Positioning WisdomTree for Ongoing Success May 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

WisdomTree, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Copies to:

Sean M. Donahue

Andrew H. Goodman

Goodwin Procter LLP

1900 N Street NW

Washington, DC 20036

(202) 346-4207

Payment of Filing Fee (Check all boxes that apply)

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Positioning WisdomTree for Ongoing Success May 2023

Forward Looking Statements This presentation contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. Any statements contained in this presentation that do not describe historical facts may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, the risks described below. If one or more of these or other risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this presentation completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements. In particular, forward-looking statements in this presentation may include statements about: anticipated trends, conditions and investor sentiment in the global markets and ETPs; anticipated levels of inflows into and outflows out of our ETPs; the sustainability of our inflows; our ability to deliver favorable rates of return to investors; competition in our business; whether we will experience future growth; our ability to gain market share; our ability to develop new products and services; our ability to maintain current vendors or find new vendors to provide services to us at favorable costs; our ability to successfully implement our strategy relating to digital assets and blockchain-enabled financial services, including WisdomTree Prime™, and achieve its objectives; projections regarding the global tokenized asset market; the ability of our long-term strategy to provide scale, stability, and margin expansion; whether the SEC will declare effective additional digital funds; our ability to successfully operate and expand our business in non-U.S. markets; the effect of laws and regulations that apply to our business; the potential effects of the resolution of the Contractual Gold Payments obligation on our earnings per share, net income, operating income, operating margin, interest income, dilution and the price of our common stock; the impact and contributions of the slate of director nominees our Company has nominated; the effectiveness of the Company’s board refreshment process in identifying director candidates with the set of skills to oversee the Company’s strategy; the ability of the director candidates proposed by Mr. Tuckwell to enhance the Company’s board or enhance its strategy; and actions of activist stockholders. Our business is subject to many risks and uncertainties, including without limitation: • declining prices of securities, gold and other precious metals and other commodities and changes in interest rates and general market conditions can adversely affect our business by reducing the market value of the assets we manage or causing WisdomTree ETP investors to sell their fund shares and trigger redemptions; • fluctuations in the amount and mix of our AUM, whether caused by disruptions in the financial markets or otherwise, including but not limited to a pandemic event such as COVID-19, or the war in Ukraine, may negatively impact revenues and operating margins, and may impede our ability to refinance our debt upon maturity or increase the cost of borrowing upon a refinancing; • competitive pressures could reduce revenues and profit margins; • we derive a substantial portion of our revenues from a limited number of products, and as a result, our operating results are particularly exposed to investor sentiment toward investing in the products’ strategies and our ability to maintain the AUM of these products, as well as the performance of these products and market-specific and political and economic risk; • a significant portion of our AUM is held in products with exposure to U.S. and international developed markets and we therefore have exposure to domestic and foreign market conditions and are subject to currency exchange rate risks; • withdrawals or broad changes in investments in our ETPs by investors with significant positions may negatively impact revenues and operating margins; • we face increased operational, regulatory, financial and other risks as a result of conducting our business internationally; • many of our ETPs have a limited track record, and poor investment performance could cause our revenues to decline; • we depend on third parties to provide many critical services to operate our business and our ETPs. The failure of key vendors to adequately provide such services could materially affect our operating business and harm WisdomTree ETP investors; and • actions of activist stockholders against us have been costly and may be disruptive and cause uncertainty about the strategic direction of our business. Other factors, such as general economic conditions, including currency exchange rate fluctuations, also may have an effect on the results of our operations. For a more complete description of the risks noted above and other risks that could cause our actual results to differ from our current expectations, see “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022. The forward-looking statements in this presentation represent our views as of the date of this presentation. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views as of any date other than the date of this presentation. Disclaimer WisdomTree has neither sought nor obtained the consent from any third party to use any statements of information contained in this presentation that have been obtained or derived from statements made or published by such third parties. Any such statements or information should not be viewed as indicating the support of such third parties for the views expressed herein. 2

Table of Contents Page 1. Company Overview 6 2. Financial and Operating Performance 13 3. Trading Performance 18 4. Tokenization and Digital Assets Opportunity Charts a Course for Accelerated Long-Term Growth 21 5. Powerful Vision for the Future of WisdomTree and Long-term Stockholder Value Creation 27 6. Our Board Has Completed a Comprehensive Review of WisdomTree’s Operations & Strategy 31 7. We Have Deliberately and Thoughtfully Assembled the Right Board For Continued Success 36 8. ETFS Capital’s Campaign is Unjustified, Unwise and Risks Value Destruction 47 9. Setting the Record Straight 55 Conclusion 59 Appendix WisdomTree, WisdomTree Prime and the Company logo are trademarks of WisdomTree, Inc., in the United States and elsewhere, whether or not accompanied by a trademark symbol. All

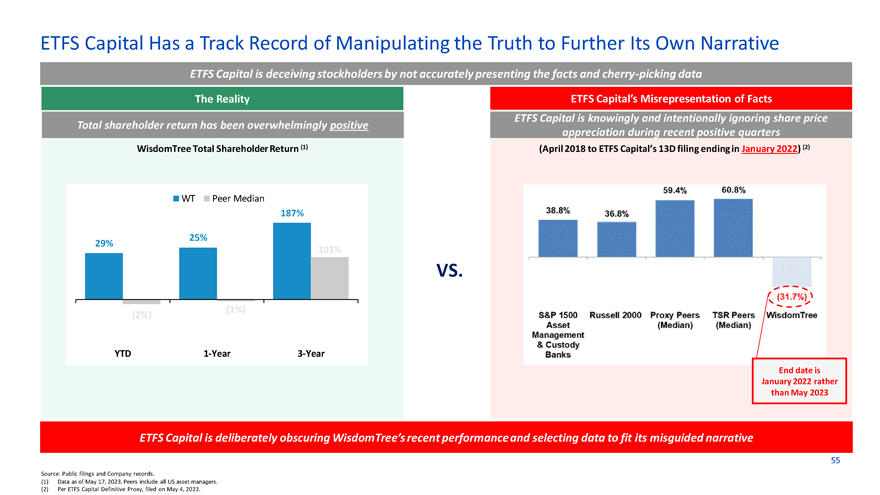

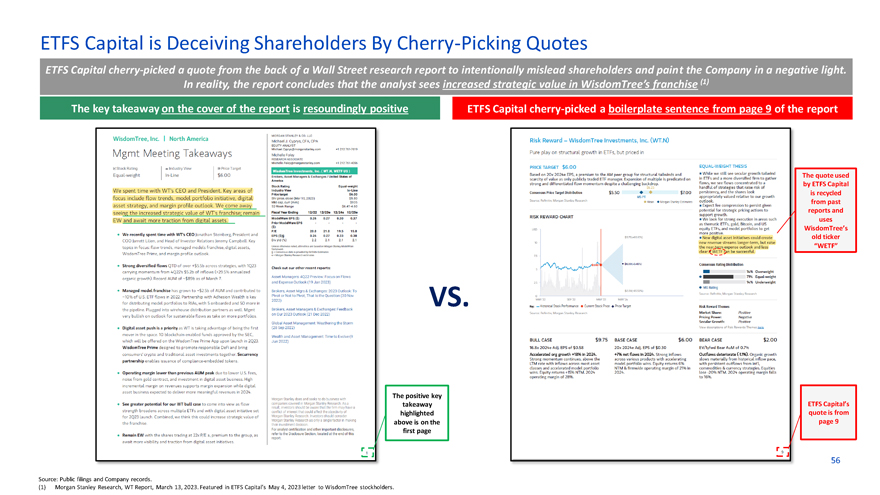

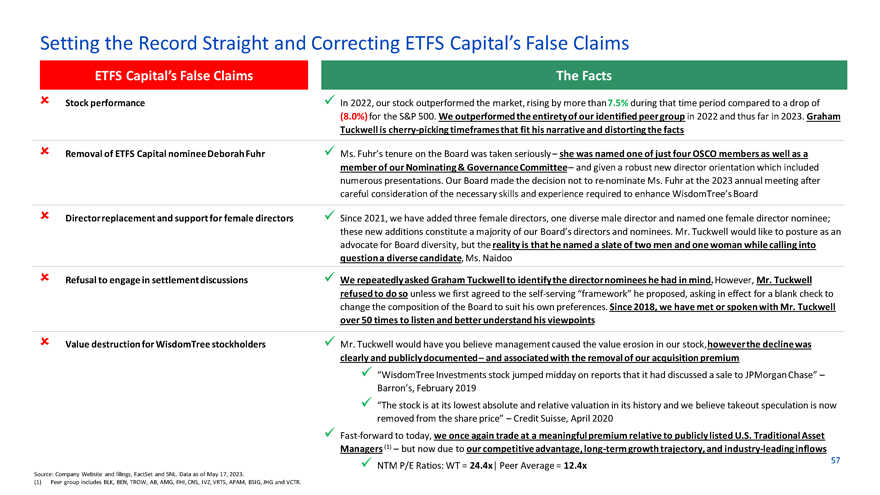

WisdomTree Has Transformed its Business to Position it for Innovation, Growth and Margin Expansion Opportunities and Refreshed its Board and Corporate Governance Practices • • We have created the largest pure-play ETP platform with a high-quality, diversified, and differentiated product suite We Have Transformed the We have enhanced our ETP platform from a small number of funds, concentrated AUM and outflows to one with a broader suite of funds, diversified AUM and consistent inflows Business to a Best-in-Class ETP • With the exception of BlackRock, WidsomTree is the only publicly listed U.S. traditional asset manager to have consistent inflows for the Platform, Which has Consistently Outperformed Peers past 10 quarters • Our efforts to transform the Company have been rewarded by the market, which has made WisdomTree the best performing stock over the past three years, one year and year-to-date, relative to all other publicly listed U.S. traditional asset managers (1) • By focusing on (i) the most relevant investment themes and (ii) areas where we can capture outsized wins, we will continue to take market share Focused & Aggressive Organic Growth and position WisdomTree as the #1 Traditional Asset Manager in the U.S. + • WisdomTree’s 31.4% 2023 YTD annualized organic growth and 15.7% 2022 organic growth are significantly ahead of its publicly listed Forward Looking Leadership U.S. traditional asset management peers = • It is not enough to just win today and tomorrow, by investing in digital assets, tokenization and blockchain-enabled finance, we are ensuring that WisdomTree Continuing to our competitors do not gain any advantages over our platform in the future – we are committed to ensuring that WisdomTree will outperform Outpace Peers peers on a long-term basis • Our long-term strategy will continue to provide scale, stability, and margin expansion • Assembled experience, expertise, and diversity critical to overseeing WisdomTree’s long-term strategy and maintaining momentum We Have Undertaken a Rigorous • Appointed five new independent directors since 2021, all of whom are diverse Review of our Strategy and • Established an Operations and Strategy Committee of the Board to conduct a review that resulted in unanimous support of our strategy and Assembled the Right Board for management Continued Success • Enhanced corporate governance and compensation practices to increase alignment and accountability to stockholders • Long track record of attempting to engage constructively with ETFS Capital despite its unreasonableness • Unnecessary: Our Board – with input from ETFS Capital and their nominees from their 2022 campaign – extensively reviewed WisdomTree’s ETFS Capital’s Campaign is strategy last year and unanimously supported the Company’s strategy and management Unnecessary, Unwise and Risks • Unwise: WisdomTree risks losing integral expertise if Graham Tuckwell and ETFS Capital’s nominees are elected Value Destruction • Risks value destruction: Graham Tuckwell’s past and continuing conduct raises serious questions about his and ETFS Capital’s ethics and decision making Source: Company Website and filings, FactSet and SNL. Data as of May 17, 2023. (1) Based on Total Shareholder Return. Peer group includes BLK, BEN, TROW, AB, AMG, FHI, CNS, IVZ, VRTS, APAM, BSIG, JHG and VCTR.

Company Overview

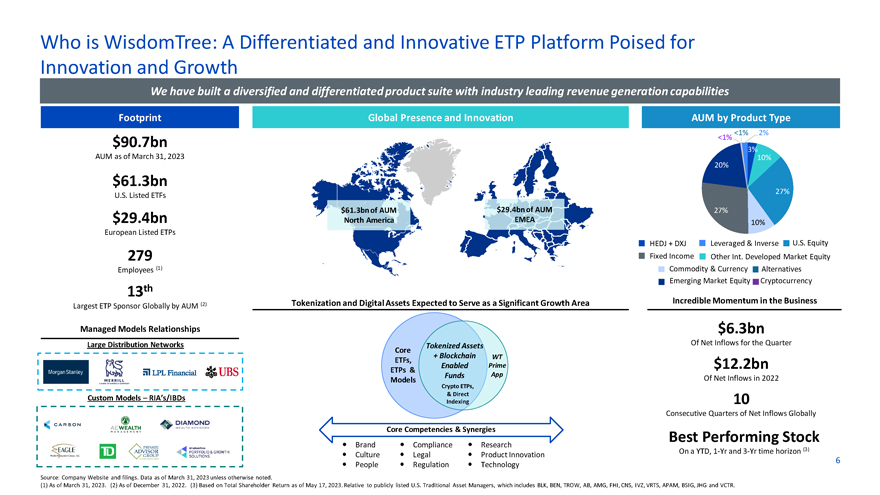

Who is WisdomTree: A Differentiated and Innovative ETP Platform Poised for Innovation and Growth We have built a diversified and differentiated product suite with industry leading revenue generation capabilities Footprint Global Presence and Innovation AUM by Product Type <1% 2% $90.7bn <1% 3% AUM as of March 31, 2023 10% 20% $61.3bn 27% U.S. Listed ETFs $61.3bn of AUM $29.4bn of AUM 27% $29.4bn North America EMEA 10% European Listed ETPs HEDJ + DXJ Leveraged & Inverse U.S. Equity 279 Fixed Income Other Int. Developed Market Equity Employees (1) Commodity & Currency Alternatives th Emerging Market Equity Cryptocurrency 13 Incredible Momentum in the Business Largest ETP Sponsor Globally by AUM (2) Tokenization and Digital Assets Expected to Serve as a Significant Growth Area Managed Models Relationships $6.3bn Large Distribution Networks Tokenized Assets Of Net Inflows for the Quarter Core + Blockchain WT ETFs, Prime Enabled $12.2bn ETPs & Funds App Models Of Net Inflows in 2022 Crypto ETPs, & Direct Custom Models – RIA’s/IBDs Indexing 10 Consecutive Quarters of Net Inflows Globally Core Competencies & Synergies Best Performing Stock ï,— Brandï,— Complianceï,— Research On a YTD, 1-Yr and 3-Yr time horizon (3)ï,— Cultureï,— Legalï,— Product Innovation 6 ï,— Peopleï,— Regulationï,— Technology Source: Company Website and filings. Data as of March 31, 2023 unless otherwise noted. (1) As of March 31, 2023. (2) As of December 31, 2022. (3) Based on Total Shareholder Return as of May 17, 2023. Relative to publicly listed U.S. Traditional Asset Managers, which includes BLK, BEN, TROW, AB, AMG, FHI, CNS, IVZ, VRTS, APAM, BSIG, JHG and VCTR.

