UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

SCHEDULE

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act

of 1934

(Amendment No. 1)

_________________

|

Filed by the Registrant |

☒ |

|

Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

|

☒ |

Revised Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☐ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

______________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply)

|

☒ |

No fee required. |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

2024

Notice

of Annual Meeting

and Proxy Statement

REVISED PRELIMINARY PROXY STATEMENT

SUBJECT TO COMPLETION DATED April 26, 2024

WisdomTree, Inc.

Notice of 2024 Annual Meeting of Stockholders

We cordially invite you to attend the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of WisdomTree, Inc. (“WisdomTree”, the “Company”, “we” or “our”). Stockholders as of the record date for the Annual Meeting are entitled to vote on the items set forth below. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on.

See the “General Information for Stockholders About the Annual Meeting” section of the proxy statement on page 10 for information about voting and attending the Annual Meeting.

|

Date And Time: [•], 2024 at [•], Eastern Time |

Meeting Address: [•] |

Record Date: [•], 2024 |

Mailing Date: On or about [•], 2024 |

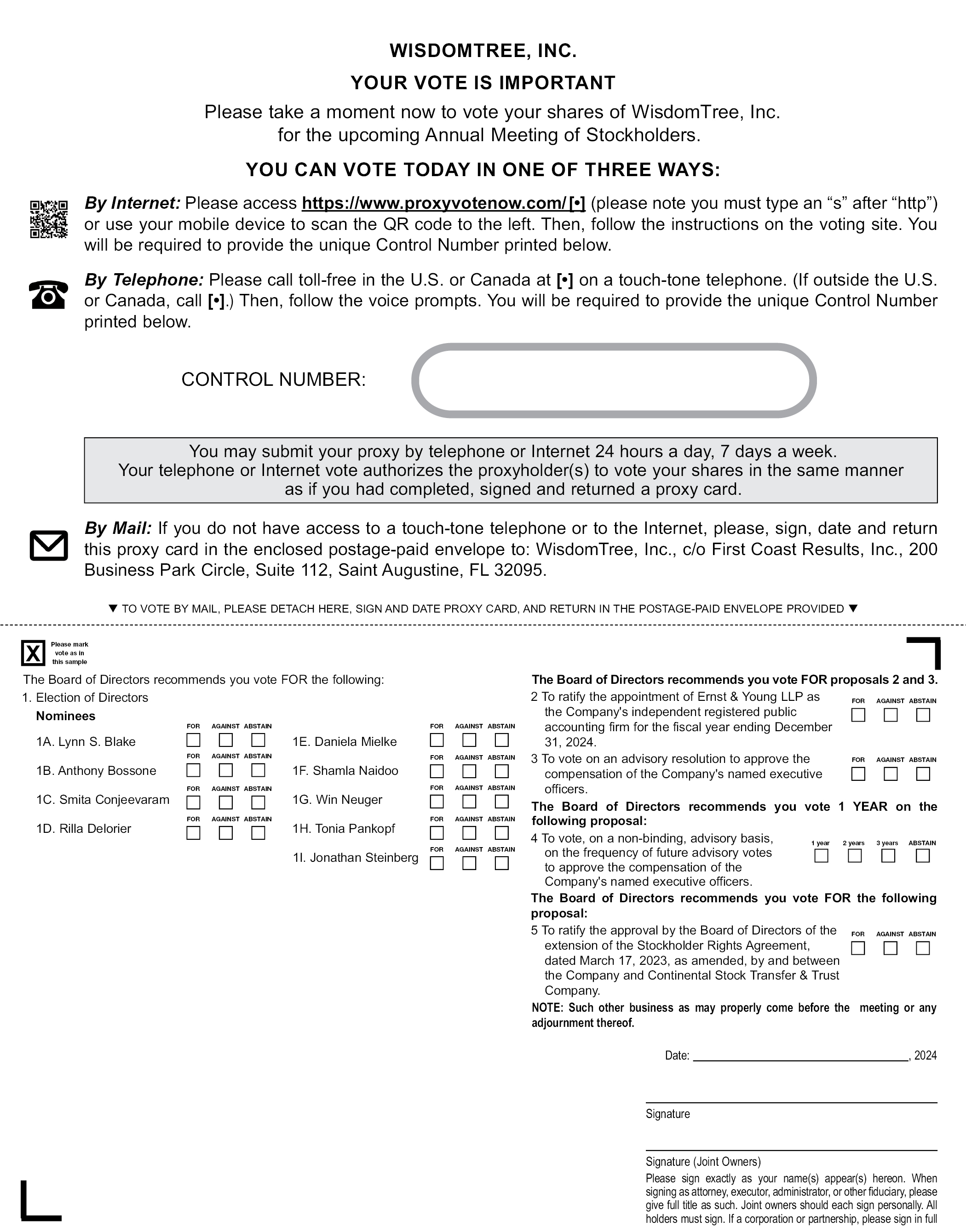

Voting Matters and Board Recommendations

At or before the Annual Meeting, we ask that you vote on the following items:

|

Proposal |

Board |

Page | |

|

1 |

Elect nine members of our Board of Directors |

FOR |

21 |

|

2 |

Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 |

FOR |

36 |

|

3 |

Vote on an advisory resolution to approve the compensation of our named executive officers |

FOR |

39 |

|

4 |

Vote, on a non-binding, advisory basis, on the frequency of future advisory votes to approve the compensation of our named executive officers |

ONE YEAR |

40 |

|

5 |

Ratify the approval by our Board of Directors of the extension of the Stockholder Rights Agreement, dated March 17, 2023, as amended, by and between the Company and Continental Stock Transfer & Trust Company |

FOR |

41 |

In addition, stockholders are asked to transact any other business that may properly come before the meeting or any postponements or adjournments thereof.

WisdomTree, Inc. | 2024 Proxy Statement

How to Vote

Please follow the easy instructions on your WHITE proxy card or voting instruction form to vote in any of the following ways:

|

|

Vote by Internet You may vote electronically by locating the unique control number on your WHITE proxy card or voting instruction form and accessing the following website https://www.proxyvotenow.com/[•]. | |

|

|

Vote by QR Code Scan the QR code on your computer or mobile phone, which will take you to https://www.proxyvotenow.com/[•] where you will be prompted to enter your unique control number on your WHITE proxy card or voting instruction form. | |

|

|

Vote by Phone Call [•] toll-free from the U.S. and Canada. If outside the U.S. or Canada, call [•]. | |

|

|

Vote by Mail If you received printed proxy materials, you may submit your vote by completing, signing and dating each proxy card or voting instruction form received and returning it in the pre-paid envelope. | |

|

|

Vote at the Meeting Stockholders of record, or beneficial owners with a legal proxy from their bank, broker or other nominees, can also vote at the Annual Meeting. Please find instructions below regarding attendance. |

A list of the stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose germane to the Annual Meeting on a reasonably accessible electronic network for a period of ten (10) days prior to the Annual Meeting date. Please email Marci Frankenthaler, Secretary, at mfrankenthaler@wisdomtree.com if you wish to examine the stockholder list prior to the Annual Meeting.

As you may be aware, ETFS Capital Limited (“ETFS Capital”), which owns approximately 10% of our common stock, is conducting a solicitation pursuant to which it is waging a campaign to vote against the election of [•] director nominees nominated by your Board of Directors. You may receive proxy solicitation materials from ETFS Capital or other persons or entities affiliated with ETFS Capital, including an opposition proxy statement and proxy card. Please be advised that we are not responsible for the accuracy of any information provided by or relating to ETFS Capital contained in any proxy solicitation materials filed or disseminated by ETFS Capital or any other statements that they may otherwise make.

Our Board of Directors unanimously recommends that you vote “FOR” all nine WisdomTree nominees proposed by our Board of Directors using the WHITE proxy card.

Our Board of Directors strongly urges you NOT to sign or return any proxy card or voting instruction form sent to you by or on behalf of ETFS Capital. If you do sign a proxy card or voting instruction form sent to you by ETFS Capital, however, you have the right to change your vote by using the enclosed WHITE proxy card or voting instruction form. Only the latest dated, signed proxy card or voting instruction form you vote will be counted.

WisdomTree, Inc. | 2024 Proxy Statement

If you have previously submitted a proxy card or voting instruction form sent to you by or on behalf of ETFS Capital, you can revoke that proxy card or voting instruction form and vote for your Board of Directors’ nominees and in accordance with the Board of Directors’ recommendations on the other matters to be voted on at the Annual Meeting by voting over the Internet, by telephone or by completing, signing, dating and returning the enclosed WHITE proxy card or WHITE voting instruction form by mail in the postage-paid envelope provided.

It is very important that your shares be represented and voted at the Annual Meeting no matter how many shares you own. Whether or not you plan to attend the Annual Meeting in person, we hope you will vote as soon as possible. You may vote over the Internet, by telephone, or by mailing the WHITE proxy card or WHITE voting instruction form in the postage-paid envelope provided. Returning your proxy or voting instruction form or voting over the Internet or by telephone does not deprive you of your right to attend the Annual Meeting in person and to vote your shares at the Annual Meeting in person.

By order of the Board of Directors,

Marci Frankenthaler, Secretary

WisdomTree, Inc. | 2024 Proxy Statement

|

Important

Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders We

have elected to utilize the “full set delivery” option and are delivering paper copies to all stockholders entitled thereto

of all proxy materials, as well as providing access to those proxy materials on a publicly accessible website. The proxy statement

and our Annual Report on Form 10-K

for the year ended December 31, 2023 are available on our investor relations website at: This proxy statement contains information about the 2024 annual meeting of stockholders of WisdomTree, Inc. Proxy materials will be first sent to stockholders on or about [•], 2024. |

IMPORTANT

Your vote at this year’s Annual Meeting is especially important, no matter how many or how few shares you own. Please sign and date the enclosed WHITE proxy card and return it in the enclosed postage paid envelope promptly, or follow the instructions set forth on the enclosed WHITE proxy card to vote over the Internet or by telephone.

All stockholders are invited to attend the Annual Meeting. Whether or not you expect to attend the Annual Meeting in person, we respectfully urge you to vote over the Internet, by telephone or by signing, dating and returning the enclosed WHITE proxy card as promptly as possible. Stockholders who execute a proxy card may nevertheless attend the Annual Meeting, revoke their proxy and vote their shares during the Annual Meeting. “Street name” stockholders who wish to vote their shares during the Annual Meeting will need to obtain a legal proxy from the bank, broker or other nominee in whose name their shares are registered. The instructions for voting over the Internet or by telephone are provided on your proxy card.

ETFS Capital is conducting a solicitation pursuant to which it is waging a campaign to vote against the election of [•] director nominees nominated by your Board of Directors. THE BOARD OF DIRECTORS STRONGLY URGES YOU NOT TO SIGN OR RETURN ANY PROXY CARD OR VOTING INSTRUCTION FORM THAT YOU MAY RECEIVE FROM ETFS CAPITAL OR ANY PERSON OTHER THAN THE COMPANY. IF YOU HAVE PREVIOUSLY SIGNED A PROXY CARD SENT TO YOU BY ETFS CAPITAL, YOU MAY REVOKE IT AND VOTE FOR YOUR BOARD OF DIRECTORS’ NOMINEES AND IN ACCORDANCE WITH THE BOARD OF DIRECTORS’ RECOMMENDATIONS ON THE OTHER MATTERS TO BE VOTED ON AT THE ANNUAL MEETING BY SUBMITTING A LATER-DATED PROXY ELECTRONICALLY BY FOLLOWING THE INSTRUCTIONS ON THE ENCLOSED WHITE PROXY CARD, OR BY SIGNING, MARKING, DATING AND MAILING THE ENCLOSED WHITE PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED. Any proxy card you sign and return from ETFS Capital for any reason could invalidate previous WHITE proxy cards sent by you to support our Board of Directors.

