Exhibit 99.1

Gold Royalty Buyout May 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

WisdomTree, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Copies to:

Sean M. Donahue

Andrew H. Goodman

Goodwin Procter LLP

1900 N Street NW

Washington, DC 20036

(202) 346-4207

Payment of Filing Fee (Check all boxes that apply)

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 10, 2023

WisdomTree, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-10932 | 13-3487784 | ||

| (State or other jurisdiction of incorporation) |

Commission File Number: |

(IRS Employer Identification No.) |

| 250 West 34th Street |

| 3rd Floor |

| New York, NY 10119 |

| (Address of principal executive offices, including zip code) |

(212) 801-2080

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

Trading |

Name of each exchange on which registered | ||

| Common Stock, $0.01 par value | WT | The New York Stock Exchange | ||

| Preferred Stock Purchase Rights | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement. |

SPA Agreement

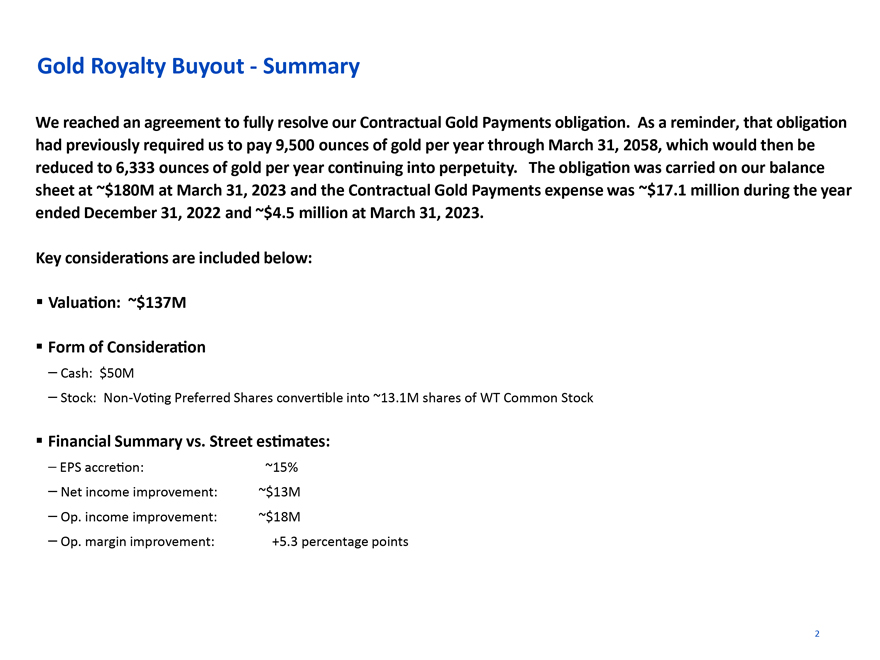

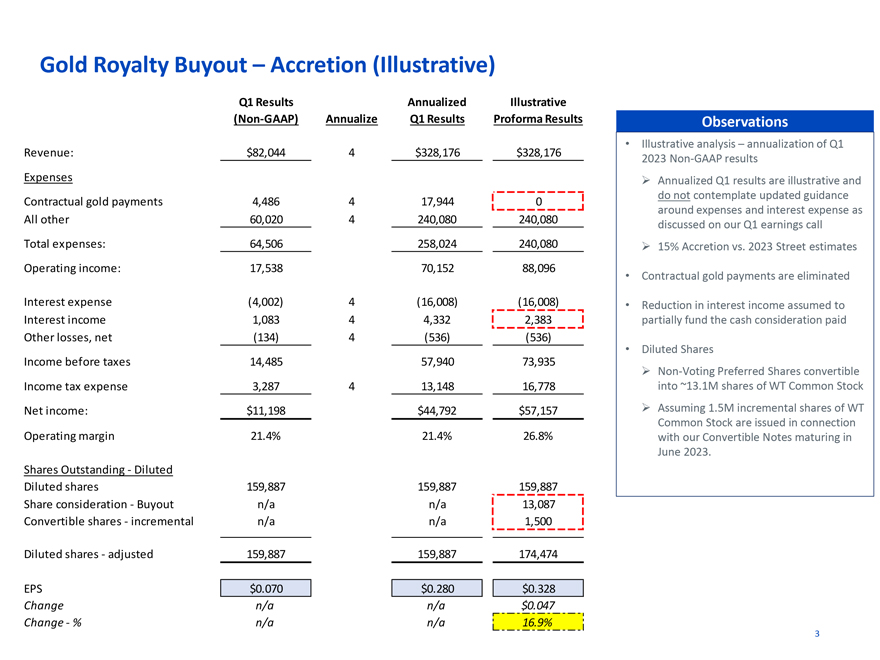

In April 2018, WisdomTree International Holdings Ltd (“WTHL”), a subsidiary of WisdomTree, Inc. (the “Company”), acquired the European exchange-traded commodity, currency and leveraged-and-inverse business of ETFS Capital Limited (“ETFS”) through the acquisition of Electra Target HoldCo Limited (“ETH”) and its subsidiaries (the “2018 Acquisition”). In connection with the 2018 Acquisition, WTHL, ETH and ETFS entered into an agreement pursuant to which ETH agreed to make fixed payments to ETFS of physical gold bullion equating to 9,500 ounces of gold per year through March 31, 2058, which would then be reduced to 6,333 ounces of gold per year continuing into perpetuity (the “Contractual Gold Payments”), in order to enable ETFS to continue to meet its payment obligations under prior royalty agreements (the “historical royalty agreements”) that ETFS had with the World Gold Council (“WGC”), Gold Bullion Holdings (Jersey) Limited, a subsidiary of WGC (“GBH”), Graham Tuckwell (“GT”), and Rodber Investments Limited (“RIL”), an entity controlled by GT, who is also the Chairman of ETFS. ETH made the Contractual Gold Payments to ETFS, which then continued to pass through the payments to the other parties pursuant to the historical royalty agreements.

On May 10, 2023, the Company entered into and closed on a Sale, Purchase and Assignment Deed relating to the Contractual Gold Payments with WTHL, ETH, ETFS, WGC, GBH, GT and RIL (the “SPA Agreement”) to extinguish the Company’s obligations relating to the Contractual Gold Payments (the “Transaction”). Pursuant to the SPA Agreement, the Company issued 13,087 shares of Series C Non-Voting Convertible Preferred Stock, $0.01 par value per share (the “Series C Preferred Shares”), which are convertible into 13,087,000 shares of the Company’s common stock (the “Conversion Shares”), and paid an aggregate of approximately $50 million. The consideration paid pursuant to the SPA Agreement resulted in GBH receiving approximately $4.4 million in cash and the Series C Preferred Shares, and RIL receiving approximately $45.6 million in cash.

The SPA Agreement contains certain representations and warranties, covenants and conditions customary for similar transactions.

The foregoing description of the SPA Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the SPA Agreement, which is attached hereto as Exhibit 10.1 and is incorporated by reference in its entirety.

Investor Rights Agreement

On May 10, 2023, in connection with the Transaction and issuance of the Series C Preferred Shares, the Company and GBH entered into an Investor Rights Agreement (the “Investor Rights Agreement”), pursuant to which, among other things:

| • | Restrictions on Transfer. The Series C Preferred Shares are not transferable to any person other than an affiliate of GBH, the Company or an affiliate of the Company. |

| • | Conversion only in Connection with Sales. As described in Item 5.03 below, under the Certificate of Designations (as defined below), all or any portion of the Series C Preferred Shares held by a holder may be converted into shares of common stock only in connection with the sale of all or any portion of such common stock on an arms-length basis by such holder to a bona fide third-party purchaser. Under the Investor Rights Agreement, GBH is subject to restrictions on the manner in which the Conversion Shares can be sold. Approved sales include specified block trades, underwritten shelf takedowns and other private placements, in each case, subject to and in accordance with the limitations set forth in the Investor Rights Agreement. GBH has agreed not to distribute or sell any Conversion Shares to any person that would knowingly result in that person, together with such person’s affiliates and associates, owning, controlling or otherwise having any beneficial ownership interest representing in the aggregate 5% or more of the then outstanding shares of the Company’s common stock. GBH also has agreed not to distribute or sell any Conversion Shares to ETFS, GT or any of their affiliates, associates or any Group (as that term is used in Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and as defined in Rule 13d-5 thereunder) formed by the foregoing persons. |

| • | Registration Rights. Any time from the later of the filing of the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023 and August 15, 2023 (the “First Filing Date”) until the fifth anniversary of such date, GBH may request that the Company prepare and file a registration statement covering the resale of the Conversion Shares. In addition, from and after the First Filing Date, GBH may request to sell all or any portion of the Conversion Shares pursuant to specified block trades, underwritten shelf takedowns and other private placements, in each case, subject to and in accordance with the limitations set forth in the Investor Rights Agreement. Under the Investor Rights Agreement, GBH is also entitled to certain “piggyback” registration rights in connection with certain underwritten offerings of the Company’s common stock by the Company. |

| • | Amendment to Certificate of Incorporation or Certificate of Designations. For so long as GBH holds the Conversion Shares, the Company will not amend its certificate of incorporation or the Certificate of Designations (as defined below) in any manner materially adverse to GBH without the written consent of GBH. |

The foregoing description of the Investor Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Investor Rights Agreement, which is attached hereto as Exhibit 4.1 and is incorporated by reference in its entirety.

