UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

Form

______________________

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For fiscal year ended

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _ to _.

Commission File Number

______________________

(Exact name of registrant as specified in its charter)

______________________

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| | |

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

______________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | The | |

| | The |

Securities registered pursuant to Section 12(g) of the Act:

None

______________________

Indicate by check mark if the registrant is

a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes

☒

Indicate by check mark if the registrant is

not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐

Yes ☒

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. ☒

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||

| Non-accelerated filer | ☐ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

At June 30, 2024, the aggregate market value of the registrant’s Common Stock held by non-affiliates (computed by reference to the closing sale price of such shares on The New York Stock Exchange on June 28, 2024) was $

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Report, to the extent not set forth herein, is incorporated herein by reference from the registrant’s definitive proxy statement relating to the Annual Meeting of Stockholders to be held in 2025, which definitive proxy statement shall be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Report relates.

WISDOMTREE, INC.

Form 10-K

For the Fiscal Year Ended December 31, 2024

TABLE OF CONTENTS

Unless otherwise indicated, references to “the Company,” “we,” “us,” “our” and “WisdomTree” mean WisdomTree, Inc. and its subsidiaries.

WisdomTree®, WisdomTree Prime®, WisdomTree Connect™ and Modern Alpha® are trademarks of WisdomTree, Inc. in the United States and in other countries. All other trademarks are the property of their respective owners.

| i |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or Report, contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect our results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed in the section entitled “Risk Factors” and elsewhere in this Report. If one or more of these or other risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this Report and the documents that we reference in this Report and have filed with the U.S. Securities and Exchange Commission, or the SEC, as exhibits to this Report, completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements.

In particular, forward-looking statements in this Report may include statements about:

| ● | anticipated trends, conditions and investor sentiment in the global markets and exchange-traded products, or ETPs; |

| ● | anticipated levels of inflows into and outflows out of our ETPs; |

| ● | our ability to deliver favorable rates of return to investors; |

| ● | competition in our business; |

| ● | whether we will experience future growth; |

| ● | our ability to develop new products and services and their potential for success; |

| ● | our ability to maintain current vendors or find new vendors to provide services to us at favorable costs; |

| ● | our ability to successfully implement our strategy relating to digital assets and blockchain-enabled financial services, including WisdomTree Prime and WisdomTree Connect, and achieve its objectives; |

| ● | our ability to successfully operate and expand our business in non-U.S. markets; |

| ● | the effect of laws and regulations that apply to our business; and |

| ● | actions of activist stockholders. |

The forward-looking statements in this Report represent our views as of the date of this Report. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views as of any date other than the date of this Report.

| 1 |

PART I

| ITEM 1. | BUSINESS |

Our Company

We are a global financial innovator, offering a diverse suite of ETPs, models, solutions and products leveraging blockchain technology. Our offerings empower investors to shape their financial future and equip financial professionals to grow their businesses. Leveraging the latest financial infrastructure, we create products that emphasize access, transparency and provide an enhanced user experience. Building on our heritage of innovation, we have introduced next-generation digital products and services, including blockchain-enabled mutual funds (“Digital Funds”), tokenized assets and our blockchain-native digital wallet, WisdomTree Prime®, which is currently available in 45 U.S. states, covering approximately 80% of the U.S. population. Our institutional platform, WisdomTree Connect™, further expands access to our tokenized assets.

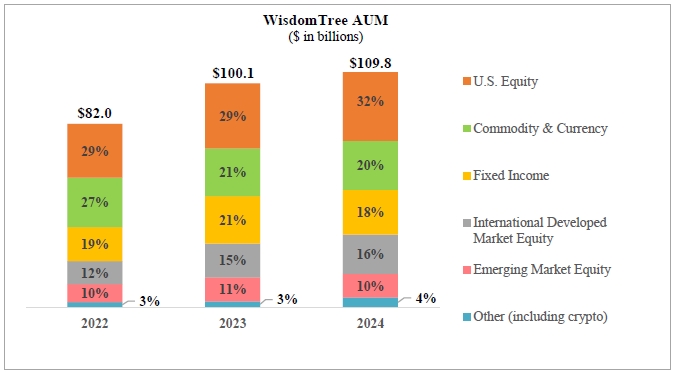

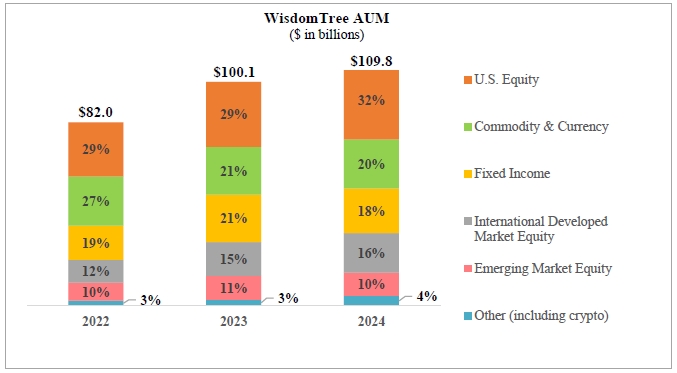

As of December 31, 2024, we managed approximately $109.8 billion in assets under management, or AUM. Our ETPs span a broad range of strategies including equities, fixed income, commodities, leveraged-and-inverse, currency, alternatives and cryptocurrency exposures. We have launched many first-to-market products and pioneered a unique alternative-weighting approach called “Modern Alpha” that combines the outperformance potential of active management with the cost effective benefits of passive management.

Our products are distributed across all major asset management industry channels, including banks, brokerage firms, registered investment advisers, institutional investors, private wealth managers and online brokers, primarily through our dedicated sales team. We believe technology is transforming how financial advisors conduct business, and through our Advisor and Portfolio Solutions programs we offer technology-enabled and research-driven solutions. These include portfolio construction, asset allocation, practice management services and digital tools to help advisors address technology challenges and scale their businesses.

As pioneers in blockchain-enabled financial services, we view the tokenization of real-world assets to be the next phase in the evolution of our industry. Through our digital assets strategy, we are committed to “responsible DeFi,” aligning with regulatory standards to foster growth in this rapidly evolving space. We believe that expanding into digital assets and blockchain-enabled finance not only complements our core competencies but will diversify our revenue streams and further contribute to our growth.

We were incorporated under the laws of the state of Delaware on September 19, 1985 as Financial Data Systems, Inc. and were ultimately renamed WisdomTree, Inc. on November 7, 2022.

Assets Under Management

WisdomTree ETPs

We offer ETPs covering equity, fixed income, commodities, leveraged-and-inverse, currency, alternatives and cryptocurrency. The chart below sets forth the asset mix of our ETPs at December 31, 2022, 2023 and 2024:

| 2 |

Our Operating and Financial Results

We operate as an ETP sponsor and asset manager, providing investment advisory services globally through our subsidiaries in the U.S. and Europe.

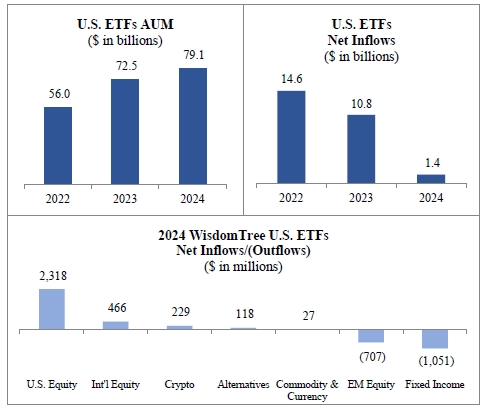

U.S. Listed ETFs

The AUM of our U.S. listed exchange traded funds, or U.S. listed ETFs, increased from $72.5 billion at December 31, 2023 to $79.1 billion at December 31, 2024 due to market appreciation and net inflows.