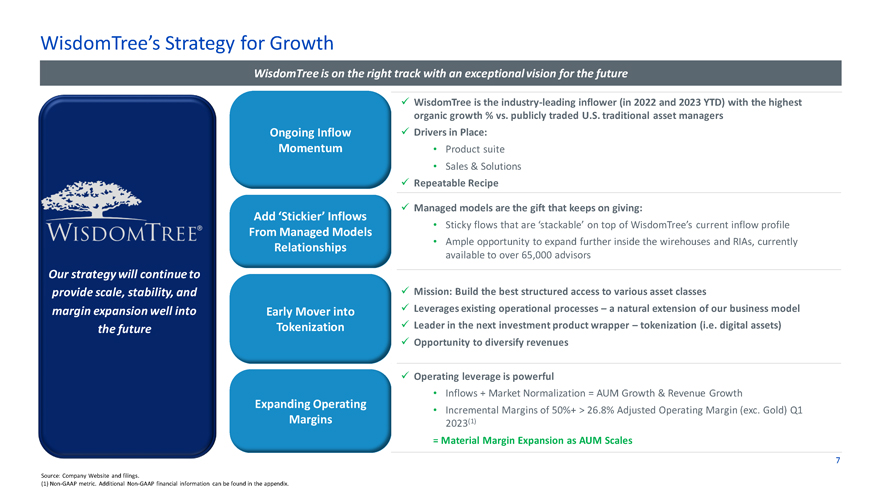

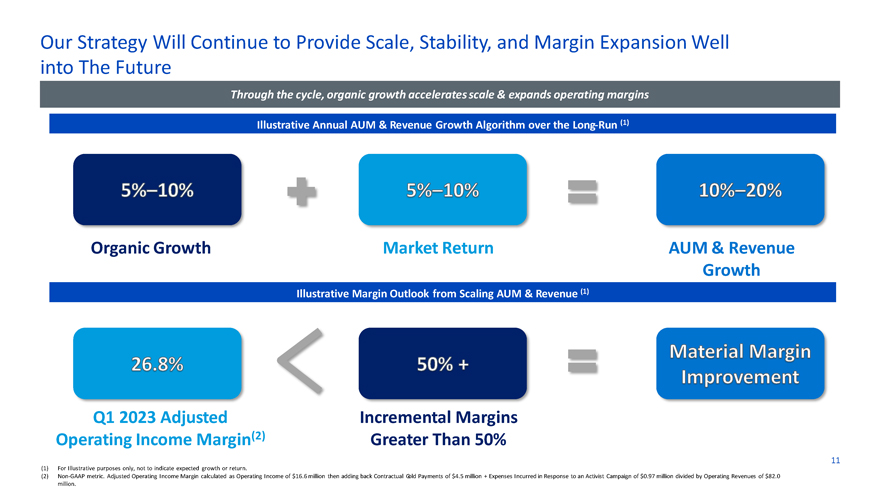

WisdomTree’s Strategy for Growth WisdomTree is on the right track with an exceptional vision for the future ✓ WisdomTree is the industry-leading inflower (in 2022 and 2023 YTD) with the highest organic growth % vs. publicly traded U.S. traditional asset managers Ongoing Inflow ✓ Drivers in Place: Momentum • Product suite • Sales & Solutions ✓ Repeatable Recipe ✓ Managed models are the gift that keeps on giving: Add ‘Stickier’ Inflows Sticky flows that are ‘stackable’ on top of WisdomTree’s current inflow profile • From Managed Models • Ample opportunity to expand further inside the wirehouses and RIAs, currently Relationships available to over 65,000 advisors Our strategy will continue to provide scale, stability, and ✓ Mission: Build the best structured access to various asset classes margin expansion well into Early Mover into ✓ Leverages existing operational processes – a natural extension of our business model the future Tokenization ✓ Leader in the next investment product wrapper – tokenization (i.e. digital assets) ✓ Opportunity to diversify revenues ✓ Operating leverage is powerful • Inflows + Market Normalization = AUM Growth & Revenue Growth Expanding Operating • Incremental Margins of 50%+ > 26.8% Adjusted Operating Margin (exc. Gold) Q1 Margins 2023(1) = Material Margin Expansion as AUM Scales 7 Source: Company Website and filings. (1) Non-GAAP metric. Additional Non-GAAP financial information can be found in the appendix.

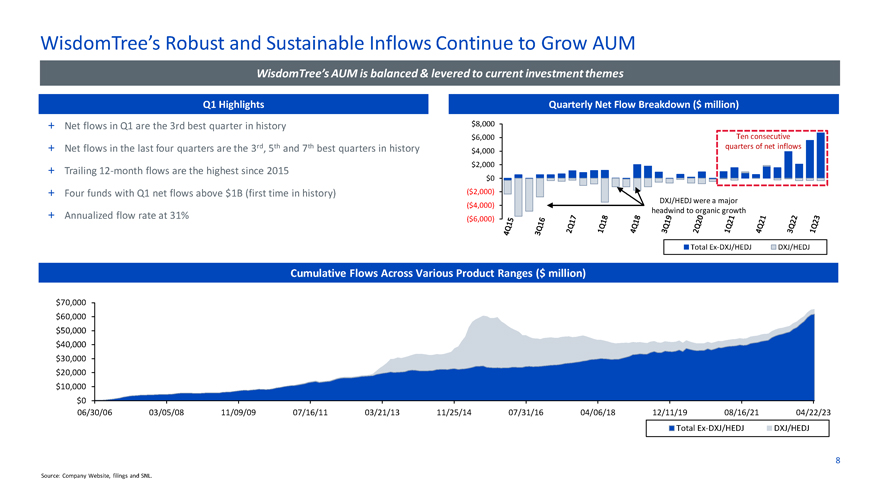

WisdomTree’s Robust and Sustainable Inflows Continue to Grow AUM WisdomTree’s AUM is balanced & levered to current investment themes Q1 Highlights Quarterly Net Flow Breakdown ($ million) + Net flows in Q1 are the 3rd best quarter in history $8,000 $6,000 Ten consecutive + Net flows in the last four quarters are the 3rd, 5th and 7th best quarters in history quarters of net inflows $4,000 $2,000 + Trailing 12-month flows are the highest since 2015 $0 + Four funds with Q1 net flows above $1B (first time in history) ($2,000) DXJ/HEDJ were a major ($4,000) headwind to organic growth + Annualized flow rate at 31% ($6,000) Total Ex-DXJ/HEDJ DXJ/HEDJ Cumulative Flows Across Various Product Ranges ($ million) $70,000 $60,000 $50,000 $40,000 $30,000 $20,000 $10,000 $0 06/30/06 03/05/08 11/09/09 07/16/11 03/21/13 11/25/14 07/31/16 04/06/18 12/11/19 08/16/21 04/22/23 Total Ex-DXJ/HEDJ DXJ/HEDJ 8 Source: Company Website, filings and SNL.

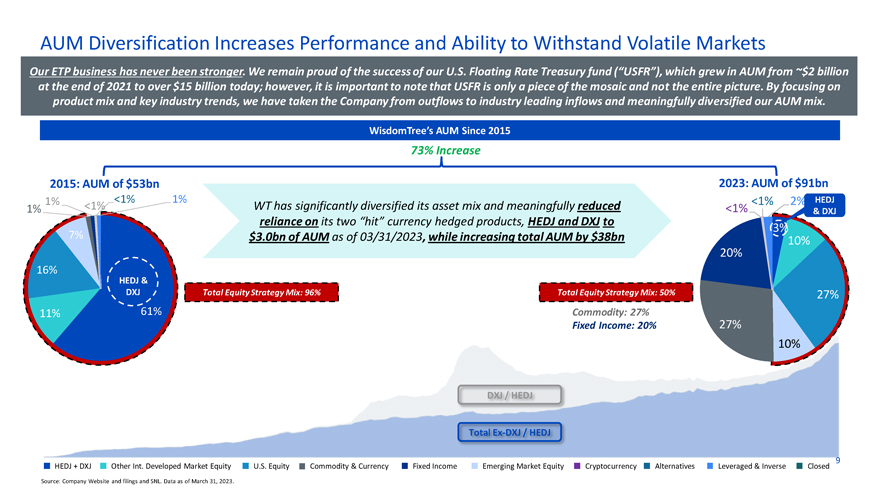

$ AUM Diversification Increases Performance and Ability to Withstand Volatile Markets Our ETP business has never been stronger. We remain proud of the success of our U.S. Floating Rate Treasury fund (“USFR”), which grew in AUM from ~$2 billion at the end of 2021 to over $15 billion today; however, it is important to note that USFR is only a piece of the mosaic and not the entire picture. By focusing on product mix and key industry trends, we have taken the Company from outflows to industry leading inflows and meaningfully diversified our AUM mix. WisdomTree’s AUM Since 2015 73% Increase 2015: AUM of $53bn 2023: AUM of $91bn 1% <1% 1% <1% 2% HEDJ 1% <1% WT has significantly diversified its asset mix and meaningfully reduced <1% & DXJ reliance on its two “hit” currency hedged products, HEDJ and DXJ to 3% 7% $3.0bn of AUM as of 03/31/2023, while increasing total AUM by $38bn 10% 20% 16% HEDJ & DXJ Total Equity Strategy Mix: 96% Total Equity Strategy Mix: 50% 27% 11% 61% Commodity: 27% Fixed Income: 20% 27% DXJ / HEDJ Total Ex-DXJ / HEDJ 9 HEDJ + DXJ Other Int. Developed Market Equity U.S. Equity Commodity & Currency Fixed Income Emerging Market Equity Cryptocurrency Alternatives Leveraged & Inverse Closed Source: Company Website and filings and SNL. Data as of March 31, 2023.

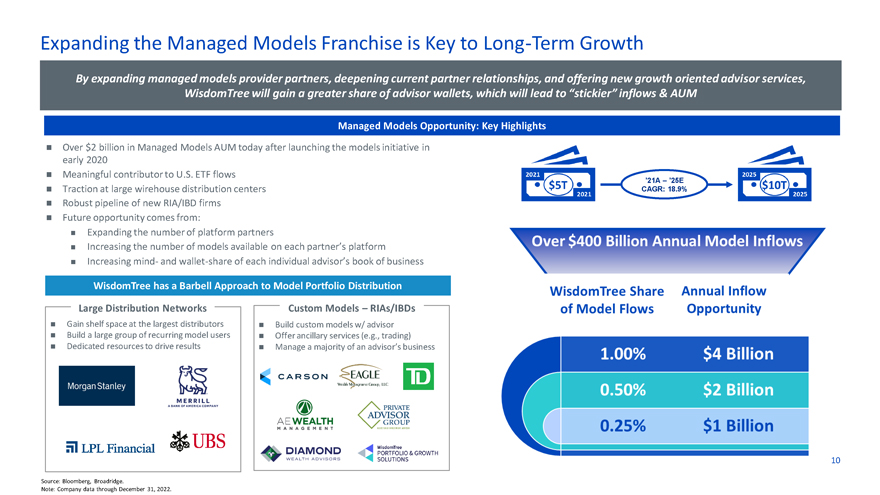

Expanding the Managed Models Franchise is Key to Long-Term Growth By expanding managed models provider partners, deepening current partner relationships, and offering new growth oriented advisor services, WisdomTree will gain a greater share of advisor wallets, which will lead to “stickier” inflows & AUM Managed Models Opportunity: Key Highlights â—¼ Over $2 billion in Managed Models AUM today after launching the models initiative in early 2020 â—¼ Meaningful contributor to U.S. ETF flows ’21A – ’25E â—¼ Traction at large wirehouse distribution centers CAGR: 18.9% â—¼ Robust pipeline of new RIA/IBD firms â—¼ Future opportunity comes from: â—¼ Expanding the number of platform partners â—¼ Increasing the number of models available on each partner’s platform â—¼ Increasing mind- and wallet-share of each individual advisor’s book of business WisdomTree has a Barbell Approach to Model Portfolio Distribution Large Distribution Networks Custom Models – RIAs/IBDs â—¼ Gain shelf space at the largest distributors â—¼ Build custom models w/ advisor â—¼ Build a large group of recurring model users â—¼ Offer ancillary services (e.g., trading) â—¼ Dedicated resources to drive results â—¼ Manage a majority of an advisor’s business 10 Source: Bloomberg, Broadridge. Note: Company data through December 31, 2022.

Our Strategy Will Continue to Provide Scale, Stability, and Margin Expansion Well into The Future Through the cycle, organic growth accelerates scale & expands operating margins Illustrative Annual AUM & Revenue Growth Algorithm over the Long-Run (1) Organic Growth Market Return AUM & Revenue Growth Illustrative Margin Outlook from Scaling AUM & Revenue (1) Q1 2023 Adjusted Incremental Margins Operating Income Margin(2) Greater Than 50% 11 (1) For Illustrative purposes only, not to indicate expected growth or return. (2) Non-GAAP metric. Adjusted Operating Income Margin calculated as Operating Income of $16.6 million then adding back Contractual Gold Payments of $4.5 million + Expenses Incurred in Response to an Activist Campaign of $0.97 million divided by Operating Revenues of $82.0 million.

Financial and Operating Performance

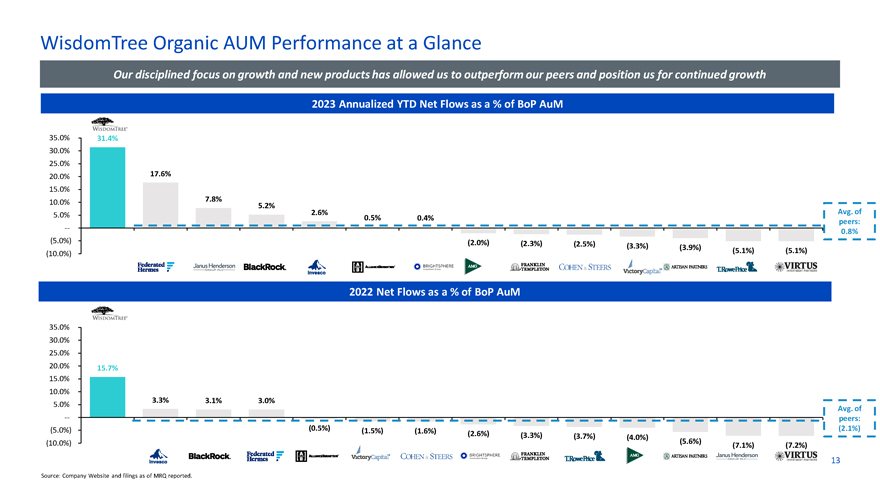

WisdomTree Organic AUM Performance at a Glance Our disciplined focus on growth and new products has allowed us to outperform our peers and position us for continued growth 2023 Annualized YTD Net Flows as a % of BoP AuM 35.0% 31.4% 30.0% 25.0% 20.0% 17.6% 15.0% 10.0% 7.8% 5.2% 2.6% Avg. of 5.0% 0.5% 0.4% peers: — 0.8% (5.0%) (2.0%) (2.3%) (2.5%) (3.3%) (3.9%) (10.0%) (5.1%) (5.1%) WT FHI BLK IVZ AB AMG BEN CNS VCTR APAM TROW VRTS 2022 Net Flows as a % of BoP AuM 35.0% 30.0% 25.0% 20.0% 15.7% 15.0% 10.0% 3.3% 3.1% 3.0% 5.0% Avg. of — peers: (5.0%) (0.5%) (1.5%) (1.6%) (2.1%) (2.6%) (3.3%) (3.7%) (4.0%) (10.0%) (5.6%) (7.1%) (7.2%) WT IVZ BLK FHI AB VCTR CNS BEN TROW AMG APAM VRTS 13 Source: Company Website and filings as of MRQ reported.

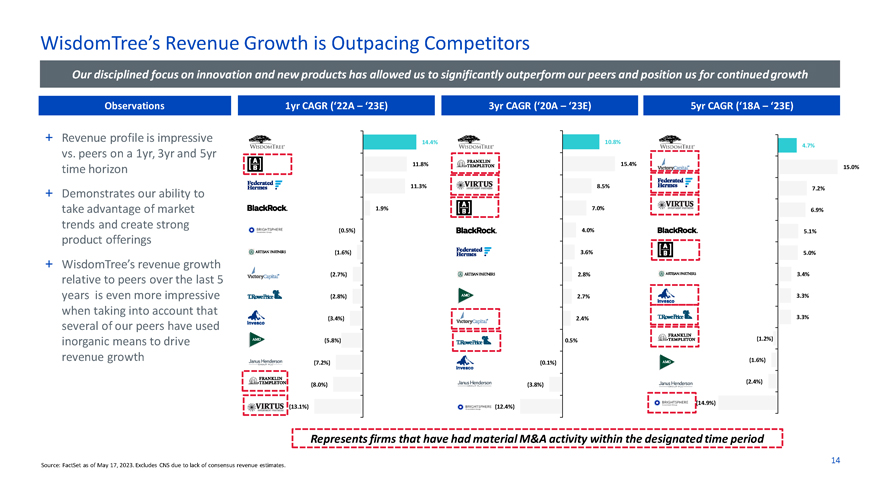

WisdomTree’s Revenue Growth is Outpacing Competitors Our disciplined focus on innovation and new products has allowed us to significantly outperform our peers and position us for continued growth Observations 1yr CAGR (‘22A – ‘23E) 3yr CAGR (‘20A – ‘23E) 5yr CAGR (‘18A – ‘23E) + Revenue profile is impressive 14.4% 10.8% vs. peers on a 1yr, 3yr and 5yr 4.7% 11.8% 15.4% time horizon 15.0% + Demonstrates our ability to 11.3% 8.5% 7.2% take advantage of market 1.9% 7.0% 6.9% trends and create strong (0.5%) 4.0% 5.1% product offerings (1.6%) 3.6% 5.0% + WisdomTree’s revenue growth (2.7%) 2.8% 3.4% relative to peers over the last 5 years is even more impressive (2.8%) 2.7% 3.3% when taking into account that 3.3% several of our peers have used (3.4%) 2.4% inorganic means to drive (5.8%) 0.5% (1.2%) revenue growth (1.6%) (7.2%) (0.1%) (2.4%) (8.0%) (3.8%) (14.9%) (13.1%) (12.4%) Represents firms that have had material M&A activity within the designated time period 14 Source: FactSet as of May 17, 2023. Excludes CNS due to lack of consensus revenue estimates.

