UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

Form

____________________________

| (Mark One) | ||

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For fiscal year ended

or

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to ________.

Commission File Number

____________________________

____________________________

| | | |

| (State or other jurisdiction of | (IRS Employer |

| | | |

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

____________________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| | | | ||

| | |

Securities registered pursuant to Section 12(g) of the Act:

None

____________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | ☒ | Accelerated filer | ☐ | |||||

| Non-accelerated filer | ☐ | Smaller reporting company | | |||||

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

At June 30, 2023, the aggregate market value of the registrant’s Common Stock held by non-affiliates (computed by reference to the closing sale price of such shares on The New York Stock Exchange on June 30, 2023) was $

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Report, to the extent not set forth herein, is incorporated herein by reference from the registrant’s definitive proxy statement relating to the Annual Meeting of Stockholders to be held in 2024, which definitive proxy statement shall be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Report relates.

WISDOMTREE, INC.

Form 10-K

For the Fiscal Year Ended December 31, 2023

TABLE OF CONTENTS

|

2 |

||||

|

ITEM 1. |

2 |

|||

|

ITEM 1A. |

25 |

|||

|

ITEM 1B. |

40 |

|||

|

ITEM 1C. |

40 |

|||

|

ITEM 2. |

41 |

|||

|

ITEM 3. |

41 |

|||

|

ITEM 4. |

41 |

|||

|

42 |

||||

|

ITEM 5. |

42 |

|||

|

ITEM 6. |

42 |

|||

|

ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

43 |

||

|

ITEM 7A. |

73 |

|||

|

ITEM 8. |

74 |

|||

|

ITEM 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

74 |

||

|

ITEM 9A. |

74 |

|||

|

ITEM 9B. |

75 |

|||

|

ITEM 9C. |

Disclosure Regarding Foreign Jurisdictions That Prevent Inspections |

75 |

||

|

75 |

||||

|

ITEM 10. |

75 |

|||

|

ITEM 11. |

76 |

|||

|

ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

76 |

||

|

ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

76 |

||

|

ITEM 14. |

76 |

|||

|

76 |

||||

|

ITEM 15. |

76 |

|||

|

ITEM 16. |

76 |

|||

Unless otherwise indicated, references to “the Company,” “we,” “us,” “our” and “WisdomTree” mean WisdomTree, Inc. and its subsidiaries.

WisdomTree®, WisdomTree Prime™ and Modern Alpha® are trademarks of WisdomTree, Inc. in the United States and in other countries. All other trademarks are the property of their respective owners.

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or Report, contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect our results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed in the section entitled “Risk Factors” and elsewhere in this Report. If one or more of these or other risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this Report and the documents that we reference in this Report and have filed with the Securities and Exchange Commission, or the SEC, as exhibits to this Report, completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements.

In particular, forward-looking statements in this Report may include statements about:

• anticipated trends, conditions and investor sentiment in the global markets and exchange-traded products, or ETPs;

• anticipated levels of inflows into and outflows out of our ETPs;

• our ability to deliver favorable rates of return to investors;

• competition in our business;

• whether we will experience future growth;

• our ability to develop new products and services and their potential for success;

• our ability to maintain current vendors or find new vendors to provide services to us at favorable costs;

• our ability to successfully implement our strategy relating to digital assets and blockchain-enabled financial services, including WisdomTree Prime, and achieve its objectives;

• our ability to successfully operate and expand our business in non-U.S. markets;

• the effect of laws and regulations that apply to our business; and

• actions of activist stockholders.

The forward-looking statements in this Report represent our views as of the date of this Report. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views as of any date other than the date of this Report.

1

PART I

ITEM 1. BUSINESS

Our Company

We are a global financial innovator, offering a well-diversified suite of exchange traded products, or ETPs, models, solutions and products leveraging blockchain technology. We empower investors and consumers to shape their future and support financial professionals to better serve their clients and grow their businesses. We are leveraging the latest financial infrastructure to create products that provide access, transparency and an enhanced user experience. Building on our heritage of innovation, we are also developing and have launched next-generation digital products, services and structures, including digital or blockchain-enabled mutual funds (“Digital Funds”) and tokenized assets, as well as our blockchain-native digital wallet, WisdomTree Prime, which is currently available in the U.S. in 38 states, representing approximately 70% of the U.S. population.

We had approximately $100.1 billion in assets under management, or AUM, as of December 31, 2023. Our family of ETPs includes products that provide exposure to equities, fixed income, commodities, leveraged-and-inverse, currency, alternatives and cryptocurrency strategies. We have launched many first-to-market products and pioneered alternative weighting we call “Modern Alpha,” which combines the outperformance potential of active management with the benefits of passive management to offer investors cost-effective funds that are built to perform. Most of our equity-based funds employ a fundamentally weighted investment methodology, which weights securities based on factors such as dividends, earnings or investment factors, whereas most other industry indexes use a capitalization weighted methodology. These products are distributed through all major channels in the asset management industry, including banks, brokerage firms, registered investment advisers, institutional investors, private wealth managers and online brokers primarily through our sales force. We believe technology is altering the way financial advisors conduct business and through our Advisor and Portfolio Solutions programs we offer technology-enabled and research-driven solutions including portfolio construction, asset allocation, practice management services and digital tools to help financial advisors address technology challenges and grow and scale their businesses.

We are at the forefront of innovation and believe that tokenization and leveraging the utility of blockchain technology is the next evolution in financial services. We are building the foundation that we believe will allow us to lead in this coming evolution. WisdomTree Prime, our blockchain-native digital wallet, positions us to expand our blockchain-enabled financial product and services offerings with a new direct-to-consumer channel where spending, saving and investing are united. As we continue to pursue our digital assets strategy, we are embracing what we refer to as “responsible DeFi,” which we believe upholds the foundational principles of regulation in this innovative and quickly evolving space. We believe that our expansion into digital assets and blockchain-enabled finance complements our existing core competencies in a holistic manner and will diversify our revenue streams and contribute to our growth.

We were incorporated under the laws of the state of Delaware on September 19, 1985 as Financial Data Systems, Inc. and were ultimately renamed WisdomTree, Inc. on November 7, 2022.

