UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

_______________________

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

WisdomTree, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Copies to:

Sean M. Donahue

Paul Hastings LLP

2050 M Street NW

Washington, DC 20036

(202) 551-1704

Payment of Filing Fee (Check all boxes that apply)

| x | No fee required. |

| o | Fee paid previously with preliminary materials. |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

WisdomTree is Delivering for StockholdersMay 2024

Forward Looking StatementsThis presentation contains forward-looking statements that are based on our management's beliefs and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that maycause our actual results, levels of activity, performance or achievements to be materially different from any future results,levels of activity, performance or achievements expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expects," "intends," "plans," "anticipates," "believes," "estimates," "predicts," "potential," "continue" or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, the risks described below. If one or moreofthese or other risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or resultsmay vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this presentationcompletely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements.In particular, forward-looking statements in this presentation may include statements about:?anticipated trends, conditions and investor sentiment in the global markets and ETPs;?anticipated levels of inflows into and outflows out of our ETPs;?our ability to deliver favorable rates of return to investors;?competition in our business;?whether we will experience future growth;?our ability to develop new products and services and their potential for success;?our ability to maintain current vendors or find new vendors to provide services to us at favorable costs;?our ability to successfully implement our strategy relating to digital assets and blockchain-enabled financial services, including WisdomTree Prime®, and achieve its objectives;?our ability to successfully operate and expand our business in non-U.S. markets;?the effect of laws and regulations that apply to our business; and?actions of activist stockholders.Our business is subject to many risks and uncertainties, including without limitation:?declining prices of securities, gold and other precious metals and other commodities and changes in interest rates and general market conditions can adversely affect our business by reducing the market value of the assets we manage or causing WisdomTreeETP investors to sell their fund shares and trigger redemptions;?fluctuations in the amount and mix of our AUM, whether caused by disruptions in the financial markets or otherwise, includingbut not limited to events such as a pandemic or war, geopolitical conflicts, political events, acts of terrorism and other mattersbeyond our control, may negatively impact revenues and operating margins, and may impede our ability to refinance our debt upon maturity or increase the cost of borrowing upon a refinancing;?competitive pressures could reduce revenues and profit margins;?we derive a substantial portion of our revenues from a limited number of products, and, as a result, our operating results are particularly exposed to investor sentiment toward investing in the products' strategies and our ability to maintain the AUM ofthese products, as well as the performance of these products and market-specific and political and economic risk;?a significant portion of our AUM is held in products with exposure to U.S. and international developed markets, and we thereforehave exposure to domestic and foreign market conditions and are subject to currency exchange rate risks;?withdrawals or broad changes in investments in our ETPs by investors with significant positions may negatively impact revenues and operating margins;?we face increased operational, regulatory, financial and other risks as a result of conducting our business internationally, andas we expand our digital assets product offerings and services beyond our existing ETP business;?many of our ETPs have a limited track record, and poor investment performance could cause our revenues to decline;?we depend on third parties to provide many critical services to operate our business and our ETPs. The failure of key vendorstoadequately provide such services could materially affect our operating business and harm WisdomTree ETP investors; and?actions of activist stockholders against us, which have been costly and may be disruptive and cause uncertainty about the strategic direction of our business.Other factors, such as general economic conditions, including currency exchange rate fluctuations, also may have an effect onthe results of our operations. For a more complete description of the risks noted above and other risks that could cause our actual results to differ from our current expectations, see "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2023 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024.The forward-looking statements in this presentation represent our views as of the date of this presentation. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views as of any date other than the date of this presentation.This presentation contains non-GAAP financial measures and key metrics relating to the Company's past and expected future performance. These measures and metrics should be reviewed in conjunction with the most comparable GAAP financial measures and should not be considered substitutes for, or superior to, those GAAP financial measures. DisclaimerThe views and opinions expressed in this presentation are those of the management of WisdomTree as of the date hereof. WisdomTree has neither sought nor obtained the consent from any third party to use any statements of information contained inthis presentation that have been obtained or derived from statements made or published by such third parties. Any such statements or information should not be viewed as indicating the support of such third parties for the views expressed herein.Important Additional Information The Company and certain of its directors and executive officers are participants in the solicitation of proxies from the Company's stockholders in connection with the Company's 2024 annual meeting of stockholders (the "2024 Annual Meeting"). The Companyfiled its definitive proxy (the "Proxy Statement"), containing a form of WHITE proxy card, with the U.S. Securities and Exchange Commission (the "SEC") on April 29, 2024 in connection with the solicitation of proxies from the Company's stockholders. This presentation is not a substitute for any proxy statement or other document that the Company has filed or may file with the SEC in connection with any solicitation by the Company. THE COMPANY'S STOCKHOLDERS AND INVESTORS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ACCOMPANYING WHITE PROXY CARD FILED BY THE COMPANY AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE SOLICITATION. The Proxy Statement for the 2024 Annual Meeting contains information regarding the direct and indirect interests, by security holdings or otherwise, of the Company's directors and executive officers in the Company's securities. To the extent holdings of the Company's securities by such potential participants (or the identity of such participants) have changed since the information printed in the Proxy Statement, such information has been or will be reflected on Statements of Change in Ownership on Forms 3 and 4 filed with the SEC. The Company's stockholders andinvestors may obtain copies of these documents and other documents filed with the SEC by the Company free of charge through thewebsite maintained by the SEC at www.sec.gov. Copies of the documents filed by the Company are also available free of charge by accessing the Company's website at https://ir.wisdomtree.com/.WisdomTree ?May 20242

WisdomTree is Delivering for Our StockholdersStock Price Performance and Financial Results Indicate Strategy is Delivering Stockholder ValueRealizing Potential Across Digital Assets and a Blockchain-enabled PortfolioSignificant Enhancements to Corporate Governance with the Right Leadership to Oversee Our Strategy+Stock price is up 39% since the 2023 Annual Meeting. In March 2024, our stock surpassed its 5-year high+5 of 8 research analysts rate the Company a "BUY"+540 bps of adjusted operating margin expansion year over year (1)+A top performing TSR among 13 publicly traded asset manager peers, including WT, over the most recent YTD, 1-, 2-, 3-, and 4-year time periods (2)+Achieved record AUM of $107.2 billion as of March 31, 2024, and over three consecutive years of positive inflows, while fee capture on flows during the past 15 months was 2x greater than FY 2022+Launched a D2C channel and our blockchain-native wallet, WisdomTree Prime®, which provides investors access to tokenized gold and U.S. dollar tokens, blockchain-enabled mutual funds and select crypto currencies+Expanded the availability of WisdomTree Prime to 41 states and nearly 75% of the U.S. population+Launched the WisdomTree Prime Visa Debit Card and have plans to enable peer-to-peer transfers and payments+Independent, diverse and highly qualified Board with the right mix of skillsets to oversee our strategy+Added six new, independent voices since 2021, with the necessary expertise to help execute our strategy and recently rotated all committee chairs, each led by new directors. The average tenure of our independent Board members is 4 years+Our Board includes two independent directors nominated by ETFS Capital and elected by stockholders who support the Board's current strategic plan and vision"We believe WT's growth is accelerating as higher fee funds take centerstage and optionality exists with WT Prime and tokenization. As such, we upgrade to [outperform] from [market perform] and increase [our price target] to $12 from $8.50.""WT's key advantage against industry behemoths?is its ability and willingness to quickly design and launch the products in niche categories early where they can take meaningful market share without the need to win ?big beta buckets'."Northland CapitalMarkets,April3,2024Craig-Hallum,March6,2024Source: Company Website and filings, FactSet and SNL. Data as of May 22, 2024.Note: Permission to use quotes neither sought or obtained.(1)Non-GAAP metric. (2)Based on Total Shareholder Return. In addition to WT, peer group includes AB; AMG; APAM; BEN; BLK; BSIG; FHI; IVZ; JHG; TROW; VCTR; VRTS.WisdomTree ?May 20243