Amendment to Stockholder Rights Agreement

The information set forth under “Item 3.03 Material Modification to Rights of Security Holders” of this Current Report on Form 8-K with respect to the entry into Amendment 2 to the Stockholder Rights Agreement (as described below) is incorporated into this Item 1.01 by reference in its entirety.

| Item 3.02 | Unregistered Sales of Equity Securities. |

The information contained under “SPA Agreement” with respect to the Series C Preferred Shares in Item 1.01 above is incorporated by reference into this Item 3.02. The Series C Preferred Shares were sold in reliance on the exemptions provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and/or Regulation D promulgated thereunder.

| Item 3.03 | Material Modification to Rights of Security Holders. |

The Company entered into an amendment, effective as of May 10, 2023 (“Amendment 2”), to the Stockholder Rights Agreement, dated as of March 17, 2023 (the “Stockholder Rights Agreement”), between the Company and Continental Stock Transfer & Trust Company, as Rights Agent, as amended by Amendment No. 1 thereto, dated as of May 4, 2023. Amendment 2 amends the Stockholder Rights Agreement by amending the definition of “Acquiring Person” in Section 1(a) of the Stockholder Rights Agreement to provide that the parties to the SPA Agreement will not be deemed to be an “Acquiring Person” solely by virtue of, or as a result of, the parties’ entry into the SPA Agreement, the issuance of the Series C Preferred Shares to GBH, and the performance or consummation of any of the other transactions contemplated by the SPA Agreement, among other conditions, under the terms and conditions set forth in Amendment 2.

The foregoing description of Amendment 2 does not purport to be complete and is qualified in its entirety by reference to the full text of Amendment 2, which is attached hereto as Exhibit 4.2 and is incorporated by reference in its entirety.

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

Pursuant to the terms of the SPA Agreement, on May 10, 2023, the Company filed a Certificate of Designations of Series C Non-Voting Convertible Preferred Stock (the “Certificate of Designations”) with the Delaware Secretary of State establishing the rights, preferences and limitations relating to the Series C Preferred Shares. The Series C Preferred Shares are intended to provide GBH with economic rights equivalent to the Company’s common stock on an as converted basis. The Series C Preferred Shares have no voting rights, are not transferrable other than to an affiliate of GBH, the Company or an affiliate of the Company, and have the same priority with regard to dividends, distributions and payments as the common stock and the Series A non-voting convertible preferred stock.

In connection with the Transaction, the Company issued 13,087 Series C Preferred Shares, which are convertible into an aggregate of 13,087,000 shares of common stock, subject to certain restrictions described in this Item 5.03 and above under the heading “Item 1.01 Entry Into a Material Definitive Agreement – Investor Rights Agreement.”

Restrictions on Conversion of Series C Preferred Shares

The Series C Preferred Shares are convertible into 13,087,000 shares of the Company’s common stock, subject to the following restrictions:

| • | Conversion only in Connection with Sales. Each Series C Preferred Share is convertible only in connection with the sale of all or any portion of the Company’s common stock on an arms-length basis by a holder of such Series C Preferred Shares to a bona fide third-party purchaser, pursuant to (i) an effective registration statement under the Securities Act or (ii) an exemption from registration under the Securities Act, provided any such sale is conditioned on the terms of the Investor Rights Agreement and the execution and delivery of documents as reasonably necessary to effectuate such sale. |

| • | Limitation on Beneficial Ownership. As described in the Certificate of Designations, the Company will not issue, and GBH will not have the right to require the Company to issue, any shares of common stock upon conversion of the Series C Preferred Shares if, as a result of such conversion, GBH (together with its affiliates and certain attributable parties) would beneficially own in excess of 4.99% of the shares of the Company’s common stock outstanding immediately after giving effect to such conversion. |

| • | Exchange Cap. As described in the Certificate of Designations, the Company will not issue any shares of common stock upon conversion of the Series C Preferred Shares if the issuance would exceed the aggregate number of shares of common stock that the Company may issue without breaching its obligations under the rules of the New York Stock Exchange, unless the Company obtains stockholder approval for the issuance of the Company’s common stock upon conversion of the Series C Preferred Shares in excess of such amount. |

The foregoing description of the Certificate of Designations does not purport to be complete and is qualified in its entirety by reference to the full text of the Certificate of Designations, which is attached hereto as Exhibit 3.1 and is incorporated by reference in its entirety.

| Item 7.01 | Regulation FD Disclosure. |

Presentation

Presentation materials concerning the Transaction, which will be available on the Company’s investor relations website at https://ir.wisdomtree.com, are attached hereto as Exhibit 99.1 and are incorporated herein by reference in their entirety.

Press Release

On May 10, 2023, the Company issued a press release announcing the closing of the Transaction, a copy of which is attached hereto as Exhibit 99.2 and incorporated herein by reference in its entirety.

The information furnished pursuant to this Item 7.01, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities under that Section and shall not be deemed incorporated by reference into any filing under the Securities Act.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| 3.1 | Certificate of Designations of Series C Non-Voting Convertible Preferred Stock of WisdomTree, Inc. | |

| 4.1* | Investor Rights Agreement, dated as of May 10, 2023, by and between WisdomTree, Inc. and Gold Bullion Holdings (Jersey) Limited | |

| 4.2 | Amendment No. 2, dated as of May 10, 2023, to Stockholder Rights Agreement, dated as of March 17, 2023, between WisdomTree, Inc. and Continental Stock Transfer & Trust Company, as Rights Agent | |

| 10.1* | Sale, Purchase and Assignment Deed, dated as of May 10, 2023, by and between WisdomTree, Inc., WisdomTree International Holdings Ltd, Electra Target HoldCo Limited, ETFS Capital Limited, World Gold Council, Gold Bullion Holdings (Jersey) Limited, Rodber Investments Limited and Graham Tuckwell | |

| 99.1 | Presentation, dated May 10, 2023 | |

| 99.2 | Press Release, dated May 10, 2023 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

| * | Schedules and exhibits to these Exhibits have been omitted in accordance with Item 601 of Regulation S-K. The Company agrees to furnish supplementally a copy of all omitted schedules and exhibits to the Securities and Exchange Commission or its staff upon request. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| WisdomTree, Inc. | ||||||

| May 10, 2023 | By: | /s/ Marci Frankenthaler | ||||

| Marci Frankenthaler | ||||||

| Chief Legal Officer and Secretary | ||||||

EXHIBIT 3.1

CERTIFICATE OF DESIGNATIONS

OF

SERIES C NON-VOTING CONVERTIBLE PREFERRED STOCK

OF

WISDOMTREE, INC.

WisdomTree, Inc., a corporation organized and existing under the General Corporation Law of the State of Delaware (the “Corporation”), hereby certifies that the following resolution was adopted by the Board of Directors of the Corporation (the “Board of Directors” or the “Board”) as required by Section 151 of the General Corporation Law of the State of Delaware at a meeting duly called and held on May 4, 2023:

RESOLVED, that pursuant to the authority granted to and vested in the Board of Directors in accordance with the Amended and Restated Certificate of Incorporation of the Corporation, as amended, the Board of Directors hereby creates a series of preferred stock, par value $0.01 per share, of the Corporation designated as Series C Non-Voting Convertible Preferred Stock, and hereby states the designation and number of shares, and fixes the relative rights, preferences and limitations thereof as follows:

SERIES C NON-VOTING CONVERTIBLE PREFERRED STOCK

1. Designation and Number of Shares. There shall hereby be created and established a series of preferred stock of the Corporation designated as “Series C Non-Voting Convertible Preferred Stock” (the “Series C Preferred Shares”). The authorized number of Series C Preferred Shares shall be thirteen thousand eighty seven (13,087). Each Series C Preferred Share shall have a par value of $0.01. Capitalized terms not defined herein shall have the meaning as set forth in Section 12 below.