2

Assets Under Management

WisdomTree ETPs

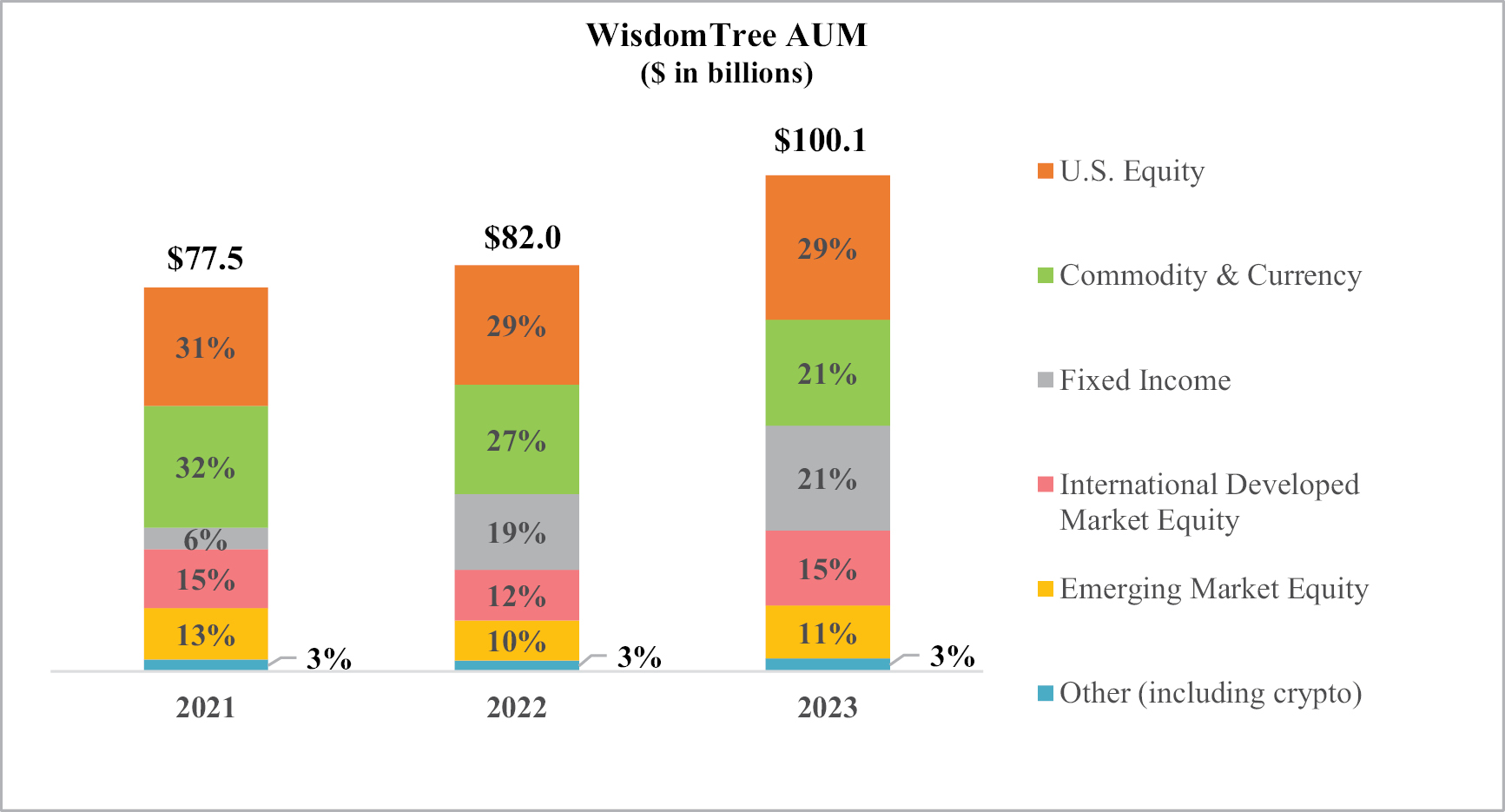

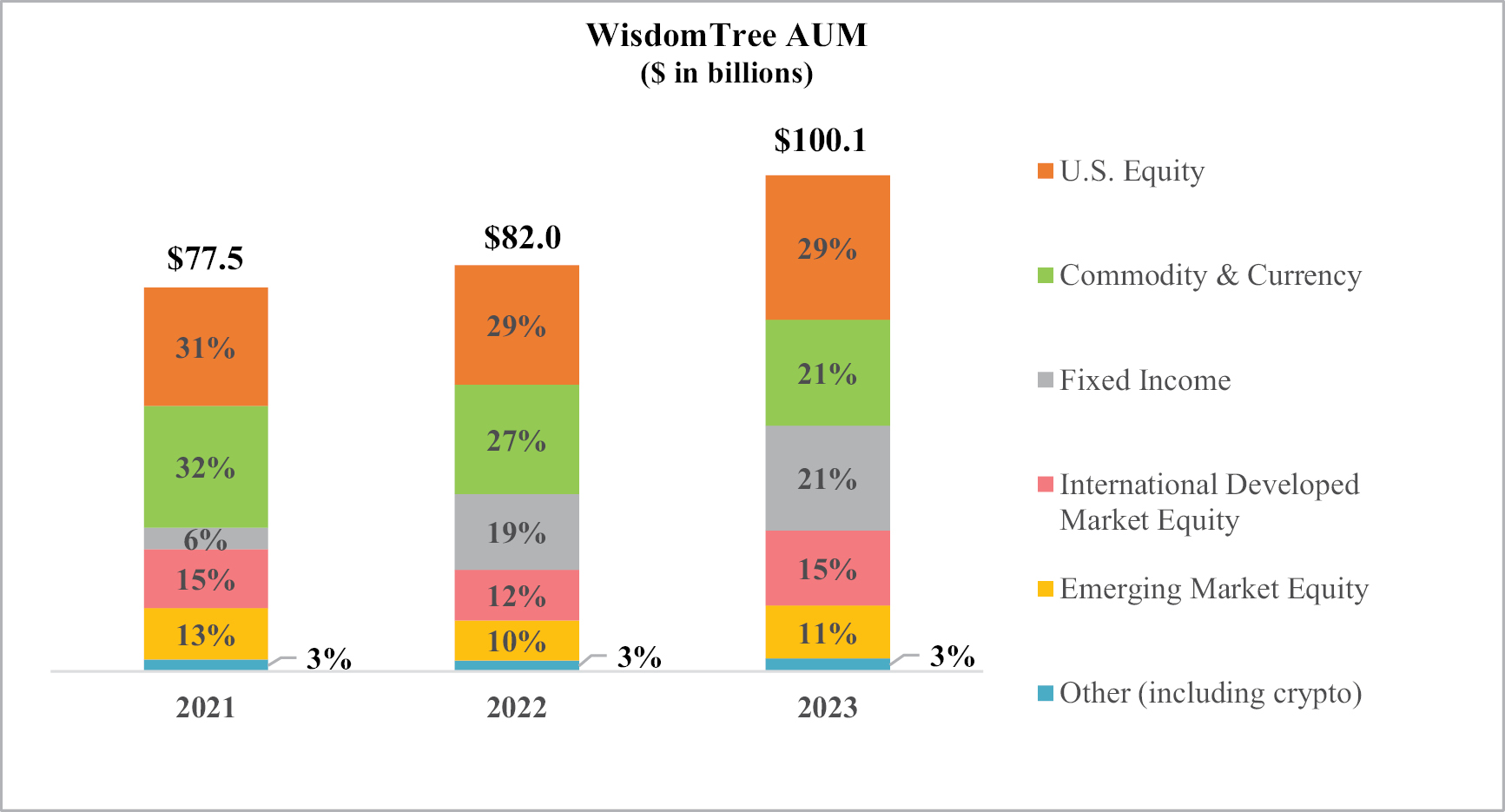

We offer ETPs covering equity, fixed income, commodities, leveraged-and-inverse, currency, alternatives and cryptocurrency. The chart below sets forth the asset mix of our ETPs at December 31, 2021, 2022 and 2023:

Our Operating and Financial Results

We operate as an ETP sponsor and asset manager, providing investment advisory services globally through our subsidiaries in the U.S. and Europe.

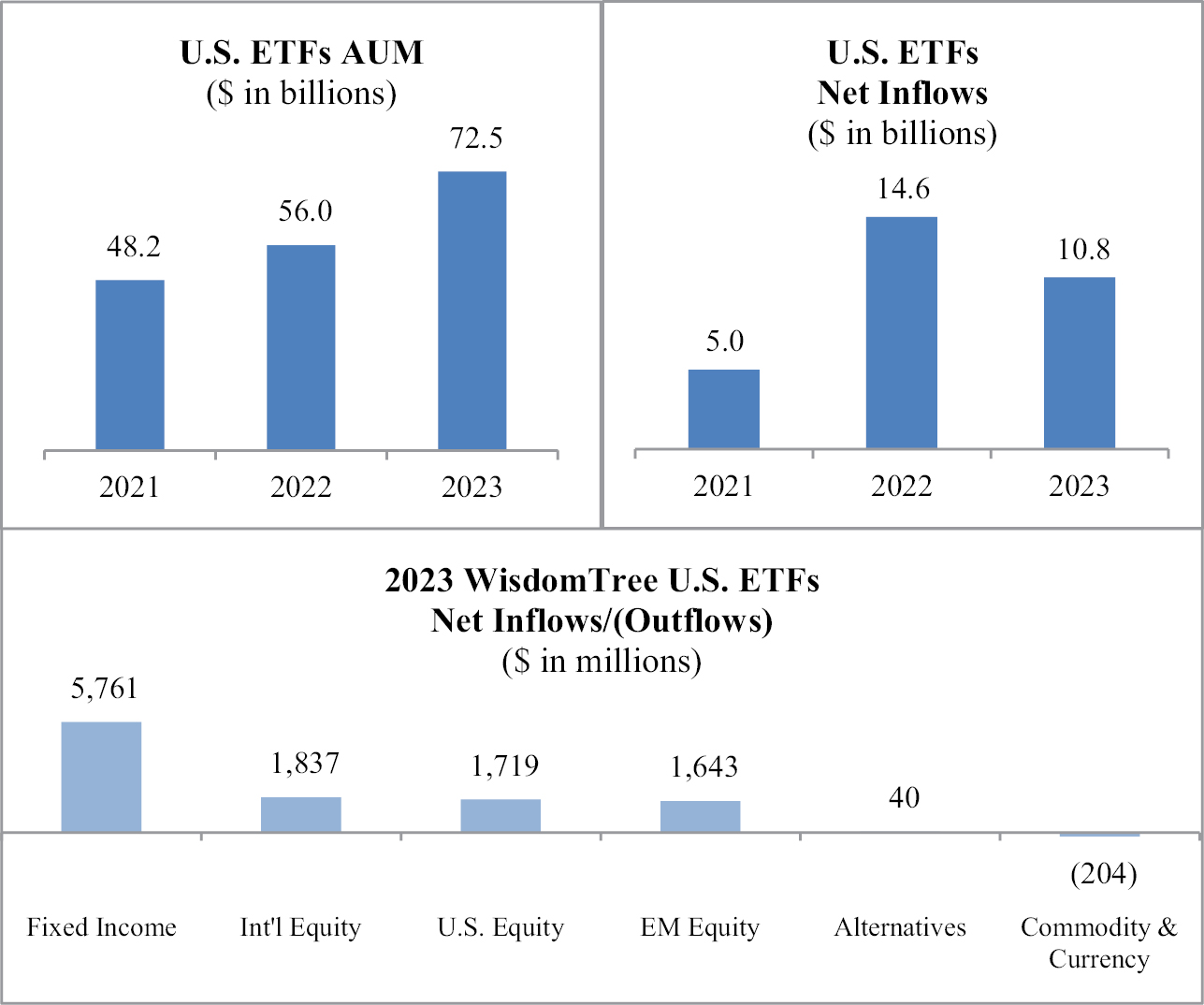

U.S. Listed ETFs

The AUM of our U.S. listed exchange traded funds, or U.S. listed ETFs, increased from $56.0 billion at December 31, 2022 to $72.5 billion at December 31, 2023 due to net inflows and market appreciation.

