides an overview of the specific skills, experiences and areas of knowledge of our director nominees and continuing directors that allow the Board of Directors to effectively serve and represent the interests of our stockholders, customers and employees. In addition, directors gain substantial experience through serving on our Board of Directors, which involves significant exposure to the complex regulations and changing landscape of the financial services industry.

| Skills and Experience | Blake | Bossone | Conjeevaram | Mielke | Naidoo | Neuger | Salerno | Singleton | Steinberg | |||||||||

| Accounting/Financial Reporting |

|

⚫ | ⚫ | ⚫ |

|

⚫ | ⚫ | ⚫ |

| |||||||||

| Corporate Governance |

⚫ | ⚫ | ⚫ |

|

|

⚫ | ⚫ | ⚫ | ⚫ | |||||||||

| Global Business |

|

⚫ | ⚫ | ⚫ | ⚫ | ⚫ |

|

⚫ | ⚫ | |||||||||

| Legal and Regulatory |

|

⚫ | ⚫ |

|

⚫ |

|

|

|

| |||||||||

| Financial Services/Asset Management |

⚫ | ⚫ | ⚫ | ⚫ |

|

⚫ | ⚫ | ⚫ | ⚫ | |||||||||

| Executive Leadership |

⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | |||||||||

| Other Public Company Experience |

|

|

⚫ | ⚫ | ⚫ |

|

⚫ |

|

| |||||||||

| Risk Management |

⚫ | ⚫ |

|

⚫ | ⚫ |

|

|

|

| |||||||||

| ETF |

⚫ | ⚫ |

|

|

|

⚫ | ⚫ | ⚫ | ⚫ | |||||||||

| Information Technology |

|

|

|

⚫ | ⚫ |

|

|

|

| |||||||||

6 WISDOMTREE, INC. | 2023 PROXY STATEMENT

Proxy Summary

BOARD GOVERNANCE OVERVIEW

Our Board of Directors is committed to strong and effective governance and oversight. Annually, the Board reviews and enhances, as necessary, its practices for Board independence, accountability and effectiveness. Below are some highlights of our Board governance program.

| Board Independence |

| |

| Separation of Roles |

The roles of Chair of the Board and Chief Executive Officer are completely separate. | |

| Substantial Majority of Independent Directors |

All directors are considered independent under applicable standards except Jonathan Steinberg, our CEO. | |

| Independent Director-Led Committees |

All standing Board committees are comprised entirely of independent directors. | |

| Executive Sessions |

Independent directors regularly meet in executive session without management throughout the year. | |

| Board Accountability |

| |

| Attendance |

The Board and its committees had a 99% aggregate attendance rate in 2022. | |

| Majority Voting Standards |

We utilize majority voting requirements for uncontested director elections. | |

| Oversight of Strategy |

The Board oversees the development of strategic objectives and receives updates on the implementation of strategic plans throughout the year at regularly scheduled Board meetings. The Board also reviews the risk assessment of the strategic plan. | |

| Oversight of ESG Matters |

The Nominating and Governance Committee reviews and provides oversight of our strategy, initiatives and policies concerning corporate social responsibility, including ESG matters, and makes recommendations to the Board regarding our ESG initiatives. | |

| Stock Ownership Guidelines |

Our non-employee directors and executive officers are subject to stock ownership guidelines. | |

| Prohibition of Pledging, Hedging, Short Sales and Derivative Transactions |

Our Insider Trading Policy prohibits pledging, hedging, short sales and derivative transactions in our securities by directors, officers and employees. | |

| Oversight of Executive Management Succession Planning |

The Board engages in regular executive management succession planning reviews, as well as succession planning discussions at the Compensation Committee level. | |

| Proxy Access |

Stockholders that meet certain requirements can have their director nominees included in our proxy statement. | |

| Board Effectiveness |

| |

| Robust Self-Assessments |

The Board and each committee complete written self-assessments. Management implements action plans based on directors’ feedback and reports to the Board on the implementation of those plans to ensure continuous improvement. | |

| Director Education Program |

To enhance directors’ knowledge on topics relevant to oversight of the Company, Board members participate in educational programs, including through a membership we procure for each director with the National Association of Corporate Directors. | |

| Broad Director Onboarding Program |

Our comprehensive onboarding program seeks to quickly integrate new directors in our business and culture and features one-on-one sessions with senior executives and functional area representatives, and training on Company policies and industry trends. | |

| Board Succession Planning |

The Board, and its relevant committees, discuss director succession planning, focusing on business needs, industry trends, diverse perspectives and stockholder expectations. | |

| Over-Boarding Restrictions |

To maintain Board effectiveness, ensure that directors have sufficient time to devote to their duties, and align with stockholder expectations, directors may serve on up to five total public company boards and directors who serve as our CEO or an executive officer may serve on a total of two public company boards. | |

| Strong Corporate Governance Guidelines |

Our Corporate Governance Guidelines and Board Committee Charters are clear and robust, and are reviewed annually to maintain strong and sound governance practices. | |

WISDOMTREE, INC. | 2023 PROXY STATEMENT 7

Proxy Summary

EXECUTIVE COMPENSATION

2022 Highlights

In 2022, we made the following enhancements to our executive compensation program:

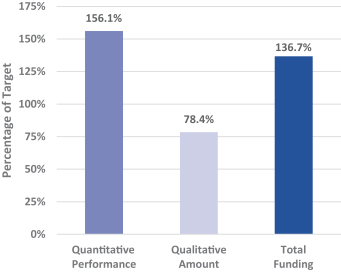

| • | greater weight was ascribed to quantitative performance metrics such that the achievement of quantitative metrics determined 75% of the executive incentive compensation pool and the remaining 25% was determined by the Compensation Committee based on qualitative results, representing a shift from the prior 50%-50% quantitative-qualitative mix applicable to 2021 compensation; |

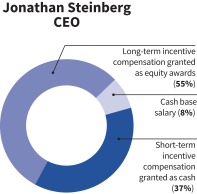

| • | all Named Executive Officers, or NEOs, received a greater percentage of incentive compensation in the form of equity, including an equity payout of 60% for our CEO compared to 52% in 2021, of which 50% consisted of performance-based restricted stock units and 50% consisted of time-based restricted stock awards; |

| • | the Compensation Committee adopted a compensation clawback policy, pursuant to which we may recoup all or a portion of the value of any cash or equity incentive compensation provided to any current or former executive officers and certain other employees in the event that our financial statements are restated due to material noncompliance with any financial reporting requirement under U.S. federal securities laws; and |

| • | our Board of Directors and stockholders adopted a new 2022 Equity Plan, which provides, among other things, that dividends on unvested time-based equity awards granted under the 2022 Equity Plan will not be paid when declared as was the case under the 2016 Equity Plan, but instead will accrue and not be paid unless and until the award vests. As a result, no dividends will be paid with respect to unvested awards under the 2022 Equity Plan. |

Impact of Total Shareholder Return on NEO Compensation

A significant portion of our executive compensation program is linked to shareholder return, as follows:

| • | relative total shareholder return, or TSR, is a performance metric included in our performance-based incentive compensation program for our NEOs. As described in the Compensation Discussion and Analysis section of this proxy statement in the subsection titled “2022 Incentive Compensation Program and Results,” the 2022 funded payout percentage for this performance metric was 224.9% of target; |

| • | long-term incentive compensation is granted entirely in the form of equity, which value is explicitly linked to TSR, and is comprised of both restricted stock awards and relative TSR-based performance-based restricted stock units, or PRSUs; |

| • | PRSUs granted for 2022 performance in January 2023 to our CEO and Chief Operating (“COO”) represent 50% of each of their respective long-term equity awards granted. PRSUs granted to our other NEOs represent 25% of each of their respective long-term equity awards granted; and |

| • | the payout on PRSUs that vested in January 2022 and January 2023 was 0% and 76.92%, respectively. |

Changes to be Effective in 2023

We made the following enhancements to our incentive compensation program that will take effect prospectively beginning in 2023:

| • | New performance metric. We introduced an additional performance metric, “Annualized Run Rate Revenue (“RRR”) from Flows” which will be computed by multiplying net flows of each of our ETPs by its expense ratio. This metric will be weighted equally with our Net Inflows metric (9.375% in each case) and represents a financial measure (revenue associated with flows) derived from a non-financial measure (net flows). We believe this new metric is a meaningful enhancement to our incentive compensation program as the composition of our flows impacts the magnitude of the change to our operating revenues. |

| • | Adjustment to payout curve. We adjusted the payout curve for financial metrics (revenues, adjusted operating income and adjusted operating margin) to be computed using two to one leverage instead of one to one leverage. For example, if actual performance is 98% of target, the payout will be 96% (i.e., 100%, minus (2% x 2)), and if actual performance is 102% of target, the payout will be 104% (i.e., 100%, plus (2% x 2)). This enhancement was made to further align pay and performance by reducing the payout when below target and further increasing the payout when above target. |

8 WISDOMTREE, INC. | 2023 PROXY STATEMENT

Proxy Summary

| • | Severance Plan and Amended Employment Agreements. See “Employment Agreements and Severance Plan” below for a description of our Severance Plan and Restrictive Covenant Agreement (each defined below) applicable to our Chief Financial Officer (“CFO”), and the amendment to employment agreements with each of our CEO, COO, Chief Administrative Officer (“CAO”) and Head of Europe (“HoE”) that we entered into in April 2023. |

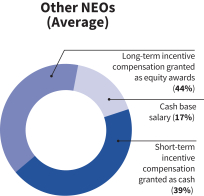

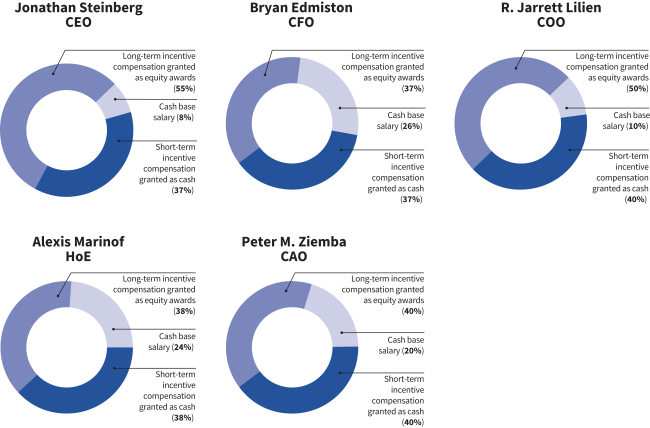

2022 Total Compensation Pay Mix

The following charts reflect the elements of 2022 total compensation for (i) our CEO and (ii) our other NEOs who were serving in their respective positions as of December 31, 2022 as a percentage of their total compensation. Incentive compensation paid to our CEO is most heavily weighted toward long-term equity incentives, followed by our COO, and then our other NEOs. Long-term equity awards consist of restricted stock awards and PRSUs. PRSUs granted to our CEO and COO represent 50% of the long-term equity awards granted. PRSUs granted to our other NEOs represent 25% of the long-term equity awards granted.