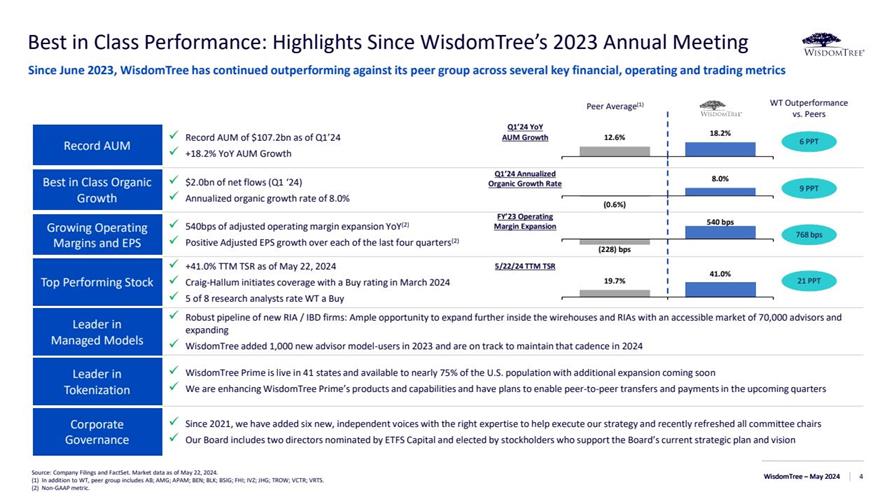

4Best in Class Performance: Highlights Since WisdomTree's 2023 Annual MeetingSource: Company Filings and FactSet. Market data as of May 22, 2024.(1)In addition to WT, peer group includes AB; AMG; APAM; BEN; BLK; BSIG; FHI; IVZ; JHG; TROW; VCTR; VRTS.(2)Non-GAAP metric. Since June 2023, WisdomTree has continued outperforming against its peer group across several key financial, operating and trading metrics?Record AUM of $107.2bn as of Q1'24 ?+18.2% YoY AUM Growth?$2.0bn of net flows (Q1 ?24)?Annualized organic growth rate of 8.0%?540bps of adjusted operating margin expansion YoY(2)?Positive Adjusted EPS growth over each of the last four quarters(2)?+41.0% TTM TSR as of May 22, 2024?Craig-Hallum initiates coverage with a Buy rating in March 2024?5 of 8 research analysts rate WT a Buy?Robust pipeline of new RIA / IBD firms: Ample opportunity to expand further inside the wirehouses and RIAs with an accessiblemarket of 70,000 advisors and expanding?WisdomTree added 1,000 new advisor model-users in 2023 and are on track to maintain that cadence in 2024?WisdomTree Prime is live in 41 states and available to nearly 75% of the U.S. population with additional expansion coming soon?We are enhancing WisdomTree Prime's products and capabilities and have plans to enable peer-to-peer transfers and payments in the upcoming quarters?Since 2021, we have added six new, independent voices with the right expertise to help execute our strategy and recently refreshed all committee chairs?Our Board includes two directors nominated by ETFS Capital and elected by stockholders who support the Board's current strategicplan and visionPeer Average(1)6 PPTWT Outperformance vs. Peers9 PPT768 bps21 PPTRecord AUMBest in Class Organic GrowthGrowing Operating Margins and EPSTop Performing StockLeader in Managed ModelsLeader in TokenizationCorporate Governance18.2% 12.6% 8.0% (0.6%) 41.0% 19.7% 540 bps(228) bpsQ1'24 YoY AUM GrowthQ1'24 Annualized Organic Growth RateFY'23 Operating Margin Expansion5/22/24 TTM TSRWisdomTree ?May 2024WisdomTree ?May 2024

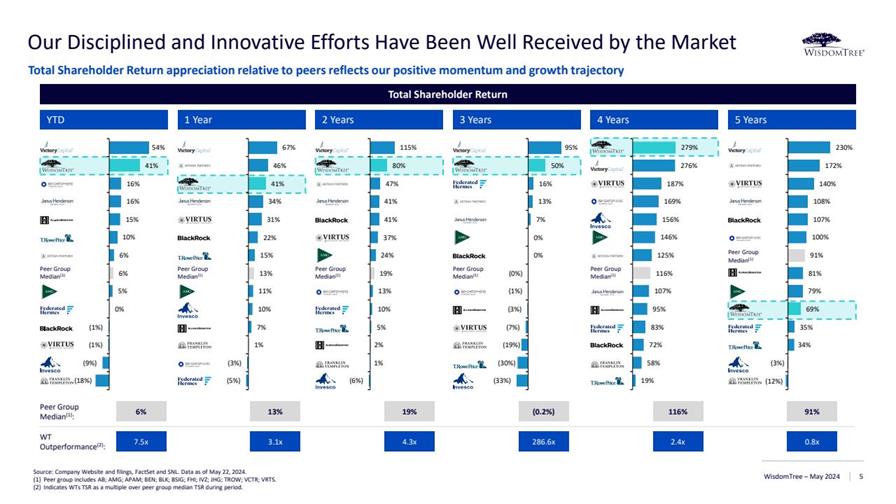

Peer Group Median(1)5Our Disciplined and Innovative Efforts Have Been Well Received by the MarketTotal Shareholder Return appreciation relative to peers reflects our positive momentum and growth trajectoryTotal Shareholder ReturnYTD1 Year2 YearsSource: Company Website and filings, FactSet and SNL. Data as of May 22, 2024.(1)Peer group includes AB; AMG; APAM; BEN; BLK; BSIG; FHI; IVZ; JHG; TROW; VCTR; VRTS.(2)Indicates WTs TSR as a multiple over peer group median TSR during period.3 Years4 Years5 YearsPeer Group Median(1):WT Outperformance(2):6%7.5x13%3.1x19%4.3x(0.2%)286.6x116%2.4x91%0.8xWisdomTree ?May 2024(18%) (9%) (1%) (1%) 0% 5% 6% 6% 10% 15% 16% 16% 41% 54% (5%) (3%) 1% 7% 10% 11% 13% 15% 22% 31% 34% 41% 46% 67% (6%) 1% 2% 5% 10% 13% 19% 24% 37% 41% 41% 47% 80% 115% (33%) (30%) (19%) (7%) (3%) (1%) (0%) 0% 0% 7% 13% 16% 50% 95% 19% 58% 72% 83% 95% 107% 116% 125% 146% 156% 169% 187% 276% 279% (12%) (3%) 34% 35% 69% 79% 81% 91% 100% 107% 108% 140% 172% 230% Peer Group Median(1)Peer Group Median(1)Peer Group Median(1)Peer Group Median(1)Peer Group Median(1)

A:Audit CommitteeC:Compensation CommitteeN&G:Nominating & Governance CommitteeNew director since 2021WisdomTree's Refreshed and Diverse Board is Overseeing the Company's Continued Growth and TransformationWithout the three directors targeted this year by ETFS Capital, the average tenure of our Board would be only 1.6 years. Directors with institutional knowledge are needed to continue to drive our success+Seasoned global investment executive and public company director with expertise in financial services+Substantial knowledge and experience in valuing corporate securities and managing capital market transactions+As Managing Partner of Pareto Advisors, provides capital investment, financial and strategic advisory servicesFinance & Capital Markets AcumenExtensive Board ExperienceFinancial & Innovation VisionaryETF ExpertIndependent Director+Founded WisdomTree in 1988 +Provides extensive knowledge of our business, stemming from founding and developing WisdomTree's proprietary index methodology+Strategic visionary providing essential insight and guidance to the Board from a management perspectiveTonia PankopfJonathan SteinbergFounder and CEONote: Represents WisdomTree's director nominees for the 2024 Annual Meeting.Committees: N&GWin Neuger+Decades of experience in senior management positions in the asset management industry +Holds deep understanding of WisdomTree's business model and expertise in ETFs, accounting and financial reporting+Grew AIG's global investment portfolio into a company with $753bn in assetsAsset Management LeaderETF ExpertIndependent ChairCommittees: C Finance & Digital Transformation Expertise +Accomplished C-suite leader with over 30 years of banking industry experience+Provides strategic expertise in leading digital transformation in financial services+Oversaw Umpqua Bank's creative, product and technology teams while serving as EVP, CSO, and Digital Transformation OfficerRilla DelorierIndependent DirectorCommittees: A+Track record of success in guiding companies through significant growth+Provides international financial, accounting and compliance expertise+A global executive with notable experience in fintech, which provides valuable oversight of WisdomTree's digital asset initiativesIndependent Director+Extensive leadership in the asset management industry+Provides expertise in investment management, including experience with institutional investor perspectives+Managed over 1,400 portfolios and ETFs with assets over $2.3tn while CIO of Global Equity Beta Solutions at State Street+Significant financial expertise, as well as experience as an equity trader and as an investor in WisdomTree since 2006+Provides global financial accounting, reporting and compliance skills+As CFO and CCO of Atlantic-Pacific Capital, oversees all global financial and administrative functions, including financial accounting, legal, compliance, tax, and human resourcesIndexing & Institutional Investor AcumenETF ExpertFinance, Accounting, Compliance & Audit ExpertiseETF ExpertGlobal Financial & Compliance ExpertiseLynn S. BlakeAnthony Bossone, CPAIndependent DirectorIndependent DirectorCommittees: A, C, N&GCommittees: A, CCommittees: C, N&GETFS Nominated and Stockholder Elected DirectorNew Audit Comm. ChairNew Comp. Comm. ChairIndependent Director+Extensive financial and transaction experience as an executive, founder, board member and advisor +Provides decades of expertise in driving growth strategies, as well as public board experience+Led PayPal's growth and strategy during a time of major digital disruption in the payments industryFinancial & Strategic Transaction AcumenDaniela MielkeCommittees: A, N&GShamla Naidoo+Experience in digital transformation with expertise in security and technology+Provides expertise in cybersecurity and digital innovation+Led IBM's innovation and growth strategy in cybersecurity as Global Chief Information Security Officer Cybersecurity, Data & Innovation LeaderIndependent Director Committees: N&GNew N&G Comm. ChairSmita Conjeevaram, CPAWisdomTree ?May 20246ETFS Nominated and Stockholder Elected Director