3

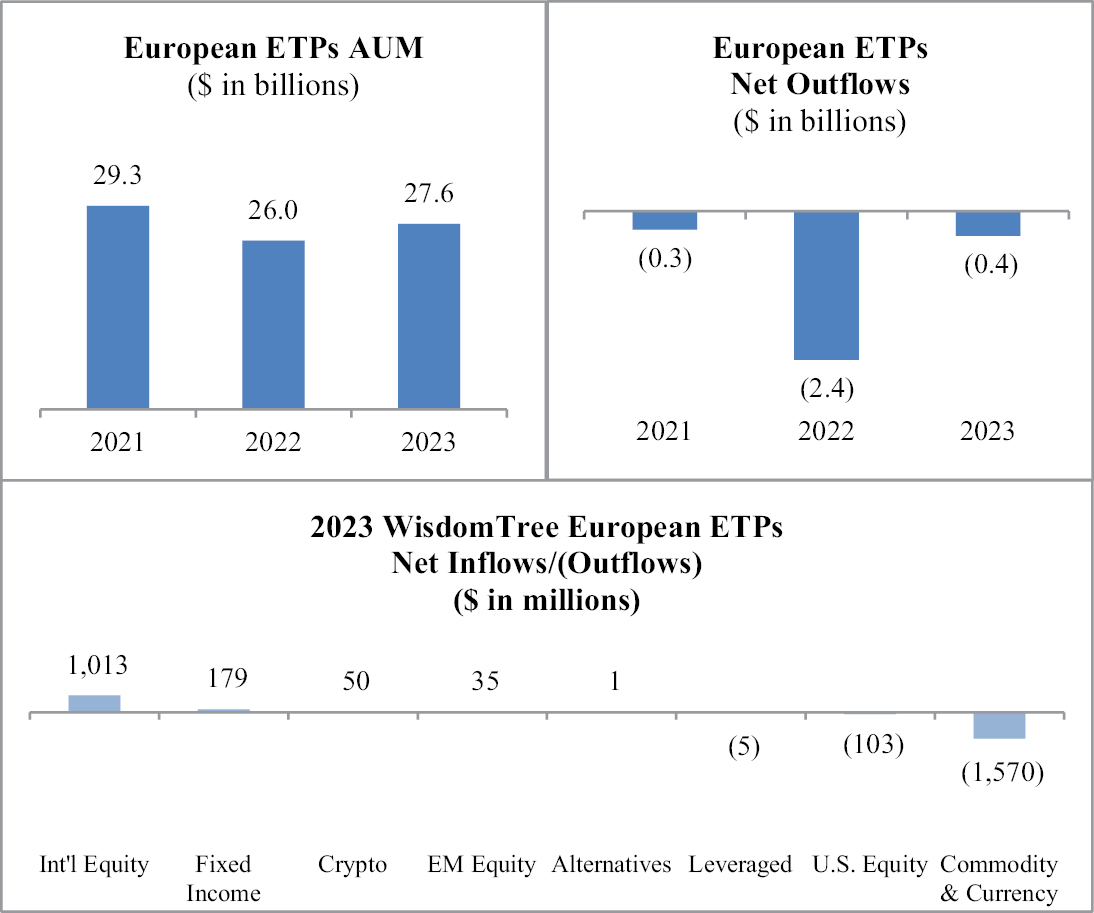

European Listed ETPs

The AUM of our European listed (including internationally cross-listed) ETPs, or European listed ETPs, increased from $26.0 billion at December 31, 2022 to $27.6 billion at December 31, 2023, due to market appreciation, partly offset by net outflows.

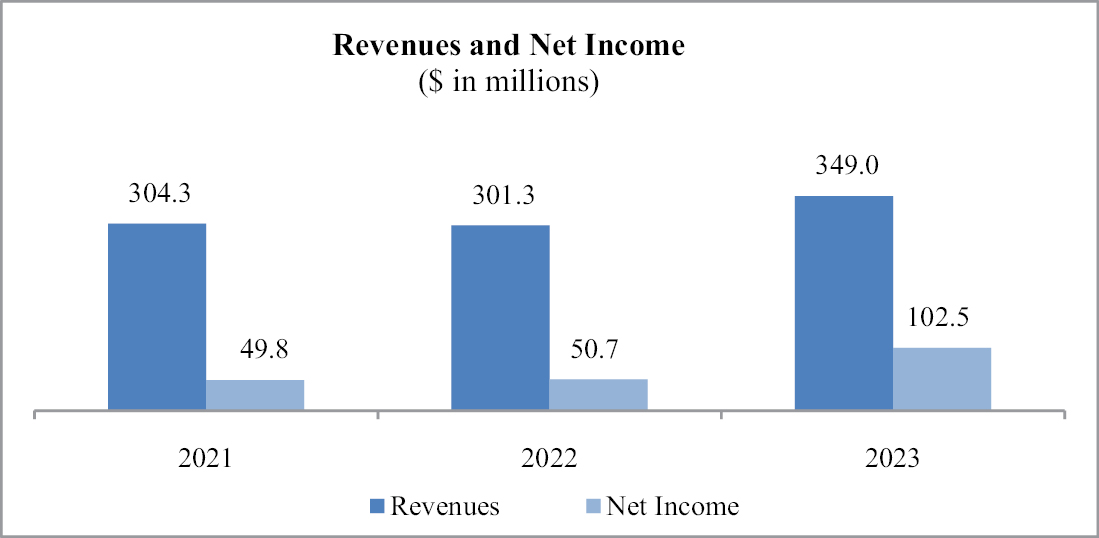

Consolidated Operating Results

The following table sets forth our revenues and net income for the last three years.

• Revenues – We recorded operating revenues of $349.0 million during the year ended December 31, 2023, up 15.8% from the year ended December 31, 2022 due to higher average AUM and higher other income from large flows from some of our European products, partly offset by a lower average advisory fee.

• Expenses – Total operating expenses increased 8.4% from the year ended December 31, 2022 to $261.5 million primarily due to higher stock-based compensation and headcount, fund management and administration costs, professional fees, marketing expenses, third-party distribution fees, sales and business development expenses and other expenses. These increases were partly offset by the termination of our deferred consideration—gold payments obligation on May 10, 2023.

• Other Income/(Expenses) – Other income/(expenses) includes interest income and interest expense, gains and losses on revaluation/termination of deferred consideration—gold payments, impairments and other losses and gains. See “Other Income/(Expenses)” in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information.

• Net income – We reported net income of $50.7 million and $102.5 million during the years ended December 31, 2022 and 2023, respectively.

See “Non-GAAP Financial Measures” included in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information.

4

Seasonality

We believe seasonal fluctuations in the asset management industry are common, however such trends are generally masked by global market events and market volatility in general. Therefore, period-to-period comparisons of our or the industry’s flows and operating results may not be meaningful or indicative of results in future periods.

Our Industry – ETPs

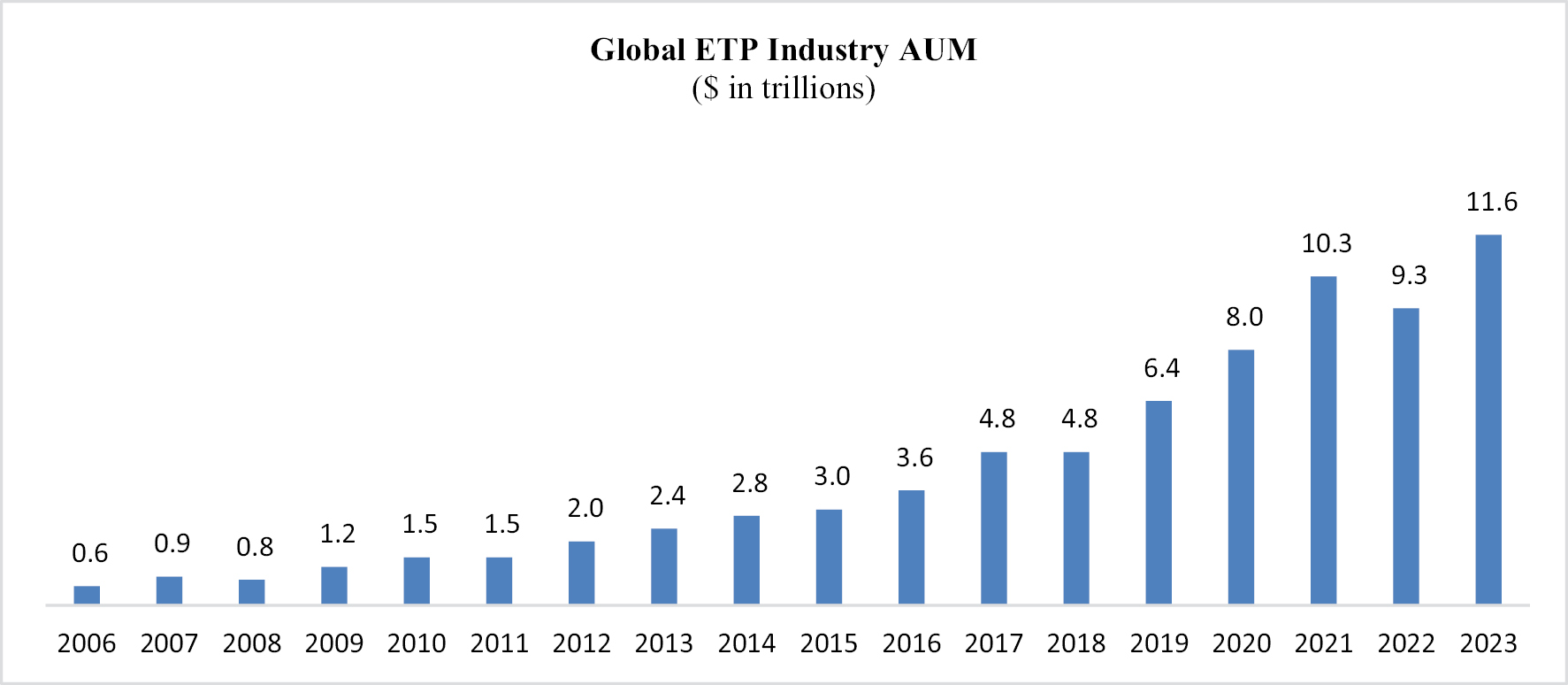

We believe ETPs have been one of the most innovative investment products to emerge in the last two decades in the asset management industry. As of December 31, 2023, aggregate AUM of ETPs globally was $11.6 trillion.

