WisdomTree Sends Letter to Stockholders

Highlights Strong Performance, Proven Strategy and Highly Qualified Directors

NEW YORK--(BUSINESS WIRE)-- WisdomTree, Inc. (NYSE: WT) (“WisdomTree” or the “Company”), a global financial innovator, today issued a letter to its stockholders urging them to vote for WisdomTree’s highly qualified director nominees at WisdomTree’s 2023 Annual Meeting of Stockholders (“2023 Annual Meeting”), which is scheduled to be held on June 16, 2023.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230502005825/en/

(Photo: Business Wire)

May 2, 2023

Fellow WisdomTree stockholders:

You have an important choice to make at the upcoming 2023 Annual Meeting of Stockholders (“2023 Annual Meeting”) of WisdomTree, Inc. (“WisdomTree” or the “Company”), which will take place on June 16, 2023. A dissident stockholder, ETFS Capital Limited (“ETFS Capital”), seeks to elect three representatives, including its chairman, Graham Tuckwell, to the WisdomTree Board of Directors. We believe that Mr. Tuckwell’s continued crusade against WisdomTree is driven purely by his personal agenda and ego, rather than by any consideration of what is best for the Company and its stockholders. We urge you NOT to sign or return any proxy card or voting instruction form that may be sent to you by ETFS Capital, and to “WITHHOLD” your vote from all three ETFS Capital nominees.

Stockholders can protect their investment in WisdomTree and put a stop to Mr. Tuckwell’s self-serving plans by voting the WHITE proxy card “FOR” ALL SIX of WisdomTree’s highly qualified director nominees, who are featured below. Each of our director nominees possesses significant and extensive experience relevant to WisdomTree’s business strategy, including global financial, accounting, compliance, technology and digital expertise, and many years in senior leadership positions in the investment management and financial services industries.

- Lynn S. Blake

- Extensive leadership experience in asset management industry

- Provides expertise in investment management, including experience with ESG investment strategies

- Managed more than 1,400 portfolios and ETFs with assets over $2.3 trillion while CIO

of Global Equity Beta Solutions at State Street

- Daniela Mielke

- Deep financial and transaction experience as executive, founder, board member and advisor

- Provides decades of expertise in driving growth strategies, and public company board experience

- Led PayPal’s growth and strategy during a time of major digital disruption in payments industry

- Shamla Naidoo

- Experienced executive and public company board director with specialization in digital and technology transformation and innovation

- Has executive experience leading digital strategies for several public companies

- Led IBM’s innovation and growth strategy in cybersecurity as Global Chief Information Security Officer

- Win Neuger

- Decades of experience in senior management positions in asset management industry

- Holds deep understanding of WisdomTree’s business model and expertise in ETFs, accounting and financial reporting

- Led the management of AIG’s global investment portfolio with $753 billion in assets

- Frank Salerno

- Extensive knowledge of ETF industry with senior management experience at large asset managers

- Provides strategic insight into asset management industry and competitive landscape

- Served as Managing Director and Chief Operating Officer of Merrill Lynch Investment Advisors – Americas Institutional Division

- Jonathan Steinberg

- Visionary leader who founded WisdomTree in 1988, continuously looking ahead for next generation of innovative digital assets and financial products (e.g., blockchain)

- Provides extensive knowledge of our business and is the developer of WisdomTree’s proprietary index methodology

- Provides essential insight and guidance to our Board from a management perspective

WISDOMTREE HAS THE RIGHT STRATEGY FOR SUCCESS AND THE RESULTS PROVE IT

Proven Success in our Exchange-Traded Product (“ETP”) Business

ETFS Capital has made false claims about the growth WisdomTree has achieved across its ETP portfolio. Our recent first quarter results tell the real story:

- Record quarter-end assets under management (“AUM”) of $90.7 billion as of March 31, 2023;

- Net inflows of $6.3 billion, the third best quarter in our history;

- Ten consecutive quarters of net inflows; and

- Annualized inflow growth rate of 31% across all products.

WisdomTree has achieved meaningful organic growth across its ETP portfolio, as shown by our annualized inflow growth rate of 31% as of March 31, 2023, following a 16% annualized inflow growth rate during the year ended December 31, 2022. This best-in-class organic growth, as compared to our Traditional Asset Management Peer Group, stems from over $18.5 billion of inflows during the past 15 months. In his misguided attacks on our performance, Mr. Tuckwell references U.S. ETF market growth, which is largely driven by “beta” exposures, a segment of the market in which we have chosen not to compete – in fact, we have a broad and diversified array of ETPs available to take advantage of market rotations.