Only your latest dated, signed proxy card or voting instruction form will be counted. Any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in this proxy statement.

|

IMPORTANT! WE

URGE YOU NOT

TO SIGN ANY PROXY CARD OR VOTING Remember, you can vote your shares over the Internet. Please

follow the easy If

you have any questions or need assistance in voting Innisfree

M&A Incorporated |

WisdomTree, Inc. | 2024 Proxy Statement

Table of Contents

|

1 | ||

|

1 | ||

|

1 | ||

|

3 | ||

|

3 | ||

|

5 | ||

|

6 | ||

|

7 | ||

|

8 | ||

|

General Information for Stockholders about the Annual Meeting |

10 | |

|

18 | ||

|

21 | ||

|

22 | ||

|

27 | ||

|

29 | ||

|

29 | ||

|

29 | ||

|

29 | ||

|

29 | ||

|

30 | ||

|

30 | ||

|

30 | ||

|

32 | ||

|

32 | ||

|

33 | ||

|

33 | ||

|

33 | ||

|

Policy Prohibiting Short Sales, Derivatives Trading, Hedging and Pledging |

34 | |

|

34 | ||

|

36 | ||

|

36 | ||

|

36 | ||

|

38 | ||

|

39 | ||

|

40 | ||

|

41 | ||

|

49 | ||

|

49 | ||

|

49 | ||

|

65 | ||

|

67 | ||

WisdomTree, Inc. | 2024 Proxy Statement

|

Table of Contents |

|

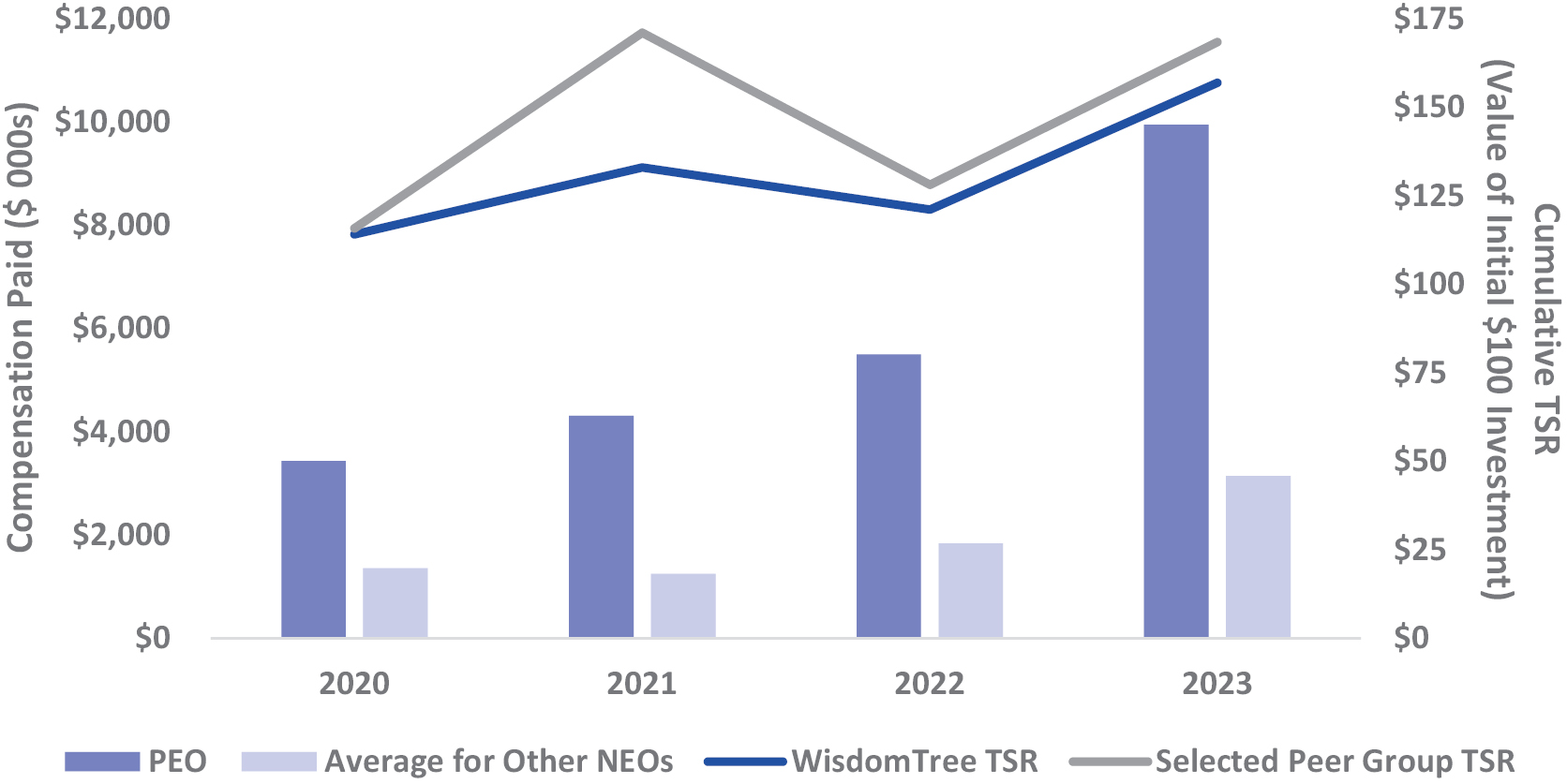

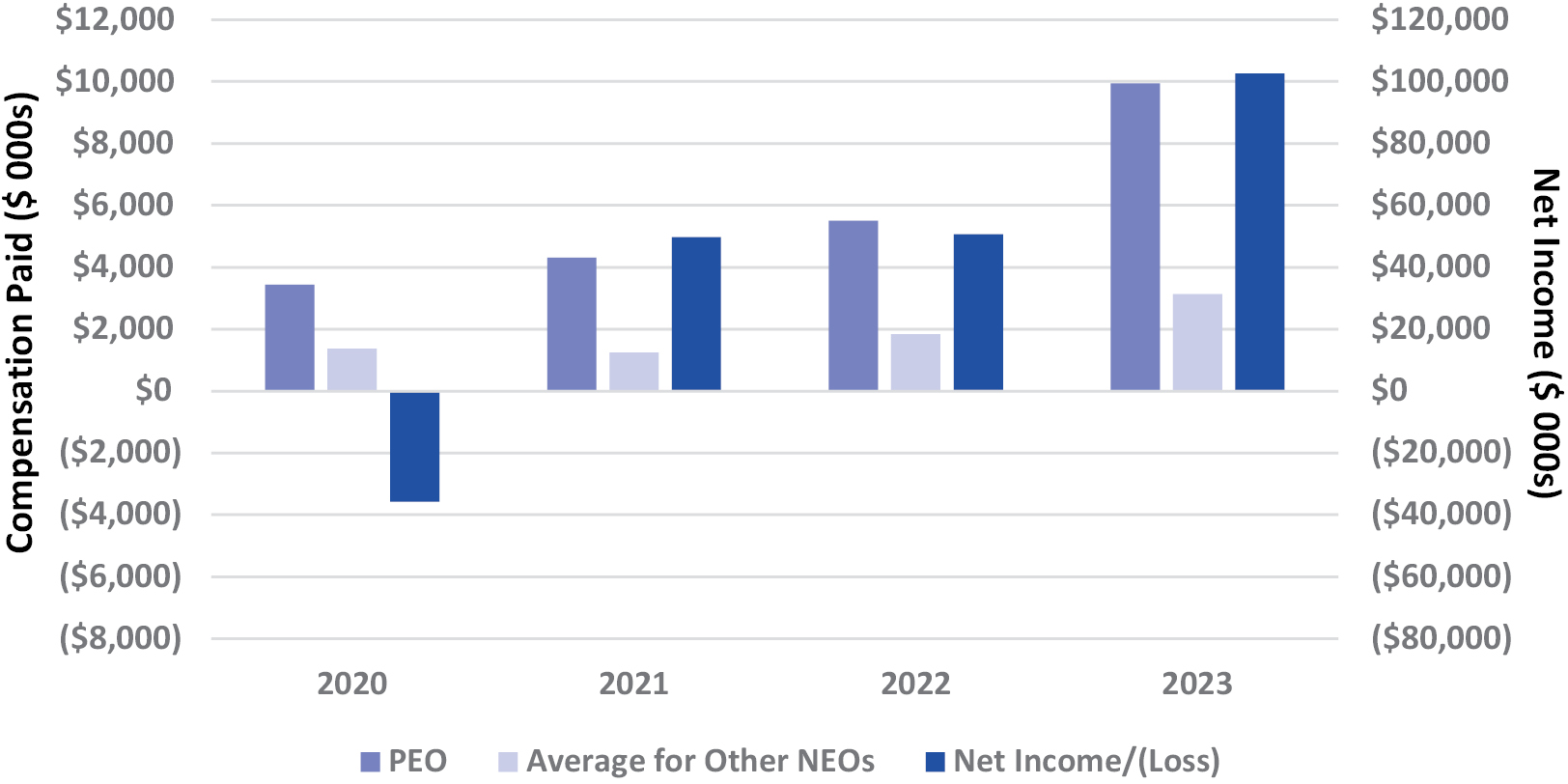

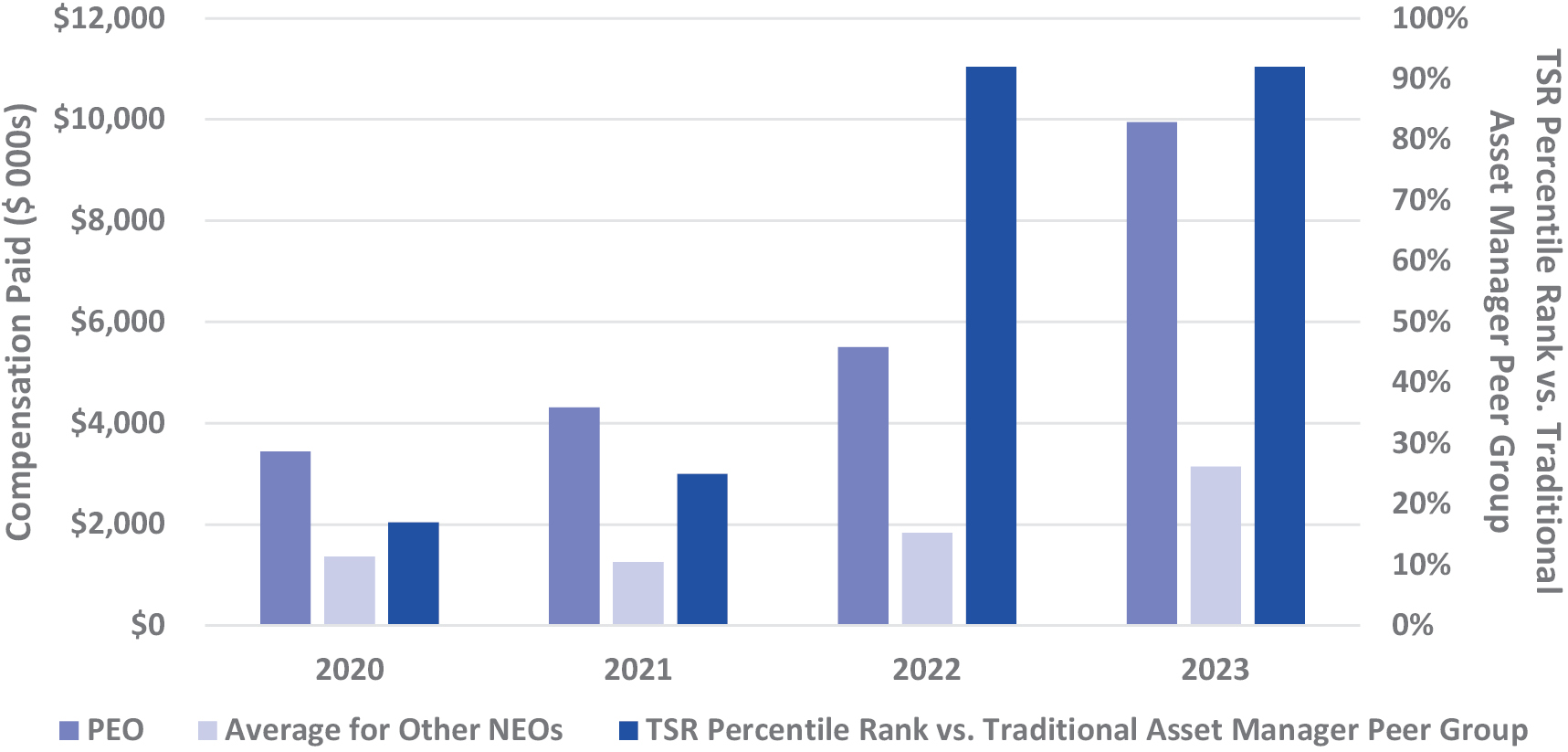

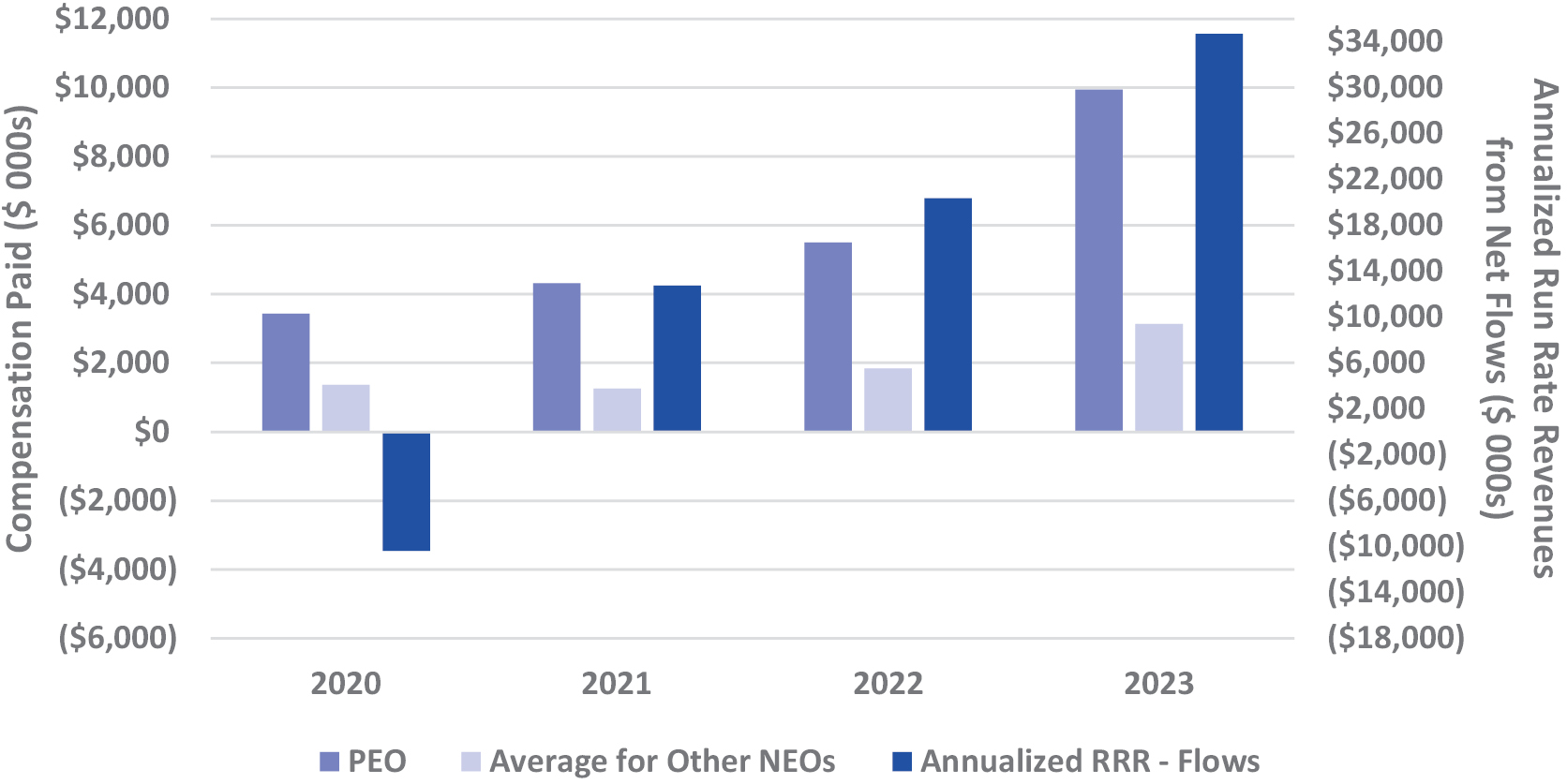

Relationship Between Compensation Actually Paid and Performance Measures |

68 | |

|

70 | ||

|

70 | ||

|

71 | ||

|

72 | ||

|

73 | ||

|

73 | ||

|

75 | ||

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

78 | |

|

78 | ||

|

81 | ||

|

81 | ||

|

81 | ||

|

81 | ||

|

81 | ||

|

82 | ||

|

82 | ||

|

82 | ||

|

A-1 | ||

|

B-1 | ||

Unless otherwise indicated, references to “the Company,” “we,” “us,” “our” and “WisdomTree” mean WisdomTree, Inc. and its subsidiaries.

WisdomTree®, WisdomTree Prime™ and Modern Alpha® are trademarks of WisdomTree, Inc. in the United States and in other countries. All other trademarks are the property of their respective owners.

WisdomTree, Inc. | 2024 Proxy Statement

WisdomTree, Inc. | 250 West 34th Street, 3rd Floor | New York, NY 10119

Proxy Statement for the 2024 Annual Meeting of Stockholders

To be Held on [•], 2024

Proxy Summary

This summary does not contain all the information that you should consider before voting. Please read this entire proxy statement carefully. For more information about our 2023 performance, please review our Annual Report on Form 10-K for the year ended December 31, 2023, a copy of which is available on our investor relations website at https://ir.wisdomtree.com/sec-filings/annual-reports.

This proxy statement and our annual report is first being mailed on or about [•], 2024 to stockholders entitled to vote at the Annual Meeting.

About our Company

WisdomTree, Inc. is a global financial innovator, offering a well-diversified suite of exchange-traded products (“ETPs”), models, solutions and products leveraging blockchain technology. We empower investors and consumers to shape their future and support financial professionals to better serve their clients and grow their businesses. We leverage the latest financial infrastructure to create products that provide access, transparency and an enhanced user experience. Building on our heritage of innovation, we are also developing and have launched next-generation digital products, services and structures, including digital or blockchain-enabled mutual funds and tokenized assets, as well as our blockchain-native digital wallet, WisdomTree Prime.

Corporate Performance Highlights

Strong Performance