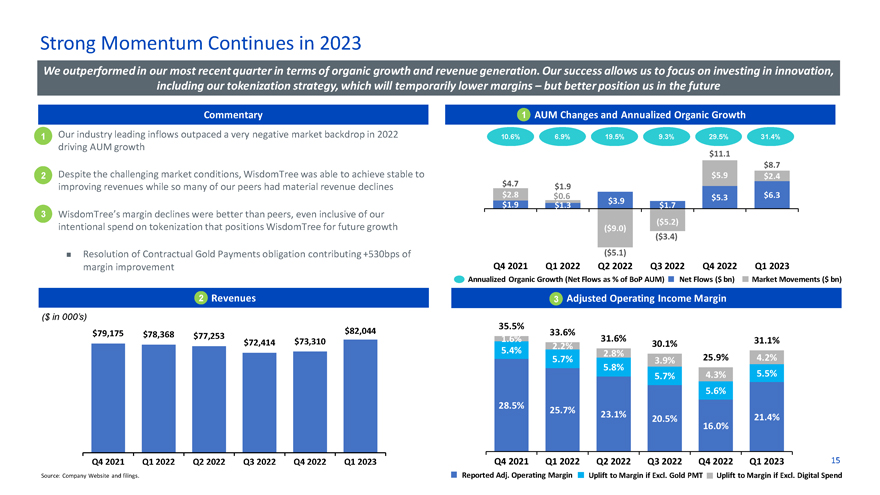

Strong Momentum Continues in 2023 We outperformed in our most recent quarter in terms of organic growth and revenue generation. Our success allows us to focus on investing in innovation, including our tokenization strategy, which will temporarily lower margins – but better position us in the future Commentary 1 AUM Changes and Annualized Organic Growth 1 â—¼ Our industry leading inflows outpaced a very negative market backdrop in 2022 10.6% 6.9% 19.5% 9.3% 29.5% 31.4% driving AUM growth $11.1 $8.7 2 â—¼ Despite the challenging market conditions, WisdomTree was able to achieve stable to $5.9 $2.4 improving revenues while so many of our peers had material revenue declines $4.7 $1.9 $2.8 $0.6 $5.3 $6.3 $3.9 $1.9 $1.3 $1.7 3 â—¼ WisdomTree’s margin declines were better than peers, even inclusive of our ($5.2) intentional spend on tokenization that positions WisdomTree for future growth ($9.0) ($3.4) â—¼ Resolution of Contractual Gold Payments obligation contributing +530bps of ($5.1) margin improvement Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Annualized Organic Growth (Net Flows as % of BoP AUM) Net Flows ($ bn) Market Movements ($ bn) 2 Revenues 3 Adjusted Operating Income Margin ($ in 000’s) 35.5% $79,175 $78,368 $82,044 33.6% $77,253 1.6% 31.6% $72,414 $73,310 30.1% 31.1% 2.2% 5.4% 2.8% 5.7% 3.9% 25.9% 4.2% 5.8% 5.7% 4.3% 5.5% 5.6% 28.5% 25.7% 23.1% 21.4% 20.5% 16.0% Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 15 Source: Company Website and filings. Reported Adj. Operating Margin Uplift to Margin if Excl. Gold PMT Uplift to Margin if Excl. Digital Spend

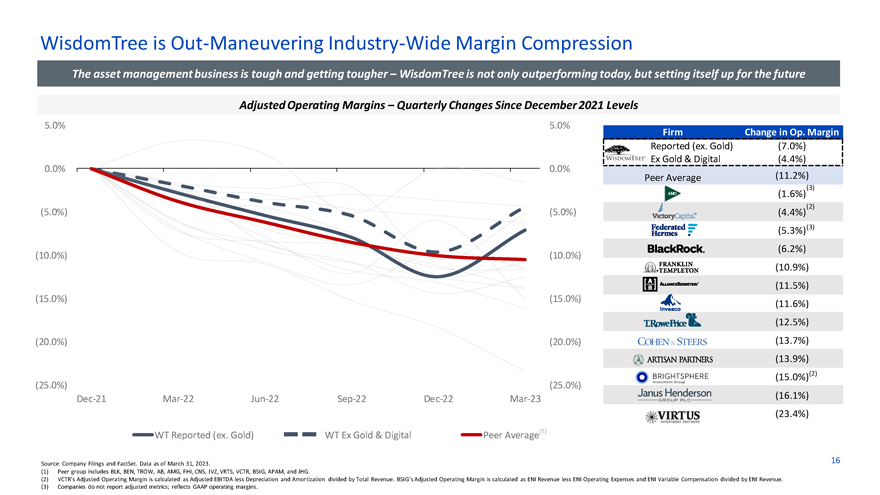

WisdomTree is Out-Maneuvering Industry-Wide Margin Compression The asset management business is tough and getting tougher – WisdomTree is not only outperforming today, but setting itself up for the future Adjusted Operating Margins – Quarterly Changes Since December 2021 Levels 5.0% 5.0% Firm Change in Op. Margin Reported (ex. Gold) (7.0%) Ex Gold & Digital (4.4%) 0.0% 0.0% Peer Average (11.2%) (3) (1.6%) (2) (5.0%) (5.0%) (4.4%) (5.3%)(3) (6.2%) (10.0%) (10.0%) (10.9%) (11.5%) (15.0%) (15.0%) (11.6%) (12.5%) (20.0%) (20.0%) (13.7%) (13.9%) (15.0%)(2) (25.0%) (25.0%) Dec-21 Mar-22 Jun-22 Sep-22 Dec-22 Mar-23 (16.1%) (23.4%) WT Reported (ex. Gold) WT Ex Gold & Digital Peer Average(1) 16 Source: Company Filings and FactSet. Data as of March 31, 2023. (1) Peer group includes BLK, BEN, TROW, AB, AMG, FHI, CNS, IVZ, VRTS, VCTR, BSIG, APAM, and JHG. (2) VCTR’s Adjusted Operating Margin is calculated as Adjusted EBITDA less Depreciation and Amortization divided by Total Revenue. BSIG’s Adjusted Operating Margin is calculated as ENI Revenue less ENI Operating Expenses and ENI Variable Compensation divided by ENI Revenue. (3) Companies do not report adjusted metrics; reflects GAAP operating margins.

Trading Performance

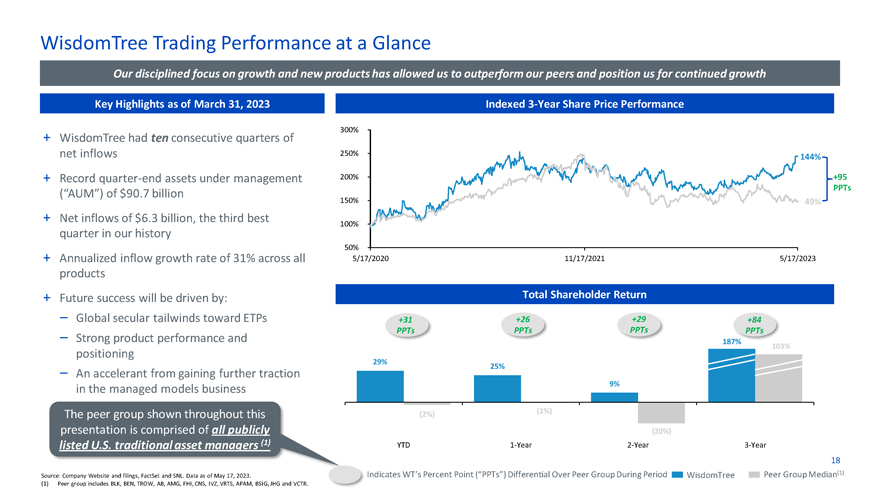

WisdomTree Trading Performance at a Glance Our disciplined focus on growth and new products has allowed us to outperform our peers and position us for continued growth Key Highlights as of March 31, 2023 Indexed 3-Year Share Price Performance WisdomTree had ten quarters 300% + consecutive of net inflows 250% 144% + Record quarter-end assets under management 200% +95 PPTs (“AUM”) of $90.7 billion 150% 49% + Net inflows of $6.3 billion, the third best 100% quarter in our history 50% + Annualized inflow growth rate of 31% across all 5/17/2020 11/17/2021 5/17/2023 products + Future success will be driven by: Total Shareholder Return – Global secular tailwinds toward ETPs +31 +26 +29 +84 product performance PPTs PPTs PPTs PPTs – Strong and 18 103% positioning 29% 25% – An accelerant from gaining further traction in the managed models business 9% (1%) The peer group shown throughout this (2%) presentation is comprised of all publicly (20%) listed U.S. traditional asset managers (1) YTD 1-Year 2-Year 3-Year 18 Indicates WT’s Percent Point (“PPTs”) Differential Over Peer Group During Period Peer Group Median(1) Source: Company Website and filings, FactSet and SNL. Data as of May 17, 2023. WisdomTree (1) Peer group includes BLK, BEN, TROW, AB, AMG, FHI, CNS, IVZ, VRTS, APAM, BSIG, JHG and VCTR.

Our Disciplined and Innovative Efforts Have Been Well Received by the Market Total Shareholder Return appreciation relative to peers reflects our positive momentum and growth trajectory Total Shareholder Return + We have outperformed all traditional asset YTD 1 Year 3 Years managers in the past 3 years 29% 25% 187% + WisdomTree continues to deliver for its stockholders by maintaining a strong 22% 23% 183% understanding of what investors look for 16% 16% 154% + YTD, WisdomTree has outperformed all 13 of its direct peers in the traditional asset 13% 11% 149% management space 7% 9% 136% The peer group shown throughout 4% 7% 128% this presentation is comprised of all 2% 2% 112% publicly listed U.S. traditional asset (2%) (1%) 103% managers (5%) (1%) 75% (6%) (4%) 57% (8%) (8%) 56% (10%) (12%) 36% (12%) (15%) 5% (14%) (21%) 4% 19 Source: FactSet as of May 17, 2023.

Tokenization and Digital Assets Opportunity Charts a Course for Accelerated Long-Term Growth

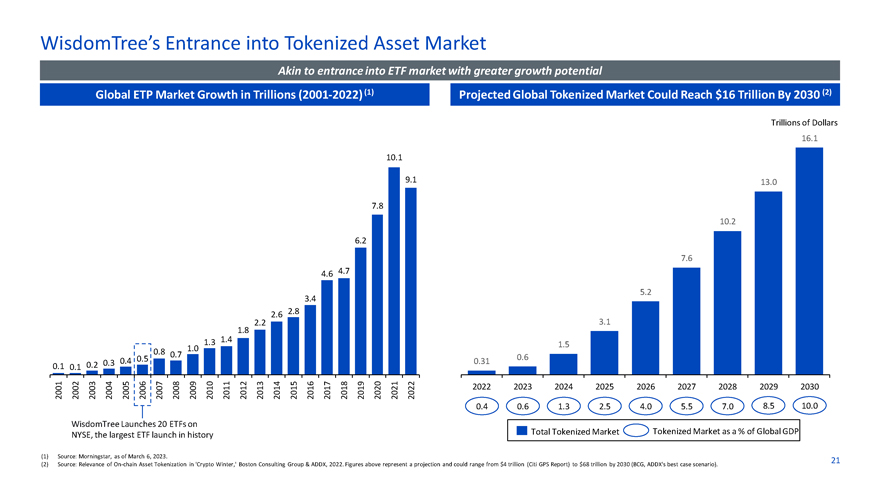

WisdomTree’s Entrance into Tokenized Asset Market Akin to entrance into ETF market with greater growth potential Global ETP Market Growth in Trillions (2001-2022)(1) Projected Global Tokenized Market Could Reach $16 Trillion By 2030 (2) Trillions of Dollars 16.1 10.1 9.1 13.0 7.8 10.2 6.2 7.6 4.6 4.7 3.4 5.2 2.6 2.8 2.2 3.1 1.8 1.3 1.4 1.5 0.8 1.0 0.7 0.6 0.4 0.5 0.31 0.1 0.2 0.3 0.1 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2022 2023 2024 2025 2026 2027 2028 2029 2030 0.4 0.6 1.3 2.5 4.0 5.5 7.0 8.5 10.0 WisdomTree Launches 20 ETFs on Tokenized Market as a % of Global GDP NYSE, the largest ETF launch in history Total Tokenized Market (1) Source: Morningstar, as of March 6, 2023. 21 (2) Source: Relevance of On-chain Asset Tokenization in ‘Crypto Winter,’ Boston Consulting Group & ADDX, 2022. Figures above represent a projection and could range from $4 trillion (Citi GPS Report) to $68 trillion by 2030 (BCG, ADDX’s best case scenario).

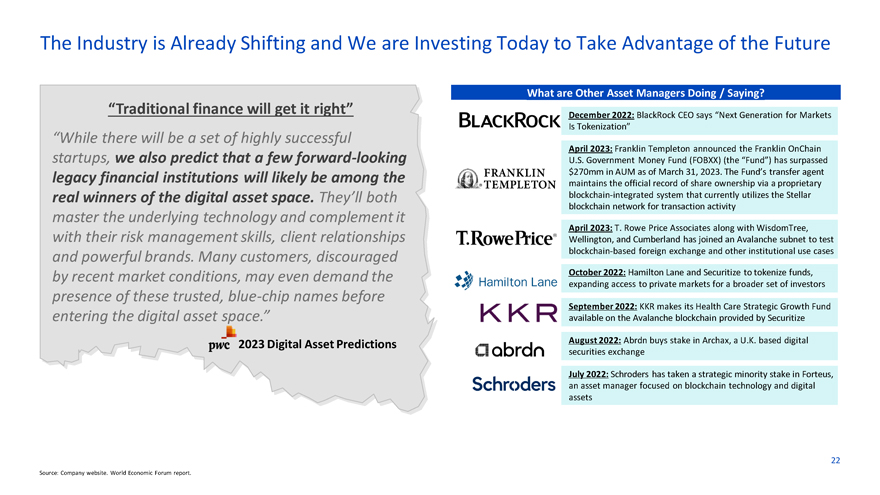

The Industry is Already Shifting and We are Investing Today to Take Advantage of the Future What are Other Asset Managers Doing / Saying? “Traditional finance will get it right” December 2022: BlackRock CEO says “Next Generation for Markets Is Tokenization” “While there will be a set of highly successful April 2023: Franklin Templeton announced the Franklin OnChain startups, we also predict that a few forward-looking U.S. Government Money Fund (FOBXX) (the “Fund”) has surpassed legacy financial institutions will likely be among the $270mm in AUM as of March 31, 2023. The Fund’s transfer agent maintains the official record of share ownership via a proprietary real winners of the digital asset space. They’ll both blockchain-integrated system that currently utilizes the Stellar master the underlying technology and complement it blockchain network for transaction activity April 2023: T. Rowe Price Associates along with WisdomTree, with their risk management skills, client relationships Wellington, and Cumberland has joined an Avalanche subnet to test and powerful brands. Many customers, discouraged blockchain-based foreign exchange and other institutional use cases by recent market conditions, may even demand the October 2022: Hamilton Lane and Securitize to tokenize funds, expanding access to private markets for a broader set of investors presence of these trusted, blue-chip names before September 2022: KKR makes its Health Care Strategic Growth Fund entering the digital asset space.” available on the Avalanche blockchain provided by Securitize 2023 Digital Asset Predictions August 2022: Abrdn buys stake in Archax, a U.K. based digital securities exchange July 2022: Schroders has taken a strategic minority stake in Forteus, an asset manager focused on blockchain technology and digital assets 22 Source: Company website. World Economic Forum report.