The strength of our franchise is showcased by the fact that net inflows over 10 consecutive quarters have been bolstered by robust growth in many different products and asset categories – as well as fund inflow leadership positions switching five different times over that timeframe – with lower reliance on any one product than at any other time in our Company’s history.

Our ETP business has never been stronger. We remain justifiably proud of the success of our U.S. Floating Rate fund (USFR), which grew in AUM from ~$2 billion at the end of 2021 to over $15 billion today; however, it is important to note that USFR is only a piece of the mosaic, and not the entire picture. In fact, while USFR brought in $11 billion of net inflows in 2022, WisdomTree experienced organic growth in seven of its eight major product categories, including a 14% growth rate ($3.3 billion of net inflows) in our U.S. Equity product suite. In addition, our Commodity product suite generated over $2 billion of net inflows during the first quarter of 2023.

Recent financial performance is outshining our peers. Our successful organic growth strategy has translated into outperformance versus our peers. In fact, relative to the eight publicly traded U.S. traditional asset manager peers who have reported earnings as of the timing of this letter, our year-over-year revenue growth has beaten the peer median by 16.5 percentage points. And, while our operating margins declined year-over-year, we outperformed the peer median decline by 2.5 percentage points. Our strategy is working, and we expect ongoing flows and AUM growth to translate into even more margin expansion and outperformance going forward, with our recent investments in digital assets creating additional value for all stockholders in the long run.

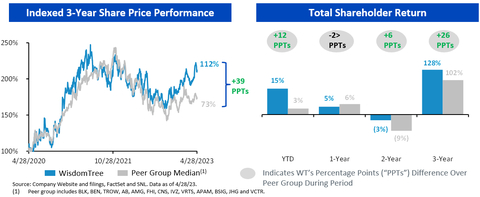

Share Price Performance Compared to our Peers

Stockholders should not be misled by the figures ETFS Capital used to compare our share price performance to peers, or by Mr. Tuckwell’s bizarre attempts to assert that only he and ETFS Capital can positively impact our stock price. We believe our share price performance should be benchmarked over a 3-year time horizon, past the phase when outflows from WisdomTree Europe Hedged Equity Fund (HEDJ) and WisdomTree Japan Hedged Equity Fund (DXJ) masked our underlying organic growth. From April 2020 to 2023, we generated approximately $24 billion of net inflows. The attached charts illustrate our share price performance and total shareholder return (TSR) in relation to our peers:

As of April 28, 2023, WisdomTree has been the second best performing stock out of 13 publicly traded U.S. traditional asset managers since January 2022. Our success in 2023 is built from the momentum we have established over the last three years. This remains consistent with our historical performance on a trailing 1-, 2- and 3-year time horizon, during which our stock price performance has been strong relative to our peer group and the market overall. Our recent first quarter adjusted diluted earnings per share (EPS)1 of $0.07 beat average consensus estimates by 40%, furthering our position as one of the best performing publicly traded U.S. traditional asset managers.

Contrary to what Mr. Tuckwell has stated, ETFS Capital’s Schedule 13D filing on January 24, 2022 had no positive impact to our stock price in the weeks that followed, and changes in our stock price in the weeks following the expiration of the 2022 Cooperation Agreement, discussed later in this letter, were muted. Increases in our stock price on or about April 11, 2023 coincided with an analyst upgrade in our stock, rather than any action by Mr. Tuckwell.

We believe investors are keenly aware that organic AUM growth is the key driver of an asset manager’s stock performance and that our share price performance over the time horizons illustrated above align with our streak of accelerating net inflows, contrary to the narrative proposed by ETFS Capital. Of note, the recent analyst upgrade of our stock to “Buy” from “Neutral” was “based on the firm’s effective product diversification and consistently strong net inflows,” and we currently have the third highest number of “Buy” ratings among the nine publicly traded U.S. traditional asset managers with a sub-$5 billion market cap included in our Traditional Asset Manager Peer Group.

Setting the Table for Margin Expansion while Investing in Future Success

The margin profile of our ETP and models franchise remains strong. We are making important investments in future growth initiatives including digital assets and blockchain-enabled finance. We consider the cumulative ~$40 million of spend on these initiatives over the past four years as a small amount compared to what we have achieved and the sizeable opportunity ahead of us. Rather than ignoring the disruptive power of new technologies (like many companies in American history, such as Kodak and Xerox), we have made investments to remain at the forefront of this secular shift, avoid disruption and thrive in the future.