2. Ranking. The Series C Preferred Shares shall rank junior with regard to dividends, distributions and payments to the Senior Stock and pari passu with regard to dividends, distributions and payments to the common stock of the Corporation and the preferred stock of the Corporation designated as Series A Non-Voting Convertible Preferred Stock (the “Series A Preferred Shares”) and any other class or series which provides that it is pari passu with the Series A Preferred Shares and Series C Preferred Shares.

3. Dividends. From and after the first date of issuance of any Series C Preferred Shares (the “Initial Issuance Date”), the holder of Series C Preferred Shares (“Holder”) shall be entitled to receive any dividends (“Dividends”) in accordance with Section 4(f) or Section 7 below.

4. Conversion; Change of Control. At any time after the Initial Issuance Date, each Series C Preferred Share shall be convertible into validly issued, fully paid and non-assessable shares of Common Stock (as defined below), on the terms and conditions set forth in this Section 4.

(a) Holder’s Conversion Right. Subject to the provisions of Section 4(d), after the Initial Issuance Date, all or any portion of the outstanding Series C Preferred Shares held by Holder shall be converted into validly issued, fully paid and non-assessable shares of Common Stock, in accordance with Section 4(c) at the Conversion Rate (defined below), in connection with the sale of all or any portion of such Common Stock on an arms-length basis by Holder to a bona fide third party purchaser (“Third Party Purchaser”) from time to time or at any time, pursuant to (i) an effective registration statement under the Securities Act of 1933, as amended (the “Securities Act”), or (ii) an exemption from registration promulgated under the Securities Act provided that any such sale shall be conditioned on the terms of the Investor Rights Agreement by and between the Corporation and the Holder dated as of May 10, 2023 (the “Investor Rights Agreement”), and provided further that any such sale shall be conditioned on the Holder executing and delivering to the Corporation such documents and items as reasonably requested by the Corporation in connection therewith and as are reasonably necessary to process or effectuate such sale. The Corporation shall not issue any fraction of a share of Common Stock upon any conversion. If the issuance would result in the issuance of a fraction of a share of Common Stock, the Corporation shall arrange for the disposition such fractional share and payment to those entitled, or pay to those entitled the fair value of such fractional share in cash. Holder shall pay any and all transfer, stamp, issuance and similar taxes that may be payable with respect to any transfer of Series C Preferred Shares or transfer of any Common Stock issuable upon conversion of any Series C Preferred Shares.

(b) Conversion Rate. Each Series C Preferred Share shall be convertible into One Thousand (1,000) shares of Common Stock (the “Conversion Rate”) upon any conversion pursuant to Section 4(a), subject to adjustment as provided herein:

(c) Mechanics of Conversion. The conversion of each Series C Preferred Share shall be conducted in the following manner:

(i) Conversion. To convert a Series C Preferred Share into shares of Common Stock pursuant to Section 4(a) on any date (a “Conversion Date”), Holder shall deliver (via electronic mail), for receipt on or prior to 11:59 p.m., New York time, on such date, a copy of an executed notice of conversion of the share(s) of Series C Preferred Shares subject to such conversion in the form attached hereto as Exhibit I (the “Conversion Notice”) to the Corporation. If required by Section 4(c)(ii), within two (2) Trading Days following a conversion of any such Series C Preferred Shares as aforesaid, Holder shall surrender to the Corporation the original certificates, if any, representing the Series C Preferred Shares (the “Preferred Share Certificates”) so converted as aforesaid (or an indemnification undertaking with respect to the Series C Preferred Shares in the case of its loss, theft or destruction as contemplated by Section 8(b)). On or before the first (1st) Trading Day following the date of receipt of a Conversion Notice, the Corporation shall transmit by electronic mail an acknowledgment of confirmation, in the form attached hereto as Exhibit II, of receipt of such Conversion Notice to Holder and the Corporation’s transfer agent (the “Transfer Agent”), which confirmation shall constitute an instruction to the Transfer Agent to process such Conversion Notice in accordance with the terms herein. On or before the second (2nd) Trading Day following the date of receipt of a Conversion Notice (or such earlier date as required pursuant to the Exchange Act or other applicable law, rule or regulation for the

2

settlement of a trade initiated on the applicable Conversion Date of such shares of Common Stock issuable pursuant to such Conversion Notice), the Corporation shall (1) provided that the Transfer Agent is participating in The Depository Trust Corporation’s (“DTC”) Fast Automated Securities Transfer Program, credit such aggregate number of shares of Common Stock to which Third Party Purchaser shall be entitled to Third Party Purchaser’s balance account with DTC through its Deposit/Withdrawal at Custodian system, or (2) if the Transfer Agent is not participating in the DTC Fast Automated Securities Transfer Program, issue and deliver (via reputable overnight courier) to the address as specified in such Conversion Notice, a certificate, registered in the name of Third Party Purchaser or its designee, for the number of shares of Common Stock to which Third Party Purchaser shall be entitled. If the number of Series C Preferred Shares represented by the Preferred Share Certificate(s) submitted for conversion pursuant to Section 4(c)(ii) is greater than the number of Series C Preferred Shares being converted, then the Corporation shall, as soon as practicable and in no event later than two (2) Trading Days after receipt of the Preferred Share Certificate(s) and at its own expense, issue and deliver to Holder a new Preferred Share Certificate (in accordance with Section 8(c)) representing the number of Series C Preferred Shares not converted.

(ii) Registration; Book-Entry. At the time of issuance of any Series C Preferred Shares hereunder, Holder may, by written request (including by electronic-mail) to the Corporation, elect to receive such Series C Preferred Shares in the form of one or more Preferred Share Certificates or in Book-Entry form. The Corporation (or the Transfer Agent, as custodian for the Series C Preferred Shares) shall maintain a register (the “Register”) for the recordation of the name and address of Holder and whether the Series C Preferred Shares are held by Holder in Preferred Share Certificates or in Book-Entry form. The entries in the Register shall be conclusive and binding for all purposes absent manifest error. Each Preferred Share Certificate shall bear the following legend:

THE SHARES OF SERIES C NON-VOTING CONVERTIBLE PREFERRED STOCK REPRESENTED BY THIS CERTIFICATE ARE NOT TRANSFERABLE TO ANY PERSON, OTHER THAN THE ISSUER OR AN AFFILIATE OF THE ISSUER OR AN AFFILIATE OF THE HOLDER. THE NUMBER OF SHARES OF SERIES C NON-VOTING CONVERTIBLE PREFERRED STOCK REPRESENTED BY THIS CERTIFICATE MAY BE LESS THAN THE NUMBER OF SHARES OF SERIES C NON-VOTING CONVERTIBLE PREFERRED STOCK STATED ON THE FACE HEREOF PURSUANT TO SECTION 4(c)(ii) OF THE CERTIFICATE OF DESIGNATIONS RELATING TO THE SHARES OF SERIES C NON-VOTING CONVERTIBLE PREFERRED STOCK REPRESENTED BY THIS CERTIFICATE.

3

THE CORPORATION WILL FURNISH TO ANY STOCKHOLDER, UPON REQUEST AND WITHOUT CHARGE, A FULL STATEMENT OF THE DESIGNATIONS, POWERS, RIGHTS, PREFERENCES, QUALIFICATIONS, RESTRICTIONS AND LIMITATIONS OF THE SHARES OF EACH CLASS AND SERIES OF THE CAPITAL STOCK OF THE CORPORATION AUTHORIZED TO BE ISSUED SO FAR AS THE SAME HAVE BEEN DETERMINED. SUCH REQUEST MAY BE MADE TO THE SECRETARY OF THE CORPORATION.

(d) Limitation on Beneficial Ownership.