|

|

Our compensation program incorporates best practices, including the following:

| What We Do |

|

What We Don’t Do | ||

| ✓ Annual say-on-pay advisory vote

✓ Pay for performance compensation philosophy

✓ Robust stock ownership guidelines

✓ Clawback policy applicable to cash and equity incentive compensation

✓ Independent compensation consultant

✓ Entirely independent Compensation Committee

✓ Annual compensation risk assessment

|

× No dividends will be paid with respect to unvested awards under the 2022 Equity Plan

× No pledging, hedging, short sales or derivative transactions

× No excessive perks

× No excessive risk taking

× No excise tax gross-ups | |||

WISDOMTREE, INC. | 2023 PROXY STATEMENT 9

General Information for Stockholders About the Annual Meeting

WHO IS SOLICITING MY VOTE?

The Board of Directors of WisdomTree, Inc. is soliciting your vote for the 2023 Annual Meeting of Stockholders (“Annual Meeting”).

HOW DO I ATTEND THE ANNUAL MEETING, AND MAY I ASK QUESTIONS?

The Annual Meeting will be held on June 16, 2023, at 10:00 a.m. Eastern Time at 250 West 34th Street, 2nd Floor, New York, NY 10119. Any stockholder may attend the Annual Meeting. If you choose to do so, please bring your proxy card and valid picture identification.

If your shares of common stock are held in a brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and this proxy statement is being forwarded to you by your broker or nominee. As a result, your name does not appear on our list of stockholders. If your stock is held in street name, in addition to a voting instruction form and picture identification, you should bring with you a letter or account statement showing that you were the beneficial owner of the Company stock on the record date, in order to be admitted to the Annual Meeting.

Even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the Annual Meeting.

HOW MANY VOTES CAN BE CAST BY ALL STOCKHOLDERS?

149,263,168 shares of our common stock were outstanding and entitled to be voted on April 27, 2023, the record date for determining stockholders eligible to vote. Each share of common stock is entitled to one vote on each matter.

WHAT AM I VOTING ON?

There are four matters scheduled for a vote:

| • | Proposal 1: Election of three Class II members and three Class III members of our Board of Directors (the “Director Election Proposal”); |

| • | Proposal 2: Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 (the “Auditor Ratification Proposal”); |

| • | Proposal 3: Vote on an advisory resolution to approve the compensation of our named executive officers (the “Executive Compensation Proposal”); and |

| • | Proposal 4: Ratification of the adoption by the Board of the Stockholder Rights Agreement, dated March 17, 2023, by and between the Company and Continental Stock Transfer & Trust Company (the “Rights Agreement Proposal”). |

HOW MANY VOTES ARE REQUIRED TO APPROVE EACH PROPOSAL?

Director Election Proposal. Under our by-laws, in a contested election, such as this year’s election, the directors must be elected by a plurality of the votes cast. This means that the six director nominees receiving the most “for” votes from the holders of shares present at the meeting or represented by proxy and entitled to vote on the election of directors will be elected. Votes “withheld” will have no effect on the Director Election Proposal. Broker non-votes, if any, will also have no effect.

10 WISDOMTREE, INC. | 2023 PROXY STATEMENT

General Information for Stockholders About the Annual Meeting

Auditor Ratification Proposal. The affirmative vote of a majority of votes cast is necessary for the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. Abstentions and broker non-votes, if any, will have no effect on this proposal.

Executive Compensation Proposal. The affirmative vote of a majority of votes cast is necessary for the approval of the advisory resolution to approve the compensation of our named executive officers. Abstentions and broker non-votes, if any, will have no effect on this proposal.

Rights Agreement Proposal. The affirmative vote of a majority of votes cast is necessary for the approval of the Stockholder Rights Agreement. Abstentions and broker non-votes, if any, will have no effect on this proposal.

WHAT ARE “BROKER NON-VOTES”?

If you are a beneficial owner whose shares of record are held by a bank, broker or other nominee (sometimes called “street name” or “nominee name”), you may instruct your bank, broker or other nominee how to vote your shares. If you do not give instructions to your bank, broker or other nominee, the bank, broker or other nominee will determine if it has the discretionary authority to vote on the particular matter. Under the rules of the New York Stock Exchange (“NYSE”), banks, brokers or other nominees have the discretion to vote on routine matters, but do not have discretion to vote on non-routine matters.

Because the Annual Meeting is the subject of a contested solicitation, to the extent ETFS Capital delivers its proxy materials to a given stockholder, all proposals at the Annual Meeting are considered “non-routine.” Moreover, if the proposals being voted on at the Annual Meeting are considered non-routine, and you hold your shares in the name of your bank, broker or other nominee and you do not provide your bank, broker or other nominee with specific instructions regarding how to vote on a proposal to be voted on at the Annual Meeting, your bank, broker or other nominee will not be permitted to vote your shares on that proposal.

HOW IS A QUORUM REACHED?

The presence, in person or by proxy, of holders of at least a majority of the total number of outstanding shares entitled to vote at the meeting is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Votes withheld, abstentions and broker non-votes will be counted as present for quorum purposes.