The chart below reflects the AUM of the global ETP industry since 2006:

Source: ETFGI LLP

As of December 31, 2023, we were the fourteenth largest ETP sponsor globally based on AUM.

|

GLOBAL RANKING |

||||

|

Rank |

ETP Sponsor |

AUM |

||

|

1 |

iShares |

3,552 |

||

|

2 |

Vanguard |

2,505 |

||

|

3 |

State Street |

1,303 |

||

|

4 |

Invesco |

543 |

||

|

5 |

Charles Schwab |

319 |

||

|

6 |

Nomura |

230 |

||

|

7 |

Amundi |

229 |

||

|

8 |

Xtrackers |

207 |

||

|

9 |

First Trust |

155 |

||

|

10 |

JPMorgan |

153 |

||

|

11 |

Dimensional |

118 |

||

|

12 |

Nikko AM |

106 |

||

|

13 |

Daiwa |

101 |

||

|

14 |

WisdomTree |

100 |

||

|

15 |

UBS |

97 |

||

Source: Morningstar

Exchange traded funds, or ETFs, have become more popular among a broad range of investors as they come to understand the benefits of ETFs and use them for a variety of purposes and strategies, including low-cost index investing and asset allocation, access to specific asset classes, protective hedging, income generation, arbitrage opportunities and diversification.

5

While ETFs are similar to mutual funds in many respects, they also have some important differences:

• Transparency. ETFs disclose the composition of their underlying portfolios on a daily basis, unlike mutual funds, which typically disclose their holdings every 90 days.

• Intraday trading, hedging strategies and complex orders. Like stocks, ETFs and other exchange-traded products can be bought and sold on exchanges throughout the trading day at market prices. ETFs update the indicative values of their underlying portfolios every 15 seconds. As publicly-traded securities, ETF shares can be purchased on margin and sold short, enabling the use of hedging strategies, and traded using limit orders, allowing investors to specify the price points at which they are willing to trade.

• Tax efficiency. In the U.S., whenever a mutual fund or ETF realizes a capital gain that is not balanced by a realized loss, it must distribute the capital gain to its shareholders. These gains are taxable to all shareholders, even those who reinvest the gain distributions in additional shares of the fund. However, most ETFs typically redeem their shares through “in-kind” redemptions in which low-cost securities are transferred out of the ETF in exchange for fund shares in a non-taxable transaction. By using this process, ETFs can avoid the transaction fees and tax impact incurred by mutual funds that sell securities to generate cash to pay out redemptions.

• Uniform pricing. From a cost perspective, ETFs are one of the most equitable investment products on the market. Investors in a U.S. listed ETF pay identical advisory fees regardless of the investors’ size, structure or sophistication. Unlike mutual funds, U.S. listed ETFs generally do not have different share classes or different expense structures for retail and institutional clients and ETFs typically are not sold with sales loads or 12b-1 fees. In many cases, ETFs offer lower expense ratios than comparable mutual funds.

ETFs are used in various ways by a range of investors, from conservative to speculative uses including:

• Low-cost index investing. ETFs provide exposure to a variety of broad-based indexes across equities, fixed income, commodities and other asset classes and strategies, and can be used as both long-term portfolio holdings or short-term trading tools. ETFs offer an efficient and less costly method by which to gain exposure to indexes as compared to individual stock ownership.

• Improved access to specific asset classes. Investors often use ETFs to gain access to specific market sectors or regions around the world or a particular asset, such as physical gold or crypto, by investing in an ETF that holds a portfolio of securities in that sector, region or asset rather than gaining exposure by purchasing individual securities, physical commodities or currencies.

• Asset allocation. Investors seeking to invest in various asset classes to develop an asset allocation model in a cost-effective manner can do so easily with ETFs, which offer broad exposure to various asset classes in a single security.

• Protective hedging. Investors seeking to protect their portfolios may use ETFs as a hedge against unexpected declines in prices of securities arising from market movements and changes in currency and interest rates.

• Income generation. Investors seeking to obtain income from their portfolios may buy fixed income ETFs that typically distribute monthly income or dividend-paying ETFs that encompass a basket of dividend-paying stocks rather than buying individual stocks.

• Speculative investing. Investors with a specific directional opinion about a market sector may choose to buy or sell (long or short) an ETF covering or leveraging that market sector.

• Arbitrage. Sophisticated investors may use ETFs to exploit perceived value differences between the ETF and the value of the ETF’s underlying portfolio of securities.

• Diversification. By definition, ETFs represent a basket of securities and each fund may contain hundreds or even thousands of different individual securities. The “instant diversification” of ETFs provides investors with broad exposure to an asset class, market sector or geography.

The ETF sector of the asset management industry continues to demonstrate that it is favored among investors. According to Morningstar, from January 1, 2021 through December 31, 2023, equity ETFs have generated positive inflows of approximately $1.9 trillion, while long-term equity mutual funds have generated outflows of approximately ($830) billion. In addition, ETF fixed income flows are benefiting from a broader range of investors gravitating toward fixed income products in the ETF structure. We believe this trend is due to the inherent benefits of ETFs – transparency, liquidity and tax efficiency.

6

We believe that our growth, and the growth of the industry in which we operate, will continue to be driven by the following factors:

• Education and greater investor awareness. Over the last several years, ETPs have been taking a greater share of inflows and AUM from mutual funds. We believe investors have become more aware of some of the deficiencies of mutual funds and other financial products and are increasing their focus on important characteristics of their traditional investments – namely transparency, tradability, liquidity, tax efficiency and fees. Their attention and education focused on these important investment characteristics may be one of the drivers of the shift in inflows from traditional mutual funds to ETPs. We believe these products will continue to take market share from traditional mutual funds and other financial products or structures such as hedge funds, separate accounts and individual stocks as investors continue to become more aware and educated about ETPs and their benefits.

• Move to fee-based models. Financial advisors are shifting their business model from one that is “transaction-based,” that is, based on commissions for trades or receiving sales loads, to a “fee-based” approach, where an overall fee is charged based on the value of AUM. This fee-based approach lends itself to the advisor selecting lower-fee financial products, and in our opinion, better aligns advisers with the interests of their clients. Since ETFs generally charge lower fees than mutual funds, we believe this model shift will benefit the ETF industry.

• Innovative product offerings. ETPs are now available for virtually every asset class including equities, fixed income, commodities, leveraged-and-inverse, currencies, alternative strategies and cryptocurrencies (with greater access in markets outside the U.S.). However, we believe that there remain substantial areas for sponsors to continue to innovate, including cryptocurrency, liquid alternative, thematic and other strategies. We also believe the further expansion of ETPs will fuel additional growth and investments from investors who typically access these products through hedge funds, separate accounts, stock investments or the futures and commodity markets.

• Changing demographics. As the “baby boomer” generation continues to mature and retire, we expect that there will be a greater demand for a broad range of investment solutions, with an emphasis on income generation and principal protection, and that more of these investors will seek advice from professional financial advisors. We believe these financial advisors will migrate more of their clients’ portfolios to ETPs due to their lower fees, better fit within fee-based models, and their ability to provide access to more diverse market sectors, improve multi-asset class allocation, and be used for different investment strategies, including income generation. Overall, we believe ETFs are well-suited to meet the needs of this large and important group of investors. In addition, since many younger investors and financial advisors have demonstrated a preference for the ETP structure over traditional product structures, we believe that wealth transfers from one generation to another will also have a positive effect on ETP industry growth.

• International markets. We believe the growth of ETPs is a global phenomenon. While the U.S. currently represents the vast majority of global ETP assets, many of the same growth drivers in the U.S. market are also taking hold in global markets.

Our Industry – Digital Assets

We believe that digital assets, tokenization and blockchain technology will help to innovate and evolve financial services from an investments, savings, payments and operational perspective. The digital assets industry has picked up significant momentum among market participants, including asset management firms, fintech firms, banks, broker-dealers and investors, which has spurred unprecedented adoption, growth and innovation. We believe that the benefits of blockchain technology can provide for the best product structures and executions in financial services. We expect that over time, benefits will include the following:

• Transparency. Blockchain technology employs mutualized standards, protocols and shared processes, acting as a single shared source of truth for network participants. The increased transparency among financial institutions and market participants may also improve regulatory reporting and monitoring.