(i) Subject to paragraph 4(d)(ii), the Corporation shall not effect the conversion of any of the Series C Preferred Shares held by Holder, and Holder shall not have the right to convert any of the Series C Preferred Shares held by Holder pursuant to the terms and conditions of this Certificate of Designations and any such conversion shall be null and void and treated as if never made, to the extent that after giving effect to such conversion, Holder together with the other Attribution Parties collectively would beneficially own in excess of 4.99% (the “Maximum Percentage”) of the shares of Common Stock outstanding immediately after giving effect to such conversion. For purposes of the foregoing sentence, the aggregate number of shares of Common Stock beneficially owned by Holder and the other Attribution Parties shall include the number of shares of Common Stock held by Holder and all other Attribution Parties plus the number of shares of Common Stock issuable upon conversion of the Series C Preferred Shares with respect to which the determination of such sentence is being made, but shall exclude shares of Common Stock which would be issuable upon (A) conversion of the remaining, nonconverted Series C Preferred Shares beneficially owned by Holder or any of the other Attribution Parties and (B) exercise or conversion of the unexercised or nonconverted portion of any other securities of the Corporation (including, without limitation, any convertible notes, convertible preferred stock or warrants) beneficially owned by Holder or any other Attribution Party subject to a limitation on conversion or exercise analogous to the limitation contained in this Section 4(d)(i). For purposes of this Section 4(d)(i), beneficial ownership shall be calculated in accordance with Section 13(d) of the Exchange Act. For purposes of determining the number of outstanding shares of Common Stock Holder may acquire upon the conversion of such Series C Preferred Shares without exceeding the Maximum Percentage, Holder may rely on the number of outstanding shares of Common Stock as reflected in (x) the Corporation’s most recent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, Current Report on Form 8-K or other public filing with the SEC, as the case may be, (y) a more recent public announcement by the Corporation or (z) any other written notice by the Corporation or the

4

Transfer Agent, if any, setting forth the number of shares of Common Stock outstanding (the “Reported Outstanding Share Number”). If the Corporation receives a Conversion Notice from Holder at a time when the actual number of outstanding shares of Common Stock is less than the Reported Outstanding Share Number, the Corporation shall notify Holder in writing of the number of shares of Common Stock then outstanding and, to the extent that such Conversion Notice would otherwise cause Holder’s and the other Attribution Parties’ beneficial ownership, as determined pursuant to this Section 4(d)(i), to exceed the Maximum Percentage, Holder must notify the Corporation of a reduced number of shares of Common Stock to be purchased pursuant to such Conversion Notice. For any reason at any time, upon the written request of Holder, the Corporation shall within two (2) Business Days confirm orally and in writing or by electronic mail to Holder the number of shares of Common Stock then outstanding. In any case, the number of outstanding shares of Common Stock shall be determined after giving effect to the conversion or exercise of securities of the Corporation, including such Series C Preferred Shares, by Holder and any other Attribution Party since the date as of which the Reported Outstanding Share Number was reported. In the event that the issuance of shares of Common Stock to Holder upon conversion of such Series C Preferred Shares results in Holder and the other Attribution Parties being deemed to beneficially own, in the aggregate, more than the Maximum Percentage of the number of outstanding shares of Common Stock (as determined under Section 13(d) of the Exchange Act), the conversion of the number of shares so issued by which Holder’s and the other Attribution Parties’ aggregate beneficial ownership exceeds the Maximum Percentage (the “Excess Shares”) shall be deemed null and void and shall be treated as if never made, and neither Holder nor the other Attribution Parties shall have the power to vote or to transfer the Excess Shares. For purposes of clarity, the shares of Common Stock issuable to Holder pursuant to the terms of this Certificate of Designations in excess of the Maximum Percentage shall not be deemed to be beneficially owned by Holder together with the other Attribution Parties for any purpose including for purposes of Section 13(d) or Rule 16a-1(a)(1) of the Exchange Act. No prior inability to convert such Series C Preferred Shares pursuant to this paragraph shall have any effect on the applicability of the provisions of this paragraph with respect to any subsequent determination of convertibility. The provisions of this paragraph shall be construed and implemented in a manner otherwise than in strict conformity with the terms of this Section 4(d)(i) to the extent necessary to correct this paragraph (or any portion of this paragraph) which may be defective or inconsistent with the intended beneficial ownership limitation contained in this Section 4(d)(i) or to make changes or supplements necessary or desirable to properly give effect to such limitation. The limitation contained in this paragraph may not be waived.

(ii) Principal Market Regulation. The Corporation shall not issue any shares of Common Stock upon conversion of any Series C Preferred Shares or otherwise pursuant to the terms of this Certificate of Designations if the issuance of such shares of Common Stock would exceed the aggregate number of shares of Common Stock which the Corporation may issue upon conversion of the Series C

5

Preferred Shares under Rule 312.03(b) or (c) of the listing rules of the New York Stock Exchange (the number of shares which may be issued without violating such rule, the “Exchange Cap”), except that such limitation shall not apply in the event that the Corporation obtains the approval of its stockholders as required by the applicable rules of the New York Stock Exchange for issuances of shares of Common Stock in excess of such amount (the “New York Stock Exchange Approval”).

(e) Change of Control. If at any time on or after the Initial Issuance Date a Change of Control is consummated, the Holder will be entitled to be paid such amount per Series C Preferred Share as would have been payable in respect of each Series C Preferred Share outstanding immediately prior to the consummation of such Change of Control had each such Series C Preferred Share been converted into Common Stock pursuant to Section 4(a) immediately prior to the consummation of such Change of Control (the “Change of Control Payment”).

(f) Adjustment of Conversion Rate upon Subdivision or Combination of Common Stock or Fundamental Transaction.

(i) Without limiting any provision of Section 7, if the Corporation at any time on or after the Initial Issuance Date subdivides (by any stock split, stock dividend, stock combination, recapitalization or other similar transaction) one or more classes of its outstanding shares of Common Stock into a greater number of shares, the Conversion Rate in effect immediately prior to such subdivision will be proportionately increased. Without limiting any provision of Section 7, if the Corporation at any time on or after the Initial Issuance Date combines (by any stock split, stock dividend, stock combination, recapitalization or other similar transaction) one or more classes of its outstanding shares of Common Stock into a smaller number of shares, the Conversion Rate in effect immediately prior to such combination will be proportionately decreased. Any adjustment pursuant to this Section 4(f) shall become effective immediately after the effective date of such subdivision or combination.

(ii) If at any time, or from time to time, on or after the Initial Issuance Date a Fundamental Transaction is consummated (other than a Change of Control) in such a way that holders of Common Stock shall be entitled to receive stock, securities, cash or assets with respect to or in exchange for Common Stock, then, as a condition of such Fundamental Transaction, lawful and adequate provisions shall be made whereby the Holder shall have the right to receive for each share of Common Stock that would have been issuable upon conversion of the Series C Preferred Shares pursuant to this Certificate of Designations immediately prior to the consummation of such Fundamental Transaction (without taking into account any limitations or restrictions on the convertibility of the Series C Preferred Shares), the kind and amount of stock, securities, cash or assets receivable as a result of such Fundamental Transaction by a holder of the number of shares of

6

Common Stock into which the Series C Preferred Shares are convertible pursuant to this Certificate of Designations immediately prior to such Fundamental Transaction (without taking into account any limitations or restrictions on the convertibility of the Series C Preferred Shares).

5. Voting Rights. Subject to Section 13, the Holder of Series C Preferred Shares shall have no voting rights.

6. Liquidation, Dissolution, Winding-Up. In the event of a Liquidation Event, Holder shall be entitled to receive in cash out of the assets of the Corporation, whether from capital or from earnings available for distribution to its stockholders, after any amount that is required to be paid to the Senior Stock, the amount per share Holder would receive if Holder converted all of the Series C Preferred Shares held by Holder into Common Stock immediately prior to the date of such payment.

7. Distribution of Assets. If the Corporation shall declare or make any dividend or other distributions of its assets (or rights to acquire its assets) to any or all holders of shares of Common Stock, by way of return of capital or otherwise (including without limitation, any distribution of cash, stock or other securities, property or options by way of a dividend, spin off, reclassification, corporate rearrangement, scheme of arrangement or other similar transaction) (the “Distributions”), then Holder, as a holder of Series C Preferred Shares, will be entitled to such Distributions as if Holder had held the number of shares of Common Stock acquirable upon complete conversion of the Series C Preferred Shares (without taking into account any limitations or restrictions on the convertibility of the Series C Preferred Shares) immediately prior to the date on which a record is taken for such Distribution or, if no such record is taken, the date as of which the record holders of Common Stock are to be determined for such Distributions (provided, however, that to the extent that Holder’s right to participate in any such Distribution would result in Holder and the other Attribution Parties exceeding the Maximum Percentage or the Exchange Cap having been exceeded, then Holder shall not be entitled to participate in such Distribution (other than a Distribution of cash) to such extent (and shall not be entitled to beneficial ownership of such shares of Common Stock as a result of such Distribution (and beneficial ownership) to such extent) and the portion of such Distribution shall be held in abeyance for Holder until such time or times as its right thereto would not result in Holder and the other Attribution Parties exceeding the Maximum Percentage or the Exchange Cap having been exceeded, as applicable, at which time or times, if any, Holder shall be granted such rights (and any rights under this Section 7 on such initial rights or on any subsequent such rights to be held similarly in abeyance) to the same extent as if there had been no such limitation).