By making these investments, we are well positioned for margin expansion. As we begin to book revenues resulting from our digital assets efforts, we expect the year-over-year impact on operating income will continue to decline before ultimately becoming a large contributor of earnings power. With incremental margins well above 50%, compounding AUM and revenue growth will translate into meaningful margin expansion in future years.

WisdomTree is currently the only publicly traded asset manager that (1) has a top line growth story driven by strong net inflows and (2) is well-positioned for an extended period of sustainable margin expansion, while (3) having a market-leading position in digital assets and blockchain-enabled finance.

Mr. Tuckwell has stated that WisdomTree should focus only on its ETP business rather than explore a complementary digital assets strategy, but he could not be more wrong. A recent report by Citi suggested that tokenized securities could be a $5 trillion market by 2030. Industry peers like Franklin Resources, BlackRock, KKR, Schroders and traditional asset management stalwarts T. Rowe Price, Wellington and Cumberland have all made their own moves into tokenized securities. Over the past four years, we have created a process to bring regulated funds onto the blockchain with multi-chain interoperability – no other firm has been able to do so or has embraced that opportunity better than WisdomTree.

The initial launch of our WisdomTree Prime™ platform later in the second quarter will allow users to access our suite of products that include nine blockchain-enabled funds, gold and U.S. dollar tokens, as well as bitcoin and ether. A secular shift toward tokenization and blockchain-enabled finance is coming – and we are currently the market leader. ETFS Capital would have us act like the Kodaks and Xeroxes of old, while our vision is to be as adaptive as Netflix and embrace disruptive technology early and quickly in order to capture a large slice of this massive opportunity.

We are entering a new chapter, one that extends and leverages core competencies, stays true to our mission, vision and values – and is marked by a focus on strengthening and evolving our business, capitalizing on our existing momentum and adding more fuel for future growth. We believe that there is significant value to be unlocked as WisdomTree continues to grow and scale.

None of Mr. Tuckwell’s nominees possesses a digital and technology skillset to help guide WisdomTree’s continued growth at this pivotal juncture.

FOLLOWING A THOROUGH REVIEW BY THE INDEPENDENT OPERATIONS AND STRATEGY COMMITTEE, WISDOMTREE’S BOARD UNANIMOUSLY ENDORSED THE COMPANY’S STRATEGY AND MANAGEMENT TEAM

Last year, WisdomTree formed an Operations and Strategy Committee of the Board composed of four independent directors, including two directors proposed by ETFS Capital and its then-partner Lion Point Capital (“Lion Point”) (together, the “stockholder group”). The Committee had the opportunity to examine our procedures, policies and strategic assumptions – and worked closely with the full Board and WisdomTree’s management team to ensure that its review was informed by a comprehensive and transparent understanding of every aspect of our Company. The Committee met numerous times as a group, with management and with the Board, including 16 management presentations from 41 presenters spanning over 40 hours, and in doing so conducted a thorough, independent review of our operations and efficiency, M&A and digital assets strategies, capital deployment, budget process, global sales, models, product development and compensation and culture.

Once the Committee completed its review and presented its findings and recommendations to the full Board, the Board (including the two directors proposed by the stockholder group) voted unanimously to endorse that WisdomTree’s current strategy is the right path forward for stockholder value creation and that we have the appropriate management team to execute on this strategy. It is difficult to understand how Mr. Tuckwell can find issues with WisdomTree’s strategy and management when his own 2022 directors, after a forensic review, endorsed both!

THE WISDOMTREE BOARD HAS CONSISTENTLY DEMONSTRATED ITS COMMITMENT TO STOCKHOLDER ENGAGEMENT, BOARD REFRESHMENT AND ENHANCED CORPORATE GOVERNANCE

Mr. Tuckwell has been a stockholder of WisdomTree since 2018, when the company he founded, ETF Securities Limited (now ETFS Capital), sold its European asset management business to WisdomTree (the “ETFS Acquisition”). At that time, Mr. Tuckwell agreed to be a passive stockholder of WisdomTree. Out of concern regarding Mr. Tuckwell’s character, conduct and conflicts of interest, we negotiated limits on his ability to control WisdomTree, capping his voting power at 10% and stipulating that he had no contractual right to Board representation. Despite agreeing to those limitations at that time, over the last five years, Mr. Tuckwell has demanded on numerous occasions to be added to WisdomTree’s Board, in the apparent (and mistaken) belief that only he can guide your company forward. In accordance with our fiduciary duties, the Board has considered his request multiple times, and in every instance concluded that he would not be a suitable addition to the Board, as he lacks the temperament and public company board experience to enhance our Board, and has conflicts of interest that compromise his independence and put him at odds with the interests of other stockholders.