• Our business continues a multi-year trend of significant positive momentum as we execute against our long-term strategic initiatives. Our revenues and operating income increased 15.8% and 45.6%, respectively, during the year ended December 31, 2023 as compared to the prior year, which translated into 520 basis points of operating margin expansion. In 2023, we generated over $10.4 billion of net inflows, representing annual organic flow growth of approximately 13%. Our inflow profile is both broad and deep, particularly in fixed income, international equity and emerging markets products, representing organic flow growth in these categories of 39%, 28% and 21%, respectively. This diversification increased our year-to-date average fee capture on our flows, which was approximately two times greater than our fee capture in the prior year. We believe our AUM diversification and product performance have us well-positioned for this growth trajectory to continue.

• Our AUM reached record highs of $100.1 billion and $107.3 billion as of December 31, 2023 and March 31, 2024, respectively.

• Our models strategy is succeeding, with our model portfolios available to over 70,000 advisors. We are focused on adding new clients and continuing to deepen our impact on partner platforms such as Merrill Lynch, Morgan Stanley, LPL Financial and others, as well as being an outsourced solution for smaller registered investment advisers and independent broker-dealers to make model portfolios easier to trade through our Portfolio Solutions program. In 2023, the number of advisors utilizing our models doubled from approximately 1,000 to 2,000. We believe that continued success penetrating our accessible market and in winning advisor mindshare should lead to model flows that are recurring in nature and stackable on top of our current inflow profile.

WisdomTree, Inc. | 2024 Proxy Statement 1

|

Proxy Summary |

• While we remain focused on providing investors with the best product structure to access various asset classes through ETPs, we believe that by leveraging blockchain technology, tokenized assets will be the preferred product structure of tomorrow and the future of financial services. We are an early mover in this space, with the launch of our blockchain-native wallet, WisdomTree Prime, a direct-to-consumer channel where spending, saving and investing are united. WisdomTree Prime currently provides investors access to bitcoin, ether, tokenized gold and U.S. dollar tokens, as well as 13 digital or blockchain-enabled mutual funds, including a government money market fund and other digital funds offering asset allocation, fixed income and equity exposures. The WisdomTree Prime debit card is live and available to customers, with peer-to-peer transfers to be available in the upcoming quarters. Further advancements in our digital assets business include the New York State Department of Financial Services (“DFS”) – the premier regulator for businesses that engage in tokenization and other digital assets activities – recently granting WisdomTree a limited purpose trust company charter, which will enable New York resident customers to access WisdomTree Prime and allow us to offer products and perform services under DFS supervision and associated legal protections. Including the forthcoming launch in New York, WisdomTree Prime will be available in 41 states, comprising approximately 75% of the U.S. population. We believe there is immense opportunity in our tokenization strategy, and we are exploring strategic partnerships and other business development opportunities for both our platform and product suite that could result in additional tokenization revenue streams in the future.