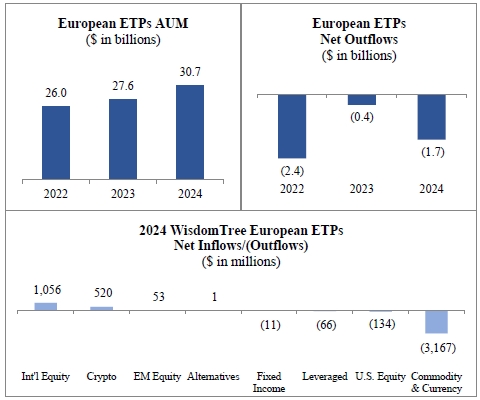

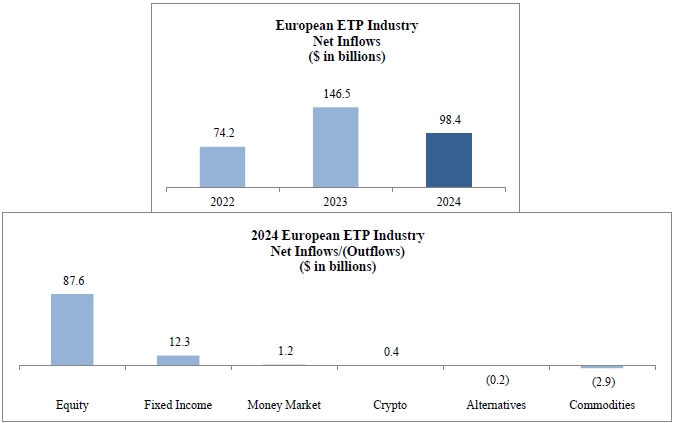

European Listed ETPs

The AUM of our European listed (including internationally cross-listed) ETPs, or European listed ETPs, increased from $27.6 billion at December 31, 2023 to $30.7 billion at December 31, 2024, due to market appreciation, partly offset by net outflows.

| 3 |

Consolidated Operating Results

The following table sets forth our revenues and net income for the last three years.

| ● | Revenues – We recorded operating revenues of $427.7 million during the year ended December 31, 2024, up 22.5% from the year ended December 31, 2023 due to higher average AUM and higher other revenues attributable to our European listed ETPs. In addition, operating revenues during the year ended December 31, 2024 include $4.3 million of other revenue related to legal and other expenses expected to be covered by insurance that were incurred in connection with a settlement with the SEC regarding certain statements about the ESG screening process for three ETFs advised by WisdomTree Asset Management, Inc. (the “SEC ESG Settlement”). |

| ● | Expenses – Total operating expenses increased 11.1% from the year ended December 31, 2023 to $290.4 million primarily due to higher incentive and stock-based compensation expense and increased headcount, fund management and administration costs, marketing expenses, sales and business development expenses, third-party distribution fees, as well as higher depreciation and amortization. Operating expenses during the year ended December 31, 2024 also includes $4.3 million of legal and other related expenses expected to be covered by insurance that were incurred in connection with the SEC ESG Settlement. These increases were partly offset by lower contractual gold payments associated with the termination of our deferred consideration—gold payments obligation on May 10, 2023. |

| ● | Other Income/(Expenses) – Other income/(expenses) includes interest income and interest expense, gains and losses on revaluation/termination of deferred consideration—gold payments, impairments and other losses and gains. See “Other Income/(Expenses)” in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information. |

| ● | Net income – We reported net income of $102.5 million and $66.7 million during the years ended December 31, 2023 and 2024, respectively. |

See “Non-GAAP Financial Measures” included in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information.

Seasonality

We believe seasonal fluctuations in the asset management industry are common, however such trends are generally masked by global market events and market volatility in general. Therefore, period-to-period comparisons of our or the industry’s flows and operating results may not be meaningful or indicative of results in future periods.

| 4 |

Our Industry – ETPs

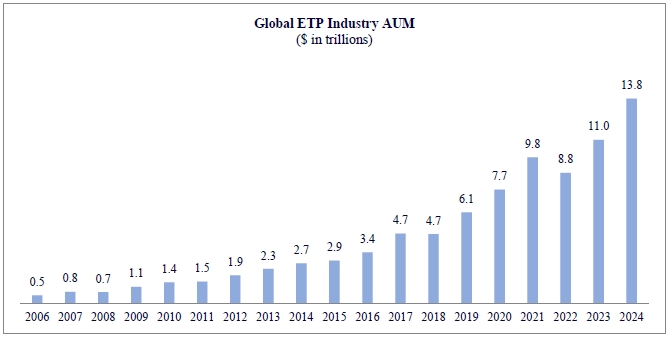

We believe ETPs have been one of the most innovative investment products to emerge in the last two decades in the asset management industry. As of December 31, 2024, aggregate AUM of ETPs globally was $13.8 trillion.

The chart below reflects the AUM of the global ETP industry since 2006:

|

Source: Morningstar |

As of December 31, 2024, we were the 15th largest ETP sponsor globally based on AUM.

| GLOBAL RANKING | |||||

| Rank | ETP Sponsor | AUM | |||

| ($ in billions) | |||||

| 1 | iShares | 4,235 | |||

| 2 | Vanguard | 3,200 | |||

| 3 | State Street | 1,609 | |||

| 4 | Invesco | 751 | |||

| 5 | Charles Schwab | 395 | |||

| 6 | Amundi | 278 | |||

| 7 | Xtrackers | 270 | |||

| 8 | Nomura | 242 | |||

| 9 | JPMorgan | 220 | |||

| 10 | First Trust | 181 | |||

| 11 | Dimensional | 168 | |||

| 12 | UBS | 119 | |||

| 13 | Nikko AM | 111 | |||

| 14 | VanEck | 110 | |||

| 15 | WisdomTree | 110 | |||

| 16 | Fidelity | 107 | |||

| 17 | Daiwa | 105 | |||

| 18 | BMO | 95 | |||

| 19 | Global X | 88 | |||

| 20 | ProFunds/ProShares | 78 | |||

Source: Morningstar | |||||

| 5 |

Exchange traded funds, or ETFs, while similar to mutual funds in many respects, attract a wide array of investors who value their unique benefits, including:

| ● | Transparency. ETFs disclose the composition of their underlying portfolios on a daily basis, unlike mutual funds, which typically disclose their holdings every 90 days. |

| ● | Intraday trading, hedging strategies and complex orders. Like stocks, ETFs and other exchange-traded products can be bought and sold on exchanges throughout the trading day at market prices. ETFs update the indicative values of their underlying portfolios every 15 seconds. As publicly-traded securities, ETF shares can be purchased on margin and sold short, enabling the use of hedging strategies, and traded using limit orders, allowing investors to specify the price points at which they are willing to trade. |

| ● | Tax efficiency. In the U.S., whenever a mutual fund or ETF realizes a capital gain that is not balanced by a realized loss, it must distribute the capital gain to its shareholders. These gains are taxable to all shareholders, even those who reinvest the gain distributions in additional shares of the fund. However, most ETFs typically redeem their shares through “in-kind” redemptions in which low-cost securities are transferred out of the ETF in exchange for fund shares in a non-taxable transaction. By using this process, ETFs can avoid the transaction fees and tax impact incurred by mutual funds that sell securities to generate cash to pay out redemptions. |

| ● | Uniform pricing. From a cost perspective, ETFs are one of the most equitable investment products on the market. Investors in a U.S. listed ETF pay identical advisory fees regardless of the investors’ size, structure or sophistication. Unlike mutual funds, U.S. listed ETFs generally do not have different share classes or different expense structures for retail and institutional clients and ETFs typically are not sold with sales loads or 12b-1 fees. In many cases, ETFs offer lower expense ratios than comparable mutual funds. |