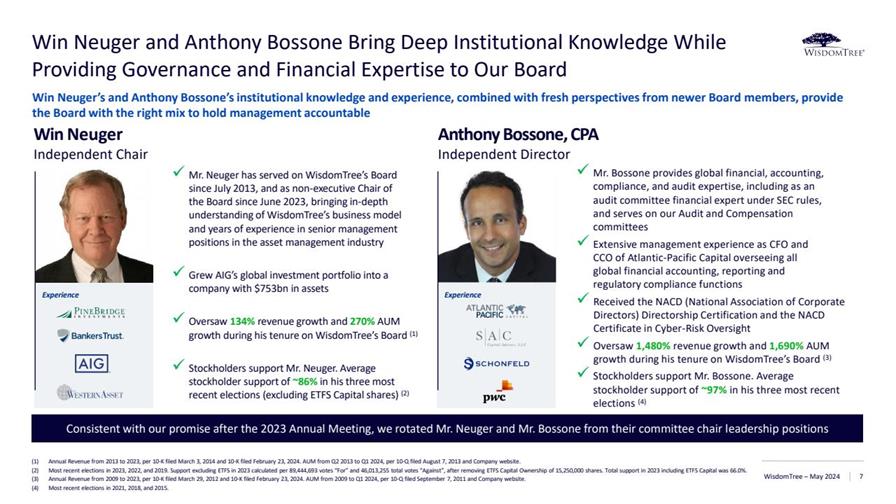

WisdomTree ?May 20247Win Neuger and Anthony Bossone Bring Deep Institutional Knowledge While Providing Governance and Financial Expertise to Our BoardWin Neuger's and Anthony Bossone's institutional knowledge and experience, combined with fresh perspectives from newer Board members, provide the Board with the right mix to hold management accountableWinNeugerIndependent Chair?Mr. Bossone provides global financial, accounting, compliance, and audit expertise, including as an audit committee financial expert under SEC rules, and serves on our Audit and Compensation committees?Extensive management experience as CFO and CCO of Atlantic-Pacific Capital overseeing all global financial accounting, reporting and regulatory compliance functions?Received the NACD (National Association of Corporate Directors) Directorship Certification and the NACD Certificate in Cyber-Risk Oversight?Oversaw 1,480%revenue growth and 1,690%AUM growth during histenure on WisdomTree's Board (3)?Stockholders support Mr. Bossone. Average stockholder support of ~97% in his three most recent elections (4)?Mr. Neuger has served on WisdomTree's Board since July 2013, and as non-executive Chair of the Board since June 2023, bringing in-depth understanding of WisdomTree's business model and years of experience in senior management positions in the asset management industry?Grew AIG's global investment portfolio into a company with $753bn in assets?Oversaw 134%revenue growth and 270% AUM growth during his tenure on WisdomTree's Board (1)?Stockholders support Mr. Neuger. Average stockholder support of ~86% in his three most recent elections (excluding ETFS Capital shares) (2)Anthony Bossone, CPAIndependent DirectorExperienceExperienceConsistent with our promise after the 2023 Annual Meeting, we rotated Mr. Neuger and Mr. Bossone from their committee chair leadership positions(1)Annual Revenue from 2013 to 2023, per 10-K filed March 3, 2014 and 10-K filed February 23, 2024. AUM from Q2 2013 to Q1 2024, per 10-Q filed August 7, 2013 and Company website.(2)Most recent elections in 2023, 2022, and 2019. Support excluding ETFS in 2023 calculated per 89,444,693 votes "For" and 46,013,255 total votes "Against", after removing ETFS Capital Ownership of 15,250,000 shares. Total support in 2023 including ETFS Capital was 66.0%.(3)Annual Revenue from 2009 to 2023, per 10-K filed March 29, 2012 and 10-K filed February 23, 2024. AUM from 2009 to Q1 2024, per 10-Q filed September 7, 2011 and Company website.(4)Most recent elections in 2021, 2018, and 2015.

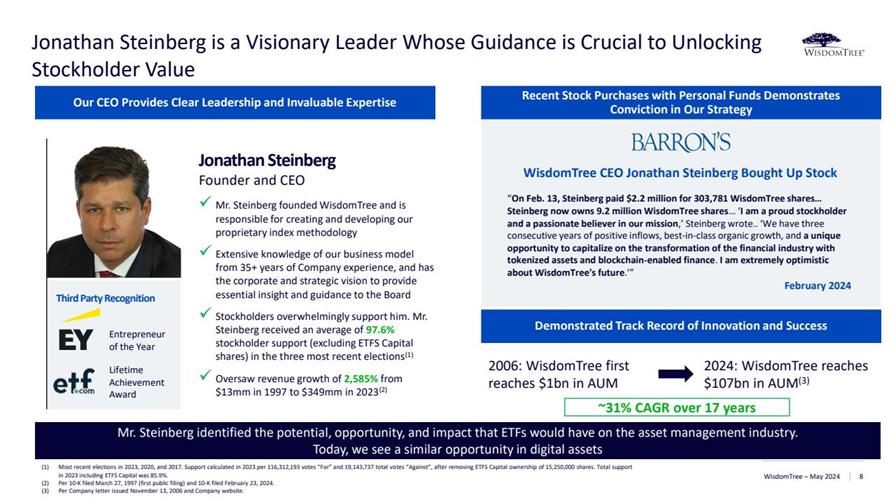

WisdomTree ?May 20248Jonathan Steinberg is a Visionary Leader Whose Guidance is Crucial to Unlocking Stockholder Value?Mr. Steinberg founded WisdomTree and is responsible for creating and developing our proprietary index methodology?Extensive knowledge of our business model from 35+ years of Company experience, and has the corporate and strategic vision to provide essential insight and guidance to the Board?Stockholders overwhelmingly support him. Mr. Steinberg received an average of 97.6%stockholder support (excluding ETFS Capital shares) in the three most recent elections(1)?Oversaw revenue growth of 2,585%from $13mm in 1997 to $349mm in 2023(2)Our CEO Provides Clear Leadership and Invaluable ExpertiseRecent Stock Purchases with Personal Funds Demonstrates Conviction in Our StrategyDemonstrated Track Record of Innovation and Success"On Feb. 13, Steinberg paid $2.2 million for 303,781 WisdomTree shares? Steinberg now owns 9.2 million WisdomTree shares? ?I am a proud stockholder and a passionate believer in our mission,' Steinberg wrote.. ?We have three consecutive years of positive inflows, best-in-class organic growth, and a unique opportunity to capitalize on the transformation of the financial industry with tokenized assets and blockchain-enabled finance. I am extremely optimistic about WisdomTree's future.'"February 2024WisdomTree CEO Jonathan Steinberg Bought Up StockEntrepreneur of the YearLifetime Achievement Award2006: WisdomTree first reaches $1bn in AUM2024: WisdomTree reaches $107bn in AUM(3)(1)Most recent elections in 2023, 2020, and 2017. Support calculated in 2023 per 116,312,193 votes "For" and 19,143,737 total votes"Against", after removing ETFS Capital ownership of 15,250,000 shares. Total support in 2023 including ETFS Capital was 85.9%.(2)Per 10-K filed March 27, 1997 (first public filing) and 10-K filed February 23, 2024.(3)Per Company letter issued November 13, 2006 and Company website.Mr. Steinberg identified the potential, opportunity, and impact that ETFs would have on the asset management industry. Today, we see a similar opportunity in digital assetsThird Party Recognition~31% CAGR over 17 yearsJonathan SteinbergFounder and CEO