8. Reissuance of Preferred Share Certificates and Book Entries.

(a) Transferability. The Series C Preferred Shares shall not be transferable to any Person other than an Affiliate of the Holder, the Corporation or an Affiliate of the Corporation.

7

(b) Lost, Stolen or Mutilated Preferred Share Certificate. Upon receipt by the Corporation of evidence reasonably satisfactory to the Corporation of the loss, theft, destruction or mutilation of a Preferred Share Certificate, and, in the case of loss, theft or destruction, of any indemnification undertaking by Holder to the Corporation in customary and reasonable form and, in the case of mutilation, upon surrender and cancellation of such Preferred Share Certificate, the Corporation shall execute and deliver to Holder a new Preferred Share Certificate (in accordance with Section 8(c)) representing the applicable outstanding number of Series C Preferred Shares.

(c) Issuance of New Preferred Share Certificate or Book-Entry. Whenever the Corporation is required to issue a new Preferred Share Certificate or a new Book-Entry pursuant to the terms of this Certificate of Designations, such new Preferred Share Certificate or new Book-Entry (i) shall represent, as indicated on the face of such Preferred Share Certificate or in such Book-Entry, as applicable, the number of Series C Preferred Shares remaining outstanding which, when added to the number of Series C Preferred Shares represented by the other new Preferred Share Certificates or other new Book-Entry, as applicable, issued in connection with such issuance, does not exceed the number of Series C Preferred Shares remaining outstanding under the original Preferred Share Certificate or original Book-Entry, as applicable, immediately prior to such issuance of new Preferred Share Certificate or new Book-Entry, as applicable, and (ii) shall have an issuance date, as indicated on the face of such new Preferred Share Certificate or in such new Book-Entry, as applicable, which is the same as the issuance date of the original Preferred Share Certificate or in such original Book-Entry, as applicable.

9. Construction; Headings. This Certificate of Designations shall be deemed to be jointly drafted by the Corporation and Holder and shall not be construed against any such Person as the drafter hereof. The headings of this Certificate of Designations are for convenience of reference and shall not form part of, or affect the interpretation of, this Certificate of Designations. Unless the context clearly indicates otherwise, each pronoun herein shall be deemed to include the masculine, feminine, neuter, singular and plural forms thereof. The terms “including,” “includes,” “include” and words of like import shall be construed broadly as if followed by the words “without limitation.” The terms “herein,” “hereunder,” “hereof” and words of like import refer to this entire Certificate of Designations instead of just the provision in which they are found. Unless expressly indicated otherwise, all section references are to sections of this Certificate of Designations.

10. Notices. The Corporation shall provide Holder with prompt written notice of all actions taken pursuant to the terms of this Certificate of Designations, including in reasonable detail a description of such action and the reason therefor. Any notices, consents, waivers or other communications required or permitted to be given under the terms hereof must be in writing and will be deemed to have been delivered: (i) upon receipt, when delivered personally; (ii) upon receipt, when sent by electronic mail; or (iii) one Business Day after deposit with an overnight courier service, in each case properly addressed to the party to receive the same, as follows:

(i) if to the Corporation, to:

WisdomTree, Inc.

250 West 34th Street, 3rd Floor

New York, NY 10119

Attention: Chief Legal Officer or General Counsel

Email: legalnotice@wisdomtree.com

8

With a copy to:

Goodwin Procter LLP

100 Northern Avenue

Boston, Massachusetts 02210

Attention: Jocelyn Arel

Email: JArel@goodwinlaw.com

Goodwin Procter LLP

1900 N Street, N.W.

Washington, D.C. 20001

Attention: James A. Hutchinson

Email: JHutchinson@goodwinlaw.com

(ii) if to Holder in accordance with the address and/or e-mail address of Holder set forth on the books and records of the Corporation; or to such other address and/or e-mail address and/or to the attention of such Person as the recipient party has specified by written notice given to each other party five (5) days prior to the effectiveness of such change.

11. Severability. Whenever possible, each provision hereof will be interpreted in a manner as to be effective and valid under applicable law, but if any provision hereof is held to be prohibited by or invalid under applicable law, then such provision will be ineffective only to the extent of such prohibition or invalidity, without invalidating or otherwise adversely affecting the remaining provisions hereof.

12. Certain Defined Terms. For purposes of this Certificate of Designations, the following terms shall have the following meanings:

(a) “Affiliate” or “Affiliated” means, with respect to any Person, any other Person that directly or indirectly controls, is controlled by, or is under common control with, such Person, it being understood for purposes of this definition that “control” of a Person means the power directly or indirectly either to vote at least fifty-one percent (51%) or more of the stock having ordinary voting power for the election of directors of such Person or direct or cause the direction of the management and policies of such Person whether by contract or otherwise.

(b) “Attribution Parties” means, collectively, the following Persons and entities: (i) any investment vehicle, including, any funds, feeder funds or managed accounts, currently, or from time to time after the Initial Issuance Date, directly or indirectly managed or advised by Holder’s investment manager or any of its Affiliates or principals, (ii) any direct or indirect Affiliates of Holder, or any of the foregoing, (iii) any Person acting or who could be deemed to be acting as a Group together with Holder or any of the foregoing, (iv) any Third Party Purchaser; and (v) any other Persons whose beneficial ownership of the Corporation’s Common Stock would or could be aggregated with Holder’s and the other

9

Attribution Parties for purposes of Section 13(d) of the Exchange Act. For clarity, the purpose of the foregoing is to subject collectively Holder and all other Attribution Parties to the Maximum Percentage.

(c) “Book-Entry” means each entry on the Register evidencing one or more Series C Preferred Shares held by Holder in lieu of a Preferred Share Certificate issuable hereunder.

(d) “Business Day” means any day other than Saturday, Sunday or other day on which commercial banks in The City of New York are authorized or required by law to remain closed.

(e) “Change of Control” means any Fundamental Transaction other than (i) any reorganization, recapitalization or reclassification of the Common Stock in which holders of the Corporation’s voting power immediately prior to such reorganization, recapitalization or reclassification continue after such reorganization, recapitalization or reclassification to hold publicly traded securities and, directly or indirectly, are the holders of more than 50% of the voting power of the surviving entity (or entities with the authority or voting power to elect the members of the board of directors (or their equivalent if other than a corporation) of such entity or entities) after such reorganization, recapitalization or reclassification, or (ii) pursuant to a migratory merger effected solely for the purpose of changing the jurisdiction of incorporation of the Corporation.

(f) “Common Stock” means (i) the Corporation’s shares of common stock, $0.01 par value per share, and (ii) any capital stock into which such common stock shall have been changed or any share capital resulting from a reclassification of such common stock.

(g) “Exchange Act” means the United States Securities Exchange Act of 1934, as amended, and the rules and regulations of the SEC promulgated thereunder.

(h) “Fundamental Transaction” means (i) that the Corporation shall, directly or indirectly, including through subsidiaries, Affiliates or otherwise, in one or more related transactions, (A) consolidate or merge with or into (whether or not the Corporation is the surviving corporation) another Subject Entity, or (B) sell, assign, transfer, convey or otherwise dispose of all or substantially all of the properties or assets of the Corporation to one or more Subject Entities, or (C) make, or allow one or more Subject Entities to make, or allow the Corporation to be subject to or have its Common Stock be subject to or party to one or more Subject Entities making, a purchase, tender or exchange offer that is accepted by the holders of at least either (x) 50% of the outstanding shares of Common Stock, (y) 50% of the outstanding shares of Common Stock calculated as if any shares of Common Stock held by all Subject Entities making or party to, or Affiliated with any Subject Entities making or party to, such purchase, tender or exchange offer were not outstanding; or (z) such number of shares of Common Stock such that all Subject Entities making or party to, or Affiliated with any Subject Entity making or party to, such purchase, tender or exchange offer, become collectively the beneficial owners (as defined in Rule 13d-3 under the Exchange Act) of at least 50% of the outstanding shares of Common Stock, or (D) consummate a