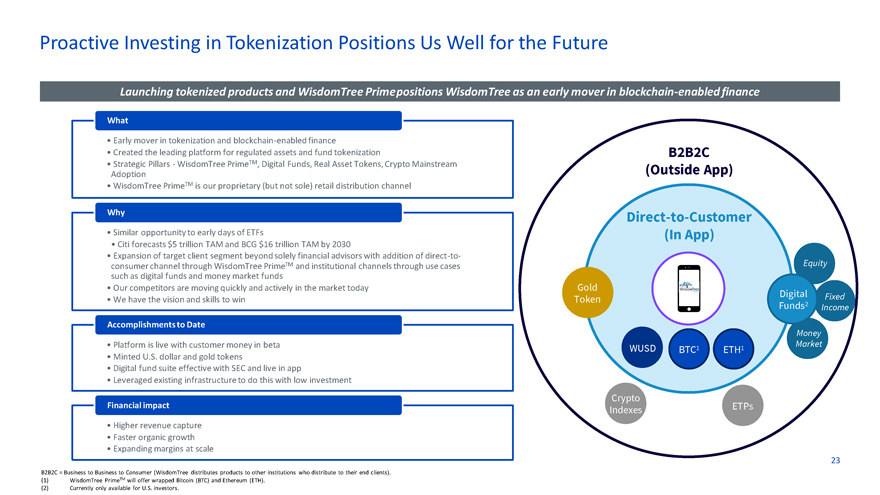

Proactive Investing in Tokenization Positions Us Well for the Future Launching tokenized products and WisdomTree Primepositions WisdomTree as an early mover in blockchain-enabled finance What • Early mover in tokenization and blockchain-enabled finance • Created the leading platform for regulated assets and fund tokenization B2B2C • Strategic Pillars—WisdomTree PrimeTM, Digital Funds, Real Asset Tokens, Crypto Mainstream (Outside App) Adoption • WisdomTree PrimeTM is our proprietary (but not sole) retail distribution channel Why Direct-to-Customer • Similar opportunity to early days of ETFs (In App) • Citi forecasts $5 trillion TAM and BCG $16 trillion TAM by 2030 • Expansion of target client segment beyond solely financial advisors with addition of direct-to-consumer channel through WisdomTree PrimeTM and institutional channels through use cases Equity such as digital funds and money market funds • Our competitors are moving quickly and actively in the market today Gold Digital Fixed • We have the vision and skills to win Token Funds2 Income Accomplishments to Date Money • Platform is live with customer money in beta WUSD 1 1 Market • Minted U.S. dollar and gold tokens BTC ETH • Digital fund suite effective with SEC and live in app • Leveraged existing infrastructure to do this with low investment SMA2 Financial impact Crypto Indexes ETPs • Higher revenue capture • Faster organic growth • Expanding margins at scale 23 B2B2C = Business to Business to Consumer (WisdomTree distributes products to other institutions who distribute to their end clients). (1) WisdomTree PrimeTM will offer wrapped Bitcoin (BTC) and Ethereum (ETH). (2) Currently only available for U.S. investors.

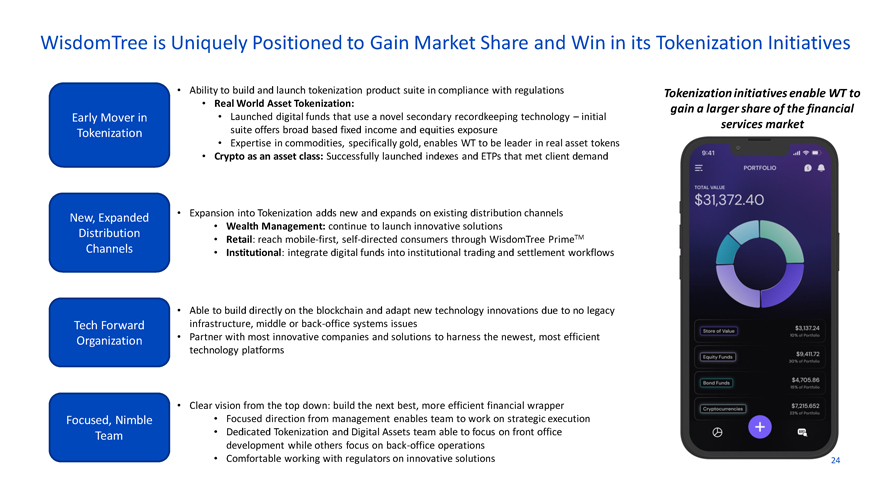

WisdomTree is Uniquely Positioned to Gain Market Share and Win in its Tokenization Initiatives • Ability to build and launch tokenization product suite in compliance with regulations Tokenization initiatives enable WT to • Real World Asset Tokenization: gain a larger share of the financial Early Mover in • Launched digital funds that use a novel secondary recordkeeping technology – initial services market Tokenization suite offers broad based fixed income and equities exposure • Expertise in commodities, specifically gold, enables WT to be leader in real asset tokens • Crypto as an asset class: Successfully launched indexes and ETPs that met client demand • Expansion into Tokenization adds new and expands on existing distribution channels New, Expanded • Wealth Management: continue to launch innovative solutions Distribution TM Channels • Retail: reach mobile-first, self-directed consumers through WisdomTree Prime • Institutional: integrate digital funds into institutional trading and settlement workflows • Able to build directly on the blockchain and adapt new technology innovations due to no legacy Tech Forward infrastructure, middle or back-office systems issues Organization • Partner with most innovative companies and solutions to harness the newest, most efficient technology platforms • Clear vision from the top down: build the next best, more efficient financial wrapper Focused, Nimble • Focused direction from management enables team to work on strategic execution Team • Dedicated Tokenization and Digital Assets team able to focus on front office development while others focus on back-office operations • Comfortable working with regulators on innovative solutions 24

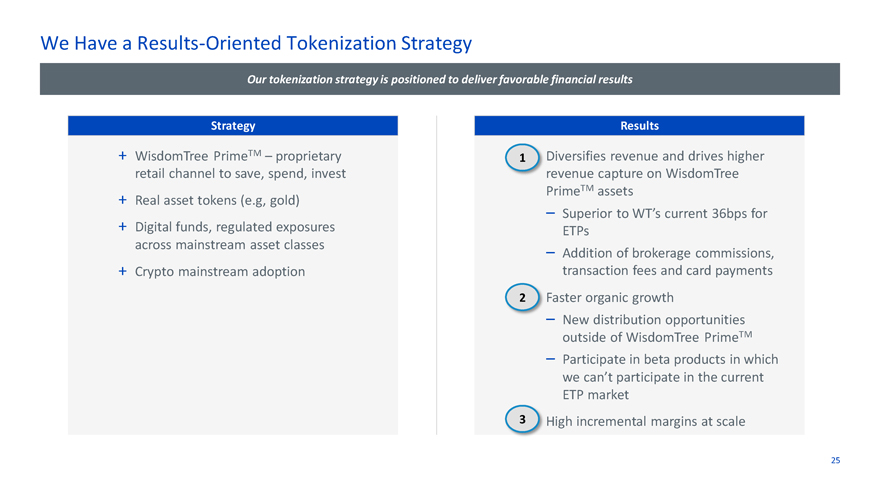

We Have a Results-Oriented Tokenization Strategy Our tokenization strategy is positioned to deliver favorable financial results Strategy Results + WisdomTree PrimeTM – proprietary 1 Diversifies revenue and drives higher retail channel to save, spend, invest revenue capture on WisdomTree + PrimeTM assets Real asset tokens (e.g, gold) – + Superior to WT’s current 36bps for Digital funds, regulated exposures ETPs across mainstream asset classes – Addition of brokerage commissions, + Crypto mainstream adoption transaction fees and card payments 2 Faster organic growth – New distribution opportunities outside of WisdomTree PrimeTM – Participate in beta products in which we can’t participate in the current ETP market 3 High incremental margins at scale 25

Powerful Vision for the Future of WisdomTree and Long-term Stockholder Value Creation

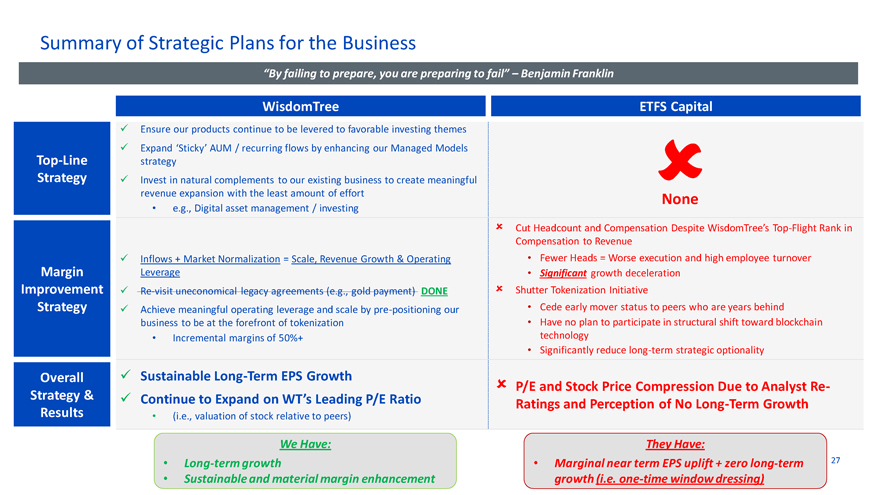

Summary of Strategic Plans for the Business “By failing to prepare, you are preparing to fail” – Benjamin Franklin WisdomTree ETFS Capital ? Ensure our products continue to be levered to favorable investing themes ? Expand ‘Sticky’ AUM / recurring flows by enhancing our Managed Models Top-Line strategy Strategy ? Invest in natural complements to our existing business to create meaningful ? revenue expansion with the least amount of effort None • e.g., Digital asset management / investing ? Cut Headcount and Compensation Despite WisdomTree’s Top-Flight Rank in Compensation to Revenue ? Inflows + Market Normalization = Scale, Revenue Growth & Operating • Fewer Heads = Worse execution and high employee turnover Margin Leverage • Significant growth deceleration Improvement ? Re-visit uneconomical legacy agreements (e.g., gold payment) DONE? Shutter Tokenization Initiative Strategy ? Achieve meaningful operating leverage and scale by pre-positioning our • Cede early mover status to peers who are years behind business to be at the forefront of tokenization • Have no plan to participate in structural shift toward blockchain • Incremental margins of 50%+ technology • Significantly reduce long-term strategic optionality Overall ? Sustainable Long-Term EPS Growth ? P/E and Stock Price Compression Due to Analyst Re-Strategy & ? Continue to Expand on WT’s Leading P/E Ratio Ratings and Perception of No Long-Term Growth Results • (i.e., valuation of stock relative to peers) We Have: They Have: • Long-term growth • Marginal near term EPS uplift + zero long-term 27 • Sustainable and material margin enhancement growth (i.e. one-time window dressing)

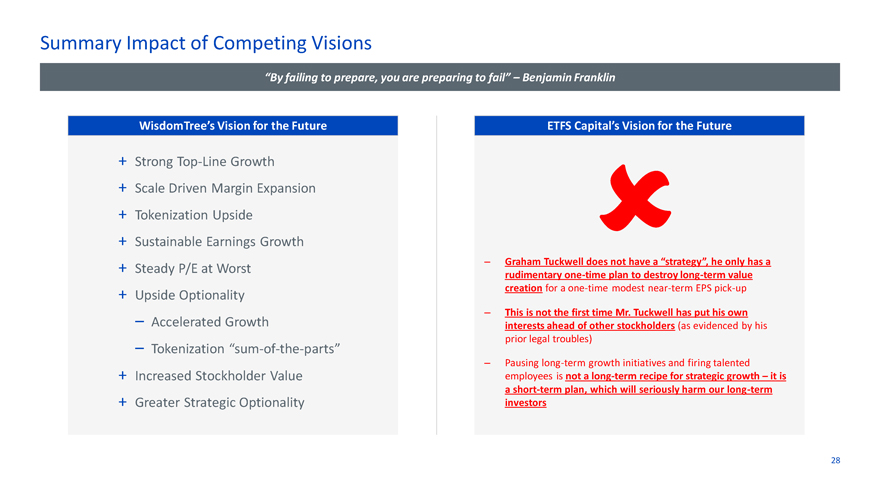

Summary Impact of Competing Visions “By failing to prepare, you are preparing to fail” – Benjamin Franklin WisdomTree’s Vision for the Future ETFS Capital’s Vision for the Future + Strong Top-Line Growth + Scale Driven Margin Expansion + Tokenization Upside + Sustainable Earnings Growth? + – Graham Tuckwell does not have a “strategy”, he only has a Steady P/E at Worst rudimentary one-time plan to destroy long-term value + creation for a one-time modest near-term EPS pick-up Upside Optionality Accelerated Growth – This is not the first time Mr. Tuckwell has put his own – interests ahead of other stockholders (as evidenced by his Tokenization prior legal troubles) – “sum-of-the-parts” – Pausing long-term growth initiatives and firing talented + Increased Stockholder Value employees is not a long-term recipe for strategic growth – it is a short-term plan, which will seriously harm our long-term + Greater Strategic Optionality investors 28

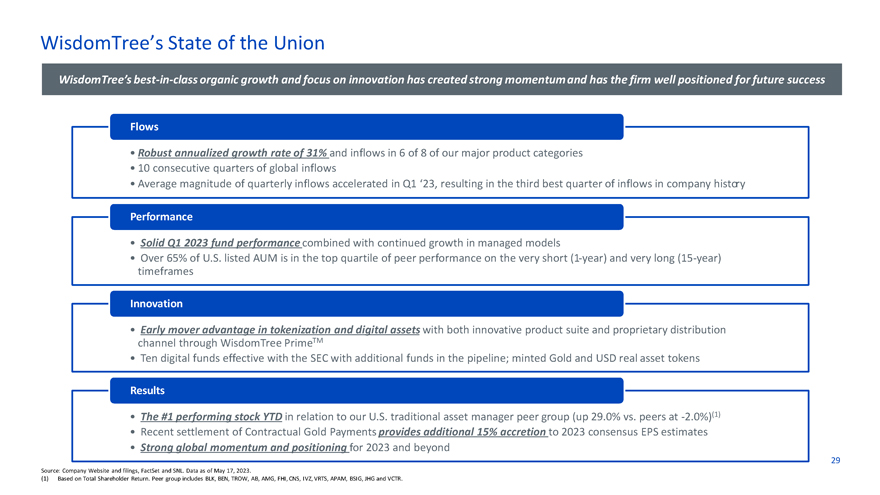

WisdomTree’s State of the Union WisdomTree’s best-in-class organic growth and focus on innovation has created strong momentum and has the firm well positioned for future success Flows • Robust annualized growth rate of 31% and inflows in 6 of 8 of our major product categories • 10 consecutive quarters of global inflows • Average magnitude of quarterly inflows accelerated in Q1 ‘23, resulting in the third best quarter of inflows in company history Performance • Solid Q1 2023 fund performance combined with continued growth in managed models • Over 65% of U.S. listed AUM is in the top quartile of peer performance on the very short (1-year) and very long (15-year) timeframes Innovation • Early mover advantage in tokenization and digital assets with both innovative product suite and proprietary distribution channel through WisdomTree PrimeTM • Ten digital funds effective with the SEC with additional funds in the pipeline; minted Gold and USD real asset tokens Results • The #1 performing stock YTD in relation to our U.S. traditional asset manager peer group (up 29.0% vs. peers at -2.0%)(1) • Recent settlement of Contractual Gold Payments provides additional 15% accretion to 2023 consensus EPS estimates • Strong global momentum and positioning for 2023 and beyond 29 Source: Company Website and filings, FactSet and SNL. Data as of May 17, 2023. (1) Based on Total Shareholder Return. Peer group includes BLK, BEN, TROW, AB, AMG, FHI, CNS, IVZ, VRTS, APAM, BSIG, JHG and VCTR.