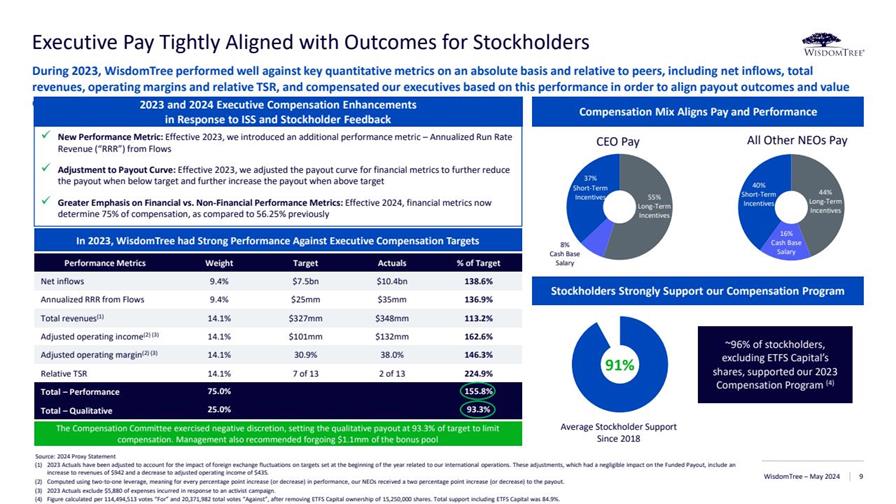

WisdomTree ?May 20249Executive Pay Tightly Aligned with Outcomes for StockholdersDuring 2023, WisdomTree performed well against key quantitative metrics on an absolute basis and relative to peers, includingnet inflows, total revenues, operating margins and relative TSR, and compensated our executives based on this performance in order to align payout outcomes and value creation91%Average Stockholder Support Since 2018CEO PayAll Other NEOs Pay?New Performance Metric: Effective 2023, we introduced an additional performance metric ?Annualized Run Rate Revenue ("RRR") from Flows?Adjustment to Payout Curve: Effective 2023, we adjusted the payout curve for financial metrics to further reduce the payout when below target and further increase the payout when above target?Greater Emphasis on Financial vs. Non-Financial Performance Metrics: Effective 2024, financial metrics now determine 75% of compensation, as compared to 56.25% previouslyCompensation Mix Aligns Pay and PerformanceStockholders Strongly Support our Compensation Program55%Long-Term Incentives8%Cash Base Salary37%Short-Term Incentives44%Long-Term Incentives16%Cash Base Salary40%Short-Term IncentivesPerformance Metrics WeightTargetActuals% of TargetNet inflows9.4%$7.5bn$10.4bn138.6%Annualized RRR from Flows9.4%$25mm$35mm136.9%Total revenues(1)14.1%$327mm$348mm113.2%Adjusted operating income(2) (3)14.1%$101mm$132mm162.6%Adjusted operating margin(2) (3)14.1%30.9%38.0%146.3%Relative TSR14.1%7 of 132 of 13224.9%Total ?Performance75.0%155.8%Total ?Qualitative 25.0%93.3%The Compensation Committee exercised negative discretion, setting the qualitative payout at 93.3% of target to limit compensation. Management also recommended forgoing $1.1mm of the bonus poolIn 2023, WisdomTree had Strong Performance Against Executive Compensation Targets~96% of stockholders, excluding ETFS Capital's shares, supported our 2023 Compensation Program (4)Source: 2024 Proxy Statement(1)2023 Actuals have been adjusted to account for the impact of foreign exchange fluctuations on targets set at the beginning of the year related to our international operations. These adjustments, which had a negligible impact on the Funded Payout, include anincrease to revenues of $942 and a decrease to adjusted operating income of $435.(2)Computed using two-to-one leverage, meaning for every percentage point increase (or decrease) in performance, our NEOs received a two percentage point increase (or decrease) to the payout.(3)2023 Actuals exclude $5,880 of expenses incurred in response to an activist campaign.(4)Figure calculated per 114,494,513 votes "For" and 20,371,982 total votes "Against", after removing ETFS Capital ownership of15,250,000 shares. Total support including ETFS Capital was 84.9%.2023 and 2024 Executive Compensation Enhancements in Response to ISS and Stockholder Feedback

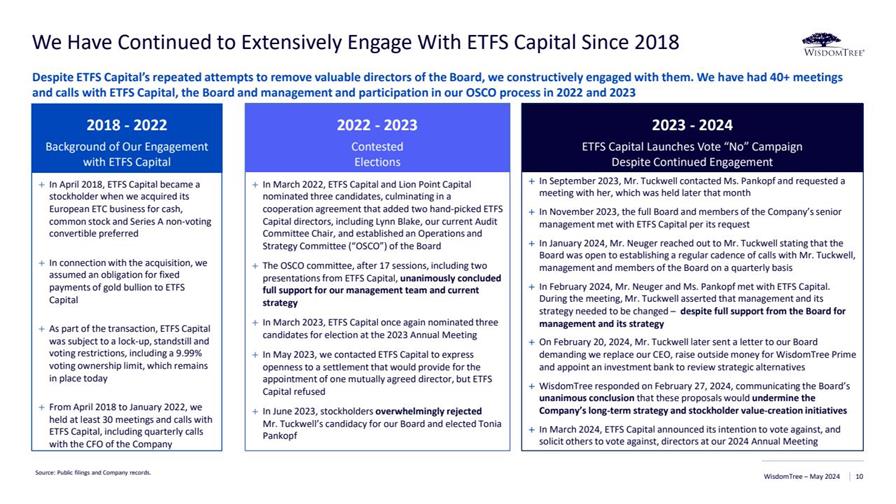

WisdomTree ?May 202410We Have Continued to Extensively Engage With ETFS Capital Since 2018Despite ETFS Capital's repeated attempts to remove valuable directors of the Board, we constructively engaged with them. We havehad 40+ meetings and calls with ETFS Capital, the Board and management and participation in our OSCO process in 2022 and 2023Background of Our Engagement with ETFS CapitalETFS Capital Launches Vote "No" CampaignDespite Continued Engagement2018 -20222023 -2024Source: Public filings and Company records.Contested Elections 2022 -2023In March 2022, ETFS Capital and Lion Point Capital nominated three candidates, culminating in a cooperation agreement that added two hand-picked ETFS Capital directors, including Lynn Blake, our current Audit Committee Chair, and established an Operations and Strategy Committee ("OSCO") of the BoardThe OSCO committee, after 17 sessions, including two presentations from ETFS Capital, unanimously concluded full support for our management team and current strategyIn March 2023, ETFS Capital once again nominated three candidates for election at the 2023 Annual MeetingIn May 2023, we contacted ETFS Capital to express openness to a settlement that would provide for the appointment of one mutually agreed director, but ETFS Capital refusedIn June 2023, stockholders overwhelmingly rejected Mr. Tuckwell's candidacy for our Board and elected Tonia PankopfIn April 2018, ETFS Capital became a stockholder when we acquired its European ETC business for cash, common stock and Series A non-voting convertible preferred In connection with the acquisition, we assumed an obligation for fixed payments of gold bullion to ETFS CapitalAs part of the transaction, ETFS Capital was subject to a lock-up, standstill and voting restrictions, including a 9.99% voting ownership limit, which remains in place todayFrom April 2018 to January 2022, we held at least 30 meetings and calls with ETFS Capital, including quarterly calls with the CFO of the CompanyIn September 2023, Mr. Tuckwell contacted Ms. Pankopf and requested a meeting with her, which was held later that monthIn November 2023, the full Board and members of the Company's senior management met with ETFS Capital per its requestIn January 2024, Mr. Neuger reached out to Mr. Tuckwell stating that the Board was open to establishing a regular cadence of calls with Mr. Tuckwell, management and members of the Board on a quarterly basisIn February 2024, Mr. Neuger and Ms. Pankopf met with ETFS Capital. During the meeting, Mr. Tuckwell asserted that management and its strategy needed to be changed ?despite full support from the Board for management and its strategyOn February 20, 2024, Mr. Tuckwell later sent a letter to our Board demanding we replace our CEO, raise outside money for WisdomTree Prime and appoint an investment bank to review strategic alternativesWisdomTree responded on February 27, 2024,communicating the Board's unanimous conclusion that these proposals would undermine the Company's long-term strategy and stockholder value-creation initiativesIn March 2024, ETFS Capital announced its intention to vote against, and solicit others to vote against, directors at our 2024 Annual Meeting

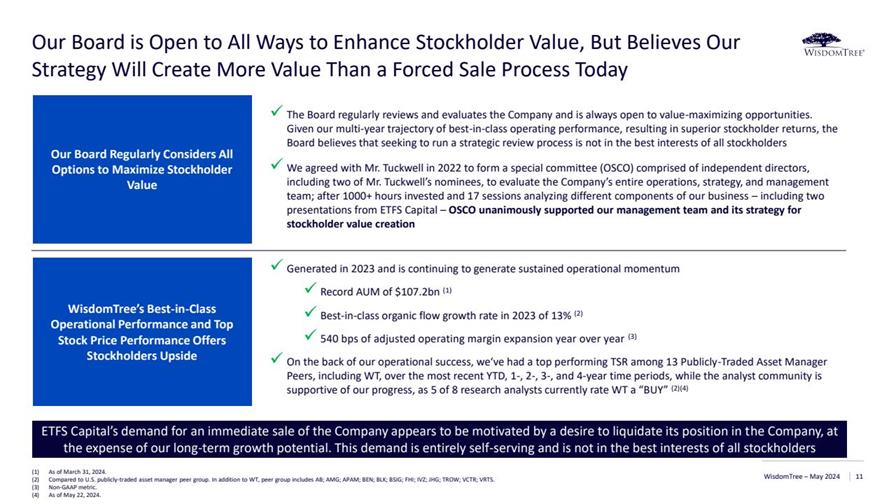

WisdomTree ?May 202411Our Board is Open to All Ways to Enhance Stockholder Value, But Believes Our Strategy Will Create More Value Than a Forced Sale Process Today(1)As of March 31, 2024.(2)Compared to U.S. publicly-traded asset manager peer group. In addition to WT, peer group includes AB; AMG; APAM; BEN; BLK; BSIG;FHI; IVZ; JHG; TROW; VCTR; VRTS.(3)Non-GAAP metric. (4)As of May 22, 2024. WisdomTree's Best-in-Class Operational Performance and Top Stock Price Performance Offers Stockholders UpsideOur Board Regularly Considers All Options to Maximize Stockholder ValueETFS Capital's demand for an immediate sale of the Company appears to be motivated by a desire to liquidate its position in the Company, at the expense of our long-term growth potential. This demand is entirely self-serving and is not in the best interests of all stockholders?Generated in 2023 and is continuing to generate sustained operational momentum?Record AUM of $107.2bn (1)?Best-in-class organic flow growth rate in 2023 of 13% (2)?540 bps of adjusted operating margin expansion year over year (3)?On the back of our operational success, we?ve had a top performing TSR among 13 Publicly-Traded Asset Manager Peers, including WT, over the most recent YTD, 1-, 2-, 3-, and 4-year time periods, while the analyst community is supportive of our progress, as 5 of 8 research analysts currently rate WT a "BUY" (2)(4)?The Board regularly reviews and evaluates the Company and is always open to value-maximizing opportunities. Given our multi-year trajectory of best-in-class operating performance, resulting in superior stockholder returns, the Board believes that seeking to run a strategic review process is not in the best interests of all stockholders?We agreed with Mr. Tuckwell in 2022 to form a special committee (OSCO) comprised of independent directors, including two of Mr. Tuckwell's nominees, to evaluate the Company's entire operations, strategy, and management team; after 1000+ hours invested and 17 sessions analyzing different components of our business ?including two presentations from ETFS Capital ?OSCO unanimously supported our management team and its strategy for stockholder value creation