• Economic benefits. Automated, more efficient processes may lead to reduced operational, transactional and infrastructure costs.

7

• Streamlined processes. Automation and overall operational efficiency increases with the use of blockchain technology. It enables real-time (near instant) settlement, auditability and reporting; and it reduces processing times, the potential for error and delay, and the number of steps and intermediaries required to achieve the same levels of confidence in traditional processes, thereby reducing counterparty risks.

• New products and potential markets. Blockchain technology can make fractionalized ownership of real-world assets and tokenized economies a reality, with the same, if not better, level of security and scalability found in traditional finance.

• Programmable capabilities. Through the creation and execution of smart contracts, governance protocols, compliance, data privacy, customer identification (e.g., KYC/AML), system incentives and features can be programmed or built into the assets themselves.

• Scalability. Blockchain technology supports interoperability between private and public blockchains, thereby expanding the global reach and resiliency of transactions.

The laws and regulatory frameworks pertaining to digital assets and blockchain technology continue to evolve with an increase in scope and complexity. Contemporaneously, there has been heightened regulatory scrutiny of digital asset activities, which include material litigation and regulatory proceedings (e.g., enforcement actions) by government authorities, an increase in cybersecurity incidents leading to the theft or severe loss of assets, and insolvency proceedings (including bankruptcies) resulting from a variety of factors including poor risk management and oversight controls, speculative or risky behavior, and/or fraud or the misappropriation of customer funds. As a financial innovator seeking to bridge the gap between traditional finance and blockchain-enabled finance, we are embracing what we refer to as “responsible DeFi” for our digital assets and blockchain-enabled products and services, which we believe upholds the foundational principles of regulation in this innovative and rapidly evolving space. We are committed to being a trusted provider of innovative products and services guided by proactive engagement and continued collaboration with current and new regulators.

Competition in the digital assets industry on a global basis is increasing, ranging from large, established financial incumbents to smaller, early-stage financial technology providers and companies. There are jurisdictions with more stringent and robust regulatory and compliance requirements than others, which could impact the ability of a company to compete in the digital assets industry. We believe that we will continue to successfully compete in the digital assets industry by offering innovative products through digital asset exposures, generating strong after-fee performance and track records, embracing regulation, developing strategic partnerships with participants in the digital assets ecosystem, promoting thought leadership and investor education or awareness, building upon our brand and attracting and retaining talented employees. We remain focused on providing the best structures and executions in financial services through digital assets and blockchain technology.

Our Competitive Strengths

• Well-positioned in large and growing markets. We believe that ETPs are well positioned to grow significantly faster than the asset management industry as a whole, making our focus on ETPs an advantage over traditional asset management firms. We also believe that asset tokenization will be the future of financial services and expect our early-mover position in digital assets will serve to solidify our position as a forward-thinking innovator and industry leader in blockchain-enabled financial services.

• Strong, seasoned and creative management team. We have built a strong and dedicated senior leadership team. Most of our leadership team has significant ETP or financial services industry experience in fund operations, regulatory and compliance oversight, product development and management or marketing and communications. We also continue to expand our global digital assets team, which is focused on growing existing and developing new investment products, indexes and strategies that provide exposure to digital assets, along with new blockchain-enabled products and services across global markets. Whether through ETPs, digital assets or decentralized finance, we will continue to be a trusted provider of innovative products and services guided by proactive engagement and regulatory collaboration. We believe that our team has demonstrated an ability to innovate as well as recognize and respond to market opportunities and effectively execute our strategy and has a proven track record including developing an ETP sponsor from the ground up despite significant competitive regulatory and operational barriers.

8

• Strong performance. We create our own indexes, most of which weight companies in our equity ETFs by a measure of fundamental value and are rebalanced annually. By contrast, traditional indexes are market capitalization weighted and tend to track the momentum of the market. We also offer actively managed ETFs, as well as ETFs based on third-party indexes. In evaluating the performance of our U.S. listed equity, fixed income and alternative ETFs against actively managed and index based mutual funds and ETFs, over 80% of our U.S. listed AUM covered by Morningstar were in the top two quartiles of peer performance in the 3-year and 10-year timeframes. In addition, approximately 50% of our U.S. listed AUM is rated 4- or 5-star by Morningstar.

• Differentiated product set, powered by innovation and performance. Our products span a variety of traditional and high growth asset classes covering equity, fixed income, commodity, leveraged-and-inverse, currency, alternative strategies and cryptocurrency, and include both passive and actively managed funds. We are also developing and have launched next-generation digital products, services and structures, including Digital Funds and tokenized assets. Our innovations include the following:

• the launch of the WisdomTree Prime mobile application, our blockchain-native digital wallet that serves as a new direct-to-consumer channel positioning us as an early mover and industry leader in blockchain-enabled financial services; the application is currently available in 38 states in the U.S., representing approximately 70% of the U.S. population;

• the tokenization of real-world assets like physical gold (i.e., gold tokens) and U.S. dollars (i.e., dollar tokens);

• 13 Digital Funds accessible through WisdomTree Prime including a government money market fund and other digital funds offering asset allocation, fixed income and equity exposures that use blockchain technology to maintain a secondary record of their respective shares on one or more blockchains (e.g., Stellar or Ethereum);

• among the first to launch a spot bitcoin ETF in the U.S.;

• the first ETF to add bitcoin futures exposure;

• the first gold and oil ETPs via our acquisition of the European exchange-traded commodity, currency and leveraged-and-inverse business of ETFS Capital Limited, or ETFS Capital. Throughout this Report, we refer to the acquired business as ETFS and the acquisition as the ETFS Acquisition;

• the first emerging markets small-cap equity ETF;

• the first actively managed currency ETF;

• the first ETF to provide investors with access to the Additional Tier 1 Contingent Convertible, or CoCo, bond market;

• one of the first international local currency denominated fixed income ETFs;

• the first managed futures strategy ETF;

• the first currency hedged international equity ETFs in the U.S.;

• the first 90/60 balanced ETF;

• the first multifactor ETFs incorporating dynamic currency hedging as a factor; and

• the first smart beta corporate bond suite.

Our product development strategy utilizes our Modern Alpha approach, which combines the outperformance potential of active management with the benefits of passive management to offer investors cost-effective funds that are built to perform. Self-indexing is a significant component of this approach. Many of our products are based on proprietary WisdomTree indexes which we believe gives us several advantages. First, it minimizes our third-party index licensing fees, which increases our profitability. Second, because we develop our own intellectual property, we are intimately familiar with our strategies and able to effectively communicate their value proposition in the market with research content and support. Third, it can enhance our speed to market and first mover advantage. Fourth, because these indexes are proprietary to WisdomTree, we may face similar competition, but we never face exact competition. Our expertise in product development combined with our self-indexing capabilities provides a strategic advantage, enabling us to launch innovative products. Building on our heritage of innovation, we are developing and have launched next-generation digital products and structures, including Digital Funds and tokenized assets.

9

• Extensive marketing, research and sales efforts. We have invested significant resources to establish the WisdomTree brand and to promote our products through online and television targeted advertising and social media, as well as through our public relations efforts. Close to 40% of our employees are dedicated to marketing, research and sales. Our sales professionals are the primary points of contact for financial advisors, independent advisory firms and institutional investors who invest in our ETPs. Their efforts are enhanced through value-added services provided by our research and marketing efforts. We have strong relationships with financial advisors and institutional investors and we believe that by strategically aligning these advisor relationships and marketing campaigns with targeted research and sales initiatives and products that align with market sentiment, we differentiate ourselves from our competitors.

• Efficient business model with lower risk profile. We have invested heavily in digital tools and data to market and sell our products and in the internal development of our core competencies with respect to product development, marketing, research and sales of our products. We outsource to third parties those services that are not our core competencies or may be resource or risk intensive, such as the portfolio management responsibilities and fund accounting operations of our products. In addition, our licensing costs are moderated since we create our own indexes for most of our ETFs.

Our Growth Strategies

We are a global financial innovator, offering a well-diversified suite of ETPs, models, solutions and products leveraging blockchain-enabled technology, with AUM of $100.1 billion as of December 31, 2023. We are at the forefront of innovation and believe that tokenization and leveraging the utility of blockchain technology is the next evolution in financial services. We are building the foundation that we believe will allow us to lead in this coming evolution. WisdomTree Prime, our blockchain-native digital wallet, positions us to expand our blockchain-enabled financial services product offerings with a new direct-to-consumer channel where spending, saving and investing are united. As we continue to pursue our digital assets strategy, we are embracing what we refer to as “responsible DeFi,” which we believe upholds the foundational principles of regulation in this innovative and rapidly evolving space. We believe that our expansion into digital assets complements our existing core competencies in a holistic manner and will diversify our revenue streams and contribute to our growth. Our strategy includes the following:

• Launch innovative ETPs that diversify our product offerings and revenues. We have launched many first-to-market ETFs in the U.S. and pioneered alternative weighting and performance methods we call “Modern Alpha,” which combines the outperformance potential of active management with the benefits of passive management to offer investors cost-effective funds that are built to perform. Our growth plan focuses on filling strategic gaps and seizing tactical opportunities by launching new products globally.