Our Board Has Completed a Comprehensive Review of WisdomTree’s Operations & Strategy

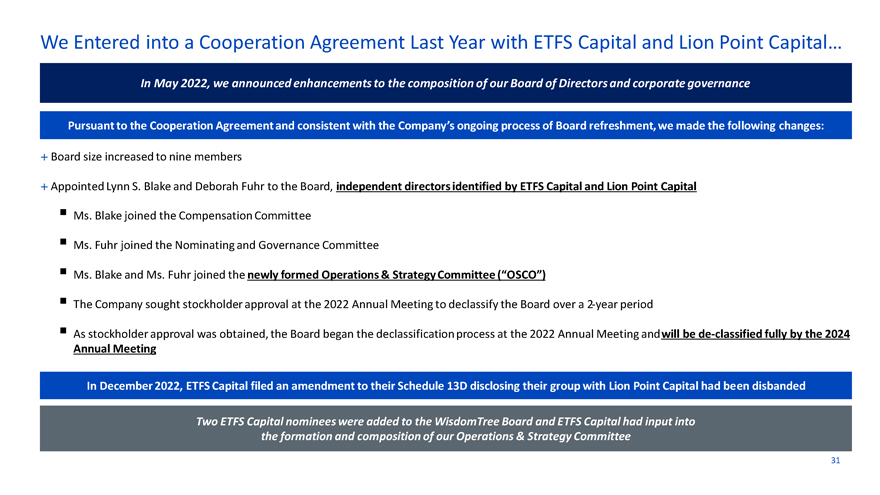

We Entered into a Cooperation Agreement Last Year with ETFS Capital and Lion Point Capital… In May 2022, we announced enhancements to the composition of our Board of Directors and corporate governance Pursuant to the Cooperation Agreement and consistent with the Company’s ongoing process of Board refreshment, we made the following changes: ïƒ^ Board size increased to nine members ïƒ^ Appointed Lynn S. Blake and Deborah Fuhr to the Board, independent directors identified by ETFS Capital and Lion Point Capital ? Ms. Blake joined the Compensation Committee ? Ms. Fuhr joined the Nominating and Governance Committee ? Ms. Blake and Ms. Fuhr joined the newly formed Operations & Strategy Committee (“OSCO”) ? The Company sought stockholder approval at the 2022 Annual Meeting to declassify the Board over a 2-year period ? As stockholder approval was obtained, the Board began the declassification process at the 2022 Annual Meeting andwill be de-classified fully by the 2024 Annual Meeting In December 2022, ETFS Capital filed an amendment to their Schedule 13D disclosing their group with Lion Point Capital had been disbanded Two ETFS Capital nominees were added to the WisdomTree Board and ETFS Capital had input into the formation and composition of our Operations & Strategy Committee 31

…And Formed a New Committee to Review WisdomTree’s Strategy & Operations 50% of OSCO members were directors nominated by ETFS Capital and ETFS Capital made multiple presentations to the Committee Committee Members Committee Charter Smita Conjeevaram Lynn S. Blakeïƒ^ The purpose of OSCO was to review operations and strategy OSCO Chair and Independent Director and make formal recommendations to the full Board on: Independent Director ? Operational improvement opportunities; ? Company strategy; Anthony Bossone Deborah Fuhr ? Management changes (if the Committee so Independent Director Independent Director determined); and ? Whether to continue or dissolve the Committee after it presented its recommendations. Denotes member of OSCO nominated by ETFS Capital ïƒ^ During the duration of the Committee’s existence, it was tasked with advising the Board in executive session on Prior to OSCO’s first meeting, Lynn S. Blake and Deborah Fuhr were provided with new management’s execution of the operational director orientation consisting of 8 sessions, which included 18 presentations from 41 recommendations made by the Committee presenters 32

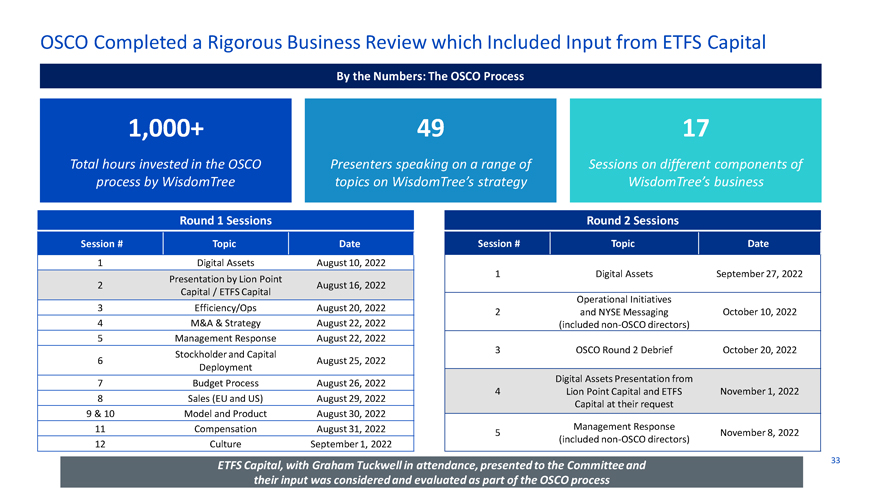

OSCO Completed a Rigorous Business Review which Included Input from ETFS Capital By the Numbers: The OSCO Process 1,000+ 49 17 Total hours invested in the OSCO Presenters speaking on a range of Sessions on different components of process by WisdomTree topics on WisdomTree’s strategy WisdomTree’s business Round 1 Sessions Round 2 Sessions Session # Topic Date Session # Topic Date 1 Digital Assets August 10, 2022 1 Digital Assets September 27, 2022 Presentation by Lion Point 2 August 16, 2022 Capital / ETFS Capital Operational Initiatives 3 Efficiency/Ops August 20, 2022 2 and NYSE Messaging October 10, 2022 4 M&A & Strategy August 22, 2022 (included non-OSCO directors) 5 Management Response August 22, 2022 3 OSCO Round 2 Debrief October 20, 2022 Stockholder and Capital 6 August 25, 2022 Deployment Digital Assets Presentation from 7 Budget Process August 26, 2022 4 Lion Point Capital and ETFS November 1, 2022 8 Sales (EU and US) August 29, 2022 Capital at their request 9 & 10 Model and Product August 30, 2022 11 Compensation August 31, 2022 Management Response 5 November 8, 2022 (included non-OSCO directors) 12 Culture September 1, 2022 ETFS Capital, with Graham Tuckwell in attendance, presented to the Committee and 33 their input was considered and evaluated as part of the OSCO process

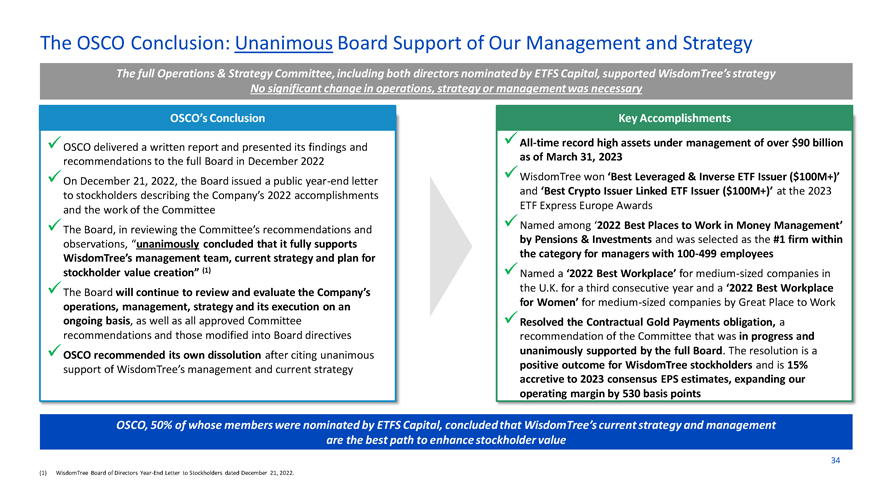

The OSCO Conclusion: Unanimous Board Support of Our Management and Strategy The full Operations & Strategy Committee, including both directors nominated by ETFS Capital, supported WisdomTree’s strategy No significant change in operations, strategy or management was necessary OSCO’s Conclusion Key Accomplishments ?OSCO delivered a written report and presented its findings and ?All-time record high assets under management of over $90 billion recommendations to the full Board in December 2022 as of March 31, 2023 ?On December 21, 2022, the Board issued a public year-end letter ?WisdomTree won ‘Best Leveraged & Inverse ETF Issuer ($100M+)’ to stockholders describing the Company’s 2022 accomplishments and ‘Best Crypto Issuer Linked ETF Issuer ($100M+)’ at the 2023 and the work of the Committee ETF Express Europe Awards ?The Board, in reviewing the Committee’s recommendations and ?Named among ‘2022 Best Places to Work in Money Management’ observations, “unanimously concluded that it fully supports by Pensions & Investments and was selected as the #1 firm within WisdomTree’s management team, current strategy and plan for the category for managers with 100-499 employees stockholder value creation” (1) ?Named a ‘2022 Best Workplace’ for medium-sized companies in ?The Board will continue to review and evaluate the Company’s the U.K. for a third consecutive year and a ‘2022 Best Workplace operations, management, strategy and its execution on an for Women’ for medium-sized companies by Great Place to Work ongoing basis, as well as all approved Committee ?Resolved the Contractual Gold Payments obligation, a recommendations and those modified into Board directives recommendation of the Committee that was in progress and ?OSCO recommended its own dissolution after citing unanimous unanimously supported by the full Board. The resolution is a support of WisdomTree’s management and current strategy positive outcome for WisdomTree stockholders and is 15% accretive to 2023 consensus EPS estimates, expanding our operating margin by 530 basis points OSCO, 50% of whose members were nominated by ETFS Capital, concluded that WisdomTree’s current strategy and management are the best path to enhance stockholder value 34 (1) WisdomTree Board of Directors Year-End Letter to Stockholders dated December 21, 2022.

We Have Deliberately and Thoughtfully Assembled the Right Board For Continued Success

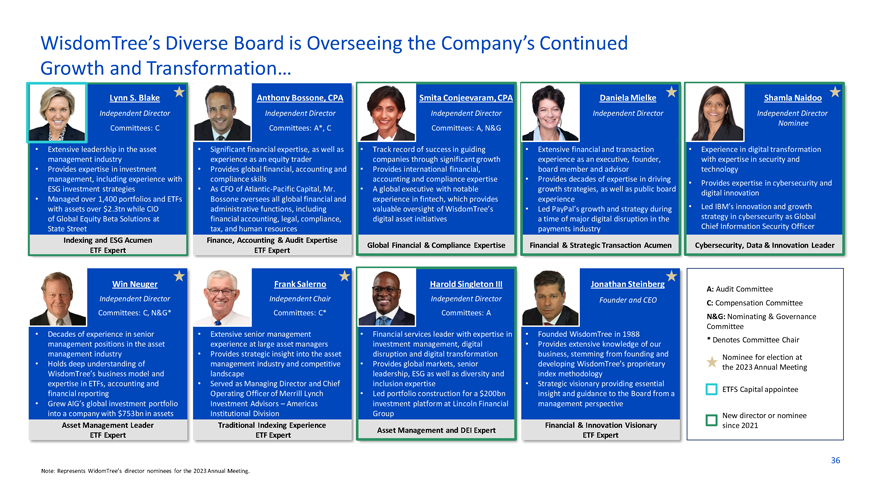

WisdomTree’s Diverse Board is Overseeing the Company’s Continued Growth and Transformation… Lynn S. Blake Anthony Bossone, CPA Smita Conjeevaram, CPA Daniela Mielke Shamla Naidoo Independent Director Independent Director Independent Director Independent Director Independent Director Nominee Committees: C Committees: A*, C Committees: A, N&G • Extensive leadership in the asset • Significant financial expertise, as well as • Track record of success in guiding • Extensive financial and transaction • Experience in digital transformation management industry experience as an equity trader companies through significant growth experience as an executive, founder, with expertise in security and • Provides expertise in investment • Provides global financial, accounting and • Provides international financial, board member and advisor technology management, including experience with compliance skills accounting and compliance expertise • Provides decades of expertise in driving ESG investment public board • Provides expertise in cybersecurity and strategies • As CFO of Atlantic-Pacific Capital, Mr. • A global executive with notable growth strategies, as well as Managed over 1,400 portfolios and ETFs Bossone oversees all global financial and experience in fintech, which provides digital innovation • experience with assets over $2.3tn while CIO administrative functions, including valuable oversight of WisdomTree’s • Led PayPal’s growth and strategy during • Led IBM’s innovation and growth of Global Equity Beta Solutions at financial accounting, legal, compliance, digital asset initiatives a time of major digital disruption in the strategy in cybersecurity as Global State Street tax, and human resources payments industry Chief Information Security Officer Indexing and ESG Acumen Finance, Accounting & Audit Expertise Global Financial & Compliance Expertise Financial & Strategic Transaction Acumen Cybersecurity, Data & Innovation Leader ETF Expert ETF Expert Win Neuger Frank Salerno Harold Singleton III Jonathan Steinberg A: Audit Committee Independent Director Independent Chair Independent Director Founder and CEO C: Compensation Committee Committees: C, N&G* Committees: C* Committees: A N&G: Nominating & Governance Committee • Decades of experience in senior • Extensive senior management • Financial services leader with expertise in • Founded WisdomTree in 1988 * Denotes Committee Chair management positions in the asset experience at large asset managers investment management, digital • Provides extensive knowledge of our management industry • Provides strategic insight into the asset disruption and digital transformation business, stemming from founding and Nominee for election at • Holds deep understanding of management industry and competitive • Provides global markets, senior developing WisdomTree’s proprietary the 2023 Annual Meeting WisdomTree’s business model and landscape leadership, ESG as well as diversity and index methodology expertise in ETFs, accounting and • Served as Managing Director and Chief inclusion expertise • Strategic visionary providing essential ETFS Capital appointee financial reporting Operating Officer of Merrill Lynch • Led portfolio construction for a $200bn insight and guidance to the Board from a • Grew AIG’s global investment portfolio Investment Advisors – Americas investment platform at Lincoln Financial management perspective into a company with $753bn in assets Institutional Division Group New director or nominee Asset Management Leader Traditional Indexing Experience Financial & Innovation Visionary since 2021 Asset Management and DEI Expert ETF Expert ETF Expert ETF Expert 36 Note: Represents WidomTree’s director nominees for the 2023 Annual Meeting.