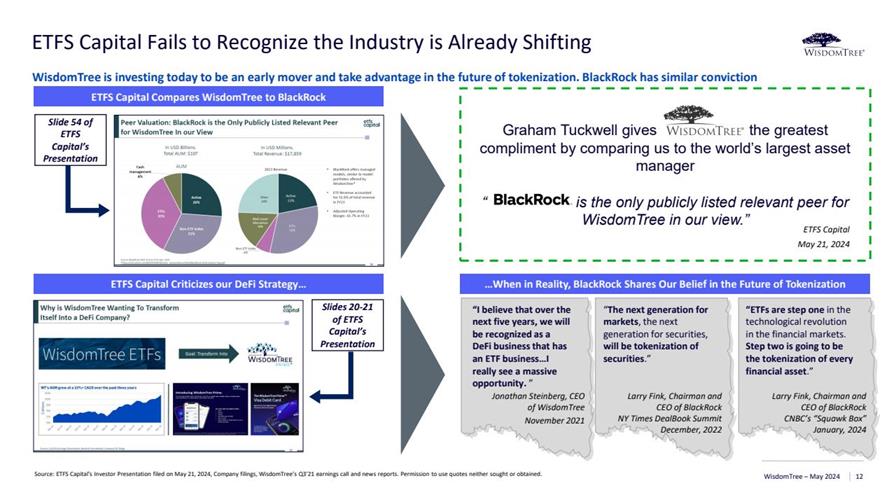

Graham Tuckwell gives WisdomTreethe greatest compliment by comparing us to the world's largest asset manager" BlacRoc is the only publicly listed relevant peer for WisdomTree in our view."ETFS CapitalMay 21, 202412ETFS Capital Fails to Recognize the Industry is Already ShiftingSource: ETFS Capital's Investor Presentation filed on May 21, 2024, Company filings, WisdomTree's Q3'21 earnings call and news reports. Permission to use quotes neither sought or obtained. WisdomTree is investing today to be an early mover and take advantage in the future of tokenization. BlackRock has similar convictionETFS Capital Criticizes our DeFi Strategy??When in Reality, BlackRock Shares Our Belief in the Future of TokenizationWisdomTree ?May 2024ETFS Capital Compares WisdomTree to BlackRockSlides 20-21 of ETFS Capital's PresentationSlide 54 of ETFS Capital's Presentation"I believe that over the next five years, we will be recognized as a DeFi business that has an ETF business?I really see a massive opportunity. "Jonathan Steinberg, CEO of WisdomTreeNovember 2021 "The next generation for markets, the next generation for securities, will be tokenization of securities.""ETFs are step one in the technological revolution in the financial markets. Step two is going to be the tokenization of every financial asset."Larry Fink, Chairman and CEO of BlackRockNY Times DealBook Summit December, 2022Larry Fink, Chairman and CEO of BlackRockCNBC's "Squawk Box" January, 2024

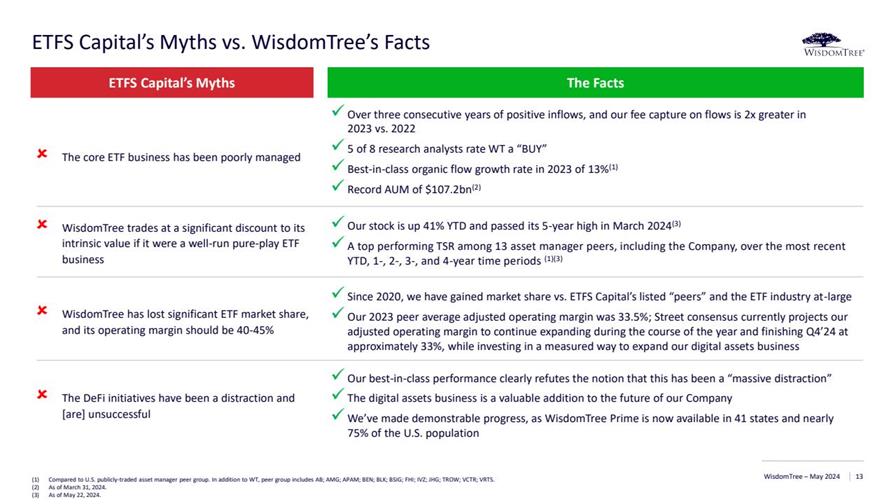

WisdomTree ?May 202413ETFS Capital's Myths vs. WisdomTree's Facts(1)Compared to U.S. publicly-traded asset manager peer group. In addition to WT, peer group includes AB; AMG; APAM; BEN; BLK; BSIG;FHI; IVZ; JHG; TROW; VCTR; VRTS.(2)As of March 31, 2024.(3)As of May 22, 2024.ETFS Capital's MythsThe FactsThe core ETF business has been poorly managed?Over three consecutive years of positive inflows, and our fee capture on flows is 2x greater in 2023 vs. 2022?5 of 8 research analysts rate WT a "BUY"?Best-in-class organic flow growth rate in 2023 of 13%(1)?Record AUM of $107.2bn(2) WisdomTree trades at a significant discount to its intrinsic value if it were a well-run pure-play ETF business?Our stock is up 41% YTD and passed its 5-year high in March 2024(3)?A top performing TSR among 13 asset manager peers, including the Company, over the most recent YTD, 1-, 2-, 3-, and 4-year time periods (1)(3)The DeFi initiatives have been a distraction and [are] unsuccessful?Our best-in-class performance clearly refutes the notion that this has been a "massive distraction"?The digital assets business is a valuable addition to the future of our Company?We've made demonstrable progress, as WisdomTree Prime is now available in 41 states and nearly 75% of the U.S. populationWisdomTree has lost significant ETF market share, and its operating margin should be 40-45%?Since 2020, we have gained market share vs. ETFS Capital's listed "peers" and the ETF industry at-large?Our 2023 peer average adjusted operating margin was 33.5%; Street consensus currently projects our adjusted operating margin to continue expanding during the course of the year and finishing Q4'24 at approximately 33%, while investing in a measured way to expand our digital assets business

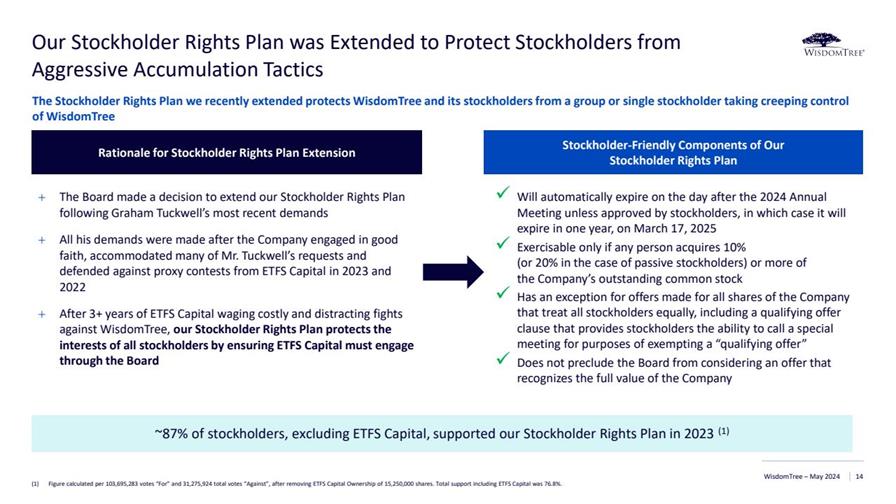

WisdomTree ?May 202414Our Stockholder Rights Plan was Extended to Protect Stockholders from Aggressive Accumulation TacticsThe Stockholder Rights Plan we recently extended protects WisdomTree and its stockholders from a group or single stockholder taking creeping control of WisdomTree?Will automatically expire on the day after the 2024 Annual Meeting unless approved by stockholders, in which case it will expire in one year, on March 17, 2025?Exercisable only if any person acquires 10% (or 20% in the case of passive stockholders) or more of the Company's outstanding common stock?Has an exception for offers made for all shares of the Company that treat all stockholders equally, including a qualifying offer clause that provides stockholders the ability to call a special meeting for purposes of exempting a "qualifying offer"?Does not preclude the Board from considering an offer that recognizes the full value of the Company+The Board made a decision to extend our Stockholder Rights Plan following Graham Tuckwell's most recent demands+All his demands were made after the Company engaged in good faith, accommodated many of Mr. Tuckwell's requests and defended against proxy contests from ETFS Capital in 2023 and 2022 +After 3+ years of ETFS Capital waging costly and distracting fights against WisdomTree, our Stockholder Rights Plan protects the interests of all stockholders by ensuring ETFS Capital must engage through the BoardStockholder-Friendly Components of Our Stockholder Rights PlanRationale for Stockholder Rights Plan Extension(1)Figure calculated per 103,695,283 votes "For" and 31,275,924 total votes "Against", after removing ETFS Capital Ownership of 15,250,000 shares. Total support including ETFS Capital was 76.8%.DRAFT?ForDiscussion PurposesOnly~87% of stockholders, excluding ETFS Capital, supported our Stockholder Rights Plan in 2023 (1)