WHAT IS THE DIFFERENCE BETWEEN A STOCKHOLDER OF RECORD AND A BENEFICIAL OWNER OF SHARES HELD IN STREET NAME?

Stockholder of record. If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, you are considered a “stockholder of record,” or record holder, with respect to those shares, and we sent the proxy materials directly to you.

Beneficial owner of shares held in street name. If your shares are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, then you are the “beneficial owner” of shares held in “street name,” and the proxy materials were forwarded to you by that organization. As a beneficial owner, you have the right to instruct your broker, bank, or nominee how to vote your shares.

WILL THERE BE A PROXY CONTEST AT THE ANNUAL MEETING?

We have received notice from ETFS Capital, which owns approximately 10.2% of our common stock, expressing the intention of ETFS Capital to nominate three director candidates for election to our Board of Directors at the Annual Meeting at which three Class II and three Class III directors are to be elected (the “ETFS Capital Nominees”). We do not

WISDOMTREE, INC. | 2023 PROXY STATEMENT 11

General Information for Stockholders About the Annual Meeting

endorse the election of any of the ETFS Capital Nominees as directors. You may receive proxy solicitation materials from ETFS Capital or other persons or entities affiliated with ETFS Capital, including an opposition proxy statement and proxy card. Please be advised that we are not responsible for the accuracy of any information provided by or relating to ETFS Capital contained in any proxy solicitation materials filed or disseminated by ETFS Capital or any other statements that they may otherwise make.

You may receive multiple mailings from ETFS Capital. You will also likely receive multiple mailings from the Company prior to the date of the Annual Meeting, so that our stockholders have our latest proxy information and materials to vote. Proxy cards provided by the Company will be WHITE. Please see “What should I do if I receive a proxy card from ETFS Capital?” and “What does it mean if I receive more than one WHITE proxy card or voting instruction form?” below for more information.

WHAT SHOULD I DO IF I RECEIVE A PROXY CARD FROM ETFS CAPITAL?

Our Board does not endorse any of the ETFS Capital Nominees and strongly urges you NOT to sign or return any proxy card or voting instruction form that you may receive from ETFS Capital or any person other than the Company.

HOW DO I VOTE?

For the Director Election Proposal you may either vote “For” or “Withhold.” For each of the other proposals, you may either vote “For” or “Against” or abstain from voting.

The Board of Directors recommends that you vote:

| • | “FOR” each of the Company’s director nominees to be elected to the Board named in the Director Election Proposal; |

| • | “FOR” the Auditor Ratification Proposal; |

| • | “FOR” the Executive Compensation Proposal; and |

| • | “FOR” the Rights Agreement Proposal. |

Votes cast by proxy or during the Annual Meeting will be counted by the person(s) we appoint to act as inspector of election for the meeting. The inspector of election will count all votes “for,” “withheld,” and “against,” as well as abstentions and broker non-votes, as applicable, for each matter to be voted on at the Annual Meeting.

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote by attending the Annual Meeting or vote by proxy over the Internet or by returning an executed proxy card. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You still may attend the Annual Meeting and vote during the Annual Meeting even if you have already voted by proxy.

| • | To vote using a traditional proxy card, complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

| • | To vote over the Internet, simply follow the instructions and use the control number included on your proxy card. |

| • | If you attend the Annual Meeting, you can also vote during the Annual Meeting. |

Beneficial Owner: Shares Registered in the Name of Broker or Other Nominee

If you are a beneficial owner of shares registered in the name of your broker, bank, or other nominee, these proxy materials along with a voting instruction form are being provided by that organization rather than the Company. Simply

12 WISDOMTREE, INC. | 2023 PROXY STATEMENT

General Information for Stockholders About the Annual Meeting

follow the instructions and mail the voting instruction form or vote over the Internet to ensure that your vote is counted. To vote by attending the Annual Meeting, you must obtain a valid legal proxy from your broker, bank or other nominee. Follow the instructions from your broker, bank or other nominee included with these proxy materials, or contact your broker, bank or other nominee to request a legal proxy.

WHAT HAPPENS IF I DO NOT VOTE?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing and mailing your proxy card, over the Internet, or by attending the Annual Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Other Nominee

If you are a beneficial owner and do not instruct your broker, bank, or other nominee how to vote your shares by completing and mailing the voting instruction form or voting over the Internet, the question of whether your broker or nominee will still be able to vote your shares depends on whether the particular proposal is a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Because the Annual Meeting is the subject of a contested solicitation, to the extent ETFS Capital delivers its proxy materials to a given stockholder, all proposals at the Annual Meeting are considered “non-routine.” Moreover, if the proposals being voted on at the Annual Meeting are considered non-routine, and you hold your shares in the name of your bank, broker or other nominee and you do not provide your bank, broker or other nominee with specific instructions regarding how to vote on a proposal to be voted on at the Annual Meeting, your bank, broker or other nominee will not be permitted to vote your shares on that proposal.

WHAT IF I RETURN A PROXY CARD OR VOTING INSTRUCTION FORM OR OTHERWISE VOTE BUT DO NOT MAKE SPECIFIC CHOICES?

If you return a signed and dated proxy card or voting instruction form without marking voting selections, your shares will be voted, as applicable:

| • | “FOR” each of the Company’s director nominees to be elected to the Board named in the Director Election Proposal; |

| • | “FOR” the Auditor Ratification Proposal; |

| • | “FOR” the Executive Compensation Proposal; and |

| • | “FOR” the Rights Agreement Proposal. |

WHAT HAPPENS IF I RETURN A UNIVERSAL PROXY CARD BUT GIVE VOTING INSTRUCTIONS FOR MORE THAN SIX NOMINEES?