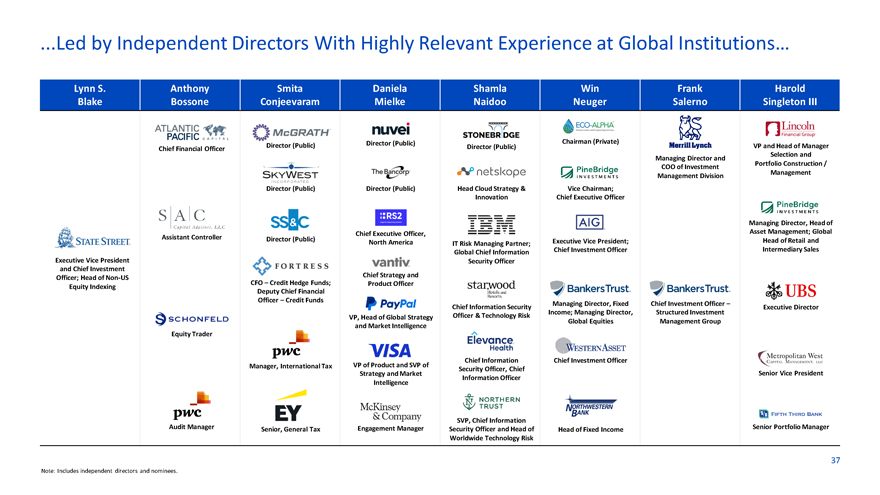

...Led by Independent Directors With Highly Relevant Experience at Global Institutions… Lynn S. Anthony Smita Daniela Shamla Win Frank Harold Blake Bossone Conjeevaram Mielke Naidoo Neuger Salerno Singleton III Director (Public) Chairman (Private) Director (Public) Director (Public) VP and Head of Manager Chief Financial Officer Selection and Managing Director and Portfolio Construction / COO of Investment Management Management Division Director (Public) Director (Public) Head Cloud Strategy & Vice Chairman; Innovation Chief Executive Officer Managing Director, Head of Assistant Controller Chief Executive Officer, Asset Management; Global Director (Public) Executive Vice President; Head of Retail and North America IT Risk Managing Partner; Chief Investment Officer Intermediary Sales Global Chief Information Executive Vice President Security Officer and Chief Investment Chief Strategy and Officer; Head of Non-US CFO – Credit Hedge Funds; Product Officer Equity Indexing Deputy Chief Financial Officer – Credit Funds Managing Director, Fixed Chief Investment Officer – Chief Information Security Income; Managing Director, Structured Investment Executive Director VP, Head of Global Strategy Officer & Technology Risk Global Equities Management Group and Market Intelligence Equity Trader Chief Information Chief Investment Officer Manager, International Tax VP of Product and SVP of Security Officer, Chief Strategy and Market Senior Vice President Information Officer Intelligence SVP, Chief Information Audit Manager Senior, General Tax Engagement Manager Security Officer and Head of Head of Fixed Income Senior Portfolio Manager Worldwide Technology Risk 37 Note: Includes independent directors and nominees.

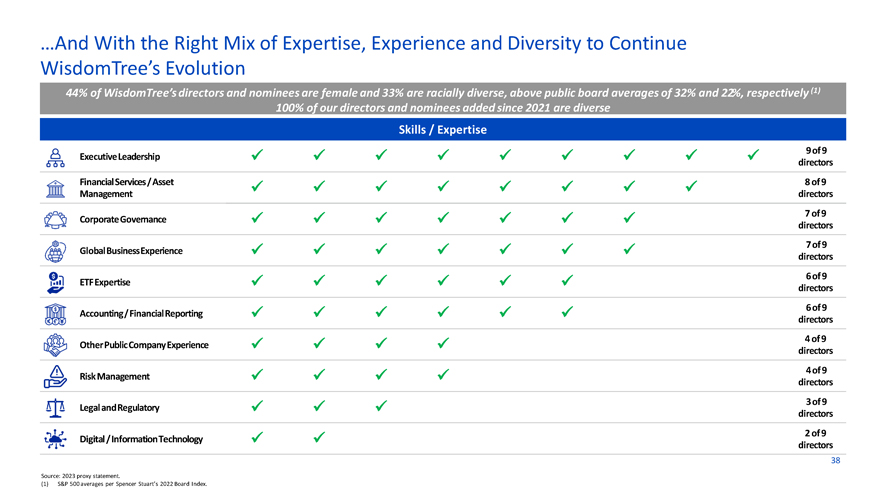

…And With the Right Mix of Expertise, Experience and Diversity to Continue WisdomTree’s Evolution 44% of WisdomTree’s directors and nominees are female and 33% are racially diverse, above public board averages of 32% and 22%, respectively (1) 100% of our directors and nominees added since 2021 are diverse Skills / Expertise 9 of 9 Executive Leadership ? ✓ directors Financial Services / Asset ? ✓ 8 of 9 Management directors 7 of 9 Corporate Governance ? ✓ directors 7 of 9 Global Business Experience ? ✓ directors 6 of 9 ETF Expertise ? ✓ directors 6 of 9 Accounting / Financial Reporting ? ✓ directors 4 of 9 Other Public Company Experience ? ✓ directors 4 of 9 Risk Management ? ✓ directors 3 of 9 Legal and Regulatory ? ✓ directors 2 of 9 Digital / Information Technology ?ï ✓ directors 38 Source: 2023 proxy statement. (1) S&P 500 averages per Spencer Stuart’s 2022 Board Index.

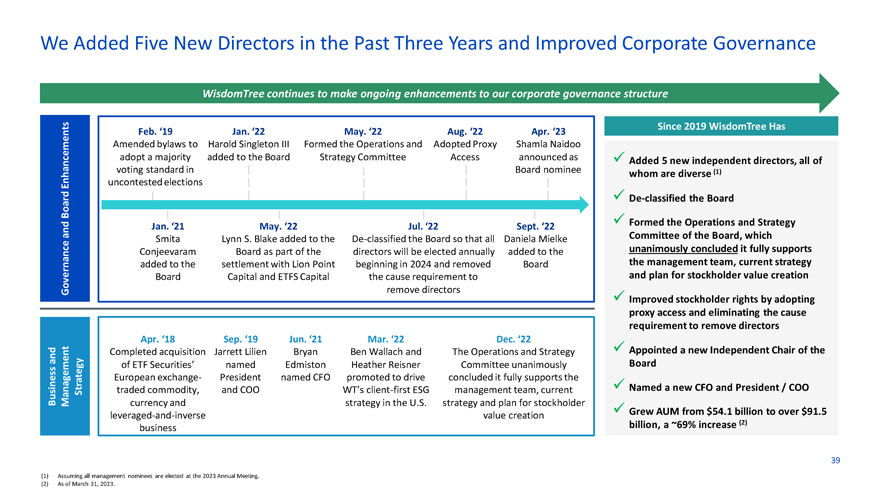

We Added Five New Directors in the Past Three Years and Improved Corporate Governance WisdomTree continues to make ongoing enhancements to our corporate governance structure Since 2019 WisdomTree Has Feb. ‘19 Jan. ‘22 May. ‘22 Aug. ‘22 Apr. ‘23 Amended bylaws to Harold Singleton III Formed the Operations and Adopted Proxy Shamla Naidoo adopt a majority added to the Board Strategy Committee Access announced as ?Added 5 new independent directors, all of voting standard in Board nominee (1) Enhancements uncontested elections whom are diverse Board ?De-classified the Board and Jan. ‘21 May. ‘22 Jul. ‘22 Sept. ‘22 ?Formed the Operations and Strategy Committee of the Board, which ce Smita Lynn S. Blake added to the De-classified the Board so that all Daniela Mielke Conjeevaram Board as part of the directors will be elected annually added to the unanimously concluded it fully supports added to the settlement with Lion Point beginning in 2024 and removed Board the management team, current strategy Board Capital and ETFS Capital the cause requirement to and plan for stockholder value creation Governan remove directors ?Improved stockholder rights by adopting proxy access and eliminating the cause requirement to remove directors Apr. ‘18 Sep. ‘19 Jun. ‘21 Mar. ‘22 Dec. ‘22 and ent Completed acquisition Jarrett Lilien Bryan Ben Wallach and The Operations and Strategy ?Appointed a new Independent Chair of the of ETF Securities’ named Edmiston Heather Reisner Committee unanimously Board European exchange- President named CFO promoted to drive concluded it fully supports the Strategy traded commodity, and COO WT’s client-first ESG management team, current ?Named a new CFO and President / COO Business Managem currency and strategy in the U.S. strategy and plan for stockholder leveraged-and-inverse value creation ?Grew AUM from $54.1 billion to over $91.5 billion, a ~69% increase (2) business 39 (1) Assuming all management nominees are elected at the 2023 Annual Meeting. (2) As of March 31, 2023.

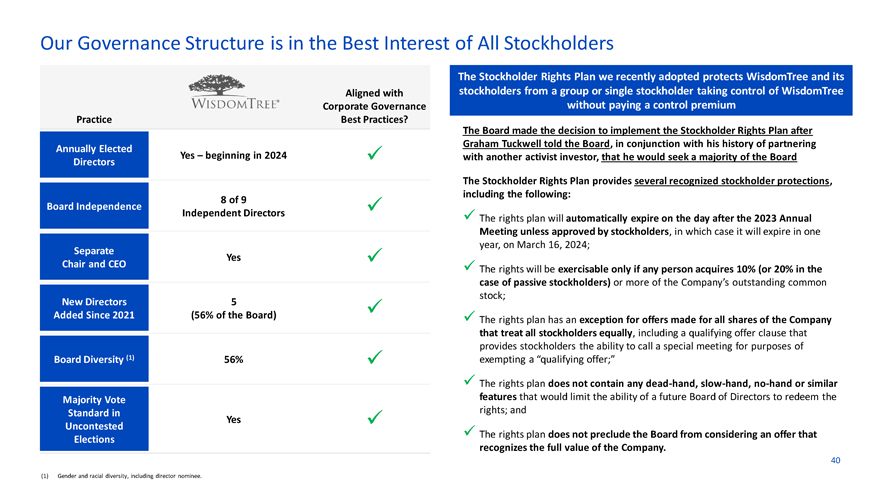

Our Governance Structure is in the Best Interest of All Stockholders The Stockholder Rights Plan we recently adopted protects WisdomTree and its Aligned with stockholders from a group or single stockholder taking control of WisdomTree Corporate Governance without paying a control premium Practice Best Practices? The Board made the decision to implement the Stockholder Rights Plan after Graham Tuckwell told the Board, in conjunction with his history of partnering Annually Elected Yes – beginning in 2024 with another activist investor, that he would seek a majority of the Board Directors The Stockholder Rights Plan provides several recognized stockholder protections, including the following: 8 of 9 Board Independence Independent Directors The rights plan will automatically expire on the day after the 2023 Annual Meeting unless approved by stockholders, in which case it will expire in one year, on March 16, 2024; Separate Yes Chair and CEO The rights will be exercisable only if any person acquires 10% (or 20% in the case of passive stockholders) or more of the Company’s outstanding common stock; New Directors 5 Added Since 2021 (56% of the Board) The rights plan has an exception for offers made for all shares of the Company that treat all stockholders equally, including a qualifying offer clause that provides stockholders the ability to call a special meeting for purposes of Board Diversity (1) 56% exempting a “qualifying offer;” The rights plan does not contain any dead-hand, slow-hand, no-hand or similar Majority Vote features that would limit the ability of a future Board of Directors to redeem the Standard in rights; and Yes Uncontested The rights plan does not preclude the Board from considering an offer that Elections recognizes the full value of the Company. 40 (1) Gender and racial diversity, including director nominee.

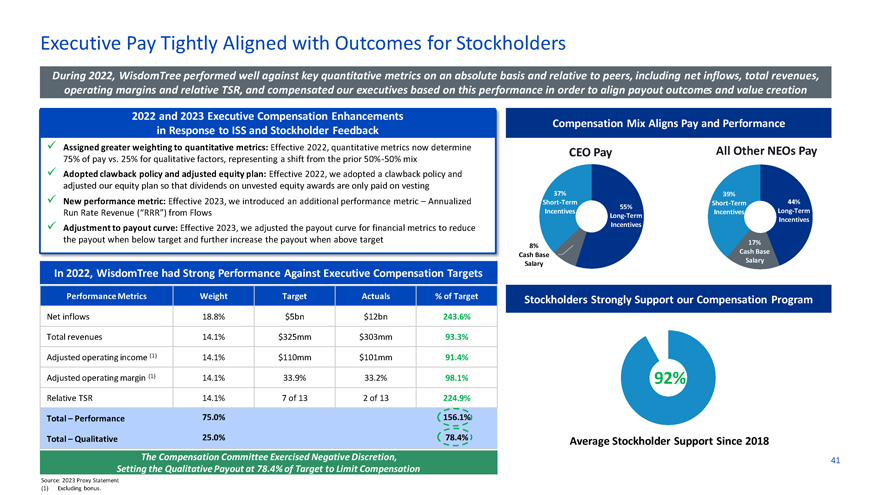

Executive Pay Tightly Aligned with Outcomes for Stockholders During 2022, WisdomTree performed well against key quantitative metrics on an absolute basis and relative to peers, including net inflows, total revenues, operating margins and relative TSR, and compensated our executives based on this performance in order to align payout outcomes and value creation 2022 and 2023 Executive Compensation Enhancements Compensation Mix Aligns Pay and Performance in Response to ISS and Stockholder Feedback ? Assigned greater weighting to quantitative metrics: Effective 2022, quantitative metrics now determine CEO Pay All Other NEOs Pay 75% of pay vs. 25% for qualitative factors, representing a shift from the prior 50%-50% mix ? Adopted clawback policy and adjusted equity plan: Effective 2022, we adopted a clawback policy and adjusted our equity plan so that dividends on unvested equity awards are only paid on vesting 37% 39% ? New performance metric: Effective 2023, we introduced an additional performance metric – Annualized Short-Term Short-Term 44% 55% Run Rate Revenue (“RRR”) from Flows Incentives Incentives Long-Term Long-Term Incentives ? Adjustment to payout curve: Effective 2023, we adjusted the payout curve for financial metrics to reduce Incentives the payout when below target and further increase the payout when above target 8% 17% Cash Base Cash Base Salary Salary In 2022, WisdomTree had Strong Performance Against Executive Compensation Targets Performance Metrics Weight Target Actuals % of Target Stockholders Strongly Support our Compensation Program Net inflows 18.8% $5bn $12bn 243.6% Total revenues 14.1% $325mm $303mm 93.3% Adjusted operating income (1) 14.1% $110mm $101mm 91.4% Adjusted operating margin (1) 14.1% 33.9% 33.2% 98.1% 92% Relative TSR 14.1% 7 of 13 2 of 13 224.9% Total – Performance 75.0% 156.1% Total – Qualitative 25.0% 78.4% Average Stockholder Support Since 2018 The Compensation Committee Exercised Negative Discretion, 41 Setting the Qualitative Payout at 78.4% of Target to Limit Compensation Source: 2023 Proxy Statement (1) Excluding bonus.