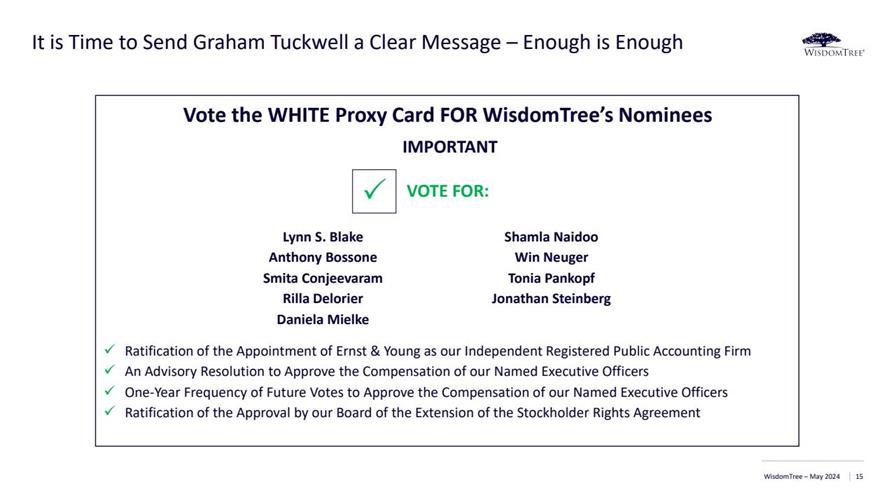

WisdomTree ?May 202415It is Time to Send Graham Tuckwell a Clear Message ?Enough is EnoughVote the WHITE Proxy Card FOR WisdomTree's NomineesIMPORTANTLynn S. BlakeAnthony BossoneSmita ConjeevaramRilla DelorierDaniela Mielke Shamla NaidooWin NeugerTonia PankopfJonathan SteinbergVOTE FOR:?Ratification of the Appointment of Ernst & Young as our Independent Registered Public Accounting Firm?An Advisory Resolution to Approve the Compensation of our Named Executive Officers?One-Year Frequency of Future Votes to Approve the Compensation of our Named Executive Officers?Ratification of the Approval by our Board of the Extension of the Stockholder Rights Agreement

WisdomTree ?May 2024Appendix16

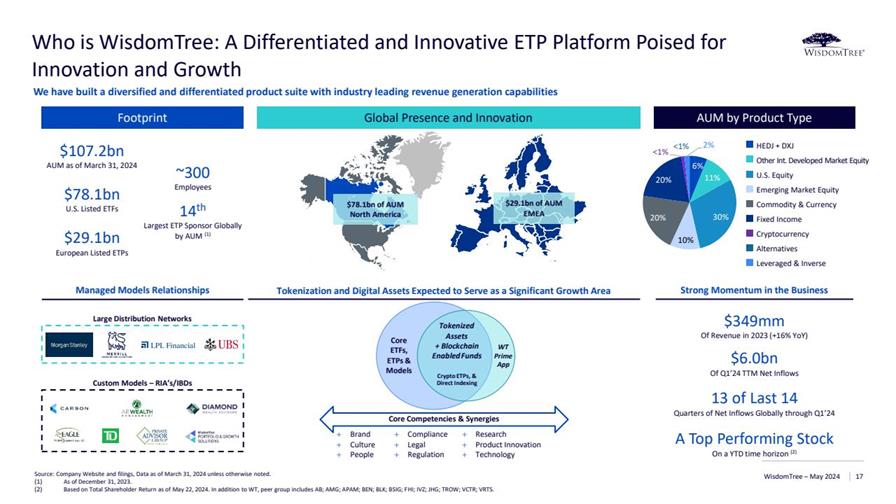

We have built a diversified and differentiated product suite with industry leading revenue generation capabilitiesWisdomTree ?May 202417Who is WisdomTree: A Differentiated and Innovative ETP Platform Poised for Innovation and GrowthManaged Models RelationshipsStrong Momentum in the BusinessFootprintAUM by Product TypeGlobal Presence and Innovation$107.2bnAUM as of March 31, 2024$78.1bnU.S. Listed ETFs$29.1bnEuropean Listed ETPs~300Employees14thLargest ETP Sponsor Globally by AUM (1)$78.1bn of AUM North AmericaTokenizedAssets+Blockchain EnabledFundsWTPrime AppCore ETFs,ETPs & ModelsCryptoETPs, & Direct IndexingCore Competencies & Synergies+Brand+Culture+People+Compliance+Legal+Regulation+Research+Product Innovation+TechnologyTokenization and Digital Assets Expected to Serve as a Significant Growth AreaCustom Models ?RIA's/IBDsLarge Distribution Networks$29.1bn of AUMEMEAFixed IncomeCommodity & CurrencyU.S. EquityEmerging Market EquityLeveraged & Inverse AlternativesCryptocurrency13 of Last 14 Quarters of Net Inflows Globally through Q1'24$349mmOf Revenue in 2023 (+16% YoY)A Top Performing StockOn a YTD time horizon (2)$6.0bnOf Q1'24 TTM Net Inflows6% 11% 30% 10% 20% 20% <1%<1%2% HEDJ + DXJOther Int. Developed Market EquitySource: Company Website and filings, Data as of March 31, 2024 unless otherwise noted.(1)As of December 31, 2023.(2)Based on Total Shareholder Return as of May 22, 2024. In addition to WT, peer group includes AB; AMG; APAM; BEN; BLK; BSIG; FHI;IVZ; JHG; TROW; VCTR; VRTS.

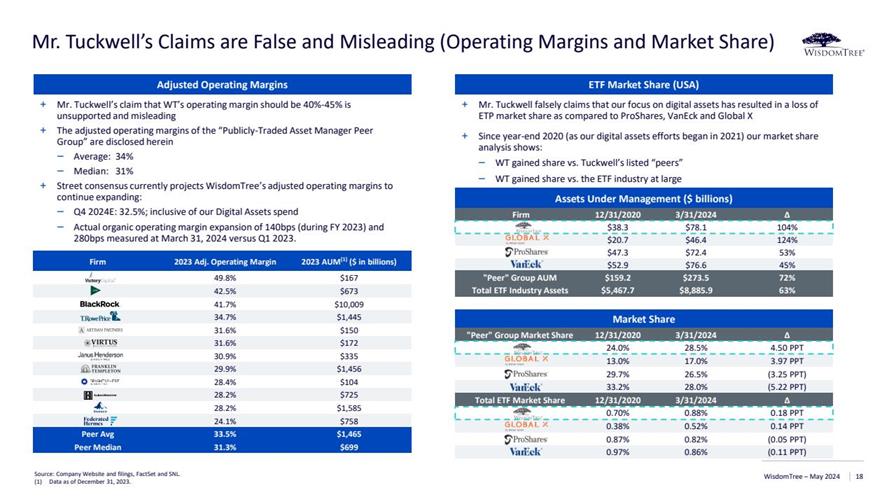

WisdomTree ?May 202418Mr. Tuckwell's Claims are False and Misleading (Operating Margins and Market Share)Adjusted Operating MarginsFirm2023 Adj. Operating Margin2023 AUM(1)($ in billions)49.8% $16742.5%$67341.7% $10,00934.7% $1,44531.6% $15031.6% $17230.9% $33529.9% $1,45628.4%$10428.2% $72528.2% $1,58524.1% $758Peer Avg33.5% $1,465Peer Median31.3% $699+Mr. Tuckwell's claim that WT's operating margin should be 40%-45% is unsupported and misleading+The adjusted operating margins of the "Publicly-Traded Asset Manager Peer Group" are disclosed herein?Average: 34%?Median: 31%+Street consensus currently projects WisdomTree's adjusted operating margins to continue expanding:?Q4 2024E: 32.5%; inclusive of our Digital Assets spend ?Actual organic operating margin expansion of 140bps (during FY 2023) and 280bps measured at March 31, 2024 versus Q1 2023.+Mr. Tuckwell falsely claims that our focus on digital assets has resulted in a loss of ETP market share as compared to ProShares, VanEck and Global X+Since year-end 2020 (as our digital assets efforts began in 2021) our market share analysis shows:?WT gained share vs. Tuckwell's listed "peers"?WT gained share vs. the ETF industry at largeETF Market Share (USA)Assets Under Management ($ billions)Firm 12/31/20203/31/2024?$38.3 $78.1104% $20.7 $46.4124% $47.3$72.4 53% $52.9$76.6 45% "Peer" Group AUM$159.2 $273.572% Total ETF Industry Assets$5,467.7$8,885.963% Source: Company Website and filings, FactSet and SNL.(1) Data as of December 31, 2023.Market Share"Peer" Group Market Share12/31/20203/31/2024?24.0% 28.5% 4.50 PPT 13.0% 17.0% 3.97 PPT29.7% 26.5% (3.25 PPT)33.2% 28.0% (5.22 PPT)Total ETF Market Share12/31/20203/31/2024?0.70% 0.88% 0.18 PPT0.38% 0.52% 0.14 PPT0.87% 0.82% (0.05 PPT)0.97% 0.86% (0.11 PPT)