ETFs are used in various ways by a range of investors with varying strategies and objectives, from conservative to speculative uses including:

| ● | Low-cost index investing. ETFs provide exposure to a variety of broad-based indexes across equities, fixed income, commodities and other asset classes and strategies, and can be used as both long-term portfolio holdings or short-term trading tools. ETFs offer an efficient and less costly method by which to gain exposure to indexes as compared to individual stock ownership. |

| ● | Improved access to specific asset classes. Investors often use ETFs to gain access to specific market sectors or regions around the world or a particular asset, such as physical gold or crypto, by investing in an ETF that holds a portfolio of securities in that sector, region or asset rather than gaining exposure by purchasing individual securities, physical commodities or currencies. |

| ● | Asset allocation. Investors seeking to invest in various asset classes to develop an asset allocation model in a cost-effective manner can do so easily with ETFs, which offer broad exposure to various asset classes in a single security. |

| ● | Protective hedging. Investors seeking to protect their portfolios may use ETFs as a hedge against unexpected declines in prices of securities arising from market movements and changes in currency and interest rates. |

| ● | Income generation. Investors seeking to obtain income from their portfolios may buy fixed income ETFs that typically distribute monthly income or dividend-paying ETFs that encompass a basket of dividend-paying stocks rather than buying individual stocks. |

| ● | Speculative investing. Investors with a specific directional opinion about a market sector may choose to buy or sell (long or short) an ETF covering or leveraging that market sector. |

| ● | Arbitrage. Sophisticated investors may use ETFs to exploit perceived value differences between the ETF and the value of the ETF’s underlying portfolio of securities. |

| ● | Diversification. By definition, ETFs represent a basket of securities and each fund may contain hundreds or even thousands of different individual securities. The “instant diversification” of ETFs provides investors with broad exposure to an asset class, market sector or geography. |

| 6 |

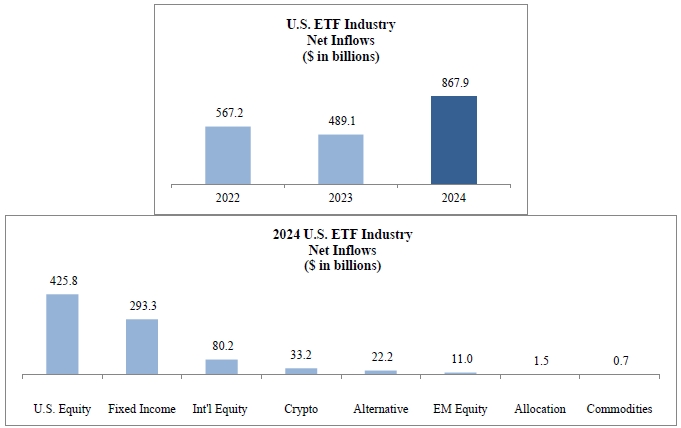

The ETF sector of the asset management industry remains highly favored among investors. According to Morningstar, from January 1, 2022 through December 31, 2024, equity ETFs have generated positive inflows of approximately $2.0 trillion, while long-term equity mutual funds have generated outflows of approximately ($1.6) trillion. In addition, ETF fixed income flows are benefiting from a broader range of investors gravitating toward fixed income products in the ETF structure. We believe this trend is due to the inherent benefits of ETFs – transparency, liquidity and tax efficiency.

We anticipate our growth, along with that of the industry, will continue to be driven by the following factors:

| ● | Increased investor awareness. ETPs have been gaining market share from mutual funds as investors become more aware of their key advantages – transparency, liquidity, tax efficiency and generally lower fees. We expect this shift in inflows from traditional mutual funds to ETPs to continue as investors become more informed about these benefits. |

| ● | Transition to fee-based models. Financial advisors are increasingly adopting a fee-based approach, where they charge clients based on AUM rather than earning commissions on transactions. Since ETFs typically offer lower expense ratios than mutual funds, we believe this transition will further support ETF industry growth. |

| ● | Innovative products. ETPs now cover nearly every asset class, from equities to fixed income to commodities and cryptocurrencies. Significant potential remains for innovation in areas such as thematic, liquid alternative and cryptocurrency strategies and expanding ETP access to investors who might otherwise use hedge funds, separate accounts, single-stock investments, futures or direct investment in commodity markets. |

| ● | Evolving demographics. As the “baby boomer” generation continues to retire, we anticipate increased demand for diverse investment solutions focused on income generation and principal protection, with more investors seeking guidance from financial advisors. Advisors are likely to allocate a greater share of clients’ portfolios to ETPs, given their typically lower expense ratios, alignment with fee-based models, and ability to enhance multi-asset allocation across varied market sectors. We believe ETFs are well-suited to meet the needs of this significant investor group. Additionally, with many younger investors and advisors showing a preference for ETPs, we expect generational wealth transfers to further drive growth in the ETP industry. |

| ● | International expansion. While the U.S. currently represents the majority of ETP assets, the same growth factors are emerging globally, suggesting continued international expansion for ETPs. |

Our Industry – Digital Assets

We believe that digital assets, tokenization and blockchain technology will drive innovation across financial services, transforming investments, savings, payments and operations. The digital assets industry has gained significant momentum among market participants, including asset management and fintech firms, banks, broker-dealers and investors. We anticipate that blockchain technology will enhance product structures and execution in financial services, with benefits including:

| ● | Transparency. Blockchains’ distributed ledger technology provide a shared, immutable record of transactions for network participants, potentially improving transparency, regulatory reporting, and oversight. |

| ● | Economic benefits. Automation and streamlined processes may reduce operational, transactional and infrastructure costs. |

| ● | Process efficiency. Blockchain technology enables near-instant settlement, real-time auditability, and fewer intermediaries, cutting down on errors, delays and counterparty risks. |

| ● | New products and markets. Blockchain technology supports fractionalized ownership and tokenized economies, offering secure and scalable alternatives to traditional finance. |

| ● | Programmable features. Smart contracts are programmable and can be designed to enforce governance principles, compliance requirements, data privacy protections and system incentives. They also can facilitate customer identification (e.g., KYC/AML protocols) compliance by enforcing access controls and transaction restrictions. |

| ● | Scalability. Blockchain technology supports interoperability across public and private networks which expands global transaction reach and resilience. |

The laws and regulatory frameworks for digital assets and blockchain technology are expanding in scope and complexity, accompanied by increased scrutiny of digital asset activities. This includes litigation and regulatory actions, a rise in cybersecurity incidents with asset loss, and insolvency proceedings often related to inadequate risk management, speculative practices or fraud. In addition, the new U.S. administration and Congress may propose new laws and regulations related to digital assets. As a financial innovator bridging traditional and blockchain-enabled finance, we embrace what we refer to as “responsible DeFi” for our digital asset offerings, aligning with regulatory principles in this dynamic space. We are committed to providing trusted, innovative products and services through proactive engagement and collaboration with regulators.

| 7 |

Global competition in the digital assets industry is intensifying, with players ranging from established financial incumbents to early-stage financial technology providers. Varying regulatory and compliance standards across jurisdictions may impact a company’s competitive positioning. We aim to excel in the digital assets space by offering innovative products, delivering strong after-fee performance, embracing regulation, forming strategic partnerships, promoting thought leadership and building brand recognition. Our focus remains on delivering the best structures and execution through digital assets and blockchain technology, supported by our experienced team.