If you are a stockholder of record and you vote “FOR” more than six nominees on your WHITE proxy card, your votes on the Director Election Proposal will be invalid and will not be counted. If you are a beneficial holder and you vote “FOR” more than six nominees on your WHITE voting instruction form, your votes on the Director Election Proposal will be invalid and will not be counted.

WHAT HAPPENS IF I RETURN A UNIVERSAL PROXY CARD BUT GIVE VOTING INSTRUCTIONS FOR FEWER THAN SIX NOMINEES?

If you are a stockholder of record and you vote “FOR” with respect to fewer than six nominees on your WHITE proxy card, your shares will only be voted “FOR” those nominees you have so marked. If you are a beneficial holder and you vote “FOR” with respect to fewer than six nominees on your WHITE voting instruction form, your shares will only be voted “FOR” those nominees you have so marked.

WISDOMTREE, INC. | 2023 PROXY STATEMENT 13

General Information for Stockholders About the Annual Meeting

WHO PAYS FOR THE COST OF SOLICITING PROXIES?

The entire cost of soliciting proxies on behalf of the Board, including the costs of preparing, assembling, printing and mailing this proxy statement, the WHITE proxy card and any additional soliciting materials furnished to stockholders by or on behalf of the Company, will be borne by the Company. Copies of solicitation material will be furnished to banks, brokerage firms, dealers, banks, voting trustees, their respective nominees and other agents holding shares in their names, which are beneficially owned by others, so that they may forward such solicitation material, together with our 2022 Annual Report, which includes our Form 10-K for the year ended December 31, 2022, to beneficial owners. In addition, we will reimburse these persons for their reasonable expenses in forwarding these materials to the beneficial owners.

We have engaged the proxy solicitation firm of Innisfree M&A Incorporated (“Innisfree”) to solicit proxies from stockholders in connection with the Annual Meeting. Innisfree expects that approximately 30 of its employees will assist in the solicitation of proxies. For these and related advisory services, we will pay Innisfree a fee not to exceed approximately $1.125 million plus costs and expenses. In addition, Innisfree and certain related persons will be indemnified against certain liabilities arising out of or in connection with the engagement.

We estimate that our additional out-of-pocket expenses beyond those normally associated with soliciting proxies for the Annual Meeting as a result of the potential proxy contest will be $6 million in the aggregate, of which approximately $2 million has been incurred to date. Such additional solicitation costs are expected to include the fees incurred to retain Innisfree as our proxy solicitor, as discussed above, fees of outside legal, financial and public relations advisors to advise the Company in connection with a possible contested solicitation of proxies, increased mailing costs, such as the costs of additional mailings of solicitation materials to stockholders, including printing costs, mailing costs and the reimbursement of reasonable expenses of banks, brokerage firms and other agents incurred in forwarding solicitation materials to beneficial owners, as described above, and the costs of retaining an independent inspector of election.

WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE WHITE PROXY CARD OR VOTING INSTRUCTION FORM?

You may receive more than one set of these proxy materials, including multiple copies of this proxy statement and multiple WHITE proxy cards or voting instruction forms. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction form for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one WHITE proxy card. To ensure that all of your shares are voted, please vote using each WHITE proxy card or voting instruction form you receive or, if you vote over the Internet, you will need to enter each of your control numbers. Remember, you may vote over the Internet or by signing, dating and returning the WHITE proxy card in the postage-paid envelope provided, or by voting at the Annual Meeting.

As previously noted, ETFS Capital has provided us with a notice indicating that it intends to nominate three director candidates for election as directors at the Annual Meeting at which three Class II and three Class III directors are to be elected. As a result, you may receive proxy cards from both the Company and ETFS Capital. To ensure that stockholders have our latest proxy information and materials to vote, the Board may conduct multiple mailings prior to the date of the Annual Meeting, each of which will include a WHITE proxy card. The Board encourages you to vote each WHITE proxy card you receive.

THE BOARD STRONGLY URGES YOU TO REVOKE ANY PROXY CARD OR VOTING INSTRUCTION FORM YOU MAY HAVE RETURNED WHICH YOU RECEIVED FROM ETFS CAPITAL.

THE BOARD STRONGLY URGES YOU NOT TO SIGN OR RETURN ANY PROXY CARD OR VOTING INSTRUCTION FORM THAT YOU MAY RECEIVE FROM ETFS CAPITAL, EVEN AS A PROTEST VOTE AGAINST ETFS CAPITAL OR ETFS CAPITAL’S NOMINEES.

14 WISDOMTREE, INC. | 2023 PROXY STATEMENT

General Information for Stockholders About the Annual Meeting

CAN I CHANGE MY VOTE OR REVOKE MY PROXY?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| • | You may submit another properly completed proxy card with a later date. |

| • | You may grant a subsequent proxy over the Internet. |

| • | You may send a timely written notice that you are revoking your proxy to our Secretary, Marci Frankenthaler, at WisdomTree, Inc., 250 West 34th Street, 3rd Floor, New York, NY 10119. |

| • | You may attend the Annual Meeting and vote. Attendance at the Annual Meeting will not, by itself, revoke your proxy. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

COULD OTHER MATTERS BE DECIDED AT THE ANNUAL MEETING?