• Our recent achievements and strong performance were reflected in our stock price performance in relation to our peers. As described in the Compensation Discussion and Analysis section of this proxy statement, our total shareholder return, or TSR, ranking was 2nd among a peer group of 13 publicly-traded asset managers for the second straight year. Additionally, WisdomTree’s stock price was up over 25% and 30% during 2023 and the first quarter of 2024, respectively, and in March 2024 surpassed its 5-year high.

Balance Sheet Management

• We reduced our convertible senior notes outstanding by $45.0 million by issuing $130.0 million of convertible senior notes due 2028 and retiring $175.0 million of convertible senior notes due 2023.

• In May 2023, we closed a transaction resulting in the termination of our contractual gold payments obligation to ETFS Capital Limited for $50.0 million in cash and shares of Series C Non-Voting Convertible Preferred Stock convertible into approximately 13.1 million shares of our common stock (the “Series C Preferred Stock”). The value of these shares was $86.9 million based on the closing price of our common stock on May 9, 2023 of $6.64 per share. The transaction expanded our operating margin by over 500 basis points, was accretive to earnings per share and reduced volatility in our financial results.

• In November 2023, we repurchased the Series C Preferred Stock for aggregate cash consideration of approximately $84.4 million, comprised of $40.0 million paid upfront and the remainder in equal annual installments on the first, second and third anniversaries of the closing date, with no requirement to pay interest. The implied price per share of the repurchase was $6.02 when considering the interest-free financing element of the transaction, and the repurchase was accretive to earnings per share.

• We continue to return capital to our stockholders in the form of a quarterly cash dividend, which we have paid consecutively since 2014. Over the last four years, we also have repurchased approximately 14.6 million shares of our common stock for an aggregate cost of approximately $72.7 million in addition to the repurchase of the Series C Preferred Stock described above.

Disciplined Risk Management

• Our Board of Directors (“Board”) actively oversees the development of strategic objectives and receives updates on the implementation of strategic plans throughout the year at regularly scheduled Board meetings. The Board also reviews the risk assessment of the strategic plan.

• In addition, we have established a Global Risk Committee, consisting of members of senior management, which oversees risks both inside and outside of the firm, including any heightened or changed risks as they relate to independent third-party service providers. The Global Risk Committee meets quarterly and reports to the Audit Committee of the Board at regularly scheduled Audit Committee meetings.

2 WisdomTree, Inc. | 2024 Proxy Statement

|

Proxy Summary |

• We have implemented a cybersecurity risk management program that identifies, assesses and treats cybersecurity risks, which is directed by our Chief Information Officer (“CIO”) and overseen by the Audit Committee. The CIO regularly reports to the Audit Committee on our cybersecurity risks, and the chair of the Audit Committee reports on these discussions to the Board.

Mission, Vision, Values

We strive to differentiate ourselves in the asset management industry through our sense of community and purpose integrated into our culture, where every employee has a voice. Guided by our mission, vision and values and a defined framework for growth, we believe we are well positioned for success.

Our mission is to deliver a better financial experience through the quality of our products, solutions and engagement.

Our vision is to be the leader in the best transparent structures and executions in financial services.

Our values are grounded in:

• Excellence & Innovation – we “think big” and are not afraid to disrupt the status quo, and we relentlessly focus on improving our process, products and solutions to drive positive change in the business and continually advance our mission.

• Transparency & Accountability – we always strive to do the right thing, without shortcuts or exceptions, and we learn from our mistakes and celebrate success.

• Having Fun – we work with integrity and purpose and support each other as a global team.

Corporate Responsibility

Corporate responsibility is embedded throughout our business, which we believe benefits our employees, stockholders and other stakeholders. We have made a firmwide commitment to incorporate corporate responsibility efforts through various initiatives, including working to enhance our employee experience through training and the provision of employee benefits, investing in our community through firmwide service projects, caring for our environment and continuously striving to improve corporate governance. We are proud to have built a diverse and inclusive workforce across gender, race, age and ability, including in our leadership teams and our Board.

We have established a Global Sustainability Committee as well as jurisdictional working groups to drive sustainability initiatives across our business with oversight from our Board, the Nominating and Governance Committee and our executive management team. Our Global Sustainability Committee is comprised of leaders throughout the firm and is responsible for developing and implementing our corporate sustainability strategy across the Company.

WisdomTree, Inc. | 2024 Proxy Statement 3

|

Proxy Summary |

Included below are highlights of our corporate responsibility programs and practices. Our Corporate Responsibility Report, available on our investor relations website at https://ir.wisdomtree.com/company-information/corporate-responsibility/, provides additional details about these programs and policies and the corporate sustainability positioning of our firm as a whole.

|

Responsible Investing |

• In Europe, we offer a variety of products with environmental, social and governance (“ESG”) integration, including our Battery Solutions, Renewable Energy and Recycling Decarbonisation UCITS products. We also apply ESG screens across all of our equity and certain fixed income UCITS products. • As of March 31, 2024, we offer 24 ETPs in Europe that are categorized as Article 8 products under the EU Sustainable Finance Disclosures Regulation (“SFDR”) and two ETPs that are categorized as Article 9 products under the SFDR. Article 8 products promote, among other characteristics, environmental or social characteristics or a combination of those characteristics, provided that the companies in which the investments are made follow good governance practices. Article 9 products have sustainable investment as their objective. |

|

Diversity,

Equity |

• Our global DEI Council of senior leaders and employees represents our employee base and promotes a diverse and inclusive workplace culture. In 2023, the DEI Council held training sessions on understanding neurodiversity, implicit bias and embedding inclusion in feedback, roundtables on success and failure, and financial literacy workshops for employees and secondary school students. The DEI Council also promoted awareness days and months across the firm including with respect to black history, women’s history, pride, mental health and men’s health. • Our Women’s Initiative Network, or WIN, is an employee-led network designed to provide opportunities and support from all genders for women at WisdomTree, career development and professional training opportunities, and female empowerment and leadership within the organization. Since its inception in 2019, WIN has held numerous global events, including panel discussions on women in the workforce featuring Company employees and notable guest speakers, interactive seminars on topics including negotiation skills, workshops and coaching sessions to enhance confidence to speak up, and various roundtable forums and in-person and virtual social gatherings to promote connectivity and increase engagement. WIN also produces regular internal “spotlight” newsletters to increase visibility and raise the profile of our female employees. In addition, through WIN’s mentorship program, WIN members of all genders are connected with firm leaders who can help them achieve their career development goals. |

|

Enhancing Our Employee Experience |

• We offer our employees extensive health, wellness, career development and other benefits, including a monthly stipend to cover remote work-related business expenses, numerous wellness programs, an educational assistance program, and unlimited paid time-off for U.S. employees and flexible sick leave policies. • Our annual “Team Alpha” Awards recognize employees who led significant successes while exhibiting extraordinary teamwork and demonstrating strong character. • In the U.S., we were named a “Best Places to Work in Money Management” by Pensions & Investments for the fourth consecutive year and seven years total, and we ranked second within the category for managers with 100-499 employees, the second consecutive year earning a ranking among the top five employers. In the U.K., we were also named a “Best Workplace” for medium-sized companies for the fourth consecutive year and a “Best Workplace for Women” for medium-sized companies for the first time by Great Place to Work. |

|

Investing in Our Community |

• We encourage employees to be active members of the community and to give back through a variety of programs, including paid time-off to volunteer at a charitable organization of their choice. • We continue to support charitable causes through regular donations. In 2023, we contributed to 100 Black Men of America, the Thurgood Marshall College Fund and the NAACP Legal Defense Fund for Black History Month, Autism Speaks for Autism Awareness Month, and the Nature Conservancy for Earth Day, among many others including the Jazz Foundation of America. Our U.S. WIN members also volunteered with GradBag, a charitable organization whose mission is to support underserved college-bound students and to advance sustainability. WIN volunteers helped unload supplies and stage a shopping area for lightly used dorm room essentials for redistribution to incoming students in-need. • In our European offices, we supported a wide range of charities. We participated in several running events to raise money for Ambitious about Autism, Teach First and the Lullaby Trust. Our Europe WIN members partnered with The Malala Fund and Refuge to host “lunch and learn” events to raise awareness and funds for the charities. We also joined the Thames 21 Beach Clean to clean the Thames River shore, donated winter coats for homeless charities to Wrap Up, and volunteered for a day of gardening and participated in a 10-mile walk to raise money for Greenfingers, a local children’s hospice. |

4 WisdomTree, Inc. | 2024 Proxy Statement

|

Proxy Summary |

|

Caring for Our Environment |

• Our entire global workforce operates under our “Work Smart” philosophy, where time in the office is generally not prescribed, and team leaders are empowered to determine how their teams work best, based on their roles, with employees remaining accountable for achieving individual, team and Company outcomes. In keeping with this approach, we maintain a smaller office footprint, which we believe has enhanced our efficiency and sustainability and will continue to do so in the future. • Through carbon-offsetting, our European operations have been certified carbon neutral since 2019. Partnering with Carbon Footprint, we successfully calculated and offset our carbon emissions in Europe. We are engaging with a third-party consultant to expand this initiative on a global level. |

|

Corporate Governance |

• As described under “Board Governance Overview” below, our Board is committed to strong and effective governance and oversight through a number of policies, practices and procedures. |

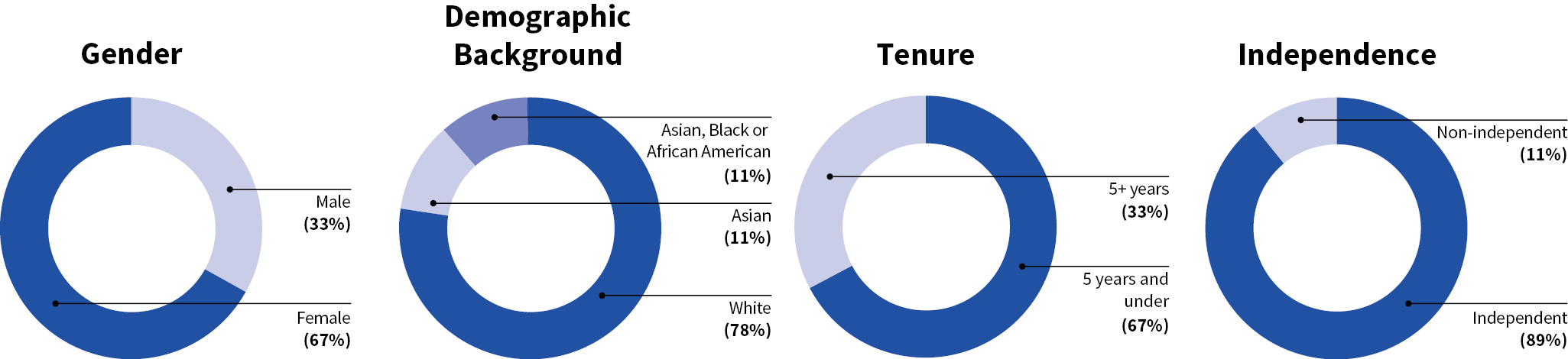

Board of Directors Highlights

We have a diverse, independent and highly qualified Board that oversees WisdomTree’s strategy and performance with the best interests of all stockholders in mind. Our Board is also highly focused on corporate governance. Over the past three years, our Board has been substantially refreshed, adding key additional experience and perspective, and all committee chair positions have been rotated and are held by female directors who joined the Board during this period.