Our Competitive Strengths

| ● | Well-positioned in growing markets. We believe ETPs are set to grow faster than the broader asset management industry, giving us an edge over legacy mutual fund providers. We also expect our early entry into digital assets will reinforce our role as an innovator and leader in blockchain-enabled financial services. |

| ● | Experienced and innovative leadership. Our seasoned team brings deep expertise across ETPs, fund operations, regulatory compliance, marketing and product development. We are continuing to expand our global digital assets team to develop new investment products, indexes and blockchain-enabled solutions. Whether through ETPs, digital assets or decentralized finance, we are committed to delivering innovative, trusted products and services in collaboration with regulators. We believe our team has consistently capitalized on market opportunities, building a competitive ETP sponsor despite significant competitive, regulatory and operational challenges. |

| ● | Strong performance. We create our own indexes, most of which weight companies in our equity ETFs by a measure of fundamental value and are rebalanced annually. By contrast, traditional indexes are market capitalization weighted and tend to track the momentum of the market. We also offer actively managed ETFs and ETFs that track third-party indexes. In evaluating the performance of our U.S. listed equity, fixed income and alternative ETFs against actively managed and index based mutual funds and ETFs, over 80% of our U.S. listed AUM covered by Morningstar were in the top quartile of peer performance on the 3-year timeframe and over 65% of our U.S. listed AUM covered by Morningstar were in the top two quartiles of peer performance on the 10-year timeframe. In addition, approximately 59% were rated 4- or 5-star by Morningstar. |

| ● | Differentiated product set, powered by innovation and performance. Our product suite spans traditional and high growth asset classes including equity, fixed income, commodity, leveraged-and-inverse, currency, alternative strategies and cryptocurrency, across both passive and actively managed funds. We are pioneering next-generation digital offerings, such as Digital Funds and tokenized assets. Key innovations include: |

| • | WisdomTree Prime Mobile App: Our blockchain-native digital wallet serves as a direct-to-consumer channel, currently available in 45 states (or 80% of the U.S. population), positioning us as an early mover and industry leader in blockchain-enabled financial services. The frequent release of new features and product updates enhance the application’s product offering; |

| • | WisdomTree Connect: This platform offers businesses and institutional users direct access to our Digital Funds using their own self-hosted wallet or a third-party custodial wallet service. In the future, we believe that the WisdomTree Connect platform will also enable additional distribution capabilities through potential business-to-business-to-consumer (B2B2C) opportunities; |

| • | Real-World Asset Tokenization: We offer tokenized physical assets like gold and U.S. dollars, as well as a suite of 13 Digital Funds offering asset allocation, fixed income and equity exposures using a blockchain integrated recordkeeping system on networks such as Stellar or Ethereum; and |

| • | First-to-Market ETF Offerings: We have been the first to introduce groundbreaking ETFs, including the first currency-hedged international equity ETFs in the U.S., the first gold and oil ETPs in Europe and the first smart beta corporate bond suite. Other market firsts include the first ETF to add bitcoin futures exposure, multifactor ETFs with dynamic currency hedging as a factor, a 90/60 balanced ETF and the emerging markets small-cap equity ETF, as well as one of the first spot bitcoin ETFs in the U.S. |

Our product development strategy utilizes our Modern Alpha approach, which combines the outperformance potential of active management with the cost-effective benefits of passive management, delivering products optimized for performance. Self-indexing is a core part of this strategy, providing competitive advantages such as reduced third-party index licensing fees for higher profitability, effective market positioning and research content, speed to market, and a unique value proposition in our proprietary WisdomTree indexes. This distinctive approach allows us to lead with innovative products that are built to perform.

| ● | Extensive marketing, research and sales efforts. We have made substantial investments to build the WisdomTree brand and promote our products through targeted online, television and social media advertising, as well as through public relations. Approximately 39% of our team is dedicated to marketing, research and sales. Our sales professionals serve as the primary contacts for financial advisors, independent advisory firms and institutional investors in our ETPs, supported by value-added insights from our research and marketing teams. By aligning advisor relationships with marketing and targeted research and products that resonate with market sentiment, we believe we stand out from competitors. |

| 8 |

| ● | Efficient business model with lower risk profile. Our investments in digital tools, data and core capabilities in product development, marketing, research and sales support an efficient business model. We outsource to third parties those services that are not our core competencies or may be resource or risk intensive, such as portfolio management and fund accounting operations of our products. Additionally, our licensing costs are moderated since we create our own indexes for most of our ETFs, further enhancing operational efficiency. |

Our Growth Strategies

With $109.8 billion in AUM as of December 31, 2024, WisdomTree is a global financial innovator, offering a diverse suite of ETPs, model portfolios and blockchain-enabled financial solutions. Our strategic growth initiatives seek to scale our core offerings, expand market reach and enhance client engagement, focusing on four key areas:

| ● | Scaling ETP AUM and Diversifying Revenue Streams: We continue to strengthen our position as a leader in the ETP industry by expanding our product lineup and increasing advisor engagement. In 2024, we grew both our advisor base and the number of ETPs held per advisor, reinforcing our market leadership through innovative, first-to-market strategies that blend active and passive management for cost-effective performance. We are committed to expanding our ETP offerings to meet evolving investor needs while also broadening our revenue base beyond traditional expense ratios, enhancing financial resilience. In 2024, we generated $32.4 million in other revenue, underscoring our success in diversifying income streams. We aim to build on this momentum by further deepening client engagement, expanding our solutions and being an early mover in tokenization. |

| ● | Leadership in Digital Assets and Tokenization: We are pioneering the next evolution of finance through tokenization, driven by a nascent secular shift towards tokenized assets that we believe is reshaping the financial industry. Our blockchain-native digital wallet, WisdomTree Prime, provides direct-to-consumer access to digital assets, including bitcoin, ether, tokenized gold, U.S. dollar tokens and 13 Digital Funds, while also enabling spending functionality through a co-branded debit card. WisdomTree Connect supports institutional clients by offering direct access to our Digital Funds via self-hosted or third-party custodial wallets. With regulatory approvals expanding and market adoption accelerating, we believe that we are well-positioned to capitalize on the transformative potential of tokenized assets. |

| ● | Strengthening Model Portfolios and Advisor Solutions: Our ability to deliver strong model performance and asset growth enables us to navigate rigorous selection processes at some of the leading wealth management firms in the United States. Through our Portfolio Solutions program, we are pursuing registered investment advisors and independent broker-dealers offering customization services with the goal of managing a majority of each firm’s assets. We aim to increase the number of advisors utilizing our model portfolios, expand the number of accounts per advisor and grow assets per account. Our Portfolio Solutions program offers financial advisors with scalable frameworks for model portfolio delivery through three key offerings: |

| • | Portfolio Consultations: For advisor-built portfolios, we offer personalized, in-depth evaluations of model portfolios, including analyses of portfolio composition, stress testing and assessments of holdings and overlaps, to enhance performance and risk management. |

| • | Chief Investment Office (CIO)-Managed Model Portfolios: For outsourced portfolios, financial advisors can gain access to our CIO-Managed Model Portfolios, which cater to a wide array of client investment goals. Advisors can implement these models directly, via model marketplaces or on third-party platforms. |

| • | Shared CIO: Advisors collaborate with our models investment team to co-manage portfolios for their clients, with options for advisors to delegate trading, rebalancing and tax optimization tasks leveraging third-party service providers or platforms, providing flexibility and strategic alignment. |

Our model portfolios are accessible across a number of platforms including Merrill Lynch, LPL Financial, UBS, Charles Schwab, Envestnet, Adhesion and others. In 2024, the number of advisors utilizing at least one of our models surpassed 2,500, reflecting steady progress as we build deeper relationships, improve asset retention and create more stable, higher-quality revenue streams with significant growth potential.

| ● | Strategic Innovation and Capital Deployment: Innovation has always been a cornerstone of our success. We are integrating artificial intelligence (AI) into certain aspects of our daily workflows to drive scalability and efficiency, while continuing to assess its broader applications over time. Additionally, we continue to take a proactive approach to capital deployment. We have repurchased over $100.0 million of our common stock over the past four years. Looking ahead, we will continue to evaluate additional stock buybacks, as well as potential strategic acquisitions and partnerships that align with our long-term vision. |

| 9 |

We believe our disciplined execution and our growth strategies position us for continued success in 2025 and beyond. By expanding our revenue streams, leading in blockchain-enabled finance, deepening advisor relationships, leveraging technology and effectively deploying capital, we are driving sustainable growth and creating long-term value for stockholders.