10

stock or share purchase agreement or other business combination (including, without limitation, a reorganization, recapitalization, spin-off or scheme of arrangement) with one or more Subject Entities whereby all such Subject Entities, individually or in the aggregate, acquire, either (x) at least 50% of the outstanding shares of Common Stock, (y) at least 50% of the outstanding shares of Common Stock calculated as if any shares of Common Stock held by all the Subject Entities making or party to, or Affiliated with any Subject Entity making or party to, such stock purchase agreement or other business combination were not outstanding; or (z) such number of shares of Common Stock such that the Subject Entities become collectively the beneficial owners (as defined in Rule 13d-3 under the Exchange Act) of at least 50% of the outstanding shares of Common Stock, or (E) reorganize, recapitalize or reclassify its Common Stock, (ii) that the Corporation shall, directly or indirectly, including through subsidiaries, Affiliates or otherwise, in one or more related transactions, allow any Subject Entity individually or the Subject Entities in the aggregate to be or become the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, whether through acquisition, purchase, assignment, conveyance, tender, tender offer, exchange, reduction in outstanding shares of Common Stock, merger, consolidation, business combination, reorganization, recapitalization, spin-off, scheme of arrangement, reorganization, recapitalization or reclassification or otherwise in any manner whatsoever, of either (A) at least 50% of the aggregate ordinary voting power represented by issued and outstanding Common Stock, (B) at least 50% of the aggregate ordinary voting power represented by issued and outstanding Common Stock not held by all such Subject Entities as of the date of this Certificate of Designations calculated as if any shares of Common Stock held by all such Subject Entities were not outstanding, or (C) a percentage of the aggregate ordinary voting power represented by issued and outstanding shares of Common Stock or other equity securities of the Corporation sufficient to allow such Subject Entities to effect a statutory short form merger or other transaction requiring other shareholders of the Corporation to surrender their shares of Common Stock without approval of the shareholders of the Corporation or (iii) directly or indirectly, including through subsidiaries, Affiliates or otherwise, in one or more related transactions, the issuance of or the entering into any other instrument or transaction structured in a manner to circumvent, or that circumvents, the intent of this definition in which case this definition shall be construed and implemented in a manner otherwise than in strict conformity with the terms of this definition to the extent necessary to correct this definition or any portion of this definition which may be defective or inconsistent with the intended treatment of such instrument or transaction.

(i) “Group” means a “group” as that term is used in Section 13(d) of the Exchange Act and as defined in Rule 13d-5 thereunder.

(j) “Liquidation Event” means, whether in a single transaction or series of transactions, the voluntary or involuntary liquidation, dissolution or winding up of the Corporation, taken as a whole.

(k) “Person” means any individual, limited liability company, partnership, firm, corporation, association, trust, unincorporated organization, government or any department or agency thereof or other entity, as well as any Group.

11

(l) “Principal Market” means the New York Stock Exchange.

(m) “SEC” means the United States Securities and Exchange Commission or the successor thereto.

(n) “Senior Stock” means any class or series of capital stock of the Corporation the terms of which expressly provide that such class or series will rank senior to the Common Stock or the Series C Preferred Shares as to dividend rights and/or as to rights on liquidation, dissolution or winding up of the Corporation (in each case, without regard to whether dividends accrue cumulatively or non-cumulatively). For the benefit of doubt, the Series B Junior Participating Cumulative Preferred Stock of the Corporation is Senior Stock.

(o) “Subject Entity” means any Person, Persons or Group or any Affiliate or associate of any such Person, Persons or Group.

(p) “Third Party” means any Person other than the Holder, the Corporation or any of their respective Affiliates.

(q) “Trading Day” means any day on which the New York Stock Exchange (or any successor thereto) is open for trading of securities.

13. Amendments. At any time when any Series C Preferred Shares are outstanding, without the affirmative consent of the Holder, the Corporation will not amend, alter or repeal its Amended and Restated Certificate of Incorporation or this Certificate of Designations in a manner that is adverse to the rights, preferences or privileges of the Series C Preferred Shares.

* * * * *

12

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Designations of Series C Non-Voting Convertible Preferred Stock of WisdomTree, Inc. to be signed by its Chief Executive Officer on this 10th day of May, 2023.

| WISDOMTREE, INC. | ||

| By: | /s/ Jonathan Steinberg | |

| Name: Jonathan Steinberg | ||

| Title: Chief Executive Officer | ||

EXHIBIT I

CONVERSION NOTICE

Reference is made to the Certificate of Designations (the “Certificate of Designations”) of the Series C Non-Voting Convertible Preferred Stock, $0.01 par value per share (the “Series C Preferred Shares”), of WisdomTree, Inc. (the “Corporation”). In accordance with and pursuant to the Certificate of Designations and the Investor Rights Agreement by and between the Corporation and the Holder (as defined therein) dated as of May 10, 2023 (the “Investor Rights Agreement”), the undersigned holder of Series C Preferred Shares (the “Holder”) and the undersigned bona fide third party purchaser (the “Third Party Purchaser”) hereby elect to convert the number of Series C Preferred Shares of the Corporation, indicated below into shares of common stock, $0.01 value per share (the “Common Stock”), of the Corporation, as of the date specified below.

In connection with the conversion of the Series C Preferred Shares and sale of the Common Stock, the undersigned each represent and warrant to the Corporation as follows:

| • | As of the date hereof, the number of shares of Common Stock beneficially owned by the undersigned Third Party Purchaser (together with such Third Party Purchaser’s Affiliates, and any other Person whose beneficial ownership of Common Stock would be aggregated with the Third Party Purchaser’s for purposes of Section 13(d) or Section 16 of the Exchange Act and the applicable regulations of the Commission, including any “group” of which the Third Party Purchaser is a member (the foregoing, “Attribution Parties”)), including the number of shares of Common Stock issuable upon conversion of the Series C Preferred Stock subject to this Notice of Conversion, but excluding the number of shares of Common Stock which are issuable upon (A) conversion of any remaining, unconverted Series C Preferred Shares beneficially owned by a Holder or any of its Attribution Parties, is %, and does not represent in the aggregate five percent (5%) or more of the Corporation’s then outstanding common stock. For purposes hereof, beneficial ownership shall be calculated in accordance with Section 13(d) of the Exchange Act and the applicable regulations of the Commission. In addition, for purposes hereof, “group” has the meaning set forth in Section 13(d) of the Exchange Act and the applicable regulations of the Commission. |

| • | The Third Party Purchaser is not an individual to whom sales are prohibited under Section 2.1(d) of the Investor Rights Agreement. |

In addition, if the undersigned Holder wishes to sell any Common Stock to a Third Party Purchaser pursuant to Rule 144 under the Securities Act of 1933, the Holder acknowledges and agrees that in order to have the Securities Act restrictive legend removed from any such Common Stock, the Holder must provide the Corporation with a Stockholder Certificate to Issuer’s Counsel that is satisfactory to the Corporation’s legal counsel indicating that the Holder meets the conditions of Rule 144 and Corporation’s legal counsel must be willing to give a legal opinion to such transfer agent with respect to removal of such legend. Furthermore, prior to any restrictive legend being removed from any Common Stock, the Holder shall provide a selling securityholder’s representation letter and a brokers representation to the Corporation’s transfer agent.

Notwithstanding the foregoing, Holder may only Dispose of any Registrable Securities (as those terms are defined in the Investor Rights Agreement) pursuant to a Rule 144 sale if, and to the extent, the Corporation fails to perform or materially breaches any of its obligations under Section 2.2(a)(i), Section 2.2(a)(ii), Section 2.2(b), Section 2.2(c)(i), Section 2.2(c)(ii), Section 2.2(c)(iii), Section 2.2(d), Section 2.2(f), Section 2.3(a), Section 2.3(b), Section 2.4(a), Section 2.4(c) or Section 2.4(e) of the Investor Rights Agreement and the Corporation has not cured such breach within thirty (30) days after the Holder has given the Corporation written notice of such breach and of Holder’s intention to Dispose of Registrable Securities pursuant to a Rule 144 sale.

| Date of Conversion: |

||||||||||

| Aggregate number of Series C Preferred Shares to be converted |

||||||||||

| Name of Third Party Purchaser |

||||||||||

| Please issue the Common Stock into which the applicable Series C Preferred Shares are being converted to Third Party Purchaser, or for its benefit, as follows: | ||||||||||

| ☐ Check here if requesting delivery as a certificate to the following name and to the following address: | ||||||||||

| Issue to: |

||||||||||

| ☐ Check here if requesting delivery by Deposit/Withdrawal at Custodian as follows: | ||||||||||

| DTC Participant: |

||||||||||

| DTC Number: |

||||||||||

| Account Number: |

||||||||||

| Date: _____________ __,_____ | ||

| Name of Registered Holder | ||

| Date: _____________ __,_____ | ||

| Name of Third Party Purchaser | ||

| By: |

||

| Name: | ||

| Title: | ||

| Tax ID:_______________________________ | ||

| E-mail Address: | ||

EXHIBIT II

ACKNOWLEDGMENT

The Corporation hereby acknowledges this Conversion Notice and hereby directs _________________ to issue the above indicated number of shares of Common Stock in accordance with the Transfer Agent Instructions dated _____________, 20__ from the Corporation and acknowledged and agreed to by ________________________.

| WISDOMTREE, INC. | ||

| By: | ||

| Name: | ||

| Title: | ||

EXHIBIT 4.1

INVESTOR RIGHTS AGREEMENT

BY AND BETWEEN

WISDOMTREE, INC.