Refusing to take “no” for an answer last year, Mr. Tuckwell formed a group with Lion Point, a professional activist investor, to pursue a proxy contest at the 2022 Annual Meeting of Stockholders. We met with this group 13 times over the course of two months, striving in good faith to reach a mutually acceptable resolution to avert a costly, distracting and unnecessary proxy fight to the detriment of stockholders. Despite Mr. Tuckwell’s intransigence and erratic behavior during the negotiation process, including an 11th hour attempt to derail reaching an agreement, we eventually entered into a cooperation agreement with the stockholder group in May 2022, which included appointing two new directors proposed by the stockholder group, seeking stockholder approval to declassify WisdomTree’s Board, and creating the Operations and Strategy Committee that included the two directors proposed by the stockholder group. We felt so strongly about the terms of that agreement regarding WisdomTree’s corporate governance and composition of the Board that we committed publicly to implement most of its provisions prior to reaching an agreement with the stockholder group, and regardless of the vote at the 2022 Annual Meeting of Stockholders.

As a result of the Board’s continuing efforts to enhance corporate governance, during the past year WisdomTree adopted proxy access by-law provisions, revised our insider trading policy to prohibit hedging and pledging, initiated the de-classification of our Board and adopted a compensation clawback policy. In addition, we also amended our Nominating and Governance Committee Charter to empower this Committee to review and provide oversight on initiatives and policies concerning corporate social responsibility (e.g., ESG matters), and revised our corporate governance guidelines to ensure that the Committee considers diverse candidates inclusive of gender, race, ethnicity, age, gender identity, gender expression and sexual orientation in the pool of candidates for election to the Board.

We have completed significant Board refreshment over the past few years, having added five new directors since January 2021, all of them female and/or diverse, and these new directors constitute a majority of the Board. We continue to identify outstanding Board candidates, without Mr. Tuckwell’s “assistance,” including our newest candidate, digital technology expert Shamla Naidoo.

Contrary to Mr. Tuckwell’s assertions – which are both misleading and hypocritical – WisdomTree’s Board is both inclusive and diverse, with women constituting 44% of the Board and women and persons of color together constituting 55%. In an April 24 press release, he criticized the Board for the departure of two female directors over the past ten months, conveniently omitting the fact that the Board has added two other female directors in the same timeframe and nominated a third woman for election this year. Indeed, his proxy materials are conspicuously silent regarding Lynn S. Blake, a director he proposed last year, who was seated by the Board, elected overwhelmingly by stockholders at last year’s annual meeting, and nominated by the Board for re-election this year based on her expertise and contributions during the past year. Mr. Tuckwell would like to posture as an advocate for Board diversity, but in reality he has named a slate of two men and one woman and explicitly challenged the qualifications of a woman of color, Ms. Naidoo.

YOUR BOARD HAS WORKED IN GOOD FAITH TO AVOID GRAHAM TUCKWELL’S PERSONALLY MOTIVATED, UNNECESSARY AND UNWARRANTED PROXY CONTEST

Lion Point dissolved its partnership with ETFS Capital in December 2022, suggesting that Lion Point saw no value in continuing to support Mr. Tuckwell’s ego-driven crusade against WisdomTree. In the months since, Mr. Tuckwell has evidently been unable to convince any other professional activist investor to join him in the place of Lion Point, perhaps because they do not see a case for change at WisdomTree. Unfortunately, even without allies, Mr. Tuckwell is once again waging another needless proxy contest that puts the Company’s future and your investment at risk. Your Board has once again been willing to engage in good faith with Mr. Tuckwell, having communicated and met with him and his representatives seven times in the month prior to ETFS Capital formally initiating this proxy contest.

During our discussions in 2023, Mr. Tuckwell persistently demanded that the Board agree to replace four incumbent directors with three new directors of his choosing and one director mutually agreed upon. We repeatedly asked him to identify the director nominees he had in mind, showing our willingness to review and consider the potential new directors’ suitability and ability to add value to the Board. He refused to do so unless we first agreed to the self-serving ‘framework’ he proposed, asking in effect for a blank check to change the composition of the Board to suit his own preferences, something we could not possibly grant given our fiduciary duty to act in the best interests of all WisdomTree stockholders. Given WisdomTree’s strong operating results and stock performance, we view Mr. Tuckwell’s demands for Board changes as unjustified and unwarranted for our stockholders.