Human Capital Resources

We operate in the highly competitive asset management industry, where attracting, retaining and motivating skilled employees across operations, product development, research, technology, sales and marketing is critical to our success. Our ability to recruit and retain talent depends on our culture, career development opportunities and competitive compensation and benefits. We foster a sense of community and purpose, encouraging an inclusive workplace where every voice is heard.

Employee Profile

As of December 31, 2024, we had 313 full-time employees globally, with 201 in the U.S. and 112 in Europe. We consider our relations with employees to be good.

Inclusion and Engagement

We believe engaging employees fosters innovation and drives commitment and productivity. We communicate frequently and transparently with our employees, including through an annual global virtual offsite, frequent town halls and weekly firmwide updates. Feedback is gathered individually and through surveys and employees are encouraged to participate in volunteer and charitable events. In 2024, our “Team Alpha” Awards celebrated key achievements and recognized exemplary teamwork for the fifth consecutive year.

We recognize that a diverse set of perspectives is critical to innovation and have built a global workforce inclusive of gender, race, ethnicity, religion, age, disability and more. We prioritize fairness and equality through inclusive policies and practices. Our global, employee-led Diversity, Equity and Inclusion (DEI) Council, established in 2021, oversees initiatives like neurodiversity training, implicit bias workshops, inclusive feedback training and financial literacy programs. The DEI Council also promotes awareness days and months across the firm in recognition of Black history, women’s history, pride, mental health and men’s health, among others.

Our global employee-led Women’s Initiative Network (WIN) was launched in 2019 and supports career and leadership development through global events, seminars, roundtable forums, charitable giving initiatives, and a mentorship program that connects WIN members of all genders with firm leaders to help them achieve their career development goals. WIN initiatives have fostered firm-wide connectivity and increased internal and external visibility for female employees.

The success of our employee inclusion and engagement efforts is demonstrated by our 93.8% employee retention rate in 2024. We also achieved overall positive results from our 2024 global employee engagement survey, with a 99% participation rate. Additionally, in the U.S., we were named a “2024 Best Places to Work in Money Management” by Pensions & Investments for the fifth consecutive year and ranked second within the category for managers with 100-499 employees. In the U.K., we were also named Best Workplace for medium-sized companies for the fifth consecutive year and a 2024 Best Workplace for Women by Great Place to Work.

Wellness, Health and Safety

The wellbeing of our employees is a primary focus. We are continuously evolving and refining how we work best to achieve individual, team and Company goals. We embrace a “Work Smart” philosophy that transcends physical work settings, with a focus on optimizing productivity, efficiency and effectiveness of our work. Time in the office generally is not prescribed, and team leaders are empowered to determine how their teams work best, based on their roles, with employees remaining accountable for achieving individual, team and Company outcomes.

To foster employee wellbeing and a healthy work-life balance, we offer numerous wellness programs including yoga, meditation and mental health resources. Our U.S. employees also enjoy “wellness days,” which are additional scheduled office closures around major market holidays for employees to collectively disconnect and rejuvenate. Employees also receive stipends for remote work expenses and robust technology support.

In keeping with “Work Smart,” we maintain an office footprint globally that aligns with the number of employees expected to collaborate in person on any given day, while providing a space for employees to work and socialize. Our offices are located in buildings with robust security procedures, fire safety and sanitation and health practices.

Compliance, Training and Development

We are committed to complying with all applicable laws, rules and regulations and each employee is responsible for understanding and adhering to the standards and restrictions they impose. All new employees attend a compliance training session with a compliance officer during onboarding, and thereafter, employees are required to attend firmwide annual compliance training and to complete compliance certifications annually and in some instances, quarterly. We also conduct mandatory cybersecurity training and other training programs as required by law.

| 10 |

Employee development is prioritized with role-specific training, small group meetings with senior leaders, departmental webinars, continuing education support, leadership development courses and individual and team coaching. We also hold regular town halls to share business developments, employee news and job openings, as well as to provide opportunities for employees to hone their presentation skills by sharing department updates.

Compensation and Benefits

We are committed to attracting, retaining and rewarding our employees through a competitive compensation program that aligns employee and stockholder interests. Our incentive compensation program rewards both individual and Company performance, incorporating quantitative metrics and qualitative results that incentivize growth. We believe a key to our success is our entrepreneurial culture, where employees think and act like owners. Equity awards are an important component of our compensation strategy, reinforcing this ownership mindset and further aligning employee incentives with stockholder value. We also offer a wide array of benefits including generous healthcare coverage, paid vacation (unlimited in the U.S.), parental, sabbatical and sick leave, life and travel insurance, short- and long-term disability benefits, educational assistance and, in the U.S., a 401(k) plan with a matching contribution of up to 50% of eligible employee contributions.

Our Product Categories

U.S. Equity

We offer equity products that provide access to the securities of large, mid and small-cap companies located in the U.S., as well as particular market sectors and styles. Our U.S. Equity products generally track our own indexes and quantitative active strategies. Total AUM of our U.S. Equity products was $35.4 billion at December 31, 2024.

Commodity & Currency

We offer products in Europe with exposure to gold and other precious metals and commodities such as silver and platinum, oil and energy, agriculture and broad basket commodities. Our currency products provide investors with exposure to developed and emerging markets currencies, as well as exposures to foreign currencies relative to the U.S. dollar. Total AUM of our Commodity & Currency products was $21.9 billion at December 31, 2024.

Fixed Income

Our Fixed Income products seek to enhance income potential within the fixed income universe. We offer a suite of bond products based on either leading fixed income benchmarks we license from third parties or active strategies. We also launched the industry’s first smart beta corporate bond suite and first floating rate U.S. Treasury product. Other product offerings include those that seek to track a yield-enhanced index of U.S. investment grade bonds and international fixed income products which are denominated in either local or U.S. currencies. Total AUM of our Fixed Income products was $20.0 billion at December 31, 2024.

International Developed Market Equity

Our International Developed Market Equity products offer a variety of strategies including currency hedged and dynamic currency hedged products, exposures to large, mid and small-cap companies in these markets and multifactor strategies. Total AUM of our International Developed Market Equity products was $17.6 billion at December 31, 2024.

Emerging Market Equity

Our Emerging Market Equity products provide access to exposure of large, mid and small-cap companies located in Taiwan, China, India, Russia, South Africa, South Korea and other emerging markets regions. These products also track our own indexes or quantitative active strategies. Total AUM of our Emerging Market Equity products was $10.5 billion at December 31, 2024.

Leveraged & Inverse

We offer leveraged products which seek to achieve a return that is a multiple of the performance of the underlying index and inverse products that seek to deliver the opposite of the performance in the index or benchmark they track. Strategies span across equity, commodity, government bond and currency exposures. Total AUM of our Leveraged & Inverse products was $1.9 billion at December 31, 2024.

Cryptocurrency

Our cryptocurrency ETPs provide investors with a simple, secure and cost-efficient way to gain exposure to the price of cryptocurrencies, while utilizing the best of traditional financial infrastructure and product structuring. We offer exposures to bitcoin, ether, crypto asset baskets and other cryptocurrency exposures. Total AUM of our cryptocurrency products was $1.9 billion at December 31, 2024.

| 11 |

Alternatives

Our Alternative products include the industry’s first managed futures strategy ETF, a collateralized put write strategy ETF, a global target range strategy ETF, and an alternative high income ETF focused on publicly traded alternative solutions to private credit. We also intend to explore additional alternative strategy products in the future. Total AUM of our Alternative products was $0.5 billion at December 31, 2024.

Our Sales, Marketing and Research Efforts

Sales

We distribute our ETPs across major asset management channels, including banks, brokerage firms, registered investment advisers, institutional investors, private wealth managers, and online brokers. Our primary focus is on financial and investment advisers who act as intermediaries, rather than directly targeting retail clients. We do not pay commissions or offer 12b-1 fees to financial advisors for recommending our products.