We do not know of any other matters that may be presented for action at the Annual Meeting. Should any other business come before the meeting, the persons named on the proxies will have discretionary authority to vote the shares represented by such proxies in their best judgment, subject to compliance with Rule 14a-4(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

WHAT HAPPENS IF THE ANNUAL MEETING IS POSTPONED OR ADJOURNED?

Your proxy may be voted at the postponed or adjourned meeting. You will be able to change your proxy until it is voted.

WHAT IS THE DEADLINE TO PROPOSE ACTIONS FOR CONSIDERATION OR TO NOMINATE INDIVIDUALS TO SERVE AS DIRECTORS AT THE 2024 ANNUAL MEETING OF STOCKHOLDERS?

Requirements for stockholder proposals to be considered for inclusion in our proxy materials

Stockholders who wish to present proposals for inclusion in our proxy materials for our 2024 annual meeting of stockholders may do so by following the procedures prescribed in Rule 14a-8 under the Exchange Act. Our Secretary must receive stockholder proposals intended to be included in our proxy statement and form of proxy relating to our 2024 annual meeting of stockholders made under Rule 14a-8 by January 2, 2024. Any proposal of business must be mailed to Marci Frankenthaler, Secretary, WisdomTree, Inc., 250 West 34th Street, 3rd Floor, New York, NY 10119. We also encourage you to submit any such proposals by email to mfrankenthaler@wisdomtree.com.

Requirements for director nominations to be considered for inclusion in our proxy materials

Our by-laws permit a stockholder, or a group of up to 20 stockholders, who meet the eligibility requirements of our by-laws to utilize our “proxy access” by-law provision. “Proxy access” can be used to nominate up to the greater of two nominees or 25% of the total number of directors who are members of the Board as of the date that the stockholder(s) notifies us of the intent to utilize proxy access (the “proxy access notice”). Director nominations submitted under this by-law provision must be delivered to us no earlier than January 2, 2024, and no later than February 1, 2024. The proxy

WISDOMTREE, INC. | 2023 PROXY STATEMENT 15

General Information for Stockholders About the Annual Meeting

access notice must comply with the requirements in our by-laws. To be eligible to utilize our proxy access by-law provision, the stockholder(s) must have continuously owned at least 3% of our outstanding common stock for at least three years as of the date of the proxy access notice. Consistent with standard market practice, proxy access is only available to eligible stockholders who acquired our common stock in the ordinary course of business and not with the intent to change or influence control at WisdomTree and who do not presently have such intent.

Requirements for stockholder proposals and director nominations to be brought before an annual meeting

It is the policy of our Nominating and Governance Committee to consider nominations for candidates to our Board of Directors that are properly submitted by our stockholders in accordance with our by-laws. Under our current by-laws, proposals of business other than those to be included in our proxy materials following the procedures described in Rule 14a-8 and nominations for directors may be made by any stockholder who was a stockholder of record at the time of the giving of notice provided for in our by-laws, who is entitled to vote at the meeting, who is present in person or by proxy at the meeting and who complies with the notice procedures set forth in our by-laws (i.e., notice must be timely given and contain the information required by the by-laws). To be timely, a notice with respect to the 2024 annual meeting of stockholders must be delivered to our Secretary no earlier than February 17, 2024 and no later than March 18, 2024, unless the date of the 2024 annual meeting of stockholders is advanced by more than 30 days or delayed by more than 60 days from the anniversary date of the Annual Meeting, in which event the by-laws provide different notice requirements. Any proposal of business or nomination must be mailed to Marci Frankenthaler, Secretary, WisdomTree, Inc., 250 West 34th Street, 3rd Floor, New York, NY 10119. We also encourage you to submit any such proposal of business or nomination by email to mfrankenthaler@wisdomtree.com.

In addition, because our by-laws require a stockholder to include a statement that it intends to solicit the holders of shares representing at least 67% of the voting power of shares entitled to vote on the election of directors in support of director nominees other than the Company’s nominees, a stockholder must effectively provide the notice required under Rule 14a-19 by the same deadline noted above to submit a notice of nomination at an annual meeting of stockholders.

Recommendation of Director Candidates by Stockholders

The Nominating and Governance Committee will evaluate candidates for the position of director recommended by stockholders in the same manner as candidates from other sources and will determine whether to interview any candidates or seek any additional information.

WHO SHOULD I CALL IF I HAVE ANY ADDITIONAL QUESTIONS?

If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, Innisfree M&A Incorporated, toll free at (877) 750-5836.

POLICIES ON REPORTING CONCERNS ABOUT ACCOUNTING AND OTHER MATTERS AND COMMUNICATING WITH NON-EMPLOYEE DIRECTORS

Our Board of Directors and Audit Committee have adopted policies on reporting concerns regarding accounting and other matters and on communicating with the non-employee directors. Any person, including any employee, who has a concern about the conduct of WisdomTree or any of its people, including with respect to accounting, internal accounting controls or auditing matters, may, in a confidential or anonymous manner, communicate that concern to Anthony Bossone, the Audit Committee chair, who is the designated contact for these purposes. Contact may be made by writing to him, care of the Audit Committee, at our offices at 250 West 34th Street, 3rd Floor, New York, NY 10119, or by email at auditcommittee@wisdomtree.com. Any interested party, including any employee, who wishes to communicate directly with the presiding director of the executive sessions of our non-employee directors, or with our non-employee directors as a group, may contact Frank Salerno, Chair of the Board of Directors, by writing to him, care of the Chair of the Board, at our offices using the above address, or by email at WTIchairman@wisdomtree.com.