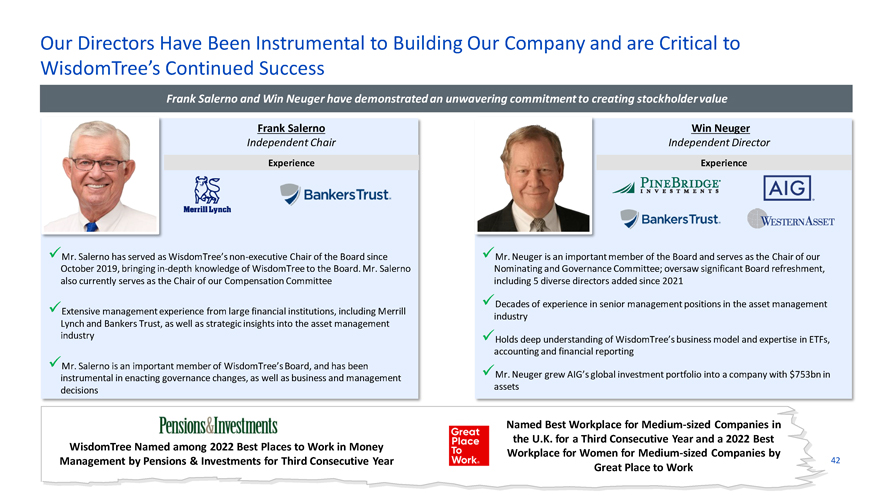

Our Directors Have Been Instrumental to Building Our Company and are Critical to WisdomTree’s Continued Success Frank Salerno and Win Neuger have demonstrated an unwavering commitment to creating stockholder value Frank Salerno Win Neuger Independent Chair Independent Director Experience Experience ??❒? Salerno has served as WisdomTree’s non-executive Chair of the Board since ??❒? Neuger is an important member of the Board and serves as the Chair of our October 2019, bringing in-depth knowledge of WisdomTree to the Board. Mr. Salerno Nominating and Governance Committee; oversaw significant Board refreshment, also currently serves as the Chair of our Compensation Committee including 5 diverse directors added since 2021 ??☒◆?∎??❖? management experience from large financial institutions, including Merrill ???????? of experience in senior management positions in the asset management Lynch and Bankers Trust, as well as strategic insights into the asset management industry industry ??☐●?? deep understanding of WisdomTree’s business model and expertise in ETFs, accounting and financial reporting ??❒? Salerno is an important member of WisdomTree’s Board, and has been instrumental in enacting governance changes, as well as business and management ??❒? Neuger grew AIG’s global investment portfolio into a company with $753bn in decisions assets Named Best Workplace for Medium-sized Companies in the U.K. for a Third Consecutive Year and a 2022 Best WisdomTree Named among 2022 Best Places to Work in Money Workplace for Women for Medium-sized Companies by 42 Management by Pensions & Investments for Third Consecutive Year Great Place to Work

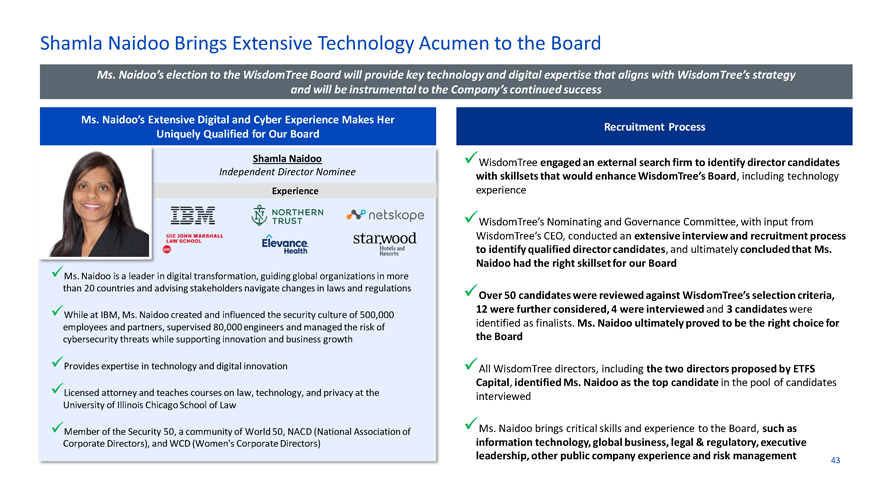

Shamla Naidoo Brings Extensive Technology Acumen to the Board Ms. Naidoo’s election to the WisdomTree Board will provide key technology and digital expertise that aligns with WisdomTree’s strategy and will be instrumental to the Company’s continued success Ms. Naidoo’s Extensive Digital and Cyber Experience Makes Her Recruitment Process Uniquely Qualified for Our Board Shamla Naidoo ?WisdomTree engaged an external search firm to identify director candidates Independent Director Nominee with skillsets that would enhance WisdomTree’s Board, including technology Experience experience ?WisdomTree’s Nominating and Governance Committee, with input from WisdomTree’s CEO, conducted an extensive interview and recruitment process to identify qualified director candidates, and ultimately concluded that Ms. Naidoo had the right skillset for our Board ?Ms. Naidoo is a leader in digital transformation, guiding global organizations in more than 20 countries and advising stakeholders navigate changes in laws and regulations ?Over 50 candidates were reviewed against WisdomTree’s selection criteria, 12 were further considered, 4 were interviewed and 3 candidates were ?While at IBM, Ms. Naidoo created and influenced the security culture of 500,000 identified as finalists. Ms. Naidoo ultimately proved to be the right choice for employees and partners, supervised 80,000 engineers and managed the risk of cybersecurity threats while supporting innovation and business growth the Board ?Provides expertise in technology and digital innovation ?All WisdomTree directors, including the two directors proposed by ETFS Capital, identified Ms. Naidoo as the top candidate in the pool of candidates ?Licensed attorney and teaches courses on law, technology, and privacy at the interviewed University of Illinois Chicago School of Law ?Member of the Security 50, a community of World 50, NACD (National Association of ?Ms. Naidoo brings critical skills and experience to the Board, such as Corporate Directors), and WCD (Women’s Corporate Directors) information technology, global business, legal & regulatory, executive leadership, other public company experience and risk management 43

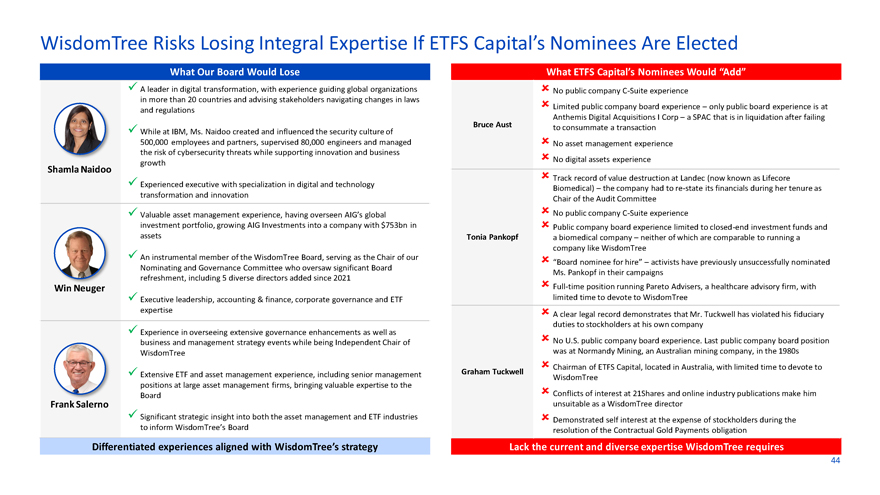

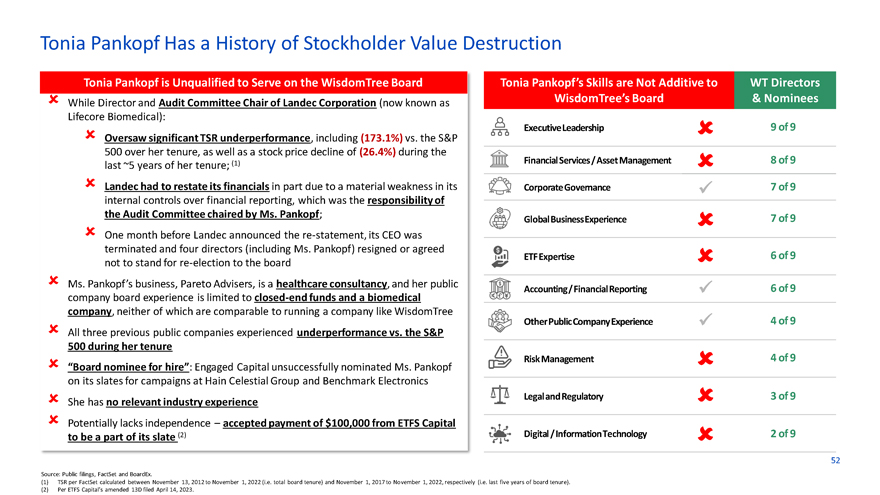

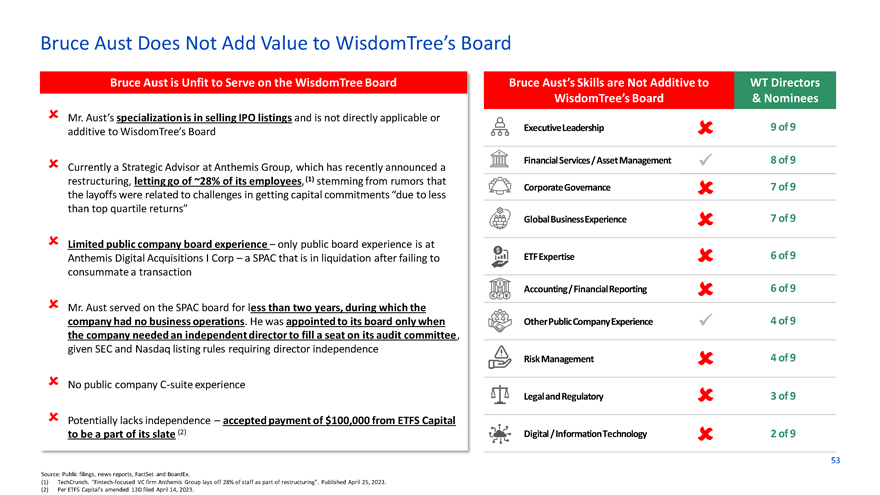

WisdomTree Risks Losing Integral Expertise If ETFS Capital’s Nominees Are Elected What Our Board Would Lose What ETFS Capital’s Nominees Would “Add” ?A leader in digital transformation, with experience guiding global organizations ?No public company C-Suite experience in more than 20 countries and advising stakeholders navigating changes in laws ?Limited public company board experience – only public board experience is at and regulations Anthemis Digital Acquisitions I Corp – a SPAC that is in liquidation after failing Bruce Aust to consummate a transaction ?While at IBM, Ms. Naidoo created and influenced the security culture of 500,000 employees and partners, supervised 80,000 engineers and managed ?No asset management experience the risk of cybersecurity threats while supporting innovation and business ?No digital assets experience growth Shamla Naidoo ?Experienced executive with specialization in digital and technology ?Track record of value destruction at Landec (now known as Lifecore transformation and innovation Biomedical) – the company had to re-state its financials during her tenure as Chair of the Audit Committee ?Valuable asset management experience, having overseen AIG’s global?No public company C-Suite experience investment portfolio, growing AIG Investments into a company with $753bn in ?Public company board experience limited to closed-end investment funds and assets Tonia Pankopf a biomedical company – neither of which are comparable to running a company like WisdomTree ?An instrumental member of the WisdomTree Board, serving as the Chair of our ? “Board nominee for hire” – activists have previously unsuccessfully nominated Nominating and Governance Committee who oversaw significant Board Ms. Pankopf in their campaigns refreshment, including 5 diverse directors added since 2021 Win Neuger?Full-time position running Pareto Advisers, a healthcare advisory firm, with ?Executive leadership, accounting & finance, corporate governance and ETF limited time to devote to WisdomTree expertise ?A clear legal record demonstrates that Mr. Tuckwell has violated his fiduciary duties to stockholders at his own company ?Experience in overseeing extensive governance enhancements as well as business and management strategy events while being Independent Chair of ?No U.S. public company board experience. Last public company board position WisdomTree was at Normandy Mining, an Australian mining company, in the 1980s?Chairman of ETFS Capital, located in Australia, with limited time to devote to ?Extensive ETF and asset management experience, including senior management Graham Tuckwell WisdomTree positions at large asset management firms, bringing valuable expertise to the Board?Conflicts of interest at 21Shares and online industry publications make him Frank Salerno unsuitable as a WisdomTree director ?Significant strategic insight into both the asset management and ETF industries ?Demonstrated self interest at the expense of stockholders during the to inform WisdomTree’s Board resolution of the Contractual Gold Payments obligation Differentiated experiences aligned with WisdomTree’s strategy Lack the current and diverse expertise WisdomTree requires 44

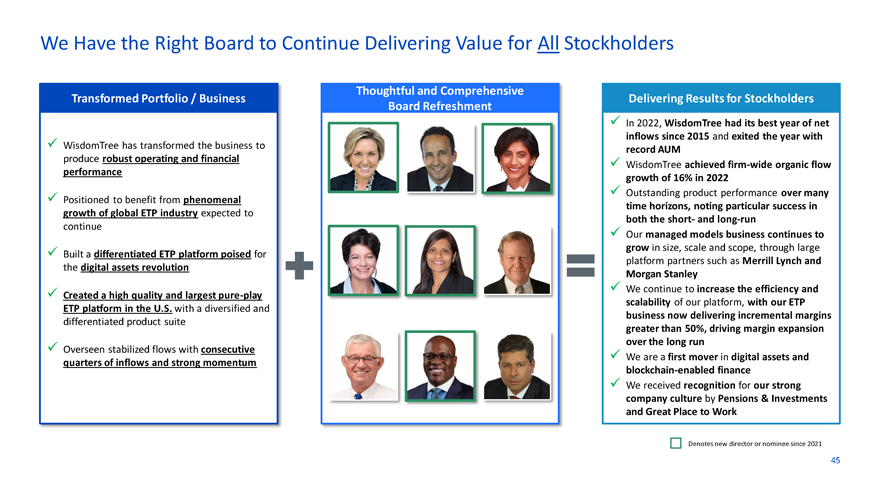

We Have the Right Board to Continue Delivering Value for All Stockholders Thoughtful and Comprehensive Transformed Portfolio / Business Delivering Results for Stockholders Board Refreshment ? In 2022, WisdomTree had its best year of net inflows since 2015 and exited the year with ? WisdomTree has transformed the business to record AUM produce robust operating and financial ? WisdomTree achieved firm-wide organic flow performance growth of 16% in 2022 ? Outstanding product performance over many ? Positioned to benefit from phenomenal time horizons, noting particular success in growth of global ETP industry expected to both the short- and long-run continue ? Our managed models business continues to grow in size, scale and scope, through large ? Built a differentiated ETP platform poised for platform partners such as Merrill Lynch and the digital assets revolution Morgan Stanley ? We continue to increase the efficiency and ? Created a high quality and largest pure-play scalability of our platform, with our ETP ETP platform in the U.S. with a diversified and business now delivering incremental margins differentiated product suite greater than 50%, driving margin expansion ? Overseen stabilized flows with consecutive over the long run ? We are a first mover in digital assets and quarters of inflows and strong momentum blockchain-enabled finance ? We received recognition for our strong company culture by Pensions & Investments and Great Place to Work Denotes new director or nominee since 2021 45

ETFS Capital’s Campaign is Unjustified, Unwise and Risks Value Destruction

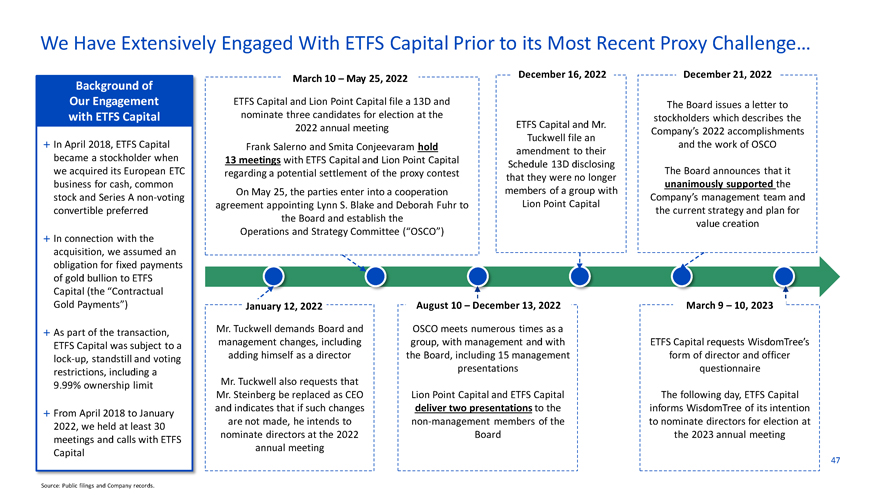

We Have Extensively Engaged With ETFS Capital Prior to its Most Recent Proxy Challenge… December 16, 2022 December 21, 2022 March 10 – May 25, 2022 Background of Our Engagement ETFS Capital and Lion Point Capital file a 13D and The Board issues a letter to with ETFS Capital nominate three candidates for election at the stockholders which describes the 2022 annual meeting ETFS Capital and Mr. Company’s 2022 accomplishments Tuckwell file an ïƒ^ In April 2018, ETFS Capital Frank Salerno and Smita Conjeevaram hold and the work of OSCO amendment to their became a stockholder when 13 meetings with ETFS Capital and Lion Point Capital Schedule 13D disclosing we acquired its European ETC regarding a potential settlement of the proxy contest The Board announces that it that they were no longer business for cash, common unanimously supported the On May 25, the parties enter into a cooperation members of a group with stock and Series A non-voting Company’s management team and agreement appointing Lynn S. Blake and Deborah Fuhr to Lion Point Capital convertible preferred the Board and establish the the current strategy and plan for Operations and Strategy Committee (“OSCO”) value creation ïƒ^ In connection with the acquisition, we assumed an obligation for fixed payments of gold bullion to ETFS Capital (the “Contractual Gold Payments”) January 12, 2022 August 10 – December 13, 2022 March 9 – 10, 2023 As part of Mr. Tuckwell demands Board and OSCO meets numerous times as a ïƒ^ the transaction, ETFS Capital was subject to a management changes, including group, with management and with ETFS Capital requests WisdomTree’s lock-up, standstill and voting adding himself as a director the Board, including 15 management form of director and officer restrictions, including a presentations questionnaire 9.99% ownership limit Mr. Tuckwell also requests that Mr. Steinberg be replaced as CEO Lion Point Capital and ETFS Capital The following day, ETFS Capital and indicates that if such changes deliver two presentations to the informs WisdomTree of its intention ïƒ^ From April 2018 to January are not made, he intends to non-management members of the to nominate directors for election at 2022, we held at least 30 nominate directors at the 2022 Board the 2023 annual meeting meetings and calls with ETFS annual meeting Capital 47 Source: Public filings and Company records.