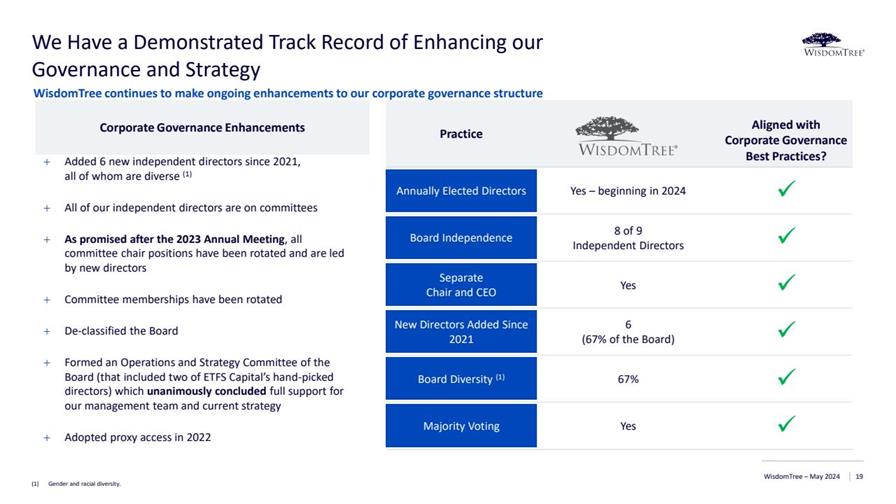

WisdomTree ?May 202419We Have a Demonstrated Track Record of Enhancing our Governance and Strategy+Added 6 new independent directors since 2021, all of whom are diverse (1)+All of our independent directors are on committees+As promised after the 2023 Annual Meeting, all committee chair positions have been rotated and are led by new directors+Committee memberships have been rotated+De-classified the Board+Formed an Operations and Strategy Committee of the Board (that included two of ETFS Capital's hand-picked directors) which unanimously concluded full support for our management team and current strategy+Adopted proxy access in 2022Corporate Governance EnhancementsPracticeAligned with Corporate Governance Best Practices?Annually Elected DirectorsYes ?beginning in 2024?Board Independence8 of 9Independent Directors?Separate Chair and CEOYes?New Directors Added Since 20216 (67% of the Board)?Board Diversity (1)67%?Majority VotingYes?(1)Gender and racial diversity.WisdomTree continues to make ongoing enhancements to our corporate governance structure

WisdomTree ?May 202420WisdomTree's Board Has the Right Mix of Expertise, Experience and DiversitySkills / ExpertiseCorporate Governance?????????9 of 9 directorsExecutive Leadership ????????8 of 9 directorsFinancial Services / Asset Management????????8 of 9 directorsGlobal Business Experience????????8 of 9 directorsAccounting / Financial Reporting???????7 of 9 directorsOther Public Company Experience??????6 of 9 directorsRisk Management??????6 of 9 directorsInformation Technology / Cybersecurity?????5 of 9 directorsETF Expertise????4 of 9 directorsLegal and Regulatory???3 of 9 directorsDigital Transformation / Marketing???3 of 9 directorsSource: 2024 proxy statement.(1)S&P 500 averages per Spencer Stuart's 2023 Board Index.67% of WisdomTree's directors and nominees are female and 22% are racially diverse, above and in-line with public board averagesof 33% and 24%, respectively, and 100% of directors and nominees added since 2021 are diverse (1)

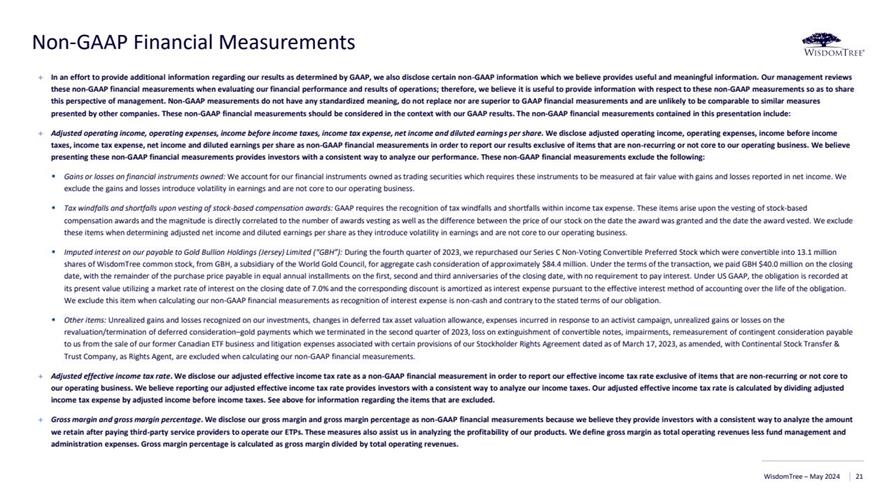

WisdomTree ?May 202421Non-GAAP Financial Measurements+In an effort to provide additional information regarding our results as determined by GAAP, we also disclose certain non-GAAP information which we believe provides useful and meaningful information. Our management reviews these non-GAAP financial measurements when evaluating our financial performance and results of operations; therefore, we believeit is useful to provide information with respect to these non-GAAP measurements so as to share this perspective of management. Non-GAAP measurements do not have any standardized meaning, do not replace nor are superior to GAAP financial measurements and are unlikely to be comparable to similar measures presented by other companies. These non-GAAP financial measurements should be considered in the context with our GAAP results. The non-GAAP financial measurements contained in this presentation include:+Adjusted operating income, operating expenses, income before income taxes, income tax expense, net income and diluted earnings per share.We disclose adjusted operating income, operating expenses, income before income taxes, income tax expense, net income and diluted earnings per share as non-GAAP financial measurements in order to report our results exclusive of items that are non-recurring or not core to our operating business. We believe presenting these non-GAAP financial measurements provides investors with a consistent way to analyze our performance. These non-GAAP financial measurements exclude the following:?Gains or losses on financial instruments owned:We account for our financial instruments owned as trading securities which requires these instruments to be measured at fair value with gains and losses reported in net income. We exclude the gains and losses introduce volatility in earnings and are not core to our operating business.?Tax windfalls and shortfalls upon vesting of stock-based compensation awards: GAAP requires the recognition of tax windfalls and shortfalls within income tax expense. These items arise upon the vesting of stock-based compensation awards and the magnitude is directly correlated to the number of awards vesting as well as the difference between the price of our stock on the date the award was granted and the date the award vested. We exclude these items when determining adjusted net income and diluted earnings per share as they introduce volatility in earnings and arenot core to our operating business.?Imputed interest on our payable to Gold Bullion Holdings (Jersey) Limited ("GBH"): During the fourth quarter of 2023, we repurchased our Series C Non-Voting Convertible Preferred Stock which were convertible into 13.1 million shares of WisdomTree common stock, from GBH, a subsidiary of the World Gold Council, for aggregate cash consideration of approximately $84.4 million. Under the terms of the transaction, we paid GBH $40.0 million on the closing date, with the remainder of the purchase price payable in equal annual installments on the first, second and third anniversariesof the closing date, with no requirement to pay interest. Under US GAAP, the obligation is recorded at its present value utilizing a market rate of interest on the closing date of 7.0% and the corresponding discount is amortizedasinterest expense pursuant to the effective interest method of accounting over the life of the obligation. We exclude this item when calculating our non-GAAP financial measurements as recognition of interest expense is non-cash and contrary to the stated terms of our obligation.?Other items: Unrealized gains and losses recognized on our investments, changes in deferred tax asset valuation allowance, expenses incurred in response to an activist campaign, unrealized gains or losses on the revaluation/termination of deferred consideration?gold payments which we terminated in the second quarter of 2023, loss on extinguishment of convertible notes, impairments, remeasurement of contingent consideration payable to us from the sale of our former Canadian ETF business and litigation expenses associated with certain provisions of our Stockholder Rights Agreement dated as of March 17, 2023, as amended, with Continental Stock Transfer & Trust Company, as Rights Agent, are excluded when calculating our non-GAAP financial measurements.+Adjusted effective income tax rate. We disclose our adjusted effective income tax rate as a non-GAAP financial measurement in order to report our effective incometax rate exclusive of items that are non-recurring or not core to our operating business. We believe reporting our adjusted effective income tax rate provides investors with a consistent way to analyze our income taxes. Our adjusted effective income tax rate is calculated by dividing adjusted income tax expense by adjusted income before income taxes. See above for information regarding the items that are excluded.+Gross margin and gross margin percentage. We disclose our gross margin and gross margin percentage as non-GAAP financial measurements because we believe they provide investors with a consistent way to analyze the amount we retain after paying third-party service providers to operate our ETPs. These measures also assist us in analyzing the profitability of our products. We define gross margin as total operating revenues less fund management and administration expenses. Gross margin percentage is calculated as gross margin divided by total operating revenues.