|

Board Committees | |||||||||

|

Name |

Age |

Gender** |

Demographic Background ** |

Independent |

Director Since |

Other Public Company Boards |

Audit |

Compensation |

Nominating & Governance |

|

Lynn S. Blake |

59 |

Female |

White |

✔ |

2022 |

United Natural Foods, Inc. |

C* |

M |

M |

|

Anthony Bossone |

53 |

Male |

White |

✔ |

2009 |

M* |

M |

||

|

Smita Conjeevaram |

63 |

Female |

Asian |

✔ |

2021 |

McGrath RentCorp; SkyWest, Inc.; SS&C Technologies Holdings, Inc. |

C |

M | |

|

Rilla Delorier |

57 |

Female |

White |

✔ |

2023 |

Atlantic Union Bankshares Corporation; Coastal Financial Corporation |

M |

||

|

Daniela Mielke |

58 |

Female |

White |

✔ |

2022 |

Nuvei Corporation; The Bancorp, Inc. |

M |

M | |

|

Shamla Naidoo |

59 |

Female |

Asian; Black or African American |

✔ |

2023 |

QBE North America |

M |

C | |

|

Win Neuger |

74 |

Male |

White |

✔ |

2013 |

M |

|||

|

Tonia Pankopf |

56 |

Female |

White |

✔ |

2023 |

M | |||

|

Jonathan Steinberg |

59 |

Male |

White |

1988 |

|||||

* Financial Expert M = Member C = Chair

** Categories and information included based on director nominees’ self-identified diversity characteristics.

WisdomTree, Inc. | 2024 Proxy Statement 5

|

Proxy Summary |

Director Qualifications and Experience

The following table provides an overview of the specific skills, experiences and areas of knowledge of our director nominees that allow the Board to effectively serve and represent the interests of our stockholders, customers and employees. In addition, directors gain substantial experience through serving on our Board, which involves significant exposure to the complex regulations and changing landscape of the financial services industry.

|

Skills and Experience |

Blake |

Bossone |

Conjeevaram |

Delorier |

Mielke |

Naidoo |

Neuger |

Pankopf |

Steinberg |

|

Corporate Governance |

● |

● |

● |

● |

● |

● |

● |

● |

● |

|

Global Business Experience |

● |

● |

● |

● |

● |

● |

● |

● |

● |

|

Executive Leadership |

● |

● |

● |

● |

● |

● |

● |

● | |

|

Financial Services/Asset Management |

● |

● |

● |

● |

● |

● |

● |

● | |

|

Accounting/Financial Reporting |

● |

● |

● |

● |

● |

● |

|||

|

Other Public Company Expertise |

● |

● |

● |

● |

● |

● |

|||

|

Risk Management |

● |

● |

● |

● |

● |

||||

|

ETF Expertise |

● |

● |

● |

● | |||||

|

Information Technology/Cybersecurity Oversight |

● |

● |

● |

● |

|||||

|

Legal and Regulatory |

● |

● |

● |

||||||

|

Digital Transformation/Marketing |

● |

● |

● |

6 WisdomTree, Inc. | 2024 Proxy Statement

|

Proxy Summary |

Board Governance Overview

Our Board is committed to strong and effective governance and oversight. Annually, and more often as necessary, the Board reviews and enhances its practices for Board independence, accountability and effectiveness. Below are some highlights of our Board governance program.

|

Board Independence |

|

|

Separation of Roles |

The roles of Chair of the Board and Chief Executive Officer are completely separate. |

|

Substantial Majority of Independent Directors |

All directors are considered independent under applicable standards except Jonathan Steinberg, our CEO. |

|

Independent Director-Led Committees |

All standing Board committees are comprised entirely of independent directors. Over the past year, the Board appointed new chairs to each of these Board committees; with these changes, all standing Board committees are chaired by female directors who joined the Board within the past three years. |

|

Executive Sessions |

Independent directors regularly meet in executive session without management throughout the year. |

|

Board Accountability |

|

|

Annually Elected Directors |

The Board is fully declassified. All directors are elected annually. |

|

Attendance |

The Board and its committees had a 96% aggregate attendance rate in 2023. |

|

Majority Voting Standards |

We utilize majority voting requirements for director elections for which there is not an opposing slate of director nominees. |

|

Oversight of Strategy |

The Board oversees the development of strategic objectives and receives updates on the implementation of strategic plans throughout the year at regularly scheduled Board meetings. The Board also reviews the risk assessment of the strategic plan. |

|

Oversight of Cybersecurity |

The Audit Committee oversees the management of cybersecurity risks, including our cybersecurity risk assessment and management policies and procedures. The Audit Committee receives regular reports on cybersecurity risks from management and, in turn, reports on these discussions to the Board. |

|

Oversight of Corporate Responsibility Matters |

The Nominating and Governance Committee reviews and provides oversight of our strategy, initiatives and policies concerning corporate responsibility, including consideration of environmental, health and safety and social matters, and makes recommendations to the Board regarding our sustainability initiatives and relevant public disclosures. |

|

Stock Ownership Guidelines |

Our non-employee directors and executive officers are subject to stock ownership guidelines. |

|

Prohibition of Pledging, Hedging, Short Sales and Derivative Transactions |

Our insider trading policy prohibits pledging, hedging, short sales and derivative transactions in our securities by directors, officers, employees and consultants who in the ordinary course of their duties have access to material nonpublic information of the Company. |

|

Oversight of Executive Management Succession Planning |

The Board engages in regular executive management succession planning reviews, as well as succession planning discussions at the Compensation Committee level. |

|

Proxy Access |

Stockholders that meet certain requirements can have their director nominees included in our proxy statement. |

WisdomTree, Inc. | 2024 Proxy Statement 7

|

Proxy Summary |

|

Board Effectiveness |

|

|

Robust Self-Assessments |

The Board and each committee complete written self-assessments. Management implements action plans based on directors’ feedback and reports to the Board on the implementation of those plans to ensure continuous improvement. |

|

Director Education Program |

To enhance directors’ knowledge on topics relevant to oversight of the Company, Board members participate in educational programs, including through a membership we procure for each director with the National Association of Corporate Directors. |

|

Broad Director Onboarding Program |

Our comprehensive onboarding program seeks to quickly integrate new directors in our business and culture and features one-on-one sessions with senior executives and functional area representatives, and training on Company policies and industry trends. |

|

Board Succession Planning |

The Board, and its relevant committees, discuss director succession planning, focusing on business needs, industry trends, diverse perspectives and stockholder expectations. |

|

Over-Boarding Restrictions |

To maintain Board effectiveness, ensure that directors have sufficient time to devote to their duties, and align with stockholder expectations, directors may serve on up to five total public company boards and directors who serve as our CEO or an executive officer may serve on a total of two public company boards. |

|

Strong Corporate Governance Guidelines |

Our Corporate Governance Guidelines and Board Committee Charters are clear and robust and are reviewed annually to maintain strong and sound governance practices. |

Executive Compensation

2023 Highlights

In 2023, we made the following enhancements to our executive compensation program:

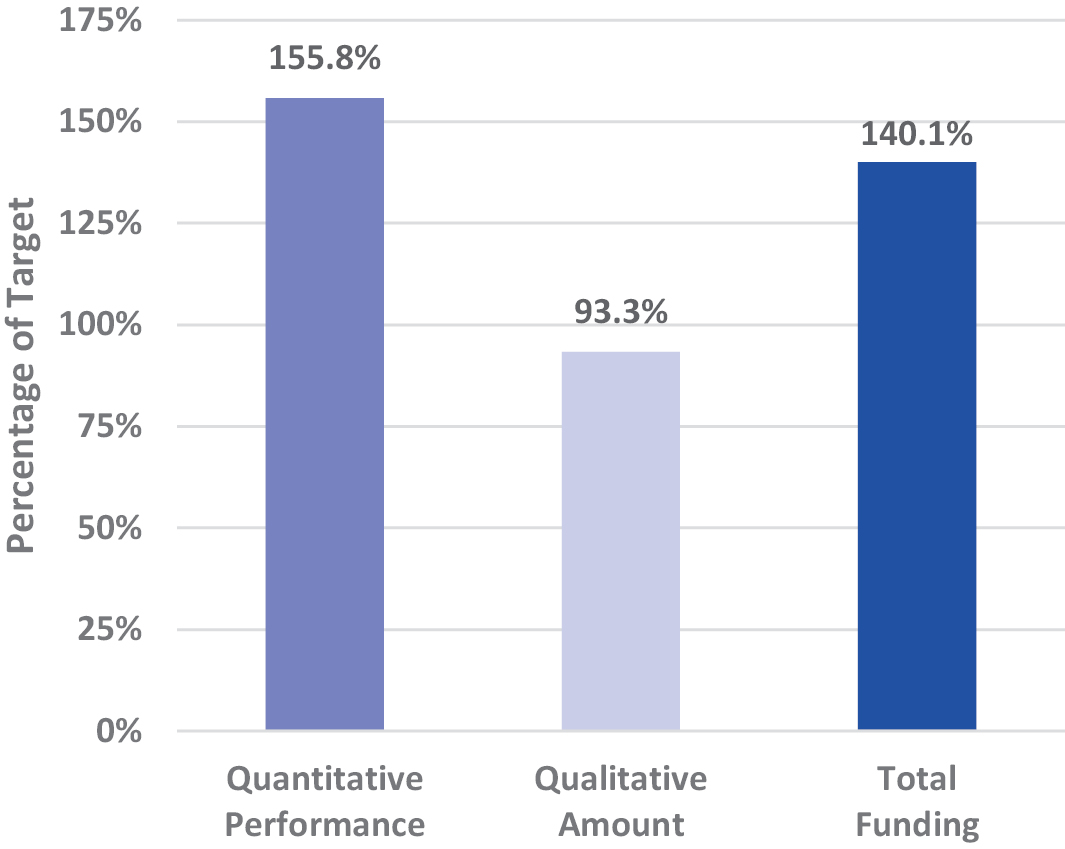

• New performance metric. We introduced an additional performance metric, “Annualized Run Rate Revenue (“RRR”) from Flows,” which is computed by multiplying net flows of each of our ETPs by its expense ratio. This metric is weighted equally with our Net Inflows metric (9.375% in each case) and represents a financial measure (revenue associated with flows) derived from a non-financial measure (net flows). We believe this new metric is a meaningful enhancement to our incentive compensation program as the composition of our flows impacts the magnitude of the change to our operating revenues.

• Adjustment to payout curve. We adjusted the payout curve for financial metrics (revenues, adjusted operating income and adjusted operating margin) to be computed using two-to-one leverage instead of one-to-one leverage. For every percentage point increase (or decrease) in performance, our NEOs received a two percentage point increase (or decrease) to the payout, which provided greater alignment with pay and performance by further reducing the payout when performance is below target and further increasing the payout when performance is above target.

• Severance Plan and Amended Employment Agreements. See “Employment Agreements and Severance Plan” below for a description of our Severance Plan and Restrictive Covenant Agreement (each defined below) applicable to our Chief Financial Officer (“CFO”), and amendments to employment agreements with each of our CEO, Chief Operating Officer (“COO”), Chief Administrative Officer (“CAO”) and Head of Europe (“HoE”) that we entered into in April 2023.