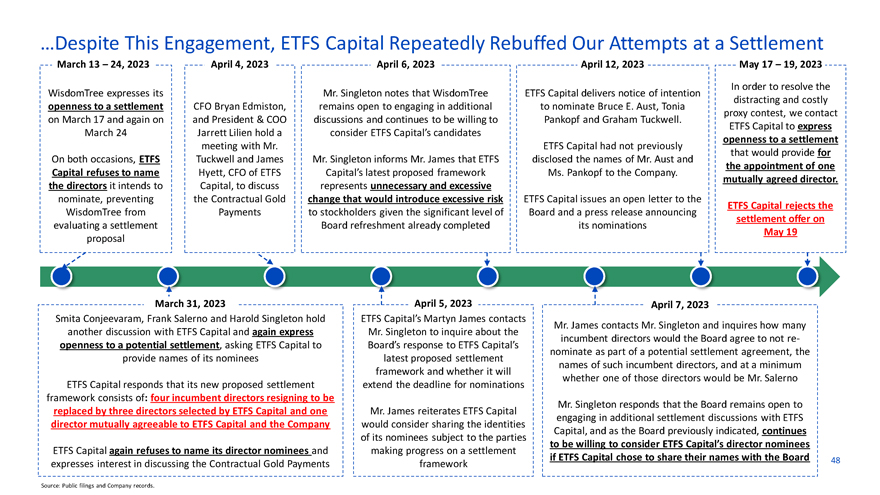

…Despite This Engagement, ETFS Capital Repeatedly Rebuffed Our Attempts at a Settlement March 13 – 24, 2023 April 4, 2023 April 6, 2023 April 12, 2023 May 17 – 19, 2023 In order to resolve the WisdomTree expresses its Mr. Singleton notes that WisdomTree ETFS Capital delivers notice of intention distracting and costly openness to a settlement CFO Bryan Edmiston, remains open to engaging in additional to nominate Bruce E. Aust, Tonia proxy contest, we contact on March 17 and again on and President & COO discussions and continues to be willing to Pankopf and Graham Tuckwell. ETFS Capital to express March 24 Jarrett Lilien hold a consider ETFS Capital’s candidates openness to a settlement meeting with Mr. ETFS Capital had not previously that would provide for On both occasions, ETFS Tuckwell and James Mr. Singleton informs Mr. James that ETFS disclosed the names of Mr. Aust and the appointment of one Capital refuses to name Hyett, CFO of ETFS Capital’s latest proposed framework Ms. Pankopf to the Company. mutually agreed director. the directors it intends to Capital, to discuss represents unnecessary and excessive nominate, preventing the Contractual Gold change that would introduce excessive risk ETFS Capital issues an open letter to the ETFS Capital rejects the WisdomTree from Payments to stockholders given the significant level of Board and a press release announcing settlement offer on evaluating a settlement Board refreshment already completed its nominations May 19 proposal March 31, 2023 April 5, 2023 April 7, 2023 Smita Conjeevaram, Frank Salerno and Harold Singleton hold ETFS Capital’s Martyn James contacts Mr. James contacts Mr. Singleton and inquires how many another discussion with ETFS Capital and again express Mr. Singleton to inquire about the incumbent directors would the Board agree to not reopenness to a potential settlement, asking ETFS Capital to Board’s response to ETFS Capital’s nominate as part of a potential settlement agreement, the provide names of its nominees latest proposed settlement names of such incumbent directors, and at a minimum framework and whether it will whether one of those directors would be Mr. Salerno ETFS Capital responds that its new proposed settlement extend the deadline for nominations framework consists of: four incumbent directors resigning to be Mr. Singleton responds that the Board remains open to replaced by three directors selected by ETFS Capital and one Mr. James reiterates ETFS Capital engaging in additional settlement discussions with ETFS director mutually agreeable to ETFS Capital and the Company would consider sharing the identities Capital, and as the Board previously indicated, continues of its nominees subject to the parties to be willing to consider ETFS Capital’s director nominees ETFS Capital again refuses to name its director nominees and making progress on a settlement if ETFS Capital chose to share their names with the Board 48 expresses interest in discussing the Contractual Gold Payments framework Source: Public filings and Company records.

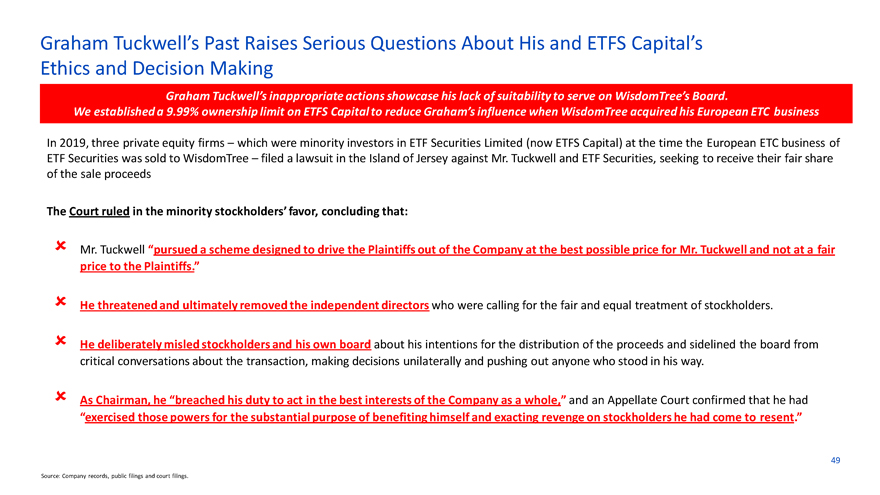

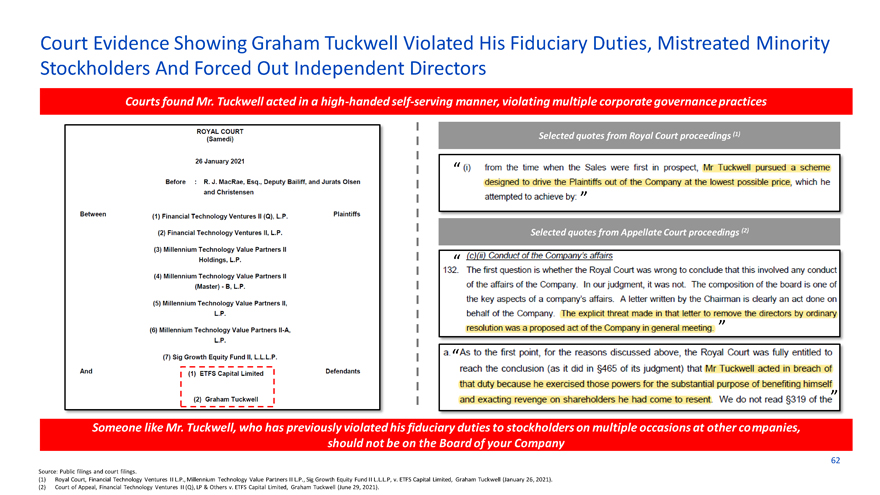

Graham Tuckwell’s Past Raises Serious Questions About His and ETFS Capital’s Ethics and Decision Making Graham Tuckwell’s inappropriate actions showcase his lack of suitability to serve on WisdomTree’s Board. We established a 9.99% ownership limit on ETFS Capital to reduce Graham’s influence when WisdomTree acquired his European ETC business In 2019, three private equity firms – which were minority investors in ETF Securities Limited (now ETFS Capital) at the time the European ETC business of ETF Securities was sold to WisdomTree – filed a lawsuit in the Island of Jersey against Mr. Tuckwell and ETF Securities, seeking to receive their fair share of the sale proceeds The Court ruled in the minority stockholders’ favor, concluding that: ? Mr. Tuckwell “pursued a scheme designed to drive the Plaintiffs out of the Company at the best possible price for Mr. Tuckwell and not at a fair price to the Plaintiffs.” ? He threatened and ultimately removed the independent directors who were calling for the fair and equal treatment of stockholders. ? He deliberately misled stockholders and his own board about his intentions for the distribution of the proceeds and sidelined the board from critical conversations about the transaction, making decisions unilaterally and pushing out anyone who stood in his way. ? As Chairman, he “breached his duty to act in the best interests of the Company as a whole,” and an Appellate Court confirmed that he had “exercised those powers for the substantial purpose of benefiting himself and exacting revenge on stockholders he had come to resent.” 49 Source: Company records, public filings and court filings.

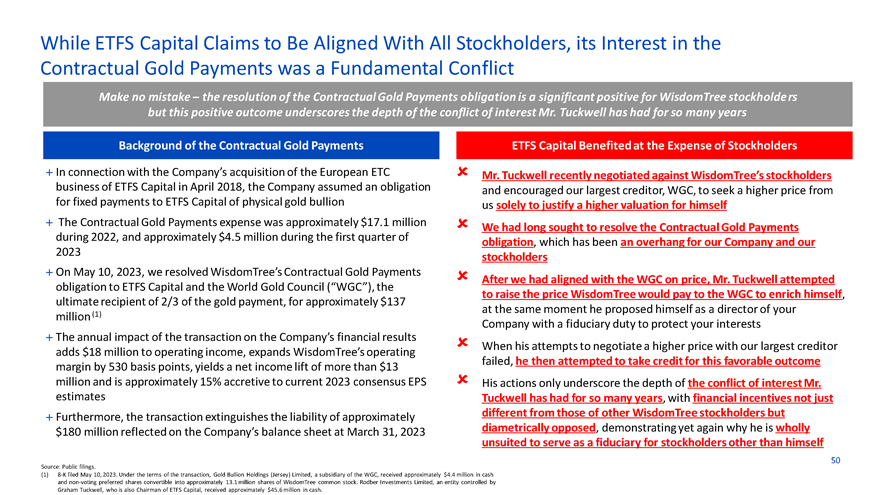

While ETFS Capital Claims to Be Aligned With All Stockholders, its Interest in the Contractual Gold Payments was a Fundamental Conflict Make no mistake – the resolution of the Contractual Gold Payments obligation is a significant positive for WisdomTree stockholders but this positive outcome underscores the depth of the conflict of interest Mr. Tuckwell has had for so many years Background of the Contractual Gold Payments ETFS Capital Benefited at the Expense of Stockholders ïƒ^ In connection with the Company’s acquisition of the European ETC ? Mr. Tuckwell recently negotiated against WisdomTree’s stockholders business of ETFS Capital in April 2018, the Company assumed an obligation and encouraged our largest creditor, WGC, to seek a higher price from for fixed payments to ETFS Capital of physical gold bullion us solely to justify a higher valuation for himselfïƒ^ The Contractual Gold Payments expense was approximately $17.1 million ? during 2022, and approximately $4.5 million during the first quarter of We had long sought to resolve the Contractual Gold Payments 2023 obligation, which has been an overhang for our Company and our stockholders ïƒ^ On May 10, 2023, we resolved WisdomTree’s Contractual Gold Payments ? After we had aligned with the WGC on price, Mr. Tuckwell attempted obligation to ETFS Capital and the World Gold Council (“WGC”), the to raise the price WisdomTree would pay to the WGC to enrich himself, ultimate recipient of 2/3 of the gold payment, for approximately $137 at the same moment he proposed himself as a director of your million(1) Company with a fiduciary duty to protect your interestsïƒ^ The annual impact of the transaction on the Company’s financial results ? When his attempts to negotiate a higher price with our largest creditor adds $18 million to operating income, expands WisdomTree’s operating failed, he then attempted to take credit for this favorable outcome margin by 530 basis points, yields a net income lift of more than $13 million and is approximately 15% accretive to current 2023 consensus EPS ? His actions only underscore the depth of the conflict of interest Mr. estimates Tuckwell has had for so many years, with financial incentives not just transaction extinguishes the liability of approximately different from those of other WisdomTree stockholders but ïƒ^ Furthermore, the $180 million reflected on the Company’s balance sheet at March 31, 2023 diametrically opposed, demonstrating yet again why he is wholly unsuited to serve as a fiduciary for stockholders other than himself 50 Source: Public filings. (1) 8-K filed May 10, 2023. Under the terms of the transaction, Gold Bullion Holdings (Jersey) Limited, a subsidiary of the WGC, received approximately $4.4 million in cash and non-voting preferred shares convertible into approximately 13.1 million shares of WisdomTree common stock. Rodber Investments Limited, an entity controlled by Graham Tuckwell, who is also Chairman of ETFS Capital, received approximately $45.6 million in cash.

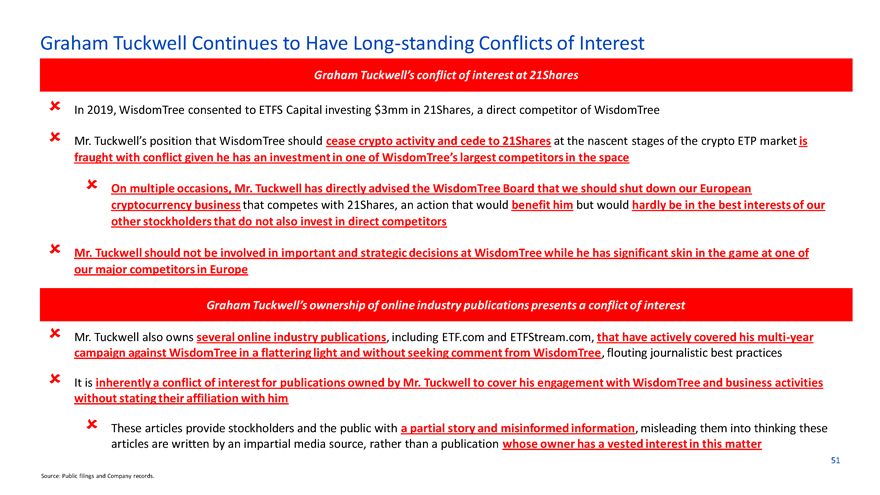

Graham Tuckwell Continues to Have Long-standing Conflicts of Interest Graham Tuckwell’s conflict of interest at 21Shares ? In 2019, WisdomTree consented to ETFS Capital investing $3mm in 21Shares, a direct competitor of WisdomTree ? Mr. Tuckwell’s position that WisdomTree should cease crypto activity and cede to 21Shares at the nascent stages of the crypto ETP market is fraught with conflict given he has an investment in one of WisdomTree’s largest competitors in the space ? On multiple occasions, Mr. Tuckwell has directly advised the WisdomTree Board that we should shut down our European cryptocurrency business that competes with 21Shares, an action that would benefit him but would hardly be in the best interests of our other stockholders that do not also invest in direct competitors? Mr. Tuckwell should not be involved in important and strategic decisions at WisdomTree while he has significant skin in the game at one of our major competitors in Europe Graham Tuckwell’s ownership of online industry publications presents a conflict of interest ? Mr. Tuckwell also owns several online industry publications, including ETF.com and ETFStream.com, that have actively covered his multi-year campaign against WisdomTree in a flattering light and without seeking comment from WisdomTree, flouting journalistic best practices? It is inherently a conflict of interest for publications owned by Mr. Tuckwell to cover his engagement with WisdomTree and business activities without stating their affiliation with him ? These articles provide stockholders and the public with a partial story and misinformed information, misleading them into thinking these articles are written by an impartial media source, rather than a publication whose owner has a vested interest in this matter 51 Source: Public filings and Company records.