Our Advisor and Portfolio Solutions programs support financial advisors and independent broker-dealers with customized portfolio and asset allocation services, research-driven and technology-enabled tools and strategic guidance to grow and scale their businesses. These solutions are designed to help financial advisors meet their clients’ needs efficiently while aligning with our investment strategies.

Senior and academic advisors, including Professor Jeremy Siegel, Senior Economist to WisdomTree, enhance our outreach by participating as keynote speakers at industry and company-hosted events. Our sales professionals provide consultative, value-added services to deepen relationships and expand our network of financial advisors.

As of December 31, 2024, our global sales team included 53 professionals. Additionally, we partner with third parties to market our products in Latin America and Israel. We work with select brokerage firms and independent broker-dealers to offer commission-free trading for certain ETPs in exchange for a share of advisory fee revenues. We believe these arrangements extend our distribution capabilities cost-effectively, and we continue to explore similar opportunities.

Marketing

Our marketing efforts are focused on the following objectives: increase our global brand awareness, leverage a robust data-driven digital sales experience to generate new clients and drive inflows to our products and model portfolios and retain existing clients, with a focus on cross-selling additional WisdomTree ETPs. We also anticipate launching marketing campaigns to drive awareness and user adoption for WisdomTree Prime and WisdomTree Connect and to position ourselves to become a leader in asset tokenization and blockchain-enabled funds. We pursue these objectives utilizing the following strategies:

| ● | Targeted advertising. We create highly targeted multi-media advertising campaigns limited to established core financial media. For example, our television advertising to promote our ETPs runs exclusively on the cable networks CNBC and Fox Business. It is anticipated that television advertising also will be utilized to promote WisdomTree Prime. Also, our digital advertising runs on many investing and ETF-specific web-sites, such as www.etftrends.com and www.etfdb.com, using targeted dynamic and personalized ad messaging. We also utilize non-linear TV advertising that leverages the same targeted segments of users who use streaming devices. In Europe, we filter the targeting of promotions by both region and language, focusing heavily on professional investors. |

| ● | Media relations. We have a full-time global corporate communications and public relations team that has established relationships with major financial and digital assets media outlets. We utilize these relationships to help increase global awareness of WisdomTree ETPs, the ETP industry in general in the U.S. and Europe and our digital assets efforts. Several members of our management team and multiple members of our research team are frequent market commentators and conference panelists. |

| ● | Database Messaging Strategy. We maintain a database of financial advisors and regularly market to them through multi-channel messaging (email, display, site) triggered by user interest and predictive analytics. These communications include research presentations, ETP-specific and educational events and market commentary from Professor Jeremy Siegel, Senior Economist to WisdomTree. For WisdomTree Prime, we also engage a retail user database with targeted messages across email, in-app notifications and push notifications based on user behavior or predictive analytics. Additionally, we share updates on product launches and provide financial education to our retail database through a monthly newsletter. |

| ● | Social media. We have implemented a social media strategy that allows us to connect directly with financial advisors and investors by offering timely access to our research material and more general market commentary. Our social media strategy allows us to continually enhance our brand reputation of expertise and thought leadership in the ETP industry. For example, we have an established presence on LinkedIn, X, Instagram, Reddit and YouTube, and our blog content is syndicated across multiple business-oriented websites. We have several employee influencer programs where employee thought leaders are approved to post specific content on their LinkedIn and X accounts. We also leverage the strength and reach of our existing brand, in addition to utilizing a highly focused “test, learn, iterate” paid and social media marketing strategy, to drive awareness and user adoption for WisdomTree Prime. |

| 12 |

| ● | Sales support. We create comprehensive materials to support our ETP sales process, including white papers, research reports, webinars, blogs, podcasts, videos and performance data for our products. Our marketing automation system connects directly to our database of financial advisors to provide our sales team with additional insights about their clients. We also have agreements with several third parties to help distribute our thought leadership materials and deliver high quality leads to the sales team. |

We will continue to evolve our marketing and communication efforts in response to changes in the ETP industry, market conditions, marketing trends and our evolving strategy around digital assets.

Research and Chief Investment Office

Our research team and Chief Investment Office serve four core functions: product development and oversight, investment research, model portfolio management, and sales support across equities, fixed income, alternatives, crypto, and asset allocation portfolios. In its index and active product development and oversight role, the team designs investment methodologies and manages the maintenance of both index-based and active strategies. The team conducts in-depth investment research on these strategies and markets, while also managing a suite of model portfolios that integrate WisdomTree and third-party products for various platforms, including WisdomTree Prime.

Our research is academic in nature and aims to support our products with white papers on the strategies underlying our indexes and ETPs, insights on market trends, and analyses of investment approaches that drive long-term performance. This content is distributed via our sales professionals, our website and blog, targeted emails to financial advisors, and through financial media and social media channels.

Additionally, the team supports sales efforts by serving as market experts during client meetings and providing custom analysis on portfolio holdings. We also collaborate with senior advisers, including Professor Jeremy Siegel, on product development ideas, model strategies and market commentaries.

Product Development

We are focused on driving continued growth through innovative product development, including through our Modern Alpha approach and our digital assets offerings. Modern Alpha combines the outperformance potential of active management with the benefits of passive management to offer investors cost-effective products that are built to perform.

Due to our proprietary index development capabilities and a strategic focus on product development, we have demonstrated an ability to launch innovative and differentiated ETPs. Building on our heritage of innovation, we are also developing next-generation digital products and structures, including Digital Funds and tokenized assets. When developing new products, we seek to position ourselves as first to market, offering improvement in structure or strategy relative to an incumbent product or offering some other key distinction relative to an incumbent product. In short, we want to add choice in the market and seek to introduce thoughtful investment solutions. Lastly, when launching new products, we seek to expand and diversify our overall product line.

Competition

The asset management industry is highly competitive, with significant competition across product offerings, fees, brand recognition and service quality. We face direct competition from other ETP sponsors and mutual fund companies, and indirect competition from larger financial institutions, including banks, insurance companies and diversified investment firms with broader distribution channels, resources and diversified revenue streams. Many of our larger competitors have extensive sales organizations and can attract clients through retail bank networks, broker-dealer networks and other channels not available to us.

ETPs now span nearly every asset class, from equities and fixed income to commodities and cryptocurrencies. As the market matures, existing and new players are introducing ETPs that often resemble our strategies. However, we believe that significant opportunities for innovation remain, particularly in cryptocurrency, thematic and alternative strategies. Our approach emphasizes being an early entrant in emerging asset classes, which can provide a significant advantage. For example, our early launches in asset classes such as fundamental weighting and currency hedging, and commodities (including gold), certain fixed income, and thematic categories, have positioned us to maintain our standing as one of the leaders of the ETP industry.

Price competition spans both commoditized products, such as traditional, market cap-weighted index exposures and more specialized categories, such as factor-based or thematic exposures. Fee reductions by competitors have been a persistent trend, with some larger firms able to offer lower fees or even use products as loss leaders due to other revenue sources. New entrants also often seek to compete by offering lower-fee ETPs. Currently, funds with fees of 20 basis points or less account for approximately 73% of net flows globally over the past three years, though these funds represent only approximately 32% of global revenues.

| 13 |

Being a first mover or one of the first providers of ETPs in a particular asset class can be a significant advantage, as the first ETP in a category to attract scale in AUM and trading liquidity is generally viewed as the most attractive product. We believe that our self-indexing model, along with our newer active ETFs, allows us to introduce proprietary products that face limited direct competition and are positioned to generate alpha versus traditional benchmarks. As investors grow more comfortable with ETP structures, we expect a stronger focus on after-fee performance rather than merely on low-cost market access. While we have selectively reduced fees on certain products that have yet to achieve scale—and may do so selectively in the future—our strategy focuses on launching new products in the same category with differentiated exposure at lower fees, rather than reducing fees on well-established products with substantial AUM, performance histories and liquidity. We generally consider our product pricing to be well-positioned within the competitive landscape.