• Establish ourselves as a leader in digital assets and blockchain-enabled financial services. Our deep experience with innovation and proven track record of entering new asset classes and markets, coupled with our firmwide strategic attention on blockchain-enabled finance and a culture focused on governance and risk management with a regulatory minded approach positions us to become a leader in the digital assets industry. We are an early mover in this space, with the launch of our blockchain-native digital wallet, WisdomTree Prime, a new direct-to-consumer channel where spending, saving and investing are united. WisdomTree Prime provides access to bitcoin, ether, tokenized gold and U.S. dollar tokens, as well as 13 Digital Funds, including a government money market fund and other digital funds offering asset allocation, fixed income and equity exposures. In addition, we have partnered with a financial institution to provide co-branded debit cards to our retail customers on the WisdomTree Prime platform. We continue to focus on enhancing the products and capabilities of the platform with plans to allow for peer-to-peer transfers and payments. We are also exploring strategic partnerships and other business development opportunities for both our platform and product suite that could unlock additional tokenization revenue streams in the future.

• Foster deeper client relationships through technology-enabled and research-driven solutions. We believe technology is altering the way financial advisors conduct business. Our Advisor and Portfolio Solutions programs provide technology-enabled and research-driven solutions to help financial advisors grow and scale their businesses and address their technology challenges.

10

The Advisor and Portfolio Solutions programs include:

• access to our U.S. model portfolios which are available to over 70,000 advisors across a number of platforms, including, Merrill Lynch, Morgan Stanley, LPL Financial, Charles Schwab, Envestnet, 55ip and others. Our model portfolios are a natural extension of our research capabilities and provide advisors access to an open-architecture approach, a tenured team and a firm dedicated to innovation and value creation. As part of this initiative, we launched a series of model portfolios in collaboration with Professor Jeremy Siegel;

• providing customized portfolio and asset allocation services to support registered investment advisers and independent broker dealers in building, implementing, and managing their client portfolios while providing strategic guidance for advisors to support their business growth;

• access to portfolio construction tools such as our award-winning Portfolio Analysis Tools Hub (PATH), an enhanced portfolio construction tool that assists financial advisors in analyzing an existing investment portfolio by examining the data and providing alternative portfolio approaches to consider in seeking to improve outcomes based on different measures;

• wealth investment research and ETF education; and

• practice management resources, including access to thought leaders in behavioral finance, leadership, and transforming wealth management technology.

• Deepen relationships with distribution platforms. We maintain relationships with certain distribution platforms that allow commission-free trading of our ETFs. These relationships are beneficial to us as they can provide greater marketing privileges and access to the platforms’ advisors. As financial advisors continue to migrate away from mutual funds, we use our expertise in ETFs to build new relationships and educate advisors about the benefits of ETFs. Some of these relationships that exist today are with LPL Financial, BNY Mellon/Pershing, Raymond James, Charles Schwab, Cetera and others.

• Leverage data intelligence to serve and expand investor base and improve sales and marketing effectiveness. We utilize a cognitive customer-focused lead prioritization system which has enhanced our distribution efforts. The system evaluates data across structured and unstructured sources such as historical investment data, market data and investor activity history, extracting behavioral insights, and is designed to enable our sales and marketing teams to optimize outreach to our current and potential investor base.

• Selectively pursue acquisitions or other strategic transactions. We may pursue acquisitions or other strategic transactions that will enable us to strengthen our current business, expand and diversify our product offerings, complement our Advisor and Portfolio Solutions programs, increase our AUM or enter into new markets. We believe pursuing acquisitions or other strategic transactions is a cost-effective means of growing our business and AUM.

Human Capital Resources

We compete in the highly competitive asset management industry. Attracting, retaining and motivating highly skilled, and sometimes highly specialized, employees in operations, product development, research, technology, sales and marketing and other positions is crucial to our ability to compete effectively. Our ability to recruit and retain such employees depends on a number of factors, including our corporate culture and work environment, informed by our values and behaviors, talent development and career opportunities and compensation and benefits. We strive to differentiate ourselves through our sense of community and purpose integrated into our culture, while encouraging a culture where every employee has a voice.

Employee Profile

At December 31, 2023, we had 303 full-time employees globally, consisting of 190 in the U.S. and 113 in Europe. We consider our relations with employees to be good.

Diversity, Equity and Inclusion (DEI)

We recognize that a diverse set of perspectives is critical to innovation and have built a diverse global workforce, inclusive of gender, race, ethnicity, religion, age, gender identity, gender expression and sexual orientation, as well as those in the disabled community. We actively seek candidates from different backgrounds and outside traditional fields and reinforce our commitment to diversity through organizational policies, such as mandating fairness and equality for all employees and creating performance appraisal systems that are non-discriminatory.

11

At WisdomTree, we envision a future of investment excellence driven by a commitment to continuously strengthen our diverse, equitable and inclusive workplace culture. Our DEI Council, formed in 2021, is comprised of senior leaders and employees from both the U.S. and Europe and provides oversight and guidance in connection with the implementation of programs designed to foster a culture where every employee thrives, leveraging diverse perspectives and inclusive practices. For example, in 2023, the DEI Council held training sessions on understanding neurodiversity, implicit bias and embedding inclusion in feedback, roundtables on success and failure, and financial literacy workshops for employees and secondary school students. The DEI Council also promoted awareness days and months across the firm including with respect to black history, women’s history, pride, mental health and men’s health.

Our Women’s Initiative Network, or WIN, is a global employee-led network designed to provide opportunities and support from all genders for women at WisdomTree, career development and professional training opportunities, and female empowerment and leadership within the organization. Since its inception in 2019, WIN has held numerous global events, including panel discussions on women in the workforce featuring WisdomTree employees and notable guest speakers, interactive seminars on topics including negotiation skills, workshops and coaching sessions to enhance confidence to speak up, and various roundtable forums, informal coffee catch-ups and in-person and virtual social gatherings to promote connectivity and increase engagement. WIN also produces regular internal “spotlight” newsletters to increase visibility and raise the profile of our female employees. Both this initiative and WIN’s coffee catch-up initiative evolved into successful firm-wide initiatives. In addition, through WIN’s mentorship program, WIN members of all genders are connected with firm leaders who can help them achieve their career development goals.

Employee Wellness, Health and Safety

The wellbeing of our employees is a primary focus. We are continuously evolving and refining how we work best to achieve individual, team and Company goals. To that end, we have embraced a “Work Smart” philosophy that transcends physical work settings, with a focus on optimizing productivity, efficiency and effectiveness of our work. Time in the office generally is not prescribed, and team leaders are empowered to determine how their teams work best, based on their roles, with employees remaining accountable for achieving individual, team and Company outcomes. To foster employee wellbeing and a healthy work-life balance, we offer numerous wellness programs including meditation and yoga classes, health webinars, a weekly wellness newsletter and access to mental health professionals and other resources. Leveraging technology, we enhance the employee experience through digital wellness platforms, facilitating remote access to health and wellbeing resources. We also offer paid vacation (unlimited in the U.S.) and sick leave policies to provide employees additional flexibility, and our U.S. employees enjoy additional “wellness days,” which are scheduled office closures around major market holidays for employees to collectively disconnect and rejuvenate. We support employees with their information technology needs, provide a monthly stipend to cover remote work-related business expenses and provide guidance for managers to ensure that employees remain connected and maintain physical, mental and emotional wellbeing.

In keeping with “Work Smart,” we now maintain a smaller office footprint globally to better align with the number of employees expected to collaborate in person on any given day, while providing a space for employees to work and socialize. As the safety and security of our employees who choose to work in our office space are of critical importance, we have selected office buildings with robust security procedures, fire safety and sanitation and health practices.

Compliance, Training and Development

We comply with all applicable government laws, rules and regulations and it is the responsibility of each employee to adhere to the standards and restrictions imposed by those laws, rules and regulations. All new employees attend a compliance training session with a compliance officer, and thereafter, employees are required to attend firmwide annual compliance training and to complete compliance certifications annually and in some instances, quarterly. We also conduct mandatory cybersecurity training and other training programs as required by law.

As we believe that our employees are our greatest asset, we recognize the importance of investing in their continued development. We provide a variety of opportunities for our employees to build new skills and further their career development. These include role-specific training courses, virtual lunches with senior leaders in a small group setting and webinars hosted by various departments to gain a holistic view of the Company. We also support employees’ continuing education, including through our educational assistance program. In addition, we invest in our current and future leaders through leadership development courses and individual and team coaching. We also hold monthly regional and quarterly global town halls to inform our employees of business developments, employee news and job openings, as well as to provide opportunities for employees to hone their presentation skills by sharing department updates.

12

Employee Engagement

We believe engaging our employees is key to fostering new ideas and driving commitment and productivity. We communicate frequently and transparently with our employees through a variety of communication methods, including an annual global virtual offsite where senior leaders review the firm’s prior-year accomplishments and articulate the objectives for the coming year, and each department presents its respective prior-year accomplishments and current-year objectives, monthly regional and quarterly global town halls and firmwide weekly emails championing the team’s work. We also seek feedback from our employees through annual engagement surveys and follow-up pulse surveys on various topics. In addition, we provide opportunities for employees to participate in volunteer and charitable events.