AND

GOLD BULLION HOLDINGS (JERSEY) LIMITED

DATED AS OF MAY 10, 2023

TABLE OF CONTENTS

Page

| 1. Definitions |

1 | |||||

| 2. Registration Rights |

7 | |||||

| 2.1 |

Approved Sales; Private Placements; Rule 144 Sales | 7 | ||||

| 2.2 |

Filing. | 8 | ||||

| 2.3 |

Requests for Underwritten Offerings | 10 | ||||

| 2.4 |

Piggyback Rights | 11 | ||||

| 2.5 |

Obligations of the Company | 13 | ||||

| 2.6 |

Obligations of GBH | 16 | ||||

| 2.7 |

Expenses | 16 | ||||

| 2.8 |

Indemnification | 16 | ||||

| 2.9 |

SEC Reports | 19 | ||||

| 2.10 |

Termination of Registration Rights. | 19 | ||||

| 3. Company Covenants |

19 | |||||

| 3.1 |

Company Information | 19 | ||||

| 3.2 |

Amendment to Certificate of Incorporation or Certificate of Designations | 19 | ||||

| 4. Miscellaneous |

20 | |||||

| 4.1 |

Governing Law; Submission to Jurisdiction | 20 | ||||

| 4.2 |

Waiver | 20 | ||||

| 4.3 |

Notices | 21 | ||||

| 4.4 |

Entire Agreement | 21 | ||||

| 4.5 |

Amendments | 21 | ||||

| 4.6 |

Headings; Nouns and Pronouns; Section References | 21 | ||||

| 4.7 |

Severability | 21 | ||||

| 4.8 |

Assignment | 21 | ||||

| 4.9 |

Successors and Assigns | 22 | ||||

| 4.10 |

Counterparts | 22 | ||||

| 4.11 |

Third Party Beneficiaries | 22 | ||||

| 4.12 |

No Strict Construction | 22 | ||||

| 4.13 |

Remedies | 22 | ||||

| 4.14 |

Specific Performance | 22 | ||||

| 4.15 |

No Conflicting Agreements | 23 | ||||

Exhibit A – Selling Stockholder Questionnaire

Exhibit B – Notices

Exhibit C – List of Pre-approved Potential Underwriters

i

INVESTOR RIGHTS AGREEMENT

THIS INVESTOR RIGHTS AGREEMENT (this “Agreement”) is made as of May 10, 2023, by and among Gold Bullion Holdings (Jersey) Limited (“GBH”), a company incorporated in Jersey with registered number 87321 and whose registered office is at 28 Esplanade, St. Helier, JE2 3QA, Jersey, and WisdomTree, Inc. (the “Company”), a Delaware corporation with its principal place of business at 250 West 34th Street, 3rd Floor, New York, New York 10119, USA.

WHEREAS, the Sale, Purchase and Assignment Deed relating to the Gold Receivables, dated as of May 10, 2023, by and among the Company, WisdomTree International Holdings Ltd, Electra Target Holdco Limited, ETFS Capital Limited, World Gold Council, GBH, Rodber Investments Limited and Graham Tuckwell (the “Purchase Agreement”) provides for the issuance by the Company to GBH of a number of shares of the Company’s Series C Non-Voting Convertible Preferred Stock, par value $0.01 per share equal to the WT Shares (as defined in the Purchase Agreement) (the “Consideration Shares”).

WHEREAS, as a condition to consummating the transactions contemplated by the Purchase Agreement, GBH and the Company have agreed upon certain rights and restrictions as set forth herein with respect to the Consideration Shares and other securities of the Company beneficially owned by GBH and its Affiliates, and it is a condition to the closing under the Purchase Agreement that this Agreement be executed and delivered by GBH and the Company.

WHEREAS, the Existing Registration Rights Agreement may be amended, and the observance of any term of the Existing Registration Rights Agreement may be waived, with (and only with) the written consent of the Company and the Persons holding a majority of the then outstanding Registrable Securities (as defined in the Existing Registration Rights Agreement).

WHEREAS, the Existing Holders hold a majority of the outstanding Registrable Securities (as defined in the Existing Registration Rights Agreement).

WHEREAS, the Existing Holders have entered into a waiver agreement with the Company with respect to the Company entering into this Agreement pursuant to Section 3(g) of the Existing Registration Rights Agreement.

NOW, THEREFORE, in consideration of the premises and mutual agreements hereinafter set forth, and for other valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Definitions. As used in this Agreement, the following terms shall have the following meanings:

(a) “Affiliate” or “Affiliated” means, with respect to any Person, any other Person that directly or indirectly controls, is controlled by, or is under common control with, such Person, it being understood for purposes of this definition that “control” of a Person means the power directly or indirectly either to vote at least fifty-one percent (51%) or more of the stock having ordinary voting power for the election of directors of such Person or direct or cause the direction of the management and policies of such Person whether by contract or otherwise.

(b) “Agreement” shall have the meaning set forth in the Preamble to this Agreement, including all Exhibits attached hereto.

(c) “Alternative Shelf Registration Statement” shall have the meaning set forth in Section 2.2(c).

(d) “Approved Sale” means a sale of Registrable Shares by GBH pursuant to a Block Trade, an Underwritten Shelf Takedown, a Company Piggyback Offering or an Other Holder Piggyback Offering.

(e) “Automatic Filing Request” shall have the meaning set forth in Section 2.2(a).

(f) “Automatic Shelf Registration Statement” means an “automatic shelf registration statement” as defined in Rule 405 promulgated under the Securities Act.

(g) “beneficial owner,” “beneficially owns,” “beneficial ownership” and terms of similar import used in this Agreement shall, with respect to a Person, have the meaning set forth in Rule 13d-3 under the Exchange Act (i) assuming the full conversion into, and exercise and exchange for, shares of Common Stock of all Common Stock Equivalents beneficially owned by such Person and (ii) determined without regard for the number of days in which such Person has the right to acquire such beneficial ownership.

(h) “Block Trade” means any non-marketed Underwritten Offering or Rule 144 Sale taking the form of a bought deal or block sale to a financial institution.

(i) “Block Trade Request” shall have the meaning set forth in Section 2.3(a).

(j) “Business Day” means any day other than Saturday, Sunday or other day on which commercial banks in The City of New York are authorized or required by law to remain closed.

(k) “Certificate of Designations” means the Certificate of Designations of Series C Non-Voting Convertible Preferred Stock of the Company.

(l) “Common Stock” shall have the meaning set forth in the Preamble to this Agreement.

2

(m) “Common Stock Equivalents” means any options, warrants or other securities or rights convertible into or exercisable or exchangeable for, whether directly or following conversion into or exercise or exchange for other options, warrants or other securities or rights, shares of Common Stock.

(n) “Company” shall have the meaning set forth in the Preamble to this Agreement.

(o) “Company Piggyback Offering” shall have the meaning set forth in Section 2.4(a).

(p) “Consideration Shares” shall have the meaning set forth in the Recitals.

(q) “Determination Date” shall have the meaning set forth in Section 2.2(b).

(r) “Disposition” or “Dispose of” means any (i) distribution, transfer or other disposition, directly or indirectly, to shareholders, partners, limited partners of GBH or any to other Person of any shares of Common Stock, or any Common Stock Equivalents, (ii) pledge, sale, contract to sell, sale of any option or contract to purchase, purchase of any option or contract to sell, grant of any option, right or warrant for the sale of, or other disposition of or transfer of any shares of Common Stock, or any Common Stock Equivalents, including, without limitation, any “short sale” or similar arrangement, or (iii) swap or any other agreement or any transaction that transfers, in whole or in part, directly or indirectly, the economic consequence of ownership of shares of Common Stock, whether any such swap or transaction is to be settled by delivery of securities, in cash or otherwise.