Instead of giving us the opportunity to evaluate his candidates prior to entering a proxy contest, Mr. Tuckwell made us aware of his nominees – Tonia Pankopf, Bruce E. Aust and himself – only in a public communication, squandering an opportunity to achieve a negotiated resolution prior to his engaging in a proxy contest against the Company. After reviewing their qualifications, we do not believe that Mr. Aust or Ms. Pankopf would add any skills or competencies to the Board that the current Board members collectively do not already possess.

GRAHAM TUCKWELL IS CONFLICTED, UNQUALIFIED AND LACKS THE REQUISITE TEMPERAMENT TO LEAD ANY PUBLIC COMPANY BOARD, ESPECIALLY WISDOMTREE’S BOARD

The ETFS Acquisition in 2018 was an exciting opportunity to meaningfully expand and enhance our presence and capabilities in the European market. We saw a chance to develop the business Mr. Tuckwell had created into something scalable and sustainable for the long-term. Of note, this past quarter was the best quarter of inflows and revenues since the European business was acquired back in 2018. We have injected life and diversity into the European UCITS product suite, growing the franchise from $0 to over $4 billion of AUM in the past 5 years. The products that WisdomTree has launched in the European market account for substantially all the cumulative net inflows across the entirety of the European business. Simply stated, the European business is broader and more robust with greater profitability and lower risk than what we inherited from the transaction. If Mr. Tuckwell were the best steward for the future of that business, he would still be running it, rather than having decided to break it up.

We knew at the time of the acquisition that Mr. Tuckwell did not have the requisite leadership capabilities or experience to grow and sustain the original business, and he certainly does not have the appropriate qualifications to grow the business as part of WisdomTree. Mr. Tuckwell is particularly ill-suited to comment on WisdomTree’s natural extension of our business related to our digital assets strategy, an area he never showed any interest in pursuing. That said, we note that Mr. Tuckwell also has recently invested in digital assets competitors, which shows that even he sees value in this current shift.

PROTECT YOUR INVESTMENT IN WISDOMTREE. REJECT GRAHAM TUCKWELL AND HIS NOMINEES AND VOTE THE WHITE PROXY CARD TODAY “FOR” ALL SIX OF WISDOMTREE’S NOMINEES, AND “WITHHOLD” ON THE ETFS CAPITAL NOMINEES

The record reflects that your Board has at every turn attempted to avoid an expensive and distracting proxy contest. Our strategy is clear, and our performance speaks for itself. Even the directors proposed by the stockholder group last year have endorsed our current strategy and management team as part of a unanimous Board vote. There is no case for change at WisdomTree, and even if there were, Mr. Tuckwell and his nominees would be the wrong people to effect that change.

We expect that over the coming weeks, you will receive copious materials from ETFS Capital, in which Mr. Tuckwell will surely claim to be concerned about the Company’s performance, its strategy and our corporate governance, but these are all just a smoke screen. Please do not be tricked by his antics – Mr. Tuckwell has nothing new to say about our strategy and operations, and we have absolutely no reason to think that he would act in the best interests of all our stockholders either as a member of the Board or as an “advisor” to his director nominees if he is able to force them onto our Board.

By voting for all six of our nominees, you will ensure that the WisdomTree Board has the right directors and mix of expertise to oversee the development and execution of our strategic objectives and the continued implementation of our strategic plans. Your vote will enable the Board to do so uninterrupted.

We are committed to acting in your best interests, and we appreciate your continued support as we work to strengthen and evolve our business. Thank you for your investment in WisdomTree.

Sincerely,

Frank Salerno

Independent Chair of the WisdomTree Board

Your vote is important, no matter how many or how few shares you own.

If you have questions about how to vote your shares, or need additional assistance, please contact the firm assisting us in the voting process:

Innisfree M&A Incorporated

Stockholders call toll-free: (877) 750-5836

Banks and brokers call collect: (212) 750-5833

IMPORTANT

We urge you NOT to sign any proxy card or voting instruction form from Graham Tuckwell or ETFS Capital Limited.