We also believe it is important to celebrate employee and Company accomplishments. In 2023, we celebrated our fourth annual “Team Alpha” Awards to mark significant events and successes and to recognize employees who led those successes while exhibiting extraordinary teamwork and demonstrating strong character. Over 50 nominations were submitted and narrowed down by a selection committee. The winners received a modest incentive compensation award, the opportunity to donate to a charity of their choice and to recognize other employees who assisted them.

The success of our employee engagement efforts is demonstrated by our employee retention rate of approximately 93.4% in 2023. We also achieved overall positive results from our 2023 global employee engagement survey, with a 99% participation rate. Additionally, in the U.S., we were named a “2023 Best Places to Work in Money Management” by Pensions & Investments for the fourth consecutive year and seventh year since the award was created. We ranked second within the category for managers with 100-499 employees, the second consecutive year earning a ranking among the top five employers. In the U.K., we were also named Best Workplace for medium-sized companies for a fourth consecutive year and a 2023 Best Workplace for Women for medium-sized companies by Great Place to Work.

Compensation and Benefits

We are committed to rewarding and supporting our employees in order to continue to attract and retain top talent. Our incentive compensation program has been designed to reward our employees for their individual performance as well as the Company’s performance and includes various quantitative metrics and qualitative results that incentivize growth. We believe a key factor in our success has been and continues to be fostering an entrepreneurial culture where our employees act and think like our owners. As such, we believe that equity awards are an important part of our employees’ overall compensation package and that incentivizing our employees with equity aligns the interests of our employees with our stockholders. We also offer a wide array of benefits including generous healthcare coverage, paid vacation (unlimited in the U.S.), parental, sabbatical and sick leave, life and travel insurance, short- and long-term disability benefits and, in the U.S., a 401(k) plan with a matching contribution of up to 50% of eligible employee contributions.

Our Product Categories

U.S. Equity

We offer equity products that provide access to the securities of large, mid and small-cap companies located in the U.S., as well as particular market sectors and styles. Our U.S. Equity products track our own indexes, the majority of which are fundamentally weighted as opposed to market capitalization weighted indexes, which assign more weight to stocks with the highest market capitalizations. These fundamentally weighted indexes focus on securities of companies that pay regular cash dividends or on securities of companies that have generated positive cumulative earnings over a certain period. We believe weighting equity markets by dividends and income, rather than by market capitalization, can provide investors with better risk-adjusted returns over longer term periods in core equity exposures. Total AUM of our U.S. Equity products was $29.2 billion at December 31, 2023.

Commodity & Currency

We offer products in Europe with exposure to gold and other precious metals and commodities such as silver and platinum, oil and energy, agriculture and broad basket commodities. Our currency products provide investors with exposure to developed and emerging markets currencies, as well as exposures to foreign currencies relative to the U.S. dollar. Total AUM of our Commodity & Currency products was $21.3 billion at December 31, 2023.

13

Fixed Income

Our Fixed Income products seek to enhance income potential within the fixed income universe. We offer a suite of rising rate bond products based on leading fixed income benchmarks we license from third parties. We also launched the industry’s first smart beta corporate bond suite. Other product offerings include those that seek to track a yield-enhanced index of U.S. investment grade bonds and international fixed income products which are denominated in either local or U.S. currencies. Total AUM of our Fixed Income products was $21.2 billion at December 31, 2023.

International Developed Market Equity

Our International Developed Market Equity products offer a variety of strategies including currency hedged and dynamic currency hedged products, exposures to large, mid and small-cap companies in these markets and multifactor strategies. Total AUM of our International Developed Market Equity products was $15.1 billion at December 31, 2023.

Emerging Market Equity

Our Emerging Market Equity products provide access to exposure of large, mid and small-cap companies located in Taiwan, China, India, Russia, South Africa, South Korea and other emerging markets regions. These products also track our own indexes, which are fundamentally weighted focusing on securities of companies that pay regular cash dividends or that have generated positive cumulative earnings over a certain period. Total AUM of our Emerging Market Equity products was $10.7 billion at December 31, 2023.

Leveraged & Inverse

We offer leveraged products which seek to achieve a return that is a multiple of the performance of the underlying index and inverse products that seek to deliver the opposite of the performance in the index or benchmark they track. Strategies span across equity, commodity, government bond and currency exposures. Total AUM of our Leveraged & Inverse products was $1.8 billion at December 31, 2023.

Cryptocurrency

Our cryptocurrency ETPs provide investors with a simple, secure and cost-efficient way to gain exposure to the price of cryptocurrencies, while utilizing the best of traditional financial infrastructure and product structuring. We offer exposures to bitcoin, ether, crypto asset baskets and other cryptocurrency exposures. Total AUM of our cryptocurrency products was $0.4 billion at December 31, 2023.

Alternatives

Our Alternative products include the industry’s first managed futures strategy ETF and a global real return ETF. We also offer a dynamic long/short U.S. equity ETF, a dynamic bearish U.S. equity ETF and a collateralized put write strategy ETF on the S&P 500 index. We also intend to explore additional alternative strategy products in the future. Total AUM of our Alternative products was $0.4 billion at December 31, 2023.

Our Sales, Marketing and Research Efforts

Sales

We distribute our ETPs through all major channels within the asset management industry, including banks, brokerage firms, registered investment advisers, institutional investors, private wealth managers and online brokers. Our primary sales efforts are not directed towards the retail segment but rather are directed towards the financial or investment adviser who acts as the intermediary between the end-client and us. We do not pay commissions, nor do we offer 12b-1 fees to financial advisors to use or recommend the use of our products.

We have developed an extensive network and relationships with financial advisors and we believe that our ETPs and related research are well structured to meet their needs and those of their clients. We have taken steps to enhance and form new relationships through our Advisor and Portfolio Solutions programs, including providing customized portfolio and asset allocation services to support registered investment advisers and independent broker dealers in building, implementing and managing their client portfolios while providing strategic guidance for advisors to support their business growth. Our Advisor and Portfolio Solutions programs also provide technology-enabled and research-driven solutions to help financial advisors grow and scale their businesses.

14

In addition, senior and academic advisors of ours, including Professor Jeremy Siegel, Senior Economist to WisdomTree, participate as keynote speakers in various industry and WisdomTree hosted conferences and events. Our sales professionals act in a consultative role to provide financial advisors with value-added services. We seek to consistently grow our network of financial advisors and we opportunistically seek to introduce new products and services that best deliver our investment strategies to investors through these distribution channels. We have our own team of 77 sales professionals globally as of December 31, 2023.

In addition, we have agreements with third parties to serve as the external marketing agents for our products in Latin America and Israel, as well as with select brokerage firms and independent broker-dealers to allow certain of our products to trade commission free on their platforms in exchange for a percentage of our advisory fee revenues from certain AUM. We believe these arrangements expand our distribution capabilities in a cost-effective manner and we may continue to enter into such arrangements in the future.

Marketing

Our marketing efforts are focused on the following objectives: increase our global brand awareness, leverage a robust data-driven digital sales experience to generate new clients and drive inflows to our products and model portfolios and retain existing clients, with a focus on cross-selling additional WisdomTree ETPs. We also anticipate launching marketing campaigns to drive awareness and user adoption for WisdomTree Prime and to position ourselves to become a leader in asset tokenization and blockchain-enabled funds. We pursue these objectives utilizing the following strategies:

• Targeted advertising. We create highly targeted multi-media advertising campaigns limited to established core financial media. For example, our television advertising to promote our ETPs runs exclusively on the cable networks CNBC, Fox Business and Bloomberg. It is anticipated that television advertising also will be utilized to promote WisdomTree Prime. Also, our digital advertising runs on many investing and ETF-specific web-sites, such as www.etftrends.com and www.etfdb.com, using targeted dynamic and personalized ad messaging. We also utilize non-linear TV advertising that leverages the same targeted segments of users who use streaming devices. In Europe, we filter the targeting of promotions by both region and language, focusing heavily on professional investors.

• Media relations. We have a full-time global corporate communications and public relations team that has established relationships with major financial and digital assets media outlets. We utilize these relationships to help increase global awareness of WisdomTree ETPs, the ETP industry in general in the U.S. and Europe and our digital assets efforts. Several members of our management team and multiple members of our research team are frequent market commentators and conference panelists.

• Database Messaging Strategy. We have a database of financial advisors to whom we regularly market through a series of messages across channels (email, display, site) that are triggered based on user interest and predictive analytics, on-demand research presentations, ETP-specific or educational events and presentations, and market commentary from Professor Jeremy Siegel, Senior Economist to WisdomTree. Additionally, in the U.S., we communicate to our retail database about new product launches and provide ETF education through a monthly newsletter.

• Social media. We have implemented a social media strategy that allows us to connect directly with financial advisors and investors by offering timely access to our research material and more general market commentary. Our social media strategy allows us to continually enhance our brand reputation of expertise and thought leadership in the ETP industry. For example, we have an established presence on LinkedIn, X (formerly Twitter), Instagram, Reddit and YouTube, and our blog content is syndicated across multiple business-oriented websites. We also leverage the strength and reach of our existing brand, in addition to utilizing a highly focused “test, learn, iterate” paid and social media marketing strategy, to drive awareness and user adoption for WisdomTree Prime.