Impact of Total Shareholder Return on NEO Compensation

A significant portion of our executive compensation program is linked to shareholder return, as follows:

• relative total shareholder return, or TSR, is a performance metric included in our performance-based incentive compensation program for our NEOs. As described in the Compensation Discussion and Analysis section of this proxy statement in the subsection titled “2023 Incentive Compensation Program and Results,” the 2023 funded payout percentage for this performance metric was 224.9% of target;

• long-term incentive compensation is granted entirely in the form of equity, which value is explicitly linked to TSR, and is comprised of both restricted stock awards and relative TSR-based performance-based restricted stock units, or PRSUs;

8 WisdomTree, Inc. | 2024 Proxy Statement

|

Proxy Summary |

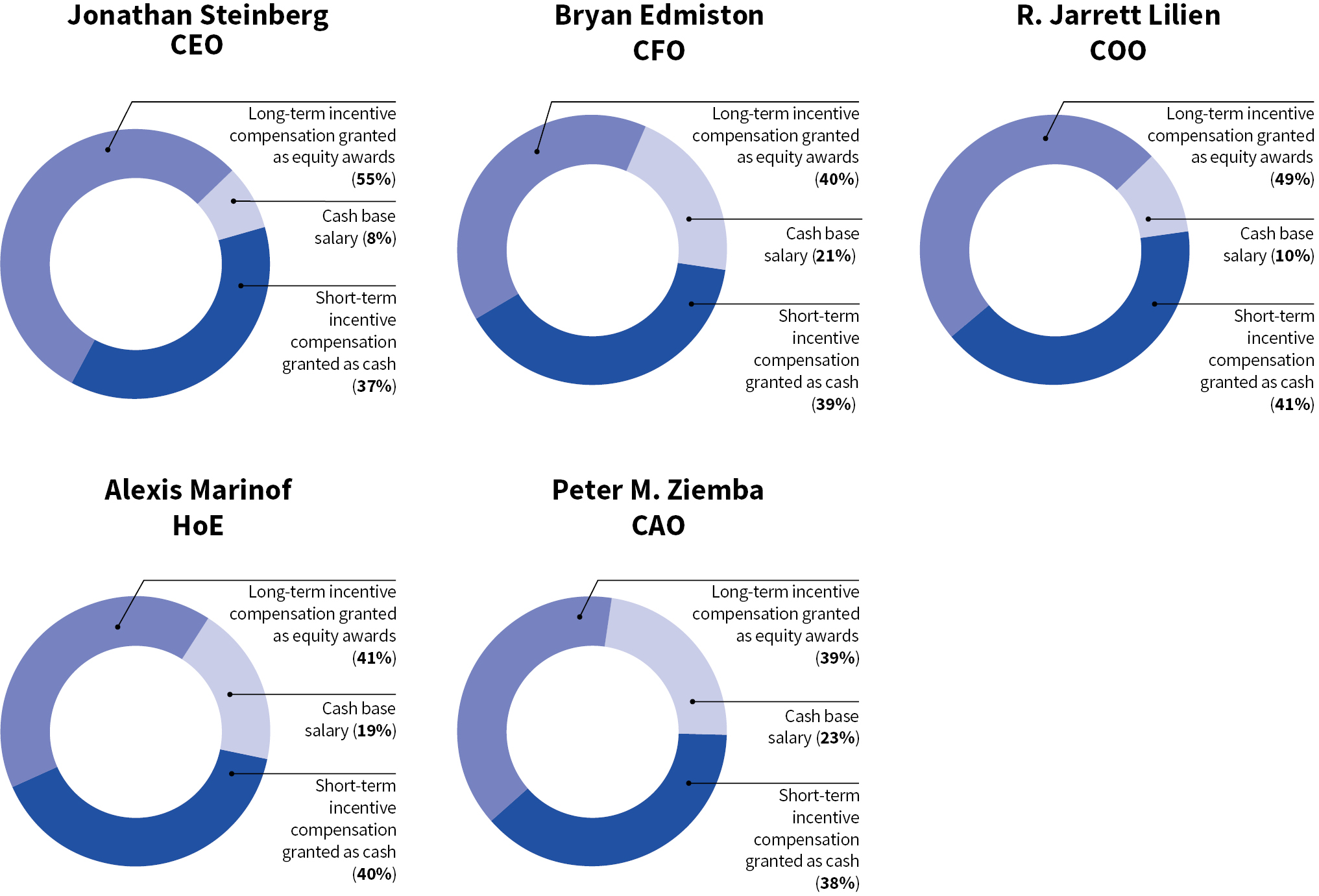

• PRSUs granted for 2023 performance in January 2024 to our CEO and COO represent 50% of each of their respective long-term equity awards granted. PRSUs granted to our other NEOs represent 25% of each of their respective long-term equity awards granted; and

• the payout on PRSUs that vested in January 2022, January 2023 and January 2024 was 0%, 76.92% and 200%, respectively.

Change to be Effective in 2024

We made the following enhancement to our incentive compensation program that will take effect prospectively beginning in 2024:

• Greater emphasis on financial vs. non-financial performance metrics. As described in the Compensation Discussion and Analysis section of this proxy statement in the subsection titled “Executive Summary – Compensation Overview,” we adjusted the weightings applied to our performance metrics such that greater emphasis will be placed on the financial metrics to further align the magnitude of our performance-driven compensation plan with our ability to pay. The financial metrics for 2024 are weighted 75.0%, as compared to 56.25% in the prior year.

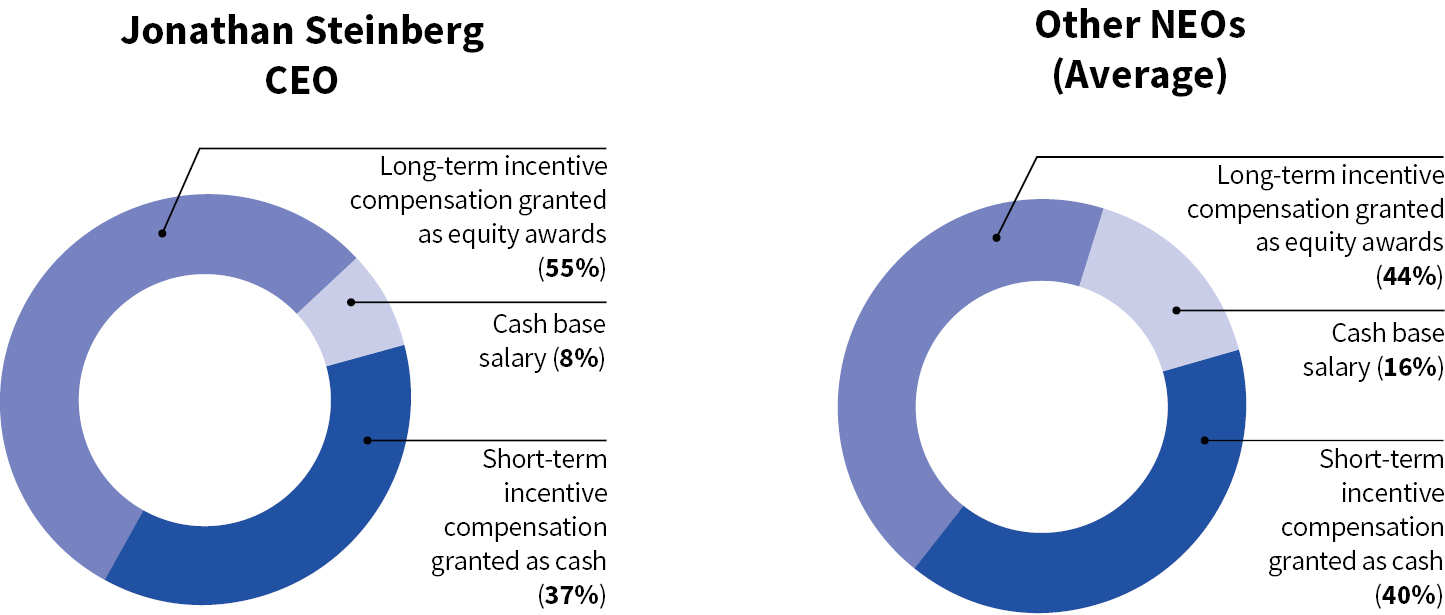

2023 Total Compensation Pay Mix

The following charts reflect the elements of 2023 total compensation for (i) our CEO and (ii) our other NEOs who were serving in their respective positions as of December 31, 2023, as a percentage of their total compensation. Incentive compensation paid to our CEO is most heavily weighted toward long-term equity incentives, followed by our COO, and then our other NEOs. Long-term equity awards consist of restricted stock awards and PRSUs. PRSUs granted to our CEO and COO represent 50% of the long-term equity awards granted. PRSUs granted to our other NEOs represent 25% of the long-term equity awards granted.

Compensation Program Best Practices

Our compensation programs incorporate best practices, including the following:

|

What We Do |

What We Don’t Do | |

|

✔ Annual say-on-pay advisory vote ✔ Pay for performance compensation philosophy ✔ Robust stock ownership guidelines ✔ Clawback policy applicable to cash and equity incentive compensation ✔ Independent compensation consultant ✔ Entirely independent Compensation Committee ✔ Annual compensation risk assessment |

û No dividends will be paid with respect to unvested awards under the 2022 Equity Plan û No pledging, hedging, short sales or derivative transactions û No excessive perks û No excessive risk taking û No excise tax gross-ups |

WisdomTree, Inc. | 2024 Proxy Statement 9

General Information for Stockholders About the Annual Meeting

Who is soliciting my vote?

The Board of Directors of WisdomTree, Inc. is soliciting your vote for the 2024 Annual Meeting of Stockholders (“Annual Meeting”).

How do I attend the Annual Meeting, and may I ask questions?

The Annual Meeting will be held on [•], 2024, at [•] a.m. Eastern Time at [•]. Any stockholder may attend the Annual Meeting. If you choose to do so, please bring your proxy card and valid picture identification. If your shares of common stock are held in a brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and this proxy statement is being forwarded to you by your broker or nominee. As a result, your name does not appear on our list of stockholders. If your stock is held in street name, in addition to a voting instruction form and picture identification, you should bring with you a letter or account statement showing that you were the beneficial owner of the Company stock on the record date, in order to be admitted to the Annual Meeting.

Even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the Annual Meeting.

In order to encourage stockholder participation and transparency, subject to our rules of conduct and procedures, we will provide stockholders attending the Annual Meeting with the ability to ask appropriate questions relating to an agenda item on which stockholders are entitled to vote during the Annual Meeting.

How many votes can be cast by all stockholders?

[•] shares of our common stock were outstanding and entitled to be voted on [•], 2024, the record date for determining stockholders eligible to vote. Each share of common stock is entitled to one vote on each matter.

What am I voting on?

There are five matters scheduled for a vote:

• Proposal 1: Election of nine members of our Board (the “Director Election Proposal”);

• Proposal 2: Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (the “Auditor Ratification Proposal”);

• Proposal 3: Vote on an advisory resolution to approve the compensation of our named executive officers (the “Executive Compensation Proposal”);

• Proposal 4: Vote, on a non-binding, advisory basis, on the frequency of future advisory votes to approve the compensation of our named executive officers (the “Advisory Vote Frequency Proposal”); and

• Proposal 5: Ratification of the approval by the Board of the extension of the Stockholder Rights Agreement, dated March 17, 2023, as amended, by and between the Company and Continental Stock Transfer & Trust Company (the “Rights Agreement Extension Proposal”).