(s) “Exchange Act” means the United States Securities Exchange Act of 1934, as amended, and the rules and regulations of the SEC promulgated thereunder.

(t) “Existing Holders” means the holders who have outstanding Registrable Securities (as defined in the Existing Registration Rights Agreement) pursuant to the Existing Registration Rights Agreement.

(u) “Existing Registration Rights Agreement” shall mean that certain Third Amended and Restated Registration Rights Agreement, dated October 15, 2009, among the Company and certain other parties thereto.

(v) “First Filing Date” shall have the meaning set forth in Section 2.2(a).

(w) “Governmental Authority” means any court, agency, authority, department, regulatory body or other instrumentality of any government or country or of any national, federal, state, provincial, regional, county, city or other political subdivision of any such government or country or any supranational organization of which any such country is a member.

3

(x) “Group” means a “group” as that term is used in Section 13(d) of the Exchange Act and as defined in Rule 13d-5 thereunder.

(y) “Law” or “Laws” means all laws, statutes, rules, regulations, orders, judgments, injunctions and/or ordinances of any Governmental Authority.

(z) “Modified Clause” shall have the meaning set forth in Section 4.7.

(aa) “Other Holder” means any Person having rights to participate in a registration of the Company’s securities, including pursuant to the Existing Registration Rights Agreement.

(bb) “Other Holder Piggyback Offering” shall have the meaning set forth in Section 2.4(c).

(cc) “Other Registrable Securities” shall have the meaning set forth in Section 2.4(a).

(dd) “Person” means any individual, limited liability company, partnership, firm, corporation, association, trust, unincorporated organization, government or any department or agency thereof or other entity, as well as any Group.

(ee) “Private Placement” means the Disposition by GBH of any Registrable Securities in a transaction exempt from the registration requirements of the Securities Act.

(ff) “Private Placement Request” shall have the meaning set forth in Section 2.2(d).

(gg) “Prospectus” means the prospectus forming a part of any Registration Statement, as supplemented by any and all prospectus supplements and as amended by any and all amendments (including post-effective amendments) and including all material incorporated by reference or explicitly deemed to be incorporated by reference in such prospectus.

(hh) “Purchase Agreement” shall have the meaning set forth in the Preamble to this Agreement, and shall include all Exhibits attached thereto.

(ii) “registers,” “registered,” and “registration” refer to a registration effected by preparing and filing a registration statement or similar document in compliance with the Securities Act, and the declaration or ordering of effectiveness of such Registration Statement or document by the SEC.

4

(jj) “Registrable Securities” means: the shares of Common Stock issuable upon conversion of the Consideration Shares; and all shares of Common Stock issued to GBH upon: (A) any stock split, stock dividend, share exchange, merger, consolidation or similar recapitalization; and (B) as (or issuable upon the exercise of any warrant, right or other security that is issued as) a dividend or other distribution with respect to, or in exchange or in replacement thereof. As to any particular Registrable Securities, such securities shall cease to be Registrable Securities when: (x) a Registration Statement with respect to the sale of such securities shall have become effective under the Securities Act and such securities shall have been sold, transferred, disposed of or exchanged in accordance with such Registration Statement; or (y) such securities shall have been otherwise properly transferred in accordance with this Agreement and the Certificate of Designations, new certificates for them not bearing a legend restricting further transfer shall have been delivered by the Company and subsequent public distribution of them shall not require registration under the Securities Act.

(kk) “Registration Expenses” means all expenses incurred by the Company in connection with any Underwritten Offering, including, without limitation, all registration and filing fees, fees and expenses of compliance with securities or blue sky Laws (including reasonable fees and disbursements of counsel in connection with blue sky qualifications of any Registrable Securities), expenses of printing (i) certificates for any Registrable Securities in a form eligible for deposit with the Depository Trust Company or (ii) Prospectuses if the printing of Prospectuses is requested by GBH, messenger and delivery expenses, fees and disbursements of counsel for the Company and its independent certified public accountants (including the expenses of any management review, cold comfort letters or any special audits required by or incident to such performance and compliance), Securities Act liability insurance (if the Company elects to obtain such insurance), the reasonable fees and expenses of any special experts retained by the Company in connection with such registration, fees and expenses of other Persons retained by the Company and the reasonable fees and expenses of one (1) counsel for GBH; provided, however, that Registration Expenses shall not include any Selling Expenses. In addition, the Company will pay its internal expenses (including, without limitation, all salaries and expenses of its officers and employees performing legal or accounting duties), the expense of any annual audit and the fees and expenses incurred in connection with the listing of the Common Stock to be registered on each securities exchange, if any, on which equity securities issued by the Company are then listed or the quotation of such securities on any national securities exchange on which equity securities issued by the Company are then quoted.

(ll) “Registration Rights Term” shall have the meaning set forth in Section 2.2(a).

(mm) “Registration Statement” means any registration statement of the Company under the Securities Act that covers any of the Registrable Securities pursuant to the provisions of this Agreement, including the related Prospectus, all amendments and supplements to such registration statement (including post-effective amendments), and all exhibits and all materials incorporated by reference or explicitly deemed to be incorporated by reference in such Registration Statement.

5

(nn) “Rule 144 Sale” means the Disposition by GBH of any Registrable Securities in compliance with Rule 144 under the Securities Act.

(oo) “SEC” means the United States Securities and Exchange Commission.

(pp) “Securities Act” means the United States Securities Act of 1933, as amended, and the rules and regulations of the SEC promulgated thereunder.

(qq) “Selling Expenses” means all underwriting discounts, selling commissions and all transfer, stamp, issuance and similar taxes, costs and expenses that may be payable with respect to the sale of Registrable Securities pursuant to this Agreement or otherwise.

(rr) “Shelf Filing Request” shall have the meaning set forth in Section 2.2(c).

(ss) “Shelf Registration” means a registration of securities pursuant to a registration statement filed with the SEC in accordance with and pursuant to Rule 415 promulgated under the Securities Act (or any successor rule then in effect).

(tt) “Shelf Registration Statement” means a registration statement to permit the public resale of the Registrable Securities.

(uu) “Subsidiary” of the Company means any corporation, association, limited liability company, partnership, joint venture or other business entity of which more than fifty percent (50%) of the voting stock or other equity interests, that is owned or controlled directly or indirectly by the Company, or one or more of the Subsidiaries of the Company, or a combination thereof.

(vv) “Substitute Shelf Registration Statement” shall have the meaning set forth in Section 2.2(b).

(ww) “Takedown Request” shall have the meaning set forth in Section 2.3(b).

(xx) “Then Outstanding Common Stock” means, at any time, the issued and outstanding shares of Common Stock at such time.

(yy) “Third Party” means any Person other than GBH, the Company or any of their respective Affiliates.

6

(zz) “Underwriter” means a securities dealer or dealers chosen by the Company which purchases any Registrable Securities as principal and not as part of such dealer’s market-making activities.

(aaa) “Underwritten Offering” means a registration in which Registrable Securities are sold to an Underwriter or GBH Underwriter for reoffering pursuant to a “takedown” of an Automatic Shelf Registration Statement, Substitute Shelf Registration Statement or Alternative Shelf Registration Statement, as applicable.

(bbb) “Underwritten Shelf Takedown” shall have the meaning set forth in Section 2.3(b).

(ccc) “Violation” shall have the meaning set forth in Section 2.8(a).

(ddd) “Well-Known Seasoned Issuer” means a “well-known seasoned issuer” as defined in Rule 405 promulgated under the Securities Act and which (a) is a “well-known seasoned issuer” under paragraph (1)(i)(A) of such definition or (b) is a “well-known seasoned issuer” under paragraph (1)(i)(B) of such definition and is also eligible to register a primary offering of its securities relying on General Instruction I.B.1 of Form S-3 under the Securities Act.

(eee) “GBH” shall have the meaning set forth in the Preamble to this Agreement.

(fff) “GBH Underwriter” means one (1) securities dealer chosen by GBH which purchases any Registrable Securities as principal and not as part of such dealer’s market-making activities.

2. Registration Rights.

2.1 Approved Sales; Private Placements; Rule 144 Sales.

(a) The Consideration Shares shall not be transferable to any Person other than an Affiliate of GBH, the Company or an Affiliate of the Company.

(b) Notwithstanding anything in this Agreement to the contrary, GBH shall not without the prior written approval of the Company, Dispose of any Registrable Securities at any time except pursuant to an Approved Sale or Private Placement, in each case, in accordance with Section 2 of this Agreement.