Beyond traditional ETPs, we are diversifying into blockchain technology and digital assets. WisdomTree Prime, our blockchain-native digital wallet, provides access to digital assets such as bitcoin, ether, tokenized gold, U.S. dollar tokens and 13 Digital Funds, including a government money market fund and asset allocation products. These tokenized products are designed to be recorded or transferred on multiple public and permissioned blockchains, enabling interoperability between blockchains and expanding client access. WisdomTree Connect offers businesses and institutional clients direct access to our Digital Funds through their own self-hosted wallet or a third-party custodial wallet service. As one of the first to launch a spot bitcoin ETF in the United States, we continue to establish our leadership in digital assets. With increasing competition from both established financial firms and fintech startups in digital assets, we are focused on “responsible DeFi,” ensuring that our products meet regulatory standards while delivering transparency, choice and inclusivity. We believe this expansion into digital assets complements our core competencies in a holistic manner, will diversify our revenue streams and contribute further to our growth.

Our competitive success will largely depend on our ability to offer innovative products, including through both traditional ETPs and digital asset exposures, as well as broader blockchain-enabled finance, including savings and payments. Key factors include maintaining strong internal controls and risk management infrastructure to foster customer trust, generating robust after-fee performance and track records, embracing regulatory standards and building distribution relationships. Additionally, we focus on promoting thought leadership and a distinctive solutions program, strengthening our brand, and attracting and retaining talented sales professionals and employees.

Regulatory Framework of the ETP Industry and Digital Assets Business

ETPs

Not all ETPs are ETFs. ETFs are a distinct type of security with features that are different than other ETPs. ETFs are open-end investment companies or unit investment trusts regulated in the U.S. by the Investment Company Act of 1940, as amended, or the Investment Company Act. This regulatory structure is designed to provide investor protection within a pooled investment product. For example, the Investment Company Act requires that at least 40% of the Trustees for each ETF must not be affiliated persons of the fund’s investment manager, or Independent Trustees. If the ETF seeks to rely on certain rules under the Investment Company Act, a majority of the Trustees for that ETF must be Independent Trustees. ETFs generally operate under regulations that allow them to operate within the ETF structure, while ETFs also operate under regulations that prohibit affiliated transactions, are subject to standard pricing and valuation rules and have mandated compliance programs. ETPs can take a number of forms in addition to ETFs, including exchange-traded notes, grantor trusts or limited partnerships. In the U.S. market, a key factor differentiating ETFs, grantor trusts and limited partnerships from exchange-traded notes is that the former hold assets underlying the ETP. Exchange traded notes, on the other hand, are debt instruments issued by the exchange-traded note sponsor. Also, each of these structures has implications for taxes, liquidity, tracking error and credit risk.

Digital Assets

As we continue to build out our digital assets business, we believe it is necessary and important to do so in compliance with applicable laws and regulations. As a result, we are actively engaged with a variety of U.S. federal and state regulators (e.g., the SEC, FINRA, New York Department of Financial Services (NYDFS) and other state regulators) to secure, as necessary, or maintain the appropriate regulatory, registration and/or licensing approvals for various business initiatives and operations, including but not limited to: a New York state-chartered limited purpose trust company; money services and money transmitter business; limited purpose broker-dealer; transfer agent; investment adviser; and investment funds. As we seek to expand globally, similar approvals and/or reliance on exemptions will be required in applicable foreign markets, which also may involve approvals specific to a digital assets or related business. As we secure the appropriate regulatory, registration and/or licensing approvals, or otherwise rely on, seek or confirm exemptions therefrom, in connection with our digital assets business, we are and will be subject to a myriad of complex and evolving global policy frameworks and associated regulatory requirements that we need to comply with, or otherwise be exempt from, to ensure that our digital assets products and services are successfully brought to different markets in a compliant manner. We remain committed to being a trusted provider of innovative products and services guided by proactive engagement and regulatory collaboration.

| 14 |

U.S. Regulation

All aspects of our business are subject to various federal and state laws and regulations. These laws and regulations are primarily intended to protect the end user, which may include retail and institutional customers, investment advisory clients and shareholders of registered investment companies. These laws generally grant supervisory agencies broad administrative powers, including the power to limit or restrict the conduct of our business and to impose fines, sanctions or other penalties for failure to comply with these laws and regulations. Further, such laws and regulations provide the basis for examination, inquiry, investigation, enforcement action and/or litigation which could materially affect our business.

We are primarily subject to the following laws and regulations, among others. The costs of complying with such laws and regulations have increased and will continue to contribute to the costs of doing business:

| ● | The Investment Advisers Act of 1940 (Investment Advisers Act). The SEC is the federal agency generally responsible for administering the U.S. federal securities laws. WisdomTree Asset Management, Inc., or WTAM, and WisdomTree Digital Management, Inc., or WT Digital Management, two of our subsidiaries, are registered as investment advisers under the Investment Advisers Act and, as such, are regulated by the SEC. The Investment Advisers Act requires registered investment advisers to comply with numerous obligations, including, among others, recordkeeping requirements, fiduciary duties, operational procedures, and registration, reporting and disclosure obligations. |

| ● | The Investment Company Act of 1940 (Investment Company Act). All of our Digital Funds and U.S. listed ETFs are registered with the SEC pursuant to the Investment Company Act. These products must comply with the applicable requirements of the Investment Company Act and other regulations, such as those related to publicly offering and listing shares, as well as requirements of Rule 6c-11, or the ETF Rule, including, among others, requirements relating to operations, fees charged, sales, accounting, recordkeeping, disclosure, transparency and governance. In addition, the SEC continues to take an active approach in its rulemaking activity by finalizing and proposing new rules and/or rule amendments under the Investment Company Act that will impact current and future Digital Fund and ETF operations and/or investments. |

| ● | Broker-Dealer Regulations. WisdomTree Securities, Inc., or WT Securities, is a FINRA member firm. As a limited purpose broker-dealer, WT Securities is operating as a mutual fund retailer for the Digital Funds offered through WisdomTree Prime. This business is separate from other WisdomTree subsidiaries operating as Digital Fund and ETF sponsors in the U.S. which are not required to be registered with the SEC as broker-dealers under the Securities Exchange Act of 1934, as amended, or Exchange Act. However, many of our employees, including all of our salespersons, are licensed with FINRA and are registered either as associated persons of WT Securities or the distributor of the WisdomTree Digital Funds and U.S. listed ETFs and, as such, are subject to FINRA rules that relate to licensing, continuing education requirements and sales practices. FINRA rules also apply to our fund marketing and sales material. |

| ● | Federal Money Services Business and State Money Transmission Laws. WisdomTree Digital Movement, Inc. is a money services business registered with the Financial Crimes Enforcement Network, or FinCEN, and a state licensed money transmitter operating a platform for the purchase, sale and exchange of digital assets, while also providing blockchain-enabled digital wallet services through WisdomTree Prime to facilitate such activity. Navigating state regulations across the U.S. provides compliance challenges and significant costs as regulations and expectations differ between states, with different states seeking to achieve different objectives with their regulations, from consumer protection to preventing money laundering. In addition, licensure requirements are quickly evolving (including regulators not permitting certain activities related to digital assets pursuant to such licenses), with the associated timeframes for licensure increasing and licensure being further complicated by recent market events and bankruptcies of firms in the digital assets space. |

| ● | Internal Revenue Code. WisdomTree Trust, WisdomTree Digital Trust and the WisdomTree Bitcoin Fund each have their own respective requirements they must satisfy to qualify for pass-through tax treatment under the Internal Revenue Code. |

| ● | U.S. Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA). Regulations adopted by the CFTC have required WTAM to become a member of the NFA and register as a commodity pool operator for a select number of our ETFs. |