How many votes are required to approve each proposal?

Director Election Proposal. Under our by-laws, the directors must be elected by the affirmative vote of a majority of the votes cast at the Annual Meeting. This means that the number of votes cast “for” a director nominee must exceed the number of votes cast “against” that nominee. Abstentions and broker non-votes, if any, will have no effect on the election of the nominees. Any nominee who does not receive a majority of votes cast “for” his or her election would be required to tender his or her resignation promptly following the failure to receive the required vote. Within 90 days of the certification

10 WisdomTree, inc. | 2024 Proxy Statement

|

General Information for Stockholders About the Annual Meeting |

of the stockholder vote, the Nominating and Governance Committee would then be required to make a recommendation to the Board as to whether the Board should accept the resignation, and the Board would be required to decide whether to accept the resignation and disclose its decision-making process.

Auditor Ratification Proposal. The affirmative vote of a majority of votes cast is necessary for the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. Abstentions and broker non-votes, if any, will have no effect on this proposal.

Executive Compensation Proposal. The affirmative vote of a majority of votes cast is necessary for the approval of the advisory resolution to approve the compensation of our named executive officers. Abstentions and broker non-votes, if any, will have no effect on this proposal.

Advisory Vote Frequency Proposal. The non-binding, advisory vote on the frequency of future advisory votes to approve the compensation of our named executive officers will be determined based on a plurality of votes cast. This means that the option that receives the most votes (every one year, every two years or every three years) will be approved on a non-binding, advisory basis. Abstentions and broker non-votes, if any, will have no effect on this proposal.

Rights Agreement Extension Proposal. The affirmative vote of a majority of votes cast is necessary for the approval of the extension of the Stockholder Rights Agreement. Abstentions and broker non-votes, if any, will have no effect on this proposal.

What are “broker non-votes”?

A broker non-vote occurs when the bank, broker or nominee holding shares in street name has not received voting instructions from the beneficial owner and either elects not to vote the shares on a routine matter at the stockholders meeting or is not permitted to vote those shares on a non-routine matter.

If you are a beneficial owner whose shares of record are held by a bank, broker or other nominee (sometimes called “street name” or “nominee name”), you may instruct your bank, broker or other nominee how to vote your shares. If you do not give instructions to your bank, broker or other nominee, the bank, broker or other nominee will determine if it has the discretionary authority to vote on the particular matter. Under the rules of the New York Stock Exchange (“NYSE”), banks, brokers or other nominees have the discretion to vote on routine matters, but do not have discretion to vote on non-routine matters.

Because the Annual Meeting is the subject of a contested solicitation, to the extent ETFS Capital delivers its proxy materials to a given stockholder, all proposals at the Annual Meeting are considered “non-routine.” Moreover, if the proposals being voted on at this Annual Meeting are “non-routine,” and if you hold your shares in the name of your bank, broker or other nominee and you do not provide your bank, broker or other nominee with specific instructions regarding how to vote on a non-routine proposal to be voted on at the Annual Meeting, your bank, broker or other nominee will not be permitted to vote your shares on that proposal.

How is a quorum reached?

The presence, in person or by proxy, of holders of at least a majority of the total number of outstanding shares entitled to vote at the meeting is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Shares held of record by stockholders or brokers, bankers or other nominees who do not return a signed and dated proxy card or voting instruction form or attend the Annual Meeting will not be considered present or represented at the Annual Meeting and will not be counted in determining the presence of a quorum. Abstentions and broker non-votes, if any, will be counted for purposes of determining whether a quorum is present for the transaction of business at the meeting.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Stockholder of record. If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, you are considered a “stockholder of record,” or record holder, with respect to those shares, and we sent the proxy materials directly to you.

WisdomTree, Inc. | 2024 Proxy Statement 11

|

General Information for Stockholders About the Annual Meeting |

Beneficial owner of shares held in street name. If your shares are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, then you are the “beneficial owner” of shares held in “street name,” and the proxy materials were forwarded to you by that organization. As a beneficial owner, you have the right to instruct your broker, bank, or nominee how to vote your shares.

IS the annual meeting subject to a contested solicitation?

ETFS Capital, which owns approximately 10% of our common stock, is conducting a solicitation pursuant to which it is waging a campaign to vote against [•] director nominees nominated by our Board of Directors. You may receive proxy solicitation materials from ETFS Capital or other persons or entities affiliated with ETFS Capital, including an opposition proxy statement and proxy card. Please be advised that we are not responsible for the accuracy of any information provided by or relating to ETFS Capital contained in any proxy solicitation materials filed or disseminated by ETFS Capital or any other statements that they may otherwise make.

You may receive multiple mailings from ETFS Capital. You will also likely receive multiple mailings from the Company prior to the date of the Annual Meeting, so that our stockholders have our latest proxy information and materials to vote. Proxy cards provided by the Company will be WHITE. Please see “What should I do if I receive a proxy card from ETFS Capital?” and “What does it mean if I receive more than one WHITE proxy card or voting instruction form?” below for more information.

What should i do if I receive a proxy card from ETFS Capital?

Our Board of Directors strongly urges you NOT to sign or return any proxy card or voting instruction form that you may receive from ETFS Capital or any person other than the Company.

How do i vote?

For each proposal, you may either vote “For” or “Against” or abstain from voting, and in the case of the Advisory Vote Frequency Proposal, you may vote for a frequency of every one year, two years or three years or abstain from voting.

The Board recommends that you vote:

• “FOR” each of the Company’s director nominees to be elected to the Board named in the Director Election Proposal;

• “FOR” the Auditor Ratification Proposal;

• “FOR” the Executive Compensation Proposal;

• “ONE YEAR” on the Advisory Vote Frequency Proposal; and

• “FOR” the Rights Agreement Extension Proposal.

Votes cast by proxy or during the Annual Meeting will be counted by the person(s) we appoint to act as inspector of election for the meeting. The inspector of election will count all votes “for” and “against,” and all votes for a frequency of every one year, two years or three years in the case of the Advisory Vote Frequency Proposal, as well as abstentions and broker non-votes, as applicable, for each matter to be voted on at the Annual Meeting.

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote by attending the Annual Meeting in person or vote by proxy over the Internet, by telephone or by returning an executed proxy card. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You still may attend the Annual Meeting and vote during the Annual Meeting even if you have already voted by proxy.

• To vote using a traditional proxy card, complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

12 WisdomTree, Inc. | 2024 Proxy Statement

|

General Information for Stockholders About the Annual Meeting |

• To vote over the Internet or by telephone, simply follow the instructions and use the control number included on the enclosed proxy card. Your vote must be received by 11:59 p.m., Eastern Time, on [•], 2024 to be counted.

• If you attend the Annual Meeting in person, you can also vote during the Annual Meeting.

Beneficial Owner: Shares Registered in the Name of Broker or Other Nominee

If you are a beneficial owner of shares registered in the name of your broker, bank, or other nominee, these proxy materials along with a voting instruction form are being provided by that organization rather than the Company. Simply follow the instructions and mail the voting instruction form or vote over the Internet or by telephone to ensure that your vote is counted. To vote by attending the Annual Meeting, you must obtain a valid legal proxy from your broker, bank or other nominee. Follow the instructions from your broker, bank or other nominee included with these proxy materials, or contact your broker, bank or other nominee to request a legal proxy. Because the Annual Meeting is the subject of a contested solicitation, to the extent ETFS Capital delivers its proxy materials to a given stockholder, all proposals at the Annual Meeting are considered “non-routine.” Moreover, if the proposals being voted on at this Annual Meeting are “non-routine,” and if you hold your shares in the name of your bank, broker or other nominee and you do not provide your bank, broker or other nominee with specific instructions regarding how to vote on a non-routine proposal to be voted on at the Annual Meeting, your bank, broker or other nominee will not be permitted to vote your shares on that proposal.

What happens if i do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing and mailing your proxy card, over the Internet, by telephone or by attending the Annual Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Other Nominee

If you are a beneficial owner and do not instruct your broker, bank, or other nominee how to vote your shares by completing and mailing the voting instruction form or voting over the Internet or by telephone, the question of whether your broker or nominee will still be able to vote your shares depends on whether the particular proposal is a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Because the Annual Meeting is the subject of a contested solicitation, to the extent ETFS Capital delivers its proxy materials to a given stockholder, all proposals at the Annual Meeting are considered “non-routine.” Moreover, if the proposals being voted on at this Annual Meeting are “non-routine,” and if you hold your shares in the name of your bank, broker or other nominee and you do not provide your bank, broker or other nominee with specific instructions regarding how to vote on a non-routine proposal to be voted on at the Annual Meeting, your bank, broker or other nominee will not be permitted to vote your shares on that proposal.

What if i return a proxy card or voting instruction form or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or voting instruction form without marking voting selections, your shares will be voted, as applicable:

• “FOR” each of the Company’s director nominees to be elected to the Board named in the Director Election Proposal;

• “FOR” the Auditor Ratification Proposal;

• “FOR” the Executive Compensation Proposal;

• “ONE YEAR” on the Advisory Vote Frequency Proposal; and

• “FOR” the Rights Agreement Extension Proposal.

WisdomTree, Inc. | 2024 Proxy Statement 13

|

General Information for Stockholders About the Annual Meeting |

Who pays for the cost of soliciting proxies?

The entire cost of soliciting proxies on behalf of the Board, including the costs of preparing, assembling, printing and mailing this proxy statement, the WHITE proxy card and any additional soliciting materials furnished to stockholders by or on behalf of the Company, will be borne by the Company. Copies of solicitation material will be furnished to banks, brokerage firms, dealers, banks, voting trustees, their respective nominees and other agents holding shares in their names, which are beneficially owned by others, so that they may forward such solicitation material, together with our 2023 Annual Report, which includes our Form 10-K for the year ended December 31, 2023, to beneficial owners. In addition, we will reimburse these persons for their reasonable expenses in forwarding these materials to the beneficial owners.

We have engaged the proxy solicitation firm of Innisfree M&A Incorporated (“Innisfree”) to solicit proxies from stockholders in connection with the Annual Meeting. Innisfree expects that approximately [•] of its employees will assist in the solicitation of proxies. For these and related advisory services, we will pay Innisfree a fee not to exceed approximately $[•] plus costs and expenses. In addition, Innisfree and certain related persons will be indemnified against certain liabilities arising out of or in connection with the engagement.

We estimate that our additional out-of-pocket expenses beyond those normally associated with soliciting proxies for the Annual Meeting as a result of the potential contested solicitation will be $[•] in the aggregate, of which approximately $[•] has been incurred to date. Such additional solicitation costs are expected to include the fees incurred to retain Innisfree as our proxy solicitor, as discussed above, fees of outside legal, financial and public relations advisors to advise the Company in connection with a possible contested solicitation of proxies, increased mailing costs, such as the costs of additional mailings of solicitation materials to stockholders, including printing costs, mailing costs and the reimbursement of reasonable expenses of banks, brokerage firms and other agents incurred in forwarding solicitation materials to beneficial owners, as described above, and the costs of retaining an independent inspector of election.