If you have already done so, you have every legal right to change your vote TODAY using the WHITE proxy card – by telephone, by internet or by signing, dating and returning the WHITE proxy card in the postage-page envelope provided in the mailing – or the WHITE voting instruction form.

VOTE FOR:

Lynn S. Blake

Daniela Mielke

Shamla Naidoo

Win Neuger

Frank Salerno

Jonathan Steinberg

WITHHOLD VOTE ON:

Bruce E. Aust

Tonia Pankopf

Graham Tuckwell

Advisors

BofA Securities is serving as financial advisor, and Goodwin Procter LLP is serving as legal counsel to WisdomTree. Innisfree M&A is serving as proxy solicitor and H/Advisors Abernathy is serving as strategic communications advisor.

About WisdomTree

WisdomTree is a global financial innovator, offering a well-diversified suite of exchange-traded products (ETPs), models and solutions. We empower investors to shape their future and support financial professionals to better serve their clients and grow their businesses. WisdomTree is leveraging the latest financial infrastructure to create products that provide access, transparency and an enhanced user experience. Building on our heritage of innovation, we are also developing next-generation digital products and structures, including digital funds and tokenized assets, as well as our blockchain-native digital wallet, WisdomTree Prime™.

WisdomTree currently has approximately $91.5 billion in assets under management globally.

WisdomTree® is the marketing name for WisdomTree, Inc. and its subsidiaries worldwide.

Cautionary Statement Regarding Forward-Looking Statements

Any statements contained in this letter that do not describe historical facts may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements are identified by use of the words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “should,” “views,” and similar expressions. Any forward-looking statements contained herein are based on current expectations, but are subject to risks and uncertainties that could cause actual results to differ materially from those indicated, including, but not limited to, the impact and contributions of the slate of director nominees WisdomTree has nominated, and WisdomTree’s ability to achieve its financial and business plans, goals and objectives and drive stockholder value, including with respect to its ability to successfully implement its strategy relating to WisdomTree Prime™, and other risk factors discussed from time to time in WisdomTree’s filings with the SEC, including those factors discussed under the caption “Risk Factors” in its most recent annual report on Form 10-K, filed with the SEC on February 28, 2023, and in subsequent reports filed with or furnished to the SEC. WisdomTree assumes no obligation and does not intend to update these forward-looking statements, except as required by law, to reflect events or circumstances occurring after today’s date.

Important Additional Information and Where to Find It

WisdomTree filed a proxy statement on Schedule 14A, an accompanying WHITE proxy card and other relevant documents with the SEC in connection with such solicitation of proxies from WisdomTree stockholders for WisdomTree’s 2023 Annual Meeting. WISDOMTREE STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ WISDOMTREE’S DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), ACCOMPANYING WHITE PROXY CARD, AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Investors and stockholders may obtain a copy of the definitive proxy statement, an accompanying WHITE proxy card, any amendments or supplements to the definitive proxy statement and other documents that WisdomTree files with the SEC at no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge on WisdomTree’s Investor Relations website at https://ir.wisdomtree.com/sec-filings or by contacting Jeremy Campbell, Head of Investor Relations, at jeremy.campbell@wisdomtree.com, as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC.

Disclaimer

WisdomTree has neither sought nor obtained the consent from any third party to use any statements or information contained in this letter that have been obtained or derived from statements made or published by such third parties. Any such statements or information should not be viewed as indicating the support of such third parties for the views expressed herein.

Category: Business Update

1 Adjusted diluted earnings-per-share is a non-GAAP financial measure. For a description of this measure and a reconciliation to the most directly comparable GAAP measure, diluted earnings per share, please see Exhibit 99.1 to our Form 8-K filed with the Securities and Exchange Commission on April 28, 2023.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230502005825/en/

Investor Relations

WisdomTree, Inc.

Jeremy Campbell

+1.646.522.2602

Jeremy.campbell@wisdomtree.com

or

Innisfree M&A Incorporated

Jonathan Salzberger / Scott Winter

+1.212.750.5833

jsalzberger@innisfreema.com / swinter@innisfreema.com

Media Relations

WisdomTree, Inc.

Jessica Zaloom

+1.917.267.3735

jzaloom@wisdomtree.com / wisdomtree@fullyvested.com

or

H/Advisors Abernathy

Jeremy Jacobs / Dana Gorman

+1.202.774.5600 / +1.212.371.5999

jeremy.jacobs@h-advisors.global / dana.gorman@h-advisors.global

Source: WisdomTree, Inc.

Released May 2, 2023