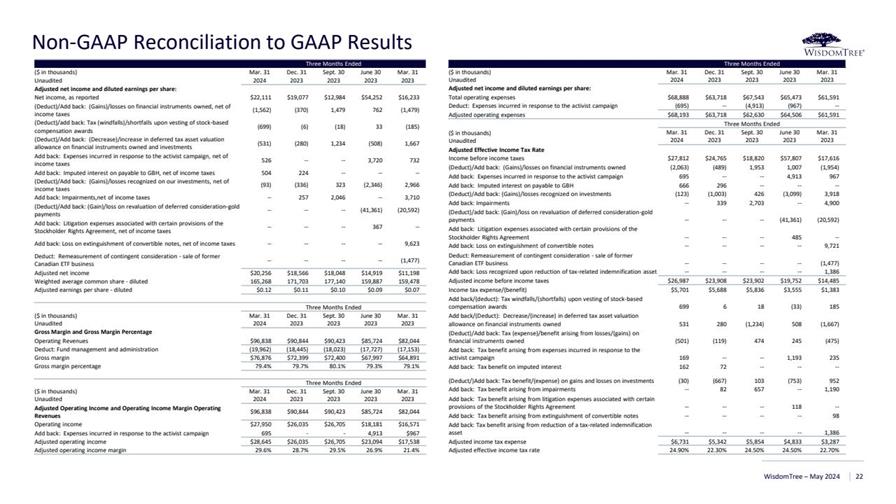

WisdomTree ?May 202422Non-GAAP Reconciliation to GAAP ResultsThree Months Ended($ in thousands)UnauditedMar. 312024Dec. 312023Sept. 302023June 30 2023Mar. 312023Adjusted net income and diluted earnings per share:Net income, as reported$22,111 $19,077 $12,984 $54,252 $16,233 (Deduct)/Add back: (Gains)/losses on financial instruments owned, net of income taxes(1,562)(370)1,479 762 (1,479)(Deduct)/add back: Tax (windfalls)/shortfalls upon vesting of stock-based compensation awards(699)(6)(18)33 (185)(Deduct)/Add back: (Decrease)/increase in deferred tax asset valuation allowance on financial instruments owned and investments(531)(280)1,234 (508)1,667 Add back: Expenses incurred in response to the activist campaign, net of income taxes526 ----3,720 732 Add back: Imputed interest on payable to GBH, net of income taxes504 224 ------(Deduct)/Add back: (Gains)/losses recognized on our investments, net of income taxes(93)(336)323 (2,346)2,966 Add back: Impairments,net of income taxes--257 2,046 --3,710 (Deduct)/Add back: (Gain)/loss on revaluation of deferred consideration-gold payments------(41,361)(20,592)Add back: Litigation expenses associated with certain provisions of the Stockholder Rights Agreement, net of income taxes------367 --Add back: Loss on extinguishment of convertible notes, net of income taxes--------9,623 Deduct: Remeasurement of contingent consideration -sale of former Canadian ETF business--------(1,477)Adjusted net income$20,256 $18,566 $18,048 $14,919 $11,198 Weighted average common share -diluted165,268171,703177,140159,887159,478Adjusted earnings per share -diluted$0.12 $0.11 $0.10 $0.09 $0.07 Three Months Ended($ in thousands)UnauditedMar. 312024Dec. 312023Sept. 302023June 30 2023Mar. 312023Gross Margin and Gross Margin Percentage Operating Revenues$96,838 $90,844 $90,423 $85,724 $82,044 Deduct: Fund management and administration(19,962)(18,445)(18,023)(17,727)(17,153)Gross margin $76,876 $72,399 $72,400 $67,997 $64,891 Gross margin percentage79.4%79.7%80.1%79.3%79.1%Three Months Ended($ in thousands)UnauditedMar. 312024Dec. 312023Sept. 302023June 30 2023Mar. 312023Adjusted Operating Income and Operating Income Margin Operating Revenues$96,838 $90,844 $90,423 $85,724 $82,044 Operating income$27,950 $26,035 $26,705 $18,181 $16,571 Add back: Expenses incurred in response to the activist campaign695--4,913 $967 Adjusted operating income$28,645 $26,035 $26,705 $23,094 $17,538 Adjusted operating income margin29.6%28.7%29.5%26.9%21.4%Three Months Ended($ in thousands)UnauditedMar. 312024Dec. 312023Sept. 302023June 30 2023Mar. 312023Adjusted net income and diluted earnings per share:Total operating expenses$68,888 $63,718 $67,543 $65,473 $61,591 Deduct: Expenses incurred in response to the activist campaign(695)--(4,913)(967)--Adjusted operating expenses$68,193 $63,718 $62,630 $64,506 $61,591 Three Months Ended($ in thousands)UnauditedMar. 312024Dec. 312023Sept. 302023June 30 2023Mar. 312023Adjusted Effective Income Tax RateIncome before income taxes$27,812 $24,765 $18,820 $57,807 $17,616 (Deduct)/Add back: (Gains)/losses on financial instruments owned(2,063)(489)1,953 1,007 (1,954)Add back: Expenses incurred in response to the activist campaign695 ----4,913 967 Add back: Imputed interest on payable to GBH666 296 ------(Deduct)/Add back: (Gains)/losses recognized on investments (123)(1,003)426 (3,099)3,918 Add back: Impairments--339 2,703 --4,900 (Deduct)/add back: (Gain)/loss on revaluation of deferred consideration-gold payments------(41,361)(20,592)Add back: Litigation expenses associated with certain provisions of the Stockholder Rights Agreement------485 --Add back: Loss on extinguishment of convertible notes--------9,721 Deduct: Remeasurement of contingent consideration -sale of former Canadian ETF business--------(1,477)Add back: Loss recognized upon reduction of tax-related indemnification asset--------1,386 Adjusted income before income taxes$26,987 $23,908 $23,902 $19,752 $14,485 Income tax expense/(benefit)$5,701 $5,688 $5,836 $3,555 $1,383 Add back/(deduct): Tax windfalls/(shortfalls) upon vesting of stock-based compensation awards699 6 18 (33)185 Add back/(Deduct): Decrease/(increase) in deferred tax asset valuation allowance on financial instruments owned531 280 (1,234)508 (1,667)(Deduct)/Add back: Tax (expense)/benefit arising from losses/(gains) on financial instruments owned (501)(119)474 245 (475)Add back: Tax benefit arising from expenses incurred in response to the activist campaign169 ----1,193 235 Add back: Tax benefit on imputed interest162 72 ------(Deduct/)Add back: Tax benefit/(expense) on gains and losses on investments(30)(667)103 (753)952 Add back: Tax benefit arising from impairments--82 657 --1,190 Add back: Tax benefit arising from litigation expenses associated with certain provisions of the Stockholder Rights Agreement------118 --Add back: Tax benefit arising from extinguishment of convertible notes--------98 Add back: Tax benefit arising from reduction of a tax-related indemnification asset--------1,386 Adjusted income tax expense$6,731 $5,342 $5,854 $4,833 $3,287 Adjusted effective income tax rate24.90%22.30%24.50%24.50%22.70%

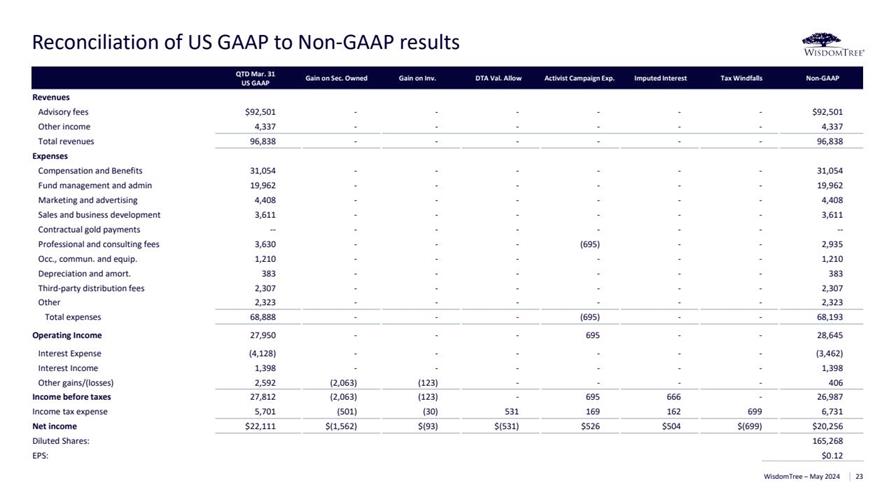

WisdomTree ?May 202423Reconciliation of US GAAP to Non-GAAP resultsQTD Mar. 31US GAAPGain on Sec. OwnedGain on Inv.DTA Val. AllowActivist Campaign Exp.Imputed InterestTax WindfallsNon-GAAPRevenuesAdvisory fees$92,501 ------$92,501 Other income4,337 ------4,337 Total revenues96,838 ------96,838 ExpensesCompensation and Benefits31,054 ------31,054 Fund management and admin19,962 ------19,962 Marketing and advertising4,408 ------4,408 Sales and business development3,611 ------3,611 Contractual gold payments----------Professional and consulting fees3,630 ---(695)--2,935 Occ., commun. and equip.1,210 ------1,210 Depreciation and amort.383 ------383 Third-party distribution fees2,307 ------2,307 Other2,323 ------2,323 Total expenses68,888 ---(695)--68,193 Operating Income27,950 ---695 --28,645 Interest Expense(4,128)------(3,462)Interest Income1,398 ------1,398 Other gains/(losses)2,592 (2,063)(123)----406 Income before taxes27,812 (2,063)(123)-695 666 -26,987 Income tax expense5,701 (501)(30)531 169 162 699 6,731 Net income$22,111 $(1,562)$(93)$(531)$526 $504 $(699)$20,256 Diluted Shares:165,268EPS:$0.12