• Sales support. We create comprehensive materials to support our sales process of our ETP products, including whitepapers, research reports, webinars, blogs, podcasts, videos and performance data for our products. Our marketing automation system connects seamlessly to our database of financial advisors to provide the sales team with additional insights about their clients.

We will continue to evolve our marketing and communication efforts in response to changes in the ETP industry, market conditions, marketing trends and our evolving strategy around digital assets.

15

Research and Chief Investment Office

Our research team and chief investment office has four core functions: product development and oversight, investment research, model portfolio management and sales support across equities, fixed income, alternatives, crypto and asset allocation portfolios. In its index and active product development and oversight role, the group is responsible for creating the investment methodologies and overseeing the maintenance of indexes and active strategies. The team also provides a variety of investment research around these indexes and markets and manages a series of model portfolios that incorporate WisdomTree and third-party products for various investment platforms, including WisdomTree Prime. Our research is typically academic-type research to support our products, including white papers on the strategies underlying our indexes and ETPs, investment insights on current market trends, and types of investment strategies that drive long-term performance. We distribute our research and insights through our sales professionals, online through our website and blog, targeted emails to financial advisors, or through financial media or social media outlets. Finally, the team supports our sales professionals in meetings as market experts and through custom analysis on client portfolio holdings. In addition, we consult with our senior advisers, including Professor Jeremy Siegel, Senior Economist to WisdomTree, on product development ideas, model collaboration and market commentaries.

Product Development

We are focused on driving continued growth through innovative product development including through our Modern Alpha approach and our digital assets offerings. Modern Alpha combines the outperformance potential of active management with the benefits of passive management to offer investors cost-effective products that are built to perform.

Due to our proprietary index development capabilities and a strategic focus on product development, we have demonstrated an ability to launch innovative and differentiated ETPs. Building on our heritage of innovation, we are also developing next-generation digital products and structures, including Digital Funds and tokenized assets. When developing new products, we seek to position ourselves as first to market, offering improvement in structure or strategy relative to an incumbent product or offering some other key distinction relative to an incumbent product. In short, we want to add choice in the market and seek to introduce thoughtful investment solutions. Lastly, when launching new products, we seek to expand and diversify our overall product line.

Competition

The asset management industry is highly competitive and we face substantial competition in virtually all aspects of our business. Factors affecting our business include fees for our products, our offerings and investment performance, brand recognition, business reputation, quality of service and the continuity of our financial advisor and platform relationships. We compete directly with other ETP sponsors and mutual fund companies and indirectly against other investment management firms, insurance companies, banks, brokerage firms and other financial institutions. Many of the firms we compete with are subsidiaries of large diversified financial companies and many others are much larger in terms of AUM, years in operations and revenues and, accordingly, have much larger sales organizations and budgets. In addition, these larger competitors may attract business through means that are not available to us, including retail bank offices, investment banking, insurance agencies and traditional broker-dealers.

ETPs are now available for virtually every asset class including equities, fixed income, commodities, alternative strategies, leveraged-and-inverse, currencies and cryptocurrencies. Existing players have broadened their suite of products offering strategies that are, in some cases, similar to ours and large traditional asset managers are also launching ETPs, some with similar strategies as well. There remain substantial areas for sponsors to continue to innovate, including but not limited to cryptocurrency, liquid alternative, thematic and other strategies.

Price competition exists in not only commoditized product categories such as traditional, market capitalization weighted index exposures and commodities, but also in non-market capitalization weighted or factor-based exposures and commodities. Fee reductions by certain of our competitors has been a trend over the last few years and continues to persist and many of our competitors are well positioned to benefit from this trend. Certain larger competitors are able to offer products at lower price points or otherwise as loss leaders due to other revenue sources available within such competitors that are currently unavailable to us. Newer players have also been entering the ETP industry and frequently seek to differentiate by offering ETPs at a lower price point. Funds are being offered with fees of 20 basis points or less, which have attracted approximately 80% of the net flows globally during the last three years. However, while these low-cost products have accumulated a significant amount of AUM recently, we estimate that these same funds represent only approximately 34% of global revenues.

16

Being a first mover, or one of the first providers of ETPs in a particular asset class, can be a significant advantage, as the first ETP in a category to attract scale in AUM and trading liquidity is generally viewed as the most attractive product. We believe that our early launch of products in a number of asset classes or strategies, including fundamental weighting and currency hedging, along with commodities including gold, certain fixed income, alternative and thematic categories, positions us well to maintain our standing as one of the leaders of the ETP industry. Additionally, we believe that our affiliated indexing or “self-indexing” model, as well as our more recent active ETFs, enable us to launch proprietary products that do not have direct competition and are positioned to generate alpha versus benchmarks. As investors increasingly become more comfortable with the product structure, we believe there will be a greater focus on after-fee performance rather than using ETPs primarily as low-cost market access vehicles. While we have selectively lowered fee rates on certain products that have yet to attain scale, and there is no assurance that we will not lower fee rates on certain products in the future, our strategy continues to include launching new funds in the same category with a differentiated exposure at a lower fee rate, rather than reducing fees on existing products with a significant amount of AUM, long performance track records, and secondary market liquidity, which continue to remain competitively priced for the value provided, among other factors. We generally believe we are well positioned from a product pricing perspective.

We also have been positioning ourselves to expand beyond our existing ETP business by leveraging blockchain technology, digital assets and principles of DeFi to deliver transparency, choice and inclusivity to customers and consumers around the world. Our blockchain-native digital wallet, WisdomTree Prime, provides access to bitcoin, ether, tokenized gold and U.S. dollar tokens, as well as 13 Digital Funds, including a government money market fund and other digital funds offering asset allocation, fixed income and equity exposures. These products have been developed with the ability to be recorded and/or transferred on multiple public and/or permissioned blockchains with interoperability between blockchains. In addition, we were among the first to launch a spot bitcoin ETF in the United States. We believe this expansion complements our core competencies in a holistic manner, will diversify our revenue streams and contribute to our growth. Competition in the digital assets industry on a global basis is increasing, ranging from large, established financial incumbents to smaller, early-stage financial technology providers and companies. There are jurisdictions with more stringent and robust regulatory and compliance requirements than others which could impact the ability of a company to compete in the digital assets industry. We are embracing what we refer to as “responsible DeFi” for our anticipated and expanded products and services which we believe upholds the foundational principles of regulation in this innovative and quickly evolving space. We remain committed to being a trusted provider of innovative products and services guided by proactive engagement and continued collaboration with current and new regulators.

Our ability to successfully compete will depend largely on offering innovative products through traditional ETPs and digital asset exposures (and more broadly in blockchain-enabled finance, including savings and payments), having strong internal controls and risk management infrastructure to enable customer trust, generating strong after-fee performance and track records, embracing regulation, developing distribution relationships, promoting thought leadership and a differentiated solutions program, building upon our brand and attracting and retaining talented sales professionals and other employees.

Regulatory Framework of the ETP Industry and Digital Assets Business

ETPs

Not all ETPs are ETFs. ETFs are a distinct type of security with features that are different than other ETPs. ETFs are open-end investment companies or unit investment trusts regulated in the U.S. by the Investment Company Act of 1940, as amended, or the Investment Company Act. This regulatory structure is designed to provide investor protection within a pooled investment product. For example, the Investment Company Act requires that at least 40% of the Trustees for each ETF must not be affiliated persons of the fund’s investment manager, or Independent Trustees. If the ETF seeks to rely on certain rules under the Investment Company Act, a majority of the Trustees for that ETF must be Independent Trustees. ETFs generally operate under regulations that allow them to operate within the ETF structure, while ETFs also operate under regulations that prohibit affiliated transactions, are subject to standard pricing and valuation rules and have mandated compliance programs. ETPs can take a number of forms in addition to ETFs, including exchange-traded notes, grantor trusts or limited partnerships. In the U.S. market, a key factor differentiating ETFs, grantor trusts and limited partnerships from exchange-traded notes is that the former hold assets underlying the ETP. Exchange traded notes, on the other hand, are debt instruments issued by the exchange-traded note sponsor. Also, each of these structures has implications for taxes, liquidity, tracking error and credit risk.

17

Digital Assets

As we continue to make progress and pursue various initiatives in connection with our digital assets business, we believe it is necessary and important to do so in compliance with applicable laws and regulations. As a result, we are actively engaged with a variety of U.S. federal and state regulators (e.g., the SEC, FINRA, New York Department of Financial Services (NYDFS) and other state regulators) to secure, as necessary, or maintain the appropriate regulatory, registration and/or licensing approvals for various business initiatives and operations, including but not limited to: a New York state-chartered limited purpose trust company; money services and money transmitter business; limited purpose broker-dealer; transfer agent; investment adviser; and investment funds. As we seek to expand globally, similar approvals and/or reliance on exemptions will be required in applicable foreign markets, which also may involve approvals specific to a digital assets or related business. As we secure the appropriate regulatory, registration and/or licensing approvals, or otherwise rely on, seek or confirm exemptions therefrom, in connection with our digital assets business, we are and will be subject to a myriad of complex and evolving global policy frameworks and associated regulatory requirements that we need to comply with, or otherwise be exempt from, to ensure that our digital assets products and services are successfully brought to different markets in a compliant manner. We remain committed to being a trusted provider of innovative products and services guided by proactive engagement and regulatory collaboration.

U.S. Regulation