What does it mean if i receive more than one white proxy card or voting instruction form?

You may receive more than one set of these proxy materials, including multiple copies of this proxy statement and multiple WHITE proxy cards or voting instruction forms. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction form for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one WHITE proxy card. To ensure that all of your shares are voted, please vote using each WHITE proxy card or voting instruction form you receive or, if you vote over the Internet or by telephone, you will need each of your control numbers. Remember, you may vote over the Internet, by telephone or by signing, dating and returning the WHITE proxy card in the postage-paid envelope provided, or by voting at the Annual Meeting.

As previously noted, ETFS Capital is conducting a solicitation pursuant to which it is waging a campaign to vote against [•] director nominees nominated by our Board. As a result, you may receive proxy cards from both the Company and ETFS Capital. To ensure that stockholders have our latest proxy information and materials to vote, the Board may conduct multiple mailings prior to the date of the Annual Meeting, each of which will include a WHITE proxy card. The Board encourages you to vote each WHITE proxy card you receive.

THE BOARD STRONGLY URGES YOU TO REVOKE ANY PROXY CARD OR VOTING INSTRUCTION FORM YOU MAY HAVE RETURNED THAT YOU RECEIVED FROM ETFS CAPITAL.

THE BOARD STRONGLY URGES YOU NOT TO SIGN OR RETURN ANY PROXY CARD OR VOTING INSTRUCTION FORM THAT YOU MAY RECEIVE FROM ETFS CAPITAL.

Can i change my vote or revoke my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

• You may submit another properly completed proxy card with a later date.

• You may grant a subsequent proxy over the Internet or by telephone.

14 WisdomTree, Inc. | 2024 Proxy Statement

|

General Information for Stockholders About the Annual Meeting |

• You may send a timely written notice that you are revoking your proxy to our Secretary, Marci Frankenthaler, at WisdomTree, Inc., 250 West 34th Street, 3rd Floor, New York, NY 10119.

• You may attend the Annual Meeting in person and vote. Attendance at the Annual Meeting will not, by itself, revoke your proxy.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

Could other matters be decided at the annual meeting?

We do not know of any other matters that may be presented for action at the Annual Meeting. Should any other business come before the meeting, the persons named on the proxies will have discretionary authority to vote the shares represented by such proxies in their best judgment, subject to compliance with Rule 14a-4(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

What happens if the Annual Meeting is postponed or adjourned?

Your proxy may be voted at the postponed or adjourned meeting. You will be able to change your proxy until it is voted.

What is the deadline to propose actions for consideration or to nominate individuals to serve as directors at the 2025 annual meeting of stockholders?

Requirements for stockholder proposals to be considered for inclusion in our proxy materials

Stockholders who wish to present proposals for inclusion in our proxy materials for our 2025 annual meeting of stockholders may do so by following the procedures prescribed in Rule 14a-8 under the Exchange Act. Our Secretary must receive stockholder proposals intended to be included in our proxy statement and form of proxy relating to our 2025 annual meeting of stockholders made under Rule 14a-8 by [•], 2025. Any proposal of business must be mailed to Marci Frankenthaler, Secretary, WisdomTree, Inc., 250 West 34th Street, 3rd Floor, New York, NY 10119. We also encourage you to submit any such proposals by email to mfrankenthaler@wisdomtree.com.

Requirements for director nominations to be considered for inclusion in our proxy materials

Our by-laws permit a stockholder, or a group of up to 20 stockholders, who meet the eligibility requirements of our by-laws to utilize our “proxy access” by-law provision. “Proxy access” can be used to nominate up to the greater of two nominees or 25% of the total number of directors who are members of the Board as of the date that the stockholder(s) notifies us of the intent to utilize proxy access (the “proxy access notice”). Director nominations submitted under this by-law provision must be delivered to us no earlier than [•], 2025, and no later than [•], 2025. The proxy access notice must comply with the requirements in our by-laws. To be eligible to utilize our proxy access by-law provision, the stockholder(s) must have continuously owned at least 3% of our outstanding common stock for at least three years as of the date of the proxy access notice. Consistent with standard market practice, proxy access is only available to eligible stockholders who acquired our common stock in the ordinary course of business and not with the intent to change or influence control at WisdomTree and who do not presently have such intent.

WisdomTree, Inc. | 2024 Proxy Statement 15

|

General Information for Stockholders About the Annual Meeting |

Requirements for stockholder proposals and director nominations to be brought before an annual meeting

It is the policy of our Nominating and Governance Committee to consider nominations for candidates to our Board that are properly submitted by our stockholders in accordance with our by-laws. Under our current by-laws, proposals of business other than those to be included in our proxy materials following the procedures described in Rule 14a-8 and nominations for directors may be made by any stockholder who was a stockholder of record at the time of the giving of notice provided for in our by-laws, who is entitled to vote at the meeting, who is present in person or by proxy at the meeting and who complies with the notice procedures set forth in our by-laws (i.e., notice must be timely given and contain the information required by the by-laws). To be timely, a notice with respect to the 2025 annual meeting of stockholders must be delivered to our Secretary no earlier than [•], 2025 and no later than [•], 2025, unless the date of the 2025 annual meeting of stockholders is advanced by more than 30 days or delayed by more than 60 days from the anniversary date of the Annual Meeting, in which event the by-laws provide different notice requirements. Any proposal of business or nomination must be mailed to Marci Frankenthaler, Secretary, WisdomTree, Inc., 250 West 34th Street, 3rd Floor, New York, NY 10119. We also encourage you to submit any such proposal of business or nomination by email to mfrankenthaler@wisdomtree.com.

In addition, because our by-laws require a stockholder to include a statement that it intends to solicit the holders of shares representing at least 67% of the voting power of shares entitled to vote on the election of directors in support of director nominees other than the Company’s nominees, a stockholder must effectively provide the notice required under Rule 14a-19 of the Exchange Act by the same deadline noted above to submit a notice of nomination at an annual meeting of stockholders.

Recommendation of Director Candidates by Stockholders

The Nominating and Governance Committee will evaluate candidates for the position of director recommended by stockholders in the same manner as candidates from other sources and will determine whether to interview any candidates or seek any additional information.

Who should i call if i have any additional questions?

If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, Innisfree M&A Incorporated, toll free at (877) 750-5836.

How can I obtain electronic access to the proxy materials?

Our proxy materials are available on our investor relations website at https://ir.wisdomtree.com/company-information/annual-reports-proxy.

Policies on Reporting Concerns About Accounting and Other Matters and Communicating with Non-employee Directors

Our Board and Audit Committee have adopted policies on reporting concerns regarding accounting and other matters and on communicating with the non-employee directors. Any person, including any employee, who has a concern about the conduct of WisdomTree or any of its people, including with respect to accounting, internal accounting controls or auditing matters, may, in a confidential or anonymous manner, communicate that concern to Lynn S. Blake, the Audit Committee chair, who is the designated contact for these purposes. Contact may be made by writing to her, care of the Audit Committee, at our offices at 250 West 34th Street, 3rd Floor, New York, NY 10119, or by email at auditcommittee@wisdomtree.com. Any interested party, including any employee, who wishes to communicate directly with the presiding director of the executive sessions of our non-employee directors, or with our non-employee directors as a group, may contact Win Neuger, Chair of the Board, by writing to him, care of the Chair of the Board, at our offices using the above address, or by email at WTIchairman@wisdomtree.com.

16 WisdomTree, Inc. | 2024 Proxy Statement

|

General Information for Stockholders About the Annual Meeting |

Where you can find more information

We file annual, quarterly and current reports, proxy statements and other information with the SEC, which are available on the SEC’s website at https://www.sec.gov. You may also read and find a copy of any document we file with the SEC on our investor relations website at https://ir.wisdomtree.com/sec-filings.

IMPORTANT

ETFS Capital may send you solicitation materials in an effort to solicit your vote against [•] director nominees nominated by our Board. THE BOARD STRONGLY URGES YOU NOT TO SIGN OR RETURN ANY PROXY CARD OR VOTING INSTRUCTION FORM THAT YOU MAY RECEIVE FROM ETFS CAPITAL OR ANY PERSON OTHER THAN THE COMPANY.

Your vote at this year’s Annual Meeting is especially important, no matter how many or how few shares you own. Please vote using the enclosed WHITE proxy card and vote “FOR” all nine WisdomTree nominees.

Only your latest dated, signed proxy card or voting instruction form will be counted. Any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in this proxy statement.

Incorporation by Reference

To the extent that this proxy statement has been or will be specifically incorporated by reference into any other filing of ours under the Securities Act of 1933 (the “Securities Act”), or the Exchange Act, the sections of this proxy statement entitled “Audit Committee Report,” to the extent permitted by the rules of the SEC, and “Compensation Committee Report” will not be deemed to be so incorporated, unless specifically provided otherwise in such filing.

Important Notice Regarding Delivery of Stockholder Documents

In accordance with a notice sent to certain of our stockholders who share a single address, only one copy of this proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2023, is being sent to that address unless we have received contrary instructions from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing and postage costs and help conserve our natural resources. However, any stockholder residing at such an address who wishes to receive a separate copy of this proxy statement or our Annual Report may send a request in writing to WisdomTree, Inc., 250 West 34th Street, 3rd Floor, New York, NY 10119, Attention: Marci Frankenthaler, Secretary, or by email to mfrankenthaler@wisdomtree.com, and we will deliver those documents promptly upon receiving the request. Any such stockholder also may contact our Secretary to receive separate proxy statements, annual reports or Notices of Internet Availability of Proxy Materials, as applicable, in the future. If you are receiving multiple copies of our annual reports and proxy statements, you may request householding in the future by contacting our Secretary.

WisdomTree, Inc. | 2024 Proxy Statement 17

Background of the Solicitation

The following chronology summarizes the key contacts between the Company and ETFS Capital since the date of the Company’s 2023 annual meeting of stockholders last year. This summary does not purport to catalogue every conversation of or among members of the Board, the Company’s management, the Company’s advisors, or representatives of ETFS Capital and their advisors relating to the solicitation.

On June 16, 2023, the Company held its 2023 annual meeting of stockholders, at which the Company’s stockholders voted to elect Lynn S. Blake, Daniela Mielke, Win Neuger, Shamla Naidoo, Jonathan Steinberg and Tonia Pankopf, a nominee of stockholder ETFS Capital Limited (“ETFS Capital”), as directors of the Company to serve until the 2024 annual meeting of stockholders (the “2024 Annual Meeting”).

On September 12, 2023, Graham Tuckwell, the Chairman of ETFS Capital, contacted Ms. Pankopf and requested a meeting with her.

On September 28, 2023, Ms. Pankopf and Mr. Tuckwell held a meeting that also included Martyn James, Managing Partner of ETFS Capital, and Mark Weeks, Vice Chairman of ETFS Capital, during which ETFS Capital expressed that their two areas of concern with respect to the Company were its European gold business and WisdomTree Prime and requested an in-person meeting with the Board during the week of November 13, 2023, when the ETFS Capital representatives would be in New York.

On October 12, 2023, Marci Frankenthaler, Chief Legal Officer and Secretary of the Company, emailed Messrs. Tuckwell and James to arrange for a meeting with the Board, stating that the full Board and select members of senior management would be available to meet on November 14, 2023.