16 WISDOMTREE, INC. | 2023 PROXY STATEMENT

General Information for Stockholders About the Annual Meeting

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC, which are available on the SEC’s website at https://www.sec.gov. You may also read and find a copy of any document we file with the SEC on our investor relations website at https://ir.wisdomtree.com/sec-filings.

INCORPORATION BY REFERENCE

To the extent that this proxy statement has been or will be specifically incorporated by reference into any other filing of ours under the Securities Act of 1933 (the “Securities Act”), or the Exchange Act, the sections of this proxy statement entitled “Audit Committee Report,” to the extent permitted by the rules of the SEC, and “Compensation Committee Report” will not be deemed to be so incorporated, unless specifically provided otherwise in such filing.

IMPORTANT NOTICE REGARDING DELIVERY OF STOCKHOLDER DOCUMENTS

In accordance with a notice sent to certain of our stockholders who share a single address, only one copy of this proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2022, is being sent to that address unless we have received contrary instructions from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing and postage costs and help conserve our natural resources. However, any stockholder residing at such an address who wishes to receive a separate copy of this proxy statement or our Annual Report may send a request in writing to WisdomTree, Inc., 250 West 34th Street, 3rd Floor, New York, NY 10119, Attention: Marci Frankenthaler, Secretary, or by email to mfrankenthaler@wisdomtree.com, and we will deliver those documents promptly upon receiving the request. Any such stockholder also may contact our Secretary to receive separate proxy statements, annual reports or Notices of Internet Availability of Proxy Materials, as applicable, in the future. If you are receiving multiple copies of our annual reports and proxy statements, you may request householding in the future by contacting our Secretary.

HOW CAN I OBTAIN ELECTRONIC ACCESS TO THE PROXY MATERIALS?

This proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2022 are available on our investor relations website at https://ir.wisdomtree.com/company-information/annual-reports-proxy.

IMPORTANT

ETFS Capital may send you solicitation materials in an effort to solicit your vote to elect up to three of the ETFS Capital Nominees to the Board at the Annual Meeting at which three Class II and three Class III directors are to be elected. THE BOARD STRONGLY URGES YOU NOT TO SIGN OR RETURN ANY PROXY CARD OR VOTING INSTRUCTION FORM THAT YOU MAY RECEIVE FROM ETFS CAPITAL OR ANY PERSON OTHER THAN THE COMPANY.

Your vote at this year’s Annual Meeting is especially important, no matter how many or how few shares you own. Please vote using the enclosed WHITE proxy card and vote “FOR” the six WisdomTree nominees.

Only your latest dated, signed proxy card or voting instruction form will be counted. Any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in this proxy statement.

WISDOMTREE, INC. | 2023 PROXY STATEMENT 17

Background of the Solicitation

The following chronology summarizes the key contacts between the Company and ETFS Capital. This summary does not purport to catalogue every conversation of or among members of the Board, the Company’s management, the Company’s advisors, or representatives of ETFS Capital and their advisors relating to the solicitation.

Board Composition and Refreshment

The Board and the Company’s Nominating and Governance Committee (for purposes of this section, the “Nominating Committee”) continually seek to identify, evaluate and recommend candidates to become members of the Board with the goal of creating a balance of knowledge, experience and diversity. Candidates are selected for, among other things, their knowledge, skills, abilities, independence, character, diversity (inclusive of gender, race, ethnicity, age, gender identity, gender expression and sexual orientation), demonstrated leadership and experience useful to the oversight of the Company’s business in the context of the needs of the Board, as further discussed in “Director Criteria, Qualifications and Experience.” In addition, director nominees are selected to have complementary, rather than overlapping, skill sets. Through this skills-based approach, the Nominating Committee focuses on reviewing the skill set of our then-existing directors and adding directors to our Board who would bring new perspectives and broaden the experience of the Board. The Nominating Committee actively seeks to identify candidates who would strengthen the ability of our Board to offer practical business advice and strategic guidance to management and fulfill its fiduciary duties to stockholders. The Nominating Committee believes having personal knowledge of or exposure to a potential candidate is important in understanding the potential candidate’s skill set and qualifications and how the potential candidate would interact with others on the Board.

Accordingly, the Board proactively added five new independent and diverse directors to the Board since January 2021. Smita Conjeevaram, an experienced financial services executive with a background in fintech, disruptive technologies and financial innovation and a track record of success in guiding companies through significant growth, was added in January 2021. Harold Singleton III, an executive with more than 30 years of experience in the investment and portfolio management industries and expertise spanning global markets and environmental, social and governance (“ESG”) strategies, was added in January 2022. Daniela Mielke, a seasoned executive with decades of experience as an executive, founder, board member and advisor to fintech, commerce, payment processing and finance companies, was added to the Board in September 2022. As discussed below, pursuant to the Cooperation Agreement with ETFS Capital, the Board agreed to increase its size by two directors to a total of nine directors and appoint Lynn S. Blake and Deborah A. Fuhr as independent members of the Board (the “2022 Group Designees”), effective on May 25, 2022. Ms. Blake’s qualifications to serve on the Board include her expertise in investment management, including her experience with ESG investment strategies, and her many years of experience in leadership positions in the asset management industry.