| ● | Products Exchange Listing Requirements. Each WisdomTree U.S. listed ETF is listed on a secondary market (each, an Exchange), including NYSE Arca, the NASDAQ Market and the Cboe Exchange, and accordingly is subject to the listing requirements of these Exchanges. Any new WisdomTree U.S. listed ETF will seek listing on an Exchange and also will need to meet continued Exchange listing requirements, which generally align with requirements of the ETF Rule. However, the SEC or an Exchange may ultimately determine not to allow the issuance of potential new WisdomTree U.S. listed ETFs or may require strategy or operational modifications as part of the registration and/or listing process. |

| ● | Corporate Exchange Listing Requirements. In addition, our common stock is listed on the New York Stock Exchange and we are therefore also subject to its rules including corporate governance listing standards, as well as federal and state securities laws. |

| 15 |

| ● | FINRA Rules. FINRA rules and guidance may affect how WisdomTree U.S. listed ETFs are sold by member firms. We currently do not offer so-called leveraged ETFs in the U.S., which may include within their holdings derivative instruments such as options, futures or swaps to obtain leveraged exposures. FINRA guidance, the recently effective SEC Rule 18f-4, or the Derivatives Rule, and/or other future rules or regulations may influence how member firms effect sales of certain WisdomTree U.S. listed ETFs, such as our currency ETFs, or how such ETFs operate, which also use some forms of derivatives, including forward currency contracts and swaps, our international hedged equity ETFs, which use currency forwards, and our rising rates bond ETFs and alternative strategy ETFs, which use futures or options. |

| ● | Section 17A of the Exchange Act. WisdomTree Transfers, Inc., or WT Transfers, is a transfer agent registered with the SEC. As a transfer agent, WT Transfers provides transfer agency and registrar services for the Digital Funds offered through WisdomTree Prime. WT Transfers’ transfer agency and registrar services are subject to Section 17A of the Exchange Act and applicable rules promulgated thereunder. |

International Regulation

Our operations outside the U.S. are subject to the laws and regulations of various non-U.S. jurisdictions and non-U.S. regulatory agencies and bodies. As we have expanded our international presence, a number of our subsidiaries and international operations have become subject to regulatory systems, in various jurisdictions, comparable to those covering our operations in the U.S. Regulators in these non-U.S. jurisdictions may have broad authority with respect to the regulation of financial services including, among other things, the authority to grant or cancel required licenses or registrations.

Jersey-Domiciled Issuers (Managed by WisdomTree Management Jersey Limited)

One of our subsidiaries, WisdomTree Management Jersey Limited, or ManJer, is a Jersey based management company providing investment and other management services to several Jersey-domiciled issuers, or ManJer Issuers, of exchange-traded commodities, or ETCs, each of which was established as a special purpose vehicle to issue exchange-traded securities. All ETCs are listed and marketed across the European Union, or EU, under Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 (as amended), or the Prospectus Regulation. Since January 4, 2021, the Central Bank of Ireland, or Central Bank, approves all ETC Base Prospectuses (with the exception of WisdomTree Issuer X Limited’s prospectus which is approved by the Swedish Financial Supervisory Authority) as meeting the requirements imposed under EU law pursuant to the Prospectus Regulation. Such approval relates only to those securities to be admitted to trading on a regulated market for the purpose of Markets in Financial Instruments Directive (recast) – Directive 2014/65/EU of the European Parliament and the Council, or MiFID II, and/or which are to be offered to the public in any European Economic Area, or EEA, Member State. All ETC prospectuses are also approved by the Financial Conduct Authority, or FCA, as U.K. Listing Authority, as competent authority pursuant to the U.K. version of Regulation (EU) No 2017/1129 of the European Parliament and the Council of 14 June 2017 on the form and content of such prospectuses and repealing Directive 2003/71/EC which is part of U.K. law by virtue of the European Union (Withdrawal) Act 2018, or the U.K. Prospectus Regulation. Each prospectus (except WisdomTree Issuer X Limited’s prospectus) is prepared, and a copy is sent to the Jersey Financial Services Commission, or JFSC, in accordance with the Collective Investment Funds (Certified Funds – Prospectuses) (Jersey) Order 2012. Each ManJer Issuer (other than WisdomTree Issuer X Limited) has obtained a certificate under the Collective Investment Funds (Jersey) Law 1988 (as amended), to enable it to undertake its functions in relation to its ETCs. At the request of the relevant ManJer Issuer, the Central Bank has notified the approval of the Base Prospectus in accordance with the Prospectus Regulation to other EU listing authorities, including Austria, Belgium, Denmark, Finland, France, Germany, Italy, Luxembourg, the Netherlands, Norway, Poland, Spain and Sweden, by providing them with certificates of approval attesting that the Base Prospectus has been prepared in accordance with the Prospectus Regulation. Each issuer may request the Central Bank to provide competent authorities in other EEA Member States with such certificates for the purposes of making a public offer in such Member States and/or for admission to trading of all or any securities on a regulated market. WisdomTree Issuer X Limited’s program for the issuance of WisdomTree digital securities does not constitute a collective investment fund for the purpose of the Collective Investment Funds (Jersey) Law 1988 (as amended) as it satisfies the requirements of Article 2 of the Collective Investments Funds (Restriction of Scope) (Jersey) Order 2000. A copy of WisdomTree Issuer X Limited’s prospectus has been delivered to the Registrar of Companies in Jersey in accordance with Article 5 of the Companies (General Provisions) (Jersey) Order 2002, and the Registrar has consented to its circulation. The JFSC has consented under Article 4 of the Control of Borrowing (Jersey) Order 1958 to the issue of the WisdomTree digital securities by WisdomTree Issuer X Limited. The prospectus of WisdomTree Issuer X Limited is also recognized by the Swiss Prospectus Office.

The ManJer Issuers are primarily subject to the following legislation and regulatory requirements:

| ● | The Companies (Jersey) Law 1991. Each ManJer Issuer is incorporated as a public limited liability company under the Companies (Jersey) Law 1991. Therefore, the ManJer Issuers are required to comply with various obligations under this law including, but not limited to, convening general meetings, keeping proper books and records and filing financial statements. |

| 16 |

| ● | The Foreign Account Tax Compliance Act, or FATCA, a U.S. federal law that was passed as part of the Hiring Incentives to Restore Employment (HIRE) Act, generally requires that foreign financial institutions and certain other non-financial foreign entities report on the foreign assets held by their U.S. account holders or be subject to withholding on withholdable payments. The HIRE Act also contained legislation requiring U.S. persons to report, depending on the value, their foreign financial accounts and foreign assets. ETCs benefit from the so called “listing exemption” and Jersey local authorities have determined that for companies which can benefit from such exemption the filing of a nil report is optional. |

| ● | The Common Reporting Standards, or CRS, were developed by the Organization for Economic Cooperation and Development and is a global reporting standard for the automatic exchange of information. The ManJer Issuers need to conduct FATCA style due diligence and annual local reporting in relation to financial accounts held directly and indirectly by residents of those jurisdictions with which the Foreign Financial Institutions (FFIs) jurisdiction of residence has signed an Intergovernmental Agreement (IGA) to implement the CRS. Unlike FATCA, there is no clear listing exemption available under the CRS so the ManJer Issuers are required to conduct full due diligence to identify such accounts and report on them on an annual basis to their local tax authorities, at least in respect of the certificated interests and primary market issuances. However, Jersey tax authorities have applied less onerous reporting obligations to interests such as ETCs that are regularly traded on an established securities market and are held through CREST, the U.K. based central securities depository. |

| ● | The Collective Investment Funds (Jersey) Law 1988. Each ManJer Issuer (other than WisdomTree Issuer X Limited) is a collective investment fund and therefore required to comply with the obligations under the Collective Investment Funds (Jersey) Law 1988 and the Code of Practice for Certified Funds. |

| ● | The Prospectus Regulation. The Base Prospectus of each ManJer Issuer has been drafted, and any offer of ETCs in any EEA Member State that has implemented the Prospectus Regulation is made in compliance with the Prospectus Regulation and any relevant implementing measure in such Member States. |