The ETFS Acquisition and Standstill Period

In April 2018, Graham Tuckwell and his affiliate, ETFS Capital, became stockholders of the Company as a result of the Company’s acquisition of ETFS Capital’s European exchange-traded commodity, currency and leveraged-and-inverse business in exchange for cash and shares of the Company’s common stock and Series A non-voting convertible preferred stock (the “ETFS Acquisition”). In connection with the ETFS Acquisition, the Company assumed an obligation for fixed payments to ETFS Capital of physical gold bullion equating to 9,500 ounces of gold per year through March 31, 2058, and thereafter reduced to 6,333 ounces of gold per year continuing into perpetuity (the “Contractual Gold Payments”). Also in connection with the ETFS Acquisition, the Company and ETFS Capital entered into an Investor Rights Agreement, pursuant to which, among other things, Mr. Tuckwell and ETFS Capital agreed to be subject to lock-up, standstill and voting restrictions. In addition, the Company and Mr. Tuckwell entered into a noncompete agreement that prohibited Mr. Tuckwell from directly or indirectly engaging in any business competitive with the Company or soliciting or hiring employees of the Company for a period of two years.

On April 11, 2018, Mr. Tuckwell and ETFS Capital filed a Schedule 13G with the SEC reporting passive beneficial ownership of 9.9% of the Company’s outstanding common stock.

From April 2018 through January 2022, the Company held at least 30 meetings and calls with Mr. Tuckwell, covering a broad range of topics, including the Company’s business, financial performance and strategy for the future.

18 WISDOMTREE, INC. | 2023 PROXY STATEMENT

Background of the Solicitation

In June 2020, Mr. Tuckwell informed the Company that he was disappointed in the Company’s operating results and suggested that the Board consider removing Jonathan Steinberg as Chief Executive Officer and appointing Mr. Tuckwell as a director. The Board rejected Mr. Tuckwell’s suggestions to remove Mr. Steinberg and appoint Mr. Tuckwell.

On April 11, 2021, the standstill provisions under the Investor Rights Agreement expired.

The 2022 Group Campaign and Nominations

On January 18, 2022, at Mr. Tuckwell’s request, Frank Salerno, the non-executive Chair of the Board, and Win Neuger, an independent director of the Board, spoke with Mr. Tuckwell. Mr. Tuckwell requested that the Company make certain Board and management changes, including, among others, to appoint Mr. Tuckwell to the Board. Mr. Tuckwell also requested that Mr. Steinberg be replaced as the Company’s Chief Executive Officer. Mr. Tuckwell indicated that if such changes were not made, he intended to nominate candidates for election as directors at the Company’s 2022 annual meeting of stockholders (the “2022 Annual Meeting”) and wage a proxy contest.

On January 24, 2022, Mr. Tuckwell and ETFS Capital filed a Schedule 13D with the SEC, converting their previously filed Schedule 13G to a Schedule 13D and disclosing beneficial ownership of 10.5% of the Company’s outstanding common stock (the “Schedule 13D”).

On March 10, 2022, Mr. Tuckwell, ETFS Capital and Lion Point Capital, LP (“Lion Point,” together with ETFS Capital and the other participants in ETFS Capital’s 2022 proxy solicitation, the “2022 Group”) filed with the SEC an amended Schedule 13D to disclose that they entered into a group agreement in connection with their collective efforts to seek changes to the composition of the Board and management of the Company. The amended Schedule 13D disclosed that the 2022 Group beneficially owned in the aggregate 13.6% of the Company’s outstanding common stock. Mr. Tuckwell and ETFS Capital reported combined beneficial ownership of 10.5% of the Company’s outstanding common stock.

On March 13, 2022, the Board unanimously adopted a narrowly tailored, limited duration stockholder rights plan (the “2022 Stockholder Rights Plan”).

On March 22, 2022, the 2022 Group filed an amended Schedule 13D with the SEC disclosing its intent to nominate three candidates to stand for election to the Board at the 2022 Annual Meeting: Mr. Tuckwell, Lynn S. Blake and Deborah A. Fuhr.

From March 29 through May 4, 2022, two members of the Board, Mr. Salerno and Ms. Conjeevaram, with input and authorization from the Board, had 13 meetings with the 2022 Group regarding potential settlement of the proxy contest. As a result of their discussions, the parties reached a final definitive cooperation agreement, exchanged signature pages and had planned to announce publicly the cooperation agreement on May 4, 2022.

On May 4, 2022, a representative of the 2022 Group sent an email to Mr. Salerno and Ms. Conjeevaram stating that the 2022 Group would not sign the cooperation agreement and that the 2022 Group instead would be issuing a press release announcing its intention to file proxy materials for a contested 2022 Annual Meeting. Moments later, the 2022 Group issued a press release and open letter to the Board, which discussed the 2022 Group’s views regarding the nature of the cooperation agreement and the discussions with the Company.

On May 5, 2022, the Company issued a press release responding to the 2022 Group’s May 4, 2022 press release and providing its views regarding the discussions that had taken place between representatives of the Company and the 2022 Group regarding the cooperation agreement.

On May 25, 2022, following further discussions between the Company and the 2022 Group, the Company entered into a Cooperation Agreement with the 2022 Group (the “Cooperation Agreement”). Pursuant to the Cooperation Agreement, the Company agreed to increase the size of the Board by two directors to a total of nine directors and appoint Mses. Blake and Fuhr as independent members of the Board, with Ms. Blake to be appointed to the Compensation Committee and Ms. Fuhr to be appointed to the Nominating Committee of the Board. Additionally, the Board formed a four-member Operations and Strategy Committee of the Board (for purposes of this section, the “Operations Committee”) to make